The other day I was asked whether I was happy that the US President was…

The best option for Ireland is to default and exit

In thinking about a restructuring scenario for the Eurozone nations it would not be consistent with an understanding of MMT to advocate default without exit. The EMU nations have to exit as they default and the restructuring of loans has to be in terms of their newly established local (national) currencies. In that way, the newly sovereign national government can ensure the banking system remains liquid (in the new currency) and that workers do not lose their bank deposits etc. Anyway, the Economist Magazine provoked me into action today. It ran a story this week (May 26, 2011) – Ireland’s chances of recovery – which carried the sub-heading “A return to decent growth is essential”. Well you don’t have a recovery without a return to growth so I thought the title etc was somewhat twee! (not the Dutch 2). I have written about the Irish disaster before – in this blog The Celtic Tiger is not a good example and this blog – The sick Celtic Tiger getting sicker – which both document the steady decline in the Irish economy that is being stage managed (that is, caused) by the irresponsible macroeconomic policies being pursued by the Irish national government. The Economist writes:

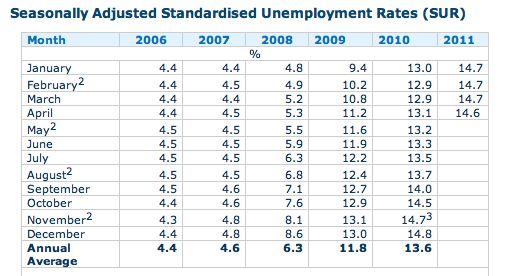

According to a report from the IMF on May 20th, Ireland’s public debt, which was just 25% of GDP in 2007, is already 96% and is due to reach 111% this year … A seemingly model fiscal pupil is now at the back of the euro-area class because of the cost of rescuing Irish banks, which has reached 42% of GDP, and a collapse in national output and property-dependent tax revenues.Thereafter followed “horrific” IMF debt projections which were described as “dismal”. There was no mention of the horrific unemployment rates in Ireland that are getting worse by the month and are now edging 15 per cent. The following table is taken from the Irish Central Statistics Office and shows the monthly seasonally adjusted unemployment rate from January 2006 to April 2011. For a government of an advanced nation (well any level of development really) to willingly impose this level of unemployment on its citizens is the headline story. All the scary headlines about public debt are sideshows.

It is clear that the Irish government faces insolvency because it is using a foreign currency and requires bond markets to lend to it to fund its deficits.

All the problems that have arisen since the property market collapsed can be attributed to it not having currency sovereignty. I realise there are many people who consider the Euro to be an inconsequential part of the story. But if the Irish government was using the “punt” then it could have restored the capital of the ailing banks (by nationalising them) without the need to impose a harsh domestic deflation.

It could have offered all the unemployed a job at a living minimum wage and kept many workers solvent and allowed them to maintain their debts in good standing.

I am not suggesting a major property crash is without consequence. But once it happened, the Euro became the story.

The Economist doesn’t agree. It says:

It is clear that the Irish government faces insolvency because it is using a foreign currency and requires bond markets to lend to it to fund its deficits.

All the problems that have arisen since the property market collapsed can be attributed to it not having currency sovereignty. I realise there are many people who consider the Euro to be an inconsequential part of the story. But if the Irish government was using the “punt” then it could have restored the capital of the ailing banks (by nationalising them) without the need to impose a harsh domestic deflation.

It could have offered all the unemployed a job at a living minimum wage and kept many workers solvent and allowed them to maintain their debts in good standing.

I am not suggesting a major property crash is without consequence. But once it happened, the Euro became the story.

The Economist doesn’t agree. It says:

Even more wrenching fiscal austerity is needed to bring the budget deficit down from the 10.6% of GDP forecast by the IMF this year towards more manageable levels. That in itself will hold a recovery back, unless Ireland’s exporters can overcome the downward pull from a beaten-up domestic economy. This is not impossible.But highly improbable especially with one of its major trading partners mired in a self-produced downturn again (Britain). Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point. The last thing the Irish economy needs is “more wrenching fiscal austerity”. The Irish labour market is self-destructing because there is not enough aggregate spending and the fiscal austerity is making matters much worse. The mainstream commentators seem to ignore path dependency. In the real world, booms in activity stimulates on-the-job training opportunities and raises potential output above the level that would have persisted had the economy remained at low levels of activity. Alternatively, as activity falls due to demand failure, both training opportunities decline and actual skills are lost, as workers lie idle. The potential capacity level falls as a result. The longer the Irish economy is stranded in its policy-induced recession the worse will be the longer-term consequences. Potential growth rates are now being damaged. So even when growth resumes at some future time, the losses will still be evident in lower than otherwise growth. Further, the damage to skill development will be severe. Unemployment stifles skill development and denies younger workers the opportunity to gain training and experience which sets them up for the future. The negative consquences of this policy folly on the 15 year olds in Ireland will be profound and that alone warrants the people overthrowing their elected officials and demanding policy action that immediately provides jobs. The point that most people do not understand and certainly the neo-liberals do not advertise is that the national government with its own currency can always employ any workers who are without work. In this respect the article in the New York Times (May, 29, 2011) – Against Learned Helplessness – by Paul Krugman is excellent. He says that:

Unemployment is a terrible scourge across much of the Western world. Almost 14 million Americans are jobless, and millions more are stuck with part-time work or jobs that fail to use their skills. Some European countries have it even worse: 21 percent of Spanish workers are unemployed. Yet a strange thing has happened to policy discussion: on both sides of the Atlantic, a consensus has emerged among movers and shakers that nothing can or should be done about jobs. Instead of a determination to do something about the ongoing suffering and economic waste, one sees a proliferation of excuses for inaction, garbed in the language of wisdom and responsibility. So someone needs to say the obvious: inventing reasons not to put the unemployed back to work is neither wise nor responsible. It is, instead, a grotesque abdication of responsibility.That is it in a nutshell. There is never a shortage of jobs available – just a shortage of funding to make them operational. Any national government with its own currency can introduce a Job Guarantee to ensure anyone who wants to work can find it. Krugman says that:

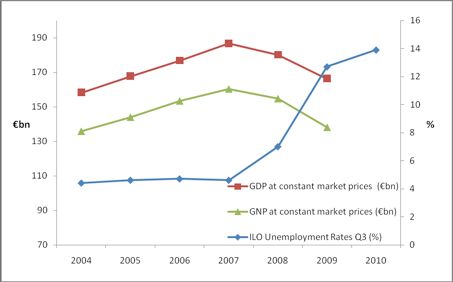

The core of our economic problem is, instead, the debt – mainly mortgage debt – that households ran up during the bubble years of the last decade … [and] … there are a number of things that could be done about it. For example, we could have W.P.A.-type programs putting the unemployed to work doing useful things like repairing roads – which would also, by raising incomes, make it easier for households to pay down debt.That should be the policy priority in all nations. For EMU nations they first have to exit the Eurozone or vote for a supra-national fiscal authority to subvert their national rights and deficit spend up to the point that the last worker who wants a job has one. All the faux issues about public insolvency have sidetracked us from that reality – the national government chooses the unemployment rate. If that choice involves a decision to surrender currency sovereignty then it is harder to undo. But never tell me that a national government intent on advancing public purpose cannot do so. The bond markets cannot stop such a government. The ECB cannot stop such a government. The IMF and OECD cannot stop such a government. All that is stopping national governments is their own mis-guided perception of macroeconomics aided and abetted by entrenched vested interests who are profiting from the malaiase. I read yesterday (link has evaded me today) that corporate profits in the US are now soaring and well beyond the pre-crisis levels whereas the real wages of workers in the US are going backwards. That tells me that there is something fundamentally wrong with the policy mix in that nation (and all nations). The Economist magazine is still hanging out the “export-led” recovery hat. But with forecasters (other than the IMF which is always optimistic and always wrong) are predicting Ireland will stay mired in recession – the “fourth year of contraction”. My understanding of the Irish data tells me that exports are not going to be strong enough to offset the on-going contraction in consumer spending, private investment and a retrenched public sector. There is no other way to achieve growth – spending creates income. Now is the time for the Irish government to abandon its ideological torture of its own people and exit the Eurozone and restore its policy choices. It will be relatively smoother sailing once it makes that very monumental decision. Some data that might scare you Here is some analysis that is not often reported or considered in all the furore about sovereign debt and bank bailouts. It is about the real economy – where people’s lives are played out. The Irish Central Statistics Office has a special unit which investigates “job churn” and provides several experimental data sets that shed light on the dynamics of the Irish labour market in ways not normally presented in the mainstream media. As background, I had a large Australian Research Council grant a few years ago to investigate labour market dynamics. Very few people pursue this sort of research yet the results are always very revealing. Several studies reveal that labour markets in countries like Australia are in a constant state of flux which means that specific jobs are continually created and destroyed as firms expand, adjust to changing labour force characteristics, restructure, contract or close. This process of job creation and destruction (JC&D) is mirrored by movements of workers between labour force states. When we consider employment dynamics using macroeconomic data we typically focus on measures of net employment changes over time. For example, say total employment in April is 8000 thousand and in May it is 8020 thousand. Then we would conclude that total employment rose by 20 thousand jobs in the month of May. You will constantly hear commentators saying that 20 thousand jobs were created in May. That is likely to be a false statement because in all likelihood many multiples of that were created at the same time as thousands were also destroyed leaving a net change of 20 thousand. In other words, a net focus at the aggregate focus prevents an understanding of flows noted above (numbers of jobs created and destroyed and movements of workers across labour force categories). A net figure showing an increase in employment of 20 thousand can be describe totally different underlying dynamics. For example, imagine that 100 thousand jobs were created and 80 thousand were destroyed in the month – which would suggest a highly fluid labour market. Compare that to just 20 thousand jobs being created and none destroyed – a much less vibrant situation. Research in this area thus analyses the flows of workers between states usually at a disaggregated industry level to gauge the extent to which the labour market is in flux. There are several technical issues involved in calculating the job creation and job destruction rates and the derivative time series but I will ignore them here. I have several academic papers out on this topic if anyone is interested in pursuing the matter more formally. We initially define the rate of employment growth in sector i (that is, a sub-sector of some industry) at some time (t) as the percentage change in employment between two periods in relation to the average size of sector i over the period in question. We then define the job creation rate for a sector as a sub-sector-weighted average of these growth rates when growth is positive. We also define the job destruction rate as a sub-sector-weighted average of these growth rates (in absolute value) when growth is negative. Aggregate gross job flow measures are then computed by summing over all sectors in an industry (or over industries). We also compute the total churn (or job reallocation rate) as the sum of the job creation and job destruction rates. Net employment growth is simply the difference between job creation and job destruction rates. You can read a Background Notes on compilation of Job Churn statistics at CSO, Ireland which describes the data set. As they note, the total change in employment in a particular industry over any one period is the difference between job creation and job destruction which is also equivalent to the difference between hires and separations. The following graph is taken from the Job Churn Background notes and shows real GDP (and real GNP) and the unemployment rate for Ireland in the period preceding the crisis and the early part of the crisis. It is self-explanatory and describes an economy in a state of collapse. The decline in the size of the economy (as shown by the real GDP decline) is staggering. But the situation has worsened considerably since that time and now unemployment is over 15 per cent notwithstanding the considerable out-migration of workers seeking employment elsewhere (many are coming to Australia to seek a job).

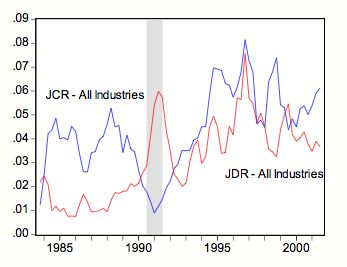

To give you something to compare the Irish gross flows data against, the following graph shows the All Industries job creation and job destruction rates in Australia between 1983 and 2002 with the shaded area corresponding the major recession that the economy endured during this period. The graph shows starkly what happens to job flows over a business cycle. As you can see during the recession (which was Australia’s worst downturn since the Great Depression) the job destruction rate soared (peaking at around 0.06) and job creation rate plunged (to around 0.01). there was considerable turmoil in the period following the recession with job creation taking a long time to establish a new dominance.

To give you something to compare the Irish gross flows data against, the following graph shows the All Industries job creation and job destruction rates in Australia between 1983 and 2002 with the shaded area corresponding the major recession that the economy endured during this period. The graph shows starkly what happens to job flows over a business cycle. As you can see during the recession (which was Australia’s worst downturn since the Great Depression) the job destruction rate soared (peaking at around 0.06) and job creation rate plunged (to around 0.01). there was considerable turmoil in the period following the recession with job creation taking a long time to establish a new dominance.

Now how does Ireland stack up in the recent period? The Central Statistics Office in Ireland has experimental data for 2006 to 2009. I will be waiting to see the 2010 data with special interest.

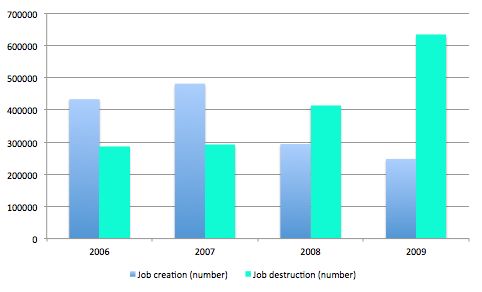

The following graph is taken from the data provided by the Central Statistics Office in Ireland and shows the numbers of jobs created and destroyed for the years 2006 to 2009. The data isn’t available for 2010 and beyond but the developments since 2009, driven by the harsh austerity program that the Irish government unwisely inflicted on its citizens will have caused job destruction to rise even higher and job creation to fall further.

Noting my new iMac colours (this is the first blog researched, produced and written using OS X), the job destruction is running at around 3 times the job creation (in numbers). I have seen this type of data for many nations now and the scale of the Irish collapse and its persistence since is without precedence.

Now how does Ireland stack up in the recent period? The Central Statistics Office in Ireland has experimental data for 2006 to 2009. I will be waiting to see the 2010 data with special interest.

The following graph is taken from the data provided by the Central Statistics Office in Ireland and shows the numbers of jobs created and destroyed for the years 2006 to 2009. The data isn’t available for 2010 and beyond but the developments since 2009, driven by the harsh austerity program that the Irish government unwisely inflicted on its citizens will have caused job destruction to rise even higher and job creation to fall further.

Noting my new iMac colours (this is the first blog researched, produced and written using OS X), the job destruction is running at around 3 times the job creation (in numbers). I have seen this type of data for many nations now and the scale of the Irish collapse and its persistence since is without precedence.

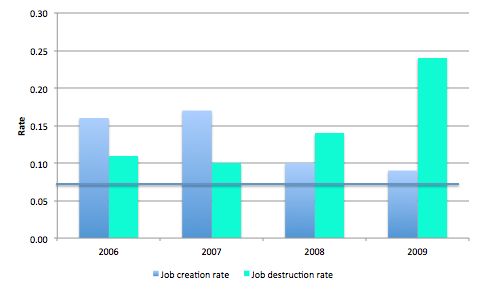

The next graph shows the job creation and job destruction rates in Ireland between 2006 and 2009. The horizontal blue line (at around 0.07) shows the worst job destruction rate that Australia had to endure in the 1991 recession aftermath to give you some impression of scale. The Australian downturn was very severe. The Irish downturn and government-sponsored perpetuation of it is a human disaster.

The next graph shows the job creation and job destruction rates in Ireland between 2006 and 2009. The horizontal blue line (at around 0.07) shows the worst job destruction rate that Australia had to endure in the 1991 recession aftermath to give you some impression of scale. The Australian downturn was very severe. The Irish downturn and government-sponsored perpetuation of it is a human disaster.

Public debt ratios do not scare me. Rising budget deficits do not scare me.

But the job destruction rates in Ireland really scared me when I started to dig into the data. They tell me that the labour market is being severely damaged and the path-dependency will be profound and long-lived. The destruction of jobs at the rates that the Central Statistics Office has calculated are without exception. Given what has happened since this data was compiled – as Ireland endures its fourth year of economic contraction I can only conclude that the costs of this destructive policy choices are so great and so permanent that the costs involved in exiting the Eurozone would be dwarfed.

I challenge all the neo-liberal, pro-Euro types to actually outline what the costs of exit would be. But they should make sure they understand that the majority of their costs would be inapplicable once currency sovereignty was restored.

Conclusion

It is easy for an outsider like me to wax lyrical about the plight of another country and its people. I recognise that. But I have no doubt that the best option for Ireland is to default and exit as soon as possible. Greece should follow its lead (or give it a lead).

And remember when considering Ireland and Greece etc do not forget that one of the most vehement proponents of fiscal austerity including cutting wages and conditions, cutting welfare support and privatising public assets was none other than Christine Lagarde, who is now trying to worm her way into the IMF as boss. She would be a disastrous choice for that position.

Tomorrow is the Australian National Accounts data for the March 2011 quarter. Our so-called booming economy will likely show a sharp contraction (probably negative growth) with net exports draining demand and public spending propping up activity. Private domestic spending will be flat. Just the right environment to impose fiscal austerity! NOT!

That is enough for today.

]]>

Public debt ratios do not scare me. Rising budget deficits do not scare me.

But the job destruction rates in Ireland really scared me when I started to dig into the data. They tell me that the labour market is being severely damaged and the path-dependency will be profound and long-lived. The destruction of jobs at the rates that the Central Statistics Office has calculated are without exception. Given what has happened since this data was compiled – as Ireland endures its fourth year of economic contraction I can only conclude that the costs of this destructive policy choices are so great and so permanent that the costs involved in exiting the Eurozone would be dwarfed.

I challenge all the neo-liberal, pro-Euro types to actually outline what the costs of exit would be. But they should make sure they understand that the majority of their costs would be inapplicable once currency sovereignty was restored.

Conclusion

It is easy for an outsider like me to wax lyrical about the plight of another country and its people. I recognise that. But I have no doubt that the best option for Ireland is to default and exit as soon as possible. Greece should follow its lead (or give it a lead).

And remember when considering Ireland and Greece etc do not forget that one of the most vehement proponents of fiscal austerity including cutting wages and conditions, cutting welfare support and privatising public assets was none other than Christine Lagarde, who is now trying to worm her way into the IMF as boss. She would be a disastrous choice for that position.

Tomorrow is the Australian National Accounts data for the March 2011 quarter. Our so-called booming economy will likely show a sharp contraction (probably negative growth) with net exports draining demand and public spending propping up activity. Private domestic spending will be flat. Just the right environment to impose fiscal austerity! NOT!

That is enough for today.

]]>

-ekathimerini.com Government close to deal with troika

Aha. The comrades IMF, ECB and EU are now in charge. Instead of having elected governments accountable to its citizens we Europeans start experimenting with independent committees stuffed with technocrats accountable to nobody. Sooner or later we can relabel our European experiment to the Soviet Union of Europe.

The path out of the crisis for Ireland passes through Merrion Square.

Athens has Constitution Square and Cairo has Tahrir. Can our Irish deartháireacha take a hint ?

“I read yesterday (link has evaded me today) that corporate profits in the US are now soaring and well beyond the pre-crisis levels whereas the real wages of workers in the US are going backwards. That tells me that there is something fundamentally wrong with the policy mix in that nation (and all nations).”

Even though companies are making big profits, with unemployment as high as it is, there is no pressure to pass on any of that profit to the workers. The question is, what is happening to the profits? Companies in the US have already got their balance sheets in great shape. If the profits are being returned to shareholders, they will want to reinvest them somewhere. Reinflated housing bubble, anyone?

Another comment on Greece. I can only recommend to read this Greek newspaper ekathimerini.com It’s like reading The Onion. The Greek education minister wants pupils to reuse textbooks to save money. Books that are in a bad state will be recycled. “The initiative is a nationwide effort aimed at increasing respect for public property,” Diamantopoulou said. Why not stop with public education in general? This will save even more money! And who needs education for NO jobs?

Re The Economist’s point on the need for austerity, Moody’s today (on the subject of Japan): “In the long run, a key to fiscal consolidation is to have economic growth strong enough to generate tax revenue.”

Just when you think they’re on the right track, they get it @rse about again, putting the ratings (including foreign currency???) on watch because they “doubt that its economy can grow quickly enough to generate higher tax revenue over the long term”, because “government plans to reduce its debt would not be strong enough given the fiscal burden from the March 11 disaster”, but “Increasing the sales tax to pay for welfare spending is probably inevitable but may not necessarily be a positive as it could hurt consumer spending”. What tha?

> The Greek education minister wants pupils to reuse textbooks to save money.

How & why does an electorate reuse outdated politicians? Can they shred soiled political parties, and re-purpose them? Greeks are now considering many alternative uses for bankers & regulators too.

Good luck. The ECB horse inside the Greek CB is already empty. How ironic.

> job destruction is running at around 3 times the job creation

ps: job destruction can be a good sign, if it’s due entirely to return-on-further-coordination;

Why isn’t there an Automatic Stabilizer law that requires freed human talent to be dynamically re-purposed to insanely great public goals, instead of sitting idle in static assets of no future value?

(banksters as the beerbelly on the abdomen of a nation? impressive aggregation of assets, of no value whatsoever except accelerating heart attacks)

Thanks Bill,

It has been obvious to people in Ireland that the Austerity we are undergoing will create the problems you outline with regards to jobs. When this is pointed out to the economists advocating the cutbacks in spending they point out “yes, but we have no choice!”.

There is no alternative has been a mantra for too long. Time to leave the Euro indeed.

Kaiser

Alex Heyworth “The question is, what is happening to the profits? Companies in the US have already got their balance sheets in great shape. If the profits are being returned to shareholders, they will want to reinvest them somewhere. Reinflated housing bubble, anyone?”

-I suppose an offset cycling of commodity bubble/crash and equity bubble/crash is the likely outcome. The commodity bubble will eat into company profits. When it no longer becomes profitable for companies to consume commodities, they will stop, prices will crash, rinse and repeat.

Interesting, the Job Creation falls rapidly before Job Destruction even kicks in to any significant extent

If I’m allowed to post a link to a piece in the Irish Times to show how bad things are getting.

The government’s strategy to get more jobs created is…… To cut the double time of the lowest paid on Sundays! I kid you not… Here’s piece from the Irish Times on it.

http://www.irishtimes.com/newspaper/opinion/2011/0531/1224298147947.html

dear Senexx (at 2011/05/31 at 22:18)

The firms tend to stop hiring first while they assess the likely depth and duration of the drop in sales. There is an incentive to carry labour that has heavy fixed costs (this is called hoarding). Once they realise that things are getting worse they convert full-time jobs into part-time, casualise part-time jobs and start laying people off. The job destruction rates at that point accelerate.

best wishes

bill

Generally US companies don’t pay a big dividend. Many are sitting on a mountain load of cash. Wonder what will happen when they start spending the stash? Should be good for jobs and growth right? how to get them spending?

Ireland should abandon the Euro and become monetarily sovereign again, so they can achieve the same great economic performance as they did before joining the Euro with an unemployment of 15%!

As an exporter country and contrary to the other PIGS, Ireland could stay in the EZ and benefit from it. They should just repudiate the debt contracted to bailout private banks.

“so they can achieve the same great economic performance as they did before joining the Euro with an unemployment of 15%!”

What under the Exchange Rate Mechanism you mean with all its constant realignments.

They might want to try a free float for a change, free up monetary policy and target domestic production.

No, I mean historically. Like when Ireland’s main exporting item was Irish people, and when the Irish GDP/capita was was below the average of the EU. The good ol’days!

MamMoTh “Ireland should abandon the Euro and become monetarily sovereign again, so they can achieve the same great economic performance as they did before joining the Euro with an unemployment of 15%!”

Before the euro they were in the european exchange rate mechanism and before that pegged to the GBP so they weren’t properly sovereign.

“

The Irish punt was devalued against the DM between 1979 and 1999. It didn’t help much until the late 90s when they implemented their neoliberal reforms.

Devaluation of a sovereign currency only helps exports. Some day MMTers should make up their mind between their pro-devaluation and anti-export led growth.

Argentina, Bill’s role model, pursues an export led growth policy with a dirty float to keep the currency undervalued after all.

Bill:

You, Warren, Marshall and Hudson should form a consultancy to help these nations leave the EU. I have a feeling there is quite a bit of work out there. We commenters will be your willing 24×7 virtual admin staff.

MamMoTh, maybe thats just you who is confused. Currency sovereignty is essential to maximizing economic wellbeing of population.

When CB buys foreign currency to maintain fixed exchange rate, it does that by using domestic currency, and that directly increases domestic money supply just like budget deficits would. That benefits whole domestic economy, not just the export sector. It is essentially deficit spending trough FX markets, and that how some nations like China can keep their budgets (roughly) balanced.

Why do you even comment if you don’t know anything about anything?

MamMoTh;

I don’t think MMT is pro-devaluation or anti-export. MMT is pro-full-employment via currency sovereignty, using all the tools of fiscal and monetary policy that are proprietary to a fully sovereign national government. MMT is pro-devaluation when devaluation aids the attainment of these goals and anti-devaluation when it isn’t. The principles on which MMT is founded lead to the conclusion that the proper buffer-stock for a modern, properly managed, mixed economy is employment – not unemployment. A sovereign government chooses some particular rate or range of unemployment – or else abdicates this responsibility to the country’s bankers and financiers. The central problem for the world today is that, under the neoliberal ideological hegemony, this abdication has become nearly universal. MMT is a sound theoretical basis for resisting and overcoming neoliberalism.

Argentina, along with most of the rest of Latin America, was the original laboratory of market fundamentalism, imposed via CIA-installed fascist dictatorships. Read “The Shock Doctrine” by Naomi Klein to recover the real history of those years. Absorb the full horror of Milton Friedmanism’s actual record. Today, the IMF has been kicked out, democracy has been restored and international finance capital has been treated to one of its few real haircuts. Hooray. And to the extent that some Latin American leaders and intellectuals have understood MMT-related ideas as part of their policy stance, hooray for that too.

MamMoth: “The Irish punt was devalued against the DM between 1979 and 1999. It didn’t help much until the late 90s when they implemented their neoliberal reforms.”

-It was allowed to gradually devalue by 36% over the decades but not actually freely floated. I really don’t think you can rule out the possibility that had it been freely floated, export led and domestic growth would have created a decent level of employment. I can see your point that in the absence of neo-liberal bubble-blowing, imported commodities such as oil etc could have been expensive, but I don’t think that that would have led to unemployment.

Neither Argentina nor the rest of Latin America were laboratories of market fundamentalism. They were examples of state sponsored capitalism at the service of private interests, corruption, cronyism and misguided nationalism. There was never anything resembling free-markets until very recently. The one country that did move more towards a free-market was Chile and did much better than the rest of the continent. Naomi Klein has no credibility left.

stone, sure a freely floating punt might have devalued even further making the Irish people even poorer than they were. Maybe they could have lowered unemployment by becoming the cheap labour force of Europe, but their standard of living wouldn’t have improved much. Misery would have been distributed in a different way, that’s all.

MamMoth, the devaluation would have made imports more expensive but it is not as simple as equating that with being poor. Domestic produced food, goods and services would have been just as affordable. The extra industry that would have grown up as a result of the devaluation could well have sustained a revaluation of the punt so that it would have been a sustainably strong currency on the basis of free trade. Ireland has plenty going for it. There is no reason why it need be less well off than say Sweden.

I think the key thing is to question why certain countries are wealthy and certain countries are poor. Clearly it is a mixture of how badly they are afflicted by cronyism etc, whether they make stuff people want, what natural resources they have and how cunning they are at fostering and exploiting asset price inflation. I guess Germany makes stuff the rest of the world wants and as a result is wealthy. Nigeria shifts every penny of export revenue it gets into UK assets so Nigeria is poor and UK is rich. I guess if the whole world was as good at making stuff as the Germans, then Germany might not be so well off. Also if the whole world was a perfect repository for Nigerian loot and made cunning financial trades, then the UK would be less well off. However I’m sure that if all countries endeavored to produce real goods and services that were needed, then the world as a whole would be better off.

MamMoTh, we’ve never been sovereign by MMT standards.

The late 80’s, when we had the Punt, the exact same rhetoric was used to cut services as is used today… “The Public Finances are out of control and we are living beyond our means”.

Ray MacSharry’s widespread spending cuts in the late 80s led to him being called ‘Mac the Knife’. The ’87 budget slashed current and capital spending telling us it was ”unpalatable but critical”. MacSharry’s budget also imposed a pay freeze and an embargo on recruitment in the public service. He abolished a number of housing grants and introduced a IR£10 charge for hospital outpatients(to get us used to paying for Healthcare). He also introduced tax breaks for Property development which sowed the seeds of what was to come….!

All this was lead by a claque of economists who’d meet in Doheny and Nesbitt’s pub and discuss how to ‘Cut the Fat’ from the public service and unleash the “free Market”. Essentially, how to begin a shift to neo-Liberalism! So, the government then was led up a garden path by Neo-liberals too. Monetary Theory was never used to push employment as MMT and Job Guarantee suggest to me they should.

In an MMT economy what’s to stop the government in Ireland investing in Education and R&D jobs? This is aside from the obvious infrastructure projects that need to be funded straight away.

Where after all did most of the high-tech and Pharma jobs which arrived in Ireland in the 1990’s come from if not from US state spending?!!!

The reasons for Irish poverty go further back of course…. All of this is after an Economic War with Britain because we refused to pay them any longer for the land they had stolen between 1169 – 1650!

Yours in post-colonial complexity,

Kaiser

Stone,

Irish industry was not prepared for open competition in the early 1800’s which is what has led to us being a largely Agricultural exporter. Basically with the Act of Union in 1801 subsuming us into Britain our industry died against theirs. We had many textile factories all over the country but all these jobs were lost. The US and Germany were able to protect their infant industry against the Bigger and already more technologically advanced British factories but we were no longer able to as tariff policies were set in London.

Then the Absentee Landlord Class made huge profits by renting the land back to us for us cultivate for export to their benefit. We became the bread basket to feed the troops off creating and maintaining the empire as we ourselves starved!

Kaiser

Kaiser, the colonial legacy need not be a permanent affliction. Singapore was also an exploited colony with no industrial base but seems to now be on its feet. The USA also recovered (I’m not saying colonialism is excusable though). Ireland is currently very wealthy by global standards. I guess the trick will be to sustain prosperity that largely sprung from a now burst property bubble.

Devaluation makes people poorer. Whether this will be reverted over time is just a gamble. Domestic production will change but not necessarily become more affordable for the people. It depends on where the resources for production come from and international market prices. If food production is sold domestically at international prices then it will be less affordable. The only thing for sure is that production will pick up because labour becomes cheaper. Hallelujah!

Any country can spend as much as it wants in education and R&D, and confiscate real resources from the private sector which will therefore produce less in the present. Whether this strategy pays off in the longer term is another gamble. It depends on which sectors of education and R&D the country invested, and which results are obtained.

If a country like most South-American countries invest in educating psychologists, philosophers, sociologists, anthropologists, and political scientists, then it is a waste of resources that will not improve the productivity of the country that will end up with too many overeducated taxi drivers. The key in education and R&D as a vector of productivity lies in science, engineering, design.

Very good! Another example for my collection of anecdotes why a monetary union in Europe will never ever work. Basically every nation in Europe can come up with some historical trauma of being raped and pillaged by some other European nation. I mean we have 2.000 years to look for some abuse. I bet once Eastern Europe is hooked up to the Euro and some calamities arise they will look up their history and blame it on the Völker-Kerker (Prison of Nations) of the Habsburg Empire. Thus a supra-national fiscal agency isn’t on the menu. Which renders the EMU a complete failure. Why not simply pat on our shoulders for having accomplished the European Union without waging some wars regularly and forget about this dreaded idea to have a common currency?

@Stone, Of course post colonial economies can develop and Ireland has done so. However, looking the interests running the ECB it’s hard to guess they are other than the Rentier who had us in Ireland under the yoke! Then a break form the ECB is the obvious first step followed by struggle toward equality in development.

@MamMoTh, what private sector resources would the government be confiscating when unemployment is 15% and emigration is 50,000 or something per year? We already have many unemployed qualified teachers and class sizes of 32 kids! Well, build bigger schools and get class sizes down. Construction companies and teachers are employed again.

@Stephan, I assume you understood what I said was firmly tongue in cheek?! That said I agree with you regarding the whole Euro project and for these reasons: History only becomes an issue if people see an obvious oppressor. The ‘Currency’ project is not in favour of people. Why have the institutions been set up to only concern themselves with price stability, for example?? The ECB is the return of the Rentier and largely the problem (Greece to sell its beaches etc).

If the Treaties were people and worker centered then perhaps more would have come of the political project.

Did anyone read WIlliam Blacks blog post IMF and ECB – Bad Cop, Crazed Cop?? Well worth it.

http://neweconomicperspectives.blogspot.com/2011/05/bad-cop-crazed-cop-imf-and-ecb.html

MamMoth “Devaluation makes people poorer. Whether this will be reverted over time is just a gamble. Domestic production will change but not necessarily become more affordable for the people.”

Devaluation makes creditors poorer and debtors wealthier. It makes wage payers wealthier and people on salaries poorer. I think the key point is not whether a strong currency or a weak currency is good but whether letting the currency float is a sensible way for “the market” to determine what is the optimal exchange rate. Currently the euro is causing Germany to have a weaker currency than it would have and Ireland to have a stronger currency. They are such different economies that it seems senseless to link them. I think there are big problems with “the market” not least that asset bubbles seem to be what “the market” wants and gets but I’m not sure what alternative you are proposing. If you are proposing “internal devaluation” then how will the debts get paid off? You could write off debts and not rescue the banks. Is that what you suggest?

stone, the EZ might not be an optimal currency area, but I am not sure Ireland being a net exporter should not belong to it. I think it’s in their advantage to remain within the EZ but they put themselves in a situation where it is hard to suggest what would be the best way out. They’ve been living beyond their means thank to the housing bubble, so a correction is clearly necessary, that is a devaluation one way or the other. The criminal thing is that they took all the burden from bailing out the banking system instead of letting it collapse or get the EU foot the bill.

MamMoTh:

As i understand it, the point of floating the currency is not to alter it’s value to promote exports, but to gain currency sovereignty, in which case the gov’t can 1. hire the portion of the workforce currently looking for work and not finding any and 2. Further stimulate the economy when needed. This is not something a gov’t can do under the constraints of a peg or gold standard.

Though i guess such a policy could stabilize net-exports in the long run, provided the economy is trading freely with another nation with similar policies. Correct me if i’m wrong!

Andrew says:

Not at all! The favored method of spending for US Corporations is to acquire smaller companies. The cash is used to pay of the owners of the acquired companies. The new merged (larger) company now lays off most of the newly acquired workforce, keeping only the essential personnel, only as long as needed!

HarPe, that is the cute theory. In the case of Ireland however it will mean devaluation. One way or the other Ireland will have to devalue. It is screwed, and it is just a matter of who gets screwed the most. Besides that, I believe a small net exporting economy like Ireland would benefit from remaining in the EZ. It is quite useless to become monetarily sovereign if you are not self-sufficient enough.

Self-sufficient? Did I miss something? Is this a new trade theory? My understanding is, that a net exporting economy produces real stuff which it prefers to ship somewhere in exchange for digital tokens. It doesn’t matter whether these tokens are $, €, £, ¥, … as long as the exporter thinks the trade is worth while. Is Switzerland self-sufficient? Maybe. If they prefer to travel with horse carts.

“Devaluation makes people poorer”

Propping up a currency make people poorer.

If you prop up a currency you are effectively using government spending to subsidise imports against domestic production. If you’re also stuck with balanced budget policies then Domestic production declines, domestic skills decline and imports surge.

But politicians like it because it passes the frog boiling test. A high currency gives the illusion of prosperity for a long period of time, even as the good jobs migrate abroad to be replaced by ever more pathetic replacements. Whereas removing the import subsidy likely causes a short term drop in the currency relative to everything else as the speculators disappear to find a more willing victim elsewhere in the world.

One of the reasons to get rid of government interest payments on bonds would be to let the economy find its true value in the world market free of financial speculators. (Or at least free of financial speculators receiving government funds. It won’t stop the carry trade).

Hello to everyone

I don’t understand if the devaluation is a good way to proceed to mantain competitivity if a Government has the sovereignty currency.

I’m italian and I’ve heard that one problem of our economy is that we can’t devaluate like we did in the past.

In this way, we lose competitivity in favor of Germany and we have to decrease the labour’s cost to remain competitive.

I’m glad if someone could tell me if this is exact or wrong.

Best wishes

Dario

Clonal Antibody “The favored method of spending for US Corporations is to acquire smaller companies. The cash is used to pay of the owners of the acquired companies. The new merged (larger) company now lays off most of the newly acquired workforce, keeping only the essential personnel, only as long as needed!”

I’ve been totally perplexed as to why the owners of the purchasing Corporations put up with this. Is the idea that aquiring and extinguishing gets rid of potential competition? Seeing it unfold it appears more a case of hubris, mismanagement and waste rather than any kind of hard headed ruthlessness. I suppose wasting workers time as a company goes through the throws of terminal mismanagement leads to more employee hours per unit of productive work and so in that way it is some kind of job creation.

stone says:

Stone, the answer to your question goes really to the very basics of why the stock market is at the base, a Ponzi scheme.

How does the owner of a company get any monetary returns? Is it because he/she gets dividends? Companies stopped paying dividends many decades ago – so that is not it. They can only monetize their investment if they sell their stock. But the stock market only compensates the owners at the margin — in other words, only a vary small proportion of stocks can be sold at the “market price” in the stock market. Thus most stock holders never get any “real” returns on their investment. The only exceptions are when a company is bought out by another company, or the other way is to take a loan using your shares as a collateral, and then defaulting — but that has its own legal problems — and if you do not default, then the sum of money obtained is only a loan, and it needs to be repaid with interest.

As far as the purchasing company is concerned, it is really only buying the “real” assets of the company — that is generally, the property of the acquired company — once the acquired assets are assimilated (think Borg!) most of the employees of the acquired company are generally in excess of what is needed — and therefore the layoffs happen. Economies of scale at work. However, this process leads to monopoly or at best an oligopoly, and therefore excess returns from that monopoly power.

Clonal Antibody, “Companies stopped paying dividends many decades ago – so that is not it. They can only monetize their investment if they sell their stock. But the stock market only compensates the owners at the margin”

I suppose companies both buy back shares and issue new shares and so if they issue shares on average at a lower price than they buy them back, then they are distributing profits to shareholders in aggregate. I guess the complexity of that system (compared to dividends) helps insiders reap the bulk of the profits. I get the impression that the system is set up such that insiders can reap both the company profits and the money paid in by pension funds, foreign dictators etc.

The deluded Irish government keeps trying to cut the budget deficit. They’ve boosted tax revenues in the short-run, but I predict these will fall in the long-term.

My question is: do they REALLY believe they can balance a budget with these levels of unemployment?

I’m quite fond of this blog’s habit of peeling away pundits/academics arguments. I think it serves a great educational purpose. I’d hope that in undertaking this task:

«I have been thinking of writing a Modern Monetary Theory (MMT) guide to debt restructuring for non-sovereign nations such as those in the Eurozone who are now essentially insolvent if we exclude ECB assistance»

counter-arguments will be weighted. I’m sure the author is familiar with Paul De Grauwe, for example, who can’t be faulted on not foreseeing the dangers of a common currency, and yet is advocating solutions other than exiting. Overshadowing this prescient author, there are some whose views are clearly one-sided and dis-ingenuous. See for example: The Significance of the Euro – A Primer Markets | Marc Chandler | 31 May 2011 10:55, which begs for a rebuttal. creditwritedowns.com/2011/05/significance-of-the-euro.html

My question is: do they REALLY believe they can balance a budget with these levels of unemployment?

Well if they cut government spending to 0 then the budget will be at least balanced.

MamMoTh wrote:

Are you suggesting that, when government cust spending by X€, government revenue will remain constant, irrespective of X?

The Tories are promising to the British people that, despite the “huge” budgetary cuts, the economy will not shrink. I find that difficult to believe…

MamMoTh,

“Well if they cut government spending to 0 then the budget will be at least balanced”!! Let them eat…… nothing!

Sarcasm intended surely?!

As William Nassau Senior said about one million dying in famine it “would scarcely be enough to do any good”. The cut cut cut chorus have the same opinion.

A serious riposte to those who do advocate the cutting of all state spending immediately came from Marx who noted of Nassau Senior’s methods in other writings “and the Professor calls that Analysis!”.

Kaiser