It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

Unemployment and Inflation – Part 7

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text during 2013 (to be ready in draft form for second semester teaching). Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

This is the continuation of the Chapter on unemployment and inflation – the series so far is:

- Unemployment and inflation – Part 1

- Unemployment and inflation – Part 2

- Unemployment and inflation – Part 3

- Unemployment and inflation – Part 4

- Unemployment and inflation – Part 5

- Unemployment and Inflation – Part 6

I am now continuing Section 12.6 on the Phillips Curve …

Chapter 12 – Unemployment and Inflation

MATERIAL HERE NOT REPEATED

[PICKING UP FROM THIS POINT …]

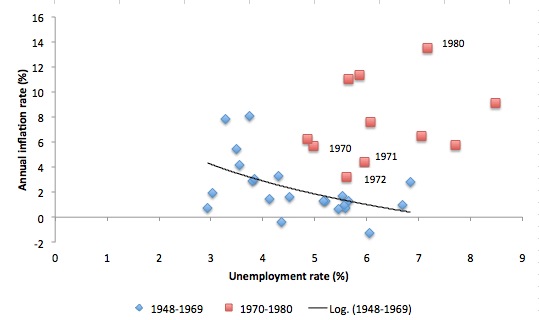

Consider Figure 12.8, which shows the combinations of the unemployment rate and the annual inflation for the US economy from 1948 to 1980. The blue diamonds show the observations for the period 1948 to 1969, and the black curve is the logarithmic regression between the inflation rate and the unemployment rate. So it shows a simple price Phillips curve of the type depicted in Equation 12.3.

The curve fits the data quite well and shows the typical trade-off between unemployment and inflation, that was considered to be fit for exploitation by policy makers, intent on keeping unemployment close to full employment.

However, consider the observations depicted by the red squares, which cover the period from 1970 to 1980. Those observations are clearly inconsistent with the stable Phillips curve representation and seem to suggest a positively sloping relationship.

This apparent shift in the Phillips curve was cast as a “collapse” in the relationship and led to accusations that the underlying conceptualisation of the Keynesian Phillips curve was flawed.

Figure 12.8 The shifting US Phillips curve – 1948-1980

Source: US Bureau of Labor Statistics. The unemployment rate series begins in 1948. The inflation rate is measured as the annual rise in the Consumer Price Index.

[NEW MATERIAL TODAY STARTS HERE]

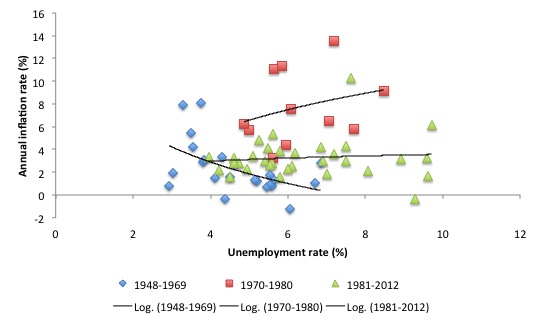

Consider Figure 12.9, which shows the relationship between the US unemployment rate (horizontal axis) and the annual inflation rate for the period 1948 to 2012, subdivided into three periods: 1948-1969; 1970-1980; and 1981-2012. As before the lines depict the logarithmic regression between the inflation rate and the unemployment rate for the three sub-periods.

What was considered to be a relatively stable relationship in the 1950s and 1960s, became unstable in the 1970s and suggested a positive relationship between inflation and unemployment. By the 1980s, as inflation moderated, it became hard to determine any relationship between inflation and unemployment in the US economy.

From an empirical perspective, then, the faith that the Phillips curve was a stable relationship that could be exploited in some predictable fashion by polict makers to maintain low unemployment became highly questionable.

Figure 12.9 The shifting US Phillips curve – 1948-2012

Source: see Figure 12.8

We always have to be very careful when we visualise data in this way. The observations between 1970 and 1980, may in fact be signifying a shifting Phillips curve relationship and the regression line is just picking up the shifting function. In other words, the relationship is unstable over time although it may permit a short-run trade-off between the inflation rate and the unemployment rate.

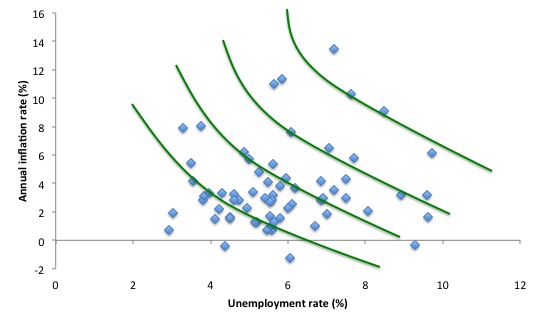

That conjecture is represented in Figure 12.10, which shows stylised Phillips Curve for the US data from 1948-2012. Please note that these are not actual estimated Phillips curves. They just demonstrate that there might be a family of such curves and each one might remain in place for a short-period, which woudl provide policy makers with a false sense of security. At some point the curve might shift out to a new loci and inflation would accelerate.

Figure 12.10 A family of Phillips curve

Source: see Figure 12.8

It should be clear from our earlier discussion of the work of A.J. Brown that the assumption that the Phillips curve was stable was always problematic.

It was known that the Phillips curve was susceptible to a sudden and/or large increase in inflation. The econometrically-estimated consumption functions in the large macroeconomic policy models, which were popular in the 1960s also became unstable in the 1970s. Some economists successfully showed that the failure of the large-scale econometric models to forecast such variables such as savings and consumption in the early 1970s could be traced to the misspecification of the structural consumption function. Most of these models ignored the possibility that rising inflation would influence consumption (for example, if consumers expect prices to rise quickly in the future they may bring forward consumption decisions).

The breakdown of the Phillips curve in the late 1960s was another “econometric” function that was misspecified because it also ignored the possibility that rising inflation might become self-fulfilling as workers and firms sought to protect their real wages and real profit margins.

Another consideration as to why the discussions about instability were largely ignored is that the “textbook” model of the Phillips curve was very attractive in its simplicity. Textbooks typically stylise discussions and eschew complicated stories for the sake of pedagogy. You will be aware that we have not taken this approach in this text. We consider a rich treatment of institutions and history to be an important part of the learning process in macroeconomics.

The work of A.J. Brown and others was insightful and probably too deeply grounded in the institutional literature to be acceptable for the way textbook writers chose to advance their pedagogy at the time.

It is probable that had Brown’s work on instability and the way changes in the institutions of wage and price determination (for example, wage bargaining and real wage resistance) change the trade-off between inflation and unemployment been more recognised, the subsequent history of the Phillips curve, which we discuss next, might have been very different.

It is a fact that the mainstream Keynesian consensus in the 1960s abstracted from the potential instability that was rooted in the institutional nature of wage and price setting. Instead, policy makers pursued the attractive notion that they could permanently maintain low unemployment rates as long as they ensured effective demand was sufficient relative to the non-government sector’s saving plans and any demand leakages from net exports.

However, the legacy of the Keynes and Classics debate persisted through the 1950s and 1960s. The neo-classical school was unwilling to accept the basic insights provided by Keynes that effective demand drove output and national income and that the capitalist monetary system was susceptible to crises of over-production.

In the late 1960s, this on-going debate about the effectiveness of fiscal and monetary policy in counter-stabilising the economic cycle was rehearsed within the Phillips curve framework.

A group of economists, centred at the University of Chicago were opposed to government attempts to maintain full employment. Their argument largely reflected their belief that a self-regulating free market would generate optimal outcomes. In other words, they were adherents of the competitive neo-classical model and considered most government intervention to be problematic.

This opposition at the microeconomic level manifested in demands for widespread deregulation in product, labour and financial markets and a major retrenchment in the size of government.

At the macroeconomic level, the Phillips curve became the “battleground”. Policy makers during the “stable” Phillips curve policy era assumed they could permanently target a low unemployment rate and incur some finite inflation rate as a consequent. The extent to which inflation rose was determined by the steepness of the Phillips curve, which was considered to be relatively flat.

The emerging Monetarists, who eschewed government intervention, challenged that view and asserted that there was no permanent (long-run) trade-off between inflation and unemployment. They claimed that, ultimately the market would ensure the unemployment rate was stable around its so-called natural rate and attempts by government to push it below this rate would lead to accelerating inflation.

Chicago economist Milton Friedman was the most vocal Monetarist and in a famous article in 1968 outlined what became known as the accelerationist hypothesis

[Full reference: Friedman, M. (1968) ‘The Role of Monetary Policy’, The American Economic Review, 58(10), March, 1-17]

12.X The Accelerationist hypothesis and the Expectations-augmented Phillips curve

The empirical instability in the relationship between unemployment and inflation opened the way for what became known as the Monetarist paradigm in macroeconomics to gain ascendancy.

The Monetarists reinterpreted the trade-off by adding the role of inflationary expectations, and in doing so, revived the Classical (pre-Keynesian) notion of a natural unemployment rate (defined as equivalent to full employment),. The devastating consequence of this assertion was the rejection of a role for demand management policies to limit unemployment to its frictional component.

The Phillips curve also became a tool in the hands of the Monetarists to regain the ground they had lost to the Keynesians. With the support of the textbooks the model endured even though the original model was lost in the process.

Despite the rich Keynesian history discussed earlier, it was easy for Friedman and others to hijack the debate. The Keynesians were operating in a dichotomised framework – at the macroeconomic level they had adopted the Phillips curve, yet they had developed very little theory to underpin it. They were particularly tense and uneasy about what were referred to as the microeconomic foundations of the relation.

There were attempts by the Keynesians to justify the Phillips curve as a competitive adjustment process, such that if there was growing demand for labour wages rose as unemployment fell.

But the Monetarists claimed that in a competitive market workers cared about real wages rather than nominal wages and so the basic Phillips curve which only focused on the relationship between percentage change in money wages and the unemployment rate was defective.

The accelerationist hypothesis was advanced in 1968 by Milton Friedman before the empirical breakdown of the relationship between inflation and unemployment emerged in the early 1970s.

So while the Phillips curve presented the Monetarists with the opportunity to debate the failings of the mainstream Keynesian analysis, it was the empirical havoc created by the 1970s oil price shocks which added weight to their (flawed) arguments.

It is important to note, that nothing had really changed in the modern statement of Monetarism that had not already been shown to be deficient, albeit in different terms, by Keynes and others.

As noted above, the Phillips curve was just one of a number of macroeconomic equations in the large policy models that ignored inflationary expectations. The misspecification was not significant while inflation was negligible. Once inflation rates soared throughout the world with the oil price rises of the early 1970s, all these misspecified relations broke down.

The Monetarists used that empirical chaos to cast the theoretical ideas of Keynesianism into disrepute. Monetarist thought emerged from this wreckage as being eminently plausible. It was a serendipitous period for the Neoclassical economists because they managed to reassert the issue of real wage bargaining before the empirical relations broke down.

Although in the mid-1960s, the Monetarist theoretical structure had undergone harsh criticism from economists like Robert Clower and Axel Leijonhufvud, the empirical shift in the Phillips curve in the early 1970s was interpreted as a validation of the Monetarist concept of a natural rate of unemployment and the negative connotations for aggregate demand management that this concept invoked.

There were two basic propositions that Friedman asserted in his attack on the Phillips curve.

First, that there is a natural rate of unemployment, which is determined by the underlying structure of the labour market and the rate of capital formation and productivity growth. For example, he claimed that minimum wages and welfare support increased the natural rate. The natural

Friedman (1968: Page 8 ) wrote:

At any moment of time there is some level of unemployment which has the property that it is consistent with equilibrium in the structure of real wages. At that level of unemployment, real wage rates are tending on average to rise at a “normal” secular rate, i.e., at a rate that can be indefinitely maintained so long as capital formation, technological improvements, etc., remain on their long-run trends. A lower level of unemployment is an indication that there is excess demand for labor that will produce upward pressure on real wage rates…. The “natural rate of unemployment”, in other words, is the level that would be ground out by the Walrasian system of general equilibrium equations, provided there is imbedded in them the actual structural characteristics of the labor and commodity markets, including market imperfections, stochastic variability in demand and supplies, the cost of gathering information about job vacancies and labor availabilities, the costs of mobility, and so on.

He later noted (Friedman, 1968: 9) that the natural rate of unemployment is not “immutable and unchangeable” but reflects his belief that it is a real variable, which is insensitive to monetary forces. That is, he considered increasing nominal aggregate demand would not reduce the natural rate.

He also considered that the natural rate was, in part, “man-made and policy-made”. For example, Monetarists argued that imposing minimum wages and providing unemployment benefits would increase the natural rate.

Second, that the Phillips curve is, at best, a short-run relationship that can only be exploited as long as workers suffer from money illusion and confuse money wage rises with real wage rises. In other words, any given short-run Phillips curve is dependent on workers assuming that price inflation is stable. Under that assumption, there is no role for price expectations in the Phillips curve.

However, Friedman and others argued that eventually workers would realise that their real wage was being eroded in price infation outstripped money wages growth. In doing so, they would start to form expectations of continuing inflation.

As a consequence, workers would build these inflationary expectations into their future outlook and pursue real wage increases, which reflected not only the state of the labour market (relative strength of demand and supply) but also how much they expected prices to rise in the period governed by the wage bargain.

The Monetarists argued that if the government attempted to reduce unemployment below the natural rate, then as the inflation rate rose, workers would demand even higher money wages growth to achieve their desired real wage levels. Ultimately, all that would result was an accelerating price level.

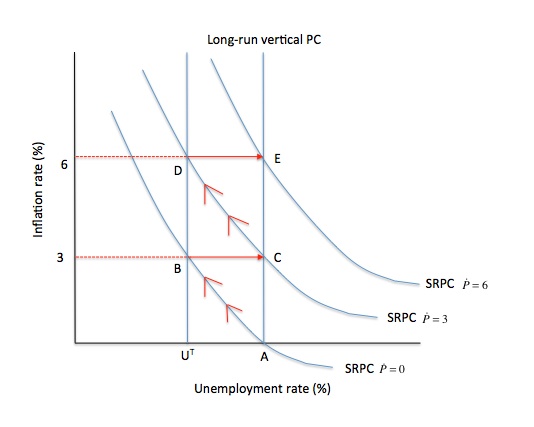

Figure 12.11 captures the accelerationist hypothesis. The short-run Phillips curves are shown conditional on a specific expectation of inflation (in this case, zero inflation, 3 per cent and 6 per cent).

Figure 12.11 The expectations-augmented long-run Phillips curve

Start at Point A, where there is zero inflation. The government forms the view that the unemployment rate is too high and adopt a lower target rate of unemployment, UT.

The government stimulates nominal aggregate demand to push the economy to point B along the SRPC Pdot=0. The increased demand for labour pushes up both the inflation rate (to 3 per cent) and money wage rates in the labour market. Monetarists assumed that the price level accelerated more quickly than money wages because the only way firms would employ more workers would be if the real wage had fallen. The Monetarists resurrected the Classical labour market and placed it at the centre of their attack on Keynesian macroeconomics.

Why would workers supply more labour if the real wage was falling? In the Classical labour market it is assumed that labour supply is a positive function of the real wage so workers will withdraw labour if the real wage falls.

The Monetarist sleight of hand was to impose what they considered to be asymmetric expectations on the workers and firms. The firms were assumed to have complete price and wage information at all times so they knew what the actual real wage was doing at any point in time. However, the workers were assumed to gather information about the inflation rate in a lagged or adaptive fashion.

Thus, workers are assumed to be initially oblivious to the rising inflation (they have zero inflationary expectations) and, thus, they mistake the rising nominal wages for an increasing real wage. As a consequence, workers willingly supply more labour even though the real wage has actually fallen.

To understand the dynamics on the demand and supply sides of the Classical labour market, please refer back to the discussion in Chapter 11 Keynes and the Classics.

The basic point is that workers care about real wages not money wages but take some time to differentiate between the two.

But the Monetarists asserted that Point B is unstable.

[TO BE CONTINUED]

Conclusion

NEXT WEEK – THE HYSTERESIS CHALLENGE TO THE ACCELERATIONIST HYPOTHESIS AND THE ROLE OF BUFFER STOCKS IN THE INFLATION PROCESS (YES … the Job Guarantee enters the picture!).

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Thank you, I am gaining a better insight into the Philips curve.

On a different point, concerning money mulitipliers (which you have blogged about recently), the OBR head sent a letter to David Cameron giving details of the money multipliers they use for forcasting. These are taken from “academic” studies but seem a little low to me. Could you comment on these.

http://budgetresponsibility.independent.gov.uk/wordpress/docs/Letter-from-Robert-Chote-to-Prime-Minister.pdf

I have a suggestion you may or may not agree with.

While the argument between the Keynesian and Monetarist views of the Phillips curve is still being played out i the text book, I suggest you avoid overt, prejudicial terminology with respect to Monetarist hypotheses. For example, where you write, “The Monetarist sleight of hand was to impose what they considered to be asymmetric expectations on the workers and firms.”, I would suggest “The Monetarist assumption…..”

At a later point, you can demonstrate that that assumption is untenable, incorrect, incomplete or whatever is the applicable term for what you demonstrate.

Personally, I loath Monetarism and I consider there is significant evidence extant that Friedman was consciously intellectually dishonest. However, a textbook needs to be cautious, judicious and somewhat dispassionate in its presentation of evidence and argument.

” However, a textbook needs to be cautious, judicious and somewhat dispassionate in its presentation of evidence and argument.”

Does it.

The opposition doesn’t.

I think its dangerous to assume that the opponents in this game play by the Queensbury Rules.

Perhaps you are going to come onto it BUT I think it is essential to also explain why once governments started doing as Friedman etc suggested; in many ways the economy did improve. If Friedman’s suggestions had not “worked” then they would not have been followed for the next thirty years. My guess was that it was down to capital flows. The oil crisis that you do mention could partly be seen as part of a wider phenomenon of global commodities no longer only being affordable for the “developed world”. Places such as Nigeria had massive increases in prosperity during the 1960s and 1970s. The rest of the world was catching up with the developed world and so commodities (including oil) had to be shared with the wider world. The monetarist “reforms” put a stop to that by using unemployment, tax “broadening” and financial deregulation to cause a switch from wage inflation to asset price inflation. Asset price inflation was the heart of the “great moderation” from 1980 to 2000. It enticed elites in the developing world to “invest” in developed world assets so as to ride the asset price inflation. The result was a fierce reversal in the fortunes of economies such as Nigeria’s. We got commodities at knock down prices and all we needed to provide in return were paper account statements to the third world elites.

Dear Stone (2013/03/09 at 18:30)

Worked for who?

In nations that embraced the NAIRU approach:

1. Trend real GDP and national income growth fell almost everywhere.

2. Persistent unemployment emerged which included a significant rise in long-term unemployment.

3. Underemployment emerged as a major new issue.

4. The pace of poverty reduction in LDCs slowed and in the poorest nations stopped altogether.

5. There was a massive redistribution of national income to profits and away from wages.

6. Real wages growth slowed and lagged well behind productivity growth.

7. Private debt levels rose.

8 And … all these trends led, inevitably and necessarily to the GFC.

You have a funny concept of improvement, which is not to say that the rest of your comment is not interesting.

best wishes

bill

Bill, I couldn’t agree with you more about the “improvement” being an illusion especially when the whole global economy is taken into account and a long term view is made BUT for some the result was viewed as a near miracle and a full vindication of the Friedman approach. Just read (as you probably already have) stuff like http://www.chu.cam.ac.uk/archives/exhibitions/1981_Budget.pdf to see what a fabulous success many people view it all to have been. My guess is that the mean real income of people in the UK was improved by the Friedman approach (even though the median income wasn’t). Basically well meaning people (such as New Labour) took it to be the pragmatic way to gain prosperity. IMO if we don’t face up to the fact that it did (transiently) benefit many people in places such as the UK then we won’t be understanding what went on. I worry that it was responsible globally for as many avoidable deaths by starvation etc as Chairman Mao was responsible for. That is why I think it is vital to understand the phenomenon fully.

I made an attempt to get my head around it in something I tried to write. Its the section, “Isn’t a financialized economy the goose that lays our golden eggs?..” of http://directeconomicdemocracy.files.wordpress.com/2013/01/direct-economic-democracy8.pdf

Bill, looking back at your part 1 of this inflation series, you say that shifts in currency exchange rates don’t constitute inflation because they are one-off events rather that a continuous process. I find that awkward to reconcile with the sometimes long drawn out nature of shifts in currency exchange rates. Again using the example of Nigeria, USD exchange rate in

1980 was 0.78 Naira

1985 was 2.83 Naira

1990 was 8.94 Naira

1995 was 54.36 Naira

2000 was 102.12 Naira

2005 was 131.01 Naira

That is hardly a one off event. It looks to me like a continuous process. I guess the textbook theory is that a shift in exchange rate will cause the country with the now cheaper currency to export more and import less and so bring things back to how they were. In practice however it looks to me as though capital flows can actually induce a self reinforcing feedback loop whereby people in the country with the depreciating currency move their savings to the country with the appreciating currency. I think tapping into that effect was a key contributor to the “great moderation” phenomenon. It necessitated a gradual lowering of interest rates from >10% down to <1% over two decades so as to drive the asset price rises to draw in the capital flows. Once that was done, the monetarists had painted themselves into a corner and so the strangle hold over emerging market economies slipped somewhat.

You say that inflation is part of a wider struggle between capital and labour. I totally agree but I also see it as part of a global struggle between Nations. My guess is that it sometimes plays out in ways that were not intended and perhaps are not even realized by those instigating the polices. Perhaps the "reforms" that gave us the great moderation were simply seen to "work" based on what happened in say the UK. It wasn't even thought how they were working. Places such as Nigeria were seen as having fallen prey to local kleptocrats who moved wealth abroad rather than building the Nigerian economy. However that phenomenon may have been induced and reinforced by what was done in the USA and UK. In the 1970s, those Nigerians who built businesses in Nigeria became rich and powerful and so directed the Nigerian economy and politics. In the 1980s and 1990s those who moved wealth abroad became the powerful and directed the politics to facilitate such transfers. I'm using Nigeria as an example but pretty much any developing country would fit the same mold. That is a big chunk of the global economy.

I’ve just now read all of your seven posts about inflation and unemployment. So far they give a fascinating insight into the period before the great moderation. Are you thinking of adding stuff about how inflation control during the great moderation shifted to being dependent on households and firms being deeply indebted? Steve Randy Waldman’s posts on Interfluidity make the point that when households have a large debt burden, monetary policy has more traction in controlling inflation. When interest rates rise, households have less disposable income because it is going to debt servicing. When interest rates fall, banks grant new loans and so provide more immediate spending money for households. Furthermore if firms are highly indebted, then workers won’t demand wage increases because the workers will fear bankruptcy of the firm and loss of their jobs.

Another thing that seems left unsaid is the effect of automation technology on the whole “capital-labour” bargain. Back in the day, capitalists were utterly dependent on having a large workforce of laborers. That is becoming less and less the case. Perhaps in the near future, robots will have made “labour” something capital has no need for. To my mind that totally turns everything upside down. In many ways it actually relieves a key tragic element of capitalism. That Kalecki “Political aspects of full employment” essay (that you posted about before) worried that periodic economic slumps might be a requirement of capitalism so as to ensure a sufficient pool of compliant workers for capitalists to hire from. Robots will always be compliant and won’t need the threat of unemployment to get them into line. What is critical though is that once human “labour” become unnecessary, “capital” comprises everyone. Perhaps ensuring that that is the case needs to be the focus when dealing with the future?????

“When interest rates rise, households have less disposable income because it is going to debt servicing.”

That rather depends on the level of fixed rates amongst those with tight income constraints. Over 50% over mortgage business in UK is fixed rate.

I would suggest that those on tight income constraints tend to fix their rate.

Neil, might fixed rate loans create an even higher hurdle for credit expansion when rates are high though? So the effect might cut both ways? I suppose across an economy of chronically over-indebted households, at any given time, loans will always be needing to be initiated/rolled over?

There are lots of ifs and buts, uncertain response periods and distribution characteristics. That’s why lots of private debt and monetary policy control mechanisms are likely a bad idea.

Neil Wilson, I’m definitely not saying that the “great moderation” wasn’t a calamitous mistake. IMO it was a calamitous mistake. I’m just saying that it did happen and a text book dealing with inflation and unemployment needs to face up to the great moderation phenomenon squarely and describe what happened and why. IMO it is no good in 2013 only describing what happened up until 1980 (I’m not suggesting Bill was going to do that).