I started my undergraduate studies in economics in the late 1970s after starting out as…

When a former US president makes things up

Some years ago – I did not have sexual relations with that woman – were the famous words that seemed to redefine everything we had come to think of sexual relations between two consenting partners. Suddenly we could have sexual relations without having them. The same person has come up with a new conclusion – the US never ran “permanent structural deficits of any size before 1981”. Hmm, you mean that for 84 per cent of those years from 1930 when the US federal government ran deficits they were just cyclical events indicating deteriorating economic conditions? Maybe the former president might say a structural deficit equivalent to 3 per cent of GDP was not of “any size”. My conclusion is different – that this statement like the previous one was another case of a former US president making things up.

In April 2010, a group of community activists put together in very quick time the Fiscal Sustainability Teach-In and Counter-Conference in Washington D.C. I was privileged to be invited to speak at the Teach-In. Here are my blog – Washington Teach-In Counter Conference – about my visit.

A full archive including video, audio and transcripts is available – HERE (thanks to the great work by Selise).

The Teach-In was organised to coincide with another event in Washington D.C. on the same day. The Peter G. Peterson Foundation staged their so-called Fiscal Summit which assembled many of the known US deficit terrorists to deride the fiscal intervention in the US by the federal government and demand fiscal austerity. Their efforts and the efforts of others have successfully intimidated the US legislature and brought on pronounced political change (as per the return of the conservatives in the mid-term elections last November).

The results of that intimidation has been that the US government has failed to meet the economic challenge before them – and has not expanded the deficit sufficiently or targetted net spending towards job creation in any appropriate ways. The recovery that was fuelled by the stimulus that was provided was weak and there are strong signs that it is petering out. The troubled US housing market is not recovering and many private insolvencies are imminent.

But still the mainstream economists who are trying to assert that cutting public spending will provide a bounty of growth and affluence.

I was sent this extraordinary document overnight – A debt limit increase without significant spending cuts & budget reforms will destroy American jobs – which is statement by a large number of mainstream economists (academic and think tank) calling for fiscal austerity as a means to create jobs. Yes, the fiscal contraction expansion crowd are now alive and well in the US, after wrecking Ireland, Greece and then moving onto the UK. Wherever this mantra is put into practice jobs disappear and economies stop growing.

The document has some value though – prospective economics students have a detailed list of university departments that they should avoid in selecting where to undertake undergraduate or postgraduate studies.

On the fightback by the mainstream economists – I thought this UK Guardian article (May 30, 2011) by Larry Elliot – The strategy of stagnation was interesting. There were key parts of his story I disagree with (mostly by degree) but overall the proposition he advances is sound.

Elliot writes that:

The counter-revolution in economics is almost complete. A flirtation with alternative thinking lasted for the six months between the near collapse of the banking system in late 2008 and the London G20 summit in April 2009. Since then, the forces of economic orthodoxy have regrouped and fought back.

… [But the alternative view is compelling] …

For the first half of the postwar period, the strength of trade unions ensured that income gains were shared across all sections of the population and income inequality declined. Since the 1970s, real wages for those in the middle and at the bottom of the income distribution have been squeezed hard. Income inequality has increased as trade unions have declined in influence. Equity withdrawal from rising property prices and much higher levels of debt filled the gap left by the stagnation of real wages until the summer of 2007, but the pressures on the so-called “squeezed middle” are now intense. These pressures will not be eased without pro-growth macro-economic policies, activist industrial strategies, stronger unions, higher real incomes across the board, and tougher action against inequality. A return to the Anglo-Saxon model will lead to stagnation, higher unemployment and even bigger public-sector deficits.

Anyway, the Peter G. Peterson Foundation repeated their efforts this year with the 2011 Fiscal Summit. Unfortunately, they have millions and the grass roots organisation that put together the Teach-In and Counter Conference do not so it was a one-sided affair this year in Washington D.C.

One of the featured presenters at the PGP Summit was former US President Bill Clinton who was introduced by Peterson in this way:

There are so many reasons I’m thrilled to have President Bill Clinton with us today. I don’t think anyone is more qualified than he to discuss the urgency of our fiscal challenges, what to do about them, and how they relate to the future of America’s prosperity and our global stature …

And on he went extolling the virtues of Clinton’s fiscal administration. He failed to mention that the Clinton surpluses squeezed the increasingly debt-ridden private sector which led to the 2001 recession.

But Clinton’s own presentation (by way of an interview with journalist Gwen Iffel) to the Summit provides us with more than enough to judge his capacity to provide input to the fiscal sustainability debate.

My conclusion: he is totally unqualified.

Thanks to the excellent efforts of US-based activist Selise who blogs at NetRootMass we have the full transcript of the Clinton appearance at the latest Peter G. Peterson Fiscal Summit. The Transcript contains some extraordinary revisions of history which I presume were not set straight by the PGP organisers in any following press reports. In fact, the revisionism that is going on at present helps support the myth that the US is on a path of fiscal insolvency.

The background blog on this topic is – Structural deficits and automatic stabilisers. A related blog that you might find interesting is – Structural deficits – the great con job! – where I discuss general problems involved in computing structural deficits.

Some of this discussion cannot help to get technical.

Here is a segment of Bill Clinton’s interview:

Gwen Iffel: How different are things now than more than a decade ago when you faced $300 billion in deficits when you came in office and when you left there were surplus as far as the eye can see?

Bill Clinton: Well, the deficit problem is worse because – let’s go back to the beginning. This started – this whole thing – we had never run permanent structural deficits of any size before 1981 when the American people bought the argument in the ’80 election that the government was a source of all evil and there was no such thing as add a good tax or no such thing as a bad tax cut.

That was the beginning of America’s involvement with structural deficits. The debt of the country was quadrupled between 1981 and 1993. Then we had four surplus budgets paid about $600 billion down on the debt. My last was obviously was mostly President Bush’s first year. We were in a recession. He proposed tax cuts but continued to propose them, so we doubled the debt again in the next eight years. Then we had the financial meltdown, which devastated the revenue stream of the government.

So this is a more severe problem. And it’s more severe because I was in – I became President at the tail end of a traditional business cycle recession. When we had clearly high real interest rates because of the debt.

This recession was caused by a financial meltdown, and the recovery has been slow even with zero interest rates. It’s more like what Japan went through after their collapse. These financial real estate collapses normally take longer to get out of than traditional business cycle recessions. So, it’s tougher now.

Score out of 10 for getting the economics right – 0

Score out of 10 for historical accuracy – 0

Mr Clinton’s former place of employment keeps very detailed – historical datasets – that allow us to trace the US economy in considerable detail back (in many cases) before the Great Depression.

The US Congressional Budget Office also publishes a regular estimate of the The Effects of Automatic Stabilizers on the Federal Budget. They provide the underlying data HERE. Their dataset goes back to the first quarter 1960. The latest edition is for April 2011.

In the following discussion, I am assuming you will read the recommended blogs that I have noted above so I will only briefly summarise the relevant conceptual material that underpins my assessment of the former President’s contribution to the summit.

Why would I be so harsh in my scores for the former President?

First, what is a structural deficit? From my blog – Structural deficits and automatic stabilisers – you will learn that the budget balance for a government (say federal) is the difference between total federal revenue and total federal outlays. So if total revenue is greater than outlays, the budget is in surplus and vice versa. It is a simple matter of accounting with no theory involved.

The budget balance is used by commentators to indicate the fiscal stance of the government. If the budget is in surplus it is concluded that the fiscal impact of government is contractionary (withdrawing net spending) and if the budget is in deficit we say the fiscal impact expansionary (adding net spending).

However, the complication is that we cannot then conclude that changes in the fiscal impact reflect discretionary policy changes. The reason for this uncertainty is that there are automatic stabilisers operating.

The US Congressional Budget Office define automatic stabilisers as “automatic changes in revenues and outlays that are attributable to cyclical movements in real (inflation-adjusted) output and unemployment”.

To see this, the most simple model of the budget balance we might think of can be written as:

Budget Balance = Revenue – Spending.

Budget Balance = (Tax Revenue + Other Revenue) – (Welfare Payments + Other Spending)

We know that Tax Revenue and Welfare Payments move inversely with respect to each other, with the latter rising when GDP growth falls and the former rises with GDP growth. These components of the Budget Balance are the so-called automatic stabilisers

In other words, without any discretionary policy changes, the Budget Balance will vary over the course of the business cycle. When the economy is weak – tax revenue falls and welfare payments rise and so the Budget Balance moves towards deficit (or an increasing deficit). When the economy is stronger – tax revenue rises and welfare payments fall and the Budget Balance becomes increasingly positive. Automatic stabilisers attenuate the amplitude in the business cycle by expanding the budget in a recession and contracting it in a boom.

So just because the budget goes into deficit doesn’t allow us to conclude that the government has suddenly become of an expansionary mind. In other words, the presence of automatic stabilisers make it hard to discern whether the fiscal policy stance (chosen by the government) is contractionary or expansionary at any particular point in time.

To overcome this uncertainty, economists devised what used to be called the Full Employment or High Employment Budget. In more recent times, this concept is now called the Structural Balance.

The structural balance is a hypothetical construct of the budget balance that would be realised if the economy was operating at potential or full employment. In other words, calibrating the budget position (and the underlying budget parameters) against some fixed point (full capacity) eliminated the cyclical component – the swings in activity around full employment.

So a full employment budget (structural budget) would be balanced if total outlays and total revenue were equal when the economy was operating at total capacity. If the budget was in surplus at full capacity, then we would conclude that the discretionary structure of the budget was contractionary and vice versa if the budget was in deficit at full capacity.

A structural deficit thus indicates that the discretionary component of the budget is acting in an expansionary manner to support non-government saving and growth.

The calculation of the structural deficit spawned a bit of an industry in the past with lots of complex issues relating to adjustments for inflation, terms of trade effects, changes in interest rates and more.

Much of the debate centred on how to compute the unobserved full employment point in the economy. There were a plethora of methods used in the period of true full employment in the 1960s. All of them had issues but like all empirical work – it was a dirty science – relying on assumptions and simplifications. But that is the nature of the applied economist’s life.

Things changed in the 1970s and beyond. At the time that governments abandoned their commitment to full employment (as unemployment rise), the concept of the Non-Accelerating Inflation Rate of Unemployment (the NAIRU) entered the debate – see my blogs – The dreaded NAIRU is still about and Redefing full employment … again!.

The NAIRU became a central plank in the front-line attack on the use of discretionary fiscal policy by governments. It was argued, erroneously, that full employment did not mean the state where there were enough jobs to satisfy the preferences of the available workforce. Instead full employment occurred when the unemployment rate was at the level where inflation was stable.

NAIRU theorists then invented a number of spurious reasons (all empirically unsound) to justify steadily ratcheting the estimate of this (unobservable) inflation-stable unemployment rate upwards. So in the late 1980s, Australian economists were claiming it was around 8 per cent. Now they claim it is around 5 per cent. The NAIRU has been severely discredited as an operational concept but it still exerts a very powerful influence on the policy debate.

Further, governments became captive to the idea that if they tried to get the unemployment rate below the NAIRU using expansionary policy then they would just cause inflation. I won’t go into all the errors that occurred in this reasoning. My 2008 book – Full Employment Abandoned with Joan Muysken is all about this period.

Now I mentioned the NAIRU because it has been widely used to define full capacity utilisation. If the economy is running an unemployment equal to the estimated NAIRU then these clowns concluded that the economy is at full capacity. Of-course, they kept changing their estimates of the NAIRU which were in turn accompanied by huge standard errors. These error bands in the estimates meant their calculated NAIRUs might vary between 3 and 13 per cent in some studies which made the concept useless for policy purposes.

But they still persist in using it because it carries the ideological weight – the neo-liberal attack on government intervention.

So they changed the name from Full Employment Budget Balance to Structural Balance to avoid the connotations of the past that full capacity arose when there were enough jobs for all those who wanted to work at the current wage levels. Now you will only read about structural balances.

And to make matters worse, they now estimate the structural balance by basing it on the NAIRU or some derivation of it – which is, in turn, estimated using very spurious models. This allows them to compute the tax and spending that would occur at this so-called full employment point. But it severely underestimates the tax revenue and overestimates the spending and thus concludes the structural balance is more in deficit (less in surplus) than it actually is.

They thus systematically understate the degree of discretionary contraction coming from fiscal policy.

So they are trying to tell us that the business cycle moves around a fixed point – currently around 5 per cent unemployment – and above that the economy is operating with spare capacity and below it the economy is operating over full capacity.

The US Congressional Budget Office follows this defective methodology. They provide a detailed account – Measuring the Effects of the Business Cycle on the Federal Budget of how they calculate the impacts of the automatic stabilisers – that is, decompose the budget outcome into structural and cyclical components. They also provide annual and quarterly data.

In effect, their methodology leads them to understate the degree of excess capacity (that is, underestimate the GDP gap).

But whatever method they use, the CBO still attempt to net out of the actual budget balance the cyclical effects of the automatic stabilisers. The intent is to produce an estimate of the discretionary component of the budget so that a more informed commentary on government policy can be made.

On Page 3 of the CBO document we read:

Calculations of the cyclically adjusted budget attempt to remove the effects of the business cycle on revenues and outlays (that is, the cyclical part of the budget).

So this is about decomposing the impacts of the automatic stabilisers from those attributable to the underlying fiscal stance. Both the revenue and spending side of the budget are adjusted.

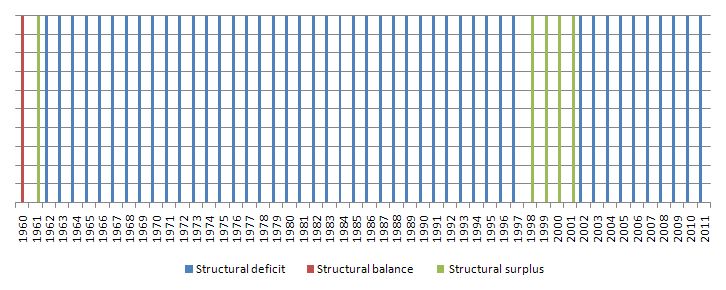

Now, let’s start with the most recent CBO data which begins in 1960. Accepting their estimates of the decomposition between structural and cyclical components at face value I produced the following graph. I gave the value 1 in each period for a structural deficit (blue column), a budget balance (red column) and a structural surplus (green column). The graph shows overwhelmingly (in a very explicit way) how many “structural deficits” there were between 1960 and 2011. The US federal government ran structural deficits 88 per cent of the time.

If the decomposition of the structural components were available before then we would see more blue columns and hardly any green ones.

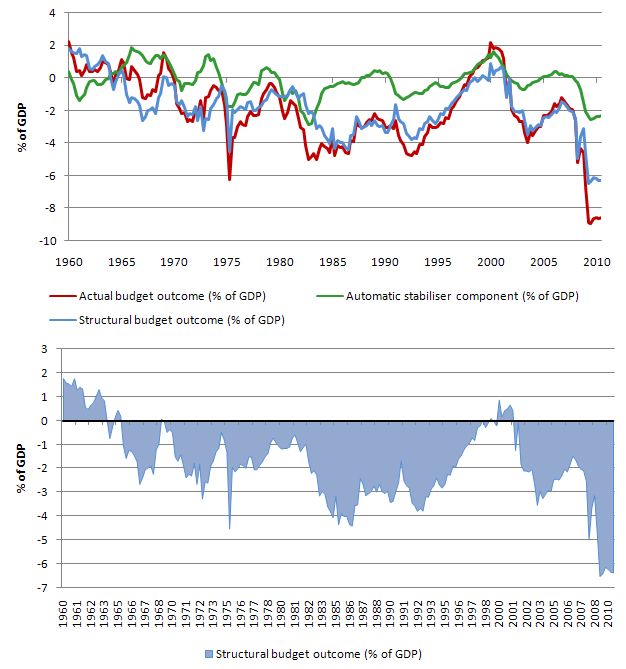

The following graph shows the decomposition of the CBO data since 1960 and the structural deficit as a percentage of GDP for the US. The normal situation over this long period has been a structural deficit.

Now if we take a longer perspective using the Office of Management and Budget data we can see that deficits overall were the norm in the US from 1930 onwards and varied with growth.

Quite apart from the actual data relating to budget deficit outcomes, how might we otherwise know that the former president’s summation that the US had never run any structural deficits before 1980 had to be a lie? Answer: Because the US economy grew before that date.

In terms of the CBO’s methodology – which is biased towards finding larger than otherwise structural deficits – the budget balance would be structurally in deficit if the actual budget balance was in deficit and the economy was operating at the CBO measure of potential real GDP. That is, what they consider to be full capacity.

At that point there would be no cyclical component by definition. You have to think for a moment but imagine the former US president was correct – that there were no structural deficits before 1980s.

Then all the deficits before 1980 would have been cyclical and given that since 1930 the US Office of Management shows that actual budget deficits occurred 85 per cent of the time (that is, were the norm), then the US economy would have to have been always operating below potential. So why would potential GDP grow over this long period if the economy was always failing to hit capacity? Why was unemployment low for much of this time with strong real GDP growth driving strong employment growth if the automatic stabilisers were always suggesting the opposite?

Conclusion

High profit forums such as the PGP Summit are influential – money buying influence as usual. Clearly, when former presidents are introduced as authorities and just revise history to suit his argument and advance the propaganda machine funded by the PGP foundation then the US citizens are being manipulated into accepting economic policies that undermine their income security and their standard of living.

The fact is that the US government has consistently run structural deficits and that policy stance has helped to “fund” employment and income growth and has contributed to the relative prosperity that Americans until recently had enjoyed.

Now, with the widespread call for fiscal austerity becoming deafening that prosperity for many including the American middle class is fading fast.

Comments Policy

Just a reminder to read my Comments Policy if you are anticipating joining the active commenting community here. I get several comments each week which consist of outlining what a low-life I am – poor writer, full of bile, obviously upset that a Nobel Prize passed me by and more of the same.

I delete all comments like this which do not contest or add to the blog in question. I don’t seek to attract a group of sycophants and I never censor views that attack what I might have said.

But I always delete comments that only seek to impugn me as a person. Whether I am like what they say or not is irrelevant. Some of the character assassinations are very long. You would be better off using your time in another way.

That is enough for today!

Bill,

I’m sure the insults are sent to you anonymously but you can probably collect the ip addresses. It might be interesting to know if any, or how many, originate from economics departments such as those you alluded to above.

Mike

Hmmm … The Center for Disease Control published lately a Preparedness 101: Zombie Apocalypse about what to do when Zombies roam the cities of the United States. I think this new epidemic of Economic Illiteracy among economists in the United States warrants also urgent intervention of the Center for Disease Control. Something like Preparedness 101: Economists Go Crazy. This Garbage Letter seems to be signed by the same contaminated economists:

150 Economists Call for Spending Cuts to Boost the Economy

It seems that the media, being corporate captives, have chosen to concentrate on the deficit rather than unemployment. Could that focus be because the coporations that own our politicians have decided that the best way toward higher profits is through forcing wage cuts by high unemployment instead of expanding sales through full employment? If that is the idea it seems to working well for them, but I wonder for how long.

By the way, as for Bill Clinton and our present President, it is my opinion that neither is a progressive, neither is trustworthy, and neither can be relied on. Thanks in part to the commentary on this site I quit listening to both of them about a year ago. And that is as far as I can go about those two because you do have a comments policy.

Bill;

I think you should save a few of the most savage and vitriolic ones and post them on an appropriate mental-health-related site. My own theory is that economic ideology has become deeply infused with sociopathic influences. Ayn Rand-ism is the most widespread version. Her poisonous tracts are now compulsory reading in tens of thousands of American classrooms. There is a point where rational-actor theories intersect with a particular kind of narcissism to produce a personality-type that is immune to normal human empathy. Add a large pinch of old-fasioned paranoia and voila! – a neocon blogger on a mission from God.

Bill,

I enjoy reading your blogs on a daily basis and have learned a ton. When I first started I was lucky if I had your Saturday quizzes at 20%, now after a few months I am usually at 80-100%. So kudos to you for teaching so well!

I try to teach these theories and facts as well on some forums, so if anyone wants to spread the knowledge please do so! It would be good to have more MMT’rs behind me 🙂

http://www.politicalpanic.com/viewforum.php?f=4

I also spread the word. My way is to post comments under articles of popular economic columnists. Multitudes of people read these comments.

Many can be reached by the compelling logic of MMT as opposed to the deeply false “analogies” of the conventional view.

I feel your pain, Bill, on the personal attacks. I read Rothbard’s book, “What Has Government Done to Our Money? and The Case for a 100 Percent Gold Dollar”, at the behest of a friend. Really crazy stuff, so I posted a detailed critique on Amazon.com. That brought the Austrian nut-jobs out of the woodwork! Here’s what I wrote, for those who may be interested:

http://www.amazon.com/review/R30TKMGF58P2AX/ref=cm_cr_pr_cmt?ie=UTF8&ASIN=0945466447&nodeID=&tag=&linkCode=#wasThisHelpful

thank you bill!

“And on he went extolling the virtues of Clinton’s fiscal administration. He failed to mention that the Clinton surpluses squeezed the increasingly debt-ridden private sector which led to the 2001 recession.”

IMO, it is more like the other way around. The clinton surpluses were a reaction to the private sector dissaving with debt and stock price gains.

I’m trying to be somewhat charitable toward the ex-President in interpreting what he could possibly mean when he says the US never ran structural deficits before 1981. On its face, the claim is flat false. Anybody who could use Google could find that out in about 2 minutes, and one doesn’t even have to subscribe to MMT to see it.

Perhaps what he means when making that claim is that the deficits prior to 1981 were not economically toxic, and so were sustainable. In other words, prior to 1981, the government was more or less taxing the right people in more or less the right amounts, and spending money more or less on the right people, in more or less the right places, stimulating consumption and investment. One could think of these sorts of deficits as not “structural” (as long as one completely abandons the rigorous use of that word in economics) in the sense that the increased economic activity stimulated by the spending increases tax revenues which pay off the deficit that was used to stimulate that activity, the deficits don’t “persist.” At the same time, excess savings is removed from those quarters of the private sector where they would otherwise be used for inflationary speculation.

After 1981, the tax burden shifted downward so that now, after factoring in all local, state and payroll taxes as well as federal taxes, the overall tax burden is fairly regressive, while at the same time spending priorities shifted, so that less spending was done to subsidize consumption and it became popular to “spend through the tax code” offering all kinds of exemptions and credits and deferments, mostly to those who didn’t need it, in an effort to stimulate savings as an indirect method of stimulating investment. Needless to say, it didn’t work the way it was sold. The excess savings of the wealthy went into speculation, and that kind of spending, where the government stimulates speculation instead of directly stimulating consumption/investment, is inflationary even in an economy that’s not at full capacity, except that wages are left out of the inflation. One can think of this kind of deficit as structural (again, completely ignoring the use of the word in economics) because that deficit isn’t paid for with increasing tax revenues unless the economy grows because the private sector + the external sector collectively run a deficit. That sort of growth isn’t sustainable, nor should the government rely on its occurrence when making economic policy. This sort of spending doesn’t stimulate the economy much at all, any growth comes from other quarters, so this kind of deficit doesn’t “pay for itself” and the deficit “persists.”

If Slick Willy made that obviously false claim in an effort to make the case that the fiscal policy position of the US was more structurally sound prior to 1981 than it is post-1981, I’m not inclined to disagree with him on that, or pick nits about the literal or technical meaning and truth of his claims. But it is good to see an in-depth argument to why the former President’s claim shouldn’t be thought of as literally or economically true. Perhaps his claim would have been more true if he’d have said that prior to 1981, the US carried no structural debt, rather than claiming they carried no structural deficits.

Your quote from Clinton seems to be focussed not on saying that gov spending should be reduced but that the Bush and Regan tax cuts for the very richest were bad. I also don’t see how increasing the deficit by reducing taxes for billionaires is supposed to help unemployment. Perhaps the billionaires may use a small portion of their new wealth funding jobs in right wing think tanks, but the bulk of it will be converted into pure asset price inflation/volatility with commodity price volatility as a sting in the tail. Weren’t the Clinton surpluses the result of capital gains tax as people bailed out of the tech stock bubble? Personally I think it is misguided to tax people on gains from selling assets rather than taxing ownership of assets but capital gains tax was hardly a Clinton innovation. The post Clinton slump was the hang-over of the crazy tech bubble. The capital gains tax was paid by those who profited from the bubble. The slump was due to the losses of those who lost in the bubble. Letting those who profited keep even more of their profits would not have helped avoid the slump.

The Petersen Foundation are scraping the bottom of the barrel if they have to draught Clinton to speak for their agenda.

Clinton has a relaxed attitude to the truth and narrowly escaped impeachment over his sordid affair and the aftermath.It is a sorry state of affairs when the likes of him are trotted out as some sort of authority.I wonder how long before Strauss-Kahn is doing the speaker circuit.

bill,

the last year is a structural deficit?

Bill,

I’d tend to look at the REALLY hate-filled comments as a sort of complement. I know, I know, that seems paradoxical — but think about it. We generally only disparage those who have really irked us in some way. In order to really irk us someone usually has to say something that really grinds our core beliefs.

So, those comments — you know the ones I’m talking about, the ones that have taken someone maybe ten minutes to type — indicate that you’ve REALLY got someone’s goat good. And since you never spend your time spewing total hate on your own blog we can only assume that these people cannot stand the fact that most of what you write proves them fundamentally wrong.

Any time I write, I always hope the anti-fans will chime in with something particularly horrendous. Although you’re probably right to save the rest of us the time and effort of reading it.

Is my reasoning perverse? Perhaps. But the internet is a perverse place.

Phil

Go easy on the former president. Where he comes from in Arkansas, a blow job isn’t “sexual relations”, it’s just fooling around.

Thanks for yet another illuminating (and succinct) post.

It seems I could, possibly, start the day without my morning coffee, but a sip of bilbo really opens the eyes.

Philip Pilkington ” And since you never spend your time spewing total hate on your own blog we can only assume that these people cannot stand the fact that most of what you write proves them fundamentally wrong.”

I wish they would try and articulate what it is that is making them angry and leave out the abuse. Are they angry about the failings of the economy? Well who isn’t. Do they think Bill’s idea would make things worse? Well please just say so and say what makes them think that.

And then there is th idea of sustainability of full employment

So for example a budget surplus at a projected full employment level probably means that even if we did get there it would not be sustainable.

This year’s Peterson summit was announced at the last minute. Clearly they learned that advance publicity would only mobilize popular opposition. But even if we had had advance notice, I am not sure that we could have pulled off another conference. The economy is in the tank and fundraising from small donors is very difficult in the present environment. Even so, we put enough of a scare into them that they did not dare advance publicity.

And as MMT points out a permanent surplus could only be supported if the US became a permanent net exporter to offset saving desire, which runs counter to being the issuer of the global reserve currency.

The people that want the US to run a permanent fiscal surplus, manage the global reserve currency, have a strong dollar, operate at optimal performance, be a continual net exporter, and be the global economic leader are caught up in their own contradictions, which amounts to a fantasy.

Very interesting blog.

I’ve been spending some time getting my head wrapped around MMT, and trying to unlearn all the apparently wrong economics I learned 35 years ago. Been reading Mr. Mosler and Mr. Roche, and am close to full “conversion” to MMT, except for a couple of things:

* Mr. Roche’s offhand comment a few months back that Mr. Bernanke does not know how our monetary system works.

* An article that popped up a few days ago on a conservative site on the great prosperity the Canadian economy is enjoying, purportedly as a result of government downsizing. I have to admit, I was shocked. I haven’t yet researched the accuracy of the history nor the soundness of the reasoning, but such inquiry is on my to-do list. (www.downsizinggovernment.org)

Any light you could shed on my two stumbling blocks would be appreciated.

As a last request, is there anybody who appears somewhat regularly on the WSJ editorial page whose monetary/fiscal views you would endorse? We get the Journal and read the debates, but it seems nobody is really representing MMT. Am I wrong about this?

Mister Lynch,

On Bernanke, read this:

http://www.levyinstitute.org/pubs/wp_636.pdf