These notes will serve as part of a briefing document that I will send off…

Japan will (yet) run out of money. Never!

A regular occurrence is the prediction of doom for Japan. Some minor upturn in Japanese government bond yields or a movement in some other irrelevant financial statistic relating to the Japanese public sector sends the financial press into apoplexy. The latest signal of impending bankruptcy being bandied about relates to the rising trend in foreign holdings of short- and longer-term Japanese government debt. This trend is explained by financial markets moving into less risky assets (in this case, Japanese government bonds) as uncertainty in other markets, for example the Eurozone, remains. However, the narrative then goes that eventually these purchasers will refrain from buying Japanese government debt and with the funding from the savings of the ageing domestic population drying up, the Japanese government will run out of money. Policy response? Cut fiscal deficits immediately through a combination of tax rises and spending cuts. All of which is nonsense and if the Japanese government follows the advice – there will be a 1997-style recession and public debt ratios will just rise faster than they are at present. It is better that we now all turn to the sport’s section of whatever news you read and relax.

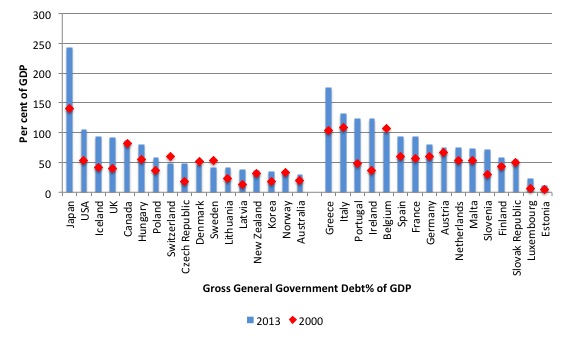

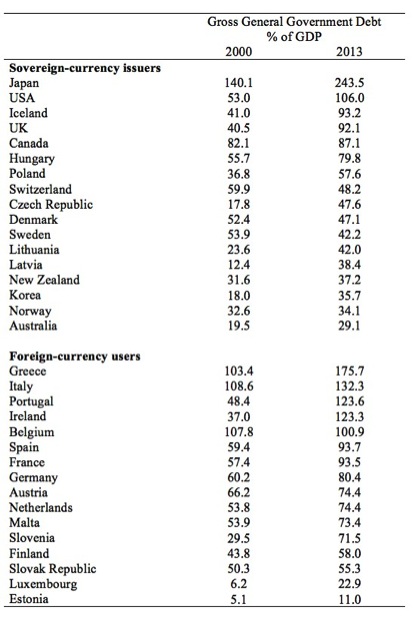

The following graph and accompanying table (taken from the IMF WEO database as at October 2013) shows the gross general government debt as a percent of GDP for 2000 and 2013 for two separate groups of nations: (a) the sovereign-currency issuers; and (b) the foreign-currency users in the Eurozone.

The countries are just a selection of those in the advanced world. Note that I’ve included Denmark, Lithuania, and Latvia in the sovereign nations even though they peg their currencies to the Euro. Clearly, they still issue their own currencies and could break the peg any time they chose.

Most commentators choose to quote statistics relating to gross public debt, which is defined by the IMF as:

… all liabilities that require payment or payments of interest and/or principal by the debtor to the creditor at a date or dates in the future.

This focus on gross debt ratios suits most of the commentators because they are larger than the net debt ratios and thus allows for more alarmist headlines.

If such a table appeared in an IMF, OECD, Fox news, Financial Times or any other similar publication then the separate groups of nations would be conflated into one list.

Comparisons then would be typically drawn along the lines that USA, the UK etc are in danger of becoming like Greece, Italy, Portugal or Ireland and as a consequence will need to tighten their fiscal positions.

The new Australian Treasurer even had the audacity to suggest that Australia was heading down the Greek path so large was our public debt. His comments just revealed how unqualified he is for the position he now holds.

The reality is that the countries in the first list have no public debt problems – that is, no risk of insolvency unless some of the debt is denominated in foreign currencies.

Note, that the last statement is quite different to saying that foreigners have bought some of the public debt issued by those nations. The country of origin of the debt holders is largely irrelevant.

For a government to be fully sovereign – which means that its liabilities are risk-free – it must only issue debt in its own currency and offered no guarantees with respect to convertibility of payments in any other currency.

All the nations in the second list (and any other nation that use a foreign currency as their domestic currency unit – that is, dollarised nations etc) – carry default-risk every time they issue a liability in their own name, irrespective of the currency that the liability is the nominated in.

In other words, all the liabilities they issue at a nominated in foreign currencies. Certainly, the Eurozone nations have taxation powers to impose obligations on their citizens that can only be relinquished in Euros. But any shortfall in taxation revenue relative to their spending must be met with debt-issuance, which means they have to borrow from the external bond markets.

The nations in the first list do not have to borrow from the private bond markets and do so as a matter of convention rather than necessity. The borrowing arrangements that these nations follow are voluntary and can be changed by regulation and/or legislation.

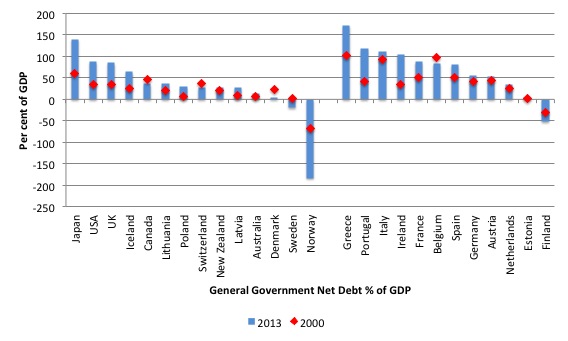

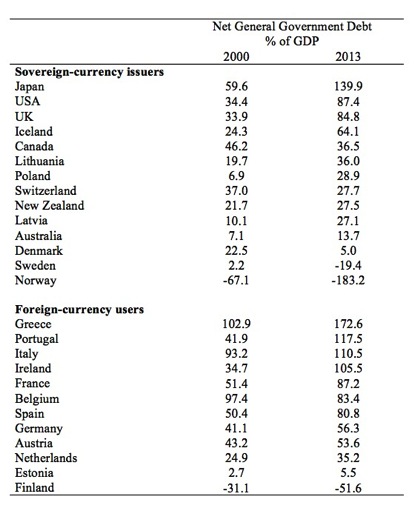

The second graph and accompanying table shows the net positions for the two groups of nations (noting that in some cases there was no net debt data available).

The IMF define net debt as:

… gross debt minus financial assets corresponding to debt instruments. These financial assets are: monetary gold and SDRs, currency and deposits, debt securities, loans, insurance, pension, and standardized guarantee schemes, and other accounts receivable.

You can see why the commentators focus on gross debt ratios – they are much larger and support catastrophe predictions more easily.

All this tells you, is that before you take into account the financial assets, that say Japan holds, it has outstanding liabilities equal to 243.5 per cent of its GDP in 2013 (noting this is an estimate by the IMF for the full year). Once you take the net position for Japan, its outstanding net liabilities drops of stately to 139.9 per cent of its GDP.

Even using the logic of the doomsayers, the net positions are substantially different to the gross positions in most cases. And remember, the world economy has been caught in the grip of the worst downturn for 80 years over the period examined.

I offer this data for interest only. I don’t think the data for public debt ratios for sovereign-currency issuing nations is very interesting at all, unless there is evidence that the nation is issuing the debt in foreign currencies, offering guarantees of convertibility to a foreign currency, indexing it in anyway to a foreign currency, or any other such nonsensical arrangement of the type that the IMF has pushed on to nations in the past.

The point is that any time you see an article or research paper that conflates nations in these two lists then you would be better turning to the sports section (or the design section, lifestyle section, or whatever is your taste) because the narrative that will follow will be spurious.

Which brings me to a paper recently published by the US National Bureau of Economic Research – Why has Japan’s Massive Government Debt Not Wreaked Havoc (Yet)?.

The link provided is to a page at the University of the Philippines where one of the authors is affiliated. The NBER insist on charging for the papers, which I suppose is a good idea given the basic law of demand is that quantity demanded declines as price rises. In other words by imposing a price less people will read the papers published, which means less people are brainwashed by the spurious mainstream outpourings.

Anyway, the bracketed part of the paper’s title – (Yet) – tells you everything.

Once again the denial of my profession is at work. For years, Japan has been demonstrating the failure of mainstream macroeconomics to predict anything useful. Mainstream macroeconomists have consistently been predicting that inflation would accelerate, that interest rates would sky-rocket and that the bond markets would stop buying government debt, and in the more extreme cases, that the Japanese government would declare itself bankrupt.

For example, one morning in April 11, 2010 I awoke to the headlines – Risk of Japan going bankrupt is real say analysts.

They tore down trees to print that newspaper!

The article’s opening sentence was:

Greece’s debt problems may currently be in the spotlight but Japan is walking its own financial tightrope …

So the first rule – the conflation of monetary systems – would mean no intelligent, educated person should read beyond that statement.

Then some Japanese stooge in the financial markets was quoted:

Japan “can’t finance” its record trillion-dollar budget passed in March for the coming year as it tries to stimulate its fragile economy …

I hope he (it was a male) was sacked for professional mal-practice.

Then a ratings agency warning was provided – “Standard & Poor’s in January warned that it might cut its rating on Japanese government bonds which could raise Japan’s borrowing costs” – again false advice – who got sacked over that?

Another so-called “bond strategist” quoted claimed:

Japan’s risk of default is low because it has a huge current account surplus, with the backing of private sector savings …

Which was a blatant lie – either the commentator – was deliberately lying to enhance the outlook for his company or he doesn’t have a clue – maybe both.

The risk of default has nothing to do with the external balance of private sector saving ratios.

The requirements for a sovereign currency-issuer with no default-risk are:

1. Issues its own currency.

2. Floats it on international markets – no pegs, etc.

3. Doesn’t borrow in any other currency.

4. Doesn’t offer any guarantees of convertibility to another currency.

That is why Japan has zero (not low) default risk.

Anyway, back to the NBER paper, which is really just more of the same. But it seems to be getting a fair amount of attention among financial commentators – much to their discredit.

None of the mainstream predictions – which have been around for at least 20 years already – have borne any resemblance to reality. When does a degenerating research program (a la Lakotos) become total defunct and ignored? That should have happened decades ago – say around 1971, when the advanced world mostly abandoned the Bretton Woods currency arrangements.

So the – (Yet) – is indicative of the denial – despite the reality and the continual empirical rejection of the mainstream predictions – they can’t quite give up on the notion that eventually catastrophe will result. For if they did – then they have to admit the whole edifice of their theoretical framework is flawed.

The paper opens thus:

Arguably the most momentous economic event in the world during the 2010-2012 period was the eurozone sovereign debt crisis …

Conflation warning – this is a paper about Japan remember.

The second paragraph opens thus:

However, the (potential) sovereign debt crisis in Japan looks even more serious than those in the eurozone economies …

Conflation achieved – stop reading. The rest will be spurious nonsense – nothing better than propaganda.

Note the – (potential) – this sort of narrative construct is accompanied by contingent claims such as “might”, “could”, “may” – and reflects the fact that these characters are so scorched from empirical failure that they creep around their offices trying to raise alarm but the daily data stares them down … and so they hedge.

What potential crisis?

A list (Table 1) is presented in the paper for the gross general government debt-to-GDP ratio but unlike my graph and tables the list conflates nations with different monetary systems where the difference is the “all to play for” division between those with zero risk and those who use foreign currencies.

We learn irrelevant statistics – “Japan’s gross general government debt-to-GDP ratio is more than twice the OECD-wide average (108.8 percent) and by far the highest in the developed world” – to which we, as informed readers, yawn and turn to the sport’s pages (or your preferential alternative).

As so-called scholarship, this paper reaches new lows.

They then pose what they think is the number 1 question: “Why has Japan been able to avoid the fiscal crises of the magnitude faced by the PIIGS economies even though her gross general government debt-to-GDP ratio is much higher?”

And offer the answer people are reluctantly using – “domestic saving is much higher (relative to domestic investment) and homebias is much stronger in Japan” – to cover up their lack of understanding.

They accept that argument but then add their own “insight” (trends in Japanese bond ownership) and conclude:

… that the surge in foreign holdings of Japanese government securities will subside (in fact, it already has), and this, combined with the projected decline in domestic saving (especially household saving) caused by population aging, will make it necessary for Japan to get its fiscal house in order. Thus, Japan’s massive government debt has not wreaked havoc in the past because of robust domestic saving and a temporary inflow of foreign capital caused by the Global Financial Crisis, but it may wreak havoc in the future as both of these factors become less applicable unless the government debt can be brought under control.

All of which will be shown to be irrelevant in the decade to come.

The facts it reports are:

1. “private banks have been by far the dominant holder of short-term government securities throughout the 2000- 2011 period, with their share fluctuating in the 50 to 90 percent range and far exceeding the shares of the Bank of Japan, government financial institutions, the general government, foreign holders, and other sectors”.

2. “private banks have been by far the dominant holder of medium- and long-term government securities throughout the 2000-2011 period, as in the case of short-term government securities, but their share (30 to 45 percent) has been far lower than in the case of short-term government securities, and government financial institutions, insurance companies, the Bank of Japan, and public pensions have also held relatively large shares, at least during certain periods”

Are you noting the “Bank of Japan” and “government financial institutions” in the list of investors. The government investing in itself! The paper actually admits that significant private investors in public bonds (such as the Japan Postal Bank) are 100 per cent government owned. Government investing in itself.

They conclude that “the high and rising share of private investors in total government debt is largely illusory”. Government investing in itself.

3. A rising share of foreign holdings since 2000 “implies greater risk of capital flight since short-term securities are more liquid than medium- and long-term securities”. What does capital flight mean here? That these foreign owners will sell their bonds to – whom? Or on maturity convert the yen held in Japanese banks to some foreign currency? So what? No productive asset will leave the Japanese economy!

4. “the share of foreign holdings of government securities increased in the case of both short-term and medium- and long-term government securities but increased much more sharply and was often more than twice as high in the case of short-term government securities than in the case of medium- and long-term government securities”.

Which means … “that although Japan was able to “buy time” by inducing foreign investors to invest temporarily in Japanese government securities, the Japanese government still needs to get its fiscal house in order, preferably sooner rather than later”.

Why? Presumably because these investors will buy other assets once the risk in international markets subsides. What then? If all else failed the Japanese government could just buy more of its own debt – to near infinity. End of discussion.

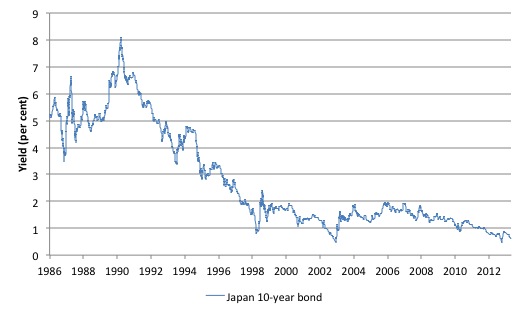

You might like to refresh your memory of the history of the Japanese 10-year bond yield since it was first issued on July 5, 1986 to yesterday (May 27, 2013). The daily data (all 10,158 observations) is available from the – Ministry of Finance).

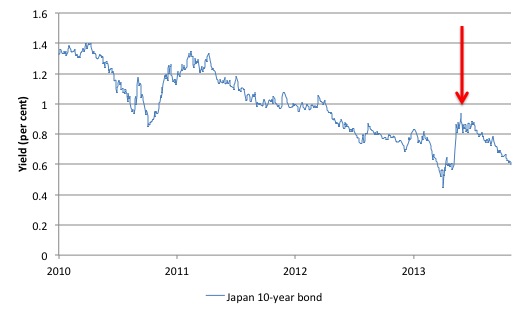

Now in May 2013, the commentators went ballistic – that little upturn in the yields (red arrow) – sent them apoplectic and the predictions were that the – (Yet)! – was finally manifesting.

The bond markets were finally calling in the piper and unless the Japanese government instituted a major fiscal austerity campaign all hell would break loose with respect to yields. At the time I commented – noting this was all nonsense.

Please read my blog – The last eruption of Mount Fuji was 305 years ago – for more discussion on this point.

Here is the close up from 2010 to the end of October (31/10/2013). The explosion in yields predicted in May didn’t seem to pan out.

We also learned at that time that the Bank of Japan was buying up government debt at its leisure, from which we conclude that the Bank of Japan is a monopoly supplier of bank reserves denominated in Yen.

There was a reference to this capacity in a 2004 paper written by Ben Bernanke and colleagues – Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment.

The authors examine the future of monetary policy when short-term interest rates, the principle tool of monetary policy get close to zero (as they are now).

They discuss various strategies that a central bank can take to alter the composition of its balance sheet “in order to affect the relative supplies of securities held by the public.”

That is, the amount of bonds held by the non-government sector.

The authors noted that:

Perhaps the most extreme example of a policy keyed to the composition of the central bank’s balance sheet is the announcement of a ceiling on some longer-term yield, below the rate initially prevailing in the market. Such a policy would entail an essentially unlimited commitment to purchase the targeted security at the announced price.

And would completely control longer maturity yields – which means end of scary future a la the neo-liberal economists who seek public attention but cannot tell the same public the truth.

The above authors (Bernanke et al) also state (in a footnote on page 25) that:

In carrying out such a policy, the Fed would need to coordinate with the Treasury, to ensure that Treasury debt issuance policies did not offset the Fed’s actions.

Which means that the two arms of government operate as a consolidated policy sector and target the same aim – maximisation of public purpose.

Mainstream economists have eschewed this sort of balance sheet strategy and claim that the only way this could be successful would be if it ratified what the market wanted anyway. That is, the only way the central bank could “enforce a ceiling on the yields of long-term Treasury securities” would be if the “targeted yields were broadly consistent with investor expectations about future values of the policy rate” (quote from paper).

The last conclusion is incorrect.

It comes from economists who mostly use “frictionless financial market” models where there is no time or transaction costs and everyone has perfect information and equal access. Clearly that sort of model has nothing to say about the real world we live in.

But more importantly, the only consequence of a discrepancy between the targeted yields and the market expectations of future yields (that is, the bond traders considered rates would rise eventually) would be that the “central bank would end up owning all or most of the targeted security.” (quote from paper).

My assessment of that outcome – excellent.

The bond traders might boycott the issues and “force” the central bank to take up all the volume on offer. So what? This doesn’t negate the effectiveness of the strategy it just means that the private buyers are missing out on a risk-free asset and have to put their funds elsewhere.

Their loss!

Eventually, if the government bond was the preferred asset the bond traders would learn that the central bank was committed to the strategy and would realise that if they didn’t take up the issue the bank would. End of story – the rats would come marching into town piped in by the central bank resolve.

The authors also suggest that it is possible that:

… even if large purchases of, say, a long-dated Treasury security were able to affect the yield on that security, the possibility exists that the yield on that security might become “disconnected” from the rest of the term structure and from private rates, thus reducing the economic impact of the policy.

That is possible. The corporate rates which reflect risk as well as inflationary expectations might deviate.

The overall point is that when there are transaction costs and “financial markets are incomplete in important ways”, the central bank can influence “term, risk, and liquidity premiums – and thus overall yields.”

The authors note that historically the strategy has been successful in a number of countries and give examples. Among the examples, they consider the “historical episode” that became known as “Operation Twist”.

I considered the issue of how the central bank can control the bond yield curve at all maturities in this blog – Operation twist – then and now.

So there is never a situation where the bond markets can destroy a nation which has currency sovereignty. Never means NEVER.

Conclusion

Another day of humiliation for the mainstream economics profession!

New government fails – already

The ABC News quoted the new federal immigration minister today in the story – Scott Morrison says Indonesia’s asylum seeker stance has ‘no rhyme or reason – who is trying to back away from the monumental policy failure of the new government in the last few days.

Prior to the election the conservatives were touting their capacity to “turn back the boats” claiming no boat would get through.

Indonesia saw to it that the conservative boasting was hot air – now we are once again taking boats and then locking the poor souls and their children up in perniciously inhumane circumstances.

The Minister’s comment today:

It’s very frustrating … there’s no real rhyme or reason to it, necessarily. This last instance became very problematic because it went very public …

Yes, it is a problem isn’t it that the public find out about these things. Better for them that nothing gets out and they just continue to abuse human rights without any of us knowing. We can then just concentrate on going shopping and when we have some political input it can be directed at vilifying the unemployed or our indigenous citizens.

Total disgrace.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

“The reality is that the countries in the first list have no public debt problems – that is, no risk of insolvency unless some of the debt is denominated in foreign currencies.”

for some countries, it is better to default on the debt denominated even in domestic currency than to monetize it (Jamaica recently: http://online.wsj.com/article/BT-CO-20130301-709720.html).

And part of the debt of former communist countries has been denominated in foreign currencies, mainly due to lower interest rates for eurobonds compared to the interest rates for bonds issued in domestic currency.

The aftermath of the North Pacific Fiat Mania has set in, Bill.

Banksters, having seen what happens when the Middle Class gets control of their own fiat, have been burned, and vow to never let it happen again.

Thanks – I am starting to track failed predictions of the collapse of the JGB market, and I had not seen this one yet.

I don’t understand why people think that a small switch to a current account deficit means that Japan is suddenly “dependent” upon foreigners. Even if the switch to a current account deficit of 1% of GDP, I imagine they could go a few decades running down foreign currency assets held by Japanese entities (I haven’t looked up the numbers yet). (And of course, on the bond market side, that’s ignoring the elephant in the room – control of the currency they are borrowing in. But it could matter for the external value of the yen.)

MMT has become detached from the physical reality of the world around us.

Japan like Europe is a entrepot economy – it depends on vast external primary goods inputs to make its products……Europe can centralize its “value added operations” by destroying peripheral nations within its system piece by piece ….what can Japan do ?

Its one of the last large homogeneous societies on Earth….. self – destruction on a European scale is not possible under such conditions as there is no “The other”….. so unlike Europe it is likely to implode all at once rather then the slow decay we have seen over the previous 3 or 4 decades.

Who is publishing these papers? Predictive subordinate injunctions have no place in academic writing. Saying ‘if x occurs, then y’ in a statistics based environment is totally pointless, you could argue that any outcome is possible if you vary the sample environment and make enough assumptions in your model. Surely the reviewers can see that in these cases the academics are trying desperately to make the data fit the theory.

Bill, given Japan’s demographics, it seems eventually they will be drawing down their savings. Can you (or someone) please analyze how that is likely to play out? It could be trouble, and then you will hear ‘I told you so’. If there is a problem it will be the lack of productivity of a society with so many retired persons, but that won’t stop people from putting the blame on ‘too much debt’.

@SteveK9

So long as Japan makes sufficient investments to maintain productivity I wouldn’t worry about depletion of savings. I might be concerned about potentially falling corporate profits, however, as machines continue to replace humans and firms can no longer extract the surplus value provided by the labor force.

Savings????????

What is savings????????????

Savings is deferred expenditure!!!!

In what??????

Why, in the currency issued by the sovereign!!!!!

So, what do the public invest their savings in??????????

If they want total security of principal and interest….. they invest in sovereign bonds!!!!!!!!!!

Becasuse………………..

The currency issuing sovereign………. can ALWAYS pay up!!!!!!

Missed………………….

Is the real issue!!!!

Domestic production of goods and services!!!!!!!!!!!!!!

It is in the sovereign’s interest to maximize domestic production of goods and services!!!!!

Through………….

Exchange rate manipulations……….. and taxes on imports (customs duties)…….

Because………………

Domestically produced goods and services are always purchasable by the Sovereign using his own currency!!!!

INDY

Is this guy’s main point that a government can’t default on a debt in its own currency? Perhaps a hard money default is unlikely (although possible) but a soft default through inflation is possible and in fact very likely. The loss in purchasing power for the creditor and likely damage to the economy is roughly the same so to some extent it’s a distinction without a huge difference.

The difference between gross and net debt is important and rarely really explained which makes me think the authors don’t really understand it. People were saying with Fannie and Freddie debt now effectively government liabilities that debt went way up. But the mortgages owned almost completely offset the liabilities so the difference is small and little addition to net debt which is the key. But only liquid assets should count or at least you need to know what assets are the offset to gross to get net.