I started my undergraduate studies in economics in the late 1970s after starting out as…

When the government owes itself $US1.6 trillion

I did some research today on the outstanding US public debt – not because I think it is particularly important but because a journalist asked me yesterday during an interview – how much of the total US Treasury Debt is held by the US government – I said off the top of my head about 42 per cent which was a quick calculation based on work I did about 12 months ago and a rapid adding up off what I remembered from the monthly reports since then with a quick division thrown in. It turns out after I have updated the databases I keep that my “guesstimate” was not misleading (as at March 2011). The journalist then said – “so lets get this straight, the US government owes itself money equivalent to 42 per cent of its total outstanding liabilities?” Answer: yes. He then responded: “to fix the debt problem why wouldn’t they just write it off?”. Answer: I don’t see a US public debt problem. But because you do, then the answer is that for the most part they could just write it off as long as their were some additional legislative changes (for example, they would have to finance the operations of the US Federal Reserve in a different manner). So who owns the US debt?

There are a few data sets that you can pull together to break the total US public debt outstanding into various categories. The US Treasury Department provides an extensive (though awkward) data resource – for example, Ownership of Federal Securities.

The US Treasury also provide data which provides a Foreign breakdown.

The US Federal Reserve provides Consolidated Balance Sheet data.

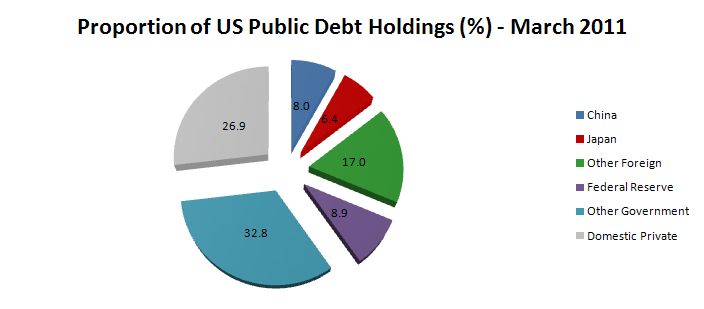

The following pie-chart is the result of some calculations as at March 2011. It shows the proportions of total US Public Debt held by various “interesting” categories. This chart tells you that the government sector held about 42 per cent of its own debt in March 2011 and the private sector held the rest (of-course).

The scare-mongering campaign that has been waged by the deficit terrorists in recent years holds out that US public debt holdings are dominated by the Chinese. If you call 8 per cent a domination then your sense of calibration is different to mine. The three largest foreign US debt holders at March 2011 are China (8 per cent); Japan (6.4 per cent) and Britain (2.3 per cent). The total foreign held share was equal to 31.4 per cent in March 2011.

The US Federal Reserve held 8.9 per cent of total US public debt in March 2011 – that is, more than China. The total holdings were around $US 1,274,274 million.

According to the US Treasury the total outstanding US public debt on August 3, 2011 was $US 14,574,607 million, which means the US Federal Reserve holdings ($US1,640,919 millions) represent around 11.3 per cent of the total outstanding US public debt.

Since January 7, 2010 the US Federal Reserve has increased its public debt holdings from $US 776,591 million to $US 1,640,919 million (change $US 864,328 million) whereas total US public debt has risen from $US 12,280,845 million to $US 14,574,607 (change $US 2,293,762 million). In other words, the US central bank has accounted for 37.7 per cent of the rise in US public debt – the dominant source.

Even more stark is the figures for this year (from January 5, 2011 to August 5, 2011). The the US Federal Reserve has increased its public debt holdings from $US 1,023,962 million to $US 1,640,919 million (change $US 616,957 million) whereas total US public debt has risen from $US 14,011,526 million to $US 14,574,607 (change $US 563,081million). That is dominance.

Given the change in US Federal Reserve holdings over the last year or more one might easily conclude that the US government (consolidated Treasury and central bank) is its largest lender. Government borrowing from itself sort of thing!

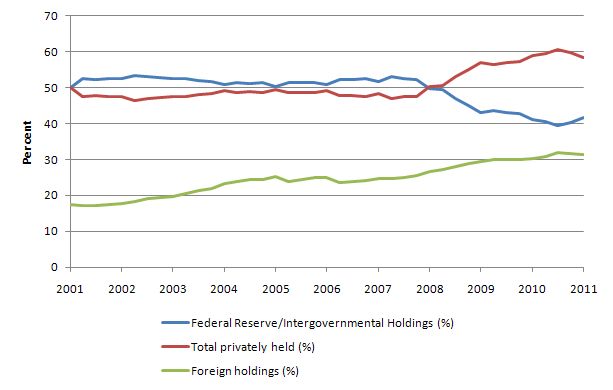

Given I claim to be a time series econometrician I always examine the trends over time. The next graph shows the evolution from March 2001 to March 2011 of the US public debt by private, public and foreign holdings (%). The foreign holdings are a subset of the private series.

There are some interesting points to note. At a time when the US public debt ratio has risen beyond what the mainstream claim is the danger point (80 per cent) – the point where they claim governments become insolvent (Rogoff and co), the private demand for US public debt has risen. Private markets know that there is no substantive default risk involved in holding the US Treasury debt notwithstanding the weak-kneed threats of the Tea Party coalition – who caved in last week when the going got tough.

The other point, in relation to the rising foreign share is that you cannot conclude that the foreigners (China, Japan etc) are “funding” the US government. The US government is the only government that issues US currency so it is impossible for the Chinese to “fund” US government spending. To understand the trend shown in the graph more fully we need to appreciate that the rising proportion of foreign-held US public debt is a direct result of the trade patterns between the countries involved (and cross trade positions).

For example, China will automatically accumulate US-dollar denominated claims as a result of it running a current account surplus against the US. These claims are held within the US banking system somewhere and can manifest as US-dollar deposits or interest-bearing bonds. The difference is really immaterial to US government spending and in an accounting sense just involves adjustments in the banking system.

The accumulation of these US-dollar denominated assets is the “reward” that the Chinese (or other foreigners) get for shipping real goods and services to the US (principally) in exchange for less real goods and services from the US. Given real living standards are based on access to real goods and services, you can work out who is on top (from a macroeconomic perspective).

Note that a worker in Detroit who is suffering from unemployment as a result of cheaper imports coming from nations with lower labour standards (pay and conditions) than the US is unlikely to agree with me. In his/her case I wouldn’t agree with me either. But I am writing as a macroeconomist here without regard to equity which isn’t to say that equity isn’t a crucial policy aim as well. I will write a blog about the microeconomic impacts of trade and especially unfair trade another day. But please do not think I disregard the plight of workers who are undermined by cheap labour nations. It is a complex issue.

Now what about the journalist’s question that the US government could reduce its debt immediately by writing off the holdings held by the US Federal Reserve current over $US1.6 trillion.

On June 28, 2011, the rather ill-informed Republican congressman from Texas and a would-be US President, Ron Paul told CNN that the U.S. should declare ‘bankruptcy’. He was asked:

If bankruptcy is the cure for Greece, is it also the cure for the United States?

[He replied]

Absolutely

And in that one word reply you can safely conclude that he doesn’t have even a basic understanding of the differences between the monetary system (EMU) that Greece has to operate within and the fiat monetary system that the US government runs as a monopoly-issuer of its own currency.

Greece could go bankrupt – by which we mean would be unable to pays its bills in Euros – because it effectively uses a foreign currency and cannot instruct “its” central bank to provide adequate funds. It actually doesn’t have a central bank anymore given that the Greek central bank is part of the European Central Bank system.

The US government can never become bankrupt. Several readers have acknowledged comments made yesterday by the former US Federal Reserve Governor Alan Greenspan to CNBC. He said in relation to S&Ps decision:

The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.

The level of surprise that a former central banker (albeit a very conservative free market-oriented one) would say such a thing surprises me. It is no secret. The way the mainstream economists have pushed this capacity under the carpet is via the hyperinflation myth. They have effectively been able to pressure governments into borrowing (back their own spending) from private markets to “fund” its spending when they know clearly that such an act is totally unnecessary.

There was an interesting PBS News Hour program a few years ago (October 7, 2008) as the US Federal Reserve was about to introduce its Quantitative Easing program for the first time. The program – Federal Reserve Employs Tools to Ease Credit Fears – interviewed economist Alan Blinder, a former vice chairman of the Board of Governors of the US Federal Reserve. Here is a snippet of the transcript after being asked to explain how the US Federal Reserve gets “money into the system”:

Well, when the Fed first starts these operations, including the other ones they do, what they try to do is re-jigger their balance sheets, sell one asset, and that for the Fed has been mostly been treasuries, and buy something else.

As that capacity gets used up, the Fed can no longer swap one asset for another. And then it has to … we use the euphemism “print money.” What that really means is somebody is on a keyboard creating electronic images of money. Large amounts of money are not cash.

So these are credits at the Federal Reserve system basically. A central bank can do that; a commercial bank cannot do that.

That couldn’t be clearer.

And then we might just recall what the current US Federal Reserve Governor matter-of-factly told the US Congress (Committee on Financial Services) on July 14, 2011 (Ron Paul is part of that Committee). The Chair Congressman Duffy asked him:

DUFFY: … When – when you buy assets, where does that money come from?

BERNANKE: We create reserves in the banking system which are just held with the Fed. It does not go out into the public.

We can argue about the technicalities but the essence is that there is no revenue-constraint operating here.

The discussion continued:

DUFFY: Does it come from tax dollars, though, to buy those assets?

BERNANKE: It does not.

Once again technicalities aside (for example, the purchase of interest-bearing assets from the private sector reduces private incomes which some might consider to be a “tax”), this reinforces the fact that the government, in this case, the federal reserve, is not revenue-constrained.

DUFFY: Are you basically printing money to buy those assets?

BERNANKE: We’re not printing money. We’re creating reserves in the banking system.

This is the electronic version of “printing money” which in Modern Monetary Theory we refer to as adding financial assets to the non-government sector.

The point here though is that the central bank acts as “part” of the overall US government (consolidated treasury-central bank) and can credit bank accounts at will. Please read my blog – The consolidated government – treasury and central bank – for more discussion on this point.

Think about what a US dollar is. Anyone holding one can present them (or the electronic version – deposits) to the US government in return for a tax credit (payment of their tax liabilities). So when the Federal Reserve credits bank accounts it is really providing Treasury tax credits to the holders of those accounts.

When a US citizen (this applies in any sovereign nation) pays their taxes the conceptual chain of events is that the central bank accounts for the payment (acknowledging the tax credit) and informs the Treasury that the tax obligation has been eliminated. The dollars don’t go anywhere! The scores are adjusted – that is it. So the central bank crediting behaviour creates assets in the non-government sector which sit in reserves held by the member banks.

The conclusion is obvious as it is powerful. These electronic credits come from nowhere and enter the non-government sector as a tax credit against obligations that the non-government agents have to government. The source of these funds cannot come from the taxpayer. Similarly, when the tax credits are redeemed they go nowhere other than into accounting books to record the events.

At this point, Ron Paul must have been “having kittens” during the Committee meeting. But back to his proposal (espoused during that CNN bankruptcy interview). In outlining that the Federal Reserve should be eliminated he said:

We owe, like, $1.6 trillion because the Federal Reserve bought that debt, so we have to work hard to pay the interest to the Federal Reserve … We don’t, I mean, they’re nobody; why do we have to pay them off?

Exactly, the government owing itself through a sequence of elaborate accounting tricks.

Now the build-up of public debt on the US central bank balance sheet arose from its Quantitative Easing program which was conducted on the false premise that the private banks were not lending because they didn’t have enough reserves. Please read my blog – Quantitative easing 101 – for more discussion on this point.

The reality is that it did nothing much – an asset swap – but denied the non-government sector of income as a result of the public debt being purchased by the US Federal Reserve. So the demand effects could have been, in fact, negative. It will be hard to determine that empirically.

But once the “damage” is done, the fact remains that the consolidated US governments holds 11 per cent of its own debt within the US Federal Reserve and more in other areas of the public sector (Social Security etc). None of those assets are necessary for anything given that the US government issues the currency and does not need to “save” before it can spend.

Some would respond by saying that the Federal Reserve provides interest earnings to the Treasury ($US 79 billion in 2010) and that the writing off of the assets from the central bank’s balance sheet would further squeeze the US government of revenue. Of-course, there is no sense to that statement once we understand the US government is never revenue constrained because it is the monopoly issuer of the currency. So the “interest payments” are an accounting ploy which do not enhance the capacity of the government to spend.

That is in contradistinction to interest payments from government to non-government holders of public debt. They add to income and enhance the capacity of the holders to spend.

What would happen if the US Federal Reserve did write off all the public debt holdings? Would they go broke? Hardly. Please read my blog – The US Federal Reserve is on the brink of insolvency (not!) – for more discussion on this point. The US central bank and hence the US government cannot go broke.

Conclusion

So the blog today just documents some of the work I was doing today – an hour or so of digging. It is more some “notes” than a definitive response to Ron Paul’s proposal. Essentially, I do not consider there to be a public debt problem in the US so the point is rather moot.

I also was looking at geographical data today documenting the unemployment rates by gender for British localities. If you overlay the labour market performance with the suburbs where the riots are occurring at present you get a pretty good fit in terms of scale versus impact. While the riots are seemingly a response to the death of a young boy at the hands of a very insensitive police force in Tottenham, the underlying causes are deep and relate to entrenched disadvantage being perpetuated through the education system and then the labour market. It might be that a GIS “forecasting” model could be assembled to predict where social unrest will become endemic as the capitalist system fails to deliver prosperity to all citizens.

The fiscal austerity will render these trends more stark. I thought this UK Guardian article (August 8, 2011) – If the rioting was a surprise, people weren’t looking – presented an interesting perspective. I started a PhD in Manchester just after the riots in the early 1980s and became very familiar with the socio-economic challenges facing the largely black communities in the inner-city (Moss Side etc). A society can only deprive a growing minority for so long.

The proponents of fiscal austerity seem to assume that everyone will play by the same rules as the punishment is meted out via spending cuts etc on selective segments of the population (usually those already significantly disadvantaged). The problem is that civilisations eventually fail because the rules change and the riots are an expression of a process where some cohorts are already well on the way to rejecting the authority of those who police the austerity on behalf of the top-end-of-town. The poor just have to learn to become mobile and inflict the damage across town rather than in their own neighbourhoods for a revolution to begin.

That is enough for today!

Hi Bill,

Great post. I’d love to see the same thing for the UK – I bet the Bank of England holds a large amount of British Government debt too.

Thanks,

Alex

As you acknowledge, MMTer’s don’t always agree with Greenspan and Bernanke. But on this one, technicalities aside as you point out, they are correct. The ironic thing about this all is politicians don’t want to listen to the very people they appoint as leaders.

Great post. Required reading for all deficit terrorists, economists, economics students, and most of all, politicians.

£194.9b out of £991.3b is held by the Bank of England.

http://www.dmo.gov.uk/documentview.aspx?docname=publications/quarterly/apr-jun11.pdf&page=Quarterly_Review

Excellent article, I have linked on my ‘blog. But could you make it clearer which US government bodies or departments own the other 32% of US central government debt? You seem to focus purely on the Fed, which makes it slightly confusing.

Bill …

I’m looking forward to the day you’re able to do this – “I will write a blog about the microeconomic impacts of trade and especially unfair trade another day.”

Thanks for today’s

Bill,

You have been so right all along. Unfortunately the American public only respond to shrill logic and scare tactics. The media is not interested in educating the public. They keep saying that the U.S. will default on its debts. How could that be?! If the debt limit is not raised, the U.S. government cannot pay its bills, yes, but there is no way it will default on its debts. When someone present a Treasury Bill at maturity, all the government has to do is to print some dollar bills to redeem the Bill.

My strange thought: God engineered the Florida ballot to put George W. Bush in the White House to screw up the U.S. so much that the young voters looked past race to elect Obama. Then He had the Republicans win last year to give us this scorched-earth House. Is this almost-default farce His way of helping China?

As you have just observed last week, the price of Treasuries is rising. This market crash is the perfect situation for China, Japan and Russia to unload their holdings and then use the proceeds to buy American stocks. The market capitalization of the Silicon Valley companies is about $1T. China and Japan can each unload $200B of Treasuries this week and then use the cash to each buy up 20% of all Silicon Valley companies,. For example, Apple generated hundreds of thousands of jobs in China, it makes sense for China Investment Corporation to own a substantial share of Apple. CIC should do that if the leadership listens to innate Chinese shrewdness rather than their Harvard-trained MBAs.

Just to finish off Postkey’s comment – in the UK, the BoE bought approx. £200 bn of gilts from commercial banks (plus a few ‘others’), and ‘paid’ for them by creating reserve balances with BoE (of which about £130 bn still shows up on BoE balance sheet, I’m not sure what happened to the rest).

So prior to QE, comm banks were owed £200 bn by the Debt Management Office and afterwards they were owed £200 bn by the BoE. The DMO and BoE are both departments of HM Treasury, of course. The whole thing is laughable.

Hi Mark,

This is some information I found in the Guardian comments section.

Thanks to a poster called echinoderm

‘5 August 2011 11:00PM

The People’s Republic is the largest single holder of the US government’s foreign debt.

But foreign debt is not most of the US’s debt. The US owes about 8% to China and 2.3% to the UK!

Most of the rest is “US individuals and institutions” and their “Social Security Trust Fund” plus bits for “US civil service retirement fund” and US military retirement fund”.’

With respect to the influx of nonresidents in the looting, you are on the money, as it were, recent reports suggest. Unemployment among the young in many of these areas is almost 50%. It is unconscionable. Livingston said that poverty is not an excuse for the rioting. Of course it isn’t. But it is an explanation or a substantial part of one. And it is such causal links that count if one wishes to prevent this sort of social unrest in the future. The elephant in the room is whether there are not some members of the government that are not sorry that this is happening as it has taken attention away, however momentarily, from their disastrous economic policies. No conspiracy being suggested, simply opportunism.

Dear Bill

The 32.8% of American Treasury debt that is owed to another part of the government is owed to Social Security. This means that it is in fact owed to the millions of American employees who contribute to Social Security. It should really be regarded as a public debt. To prepare for the retirement of the baby-boomers, American Social Security has been running surplusses. They invested part of these surplusses (or all?) in Tresury bonds. When Social Security starts running deficits, they’ll cash in these bonds, which means that Tresury has to borrow somewhere else to pay out the cash.

Regards. James

James, that’s valuable extra info.

In which case Bill was quite correct to treat the other 32% as real debts (and my first comment was a bit off-piste). As we learned in the UK, the NPV of public sector pension liabilities is £1 trillion. In theory, it would make little difference whether this is ‘unfunded’ or whether the government were to simply give the public sector pension schemes £1 trillion in UK gilts, with maturities stretching decades into the future.

Shouldn’t the reserves be considered debt as well?

I share your surprise at the surprise expressed upon hearing the US can always print money to pay it’s debts; I can only speak from experience at two universities, but 1st year econ undergrads get taught that. They just get taught, as you say, that printing money to cover deficits leads to inflation (without ever being taught how much you can get away with before that happens). You call this the “hyperinflation myth” – I’d really like to see the evidence that the central bank can monetize government on a significant scale without causing inflation.

But I think the OP makes a very important point – I have long been puzzled why the government doesn’t say: “Everybody relax! Half of this debt, we owe to ourselves and need never repay it!”

I presume central banks don’t need to “write-off” the debt, they can just maintain the size of the balance sheet by buying new debt ever time old debt matures. I guess one potential reason why the government does not say “everybody relax! half of this debt, we owe to ourselves!” is that the CB’s balance sheet position is regarded as temporary – the expectation is that the CB will shrink its balance sheet, and the government will go back to (mostly) owing the private sector / foreigners. On that basis, we can’t relax.

So when I write: “I’d really like to see the evidence that the central bank can monetize government on a significant scale without causing inflation” I need to be more precise. We already have monetized government debt on a massive scale without causing inflation, but we’ve done it with the expectation that it is only a temporary expansion of the CB balance sheet, that will last as long as the output gap does, roughly speaking. What I want to see is evidence that we can do it under the expectation that the debt is effectively written-off, i.e. that it’s going to stay on the CB balance sheet and be rolled over in perpetuity, without causing inflation.

I still believe that announcing we’re going to run a deficit and keep monetizing government debt on a large scale as a long run policy would be inflationary, but I don’t know whether announcing a massive one-off monetization of government debt – i.e. create the expectation of a permanent increase in the CB balance sheet – in the current situation, would be inflationary.

It seems to me that policy makers, and I suppose mainstream economists, believe it would be – at a time when everybody is panicking about debt, they don’t even want to draw attention to the fact that the government actually holds half of its own debt and need never repay it out of tax revenues. But with stock markets tumbling, governments under pressure to cut budgets, depressing growth, the solvency of banks in doubt, and the threat of a global “double dip” looming, announcing that central banks are buying debt and will never ask for it to be repaid looks to me like a way of solving a lot of problems. Why isn’t that option more discussed? I just don’t understand it.

If you are right that governments in Europe and the US could say: “alright, everybody stop worrying about debt, we’re going to have the central banks buy it up and effectively write it off” and that would have no or only a moderate impact upon inflation, there is a huge global policy mistake in progress.

Of course, even if such a course of action was inflationary, once can still ask how inflationary – if we are talking about effectively a one-off jump in the price level, surely that’s a price worth paying to alleviate the current situation.

Further, the distinction between a supposedly non-inflationary temporary expansion of the CB balance sheets, and a supposedly hyper-inflationary permanent increase in CB balance sheets isn’t really there, there is a continuum of possible future paths for the CB balance sheet, and the CB could let its balance sheet shrink very slowly, relative to the size of the economy, without actually shrinking it in absolute terms, just by letting economic growth do the work.

So governments could announce that we can stop worrying about debt because the central banks are going to buy it up and keep rolling it over for a long while, to give us years of breathing space until we have to think about repaying some of it by running fiscal surpluses.

Why aren’t Krugman et al. attracted to the idea of a massive one-off (semi-permanent) expansion of the central bank balance sheet, combined with an information campaign to explain this means the debt doesn’t need repaying and the fiscal pressure is off?

ah – I should have read James’ comment first. That looks important to me.

It’s funny how whenever someone mainstream mentions the govts. unlimited ability to finance via ‘printing money’ they quickly follow with an inflation disclaimer as if its some taboo thing to suggest money creation as a way of paying for things (lol).

Bill could you provide any links to your interviews/articles you’re always talking about in your blogs, would love to listen to or read the whole pieces..

Ps. Ron Paul is right up there on the list of most destructive idiots, its like pulling teeth listening to the man.

In Ron Paul’s world, the US is on the gold standard, which means that to him, there is little difference between the US and Greece. Note that thanks to Milton Friedman, from a political accounting perspective, the US is on a sort of gold standard, and so there is something to what Ron Paul is saying. Perhaps they would have liked to share a room in the same asylum.

I find Bernanke to be a curious sort. On the on hand, there is hardly a question that he can be asked where he cannot roll out some pertenant facts. On the other, he seems to be unable to combine this wealth of facts in ways he is not familiar with, hence his “deer in the headlights” over MMT, for which he almost certainly has all the facts he needs.

I did however love his “not printing money” answer to Duffy. He’s clearly blowing smoke up Duffy’s posterior by deliberately giving an answer over Duffy’s head. Much like a cat playing with a doomed mouse before tossing it aside from boredom.

As for Ron Paul “having kittens”, that should be reported to the Society for the Prevention of Cruelty to Animals. After all, he was “having son” once, and look at how badly that turned out.

“This is the electronic version of “printing money” which in Modern Monetary Theory we refer to as adding financial assets to the non-government sector.”

why are you are describing QE as adding financial assets to the private sector when it is just an asset swap?

When Social Security starts running deficits, they’ll cash in these bonds, which means that Tresury has to borrow somewhere else to pay out the cash.

Why? That misses the point of MMT entirely. And what’s so special about SS as opposed to any other govt program with liabilities, aside from some silly accounting firewall?

@ Luis Enrique

Please start at square 1. Read the “7 Innocent Deadly Frauds” pdf, which Bill has conveniently posted on the right margin of his blog. If you click on the image it will offer you the booklet to download.

Here’s a silly but mildly amusing counter-example to all these inflation fears.

It all comes from this equation:

Money x Velocity = Prices x Capacity

Now, we can assume that the velocity of money and prices stay constant, and that capacity is equivalent to employment. So the equation reduces down to:

Money = Employment

So printing money creates jobs. QED!

In all seriousness, I make just as many unrealistic assumptions as the original version which assumed constant velocity and capacity. So why is one automatically spouted as gospel by everyone and the other doomed to ridicule?

Jakob: “Shouldn’t the reserves be considered debt as well?”

If you mean “Shouldn’t commercial bank reserves i.e. deposits with the Federal Reserve Bank be considered as US government debt as well” then the answer is “Yes of course, they are exactly the same thing. A deposit with the Federal Reserve is a very short term debt, which is rolled over every day, withdrawable without notice and non-interest bearing and US Treasury bonds are longer term interest-bearing debts, but apart from that they are the same – either way, they will either be repaid by the US taxpayer or by the US government/Federal Reserve ‘printing money’.”

Dear Rob (at 2011/08/10 at 3:15)

QE is clearly an asset swap and doesn’t add net financial assets to the non-government sector. It was probably poor composition on my part – but I was considering the act of the central bank crediting bank accounts as a separate operation when I wrote that. Clearly if they purchase something with that operation it becomes an asset swap.

Thanks for that.

best wishes

bill

“The poor just have to learn to become mobile and inflict the damage across town rather than in their own neighbourhoods for a revolution to begin.”

Indeed,the stupid, ignorant and arrogant cohort in charge at present will only learn by experiencing real personal pain.

Question: Regarding your statement “For example, China will automatically accumulate US-dollar denominated claims as a result of it running a current account surplus against the US. These claims are held within the US banking system somewhere…” is it absolutely true that these claims are held within the US banking system? Can’t they be held in a foreign bank?

Thanks

“The poor just have to learn to become mobile and inflict the damage across town rather than in their own neighbourhoods for a revolution to begin.”

The rich have used the same trick for centuries!

Ron Paul is influenced by the Austrian school not Monetarism.

Looking at the pictures of the cvil disturbance in the UK, I just see gangs of laughing children playing dangerous games with the police.

The political element is why are the parents and police not doing anything? There seems to be a bit of blind eye turning. Maybe hoping the kids actions will cause the politicians to rethink their policies. Especially police cuts.

Bill said:

“When a US citizen (this applies in any sovereign nation) pays their taxes the conceptual chain of events is that the central bank accounts for the payment (acknowledging the tax credit) and informs the Treasury that the tax obligation has been eliminated. The dollars don’t go anywhere! The scores are adjusted – that is it. So the central bank crediting behaviour creates assets in the non-government sector which sit in reserves held by the member banks”

Over on Pragmatic capitalist a few of us have worked thru deficit spending a little in the USA. By law The US government cannot deficit spend without first having created savings in the form of bonds. Tax dollars credited to the treasury therefore are required or more savings must by law be created in the form of bonds for every tax dollar that ‘goes nowhere’.

When the US government deficit spends it creates an iou for the tax payer and an iou for the bond buyer. If there is no deficit it credits tax payers and debits tax payers.

If you say tax credits go nowhere it is just ignoring the realities of electronic money and their accounting and produces nothing of substance surely??

We can also say nothing is taken from our accounts when we pay taxes. Nothing is taken and nothing goes nowhere because as often as not taxes are no longer paid with physical money.

But what meaning do we wish to create by saying taxes go nowhere??? The law is very clear on this issue.

“The US government cannot deficit spend without first having created savings in the form of bonds”

Those bonds are just a Treasury liability the same as a dollar bill. If you imagine them as just currency bills with different colours you’ll see that the Treasury swaps blue money for green money because the rules say that need to keep a positive balance of green money.

And the positive balance of green money only applies at clearing. The system will fudge to make that happen so that it appears all the rules have been kept.

But has the debt ceiling debate showed last week, the computer systems have no mechanism to prevent a Treasury payment from occurring, and there is nobody in the bank who is prepared to decline a Treasury payment. So the point is moot – it’s a charade.

Neil

What matters is that the bond saver has a valueable spendable money. If he thinks otherwise he dumps that bond and interest rates rise – no different to what just happened for Italy.

Luis Enrique: “We already have monetized government debt on a massive scale without causing inflation, but we’ve done it with the expectation that it is only a temporary expansion of the CB balance sheet, that will last as long as the output gap does, roughly speaking. What I want to see is evidence that we can do it under the expectation that the debt is effectively written-off, i.e. that it’s going to stay on the CB balance sheet and be rolled over in perpetuity, without causing inflation.”

Well, I would like to see evidence that having money that we do not pay interest on is inflationary. 🙂

“What matters is that the bond saver has a valueable spendable money. If he thinks otherwise he dumps that bond and interest rates rise – no different to what just happened for Italy.”

It is different. With US bonds you have to sell that US bond to somebody with US dollars. So all that happens is that you swap the bond with somebody who wants a bond for some money.

In Italy it is different because they can swap Italian Bonds for German Bonds, both of which are denominated in the same currency. So you back a different Euro government.

You can move your money to back a different Euro government and still remain in the Euro. You can’t move your money to back a different government and remain in US dollars.

And of course the secondary market only has an indirect influence on the primary market.

Neil

The situation is essentially the same thing. The US bond holders would no longer want US dollars they would want anoother asset like gold, euros or German bonds. Bond holders would sell and get less dollars than they want and yields would be higher therefore compensating those who have taken on the inflationary risk . Newly issued bonds would have to be issued at the current yield to attract buyers.

However who will be the bail out entity?

“Newly issued bonds would have to be issued at the current yield to attract buyers.”

And yet there is no evidence that happens in any of the sovereign nations as the sectoral balances and MMT’s causality suggests.

Fundamentally the system doesn’t operate according to the model you have in mind.

>>there is no evidence that happens in any of the sovereign nations as the sectoral balances and MMT’s causality suggests.

Could you expand that a little bit please? I assume you are not saying that bond yields are not related to demand for bonds?

Hi,

not directly related, but how fits this explanation in the current debate?

http://krugman.blogs.nytimes.com/2011/08/11/franc-thoughts-on-long-run-fiscal-issues/

Regards Gerhard

luis enrique

“I’d really like to see the evidence that the central bank can monetize government on a significant scale without causing inflation. ”

http://www.monetary.org/wp-content/uploads/2011/08/yamaguchipaper.pdf

On the Workings of a Public Money System

Superb, really very good!

I have often wondered what would happen if the resources really did start to run out while among the super-rich there were individuals with more spending power than nations – I could only ever come to the conclusion of revolution.

However, this might be an optimistic turn in events:

http://www.guardian.co.uk/uk/2013/apr/03/offshore-secrets-offshore-tax-haven

32 trillion in “private” funds just waiting for a law, not a revolution, to reset the balance a little.

Wow, great article.

Have you writen about the Comprehensive Annual Finance Report (CAFR) of the United States, the individual States, Municipalities, School Districts, Library Districts and the like. I would love to get your thoughts on that. Anyones thought? No one seams to care about the trillions of dollars we have in unrestricted funds that won’t be used for anything but an investment vehicle for the Corporation. BTW, All goverenment entities are a Corporation and are requried by law to file a CAFR. And they do, LOOK at your local Municipalities CAFR and see for your self where the money is kept.

Thanks