I started my undergraduate studies in economics in the late 1970s after starting out as…

British labour market deteriorating

I have very little spare time to write my blog today so this will truly be brief. Amidst all the riots in Athens as the Eurozone farce descents further into the mire, the UK Labour Force data came out yesterday (June 15, 2011). There are some who are saying that the data presents good news. A closer examination reveals nothing of the sort. Others are claiming that there isn’t really a problem of unemployment in Britain because the unemployed are largely unemployable. That is a familiar refrain after a deep recession as the labour market struggles to keep pace with the underlying population growth. The conservatives always try to redefine what we might call full employment and claim that a much higher unemployment rate is now indicative of full capacity. The same game is being played out in Australia where despite unemployment and underemployment totally 12.2 per cent at present the Reserve Bank governor had the audacity to claim there were not that many spare labour resources (like 1.3 million odd workers don’t count any more).

Just for the record I note that yesterday, the Eurozone crisis is now firmly capturing front page headlines of the UK Guardian (June 15, 2011 edition) having snuck out of the business and economics pages.

I will write about the Eurozone again soon – after many readers have asked me to explain the Target2 system. My assessment remains the same – Greece should default and exit the EMU as soon as possible. Their budget deficit is rising (for all the wrong reasons) and the adjustment they are seeking to follow – under the bullying of the Euro bosses and the IMF etc is an impossible task.

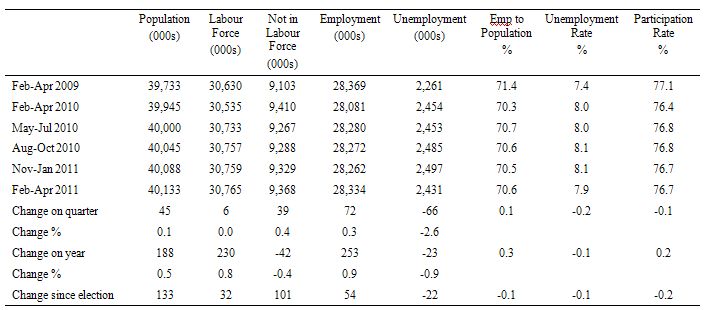

The UK Labour Force data for February to April 2011 quarter were released yesterday by the British Office of National Statistics.

The headline news seized on by the press was that employment grew by 80,000 and unemployment dropped

The UK Guardian responded to the data release with this headline – UK unemployment falling at fastest pace in a decade – but failed to mention that participation rate was also falling.

Yes, unemployment fell by 88,000 in the three months to April 2011 (all population over 16 years) and there was some employment growth although barely enough to keep pace with underlying population growth. So we have a scaling up effect but not a solid improvement in the data as it stands.

But all is not what it seems.

The ONS data is always poorly presented in my view compared say to the way the Australian Bureau of Statistics or the US Bureau of Labor Statistics presents the labour market statistics.

For example, in Summary Table 1 of the ONS publication they mix and match the categories “All aged 16 & over” with “All aged 16 to 64” so that you cannot immediately compare like with like. A bit of re-arranging using the Labour Force definitions (Working Age Population = Labour Force + Not in the Labour Force = Employment + Unemployment + Not participating etc) allows one to assemble a coherent set of results for the 16-64 year cohort from that Table.

The following Table presents the British data in that form with some additional information calculated from the data itself.

To make any sense of this you have to dig deeper into the data. The current government was elected in May 2010 so I added a comparison between the latest data and the state of the labour market they inherited.

Since the May-July 2010 quarter, the employment-population ratio has fallen by 0.1 points the participation rate has fallen by 0.2 points. How should we consider that given that the press is focusing on the drop in unemployment which over that same period is now 22 thousand lower.

Is that a good outcome? Answer: definitely not.

The actual labour force (16-64 years) in the February-April 2011 quarter was 30,765 thousand. If the participation rate had have remained at the level found at the time of the election (May-July 2010 quarter), that is, at 76.8 per cent the labour force would have been (given population growth) 30,835.2 thousand.

That is, 70 thousand workers exited the labour force since the election which has the effect of reducing the unemployment level and rate.

If the employment growth remained the same but all these “hidden unemployed” workers had have remained active (that is, staying within the statistically-defined labour force) then unemployment would have been 2,501 thousand rather than 2,431 thousand in the February-April 2011 quarter.

The unemployment rate would be 8.1 per cent rather than 7.9 per cent meaning that since the election the unemployment situation for 16-64 years olds has deteriorated not improved.

And worse is to come.

There are three very negative portents in the data.

1. Claimant count rises

The claimant count measure of unemployment (that is, the number of people claiming Jobseeker’s Allowance) rose by 19.6 thousand in May (so it represents more recent data than the quarterly Labour Force data). The claimant count is now 5.2 thousand higher than a year ago (May 2010 when the election was held. The British labour market clearly benefited from the vestiges of the fiscal stimulus introduced by the last government but that is now being pushed aside by the increasingly harsh spending cuts.

The claimant count has been rising since February 2011 which is a very bad sign.

A rising claimant counts is what economists call a “leading indicator” – it gives an early warning sign of further deterioration in the coming months. We know that GDP growth is poor and that will drive a rising unemployment rate in the second half of 2011.

2. Vacancies are falling

The vacancy ratio (the ratio of vacancies per 100 employee jobs) fell in May 2011 and total vacancies fell by 8,000. Since the election in May 2010, total vacancies have fallen by 20,000. The level of vacancies is a good indicator of labour demand. The evidence is that labour demand is softening.

3. Public sector employment falling

Since the election in May 2010, there have been 143 thousand jobs cut from the public sector (24 thousand in the last quarter) and the pace of job loss is increasing.

The data hides the fact that if you add in the temporary staff who worked on the recent census then the job loss rises to 39 thousand in the March 2011 quarter and the total job loss in the public sector since the election rises to 158 thousand.

How should we judge that? When the British Office for Budget Responsibility (OBR) provided forecasts for public employment losses in the June 2010 emergency budget (HERE they were much more optimistic than the reality that is now emerging.

Public sector employment growth has fallen by more than twice their forecast already and the situation will get worse in the next 12 months.

The point is that the losses (mostly confined to local government at this stage) will intensify over the next year.

4. Massive real wage cuts over last year

Wage growth in Britain was very weak – 1.8 per cent annualised. With inflation running at nearly 4 per cent, this means that over the last year British workers have taken a very harsh real wage cut which will lead to further weakness in aggregate demand. The business lobby like to concentrate on the cost side and ignore the demand side. Mainstream economic models would predict that a declining real wage would be a good thing for employment growth at the macroeconomic level.

But that is because they assume that aggregate demand will be constant and so the real wage cut shifts aggregate supply out. This is the famous fallacy of composition that Keynes (and Marx before him) identified.

This fallacy of composition exposes the poverty of the mainstream approach to unemployment. Macroeconomics emerged out of the failure of mainstream economics to conceptualise economy-wide problems – in particular, the problem of mass unemployment. Please read my blog – What causes mass unemployment? – for more discussion on this point.

Marx had already worked this out and you might like to read Theories of Surplus value where he discusses the problem of realisation when there is unemployment. In my view, Marx was the first to really understand the notion of effective demand – in his distinction between a notional demand for a good (a desire) and an effective demand (one that is backed with cash).

This distinction, of-course, was the basis of Keynes’ work and later debates in the 1960s where Clower and Axel Leijonhufvud demolished mainstream attempts to undermine the contribution of Keynes by advancing a sophisticated monetary understanding of the General Theory.

The point is that prior to this the mainstream failed to understand that what might happen at an individual level will not happen if all individuals do the same thing. In terms of their solutions to unemployment, they believed that one firm might be able to cut costs by lowering wages for their workforce and because their demand will not be affected they might increase their hiring.

However, they failed to see that if all firms did the same thing, total spending would fall dramatically and employment would also drop. Again, trying to reason the system-wide level on the basis of individual experience generally fails.

Wages are both a cost and an income. The mainstream ignored the income side of the wage deal. The technical issue comes down to the flawed assumption that aggregate supply and aggregate demand relationships are independent. This is a standard assumption of mainstream economics and it is clearly false.

Mass unemployment occurs when there are not enough jobs and hours of work being generated by the economy to fully employ the willing labour force. And the reason lies in there being insufficient aggregate spending of which the net spending by government is one source.

The erronous mainstream response to the persistent unemployment that has beleaguered most economies for the last three decades is to invoke supply-side measures – wage cutting, stricter activity tests for welfare entitlements, relentless training programs. But this policy approach, which has dominated over the neo-liberal period, and reflects their emphasis on the individual falls foul of the fallacy of composition problem.

They mistake a systemic failure for an individual failure. You cannot search for jobs that are not there. The main reason that the supply-side approach is flawed is because it fails to recognise that unemployment arises when there are not enough jobs created to match the preferences of the willing labour supply. The research evidence is clear – churning people through training programs divorced from the context of the paid-work environment is a waste of time and resources and demoralises the victims of the process – the unemployed.

So with unemployment already a deflationary force, the real wage cuts are likely to exacerbate the recovery hopes.

The UK Telegraph carried the story yesterday (June 15, 2011) that – The real problem is the rise in unemployables.

The journalist – who is denoted the “Head of Business” whatever that means – presumably an indicator of self-importance – said:

… despite relatively high levels of unemployment, companies are struggling to fill vacancies …

A large pool of the unemployed are unemployable, a problem that will get worse as the economy restructures towards value added, higher skilled work. Low skilled jobs are increasingly being exported to low cost economies.

In this situation, the traditional impact of high unemployment depressing wage costs no longer holds true – another blow to the doves on the Monetary Policy Committee (MPC).

Funny that vacancies are falling and real wages growth collapsed over the last year.

This is a complex topic and relates to how we view skills etc.

There is a long-standing argument that long-term unemployment has strong irreversibility properties? That is, that full employment should be redefined to occur at much higher unemployment rates than in the past because the workers are unemployable and require supply-side policies to help them develop work capacity.

However, Michael Piore (1979: 10) reminder is worth remembering always:

Presumably, there is an irreducible residual level of unemployment composed of people who don’t want to work, who are moving between jobs, or who are unqualified. If there is in fact some such residual level of unemployment, it is not one we have encountered in the United States. Never in the post war period has the government been unsuccessful when it has made a sustained effort to reduce unemployment. (emphasis in original)

(Reference: Piore, Michael J. (ed.) (1979) Unemployment and Inflation, Institutionalist and Structuralist Views, M.E. Sharpe, Inc.: White Plains.)

The orthodox approach, however, has been to consider long-term unemployment to be a (linear) constraint on a person’s chances of getting a job. The so-called negative duration effects are meant to play out through loss of search effectiveness or demand side stigmatisation of the long-term unemployed. That is, they become lazy and stop trying to find work and employers know that and decline to hire them. Over this period, skill atrophy is also claimed to occur.

So it has been common for mainstream economists and policy makers to postulate that there is a formal link between unemployment persistence, on one hand and so-called “negative dependence duration” and long-term unemployment, on the other hand. Although negative dependence duration (which suggests that the long-term unemployed exhibit a lower re-employment probability than short-term jobless) is frequently asserted as an explanation for persistently high levels of unemployment, no formal link that is credible has ever been established.

However, despite the lack of evidence, the entire logic of the 1994 OECD Jobs Study which marked the beginning of the so-called supply-side agenda defined by active labour market programs was based on this idea.

This agenda has seen the privatisation of public employment services in various nations and an obsession with training programs divorced from a paid-work context and the raft of pernicious welfare-to-work regulations. All have largely failed to achieve their aims.

Once you examine the dynamics of the data you quickly realise that short-term unemployment rates do not behave differently to long-term unemployment rates. The irreversibility hypothesis is unfounded.

Please read my blog – Long-term unemployment – stats and myths – for more discussion on this point.

To argue that long-term unemployment is a constraint on growth and therefore needs supply-side programs rather than direct job creation, you would have to find that even during growth periods, long-term unemployment was resistant to decline.

The evidence in all countries is that long-term unemployment moves closely with the official unemployment rate as the business cycle improves. There does not appear to be any strong indication of hysteresis operating. Hysteresis, in this context,is the notion that long-term unemployment is resistant to the aggregate growth cycle, perhaps because skill atrophy requires retraining before the person is able to work.

The bottom line is that if there is sufficient employment growth and firms offer appropriate training packages then workers can be absorbed back into the employed labour force.

I have run out of time today to expand on that evidence.

Conclusion

The fiscal austerity in Britain will accelerate this labour market deterioration.

I could write more about the data release but have other commitments.

So that is enough for today (it has to be!)

Fine analysis Bill, thankyou.

Also worth noting that Purchasing Managers Indeces are trending in the wrong direction: manufacturing PMI has hit a 20 month low, and growth in services PMI has been slowing since the beginning of 2011.

If companies are buying less hardware etc, they will surely be hiring fewer people. And the main cull of public sector posts is programmed to run out until 2015, so I also fail to see how the UK employment situation will improve any time soon.

“A large pool of the unemployed are unemployable, a problem that will get worse as the economy restructures towards value added, higher skilled work. Low skilled jobs are increasingly being exported to low cost economies.”

That seems to be another ‘truth by repeated assertion’ line that the Torygraph is pushing at the moment. Clearly it is a Conservative view.

This needs to be swung around to the systemic.

The problem is that businesses are not forced to use this labour (usually by lobbying for more immigration), and they can currently avoid any costs from not using them (because there is no Job Guarantee).

On a separate note, here’s a ‘forecast’ from Spanish bank BBVA in November 2007 forecasting a soft landing for Spain!

http://www.rns-pdf.londonstockexchange.com/rns/8728h_2-2007-11-16.pdf

Thanks for this, Bill. It is a shame UK journalist economists cannot get further than the synopsis and therefore present a pithy analysis.

Niel,

I agree completely but would add: politically conservatives must be forced to answer the question of how they intend to address the income needs of those they define as unemployable. Forced emigration? Concentration camps? Eugenics? What? You can not define a growing percentage of your citizens out of incomes in a market based society without making some provision for how their needs will be met or otherwise dispensed with. You either meet the needs or eliminate them. If you propose to not meet the needs, as conservatives have been for the last forty years, you should be forced to state what you will do instead. Avoiding this question is what supposed progressives have been letting conservatives get away with for forty years.

John “You can not define a growing percentage of your citizens out of incomes in a market based society without making some provision for how their needs will be met or otherwise dispensed with.”

I think the key point is that the economy needs to belong as much to those that are being “defined out” as it does to those proclaiming that they are defined out.

“a very harsh real wage cut which will lead to further weakness in aggregate demand”

Nominal final spending has grown strongly though, in fact grew more strongly in the last two quarters then in the preceding two quarters. How do you square that with any claim of “weak” aggregate demand?

The “weakness” in the economy is showing up as high inflation (GDP deflator, consumption deflator, CPI, or whatever).

“With inflation running at nearly 4 per cent,…”

Why is inflation so high in the face of so much unemployment?

Ken

This is not about the blog post, just a question on the blogs general topic.

http://www.youtube.com/watch?v=IcLPW3Wbo4o

Richard Werner – On how banks work.

Werner is an economics professor. Is chair in International Banking at the University of Southampton and director of its Centre for Banking, Finance and Sustainable Development.

As I get it he says banks use the money/deposit as reserve and create new money by money multiplier.

I’m not an expert but I perceive it as in conflict with the view I got by Bills explanations of how it works.

It seems too good to be true, (for banks), borrow (deposit) $100 for lets say 4% then create $9900 on the balance sheet to be lent at some interest.

4% on $9900 is $396. Heck they could even borrow (the deposit) the $100 at 100% and make a descent profit.

That loan/deposits create the possibility of new loans and credit multiplier expand money supply I think I can understand but the Werner explanation of how banks works seems to fantastic to be true.

The Werner example is at 1% reserve.

Dear Ken (at 2011/06/18 at 6:21)

Mostly supply side issues (energy prices) and government VAT hikes – not related to demand side of the economy. Inflation is now moderating in the UK.

best wishes

bill

Dear Gareth (at 2011/06/17 at 1:31)

You say:

The fourth quarter 2010 British National Accounts – http://www.statistics.gov.uk/pdfdir/qna0311.pdf – told us that (in chain volume terms – that is, real):

Then the first quarter 2011 data – http://www.statistics.gov.uk/cci/nugget.asp?id=192 – continues that theme:

So some boost from net exports but significant declines in consumption and private capital formation leading to a 1.8 per cent growth rate and falling.

The inflation is not being driven by domestic demand factors in Britain.

best wishes

bill

Great blog Bill.

As usual I learned more about UK job statistics in 15 minutes reading your blog than I’ve been able to glean from any other source.

Thanks

I’ll have a go at your question /L and if I’m wrong hopefully there’s help close at hand.

First, it’s true that banks use deposits to top up their reserve accounts (as I’ve recently learned here)

But the state of their reserve accounts is totally disconnected from their ability to lend.

Banks lend by leveraging off their capital base. I looked at some RBA numbers recently and it looked like the ratio was running then at about 16 times for Australian banks.

That 1% reserve you referred to could be the amount of reserves your example bank might be needing to maintain a positive reserve balance to cover the volume of settlements its level of activity might be generating (guessing a bit here). It’s certainly got nothing to do with any “multiplier”.

Generally, there’s no interest paid on reserves, so the 4% (say) the banks pay on deposits would be dead money without the ability to leverage off their capital. Either way, I’d have used the word “indecent” to describe the profit.

Bill answered some similar questions from me and Burk last week.

Hi,

Sorry, I’m not an economist but steadily becoming more interested in economy basics. I got the same question as /L as in this blog the gov (central bank) is always stated as the monopoly issuer of money. If banks on the other side can create money (credit) on the basis of some other securities this seems not completely be true. Can you pls point me to some blogs here where this explained in more detail?

I would tend to agree, but if you want to make that claim, why do you factor in the supply-side issues and look at the real growth figures rather than nominal growth?

Nominal household final consumption growth, quarter on quarter of previous year:

10Q4: 6.0%

11Q1: 5.4%

The pre-crisis trend rate is around 5%. Would you really claim these numbers indicate an economy with a massive demand shortfall from household consumption?

The real growth numbers show that retailers etc are unwilling or unable to supply an increase in volume/value for an increase in spending. But this is a surely a supply-side problem.

This is very interesting. There is one thing though, that mucks things up in Britain (and elsewhere?): some people get all sorts of state benefits which they lose if they start working. So, they are listed as unemployed, adding to the figures, but are not actively looking to work. They don’t need to and it’s of no real benefit to them. It also adds to a sense of entitlement, as in you are “owed” housing benefit, you are “entitled to” carer’s benefit, and so on. Here’s a short list:

Jobseeker’s Allowance (JSA)

Income Support

Disability Living Allowance (DLA)

Child Benefit

Working Tax Credit

Child Tax Credit

Council Tax Benefit

Housing Benefit

Attendance Allowance

Carer’s Allowance

By the way, not all of those benefits apply to all of the people, and there are dozens of others. The system is extremely complex.

@ John Armour says:

As I said im no expert just a trying to understand this stuff. As I have read here the real constrain on bank lending is capital requirements not reserve requirements, some countries don’t have the later. A link in Bills – Lending is capital- not reserve-constrained – gives a simple explanation of capital requirements:

A Primer on Bank Capital

“For example, if a bank has $100 of loans outstanding, funded by $92 of deposits and $8 of common stock invested by the bank’s owners, then this capital of $8 is available to protect the depositors against losses. If $7 worth of the loans were not repaid, there would still be more than enough money to pay back the depositors. The shareholders would suffer a nearly complete loss, but this is a considered a private matter, whereas there are strong public policy reasons to protect depositors.”

http://www.brookings.edu/~/media/Files/rc/papers/2010/0129_capital_elliott/0129_capital_primer_elliott.pdf

Douglas J. Elliott – The Brookings Institution

As I have read here bank lending/borrowing is a horizontal thing, everything that happens have an liability side and a asset/claim side. The only one that can create new money assets without liability is the monopoly issuer of the currency. As I have understood the credit multiplier is that the same money can be reused over and over again, loans create deposits. The higher the velocity the more money/credit that can buy things in the real economy. Maybe the effect is the same but I can’t get it to be coherent with R Werner’s explanation. Or I have just misunderstood everything.

Also, you paint a dismal picture of wage income, which is fair enough, but it does ignore the huge proportion of the GDP figures which show up as non-wage income: that of self-employed, and business owners, which does go to support household spending. England is known as the “nation of plumbers”, after all! 😉

(e.g. the Other income account grew 10% yoy for the last four quarters)

The “real household disposable income” figure showed -0.8% growth for 2010; better than the -1.8% real growth in wages at least. This is from relatively strong nominal growth getting whacked by a high implied deflator.

Friday

Bill will kill me if I get the wrong one

Actually he probably just wont allow the post

I think this is the one you need:

https://billmitchell.org/blog/?p=1623

john, the conservative solution to “unemployables” is to wait for them to commit crimes (either property crimes or black market trading) and then imprison them at a cost of >$20,000/year. It’s not a particularly humane or efficient system but it does work as the U.S. example shows.

Hypothetical question:

Just suppose that, over the next ten years or more, the world faced an energy crunch that it was unable to contend with via timely introduction of sufficiently energy dense substitutes on a scale capable of sustaining the modern global economy in it’s current form, leading to massive unemployment as entire industries were forced to scale back and in some cases fade from the scene..

Do you think the elites would continue to advocate for austerity measures to support chimerical budgetary concerns?

/L, you have stumbled upon one of the greatest fallacies of modern economics, exogenous money model.

In exogenous money -model, you have money multiplier and banks lend out multiples of reserves

Whereas in endogenous money -model, reserves do not play part in lending processes

As far as I know endogenous money has proven itself to be right, but they still believe in exogenous money in mainstream economics

@PZ

Again im just a layman trying to understand. In the Werner explanation of the money multiplier the bank get hold of lets say $100, borrow or deposit the put I as a reserve. In his example the reserve requirement was 1%. Then they could create $9900 from this on the balance sheet only by making a loan contract with a customer. Lets say they borrow the $100 at 4% interest and is able to lend the $9900 also at 4%. A very nice windfall, albeit they have marble offices in the center of the city and extensive executive bonuses to pay. It seems to good to be true, that would mean that they only paid 0.04% on the total.

From the explanations here I got the impression banks aren’t reserve restricted in lending and it worked practically as old time short selling. The speculator sells e.g. stock (that he don’t possess) in the morning expecting it to fall in price during the day, buy it later during the day when it have a lower price (hopefully). This could be done due to the books was balanced and closed at the end of the day. So Banks can make loans and after the fact them self lend the reserve at primarily the interbank market, but this doesn’t restrict them due to the Central Bank will always lend them if the interbank market dries up. Of course they have to fulfill capital requirements and what else regulations they have to fulfill.

I’m puzzled it is so hard for a layman to get clear answers on this issue.

Here is how I think it works:

When banks lend out money, they increase the asset side of their balance sheets (borrower’s liability is asset from bank’s perspective).

Assets and liabilities have to match. To increase their liabilities, they have to borrow money from interbank markets or get more deposits. If borrower keeps money in the same bank as he has loaned it from, assets and liabilities are increased by same amount. If he deposits them to some other bank, they can be borrowed from interbank market. Banks still make money from interest rate differentials: they have to pay interest on liabilities and get interest payments from assets.

And to be technical, banks don’t actually create money. They create credit. In the process borrowers promise to pay (to a 3rd party) gets transformed to banks promise to pay. So we have 2 simultaneous monetary systems: government system that creates money by deficit spending and private credit system that creates promises to pay.

It starts to get a bit clearer, a promise from someone to pay a certain amount to the bank creates a asset on the banks balance sheet? As long as it stays in the same bank no money have to be lending on interbank market or at the CB? If not there is a reserve requirement that have to be fulfilled. But usually I believe the borrowed money is to pay somebody, who have an account in the same bank or elsewhere that one have has expenses that have to be paid and go in to other bank accounts. I just want to make some accounting logic to the process. 🙂

“So we have 2 simultaneous monetary systems: government system that creates money by deficit spending and private credit system that creates promises to pay.”

Steve Keen often says that we don’t have a fiat money economy, we have a credit money economy with a small fiat one tacked on the side.