I started my undergraduate studies in economics in the late 1970s after starting out as…

Treasurer wants policy to be driven by models that can’t beat a random walk

On Monday (January 7, 2012) – The culpability lies elsewhere … always! – I wrote about the unacceptably large forecasting errors from the IMF derived from models that informed their input into bailout packages etc, which in turn set the fiscal austerity agenda and as resulted in millions becoming unemployed. I was interviewed about this today by the ABC National Radio program – the World Today – and told the journalist that if errors of this size occurred in medicine, the practitioner would be jailed for professional negligence. A summarised transcript from the World Today programme is available here – Eurozone jobless rate hits record high. A few snippets from a 10 minute interview! I did another interview today about a paper that came out recently from the RBA, which largely admitted its forecasting record was inferior to what we might have gained from assuming a random walk (unemployment) or simple historical averages (real GDP growth). You have to see this incompetence not in terms of some technical boffins waxing lyrical in a research paper about a range of technical measures of their errors but rather, in terms of the damage that the policy that has been informed by these errors. Today we received more evidence of that damage in the form of the ABS publication – Job Vacancies, Australia (November 2011). The evidence is clear. Our economy is faltering because policy settings have been wrong. They have been wrong because the policy setting paradigm is wrong and this has led to the use of models which deliver predictions that cannot be sustained given the underlying dynamics of the monetary system that this ideology chooses to ignore.

In November 2012, the RBA published a research paper – Estimates of Uncertainty around the RBA’s Forecasts – which also cast doubt

The Data used for the paper is very interesting and saves one having to track all the RBA forecasting publications and put together the shifting forecasting horizons.

In that paper, the RBA authors admit that

The confidence intervals … strike many observers as wide, particularly for GDP growth. In other words, our estimates of uncertainty are surprisingly high.

The RBA also say that their forecast intervals (standard errors) are very wide:

For example, the 90 per cent confidence interval for GDP growth in the year ended 2013:Q4 extends from 0.9 per cent to 5.7 per cent. That is, although the central forecast is for growth to be moderate, it could easily turn out to be very strong, or quite weak. Similarly, while little change in the unemployment rate is expected, a large increase or decrease is possible. Although the most likely outcome for headline inflation is within the RBA’s target range, it could easily be well outside. In comparison, we can be somewhat more confident about underlying inflation, which is likely to remain moderately close to the target range.

Which raises the question as to the veracity of the underlying model being used to generate these forecasts. It also means that such forecasts are virtually useless for policy making purposes. There is no reason, on statistical grounds (at the 10 per cent level of significance), to choose between a 0.9 per cent GDP growth rate and a 5.7 per cent growth rate. In statistical terms, these interval bounds are not qualitatively better or worse than the point estimate.

I don’t want this blog to be interpreted as an exclusive RBA bashing exercise. There is an extensive literature that shows that the Bank of England, the Federal Reserve Bank, OECD and of-course the IMF, all offer (systematically) poor economic forecasts.

In relation to real GDP growth, the RBA forecasts are inferior to a simple “historic (since 1959) mean” over a 12-month horizon and breaks even over the second year.

This led the authors to say:

… the low explanatory power of macroeconomic forecasts is a striking result, with important implications. For example, it affects how much weight should be placed upon forecasts of GDP in determining macroeconomic policy.

In relation to the unemployment rate, the alternative they test against is a random walk – that is, that the best estimate next period is this period’s actual value. All variation is thus stochastic and by definition unpredictable. The result is that the RBA forecasts are inferior to the random walk.

Even in relation to the “key” RBA variable, the inflation rate, and especially the forward-looking rate, which the whole premise of inflation targetting is based on, the RBA admits that:

… but – consistent with successful inflation targeting – at longer horizons deviations in underlying inflation from the RBA’s target seem to be unpredictable. Uncertainty about the forecasts for GDP growth and (beyond the immediate horizon) changes in unemployment is about the same as the variation in these variables. In other words, forecasts for these variables lack explanatory power.

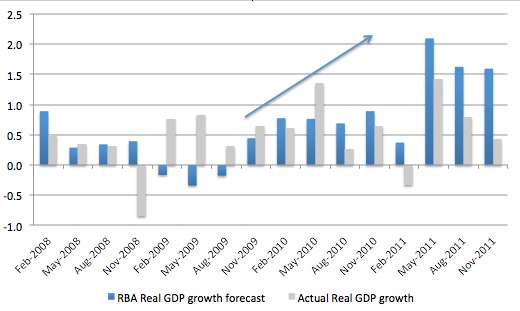

The following graph shows the RBA real GDP growth forecasts and the actual result for quarterly data from February 2008, which was the low-point unemployment rate quarter of the last economic cycle.

The blue arrowed line represents when the RBA started to tighten interest rates again. The Target rate was increased by 0.25 percentage points in October 2009, November 2009, December 2009, March 2010, April 2010, May 2010, then a break, and another rise in November 2010.

The recovery in real GDP growth in early 2009 which was sustained through 2010 was largely due to the massive fiscal policy stimulus that the Federal government introduced in late 2008.

The RBA fell prey to its own rhetoric about the strength of the rebound in commodity prices and the size of the minerals boom that was restored after the first period of the crisis, largely because the Chinese government kept their growth cycle going by using fiscal policy to inject increased spending on domestic activity as its export markets contracted (due to the decline in World trade in 2008-09).

As the Federal government started to withdraw its stimulus and begin its obsessive (now-failed) pursuit of a budget surplus the RBA was tightening monetary policy and it was clear that real GDP growth was starting to falter again, notwithstanding the massive investment that was occurring in the mining sector. The external sector was not delivering the bounty that the spin doctors were predicting and households were resuming pre-credit binge saving patterns.

The result is clear – real GDP started slowing and by early 2011 was heading south. Even at that time, the RBA was predicting strong growth. Over 2011 real GDP growth fell away sharply and despite some odd quarters (such as March 2012) when there was an investment spike, the trend downwards has continued. The RBA only started easing monetary policy again a year after its rise in November 2010.

For 12 months, it claimed the Target rate was appropriate, despite the on-going fiscal contraction and the faltering real GDP growth rate.

The other evidence available – construction activity, demand for credit and the labour market information – all pointed in the same direction. Unfortunately, the RBA ignored the underlying message and took far too long to realise that the so-called once-in-a-hundred-years mining boom was not going to deliver anything like the growth that was predicted.

That boom, was relatively strong, but the other countervailing spending contractions (mainly fiscal policy) were nullifying influences.

In the Mid-Year Economic and Fiscal Outlook 2012-13, which was published in October 2012, the Government re-affirmed its economic logic:

Returning to surplus provides ongoing scope for monetary policy to respond to economic developments and underpins confidence in Australia’s public finances at a time of global economic uncertainty.

The Treasurer’s claims that the government’s surplus promise has allowed the RBA to cut rates is a strange argument. The Government’s strategy (combined with our excessively high interest rates) has been to deliberately create unemployment in the non-mining regions so that the idle resources could then service the mining boom.

Not only will the required migration patterns fail to occur but non-government spending is not strong enough to support trend growth – mining investment boom notwithstanding. Many large employing sectors are declining due to a combination of an appreciated currency (exacerbated by high interest rates) and the withdrawal of the fiscal stimulus.

On Page 35 of the MYEFO we read:

The Government’s fiscal consolidation should continue to provide scope for monetary policy to be eased, if appropriate, without generating price and wage pressures. This recognises that in normal circumstances, monetary policy should play the primary role in managing demand to keep the economy growing at close to capacity, consistent with the medium-term inflation target. The impact of the fiscal consolidation in 2012-13 should be more than offset by growth in private demand, with the aggregate economy growing around trend.

The Treasurer has repeated this mantra endlessly over the last three years. The reliance on monetary policy as the principle counter-stabilising policy tool is a world-wide obsession, which stems from the now discredited mainstream view that fiscal multipliers are low if not negative and inflation-first policy approaches are best because any unemployment that results is temporary and incidental.

The mainstream of my profession actually convinced policy makers that fiscal policy was both dangerous and ineffective. The danger related to when they wanted to run the inflation bogey, while the latter was when anyone suggested the government use budget deficits to tackle the persistently high unemployment.

What a pack of fools! Both the economists who ran that line and the rest of us (the Royal “us”) for believing them. The last three years has demonstrated categorically that fiscal policy is the main game in the policy kit and monetary policy despite all the gymnastics from central banks is incapable of restoring solid growth without spending support being provided by fiscal policy.

The mainstream obsession about the primacy of monetary policy should be discarded. The enduring economic crisis has demonstrated that. Even the IMF has been forced to admit that fiscal multipliers are now well over 1 meaning the cuts to net public spending are not offset by greater gains in private spending.

The fiscal contraction expansion myth is exposed well and truly by these admissions. The superiority of monetary policy is also being exposed by the poor performance of the central bank forecasting models.

Further, monetary policy changes have uncertain impacts on aggregate demand, which make them unreliable vehicles to influence spending growth. They cannot target regions, sectors or demographic cohorts, other than punishing (or rewarding) debtors and rewarding (punishing) creditors and fixed income recipients. These distributional impacts are unclear in net terms.

The RBA paper makes it clear that the central bank is aware that its growth forecasts were wrong and it is now trying to backfill the damage that the resulting high interest rates, combined with the Treasurer’s policy stance, are causing.

That is, of-course, a far cry from the way the Treasurer constructs the events.

As an historical note, it is not the first time the RBA has caused major damage with its faulty policy settings. In the late 1980s, the RBA held rates at ridiculously high levels (up to 19 per cent) for far too long given the circumstances. It was obvious that such high rates would generate a downturn, especially as the Federal Government was also waxing lyrical about the budget surpluses it had achieved, not realising that this was draining demand too quickly.

Recession hit in 1991, and the Treasurer then claimed it was “the recession we had to have” – which was a disgrace for a Labor Party Treasurer to say knowing it would drive hundreds of thousands of workers out of a job. The government refused to ease fiscal policy and the RBA refused to relax monetary policy sufficiently and by the middle of 1991, Australia was in the midst of the worst economic downturn since the Great Depression.

The lengthy recession was totally policy-induced by both incompetent (ideologically-obsessed) policy positions adopted by the RBA and the Federal Treasury.

The ABS Job Vacancies data shows (seasonally-adjusted):

- Total job vacancies in November 2012 decreased by 6.9 per cent from the August-quarter 2012.

- The number of job vacancies in the private sector decreased by 6.9 per cent from the August-quarter 2012.

- The number of job vacancies in the public sector decreased by 7.5 per cent from the August-quarter 2012.

Even the celebrated boom in the mining sector is tapering with a decline of 20 per cent in vacancies reported in the year to November 2012. Over the 12 months to November 2012, public sector vacancies fell by a staggering 29.7 per cent, reflecting the harsh (and totally unnecessary) fiscal austerity that is being imposed on the government sector.

While we are continually being told that there are more than enough jobs to go around and that harsh cuts to income support payments are because the government would rather people take jobs, the reality is that the number of unemployed to each job vacancy is on the rise again.

In February 2008, the low-point unemployment rate month of the last growth cycle, there were 2.58 unemployed persons (39 vacancies for every 100 unemployed). In November 2012, the UV ratio was at 3.87 (or only 25 vacancies per 100 persons unemployed).

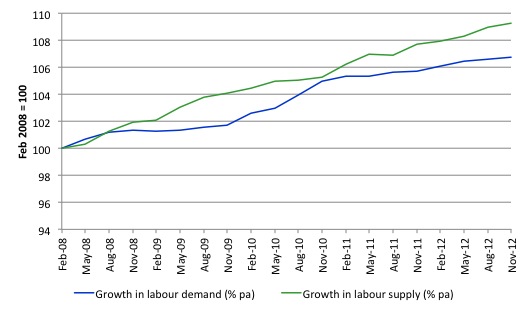

The following graph uses today’s vacancies data to show you what has been happening to labour demand and labour supply in Australia since February 2008.

Labour Supply is computed by taking the current working age population and using the participation rate at February 2008 (66 per cent). This eliminates the cyclical swings in the participation rate (it is now down to 65 per cent) and thus implicitly adds the “hidden unemployed” back into the labour force.

Labour demand is the sum of total employment and total job vacancies. I have not tried to standardise this for hours (thus taking into account the significant rise in underemployment). The reality is that in full-time equivalent units the graph (the gap between labour supply and demand) would be much worse than it is without that correction.

Both series are indexed at 100 as at February 2008. So you know that the growth in labour supply has been stronger over this period than labour demand and the divergence, which closed during the period that the government was running its fiscal stimulus, is now rising again.

So we can say this is the best outlook – and that is pretty dismal indeed.

For further information and discussion of how to interpret vacancies data please read the blog – Labour market deregulation will not reduce unemployment.

The economy is clearly not producing enough jobs. In that context, the policy environment should be expansionary. The opposite is the case in Australia. That amounts to a policy failure.

The Treasurer’s claim that monetary policy has to do the hard policy yards is comical given the RBA’s admissions that it cannot forecast better than a random walk.

It is time to shift the policy focus back onto fiscal policy which we know has more direct impacts (the multipliers are well above one) on spending and employment.

And I have even mentioned that the ABS also published its latest – Retail Sales, Australia – data today, which showed that retail turnover in November was -0.1 per cent down on the previous month.

Conclusion

The question is when will it become obvious to the general public that mainstream economists are not in some elevated species with deep insight into how the economy operates. In the main, it is a profession that is unproductive – its main outputs are regularly demonstrated to be faulty. At some point, the return policy at the store will lose credibility and the company will go broke.

It cannot come quickly enough for those who are damaged by the professional incompetence and negligence.

By the way, I thought I would turn out an anthropologist study music and culture. I became an economist at the start of the neo-liberal era because unemployment was sky-rocketing and the policy makers began to blame victims rather than see it as a systemic failure of the macroeconomy. That was my motivation.

Which means I cannot finish with noting that Eurostat published the November 2012 labour force estimates yesterday (January 8, 2013) – Euro area unemployment rate at 11.8% – which reported that the Eurozone unemployment rate is now at 11.8 per cent (another record) and rising.

The unemployment rate in Spain rose to 26.6 per cent; Greece was (as at September) at 26 per cent but it will be higher now and the rest of it. Youth (under 25) unemployment in Spain is now at 56.5 per cent and rising.

It is nothing short of a total disaster and then we read that – The euro crisis is over, declares Barroso – and I wonder when the people en masse will take to the streets and expel these indecent elitist leaders.

Pretty depressing eh!

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

“The result is that the RBA forecasts are inferior to the random walk.”

But this is excellent news! All they have to do is take the difference between the two forecasts, and *subtract* it from the random walk result – a more accurate forecast in an instant. Then all that remains to be done is to admit that the premises of their model are complete b******s.

“The question is when will it become obvious to the general public that mainstream economists are not in some elevated species with deep insight into how the economy operates.”

I think many of the general public have thought that for a long time. 🙁

Well , in my opinion the first signal that the Irish zoo is about to leave the Euro cage for another cage has been established.

http://www.finance.gov.ie/viewdoc.asp?DocID=7505

When enough of this bank junk has been sold the Irish will restart the flow so that at least some of this new fiat can be captured by private actors.

Bank of Ireland is positioning itself to eat what remains of the pies me thinks.

As Bank of Ireland investments were always a play on the return of the Punt thingy.

Remember the assets are not important – whats important is the farming of wealth inherent within the fiat.

A NTMA head guy expressing frustration with the international bond market on state television today is another signal that something is going down as it is just too nicely choreographed……

Its difficult not to be too cynical when dealing with these guys.

They are some piece of work.

The really sad thing about it all is that they will get away with it.

Bill, let me start of by saying I`m a fan of your work and this is my first ever comment. I apologize if I am out of bounds since I am not really commenting your blog post, but rather asking a question.

Krugman just posted a link to the transcript from the panel debate between himself and 3 other academics (if I can call the Chicago school representative that..), in which Valerie Ramey citing her own work – Owyang, Ramey, Zubairy (2012) – about fiscal multipliers across the board not being statistically significant above 1.0 in modern times (even counting the 30`s).

Would you be able to comment on this? I`m a mere engineer with economic interest, with a strong belief that the fiscal multiplier is almost certain to be above 1.0 in times of high unemployment. Has something been overlooked / ignored on purpose / been misinterpreted on behalf of faulty modelling?

Thanks in advance.

Bill,

John Ralston Saul has said; “Economics should not lead our society, democracy and democratic decision making should lead.”

This statement is not a denigration of economics per se. JRS does however denigrate current dominant mainstream economics from about 1970 to the present. What he is saying essentially is that the technical professions cannot lead our society. Their prescriptions and predilictions for action cannot and should not over-rule democratic decision making. Certainly, they can aspire to advise and seek to persuade but not to lead. JRS argues that in the period 1970 to the present we have elevated economics, or one form of economics namely neoclassical and monetarist economics, to a position of de facto leadership of our society. Political action is now circumscribed to that policy area and that limited set of “solutions” ordained as permissible and workable by neoclassical and monetarist economics.

It becomes clear that the technical professions should not lead our society when we frame such suggestions like this. “Scientists should lead our society” or “Doctors should lead our society” or to take the case which has become reality “Economists should lead our society”. Or to take an even more egregious suggestion like “Lawyers should lead our society”! Technical professions see solutions to society’s problems and issues largely through the lens of their own profession. Thus to engineers, the solutions which present will be those which involve large engineering projects. (Witness Campbell Newman and his traffic tunnel obsession as Lord Mayor of Brisbane.) To nuclear scientists, the solution will be more nuclear power stations. To lawyers, the solutions will be legalism, more law, more litigation especially and (one might add) more obfuscation and deception.

Finally, to narrow ideological and unempirical economists (meaning in particular the neoclassical economists) the solutions will be the application of prescriptions from ideologically conditioned models, riddled with simplistic and idealised assumptions, which bear no relation to the real world and take no notice of the feelings, needs and hopes of real people. More broadly, economists, other than those who maintain a democratic, social and human focus wider than the limits of their technical profession, will tend to see solutions in terms of abstract values like “economic efficiency” or narrow formalistic targets like GDP growth. Placing the emphasis on full employment, a living wage, adequate welfare support, progressive taxation, broad equality and equity, along with good public education and public health is quie different. Here, finally, we have human or humanised values; programs designed to suppot the entire populace and not just a privileged section.

Mainstream orthodox economics (neoclassical, monetarist) and even mainstream “heterodox” like New Keynesianism is pushing me closer to MMT. Something that attracts me to MMT is that whilst being a highly technical finance economics in one sense (the close attention to national accounts, banking processes, financial instruments, money creation, money destruction, debt, money supplies, money flows and general macroeconomic measures like GDP, unemployment etc.) it de-mystifies rather than mystifies money and finance. You would argue strongly that this is a natural consequence of this MMT approach and you would be right. However, mainstream economics is obsessed with some of the same technical measures too and it thus takes a while for the neophyte approaching MMT to realise MMT is doing something different.

Mainstream neoclassical economics uses the technical financial-economic approach in a selective, ideological and unempirical manner. That is the best way I can describe it. The outcome of this neoclassical approach is to mystify money, finance, national accounts and macroecnomic measures in a way which obscures certain features of reality and makes some things “real” which are in fact not real. In other words, I am talking here of the Reification Fallacy “also known as concretism, or the fallacy of misplaced concreteness”*. “An abstraction (abstract belief or hypothetical construct) is treated as if it were a concrete, real event, or physical entity.” I take this definition and explanation from Wikipedia.

In particular, neoclassical economics, at least in the crude and dogmatic form in which it is peddled to the public, reifies fiat money and treats it as a concrete reality. By extension, surpluses and deficits are reified and treated as concrete realities rather than as accounting conventions or abstract tools to be used to achieve specific ends; which ends broadly should be the (reasonably equitable) meeting of all reasonable needs and requirements of all the people (all members of a national polity).

In other words to greatly simplify, neoclassical economics is about protecting the “virtue” of money. Of course, the main threat to the “virtue” of money or the amount of value it represents is inflation and hyperinflation but these phenomena are not the only threats to the well-being of real human citizens. These threats, even on the monetary/finance, side alone include but are not limited to inflation, hyperinflation, deflation, stagnation, staglaltion, high interest rates, low interest rates (for some), high debt, credit, lack of credit and the list goes on. In addition, real pople face real threats beyond these; namely unemployment, under-employment, discouragement from entering the labour force, illness, malnourishment, lack of education, lack of medical services, crime, lack of good social order and cohesion etc. etc.

The way mainstream neoclassicals defend the virtue and sanctity of money and government surpluses and to achieve that sacrifice all other values and all other parties (like the unemployed) calls to mind a Don Quixote-like defence of the virtue of a lady who sells her favours.

I have not developed the second part of the idea presaged in the opening lines quoting JRS; “Economics should not lead our society, democracy and democratic decision making should lead.” However, this post is already getting too long so I will cease for now.

Every day, mainstream economics pushes me closer to MMT.

Oops, When I typo-ed “staglaltion” I meant “stagflation”.

Professions that are dealing not simply with forecasts but are as well in the business of trying to manipulate the economy may be an obsolete brand of the human specie. In the long run there simply are no free lunches no matter how much manipulation and central planning is undertaken.

I am quite certain that I will experience the disgust those persons will face from the general population before I retire into my grave.

Linus, every time you go into a store and buy something, you are “manipulating the economy”. That’s what an economy is. The problem is not so much your reasoning, but your assumptions, an over-restricted way of looking at things and above all the implicit theory of money. The things you think go without saying, are so obviously true – are frequently wrong & or “not even wrong” – they just don’t make sense. Not your fault, the lunacy is broadcast 24/7 these days in the MSM & by the charlatans of academia. MMT already incorporates the Austrian, sound money, anti-inflationary, anti- crazily-speculative finance themes that resonate with you. But this is running before you can walk, which is by far the hardest and most important part. The question to you is – what do you think money is? What is money?

(Part of the answer, not the deepest, is: ) Money is a creature of the state. Money = what you are calling “central planning”. It is LOGICALLY impossible to have money without “central planning”. No such “thing” has ever existed anywhere, or will exist anywhere. You just don’t notice, don’t recognize the “central planning” in economies that you think have money, but no “central planning”. That usually suits those central planner guys manipulating things just fine. 🙂

And MMT is all for decentralizing, minimizing such unresponsive, distant central planning. But eliminating everything that you seem to think is central planning – is just plain impossible.

In the long run, there ALWAYS are free lunches. That’s what rational economic behavior, technological progress is – finding a new free lunch. But the basic MMT / Keynesian method of getting “free lunches” is really, really simple. One that the rest of the world’s life-forms discovered long, long ago. Only humans are capable of such majestic feats of nescience, of such awesome stupidity. Get a free lunch – by NOT FURIOUSLY SMASHING TO PIECES THE LUNCH YOU ALREADY HAVE.

@ Some Guy

Don’t give me such non-sense statement that when one buys or sells something, that person is manipulating the economy. That kind of statement is total crap and you know it. Yes, I do subscribe to certain principles but not for the sake of pleasure of sticking to principles but for reasons that have a foundation in the knowledge of what is important to values associated with freedom, independence, responsibility, accountability, self respect and peace.

Fiat money is a creature of the state. Real money would be a reliable measure of value as it would not be able to be manipulated. There have been many experiences in history when such manipulations have been tried and all of them failed, I repeat, all of them failed. So do not try to preach to me that today’s central bankers are somehow above the level of humanity and will be able to manage this mess without producing great misery in the long run.

The MSM is not at all along my line of thought as they celebrate all these measures taken to avoid facing the situation head on.

As MMT as well as the Keynesian Model is clearly for using monetary policy to manipulate the economy with the illusion that this will resolve the problem. But the problem is not really understood by these clowns. The real problem IS the manipulation itself.

Please do not talk about inflation to me as you clearly have no clue what inflation is all about. You probably do not even realize that we live in a period of intended and continuous inflation since 100 years. To phantom the effect this had on the society at large will definitely exceed your capacity.

I understand very well that people look out for free lunches having been trained in it by governments the world over. So enjoy your free lunch as long as it lasts. Cheers

@Linus

“Fiat money is a creature of the state. Real money would be a reliable measure of value as it would not be able to be manipulated.”

What is real money and what can it buy you that unreal money cannot?

Or are our daily transactions with this unreal money merely figments of our imagination as we blissfully live in the matrix?

@ Real money lol

Your comment shows your short sightedness and ignorance.

Real money could not be subjected to manipulation by some phd’s that think to treat the rest of society as their lab animals. We do not even have to implement real money as the only currency but by simply allowing a currency that cannot be manipulated to be accepted (as a parallel currency to the existing one) in order to find out which type of money the population would select for their savings. I can guarantee that within a short year the currency currently in use would be mostly replaced if people have a free choice. In other words, the present currency is simply an enforcement by the corrupt elite in order to enslave us. I however am for the freedom of the individual and not for enslavement.

Of course, it may be hard for most people, to imagine what effect the slow grind of currency devaluation has on society, especially today, as we are so completely used to having an inflationary money policy. To explore that issue would be to large a subject for this blog.

I do not even object to the possibility that for solving a problem (as presently exists) to use a major devaluation by issuing sufficient currency for replacing part of the credit volume in the system on one hand and by letting defaults take place on the other hand under the condition that it is not done through the banking system but by directly benefitting the population and that it is handled in a transparent and fair manner (not simply to the benefit of indebted people but with equal consideration of the net saver). When replacing the credit volume by base money we would get the benefit of reducing the financial sector’s grip on the economy, the government and therefore on us. There are many possible mechanisms that may be employed. Unfortunately is the government to starkly beholden by the financial industry to give this potential solution a chance.

By the way the issue is handled since a long time, the devaluation of a currency benefits mainly the banks and elite while the rest of the populace looses out more and more. That is the real reason for my call for real money (meaning money that cannot be manipulated). Instead of trying to redistribute wealth via taxes, we should first of all stop the leakage that results from questionable monetary policy.

Hi, I was convinced that a bit of public spending increase would take the sting out of any medium sized recession. I came across a large dataset for UK GDP and inflation on the Internet so thought it would be interesting to see how far public spending can be used to “plug the gap”. What I found surprised me. Increasing public sector spending seems to be bad whenever it exceeds private sector growth. Take a look at the graphs in the following link:

Does public spending stimulate the economy?

It happens every time over the past 70 years. If you want to improve the economy, in the UK at least, your simplest action is to cut public spending, or so it appears. Any comments?

Dear John (at 2013/01/11 at 21:26)

Thanks for your comment.

I do not have time to do an appropriate time series analysis of your dataset using proper decomposition methodology and control

But a cursory analysis of your data suggests you should look at the way you have computed your real growth series. I produced some graphs from your data (and compared them to British ONS data). My turning points are quite different for both total GDP and your private measure and the amplitude of the cycles are different. To give one example, you have completely missed the major downturn in 1974.

The charts I created from your data are consistent in turning points etc with those I can produce from official ONS data (I suspect most of your data comes from the ONS). That tells me your calculations are suspect.

Also you should document how you computed the Private GDP series – that is not a straight forward exercise and is open to interpretation.

Other brief comments include – you have not controlled for endogeneity – that is, you have not separated the discretionary government spending from that part of spending that is driven by cycle. It is of no surprise to me that government spending rises during an economic downturn. But you cannot then say that the former causes the latter. In fact, the causality goes the other way. You have not controlled for that at all.

Further, there are complex lags in these relationships and you have assumed that the contemporaneous annual effects exhaust. I would not be so sure. A simple regression tells me otherwise.

Also, to assess the fiscal position you have to consider net spending not total spending. In other words, you have not taken into account what was happening on the other side of the budget (taxes and revenues). You cannot simply summarise the governments overall policy stance via spending.

Economists have been trying to assess the sorts of impacts you are interested in for years and they bring much more sophisticated statistical techniques to bear to ensure the issues I have raised (and there are more I don’t have time to go into) are considered and controlled for.

best wishes

bill

“A little learning is a dangerous thing;

Drink deep, or taste not the Pierian spring:

There shallow draughts intoxicate the brain,

And drinking largely sobers us again.” – Alexander Pope.

The longer passage is enjoyable;

“A little learning is a dang’rous thing;

Drink deep, or taste not the Pierian spring:

There shallow draughts intoxicate the brain,

And drinking largely sobers us again.

Fir’d at first sight with what the Muse imparts,

In fearless youth we tempt the heights of Arts,

While from the bounded level of our mind

Short views we take, nor see the lengths behind;

But more advanc’d, behold with strange surprise

New distant scenes of endless science rise!

So pleas’d at first the towering Alps we try,

Mount o’er the vales, and seem to tread the sky,

Th’ eternal snows appear already past,

And the first clouds and mountains seem the last;

But, those attain’d, we tremble to survey

The growing labours of the lengthen’d way,

Th’ increasing prospects tire our wand’ring eyes,

Hills peep o’er hills, and Alps on Alps arise!” – Pope.