In the annals of ruses used to provoke fear in the voting public about government…

So who is going to answer for their culpability?

As a researcher one learns to be circumspect in what one says until the results are firm and have been subjected to some serious stress testing (whatever shape that takes). This is especially the case in econometric analysis where the results can be sensitive to the variables used (data etc), the form of the estimating equation(s) deployed (called the functional form), the estimation technique used and more. If one sees the results varying significantly when variations in the research design then it is best to conduct further analysis before making any definitive statements. The IMF clearly don’t follow this rule of good professional practice. They inflict their will on nations – via bullying and cash blackmail – waving long-winded “Outlooks” or “Memorandums” with all sorts of modelling and graphs to give their ideological demands a sense of (unchallengeable) authority before they are even sure of the validity of the underlying results they use to justify their conclusions. And when they are wrong – which in this case means that millions more might be unemployed or impoverished – or more children might have died – they produce further analysis to say they were wrong but we just need to do more work. So who is going to answer for their culpability?

On page 43 of the latest IMF World Economic Outlook update (October 12, 2012) – Coping with High Debt and Sluggish Growth – we read the following statement:

More work on how fiscal multipliers depend on time and economic conditions is warranted.

This was part of the WEO Update, where the IMF spell out how inaccurate their estimates (biased towards zero) of the fiscal multipliers have been. I will come back to that later.

You will recall I mentioned a last week – in this blog – The moronic activity of the rating agencies – that the rule which is being used to force Eurozone nations into self-destructive fiscal austerity – the Stability and Growth Pact fiscal rule – was just made up within an hour to satisfy the political needs of the then French President, François Mitterrand.

In case you missed it – Le Parisien carried a story on September 28, 2012 – L’incroyable histoire de la naissance des 3% de déficit (The incredible story of the birth of the 3% deficit) which revealed that a senior Budget Ministry official in the Mitterrand government was asked to come up with the fiscal rules that would become the Stability and Growth Pact (SGP).

Le Parisien tracked the official down recently and asked him about the origins of the 3 per cent rule and he replied (translated from the French):

We came up with the 3% figure in less than an hour. It was a back of an envelope calculation, without any theoretical reflection. Mitterrand needed an easy rule that he could deploy in his discussions with ministers who kept coming into his office to demand money … We needed something simple. 3%? It was a good number that had stood the test of time, somewhat reminiscent of the Trinity.

As I explained in this blog – Tightening the SGP rules would deepen the crisis – the origins of the SGP fiscal rule were arbitrary and then, ex post, there were a number of research papers from the EU and OECD attempting to justify the rule on so-called “scientific grounds”.

For example, this OECD Economic Studies paper from 2000 – Estimating prudent budgetary margins for EU countries; A simulated SVAR model approach – attempted to explore the scope that the Maastricht Treaty provided EMU governments to respond to a negative aggregate demand shock (which would manifest as an output gap).

The 2000 OECD paper claimed that:

The imposition of such debt and deficit ceilings does not necessarily impose a binding constraint on the use of counter-cyclical fiscal policy because countries can run a structural deficit that is well below 3 per cent of GDP. How far below 3 per cent is likely to be enough to allow the government deficit to play its role as a shock absorber in times of an economic slowdown or recession? The answer to this question depends on the size of economic shocks, the sensitivity of deficits to those shocks, and the extent to which the authorities might want to go beyond automatic stabilisation.

In my 2008 book with Joan Muysken – Full Employment abandoned – we had a section – Stability and Growth Pact, neither stability nor growth – which reflected on our research over several years which challenged the sort of proposition that the OECD was using to justify the 3 per cent rule.

I have long claimed that the fiscal rules were too restrictive to cope with a negative demand shock of the proportions we have now witnessed. It is clear that the advice that the EU was getting at the time was that expected negative shocks would be in a certain range – well below what we have now seen possible.

The rules, in other words, were designed on an overly optimistic view of what was possible. When you look back on the literature that the elites wheeled out to support their case it is clear that they didn’t anticipate how fragile their system really was.

Had the Euro elites bothered to examine the research evidence at the time they would have realised that the 3 per cent rule was too restrictive. For example, a 1997 study by Buti et al. examined the behaviour of fiscal outcomes for EU economies between 1961 and 1996 and found that:

… during 50 episodes of recession or abrupt slowdown in growth… an excessive deficit would have occurred in eleven cases if the budget had initially been balanced, but in 28 cases if the starting point had been a deficit of 2 per cent of GDP – i.e. more than a doubling of the risk of running into excessive deficits. They also conclude that the risk of incurring an excessive deficit is high in the case of protracted recessions, even if the starting point is a balanced budget. The same conclusion is drawn with respect to exceptionally severe recessions in which real GDP falls by more than 2 per cent.

(Full reference – Buti,M., Franco, D and Ongena, H. (1997) ‘Budgetary policies during recessions – retrospective application of the Stability and Growth Pact to the post-war period’, European Commission, Economic Papers, No. 121).

There were other studies that supported that sort of conclusion which leads you to conject that the EU forced the Mitterand-rule onto the monetary system without considering the implications. Even then it was obvious that several member states would be caught out and forced to introduce growth-sapping pro-cyclical fiscal interventions if a reasonable size cyclical downturn occurred.

Further, given the logic of the EMU, these same nations would soon encounter the disdain of the “bond markets” and a Euro crisis would be inevitable.

Who is being held responsible for this culpability? Answer: the unemployed, pension recipients, and the rest of the citizens who are being punished for the incompetence of the elites.

Anyway, of relevance to today’s blog is the fact that some of this is linked to the estimation of output gaps. I have consistently argued that the way organisations such as the CBO, the IMF, the OECD, the OBR and the rest of the economic forecasting units attached to or used by governments to frame policy impose inherent ideological biases on the estimates of their output gaps.

The direction of the biases is to understate the size of the gaps and therefore conclude that the policy stance is overly expansionary when in fact it is likely to be contractionary.

I explain that position in detail in the following blogs – Structural deficits – the great con job! and Structural deficits and automatic stabilisers November 29th, 2009 – for more discussion.

The output gap measures published by the IMF and the OECD are almost certainly too conservative because they are typically based on concepts such as the NAIRU. Please read the following blog – The dreaded NAIRU is still about! – for more discussion on this point.

This is one of the reasons they keep delivering grossly inaccurate estimates in their pontifications.

What it means is that the estimates of the cyclical components of the actual deficits will almost assuredly biased downwards, which means the estimates of the “structural” component will be biased upwards.

This, in turn, means that we will be led to conclude that the discretionary fiscal position adopted by the government in question will be more expansionary or less contractionary than it actually is.

In the blog – Tightening the SGP rules would deepen the crisis – I did some calculations which you can read if interested.

What I showed was that the elites supported by the OECD etc claimed that even if a nation was running structural deficits around 1.5 per cent of GDP they would have more than enough space to avoid breaching the SGP threshold of 3 per cent based upon what the OECD was claiming were the “mean value of the maximum output gaps recorded in recessions in the major EU economies during 1975-1997”.

The problem was that these estimates of “fiscal space” were grossly overestimated.

First, the OECD and others typically assumed that before the recession all nations were at full employment already (zero output gap) which is clearly not a viable starting point. The output gaps were persistent across the Eurozone in many economies so they went into the crisis with cyclical deficits. Not all the deficits were of a structural nature.

When you consider that and note that some governments were running actual surpluses before the crisis then you start to appreciate how much fiscal drag was in the system and how reliant on private credit growth the region became. That was an unsustainable but typically neo-liberal growth strategy.

Further, the austerity approach en masse relies on the private sector offsetting this fiscal drag (and the drag on exports from the austerity given how closed the Eurozone is as a trading market). In the same way that the UK austerity assumes an already heavily indebted private sector will accumulate more debt to get the economy growing the same logic applies to the Eurozone. That is, they are just repeating the errors that led to the crisis.

Second, the analysis ignores problems of path dependence. For example, a nation could be caught in a sequence of recessions which would, under current arrangements, ratchet the public debt ratio up over time. So each recession would reduce the “space” for structural deficits in the future under the SGP rules, irrespective of whether the nation recovered to full employment in between the episodes.

Some cursory empirical analysis (in the blog mentioned) showed that even using the OECD output gaps (which were biased downwards) the current recession generated output gaps which are considerably larger than those that we considered to be reasonable to justify the SGP restrictions.

This means that there was no chance that the majority of budgets in the EMU could withstand the current crisis and remain within the SGP rules, even if they started from balanced positions.

Thus, it becomes obvious that: (a) the starting pre-crisis fiscal position for many nations was too contractionary (hence the persistently high unemployment even when the economies were growing; and (b) the resulting increase in the fiscal deficits were largely cyclical as a result of the dramatic increase in the output gaps that the collapse in private spending generated.

So the SGP limit could not even cope with a major cyclical swing. Which means that using it as a guide for the conduct of discretionary fisal policy changes is disastrous.

And so it has been. We now have nations undergoing vicious and harsh pro-cyclical fiscal policy shifts (that is, austerity) and being threatened with excessive deficit fines – when their deficit positions are just signalling how large the output gap is.

The pro-cyclical fiscal policies that are being forced on these nations, in turn, make the output gap worse and invoke even harsher penalties from the Troika. The governments are then forced to make further cuts in discretionary net public spending and the cyclical budget component gets worse.

It is almost certainly the case that the cyclical component alone breaks the SGP constraints – for Finland, Greece, Ireland, Netherlands, Spain and probably Italy.

The question that arises is – what sort of fiscal rule would force a nation to run a budget surplus at full employment as a matter of course (irrespective of the other sectoral balances) – if the cyclical response that might accompany a severe recession would violate that rule?

So the made-up 3 per cent rule is being used to violate even the most basic concept of responsible fiscal management. Fiscal policy should not be used to kill growth and drive up unemployment when there is no inflation threat and growth is collapsing as a result of inadequate private spending.

This is how arbitrary the neo-liberal period has been. Yet these arbitrary rules and assessments – all part of an elaborate smokescreen or charade – cause real damage to the lives of working people and rarely undermine the capacities of the elites. There are countless high paid officials in Brussels strutting around making all sorts of statements about the need for nations to cut welfare, wages, jobs and the like based on a rule that was just made up on the spot without any economic justification or authority.

But it gets worse.

First, there was a publication from the UK-based Capital Economics which came out last week and was reported in the FT Alphaville article (October 4, 2012) – Why the UK output gap could be a chasm. As far as I can tell this is a subscription report from Capital Economics who seem to charge enormous amounts for clients to learn the obvious. Good marketing I suppose. [EDIT: After I had published this blog, Capital Economics kindly sent me the relevant report. I appreciated that – and it is a very interesting analysis].

The article tells us that Capital Economics has concluded that the output gaps currently being used by policy makers in Britain are significantly understating the true gap between potential GDP and actual GDP.

The policies that are being based on the official output gap estimates thus assume that the UK economy has less excess capacity than is the true case. This means that the policies introduced will be almost certainly more contractionary than is being assumed.

This is one of the reasons why the official estimates from organisations like the IMF are so inaccurate (they are always overly optimistic about real output and downplay unemployment rises).

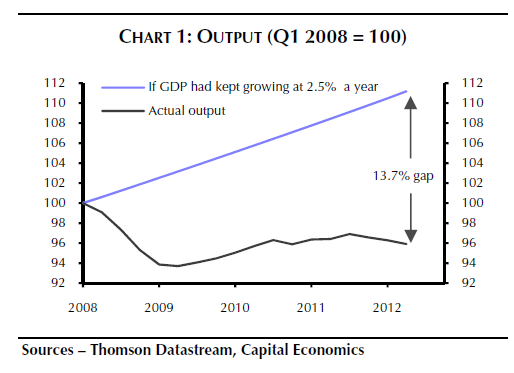

The following graph is reproduced from the Capital Economics Report.

So you can see that at present, real output is some 14 per cent below a trend-extrapolated growth rate (based on 2.5 per cent growth). Beware though. The extrapolation – which is reminiscent of the so-called peak-to-peak method of linear extrapolation which we used to use to come up with measures of potential output – assume that the starting point (a peak) – is a full capacity point.

If the the first-quarter 2001 Real GDP estimate contained some excess capacity (that is, the economy was not at full employment) then the true gap would be larger than 13.7 per cent, by the size of the excess capacity in that quarter.

The Capital Economics Report said that most forecasters claimed in relation to 2007:

That the economy was overheating in that year is a view now also held by the major international forecasters, including the IMF, OECD and European Commission

But it is likely that these estimates were “generous” especially when one considers other evidence which does not support a fully employed, overheating economy.

But that aside, Capital Economics say that bodies such as the UK Office of Budget Responsibility (OBR), which provides the modelling for Treasury, have deliberately assumed that the recession has destroyed a massive amount of productive capacity.

In relation to the above graph, this would mean that the upper (extrapolated) line would be significantly below the 2.5 per cent extrapolation. The Capital Economics report says that:

By far the bigger factor is the view that the recession caused a significant permanent loss of productive potential. The OBR’s output gap forecast in 2012 (2.6%), its estimate of the degree to which the economy was overheating in 2007 (2%) and the extent to which GDP is currently falling short of its pre-crisis trend (14%), implies a permanent loss of output of something like 9% of GDP.

The upshot is that Capital Economics believe the idea that the potential output has fallen that far is far-fetched and contrived to deliver a politically palatable scenario.

The OBR-types claim that if the output gap was larger than their 2.6 per cent (and certainly up to 14 per cent) then the UK should be deflating rapidly.

This is the same sort of arguments that came up in the mid-1970s when stagflation became a problem. The Friedman Monetarists attacked the then Keynesian orthodoxy on the grounds that demand-management had failed to deliver because economies were being confronted with rising inflation at a time when there was rising unemployment.

This was interpreted as meaning there was no coherent trade-off between the two evils and that the full employment unemployment rate (the NAIRU) was almost certainly higher than believed (that is, in the parlance of today’s blog – the output gaps were low).

But the inflation at present in the UK is either policy-driven (VAT increases) or supply-driven (energy prices etc). Demand-pull inflation – where the output gap is low and nominal demand growth strains the capacity of the economy to respond in real terms (increasing output) is non-existent at present.

Capital Economics concludes that:

… for the sake of argument, we don’t think that it is out of the question that the economy was close to its potential in 2007 and that very little output has been permanently lost in the recession. On that basis, the output gap would be about 13% of GDP.

They suggest that a reasonable conservative estimate of the output gap would “still be about 6% of GDP”. which is a far cry from the official estimate of 2.6 per cent.

Which means, following on from the earlier discussion about the SGP, that current fiscal and monetary policy settings in the UK are excessively contractionary and are likely to cause more damage than is being predicted.

Further, it means that there is undoubtedly significant scope for fiscal expansion to drive nominal aggregate demand closer to capacity without any threats of demand-pull inflation.

Finally, back to the IMF. Their admissions about fiscal multipliers is the other part of the equation.

The underestimation of output gaps is one thing. But the underestimation of the size of the fiscal multiplier is another. The first error leads to imposing policies that are excessively contractionary.

The second error then leads the government to underestimate the damage that the fiscal contraction causes. Both lead to disastrous outcomes accompanying fiscal austerity and explain why the world is in such a mess.

We are in the hands of drunken sailors who have think the rocks are further away than they are and who don’t know how strong the wind is that is pushing them towards the reef. Even as they sink – they chant a happy tune.

On Page 41 of the IMF WEO Update we encounter “Box 1.1. Are We Underestimating Short-term Fiscal Multipliers?” There is a lot of technical talk contained in the box, which is meant to give the impression that this is science we are dealing with and the IMF modellers are on top of their game.

Nothing could be further from the truth.

Here is the takeway in their own words:

he main finding, based on data for 28 economies, is that the multipliers used in generat- ing growth forecasts have been systematically too low since the start of the Great Recession, by 0.4 to 1.2, depending on the forecast source and the specifics of the estimation approach. Informal evidence suggests that the multipliers implicitly used to generate these forecasts are about 0.5. So actual multipliers may be higher, in the range of 0.9 to 1.7.

What does that mean in English? Well lets say, as part of their austerity mania, that the government cuts spending by $1 billion. Once all the adjustments are exhausted the official estimates would suggest that real GDP falls by $500 million (based on a multiplier of 0.5).

However if the multiplier was 1.7, real GDP would fall by $1.7 billion – more than 3 times the official estimate.

In other words, the estimates of the damage caused by the IMFs constant hectoring for governments to impose fiscal austerity, have been grossly understated.

Conclusion

I have run out of time today – but consider the human casualties of all of these “errors”, which are systematically being made by my profession.

Economists strut around with these papers and quote all sorts of technical gobblegodook but in the end they haven’t a clue what they are talking about. Their jobs, however, are not the ones that are risk.

In turn, the ideologues in the EU and the British government and all the rest of them use the estimates provided by these incompetent economists to impose harsh, job-destroying policies on their populations.

And then we are told:

More work on how fiscal multipliers depend on time and eco- nomic conditions is warranted.

So all of this is being imposed on people based on research evidence that doesn’t warrant the status of being called knowledge. Now we know how wrong all these agencies and government departments have been.

So who is going to be held responsible for the damage that is being caused?

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

“As far as I can tell this is a subscription report from Capital Economics who seem to charge enormous amounts for clients to learn the obvious.”

Oh yes. Hired guns and mercenaries. I’ve paid them a large amount of money for ‘expert opinions’ before now and very useful it was too for that particular project.

But it was cast iron proof that those who pay the piper always call the tune.

These guys (IMF) have always worked like this (even during bretton woods) – they do not make mistakes , they make decisions.

Geithner made the key decisions for Europe.

http://www.youtube.com/watch?v=JacGZ4LxK-0

After meeting McNamara Denis Healy became “convinced” the F 111 was cheaper.

Jenkins : the Americans wanted many things……….

These Jenkins characters are always in place withen each Vassal state.

The ECB is a arm of the FED.

Europe is seen as the new Saudi Arabia……extract the oil and ship it somewhere else.

“But the inflation at present in the UK is either policy-driven (VAT increases)…”

That’s a one-off price increase that should have dropped off the scope of year on year comparisons last January, since VAT rose by 2.5% on the 1st of January 2011. Or am I mistaken?

@Bill

Do you propose that the UK import more real goods short term via fiscal deficits to increase its long term productive capacity ?

Its real goods balance of trade in 2011 was – £100 billion !!!!!

If so that will transmit a greater real shock to countries such as Ireland as we will get even less oil from core countries.

This is a very long term decline from the 1960s.

Going as far back as the Beeching cuts and the destruction of the UK boffin culture.

I don’t think you can reverse this now – its a terminal decline.

The Big bang was all about running surplus North Sea oil through countries such Ireland & Spain via the credit banks…..they have got a yield off the grot production for a few decades but now thats over with negative sums to show for the loads of money culture.

The UK Q2 current account showed a negative of income of £5.5 billion (a record)

There is talk of the UK cutting its EU farm subsidy so as to reduce its transfers….this will be a further shock to Ireland and France.

Lets face it – we are facing civilization collapse.

The credit banks blew it on Grot and now its over.

Much of France is engaged in very major rail transport investments , much of which is off the fiscal books via PPP programmes , EIB , the local authority taxing local areas for tram and local (TER) rail systems , semi state arms of Goverment such as SNCF & RFF.

This is how for better or worse the Euro system operates……but France is sucking in real goods and fuel at the PIigs expense.

http://www.tradingeconomics.com/france/balance-of-trade

Energy is defined as the ability to do work

The 3 High speed projects it has currently going at a high tempo require huge amounts of Diesel / capital.

http://www.eib.org/attachments/press/lgv-sud-europe-atlantique-en.pdf

http://www.youtube.com/watch?v=aJNproZQ4Zs

Perhaps the UK or France can do smaller scale more labour intensive / less energy intensive operations such as this.

http://www.youtube.com/watch?v=dOkLFaIdUwA

38% state

38% region

24% RFF

but if the UK decided to do 3 high speed lines they would have to completly strip their Irish colony.

The UK has a 9.8 billion trade of Goods deficit in August !!

From a trade settlement perspective £ needs to devalue massively

But will this help its Nissan factory ?

en.wikipedia.org/wiki/Nissan_Motor_Manufacturing_UK

Its absurd 4*4 Quashqai is its saviour both in Uk sales and indeed in Irish sales where amazingly it is the second most popular car in Ireland this year (Jan -sep) ,with the even more absurd Juke model selling well. (proof the Irish have a overvalued currency subtracting from domestic demand)

A further UK devaluation will make this make a icon of past times.

It will also take Ireland out of the eurozone for sure meaning less buyers of 4*4s and more buyers for marginally profitable 1 litre petrol micro cars.

My guess is the only car plants remaining will be BMWs mini plant

en.wikipedia.org/wiki/Plant_Oxford

and maybe the Astra plant in Ellesmere under such a event.

Vauxhall moves to four-day week at Ellesmere Port factory

The Guardian – 1 hour ago

More than 2,000 workers at Vauxhall’s Ellesmere Port plant are moving to a four-day week as the carmaker’s owner, General Motors, seeks …

This is off topic but related to the cause.

please, please, please comment at this military website discussing the “foolishness of nat’l debt” – this is a community worth converting – and refer them to diverse entries at BillyBlog; the more the better

America’s strength is an illusion created by foolish borrowing

http://fabiusmaximus.com/2012/10/10/america-debt-43894/

and please be polite; the audience is mostly retired military officers; a very useful community to recruit

the audience is largely retired military officers, and the author is a respected military historian; he’s clearly out of his comfort zone re the details of currency operations, but so is 99.9% of the electorate;

Please help inform, educate and recruit these people. It may be very useful.

My question is not exactly on the topic above. It’s more to do with general MMT.

MMT appears to me to be a valid theory but like all valid theories, carefully considered, it has limiting conditions* for its application. The limiting conditions include but are not limited to the conditions of there being (globally) sovereign government actors, fiat currencies in each government zone, floating exchange rates, no gunboat or expeditionary army diplomacy and finally room and resources for further economic growth in the biosphere.

The Euro Zone violates these conditions in that the single currency area does not equal a single sovereign government area. China violates these conditions in not properly floating its currency. The USA violates these conditions by using expeditionary army “diplomacy”. Whether a small country (say Zimbabwe or Tuvalu) violates these conditions is inconsequential for the global system. The physical globe violates these conditions in that it is finite and there are space and resource limitations on growth.

How does MMT address these issues, particularly the limits to growth issue?

* Note: Even theories in physics have limiting conditions. For example, Newtonian physics is only valid (to close approximation) when the speeds involved are a tiny fraction of the speed of light.

Maybe shorter working times are answer to growth limits.

http://www.youtube.com/watch?v=580VyI6hFmo

twitter.com/transportktn/status/250530978261504000

3.4 billion this year ? the big banks are investing in RFF , JP and the lads

in.reuters.com/article/2012/09/28/idINWNA639220120928

SNCF spent 2.364 billion Euros on capital stock in Y2011 (58 % on rolling stock , 42 % on stations etc)

To compare british private investment in rail capital during Y2011 /12 was £503 million of which £369 million was rolling stock.

Many others will benefit…………

m.metal-supply.com/article/view.html?id=88176

The EIB is also operating withen a quasi fiscal capacity.

“Release date: 28 September 2012 Reference: 2012-132-EN A first EUR 100 million instalment of a EUR 300 million loan to finance the Brittany – Loire Region high-speed rail project was signed in Rennes by Philippe de Fontaine Vive, Vice-President of the European Investment Bank (EIB), and Pierrick Massiot, President of the Brittany Region

To do this effectivally withen the Euro framework they must suck Ireland & Greece dry as they are too far from the centre to save.

The Brits are without vision.

Direct from ORR

“Government subsidy towards the railway industry in 2011-12 was £3,901 million (£3.9 billion), this is £59 million lower than the previous year.

2). Government support reached its peak in 2006-07 with £6,308 million; government support has declined every year since.”

The lines to the south are now reaching capacity limits because of a lack of fiscal money as passenger numbers keep increasing.

Don’t believe the spin.

This is not the greatest investment in the rail system since the victorian era – not in real terms at least.

Much more real British resourses go into high powered 4 wheel drives.

“The UK has a 9.8 billion trade of Goods deficit in August !!

From a trade settlement perspective £ needs to devalue massively”

Why is that?

Imports can only happen if somebody is prepared to fund the process. Funding has to be in place at the same time as the import process or the transaction fails. (You can’t ship a boat full of stuff from China without letters of credit).

Getting excited about a goods imbalance without looking at services and financing (foreign savings essentially) is another example of looking at one side of the accounting equation without considering the effect of the other. It’s a fear trick. A non-balanced view.

Just like deficit hysteria.

The MMT way is to take a balanced view in the round.

In policy terms MMT suggests that you can try and eliminate foreign holding of government sector liabilities by reducing the interest paid to zero and stopping issuing government bonds. Then foreign entities must use a private sector bank as an intermediary, or go to cash to get cover from the government sector. If the private sector entity used then fails, the loss is with the foreign holder of the financial assets and they have to look to their own government for restitution in the event of a crisis (essentially the approach taken by Iceland).

Beyond that enjoy the standard of living increase given to you by foreign savers.

“How does MMT address these issues, particularly the limits to growth issue?”

The clue is in the title. MMT is a *monetary* theory. It shows how to set up the monetary system so that it provides the maximum available amount of policy room to a government.

It shows that money is never the constraint to doing things. Real things are the constraint.

It says to governments: stop worrying about money and get real.

Now what you do about managing those real constraints requires a whole set of other ideas. MMT doesn’t address them directly, because that’s not really its purpose.

Thanks Neil, that’s a good answer. I may have been making an unjustified assumption or two in relation to MMT. The assumptions were that MMT always pre-supposed under-utilised capacity and always presupposed room for growth and inexhaustible resources. Clearly MMT does not always pre-suppose under-utilised capacity. It just has a lot to say about it currently (meaning the last two to four decades!) because there has been so much under-utilised capacity about (due to policy errors not resource limitations).

The era of limits to growth is upon us and it will create many complex issues. I had it fixed in my head that MMT was ignoring the limits to growth issue because Bill often focuses on growth (and foregone growth due to bad policy). But like the under-utilised capacity issue, I guess I ought to accept that focusing on a current problem, its ramifications and short to mid-term solutions does not equate to presupposing that that problem-solution complex is an eternal given.

Very sad , rail tour / demonstration.

http://www.youtube.com/watch?v=xk2IdBH5Zaw

Peloponnese metre-gauge network belonged since its construction to the former SPAP-ΣΠΑΠ (Piraeus-Athens-Peloponnese Railways) until 1962 when they were merged to OSE-ΟΣΕ (Hellenic State Railways). All service on network was suspended in 2011 (expect “Rack Railway” Diakopto-Kalavrita,Suburban railway of Patra and local service of Katakolo-Ancient Olimpia).

Excursion train 7460 Tripoli-Kalamata-Pirgos.

People from Greece & Ireland just don’t understand that they are worth more dead then alive under this Euro regime.

The same thing happened in Ireland in the 60s.

The once prosperous protestant west cork town of Bandon was cut off by a FF soldier of destiny(todd andrews) who mindlessly copied the British Beeching cuts of the 60s partially because the rail system defined British rule for his narrow little mind…..ironic and twisted yes ?

Now this is all that remains

http://www.flickr.com/photos/finnyus/7767103728/

96,000 thousand 1960s pounds were spent to close the line according to the Cork Dork speaking (not me)

http://www.youtube.com/watch?v=dRpYINMPpgw

People are now spending 25,000 euros + on frugal diesel German cars so as to just move around.

No commons means you spend more on stuff.

The era of limits to growth is upon us and it will create many complex issues. Ikonoclast

Except for living space I see no resource limits to growth. Given sufficient energy, matter can be endlessly recycled and even if we were limited to just nuclear fission we have plenty of uranium and thorium for a couple thousand years. And once fusion is perfected, our energy problem are solved.

Also, with improving technology we are learning to do more and more with less and less material and energy.

Our problem is that our money system REQUIRES that we take on debt (or be left behind) and REQUIRES exponential growth just to service that debt.

Not even sure living space is a true constraint F Beard. Right now, at 7 billion people we would only occupy the space within the boundaries of the state of Texas if every human was alloted 1000 sq ft each. This is before even building vertical. So a planet of 21 billion would occupy 3x the state of Texas. How many billion could we put within USA alone at that density and have the whole rest of the planet for resources to supply them? Not suggesting we live at that density Im just trying to give a visual to the vastness of our space relative to the number of people we have.

So, if its not a space problem or a resource problem ( I largely agree about energy, though water is quite stressed ) what type of problem is it?

Its a moral problem which stems from an empathy problem

though water is quite stressed ) Greg

Well, there have been some recent advance using graphene (Is there anything it can’t do? 🙂 ) to desalinate water.

Also, how about an Interstate Water System to move fresh water from where it is abundant, (perhaps even temporary as in the case of a flood) to where it is needed? That should provide a sizable amount of Federal infrastructure spending for the economy and who can deny the need when various fossil sources of fresh water are being exhausted? And if power is needed for pumps then we can use electricity from existing power plants during non-peak usage hours and/or build new plants, preferably thorium ones (the waste heat from thorium reactors could also be used to desalinate sea water).

@Neil

Their “services” surplus is banking stuff in the main.

This is the activity generated from trying to manage these trade distortions….

The Big Bang of London & the Euro project is the same phenomenon.

The UK is deeply integrated with the Euro ,with or without a sov currency.

From a classical trade viewpoint the euro countries are colonies of the UK – transfering their domestic demand towards exports.

PS Neil

You have also illustrated why I could never endorse MMT

Under MMT the goverment money is not true base money.

Pure Fiat is when a King issues and taxes the currrency……….and thats it baby.

No need for central banks to “finance” the goverment.

The bill is as good as the bond, no ?

Under a pure fiat system each political hinterland would trade with each other on a equal basis as no financial capital could have a call on another areas real resourses.

It could print as much domestic currency as needed but could not get into negative real goods balance.

You must begin to understand that financial capitals serve no productive function other then extraction.

The UK via the city is the most extreme example (the US is not much better) – it does not even bother to improve its productive capacity via its imports because it is confident that it can consume goods at the others expense.

The UK went into current account deficit in 1984 , this was the cover for the this massive malinvestment episode.

http://www.youtube.com/watch?v=Pbj9auFz9Ck (3.20)

The city credit banks ran North Sea & other oil through former nation states such as Ireland & Spain making a interest return on grot investments turning them into extreme market states.

Why did they do this ? – it did not serve the UKs national interest to burn its domestic resourses so that others could consume it.

It did however serve the Citys interest……their privatised money system meant they could extract a yield from others mindless consumption……

Now that the oil is mostly gone the city must drive these vassal states into physical surplus so that the city can remain in real goods deficit (as you can see above 2012 Q2 income was -5.5Billion)

At the mindless consumption peak during 2008 Q1 it was £14.1 billion…..this is the net yield from others waste.

Its really not that complicated.

No need to get into metaphysical debates about money and its time value which has proven to have little meaning in this dash for the remaining worlds resourses.

In the end it comes down to who can consume the physical goods.

Its a malthusian dynamic of the cities making as those guys have never produced net real capital in their entire sorry history.

Pure Fiat is when a King issues and taxes the currrency……….and thats it baby. The Dork of Cork

Exactly and that’s all the monetary sovereign should do wrt its money other than to provide a risk-free (no one else properly can) storage and transaction service for that fiat that makes no loans and pays no interest – no borrowing, no credit creation, no lending of existing money, no currency swaps, nothing else.

As for the private sector, it should be able to come up with money solutions that require no government privileges. In fact, the entire population deserves restitution for the damage they have suffered because of existing government privileges for the banks.

“You have also illustrated why I could never endorse MMT

Under MMT the goverment money is not true base money.”

That you have a religious belief in something being better when there is no evidence at all that it is. There’s no difference between that belief and the ‘buy gold’ mob.

Systemically there is no difference and the two can be mechanically transformed. However a bank gets to issue its assets, it always gets its turn, and it is the turn that transfers real goods, assets and services to banks.

F. Beard says:

“Except for living space I see no resource limits to growth. Given sufficient energy, matter can be endlessly recycled and even if we were limited to just nuclear fission we have plenty of uranium and thorium for a couple thousand years. And once fusion is perfected, our energy problem are solved.”

That’s quite an assumption, there. We live in a clearly finite world, one which “recycles” not within the span of human lives but at a far more leisurely pace. How on Earth (no pun intended) can we assume infinite supply of what we, as humans, need to sustain ourselves and/or our current “standard of living”? From what you say, the answer seems to be, “By making quite arbitrary assumptions”.

Cheers.

We live in a clearly finite world, one which “recycles” not within the span of human lives but at a far more leisurely pace. Vassilis Serafimakis

With sufficient energy, we don’t have to wait on nature.

And I don’t know about your standard of living but I don’t consider mine excessive.

However a bank gets to issue its assets, it always gets its turn, and it is the turn that transfers real goods, assets and services to banks. Neil Wilson

Wow! Banks are a given with most people. But:

1) Monetarily sovereign governments clearly don’t need banks.

2) The private sector should be able to come up with money solutions that don’t need government priviledges.

Could banks survive as purely private businesses? Perhaps. But only the most prudent ones. But isn’t that what people in favor of regulating the banks desire? Prudent banking? Why not let the free market weed out the imprudent?

Funny how people bridle at the thought of limits. I suppose it’s easier to keep dreaming of some technical fix that will allow us to keep overconsuming, rather than to realign our consumption with the capacity of the biosphere to cope.

Right now, the global ecological footprint is about 1.3-1.4 times the earth’s biocapacity. This means that the human population is in overshoot, and has only been able to maintain its population by drawing down non-renewable resources, or ecological capital. As these are depleted, a population correction looms. The global average ecological footprint per capita (2008 figures) is roughly 2.7 global hectares, climbing 0.5 gha/person from 2003-2008. This compares to the 1.8 gha/person that is actually available. The average US citizen has an ecological footprint of 7.2 gha, Australia 6.7 gha/person, the UK 4.7 gha/person. A country with a footprint close to their fairly allotted amount is Cuba, with 1.9 gha/capita.

In the interests of equity, if nothing else, the developed world should reduce it’s footprint by a factor of 3-4, closer to the example of Cuba. But we won’t even take the first step of recognising that we are over-consuming. Growth must continue apace, for the economy’s sake. Never mind the impact on the life support system that is the Earth’s biosphere. The Arctic may be ice-free in summer within five years, with the prospect of positive feedbacks accelerating climate change beyond the direst predictions of the IPCC. Even if we magically stopped emitting CO2 tomorrow, feedbacks from natural sources such as permafrost are likely to ensure CO2 levels do not fall for several centuries.

Unlike financial debt, we won’t be able to declare bankruptcy on our ecological debt.

Correction: “Right now, the global ecological footprint is about 1.5 times the earth’s biocapacity”

Growth must continue apace, for the economy’s sake. ParadigmShift

Growth is required to pay the usury on debt. I advocate the use of usury-free money forms such as common stock that allow but do not require growth.

there is perhaps the best list of causes I have ever seen for the cause of the banking and housing crisis. Use this if you want to make a point with anyone –

http://www.youstand.com/news/101312/causes-of-the-great-recession-345