The other day I was asked whether I was happy that the US President was…

Qantas should be nationalised (again)

At Melbourne airport last night the Qantas jets looked resplendent with their red flying kangaroo and the “Spirit of Australia” logos. I chuckled to myself about the sheer audacity of an airline that continues to promote itself as if it is our “national carrier” yet is systematically trying to undermine aspects of our culture that we value highly. It is dangerous territory to try to define a national identity. But in Australia we continually emphasise fairness as a hallmark of our national aspiration. Yet, reality is often different to our romantic perceptions and imagery. This blog is an extended version of an Op Ed I wrote for the Fairfax media today on the Qantas dispute, which has gained some attention abroad and been the topic of choice in Australia over the last week. The reality is that the gung-ho union-hating management of the airline are now engaged in a death battle with the union movement and aim to destroy working conditions once and for all and turn the airline into a cheap, low quality outfit principally flying out of Asia while still trading on the fact that we consider it to be (as a historical artifact) an Australian icon. The only way forward for Qantas is for the Australian government to nationalise it and get it flying in the national interest.

Last Saturday, Qantas Airways grounded all its aircraft around the world in an attempt to trigger government action in a dispute it has been having with its unions. The decision received coverage around the world, in part, because it left tens of thousands of people stranded in remote destinations – holiday makers, business travellers, personal emergency travellers, etc.

It was an incredible decision for the management to take and immediately challenged their integrity in the dispute. There was no pending industrial action of any import (for example, the pilots were wearing red ties instead of their usual ties).

The company did not inform government of the decision until just before the announcement was made and the Commonwealth Heads of Government leaders were stuck in Perth. There is evidence emerging, however, that the conservative Opposition was briefed by the company some time ago and were “in the know” as to the company’s plan.

Qantas said they only made the decision that day but leaked E-mails etc suggest it was a well-planned strategy to force the government to refer the dispute to the industrial conciliation and arbitration process – Fair Work Australia – which ultimately will enforce a decision on both parties (unions and company). The expectation is that FWA will side with the company – this institution (and its forebears) has a record of allowing companies to trash working conditions etc.

The timing was also significant.

The day before Qantas held their annual meeting in Sydney and shareholders voted to increase the CEO’s annual pay by 70 per cent (to $A5 million). This was despite the fact that Qantas are claiming the industrial dispute is related to increasing costs (labour) which they allege are making the airline non-competitive.

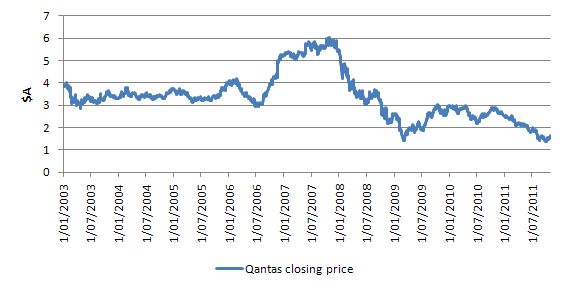

It is also despite the fact that Qantas has not paid a dividend for the last several years and the management has overseen a dramatic decline in the share price of the company.

The following graph is taken from data available HERE and shows the closing price for Qantas shares since 2003.

So another case of management being rewarded for demonstrated poor performance.

The dispute is not about pay and conditions although that is what the company is claiming it is about.

The current dispute is about the Qantas management strategy to re-create the airline as an Asian company with diminished considerations for its workforce, which arguably, have been the airline’s greatest asset.

The wage demands of the unions are very modest (barely keeping pace with inflation) and stand in stark contrast to the 70 per cent pay rise (meaning millions) that the CEO was awarded last week despite overseeing a plunging share price.

There is no question that Qantas wants to hold out its “national carrier” status but at the same time circumvent our labour laws and replace Australian jobs with poorly paid and insecure Asian jobs.

At the weekend, our Prime Minister urged our “iconic national carrier” to resume flying immediately. Despite our attachment to the flying kangaroo, the reality is that Qantas is a private company pursuing private profits and its strategic direction is contrary to our national spirit.

The Federal Government then exercised their powers under section 424 of the Fair Work Act 2009 to refer the matter to FWA. It held emergency meetings over the weekend and ordered the dispute to terminate. This is legal jargon which means the parties now have 21 days to negotiate a settlement and if there is no agreement FWA will impose a settlement.

Qantas are clearly punting on the in-built conservativeness of FWA to steam-roll the unions.

The nub of the dispute is ideological and is about the future of trade unionism in Australia.

Qantas continually trades on its historical past as the national state-owned airline flying all over the world on our behalf. Our perceptions of the airline strongly accord with this historical past even though it ceased to be our national carrier some years ago and service quality has been falling for several years.

Australians still consider the airline to be “more than just a business” (Source).

This article by Ian Verrender (who is good at corporate scrutiny but generally misinforms readers when it comes to making statements about macroeconomics) is worth reading (November 1, 2011) – Dogfight has a wider agenda: to crush unions.

It traces the influence of Qantas Chairman Leigh Clifford who “calls the shots” even though the CEO (Joyce) is the public fall guy.

Verrender says that:

Clifford is best known for his seven-year reign at the head of Rio Tinto … [and] … leading the charge to bypass unions and push for individual contracts for workers at Rio mines in Western Australia and its Hunter Valley collieries.

Saturday’s action may have been unprecedented. But it has been brewing for three years, since Clifford assumed the chair. It was an action deliberately designed to force the government’s and the Prime Minister’s hands to back the company, rather than the unions, and argue for the dispute to be terminated.

Qantas already has sought to undermine its local (and highly unionised) workforce when it created Jetstar. It exploited industrial rules to start a “green fields” company which allowed it to negotiate completely new agreements with staff – and they were considerably diminished relative to the wages and conditions that the main airline paid.

Then the company allowed Jetstar to increasingly cannabalise the routes that Qantas had services including several key international routes.

The current plan is to intensify this shift and re-create Qantas (which has been one of the highest quality services available) in the Jetstar image.

Brief history

Qantas was shorthand for the Queensland and Northern Territory Aerial Services and began life in 1920. In 1934, it merged into Qantas Empire Airways and what became British Airways took 49 per cent of the shares.

It was nationalised in 1947 By the Federal Labor government with the encouragement of the Qantas board. From that point it expanded its international operations dramatically.

Qantas gained access to the domestic market when the Australian government sold Australian Airlines to it in 1992. At the time, the Federal Labor government claimed that it could not adequately fund the expansion of the airlines natinoal and international operations.

Clearly, this was a lie. Since Australia went free of the Bretton Woods restrictions (after the US abandoned the convertible currency system in 1971), the Australian government has had total currency sovereignty.

Their claim was an ideological reflection of its growing attraction to neo-liberalism and the short-term budget boost that privatisation offered rather than being ground in the reality of its currency-issuing capacities. The Government could have provided for all of the development needs of Qantas but chose not to.

Qantas was privatised in March 1993 and is about 55 per cent Australian-owned. The law requires at least 51 per cent Australian ownership.

The Qantas privatisation was part of the large sell-off of state assets (Federal and State). It marked the beginnings of the neo-liberal period where the claims that economic activity could only be efficient if they were subject to the discipline of the private market began to dominate public policy.

It was also not long after our federal government started to claim that it had to run budget surpluses to save up for the future. The upshot was that they sold off a range of assets that had been delivering national benefits well beyond the narrow outcomes that could be attributed to the public enterprise itself.

The pursuit of budget surpluses was also a reaction to their growing attraction to the twin deficits hypothesis, which was another mainstream macroeconomics ruse to limit the scope of government activity.

Please read my blog – Twin deficits – another mainstream myth – for more discussion on this point.

At the time that privatisation was being mooted I was a co-author on a book (published by the HV Evatt Foundation – which was founded, in part, by the bequest of a former Labour Prime Minister) – The Capital Funding of Public Enterprises in Australia.

It was a detailed analysis of all the public enterprises which were later privatised. The

A review of the book at the time (and sorry it is only readable if your library subscribes to Sage Publication Databases) which covered the main chapters I was involved with said:

… the policy response of the Labor government to the external imbalances has generated a fiscal imperative which, almost inevitably, has compromised traditional Labor commitments. This ‘compromise’ has extended to the public sector enterprises. For in the context of fiscal austerity the capital requirements of public sector enterprises can appear to be merely yet another financial demand upon government … In these circumstances, sooner or later someone in the government would have to be tempted to suggest ‘privatization’, as indeed the prime minister did after the 1987 election. The Evatt Research Centre’s union-funded report on The Capital Funding of Public Enterprise is a response to these developments, designed to give rational and detailed expression to a vigorous commitment to the maintenance and reform of national public enterprise …

In relation to the politico-economic agenda of the government the Evatt Research Centre is correct to focus on the financing aspects of public sector enterprises, for it was always predictable that the government would employ a ‘widows and orphans’ versus the public sector enterprises argument, in the context of a public sector borrowing requirement constraint, to justify sale of public assets. The macroeconomic chapter provides a good, quite comprehensive coverage of the issues, and rebuts much conventional nonsense concerning the fiscal deficit, the public sector borrowing requirement, ‘crowding out’ and the current account deficit. All this deserves to be much heeded and widely circulated. For to take just one example (the link between fiscal deficit and current account deficit), the ‘twin deficits’ doctrine has become to public debate in the 1980s (the era of persistent substantial trade imbalances) what the quantity theory of money was to public debate in the 1970s (the era of persistent high inflation): a doctrine believed by almost all, and understood by almost none.

So privatisation was the expression of austerity in the early days of neo-liberalism. It has now escalated into direct attacks on workers’s wages, conditions and pension entitlements etc – and their jobs per se.

Why nationalise?

My view is that the Australian government should once again nationalise Qantas and recreate its role as the iconic national carrier operating to maximise the national interest which increasingly is diverging from the narrow private profit interests of the company.

I was interviewd by the national broadcaster – ABC radio – earlier this week to provide listeners with some context about the dispute.

At one point in the interview I noted that Qantas would be much better off if it was re-nationalised.

The announcer nearly fell off her chair and said that such a proposition was ridiculous. That reflects more on the announcer than the proposition. For a start, she was unaware of the extent of public ownership among the world’s leading national airline carriers.

The proposal is of-course far from ridiculous.

For those that think that publicly-owned corporations are inherently inefficient then it is worth considering the 2011 SkyTrax World Airline Awards.

This is an international survey and the 2011 results reflected votes by “over 18.8 million airline passengers from 100 different nationalities”.

Skytrax say that “the World Airline Awards™ are the most prestigious and respected quality recognition of front-line product and service standards across the world airline industry. With 200 airlines featured, the awards reflect customer satisfaction levels across 38 different items of airline front-line product and service”. Which is what they would say but the rankings are broadly accepted within the industry.

You can see the Survey Methodology in detail if you like.

Qantas ranked number 8 in 2011. Seven of the top 10 were either wholly or partly government-owned. There is a reason for the strong performance by these state-owned airlines.

Here is a list of the World’s Best 10 Airlines for 2011 with ownership annotations:

1. Qatar Airways – 50 per cent government-owned

2. Singapore Airlines – at least 55.37 cent government-owned

3. Asiana Airlines – private

4. Cathay Pacific Airways

5. Thai Airways – partly government-owned

6. Etihad Airways – 100 per cent government-owned (Abu Dhabi)

7. Air New Zealand – privatised in 1989 but in 2005, the airline became 75 percent government-owned after the New Zealand government injected money following losses.

8. Qantas – private

9. Turkish Airlines – some government stake

10. Emirates – 100 per cent government-owned (Dubai)

Qantas is losing market share quickly to a phalanx of lower-cost airlines operating in a very competitive environment. Quality of service is also falling as the airline attempts to cut costs. The increasing frequency of safety incidents are suggestive of cutting corners on maintenance.

As part of their short-term cost-cutting mentality, the airline failed to invest in the new fuel-efficient 777 jets which are now the plane of choice for their main competitors. As fuel costs have risen, Qantas are being badly burned by this management error.

The response of management has been to cut labour costs and to increasingly see Qantas in the image of its no-thrills offshoot Jetstar. Extending this logic has led the management to pursue setting up major Qantas staffing operations in Asia thereby side-stepping our national labour laws. That strategy runs counter to our notion of the “spirit of Australia”.

This race to the bottom and cost-cutting mentality is leading the low-price airlines to trial stand-up “seats” and other service-diminishing angles. It is hardly the outcome we want for our national carrier.

Further, Qantas will not be able to out-compete Singapore or Emirates or Etihad (all wholly or partly state-owned) because their model is wrong. State-owned airlines operate with broader goals than airlines pursuing private profit and this difference shows up in their business models – which make them more competitive.

Qantas has a business plan which it thinks will net it maximum profits. Its goals is to deliver dividends to shareholders although in recent years it has failed to do that while still rewarding its management handsomely.

The state-owned airlines – the “national carriers” – view their ambit as maximising their contribution to the nation – which in this context means bringing tourists and other business into the country. How they view “revenue” is thus very different to how Qantas sees it.

The revenue that the tourism industry enjoys as a result of the packages that the state-owned airlines offer is a reflection of the contribution of the airline. Qantas cannot think like that because it is privately owned. If it was nationalised then the way its costs its service would alter

State-owned airlines receive support from the government because they are seen as providing benefits throughout the economy. Every time a state-owned airline sells a ticket it knows that the “revenue” it generates will be much larger than the difference between the ticket price and the cost of providing that seat. Qantas never thinks like that and so is pursuing a race to the bottom where quality of service is subjugated to price. It is a losing strategy.

If Qantas was nationalised then it would have an incentive to provide high quality attractive services knowing that every tourist it was bringing in would be spending in a range of small and other businesses and generating employment throughout the economy.

As part of its narrow private-profit oriented cost cutting, Qantas cut back the destinations that it serviced. Under public ownership it could expand them again to seek out tourists for our nation.

Under public ownership, the airline would not have to shred its “brand” and lose our loyalty by establishing major operations (engineering, crew, pilots etc) in Asia. It could continue to offer its local workforce secure and well-paid jobs (in line with community standards) and it would be truly a national icon – working to serve us all.

Conclusion

I stopped flying Qantas as a first choice a few years ago when it was clear their service was declining and their customer support was becoming dramatically reduced.

I also try to avoid Jetstar as often as I can because the service is appalling and they often cancel flights without much notice or are more often late arriving and leaving. They have designed their cabins to squeeze as many passengers in as possible and if you are tall (as I am) it becomes a very uncomfortable journey.

I typically fly Virgin, which provides a reliable service, more cabin space, and much more friendly staff and responsive backup. Their fares are no higher than Jetstar. They have also begun to fly internationally from and into Australia which expands their service dramatically.

Anyway, last night I was forced to fly Jetstar out of Melbourne.

And … the flight was one hour and twenty minutes late leaving Melbourne – with no explanation. We got back to Newcastle at 22.50 instead of 21:30. Par for the course for the Qantas company really.

Digression – Greece

As I noted yesterday, I applaud the fact that the Greek government is holding a plebscite to give the people a voice. I also repeat the vote will be clouded by the way the question is asked and the conservative media onslaught that will confuse and misrepresent the issues.

Here is an example, taken from the Melbourne Age (which is published in the second largest Greek speaking city in the World outside of Athens)!

The article (November 3, 2011) – Greece must decide – now – ran the standard “Troika” line – that Greece has to “be rescued, or resign from the euro zone”.

The article says that the referendum will test the following paradox:

The consent of the people of Greece, the birthplace of democracy, was always going to be required. And it is not assured: There is anger about the austerity programme that is accompanying the European bailouts. But a clear majority of Greeks when asked also say they wish to remain in the euro zone.

This apparent conflict can be discussed in the following way.

First, not even in the parameters of the Eurozone, is it sensible to inflict any austerity on an economy after it has received a massive aggregate demand collapse.

Sure enough, the flawed design of the EMU means that bond markets fund the national government deficits and if the former lose confidence in the government’s capacity to repay their liabilities then there is only one way out of the problem – ECB intervention.

The EMU still has a central bank that has infitinite (minus one euro cent) currency-issuing capacity and can fund growth programs throughout the monetary system.

The need for growth is being usurped by the petty ideological obsessions of the Euro bosses (and the ECB) against government expansionary policies.

It is only right that the people object to that vehemently and reject the austerity. It is unnecessary and cruel and will have very long-lived effects.

Second, the fact that the clear majority of Greeks want to remain in the Euro zone suggests they do not fully understand the choices and do not appreciate that the Euro is the problem not part of the solution.

Unless the ECB plays the quasi-fiscal role forever, Greece will be vulnerable to repeated aggregate demand shocks. The ECB will not play that role indefinitely and the cost they are exacting for keeping the system solvent at present is very large and will endure for decades.

So remaining in the Euro means austerity given the politics that drive the system. The conflict above is more than a paradox – it reflects total confusion.

The Fairfax article adds to the media input that has created that confusion:

The common sense decision would be to stay in the euro zone, and stay the course. If Greece leaves, its currency will be trashed, and its banks will collapse. It will need to go through a traumatic bankruptcy that massively devalues savings and asset values before it begins the slow climb back. The alternative is also very painful, but less severe.

No, the common sense decision would be to restore the drachma, float it and use the currency sovereignty to minimise the adjustment costs (which will be significant but finite).

First, the currency will not be trashed – whatever that means. There would be an orderly realignment (a depreciation) on the day the currency was issued. In time, the currency would appreciate somewhat as the attractiveness of the Greek tourist destinations bring in Euros from the north.

I read some article this week – against the exit – saying that the Greeks would be forced to provide tourist facilities that were worn out and 1960s in quality. This is a curious argument. The facilities in place now do not have to be trashed. The lower drachma would make Greece a very attractive tourist destination and development capital would not be far behind.

Remember once debt is written off – investors chase new opportunities when they arise. Just reflect on what has happened in Argentina since it defaulted in 2002.

Second, the banks would not collapse because the Greek government would have the capacity to ensure they were capitalised and deposits (in converted drachma) guaranteed. It is a lie to say otherwise.

Third, there would be real losses arising from the depreciated currency. They would be finite as the re-alignment was established. For Greece that imports some food and other supplies this would be a significant issue. But suppliers are already withdrawing from the Greek market.

The journalist provides no argument to support the claim that “The alternative is also very painful, but less severe”. I doubt that exiting is less severe in the longer period once the exchange rate had adjusted and the Greek government focused on domestic growth strategies.

The example of Argentina is that growth returned very quickly and that spawned further growth and renewed private investment. A lot of first-world banks missed out but if they had not the local economy would have been in penury even now.

The Greek government cannot spawn growth under the current system. It could quickly get growth going if it took control with its own currency.

A trend that should spread

Yesterday (November 2, 2011), a number of students (around 35 at least) walked out of the first year economics lecture given by mainstream economist Greg Mankiw.

They sent this letter to their colleagues urging them to join them:

Feel upset about EC10 but don’t know how to show your discontent?

Want to get involved in the Occupy Movement?

Join our STUDENT WALK-OUT of EC10 on Wednesday, November 2nd at 12:15!

Gregory Mankiw will be lecturing, and this a great opportunity to show discontent with the style/material/content of the class!

We will be heading over to the higher ed march after the walk-out and anyone is welcome.

So help show solidarity with the Occupy movement by walking out of EC10 at EXACTLY 12:15.

This is later than the general walk-out, but we are making an exception because it is such a symbolic class/instructor.

Let’s show Mankiw that his lack of teaching, extremely high textbook cost, and biased instruction matter to the students!

They also posted this – An Open Letter to Greg Mankiw – explaining their action.

One hopes that this sort of action spreads across all mainstream macroeconomics programs in all universities and students demand to be educated not indoctrinated.

Here is a link to an interview that I gave the Harvard International Review in August – Debt, Deficits, and Modern Monetary Theory – which was published on October 16, 2011. It was edited by the review without my seeing the final product but overall is okay.

It is clearly a view that the students in Harvard’s ECON 10 do not ever get exposed to but should as a matter of extending their education and challenging their perceptions of the way the economy works and the choices governments have in fulfilling their roles.

That is enough for today!

Hi Bill,

I think you may find this of interest

Exiting Currency Unions (pdf) via the-mmttrader

Bill,

Is Qantas’s high wages bill due to its management remuneration?

I have thought it strange that those proponents of cheap labour/outsourcing never apply it to senior management posts – lots of sources of well qualified candidates now available.

Ha! I was going to share that Harvard article, but you are already on it, Bill. GREAT post as usual!

Kudos to the Mankiw walk out students. They made my day. R-E-S-P-E-C-T.

This blog isn’t an extended version of, this post is.

Rio Tinto? The guy ran Rio Tinto? Well then, the decision to crush the unions was made by the Qantas board BEFORE Clifford was hired. The man is (as so often is the case these days) a one-trick pony. You don’t hire this sociopath to do anything but crush unions.

Qanta could be purchased for about $7 billion. This is chicken-feed to the national goverment. It could be taken from the pointless Future Fund where government money is sent to die. The Future fund is currently holding over $70 billion.

I guess the Future Fund is rather pointless now that it has finally unloaded all its Telstra shares (well, nearly all).

It didn’t seem to have any purpose other than to sequester an embarrassingly large overhang of unsold T shares at the time it was conjured into existence. And now they’re gone (along with its Creator).

It would indeed be sweet irony if Costello’s bastard progeny could be tapped to buy Qantas back.

Unlike in 1949 when Chifley lost to Menzies over nationalisation of banking, I think this is different.

With nothing to lose, the current Labor government could do worse than float the idea.

Never mind the predictable rhetoric from the TWU, I’d love to see the Pilot’s Association come out with full page ads supporting nationalisation.

Hi Bill

Qantas can be cut up into 4 units and 3 of those are highly profitable. The 4th, international travel, has been a loss maker for some time for the reasons you have outlined. International does have benefit to the other sectors and to the nation (externality) so there some sense to govt participation. Clearly the market in air travel is not and is unlikely to ever be “free” and should be viewed as such – in a world of crony capitalism what are the benefits to Australia of a govt investment in Qantas?

If Qantas was nationalised then it would have an incentive to provide high quality attractive services knowing that every tourist it was bringing in would be spending in a range of small and other businesses and generating employment throughout the economy.

You seem to be suggesting a national airline can be subsidised in order to bring foreigners to the country who will then spend and increase aggregate demand.

But you don’t mention at all that the airline will also bring Australians abroad who will spend there which decreases aggregate demand in Australia.

So, first, your remark only applies to international flights. And, second, it doesn’t even seem to be true unless for some reason there are more foreigners flying into Australia than Australians flying abroad, or you are suggesting only tickets for foreigners should be subsidised.

Why waste time writing all this stuff. How about some direct action. Instead of just “nationalisation” how about adding the words “without compensation”? Some of these corporate cowboys just bleed companies white and then would hope the Austalian government would pay an exorbitant price for something that is ready to go broke. Lenin and the Bolshevicks did it. at least it wouls det an australian precedent.

As an employee of QANTAS, I find it difficult to see how the International arm of QANTAS is losing money. Every flight I dispatch is very heavily booked. Alan Joyce’s figures that QANYAS International is losing $216 million a year does not make sense.

There has been no explanation as to which sectors are losing money. It has a monopoly on some of the sectors (Sydney – Dallas, Sydney – Johannesburg, Sydney – Buenos Aires). It has a major percenatge of the Sydney – Los Angeles sector, and the Sydney – Honolulu sector is always nearly full.

To say that for every 100 people travelling overseas, that only 18 travel with QANTAS and that the other 82 travel with another carrier is just farcical. That would suggest that QANTAS flights are just 18% full. What has been failed to be mentioned is that QANTAS does not service a lot of sectors and destinations that other airlines do and that if they do service the same sectors, they are not having the same capacity as those other carriers.

People, please wake up and see what the corporate greed machine is doing. Not only to QANTAS, but to the Australian workforce as we know it. I have been reading articles where they say ity’s not problem to try and save money as a business. If we globalise wages, then cost of living should be globalised. Otherwise when jobs are sent off-shore, the people left on-shore have no money to pay for the basics and essentials.

What happens to the businesses here? Need I say more?