It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

Unemployment and inflation – Part 6

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text during 2013 (to be ready in draft form for second semester teaching). Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

This is the continuation of the Chapter on unemployment and inflation – the series so far is:

- Unemployment and inflation – Part 1

- Unemployment and inflation – Part 2

- Unemployment and inflation – Part 3

- Unemployment and inflation – Part 4

- Unemployment and inflation – Part 5

I am now continuing Section 12.6 on the Phillips Curve …

Chapter 12 – Unemployment and Inflation

MATERIAL HERE NOT REPEATED

|

Advanced material: The Phillips curve algebra

We have discussed the original Phillips curve (Phillips, 1958), which was a relationship between the growth in money wages and the unemployment rate. We have also seen, how a price mark-up model, allows this relationship to be expressed as one between the growth in the price level (that is, inflation) and the unemployment rate (Samuelson and Solow, 1960). The simplest linearised form of the price Phillips curve relationship is given as: (12.3) Pdot = α + βU-1 where Pdot is the rate of inflation (the dot above the P symbolising a rate of change), α is a constant, β is a coefficient which tells us how price inflation responds to the excess demand variable, U-1. U-1 is the inverse of the unemployment rate to capture the non-linear shape of the Phillips curve as hypothesised by Phillips himself and later Samuelson and Solow. [NOTE: in the final text with proper mathematical fonts the Pdot will have the dot above the P} What interpretation can we give to the coefficient, α? Referring back to the price mark-up model (Equation 12.1), we know that W.(N/Y) represents unit labour costs. N/Y is the inverse of labour productivity. We noted in the discussion above that when money wages grow in line with labour productivity there will be no inflationary pressures coming from the labour market. The term βU-1 measures the impact of the state of the labour market on inflation via money wages growth. It follows then that the coefficient, α measures the impact of productivity growth, which will be a negative factor. In other words, price inflation (holding other cost factors constant) will be equal to the growth in money wages minus labour productivity growth. |

The instability of the Phillips curve

The standard price Phillips curve model that evolved in the 1960s was supported of the dominant view of inflation at the time based on Keynes notion of an inflation gap.

In his 1940 pamphlet – How to pay for the war: a radical plan for the chancellor of the exchequer, John Maynard Keynes outlined his concept of the inflationary gap.

He aimed to apply the notion of effective demand that he developed in the – General Theory – to help understand how an under-full employment equilibrium could arise in a monetary economy – to a fully employed war-time economy.

With the onset of World War 2, the large-scale war spending funded by debt-issuance pushed capacity in the British economy to its limit. Keynes argued that even if money wage rates were constant, the rising household incomes, as employment rose, would strain the available consumption goods, which would cause inflation to accelerate.

He rejected the view of the Treasury at the time that by issuing new debentures to finance the War effort, the Government would be drawing on private “voluntary saving” and creating the non-inflationary “room” for its own spending. That idea was a hang-over of the loanable funds doctrine and failed to see that rising budget deficits also increase the flow of saving in the economy because they stimulate increases in national income.

Keynes argued that even when nominal effective demand was growing in excess of the capacity of the economy to respond in real terms (by increasing output), total saving still increased. As a result, the Treasury view that by drawing on “voluntary saving” flows the war could be financed without risking inflation was rejected by Keynes. He argued that financing the war through debt-issuance could only be non-inflationary if the government spending was equivalent to the full-employment level of saving.

In How to Pay for the War, Keynes defined the inflationary gap as an excess of planned expenditure over the available output at pre-inflation or base prices (GET EXACT PAGE). The pre-inflation benchmark was the full employment level. Thus, if an economy can meet the growth in nominal expected demand by expanding the capacity to produce goods and services, the inflationary gap would not open.

This idea was distilled into the demand-pull theory of inflation. Once full employment was reached then nominal demand growth beyond that level would be inflationary.

The Phillips curve was clearly consistent with this view of inflation. The simple theory underpinning the first Phillips curve analysis argued that as nominal demand growth pushed the unemployment rate towards its irreducible minimum (frictional unemployment), wage and price inflation would start to rise. In other words, the economy would be “pulled” into the inflationary gap by excess aggregate demand growth.

The Phillips curve demonstrated to policy makers how much inflation would arise as the economy was pulled by nominal demand growth beyond its real capacity to produce goods and services.

It is interesting to note than in the pamphlet – How to Pay for the War – Keynes also suggested that inflation could arise due to cost push factors (also called “sellers’ inflation). There had been a long line of authors who had identified inflation emerging as a result of distributional struggle over the available real income being produced.

For example, in the Marxian tradition, authors such as Michal Kalecki had advanced what became known as cost-push theories of inflation.

Within the Keynesian tradition, in Chapter 14 of Abba Lerner’s 1951 book – Economics of Employment there is a coherent discussion of how distributional struggle may lead to a wage-price spiral and generalised inflation.

With a mark-up pricing model assumed, an economy that approaches full employment will gradually eat into the “reserve army of unemployed”, which gives workers more bargaining power relative to when unemployment was higher. The workers via their trade unions were more likely to demand higher money wages. Firms might fear prolonged strikes and concede to the workers’ demands but then, in turn, defend their real profits by increasing prices (via the mark-up).

This dynamic could easily lead to a series of wage and price rises as each party sought to defend their real stake in production. As a result, inflation becomes the product of distributional struggle reflecting the relative bargaining strengths of workers and employers.

Lerner was intent on showing that the dynamic for this wage-price spiral need not come from trade unions becoming emboldened by falling unemployment. He argued that capital might seek to expand its real share by pushing up the mark-up on unit costs. Such a strategy could only be successful if workers conceded the real wage cut implied by the rising prices. Firms would be more likely to attempt this strategy when they perceived the bargaining power of workers to be weak – that is, when unemployment was higher.

In this way, Lerner recognised that inflation and high unemployment could co-exist – that is, he foreshadowed the possibility of stagflation. We will return to discuss this concept later in the Chapter because it has paramount importance to the way the discussion of the Phillips curve evolved in the 1970s.

For now, it is enough to recognise that the Phillips curve could subsume the “cost-push” theories of inflation given that they also proposed a negative relationship between unemployment and inflation. You will note though that the idea of stagflation that Lerner advanced in the early 1950s would also help understand the empirical instability in the Phillips curve that began to manifest in the late 1960s and, which led to a major shift in macroeconomic thinking.

As the US government prosecuted the Vietnam War effort through the 1960s, the inflation rate began to rise. In the late 1960s and early 1070s, the demand-pull pressures of the spending associated with the war effort combined with sharp rises in oil prices courtesy of the formation of the cartel, the Organisation of Petroleum Exporting Countries (OPEC). Oil prices under OPEC quadrupled in 1973, generated huge cost shocks to oil-dependent economies such as the US and Japan.

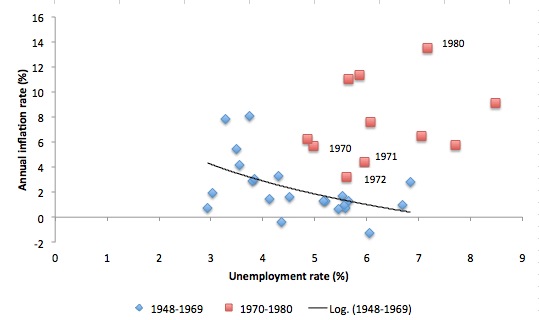

Consider Figure 12.8, which shows the combinations of the unemployment rate and the annual inflation for the US economy from 1948 to 1980. The blue diamonds show the observations for the period 1948 to 1969, and the black curve is the logarithmic regression between the inflation rate and the unemployment rate. So it shows a simple price Phillips curve of the type depicted in Equation 12.3. The curve fits the data quite well and shows the typical trade-off between unemployment and inflation, that was considered to be fit for exploitation by policy makers, intent on keeping unemployment close to full employment.

However, consider the observations depicted by the red squares, which cover the period from 1970 to 1980. Those observations are clearly inconsistent with the stable Phillips curve representation and seem to suggest a positively sloping relationship.

This apparent shift in the Phillips curve was cast as a “collapse” in the relationship and led to accusations that the underlying conceptualisation of the Keynesian Phillips curve was flawed.

Figure 12.8 The shifting US Phillips curve – 1948-1980

Source: US Bureau of Labor Statistics. The unemployment rate series begins in 1948. The inflation rate is measured as the annual rise in the Consumer Price Index.

[NOTE – RUN OUT OF TIME TODAY – WE ARE HEADING INTO THE SHIFT IN THE PHILLIPS CURVE PRIOR TO ADDING EXPECTATIONS TO IT]

Conclusion

NEXT TIME I WILL DISCUSS THE RESPONSES TO THIS INSTABILITY WHICH LEAD TO THE EVOLUTION OF THE NATURAL RATE OF UNEMPLOYMENT APPROACH WHICH STILL DOMINATES.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Re the 1970s inflation spike, it always struck me at the time that a big contributory factor was silly wage demands by trade unions, at least in the UK. This seems to be confirmed by a chart (link below) showing that wages as a proportion of GDP in the UK were at a record high in the 1970s. That might be worth a mention. See:

http://stumblingandmumbling.typepad.com/stumbling_and_mumbling/2012/12/on-wage-and-profit-shares.html