I grew up in a society where collective will was at the forefront and it…

Governments should not worry about deficits

Another relatively short blog coming up today – it is still holidays here and very sunny. There was an interesting Bloomberg article the other day (April 5, 2011) – Don’t Worry About Deficit That Will Heal Itself – which although containing some conceptual flaws arrives at the correct conclusion. That governments would be far better pursuing real goals – such as ensuring there is adequate infrastructure investment, putting into place appropriate climate change initiatives and maintaining high levels of bio-security – that becoming obsessed with fiscal horizons that they have very little control over. Further, in attempting to control these horizons, governments tend to err on too much austerity (for example, the UK and the Eurozone), which not only undermines growth but also thwarts their deficit reduction goals (via the automatic stabilisers). The lesson to be drawn from all of this is that – Governments should not worry about deficits.

The Bloomberg article was written by Ezra Klein. He says:

I’m not particularly worried about the budget deficit. In fact, of all the major problems the U.S. faces, I’m least worried about the deficit.

The budget deficit should never be a target for government decision making. It makes no sense to say that we need to say, “balance the budget”, without recourse to other more significant economic targets – such as full employment, price stability, etc.

The most obvious reason is that the government doesn’t control the budget outcome. The government budget balance is the difference between total revenue and total outlays. So if total revenue is greater than outlays, the budget is in surplus and vice versa. It is a simple matter of accounting with no theory involved.

However, we cannot conclude that changes in the fiscal outcome reflect discretionary policy changes. The reason for this uncertainty is that there are automatic stabilisers operating. To see this, the most simple model of the budget balance we might think of can be written as:

Budget Balance = Revenue – Spending.

Budget Balance = (Tax Revenue + Other Revenue) – (Welfare Payments + Other Spending)

We know that Tax Revenue and Welfare Payments move inversely with respect to each other, with the latter rising when GDP growth falls and the former rises with GDP growth. These components of the Budget Balance are the so-called automatic stabilisers

In other words, without any discretionary policy changes, the Budget Balance will vary over the course of the business cycle. When the economy is weak – tax revenue falls and welfare payments rise and so the Budget Balance moves towards deficit (or an increasing deficit). When the economy is stronger – tax revenue rises and welfare payments fall and the Budget Balance becomes increasingly positive. Automatic stabilisers attenuate the amplitude in the business cycle by expanding the budget in a recession and contracting it in a boom.

So just because the budget goes into deficit doesn’t allow us to conclude that the Government has suddenly become of an expansionary mind. In other words, the presence of automatic stabilisers make it hard to discern whether the fiscal policy stance (chosen by the government) is contractionary or expansionary at any particular point in time.

Once you understand how the automatic stabilisers work then you will realise that governments that pursue fiscal rules like a balanced budget or in the case of the Eurozone – the fiscal compact – are actually denying the operation of the automatic stabilisers.

Fiscal rules increase the variance of economic activity – the booms are bigger (probably more inflationary) and the recessions deeper – because the attenuating effect of the automatic stabilisers on aggregate demand are negated. I cover those issues in this blog – Fiscal rules going mad … for further information.

The imposition of fiscal rules is the anathema of Modern Monetary Theory (MMT), which instead sees virtue in bolstering the strength of the automatic stabilisers via the introduction of an employment guarantee.

Please read my blogs – Structural deficits – the great con job! and Structural deficits and automatic stabilisers – for more discussion on this point.

What should we be worried about?

The British Office of National Statistics recently put out their latest labour force data (March 2012) which shows that there are around 2.7 million people unemployed and 473,000 unfilled vacancies across Britain – a UV ratio of just under 6 unemployment to every vacancy.

As this UK Guardian article (April 8, 2012) notes that the:

…. headline figure hides huge regional variance in the difficulty of jobhunting … in some areas of the UK the ratio may be considerably more than 6:1. The worst-affected areas are spread all across the country: Clackmannanshire in Scotland has 35 jobseekers for every vacancy; the Isle of Wight has 21; Haringay, London, 19; and Inverclyde 18.

The Guardian article says that after further analysis they conclude that “even these figures mask the true competition for work” given the quality of work that is being advertised across Britain (in terems of guaranteed hours).

In other words, much of the job creation in Britain is in the form of low-paid, casualised employment. Further, there are more than 1.4 million underemployed persons in the British labour market, which means that there are around 4 million British workers chasing the full-time jobs on offer.

If you adjust the vacancies notified to reflect “full-time” vacancies then the figure drops to 234,000 which means that adjusted UV ratio at the aggregate level sky-rockets.

The Guardian concludes:

The challenge of finding jobs for the 2.67 million unemployed in an economy generating 450,000 vacancies is tough enough. When a further 2 million part-time and temporary workers are also chasing the core full-time vacancies – and new evidence shows these may make up just half of the total – the challenge begins to seem even tougher still. Cutting unemployment from its current level of 8.4% to its 2007 lowpoint of 5.2% could prove a long-term job indeed.

There are always significant regional disparities during a business cycle downturn, with some regions experiencing very low unemployment and others the opposite. The mainstream argument is that market-driven regional labour market adjustments should reduce these spatial inequalities – allegedly because wages fall in areas with high unemployment and few vacancies and rise elsewhere, which motivates labour supply shifts (migration and longer commuting).

My research group has done a lot of work in this area over the last decade and the evidence is contrary to the mainstream “market” view.

Contrary to neo-liberal arguments that have focused on barriers between sub-markets – principally the claim that wage rigidities prevent equilibration – research shows that, in fact, few barriers exist to adjustment at the small area level. While interactions between labour markets are strongest between proximate or neighbouring regions adjustments to disequilibria travel across all sub-markets relatively quickly.

In a geographic context such adjustments occur through commuting and migration; the majority of migration is through small moves (neighbouring regions) inside larger regions which together account for the inter-regional picture of adjustment.

The willingness to undertake such movements is heavily influenced by the macro-economy. Migration is likely to play a greater role in times of buoyant economic activity then recession, and it is the unevenness in the distribution of employment opportunities which is likely to be the key motivating factor, rather than differentials in the rewards and risks of the destination region.

At the aggregate level, higher-growth regions experience more equitable rates of growth across occupation groups than lower-growth regions. Higher growth regions tend to retain employment opportunities for manual and low-skilled workers, while such opportunities had been eroded in low growth regions. However due to strong labour market adjustment, in the form of in-migration (labour force participation is also marginally higher than other labour markets) workers in high-growth regions may not have experienced a lessening in job competition. The net result in aggregate is that, employment growth does not translate into lower unemployment rates relative to medium and low growth regions.

Examination of labour force outcomes at the aggregate level reveals that it is not just existing residents who have suffered from increased job-competition in high growth regions, but those who have chosen to move as well. The evidence shows that people who migrate to take advantage of the greater employment opportunities offered in high growth regions are not (on average) particularly successful in doing so.

While at a micro-level growth does deliver some benefits to disadvantaged workers, the highly localised nature of this growth may have worked against some disadvantaged residents and recent movers. When growth is as geographically uneven, higher-growth regions are bound to experience rapid increases in migration and commuting as competitively advantaged workers seek new work opportunities.

The higher-skill workers “bump” the lower-skill local workers out of their traditional opportunities (in the higher-growth regions).

While in some ways this is a natural process of equilibration, when national growth is insufficient to restore full-employment, migrants essentially transfer the problems of their demand-constrained origin region to the destination region, where they may or may not be resolved.

Unless growth is sufficiently strong, rapid supply increases will not be able to absorbed, and it is likely that despite growth the low-skilled, migrants and long-term unemployed will continue to disproportionately bear the brunt of a macro-wide problem.

The point is that in a demand-constrained labour market (overall), the micro adjustments that might encourage upward mobility are thwarted. The solution is always to generate more work overall.

This is why I have been a critic of the OECD supply-side approach which concentrates on skill development and training – with the implicit assumption that mass unemployment is in some way a “supply-side” phenomenon. The unemployed cannot search for jobs that are not there and the latest British data reflects a massively constrained labour market, which undermines the effectiveness of human capital development programs.

In other words, there has to be an integrated demand and supply framework. The government has to ensure there are enough jobs available and the at the same time ensure that there are skills feeding into the jobs growth.

There was a related UK Guardian article (April 8, 2012) – Brussels’ austerity drive must be stopped if eurozone is to survive – which broadened the discussion to austerity in general.

After some questionable analysis, it concludes (correctly) that:

… there has to be a recognition, belatedly, that Spain’s deficit-reduction programme needs growth more than austerity. The war chest available to Europe and the IMF is probably big enough to cope with Spain. But the adamantine belief in cutting at all costs shows that lessons still need to be learned.

The point is that policy makers should focus on ensuring the real economy is performing well – high levels of capacity utilisation, low rates of unemployment, regional opportunities for work; reducing carbon usage; and ensuring that nominal demand growth brings forth real responses rather than, exclusively nominal responses.

The last point refers to the price stability goal of macroeconomic policy.

It is clear that policy makers around the world have failed to focus on the right things.

Ezra Klein (Bloomberg article) noted that the US political debate is moving to a critical point:

Federal Reserve Chairman Ben S. Bernanke calls the end of 2012 “a fiscal cliff.” The Bush tax cuts are set to expire. The $1.2 trillion spending sequester, enforcing cuts in the defense and domestic budgets, is set to go off. Various stimulus measures — including the payroll tax cut — are scheduled to end. “Taken together,” writes the Committee for a Responsible Federal Budget, “these policies would reduce ten-year deficits by over $6.8 trillion relative to realistic current policy projections — enough to put the debt on a sharp downward path.”

In fact, if Congress gridlocks … we face the prospect of too much deficit reduction too fast. The Congressional Budget Office estimates that barreling over the fiscal cliff would increase unemployment by 1.1 percent in 2013.

The current gridlock in the US Congress is one reason that the US economy continues to grow, although last week’s employment data was not particularly compelling. But the political inaction has allowed fiscal policy to play a supporting role – albeit a diminishing one.

Once the various cut-backs occur then the US economy will follow the British and Eurozone economies into the mire. Australia will not be far behind if the May Budget cuts as hard as the Government is threatening.

The US economy will be served best if they avoid the nonsensical debates about the urgency of deficit reduction plans.

Those arguing for balanced budgets should reflect on history before they continue to undermine the prosperity of their nation.

Ezra Klein notes that:

Look what happens when you turn back the clock 70 years from today. That puts you in 1942, the year John Bumstead and Orvan Hess first saved a patient’s life using penicillin. There were no pacemakers, oral contraceptives or chemotherapy. Water wasn’t fluoridated, and health insurance was a niche product. Imagine trying to predict the trajectory of today’s health-care system from that vantage point. How incredibly, hilariously wrong would we have been?

In part for that reason, we don’t balance the budget for 70 years at a time. Indeed, we usually don’t even balance it for 10 years at a time.

I did some calculations using official NIPA data from the US Bureau of Economic Analysis, the US Congressional Budget Office and the business cycle dating tables from the US National Bureau of Economic Research.

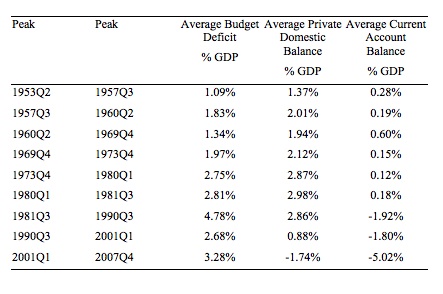

The following Table records the peak to peak quarters of all business cycles since 1953 (quarterly data is not available consistently earlier). The columns then show the sectoral balances – budget deficit; private domestic balance (S-I), and the current account balance (as a percent of GDP) – averaged over each of these business cycles (peak to peak).

Annual data for earlier periods (going back to 1930) for the fiscal outcome is consistent with the quarterly analysis.

The fact is that the US government on average runs a deficit of varying sizes (as a percent of GDP) across all business cycles.

The “balanced budget” rule has never been achieved and never will be while the other aggregates accord to their historical behaviour.

Ezra Klein concludes that:

… too much deficit reduction too fast will hurt economic growth. You can see that happening in Europe, where an excess of austerity has tipped a number of nations into fiscal holes they can’t seem to climb out of. In a city as obsessed with deficits as Washington, yet unwilling to strike smart deals that pair long-term deficit reduction with short-term support for the economy, a bad turn in the economy or a set of policy misjudgments remain a real threat.

The reality is that if the government debate about deficit reduction was curtailed and instead the policy focus shifted to issues such as infrastructure investment, climate change, urban development etc and appropriate public outlays were made, then the increased growth and employment would see the budget outcome take care of itself.

Conclusion

Ezra Klein is correct in saying that:

… when it comes to the deficit, Congress really has two choices: Do something to solve it, or do nothing and let that solve it. The same can’t be said for issues such as infrastructure and loose nukes and climate change and preparing for pandemic flu. On those questions, congressional inaction isn’t enough to make the problem disappear. So those are the issues I worry about.

With the political climate as it currently is, if the Congress does try to do something to “solve it” it is likely that it will err on the side of too much contraction and thus not only undermine growth but also thwart their desire to have smaller deficit to GDP ratios.

Far better to pursue the real issues and let the budget deficit be whatever it has to be to support the maintenance of prosperous real economies where everyone who wants a jobs (and hours of work) can be satisfied and the structural adjustments that will be required as economies move towards lower carbon usage can be achieved.

But unlike the fiscal outcome, the real issues do not solve themselves as easily and in pursing appropriate outcomes for employment growth and infrastructure development (etc), in a few years, the politicians will also be able to “enjoy” lower deficit to GDP ratios.

That is enough for today!

“Further, there are more than 1.4 million underemployed persons in the British labour market, which means that there are around 4 million British workers chasing the full-time jobs on offer.”

And then there’s 2.3 million ‘inactive – wants a job’ people who would like to work, but aren’t actively chasing jobs at the moment.

Where did you get the 1.4 million underemployed from btw? It’s not explicit in the ONS stats AFAICT. Can you give me the derivation formula you’re using?

Sky news is running a story from the CBER that getting rid of all our our public holidays (8 in the UK) will boost growth by 1.8%. On that basis lets do away with; holiday entitlement, weekends, the 8 hour working day, paid sick leave, parental leave entitlement…yup lets bring back the good ‘ol days!! I looked at the calendar, could be the first of April (feels like that most days to be honest)

Neil Wilson,

“Where did you get the 1.4 million underemployed from btw? It’s not explicit in the ONS stats AFAICT. Can you give me the derivation formula you’re using?”

I think it’s on tab 3 of the spreadsheet linked to above. Scroll down and there’s a table “Part-time workers (reasons for working part-time)”. The figure for “could not find full-time job” is 1,383,000.

So do you think it would be correct to say it is Surpluses, not Deficits, that are unsustainable?

Bill, your opening sentence displays incredibly sloppy semantics – which, ironically, is EXACTLY what caused the problem you’re discussing.

“Deficit” is defined by context, and careless use of the word generates more confusion than clarity, and hence more harm than good. There is no common, reference deficit. Individuals & groups can have deficits in any one of infinite categories.

What “deficit” SHOULD a nation’s policy manage? (Deficit in public options? Deficit in fiat?)

What metrics should a sovereign nation’s “budget” utilize? (How does one budget fiat?)

Better to clarify the semantics beforehand and specify that:

1) Fiat currency-ISSUERS manage real-metric budgets, & use fiat currency only for internal bookkeeping.

2) Currency USERS utilize currency as an accurate proxy for local real-metric budgets.

If the semantics are specified up front, most of the confused conflict melts away incidentally.

Ben, Neil,

Do we not need to add to the 1.4M those in temporary work, whose reason for being in temporary work is that they could not find a full time job? – see tab3 cell F2037.

That would make it closer to 2M underemployment.

People with the same mindset that brought us to the crisis of 2008 and who did not foresee that crisis are still in charge trying to push the same old policies with simply larger potions of the same medicine. No evaluation of what really went wrong has been made and no self-doubt about their theories is recognisable.

We probably feel better if only we believe harder.

“The solution is always to generate more work overall.”

Why can’t more people be put into retirement?

I do have one question. Is this true for both fiat states (who can run up a negative deficit) and non-fiat states (who can not run negative deficits and would have to barrow)? If true, is there then any debt limit for fiat states? Could they run a budget deficit into infinity?

The US is a fiat state that likes to pretend that it is a non-fiat state, and insists on borrowing its currency from its own federal bank, that it then uses fiat currency to pay back the interests of it barrowing its own money from itself, to itself. It’s been doing this since the 30’s and has yet to collapse or fall into hyper inflation.

Is the limitation on any economy really the raw materials, energy, and labor available to it, rather than currency (which is after all nothing more than a mental construct)?

While the gist of the discussion verges on why we should be pursuing the potential social, political and economic benefits that a full-employment economy would provide, there is little said about why the deficits themselves have become the fullness of the discussion.

The single issue that is capable of separating the dialogue so that these important benefits become more paramount in forging a national monetary policy belongs four-square on the table here.

What is stopping us from achieving those benefits?

It is the debt required to fund the deficits.

Why should we borrow the balances that are needed to achieve those benefits?

If we did not need to borrow the balances required to achieve those benefits, then who would be opposed to the deficits themselves?

I do not understand how the dialogue can take place about whether deficits matter, while we pretend that the debts associated with deficits do not matter, and in some cases are claimed to be necessary.

I don’t think so.

I don’t think there is any good reason to borrow the funds needed to achieve these goals.

It was one of Lerner’s methods of direct funding of the public’s needed services.

Were the proposal made that the benefits of non-debt funding of fiscal deficits be available within the construct of the government’s power to create money, we would have a worthwhile progressive conversation, deserving as it is, given the options out there.

@joebhed:

“Were the proposal made that the benefits of non-debt funding of fiscal deficits be available within the construct of the government’s power to create money, we would have a worthwhile progressive conversation, deserving as it is, given the options out there.”

You’ll be glad to hear then that this is exactly what Bill has being saying even before he started this blog. Here is the earliest example I could find from this blog:

https://billmitchell.org/blog/?p=332

Meanwhile, the silence surrounding the Gonski education review is deafening…

In order to analyse the validity of an idea, it is best to use an extreme experiment.

Let us assume we eliminate all taxes and simply print every year 30% currency in order to finance the government. In other words, the currency loses 30% of its value each and every year.

A government would be elected based on the promise on how much they will print in the coming years. Citizens would probably elect those politicians that promise to keep the printing at a minimum.

I have a hard time to imagine what side effects such a policy would invite. What would be the rate of interest. Who would be willing to invest? How would citizens react with regard to their consumption and savings behaviour.

To me, it sounds all nice, but the practicality of such policies would probably be very risky. Money would completely lose its function as a store of value and other items would have to replace that missing part in the equation (maybe the price of Gold would shoot to the moon).

On one aspect I certainly agree, namely, that it would be considerably more honest and would negate the banking cartel to benefit as they do now.

Here we go again – gold standard / fixed exchange rate / full employment assumptions.

MMT does not mentions printing money as a solution either.

The Ne0-Liberal diet. 99.9% fact free.

“In order to analyse the validity of an idea, it is best to use an extreme experiment.

Let us assume we eliminate all taxes and simply print every year 30% currency in order to finance the government. In other words, the currency loses 30% of its value each and every year.”

In contrast,if we assumed that we stop all “printing” and start spending within “our means” and also impose a 30% asset tax,the economy would collapse and nobody would want to invest and so on and so forth….so here i am i proved taxing wrong….

Dear Crossover (at 2012/04/10 at 18:13)

You said as if it was a inevitable conclusion:

If potential output is rising each year and the deficits are just filling the nominal spending gap to ensure full employment then the currency does not lose 30 per cent of its value each and every year. That is a myth.

It is only when the real economy can no longer respond in real terms to nominal demand growth does inflation set in.

best wishes

bill

That wasnt me proffesor! 🙂

Sorry Crossover – my mistake.

best wishes

bill

Hi Bill

Thanks for the reply. I do understand that your proposal does not mean to use such an extreme but simply the spending gap as you explain. I simply tried to use an experiment.

You mention that we would not have 30% loss of value of the currency as only the spending gap is financed to achieve full employment. First of all, any measure must work both ways to be viable and sustainable, that means during contraction as well as during expansion of the economy. Secondly, full employment is useful only if the corresponding jobs produce economic value as otherwise we simply produce further malinvestment that will become a burden down the road. Of course, the government has the ability to create as many jobs as it wants to, but that does not mean that those jobs will be useful if not created mainly by small business who will invest in an environment that does promise a reasonable return on investment only. Third, governments and central banks are increasing their influence in the economic sphere at a rate that slowly leads to the fact that they are not simply the elephant in the room but they are the market themselves. To me, this does not seem a sustainable situation and will be cause of more and more insecurity of all economic actors as politics is subject to serious disagreements within its ranks during economically difficult periods and to changes in sentiment like all of us.

Please forgive me that I not necessarily address the specific aspects of the Australian economy as I am not really familiar with the particular situation in Australia.

Dear Linus Huber (at 2012/04/11 at 5:52)

You said:

Full employment is useful because it creates social value, which is a considerably broader concept than “economic value”.

Even mainstream textbooks recognise that the goal of the economic system is to achieve efficiency, which is defined in terms of social benefits and costs rather than the more narrow private (economic) benefits and costs (which are “valued” in the private market place). The problem is that that distinction is rarely made in the debates and conservatives fall back on the concept of economic benefits to define efficiency of resource usage. They are clearly wrong in doing so – even within their own framework.

Malinvestment therefore cannot be evaluated by recourse to standard “market” metrics. What value, for example, do you put on a child seeing their parent(s) going to work each day – and learning about self-esteem and self-reliance? Conclusion – economists using the market metric = no value. Me – immense value!

best wishes

bill

to Grigory

Thanks.

Yes, I am glad to know that Bill has always posted the problems with government borrowing and the benefits of issuing the direct government payments of new money to pay for the deficits.

The problem is that Bill’s case against government borrowing and Lerner’s direct funding proposal rarely enter our discussions of what to do about the deficits.

Nothing is mentioned in this posting by Bill, for instance.

The main issue for everyone from the Peterson Group to Krugman to Keen is how to fund the deficits in a non-inflationary manner.

There is no discussion of how to directly ‘fund the balances formerly known as deficits’, without issuing any debts.

When ‘deficits’ are non-debt-funded, they are not deficits, just new money.

Eliminating the discussion of debts and deficits allows the discussion of full-employment and equity.

Thanks.

Of course, I do agree that there is social value in a low unemployment rate. The question arises at what cost (not only financial costs) do we achieve that. It is not simply a question to print money and or increase government debt but a decisive intrusion into the present rule based system and still somehow Free Markets (ever more less of that however). The whole value system we presently use will be affected and a rather small number of people will increasingly decide on seemingly required measures, leaving the individual more and more dependent on those policy decisions. As we all know, power tends to increase corruption and absolute power definitely more so.

Me for one prefers to reduce the power at the centre and increase individual responsibility as well as strengthening the influence of small communities who in turn will solve the social problems within their circle of responsibility.

bill’s post said: “You said as if it was a inevitable conclusion:

Let us assume we eliminate all taxes and simply print every year 30% currency in order to finance the government. In other words, the currency loses 30% of its value each and every year.

If potential output is rising each year and the deficits are just filling the nominal spending gap to ensure full employment then the currency does not lose 30 per cent of its value each and every year. That is a myth.

It is only when the real economy can no longer respond in real terms to nominal demand growth does inflation set in.”

I like to think of the amount of medium of exchange as a “commodity” that can trade relative to the amount of goods and services so that as the amount of goods and services goes up so does the amount of medium of exchange need to go up.

By potential output, do you mean potential output = real aggregate supply (AS) and that whatever real AS is that is what real GDP should be? Can anyone think of any circumstances where real AD is below real AS and an aggregate demand shock is NOT involved?

I believe we are getting down to the question of how more medium of exchange should be created, more private debt, more gov’t debt, gov’t deficit with “currency”, or finding a way to get more medium of exchange into circulation with “currency” while the federal gov’t runs a balanced budget.

From Mish’s blog and a translation about Spain,

“In this sense, told RNE by Europa Press, the finance minister denied that the government will opt for this possibility to help Spanish banks, as is exploring other. “We are studying the possibilities we have in hand as a government, “he assured Montoro, who has stressed that we must go” faster “in restructuring the banking sector, because you need credit to flow to achieve economic growth and job creation.

“We have to obtain and circulate the money, we are already exploring ways to accelerate the restructuring of banks in our country,” said Montoro, while predicted changes in terms of bank mergers “increasingly committed to the supply of credit” .

Utter and complete NONSENSE! Another idiot who has no idea that a zero private debt and zero public debt economy is possible and more than likely better.

“Me for one prefers to reduce the power at the centre and increase individual responsibility as well as strengthening the influence of small communities who in turn will solve the social problems within their circle of responsibility.”

I’m sure you do.

Unfortunately if you want iPods rather than mud huts, you can’t do that. It doesn’t work systemically without dismantling all of modern life. And that would completely prevent us from supporting 10 billion people on the planet.

So we are where we are, and we can’t go back without eliminating the majority of the world’s population or losing the truly amazing advances we have created. We just have to find a way of making the credit society work for everybody.

So you just have to get used to the idea that the government has to be the ‘big man’ in society and that the structures have to be put in place *and defended* to allow it to operate as the ‘big man’ on behalf of the majority of the people, not on behalf of the majority of the people owning the money.

Trying to work with ideals where there isn’t a ‘big man’ is completely against the nature of human society. There always has been a controlling class and there always will be – because its in our social nature to construct things that way. History demonstrates that in droves.

We have to recognise this takeover and sidelining of government for what it is and go get our government back from those who have sneakily appropriated it.

@ Neil

All your explanations do not negate the probability to solve problems on an communal level in areas that do not require national solutions. I repeat, power accumulation at the centre is most likely to create more problems than real solutions, simply because individualism and self interests do pervert the rule of law whereas unrealistic solutions are immediately visible on a communal level. It is not that I prefer this aspect simply for personal reasons but because it will reduce graft and corruption as the control functions within a community happen on an much closer and tighter level (with immediate consequences for bad behaviour).