Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – May 25, 2013 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

The government can run budget surpluses and still satisfy the private domestic sector desire to save overall as long as the external sector is in surplus.

The answer is False.

This is a question about the relative magnitude of the sectoral balances – the government budget balance, the external balance and the private domestic balance. The balances taken together always add to zero because they are derived as an accounting identity from the national accounts. The balances reflect the underlying economic behaviour in each sector which is interdependent – given this is a macroeconomic system we are considering.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

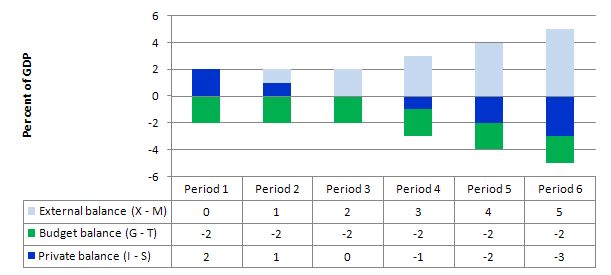

The following graph with accompanying data table lets you see the evolution of the balances expressed in terms of percent of GDP. In each period I just held the budget balance at a constant surplus (2 per cent of GDP) (green bars). This is is artificial because as economic activity changes the automatic stabilisers would lead to endogenous changes in the budget balance. But we will just assume there is no change for simplicity. It doesn’t violate the logic.

To aid interpretation remember that (I-S) > 0 means that the private domestic sector is spending more than they are earning; that (G-T) < 0 means that the government is running a surplus because T > G; and (X-M) < 0 means the external position is in deficit because imports are greater than exports.

If the nation is running an external surplus it means that the contribution to aggregate demand from the external sector is positive – that is net addition to spending which would increase output and national income.

The external deficit also means that foreigners are decreasing financial claims denominated in the local currency. Given that exports represent a real cost and imports a real benefit, the motivation for a nation running a net exports surplus (the exporting nation in this case) must be to accumulate financial claims (assets) denominated in the currency of the nation running the external deficit.

A fiscal surplus also means the government is spending less than it is “earning” and that puts a drag on aggregate demand and constrains the ability of the economy to grow. So the question is what are the relative magnitudes of the external add and the budget subtract from income?

In Period 1, there is an external balance (X – M = 0) and then for each subsequent period the external balance goes into surplus incrementing by 1 per cent of GDP each period (light-blue bars).

You can see that in the first two periods, private domestic saving is negative, then as the demand injection from the external surplus offsets the fiscal drag arising from the budget surplus, the private domestic sector breakeven (spending as much as they earn, so I – S = 0). Then the demand add overall arising from the net positions of the external and public sectors is positive and the income growth would allow the private sector to save. That is increasingly so as the net demand add increases with the increasing external surplus.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Saturday Quiz – June 19, 2010 – answers and discussion

Question 2:

Central bankers are talking about the possible need for more quantitative easing to ease the aggregate demand losses associated with the implementation of fiscal austerity programs. However QE cannot be compared to a net fiscal injection because it creates no new net financial assets in the currency of issue.

The answer is True.

Quantitative easing then involves the central bank buying assets from the private sector – government bonds and high quality corporate debt. So what the central bank is doing is swapping financial assets with the banks – they sell their financial assets and receive back in return extra reserves. So the central bank is buying one type of financial asset (private holdings of bonds, company paper) and exchanging it for another (reserve balances at the central bank). The net financial assets in the private sector are in fact unchanged although the portfolio composition of those assets is altered (maturity substitution) which changes yields and returns.

In terms of changing portfolio compositions, quantitative easing increases central bank demand for “long maturity” assets held in the private sector which reduces interest rates at the longer end of the yield curve. These are traditionally thought of as the investment rates. This might increase aggregate demand given the cost of investment funds is likely to drop. But on the other hand, the lower rates reduce the interest-income of savers who will reduce consumption (demand) accordingly.

How these opposing effects balance out is unclear but the evidence suggests there is not very much impact at all.

You should read the answer to Question 2 to reflect on how fiscal policy adds net financial assets to the non-government sector by way of contradistinction to QE.

The following blogs may be of further interest to you:

- Money multiplier and other myths

- Islands in the sun

- Operation twist – then and now

- Quantitative easing 101

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

Question 3:

The expansionary impact of deficit spending on aggregate demand is lower when the government matches the deficit with debt-issuance because then excess reserves are drained and the purchasing power is taken out of the monetary system.

The answer is False.

The mainstream macroeconomic textbooks all have a chapter on fiscal policy (and it is often written in the context of the so-called IS-LM model but not always).

The chapters always introduces the so-called Government Budget Constraint that alleges that governments have to “finance” all spending either through taxation; debt-issuance; or money creation. The writer fails to understand that government spending is performed in the same way irrespective of the accompanying monetary operations.

They claim that money creation (borrowing from central bank) is inflationary while the latter (private bond sales) is less so. These conclusions are based on their erroneous claim that “money creation” adds more to aggregate demand than bond sales, because the latter forces up interest rates which crowd out some private spending.

All these claims are without foundation in a fiat monetary system and an understanding of the banking operations that occur when governments spend and issue debt helps to show why.

So what would happen if a sovereign, currency-issuing government (with a flexible exchange rate) ran a budget deficit without issuing debt?

Like all government spending, the Treasury would credit the reserve accounts held by the commercial bank at the central bank. The commercial bank in question would be where the target of the spending had an account. So the commercial bank’s assets rise and its liabilities also increase because a deposit would be made.

The transactions are clear: The commercial bank’s assets rise and its liabilities also increase because a new deposit has been made. Further, the target of the fiscal initiative enjoys increased assets (bank deposit) and net worth (a liability/equity entry on their balance sheet). Taxation does the opposite and so a deficit (spending greater than taxation) means that reserves increase and private net worth increases.

This means that there are likely to be excess reserves in the “cash system” which then raises issues for the central bank about its liquidity management. The aim of the central bank is to “hit” a target interest rate and so it has to ensure that competitive forces in the interbank market do not compromise that target.

When there are excess reserves there is downward pressure on the overnight interest rate (as banks scurry to seek interest-earning opportunities), the central bank then has to sell government bonds to the banks to soak the excess up and maintain liquidity at a level consistent with the target. Some central banks offer a return on overnight reserves which reduces the need to sell debt as a liquidity management operation.

There is no sense that these debt sales have anything to do with “financing” government net spending. The sales are a monetary operation aimed at interest-rate maintenance. So M1 (deposits in the non-government sector) rise as a result of the deficit without a corresponding increase in liabilities. It is this result that leads to the conclusion that that deficits increase net financial assets in the non-government sector.

What would happen if there were bond sales? All that happens is that the banks reserves are reduced by the bond sales but this does not reduce the deposits created by the net spending. So net worth is not altered. What is changed is the composition of the asset portfolio held in the non-government sector.

The only difference between the Treasury “borrowing from the central bank” and issuing debt to the private sector is that the central bank has to use different operations to pursue its policy interest rate target. If it debt is not issued to match the deficit then it has to either pay interest on excess reserves (which most central banks are doing now anyway) or let the target rate fall to zero (the Japan solution).

There is no difference to the impact of the deficits on net worth in the non-government sector.

Mainstream economists would say that by draining the reserves, the central bank has reduced the ability of banks to lend which then, via the money multiplier, expands the money supply.

However, the reality is that:

- Building bank reserves does not increase the ability of the banks to lend.

- The money multiplier process so loved by the mainstream does not describe the way in which banks make loans.

- Inflation is caused by aggregate demand growing faster than real output capacity. The reserve position of the banks is not functionally related with that process.

So the banks are able to create as much credit as they can find credit-worthy customers to hold irrespective of the operations that accompany government net spending.

This doesn’t lead to the conclusion that deficits do not carry an inflation risk. All components of aggregate demand carry an inflation risk if they become excessive, which can only be defined in terms of the relation between spending and productive capacity.

It is totally fallacious to think that private placement of debt reduces the inflation risk. It does not.

You may wish to read the following blogs for more information:

Hi,

i actually got a question:

If you would alter the wording of question one to “The government can run budget surpluses and still satisfy the private domestic sector desire to save overall as long as the external sectors surplus equals -[(G-T)+(I-S)] .” Would the answer to this question then be: “yes”? I.e. the point of the original question is that external sector surplus alone is a necessary but not a sufficient condition for the two other sectors to be in surplus?

Bill – your snswer to question 2 appers to be incompatible with your answer to question 3.

If the government matches its deficit with debt then it creates no net financial assets, and is therefore comparable to QE.

If the government does not match its deficit with debt then the effect is the same, so it is still comparable with QE.

For question #1 souldnt the answer be true? Doesn’t the word can in “The government can run budget surpluses…” have the same meaning as “It is possible that” in your question? It may be unlikely that it would happen but the question doesnt ask for an assessment of the probabilities.

Aidan: Government deficit spending does create net financial assets, bonds or no bonds, so it’s not the same as QE, which swaps one financial asset for another.

Jerry Brown: But the statement goes on to say why the government ‘can’ run surpluses, and the stated reason is not sufficient, so the statement is false.

It looks like S. Keen has discovered double entry accounting:

http://www.businessspectator.com.au/article/2013/5/27/economy/qe-quantitatively-irrelevent

So if The word “can” in the question was changed to “cant” the answer would always be “true”?

@FlimFlamMan

Would you care to explain how government spending creates net financial assets when the financial liabilities created by the bond are equal to the gross financial assets created by the spending?

Net financial assets are a red herring, as by convention the financial assets created net to zero. What’s important is what’s done with those assets. QE and government deficit spending are indeed different, but they are comparable – and QE compares rather unfavourably because it doesn’t create net real assets the way government deficit spending does.

Aidan,

Yes, financial assets net to zero, but as far as I’m concerned, the only relevant question is in terms of private sector, i.e. the economy excluding public sector. In that case, as government runs budget deficits then it must, *by definition*, mean that some other sector gets the equal amount of surplus. Bonds or no bonds, deficit is deficit, which means that there must be a corresponding financial surplus somewhere else in the economy.

QE doesn’t achieve that as it simply swaps one financial asset with another, hence, no deficits or surpluses created. I hope it helps.

Jerry Brown,

If can were changed to can’t the answer would still be false, since in the right circumstances the government could run a surplus.

Statement from Question 1:

This part is true, depending on the circumstances.

Now we get to those circumstances, and this part is false, since the mere existence of an external surplus is insufficient; it has to be big enough. The precise value of ‘big enough’ will depend on what the private sector is doing.

Aidan,

Assets and liabilities for whom? Both the initial government spending and the bonds are assets for the private sector. Bonds are ever-so-slightly (didn’t want to use the ‘m’ word) less liquid, but they’re still assets.

You want my explanation, so here’s a quick and overly simple one; with any luck Neil Wilson or Bill himself or someone else who knows what they’re talking about will chime in.

Government contracts for the building of some schools and hospitals: £10 billion, not matched by taxes.

Contractor receives money and spends on workers and materials: private sector has an additional £10 billion in financial assets.

Government issues £10 billion of bonds, the purchase of which removes the equivalent amount of cash* from the private sector: private sector still has an additional £10 billion in financial assets; it lost the cash but it has the bonds.

* To simplify things I’ve assumed all the bonds are bought by private individuals in return for cash. If we start including banks and reserves I might have to draw a table.

Net financial assets are far from a red herring; they are the fundamental difference between QE and deficit spending. Financial assets created by the private sector net to zero. Government, as the issuer of the currency, can create financial assets with no corresponding private sector liability.

Well of course you can compare any one thing any other thing, but that’s not the typical usage of the word ‘comparable’. Other than that though, I agree. I’d say QE compares extremely unfavourably with deficit spending when economies, people, are facing the conditions we see in many nations today.

FlimFlamMan- Well I want half credit on my wrong answer dammit and you are making that most difficult!

Ahh, Jerry, if I had a penny for every time I’ve sat here, bargaining with the imaginary Bill in my head over the answer[s] to a Saturday Quiz; “Well, yes, I see what you mean there Bill, but if you consider that I was thinking…”. Sadly, even the Bill in my head never gives half credit.

I comfort myself with the knowledge that I can only get 3 wrong at a time now. Remember when there were 5 questions? Dark days.

” Government, as the issuer of the currency, can create financial assets with no corresponding private sector liability.”

Only if you separate the government sector from the non-government sector.

If you don’t do that then everything nets to zero.

The dividing line between government sector ‘currency issuer’ and non-government sector ‘currency user’ is an MMT division that many others do not use or do not agree with.

Neil Wilson,

Isn’t it exactly the reason why Bill put “private sector liability” there as opposed to “domestic liability” or whatever?