It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

Unemployment and Inflation – Part 9

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text during 2013 (to be ready in draft form for second semester teaching). Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

This is the continuation of the Chapter on unemployment and inflation – the series so far is:

- Unemployment and inflation – Part 1

- Unemployment and inflation – Part 2

- Unemployment and inflation – Part 3

- Unemployment and inflation – Part 4

- Unemployment and inflation – Part 5

- Unemployment and Inflation – Part 6

- Unemployment and Inflation – Part 7

- Unemployment and Inflation – Part 8

I am now continuing the discussion of the Phillips Curve …

Chapter 12 – Unemployment and Inflation

MATERIAL HERE NOT REPEATED

[PICKING UP FROM HERE]

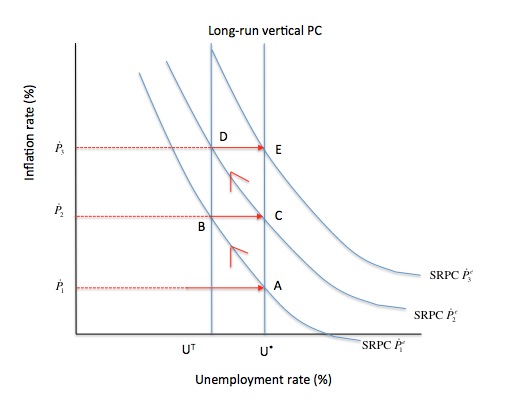

Figure 12.11 captures the accelerationist hypothesis. The short-run Phillips curves are shown conditional on a specific expectation of inflation held by the workers. The superscript e denotes “expected” inflation. We use the terminology, expectations are realised to denote a state where the expectations formed are equal to the actual outcome.

Figure 12.11 The expectations-augmented long-run Phillips curve

Start at Point A, where the inflation rate is Pdot1 and the unemployment rate is at its so-called “natural rate” (U*). At this point, the inflationary expectations held by workers (Pdote1) are consistent with the actual inflation rate Pdot1. According to Friedman, the labour market will be operating at the natural rate of unemployment, whenever inflationary expectations are realised.

To see how the accelerationist hypothesis plays out, we assume that the government is under political pressure and forms the view that U* unemployment rate is too high. It believes it can use expansionary fiscal and monetary policy to achieve a lower target rate of unemployment, UT. They also think they can exploit the Phillips Curve trade-off and move the economy to Point B, with an inflation rate of Pdot2 as the “cost” of the lower unemployment rate.

As a consequence government stimulates nominal aggregate demand to push the economy to point B. The increased demand for labour pushes up the inflation rate (to Pdot2) and money wage rates also rise in the labour market. The accelerationist hypothesis assumes that the price level accelerates more quickly than money wages and as a consequence the real wage falls.

The Monetarists resurrected the Classical labour market and placed it at the centre of their attack on Keynesian macroeconomics. Accordingly, firms will offer more employment because the real wage has now fallen and they can still profit maximise at the lower level of marginal productivity.

Why would workers supply more labour if the real wage was falling? In the Classical labour market it is assumed that labour supply is a positive function of the real wage so workers will withdraw labour if the real wage falls.

The Monetarist approach overcome that seeming problem by imposing asymmetric expectations on the workers and firms. The firms were assumed to have complete price and wage information at all times so they knew what the actual real wage was doing at any point in time.

However, the workers were assumed to gather information about the inflation rate in a lagged or adaptive fashion and thus could be fooled into believing that the real wage was rising when, in fact, it was falling.

Thus, workers are assumed to be initially oblivious to the rising inflation – that is, their inflationary expectations do not adjust to the actual inflation rate immediately. As a consequence they mistake the rising nominal wages for an increasing real wage and willingly supply more labour even though the real wage has actually fallen.

The central proposition of the Classical labour market is that workers care about real wages not money wages. The accelerationist hypothesis added the idea that workers form adaptive expectations of inflation, which means that it takes some time for them to differentiate between movements in money wages and movements in real wages.

Monetarists asserted that Point B is unstable and can only persist as long as workers are fooled into believing the money wage increases they received were equivalent to real wage increases.

But inflationary expectations adapt to the actual higher inflation rate after a time. Once the workers increase their inflationary expectations to Pdote2 then the SRPC shifts out and the labour market settles at Point C when the new expectations catch up with the higher inflation rate (Pdot2).

The path the labour market takes as it inflationary expectations adjust to the actual inflation rate and the short-run Phillips curve shift (that is, from Point B to Point C or Point D to Point E) is an empirical matter. But for Monetarists, once inflationary expectations have fully adjusted to the current inflation rate (at Points C and E, for example), the economy will return to the natural rate of unemployment (U*), irrespective of government attempts to target the lower unemployment rate.

For Friedman, the short-run dynamics of the labour market were driven by the capacity of the government to “fool” workers into believing the inflation rate was lower than the actual inflation rate. As long as some of the inflation rate is unanticipated by workers, the government can maintain the unemployment rate below the natural rate but at a costs of rising inflation.

This narrative seeks to explain mass unemployment in the same way. The Friedman story is that mass unemployment occurs when workers refuse to accept money wage offers that they think generate a real wage below the actual real wage consistent with these offers. Workers think the real wage implied by the wage offers is too low because they wrongly believe that inflation is higher than it is. That is, their inflationary expectations exceed the actual inflation rate.

As a consequence, they start quitting their jobs and/or refuse to take new job offers thinking it is better to search for higher real wage paying positions. Once they realise they have mistakenly thought inflation was higher than it actually is, they start to accept the job offers at the current money wage levels and increase their labour supply.

Friedman thus was forced to explain changes in unemployment in terms of swings in the supply of labour, driven by misconceptions of what the actual inflation rate was. And at the empirical level this theory predicts that quits will fall as employment

The simplest fact then, which would give support to this notion of supply-side shifts, is whether the quit rate is, indeed, counter-cyclical – as the theory predicts. The empirical evidence is that quit rates are pro-cyclical, which means they rise when the labour market is strong and workers feel confident about their job chances and fall when the labour market is weak and workers fear unemployment. This is exactly the opposite to what would be required to substantiate Friedman’s natural rate theory.

American economist, Lester Thurow summarised this issue succinctly:

… why do quits rise in booms and fall in recessions? If recessions are due to informational mistakes, quits should rise in recessions and fall in booms, just the reverse of what happens in the real world.

[REFERENCE: Thurow, L. (1983) Dangerous Currents, Oxford University Press; First Edition edition.]

In the Advanced Material Box – The Expectations-Augmented Phillips Curve, we present a more analytical version of the Friedman natural rate hypothesis.

The introduction of the role of inflationary expectations in the Phillips curve focused attention on how such expectations were formed. What behavioural models could be invoked to capture expectations. There were two main theories advanced by economists: (a) adaptive expectations, and later; (b) rational expectations.

Both theories considered the formation of expectations to be endogenous to the economic system. That is, developments within the system conditioned the way in which workers (and firms) formed views about the future course of inflation.

We consider the implications of these two theories in the Advanced material box – Inflationary Expectations.

|

Advanced material – The Adaptive Expectations Hypothesis

The assumption that workers formed their expectations of inflation in an adaptive manner allowed the Monetarists to conclude the government attempts to reduce the unemployment rate would only cause accelerating inflation and that the economy would always tend back to the natural rate of unemployment. The only way the government could sustain an unemployment rate below the natural rate using aggregate demand stimulus would be if they continually drove the price level ahead of the money wage level and forced the workers to continually misperceive the true inflation rate. The Adaptive Expectations hypothesis is expressed in terms of the past history of the inflation rate. The assertion is that the workers adapt their expectations of inflation as a result of learning from their past forecasting errors. The following model expresses this idea: The left-hand side of Equation 12A is the expected inflation rate in the next period (t + 1) formed by workers in period t. Equation 12A has to components on the right-hand side. First, Pdott is the actual inflation rate in the current period. Thus, workers use the current inflation rate as a baseline to what they think the inflation rate in the next period will be. Second, the term λ(Pdott – Pdotet) captures the forecast error from the previous period. Pdotet was the inflation expectation that workers formed in period t-1 of inflation in period t. The difference between that expectation and the actual rate than occurred is the size of their forecast error. The coefficient λ measures the strength of adaption to error. The higher is λ, the more responsive workers will be to actual conditions. MORE LATER HERE |

Conclusion

[MORE TO COME NEXT WEEK]

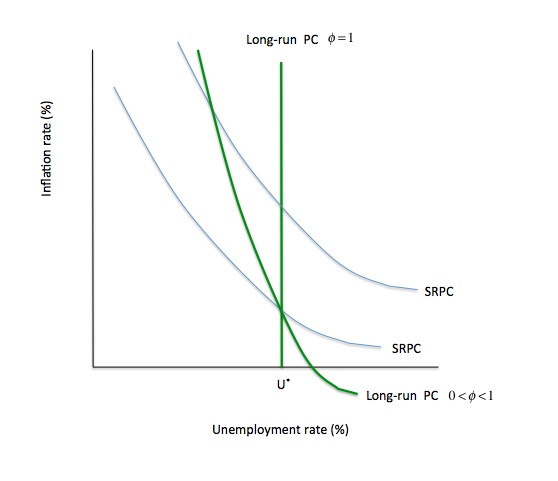

THE CHAPTER WILL CONSIDER THE CONCEPT OF HYSTERESIS WHICH QUESTIONED THE RELEVANCE OF THE φ COEFFICIENT. WE WILL THEN CONSIDER THE ARGUMENT THAT TRADE UNIONS CANNOT AFFORD TO BE TOO SUCCESSFUL IN THEIR WAGE DEMANDS WHICH LEADS TO THE CONFLICT THEORY OF INFLATION AND TAKEN TOGETHER WITH THE HYSTERESIS HYPOTHESIS A BROAD CONCEPT OF MACROECONOMIC EQUILIBRIUM WITH A LONG-RUN TRADE-OFF

THEN WE CONSIDER BUFFER STOCKS AND SHOW THAT THE PHILLIPS CURVE CAN BE RENDERED FLAT RATHER THAN VERTICAL WITH THE INTRODUCTION OF EMPLOYMENT GUARANTEES. ALL NEXT WEEK.

Major Anti-Neo-Liberal attack on Australian Treasury Building

The Canberra Times article yesterday (March 14, 2013) – Early morning city flight goes down like a lead balloon – reported on a strange attack on the Australian Federal Treasury Building in Canberra.

The Balloon Attack was probably devised as part of a strategy to regain the macroeconomic policy initiative from the neo-liberals who have infested the ranks of the government.

Clearly, the instigator was sick of the neo-liberal macroeconomic policies coming from the building and decided to do something about it.

You can see more photos of the attack and its aftermath – HERE.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Bill,

Just saw a report in which the Irish government claims it has used austerity successfully to exit the crisis. Do you have any info on this?

From CNBC, March 1, 2013: http://www.cnbc.com/id/100512946.

“Ireland has made an economic recovery using austerity and as a result, is often held up as the poster child for the European recovery.

“We have gotten our competitiveness back in a really significant way, the competitive cost is down, our exports are doing very well, foreign investment is doing exceptionally well, we are back in growth. Very, very modest but it’s real, it’s growth,” said Anne Anderson, Ireland’s permanent representative to the United Nations.

However, she cautions that austerity comes at a price.

“I don’t want for a moment to underestimate the difficulty and the hurting of Ireland – it’s very real,” Anderson said.”

I’ve forgotten what sort of text book this is going to be, but if it’s going to be a standard first year university text book, I think too much space is being devoted to the inflation / unemployment trade off.

The basic Phillips idea, i.e. that if unemployment is too low, inflation rises to some fixed and excessive level is a very simple idea. It can be set out in one or two sentences: sentences that the average undergraduate would understand.

And Friedman’s criticism is equally simple. He just said that given the above excess inflation, workers will than factor the excess inflation into their wage demands, which exacerbates the inflation still further, and possibly leads to infinite inflation. That again is very simple idea that could be set out in a sentence or two.

Bill, I like the stuff on the Phillips curve but don’t know whether there is too much of it, but I do think that there has been too little on the Keynes-Kalecki-Balogh issues, which took place over the later ’30s and early ’40s. Some of it is amusing, and his responses to Baylogh in particular give some insight into Keynes’ character. Dexter White and the Keynes conflict re Bretton Woods might have a place, too, which K’s responses to Baylogh can help illuminate White’s but especially Morgenthau’s irritation with Keynes. Although you may feel that this is too much history.

Bill,

I think this chapter is developing very well indeed, and has filled in alot of gaps in my knowledge already. I look forward to seeing what understanding MMT recommends to students. I think the detail you are covering is very important for providing the opportunity for critical thought.

Kind Regards

Bill,

UK politicians on Tuesday to pass a bill to save £130m of unlawful withdrawal of benefits to unemployed who challenged working for no pay in £ shops. Labour MPs in particular will show their true blue colours if this goes ahead.

These are interesting background lessons and very appropriate for a textbook.

It seems to me that three very important factors are not discussed:

1. The stair-step nature of contracted wages, which are usually in two to three year future looking steps, and often contain very long term commitments like pension plans.

2. The role of Government, as largest single employer in the economy, in setting standards for wages and benefits.

3. The role of monopoly conditions or high investment conditions in creating a contract friendly environment for labor negotiation.

Those balloonists have filled their balloons with a 50:50 mixture of oxygen and hydrogen. That would given an explosive mixture at the same time as being lighter than air. They could then have ignited it when near the Treasury building.

They’d probably have killed themselves, but the we all have to make sacrifices to bring about more rational economic policies than those we currently “enjoy”.

Keith,

I know it’s Bill’s opinion you’re looking for, but I’m Irish, and I can’t resist!

There is a general media and political consensus in Ireland which states that austerity is working because the country hasn’t disappeared entirely down the plughole (well, not in Dublin anyway!). The fact is, we’re subsisting on the money being given to the Government by the Troika in exchange for gutting public spending. Any recent ‘stability’ can only be attributed to these monies, as well as our maintenance of a deficit and high level of debt – it can certainly not be attributed to the ongoing attack on the public sector, the unemployed, the disabled and the poor and disadvantaged generally. If we implemented these cuts sans the Troika money, we’d be annihilated as a country, rather than thrifty Swabian housewives.