I started my undergraduate studies in economics in the late 1970s after starting out as…

I am looking for the tooth fairy too

tooth fairy delivers some sixpences to help ailing family finances – problem is that the children will run out of teeth, unlike the government who can never run out of money. In the Saturday edition of the UK Guardian (May 21, 2011) there was an article – Interest rate rises likely, says Bank of England chief economist – who claimed that interest rate rises would have a negative impact “on some families” but in terms of:

… the cost to our economy as a whole, were inflation to persist for longer and our credibility start to be eroded, would be even worse.The credibility here refers to the Bank of England as an effective inflation fighter. There is a long (flawed) literature on this in economics – which I might summarise another day. The BoE economist voted for a increase in rates at the last meeting of the Monetary Policy Committee. He was outvoted – by wiser heads. He claims that the release of the April 2011 – Consumer Price Index data had firmed up the need for an interest rate rise. He had the temerity to tell the press that:

I’m not at all confident that the recovery has taken hold and will definitely power away. However, I’m even more worried about what’s going on in terms of inflation.He is advocating pro-cyclical monetary policy which demonstrates a major flaw in the neo-liberal approach to economic management. First, the UK Office of National Statistics reported in the April 2011 CPI release that:

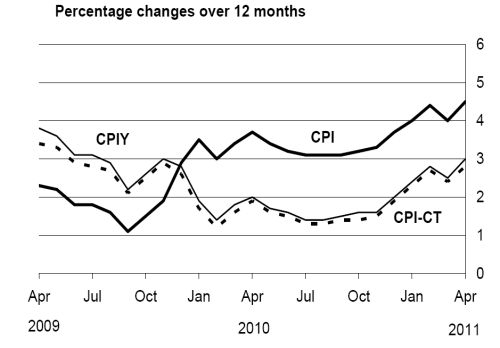

CPI annual inflation stands at 4.5 per cent, up from 4.0 per cent in March.So we are in a stagflationary situation in the UK at present – chronically deficient aggregate activity and rising inflation. Is monetary policy the correct policy tool in these situations? Following the perceived wisdom that increasing interest rates is deflationary for the moment, it is clear that if there are demand pressures building up which are driving price inflation then monetary policy tightening may ease those pressures at the expense of unemployment. But monetary policy cannot deal with external pressures that are cost based. So what is driving inflation in the UK? Transport – “an upward effect from fuels and lubricants”; “The timing of Easter had a significant impact on travel costs”) Alcohol and tobacco – “the increase in excise duties on alcohol and tobacco that came into force towards the end of March 2011 contributed to prices, overall, rising by 5.3 per cent between March and April, a record increase between any two months”. Housing and household services – “The largest upward effects came from rental costs for housing from local authorities in England and Wales and registered social landlords and charges for water supply and sewerage collection”. Conclusion 1: inflation is being driven by exogenous energy prices – cost-push factors emanating from outside of the economy – so that any anti-inflationary monetary tightening – which if the mainstream logic is correct can only work by cruelling aggregate demand – will have very large costs in terms of foregone growth and income and very little impact on the origins of the price movements. Conclusion 2: inflation is being driven by explicit government austerity policy initiatives and while nonsensical and misguided are not on-going price pressures. Inflation requires the underlying causes to be continual. Once-off movements in policy which push up the price level are not inflationary. It is mindless to be forcing prices up via fiscal austerity which then provokes the central bank to deflate further. No-one in their right mind would advocate that sort of policy mix. The ONS also provide insight in “Other measures of inflation” which attempt to net out these sorts of effects. The following graph appears on Page 8 of the April 2011 CPI release. The ONS say that the “CPIY is the same as the all items CPI except that it excludes price changes which are directly due to changes in indirect taxation (such as VAT)” while the “CPI-CT is the same as the CPI except that tax rates are kept constant at the rates they were in the base period (currently January 2011)”. It looks to me that there is no significant demand pull inflation in Britain. The underlying tendency is deflationary given how sluggish economic growth is at present (and getting worse).

I also find it amusing as an economist when I think about the way the literature has evolved over the last 30 years. Inflation targeting proponents claim that it has several advantages over other types of monetary policy. Economists outline the virtues of this approach in terms of higher sustainable growth rate and enhanced policy credibility.

Many of the so-called “gains” are attributed to the fact that inflation targeting approach provides the central bank with the independence it needs to be credible, transparent and accountable. As a consequence, this independence overcomes the time inconsistency problem raised by Thomas Sargent in 1983 whereby an inflation bias is supposedly generated by the pressure the elected government places (implicitly or explicitly) on non-elected officials in the central banks to achieve popular outcomes.

Did that make you laugh? Now inflation is being driven by governments making unpopular decisions and doing exactly the opposite to what the mainstream accuse them off (being captive to the big spending lobbies).

The BoE chief economist falls in with those who claim that tightening monetary policy will have some short-term effects (reduced output and increased unemployment (and related social costs) but a period of (“temporary”) slack is required to break inflationary expectations.

So while the causes of the inflation might be exogenous to the economy, the mainstream economists claim that these inflationary expectations become self-fulfilling prophecies and drive inflation independent of the state of demand.

This has been a long debate in economics and I won’t go into it here. Please read my blog – The myth of rational expectations – as a starting point to a Modern Monetary Theory (MMT) perspective on this point.

But what does the latest data about inflationary expectations in Britain tell us? A recent Citi/YouGov report for the UK shows that in April 2011:

I also find it amusing as an economist when I think about the way the literature has evolved over the last 30 years. Inflation targeting proponents claim that it has several advantages over other types of monetary policy. Economists outline the virtues of this approach in terms of higher sustainable growth rate and enhanced policy credibility.

Many of the so-called “gains” are attributed to the fact that inflation targeting approach provides the central bank with the independence it needs to be credible, transparent and accountable. As a consequence, this independence overcomes the time inconsistency problem raised by Thomas Sargent in 1983 whereby an inflation bias is supposedly generated by the pressure the elected government places (implicitly or explicitly) on non-elected officials in the central banks to achieve popular outcomes.

Did that make you laugh? Now inflation is being driven by governments making unpopular decisions and doing exactly the opposite to what the mainstream accuse them off (being captive to the big spending lobbies).

The BoE chief economist falls in with those who claim that tightening monetary policy will have some short-term effects (reduced output and increased unemployment (and related social costs) but a period of (“temporary”) slack is required to break inflationary expectations.

So while the causes of the inflation might be exogenous to the economy, the mainstream economists claim that these inflationary expectations become self-fulfilling prophecies and drive inflation independent of the state of demand.

This has been a long debate in economics and I won’t go into it here. Please read my blog – The myth of rational expectations – as a starting point to a Modern Monetary Theory (MMT) perspective on this point.

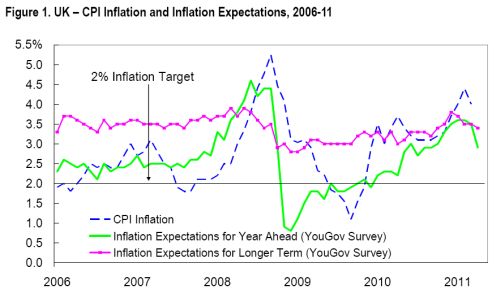

But what does the latest data about inflationary expectations in Britain tell us? A recent Citi/YouGov report for the UK shows that in April 2011:

… inflation expectations in the year ahead fell sharply, to 2.9% in April, from 3.5% in March and 3.6% in February. The April reading is the lowest since Sep-10 and the MoM drop (0.6-percent) is the third biggest decline since the survey began in late-05. The median for longer-term inflation expectations also edged down again, falling to 3.4% YoY in April from 3.5% YoY in March, having peaked at 3.8% in December. The April reading is the lowest since a matching 3.4% reading last October.So even if the mainstream was correct in this respect, there is no sign that expectations will drive inflation independent of the state of the economy. It is actually highly unlikely that inflationary expectations will drive inflation in the coming year given how poorly the real economy is going to be over that time period. Here is the graph that Citi provide based on the YouGov survey of British inflationary expectations in April 2011. The salient point to note is that expectations are now diverging from actual CPI movements which tells me that people can appreciate that there is no major demand pull going on in the UK economy at present.

Then we have to deal with the debate that increasing interest rates is an inflationary policy move rather than being as the accepted wisdom has it that it is deflationary.

It is entirely possible that rising interest rates stimulate demand in some quarters via an income effects (recipients of higher interest income are wealthier).

Just the fact that we don’t really know is telling. My view is that under certain circumstances tightening monetary policy damages demand. This will be especially so when households are carrying very high mortgage debt with little nominal income discretion.

But the point is that adding this uncertainty to an economy that is struggling with painful net public spending cuts is likely to be very damaging.

On May 20, 2011, the Guardian carried a story – Vince Cable: People do not understand how bad the economy is. We should rather consider this a piece of propaganda from the UK Business secretary (Vince Cable) who claimed that resolving “Britain’s broken economic model” would require that voters bore considerable pain and that the British government had not fully informed voters of how bad things would become.

I had some sympathy for his assertion that:

Then we have to deal with the debate that increasing interest rates is an inflationary policy move rather than being as the accepted wisdom has it that it is deflationary.

It is entirely possible that rising interest rates stimulate demand in some quarters via an income effects (recipients of higher interest income are wealthier).

Just the fact that we don’t really know is telling. My view is that under certain circumstances tightening monetary policy damages demand. This will be especially so when households are carrying very high mortgage debt with little nominal income discretion.

But the point is that adding this uncertainty to an economy that is struggling with painful net public spending cuts is likely to be very damaging.

On May 20, 2011, the Guardian carried a story – Vince Cable: People do not understand how bad the economy is. We should rather consider this a piece of propaganda from the UK Business secretary (Vince Cable) who claimed that resolving “Britain’s broken economic model” would require that voters bore considerable pain and that the British government had not fully informed voters of how bad things would become.

I had some sympathy for his assertion that:

Britain is no longer one of the world’s price setters. We take our prices from international commodity markets driven by China and India. That is something we have got to live with and adjust to. It is painful.I wrote in this blog – Be careful what we wish for … – that the pattern of resource demands was changing and that the workers in the advanced nations like the US, Australia, UK etc had been able to enjoy cheap energy (petrol etc) because China and India were poor. Those days are over and major lifestyle choices will have to be made. But that doesn’t mean that a national government in nations under challenge to restructure should run austerity policy stances which deliberately undermine the capacity of the economy to grow. Restructuring is always faster and more effective in times of growth. I also agreed with Cable that the most recent “golden decade of growth”:

… had been built on an unsustainable model of financial services.That point is clear. As government fell prey to – The Great Moderation myth – which was centrepiece of the mainstream macroeconomics narrative over the last two decades – they vested their counter-stabilisation roles in the hands of central banks (“fight inflation first”) and ran tight fiscal policies. They then focused their policy efforts on deregulating financial and labour markets which allowed for a massive redistribution of income to profits away from wages (providing the financial markets with a big boost in gambling chips) and increasingly risky and illegal financial behaviour to occur. The crisis was always going to happen as the dynamic of the microeconomic reform agenda played out. But the curious part of all this is that there were many strands to the neo-liberal narrative including the virtuosity of budget surpluses and the evil of public debt. Some of these strands are being excroriated from the narrative as a result of the crash – so we now hear that consumers need to be careful about how much debt they take on. But other parts of the intertwined story are being taken out of this context and maintained as essential reform agendas. One of the reasons the governments were able to run budget surpluses (or low deficits) and avoid recession over the “golden decade of growth” was because the private sector kept growth going with too much debt. One of the reasons the private sector took on too much debt was because real wages growth was being squeezed by the labour market deregulations. It is all connected. Governments cannot run surpluses when there is an external deficit (which is typical) and the private sector overall is saving (which is typical). The curious point then is that the public debate is being very ill-informed by the economists. If you want to cut budget deficits at a time when non-government spending is flat and not capable of supporting a growing aggregate demand then you will see slower economic growth and rising unemployment. Krugman’s New York Times article (May 22, 2011) – When Austerity Fails – is (mostly) correct. He says the “pain caucus” (aka deficit terrorists) are basing their call for “sound money and balanced budgets” on:

… economic fantasies, in particular belief in the confidence fairy – that is, belief that slashing spending will actually create jobs, because fiscal austerity will improve private-sector confidence. Unfortunately, the confidence fairy keeps refusing to make an appearance. And a dispute over how to handle inconvenient reality threatens to make Europe the flashpoint of a new financial crisis.He indicts the head of the ECB (Jean-Claude Trichet) who “bought into the doctrine of expansionary austerity” so thoroughly that the ECB “began preaching austerity as a universal economic elixir that should be imposed immediately everywhere, including in countries like Britain and the United States that still have high unemployment and aren’t facing any pressure from the financial markets”. My (mostly) descriptor above refers to the last sentence about “pressure from the financial markets” – but that is another story. I also agree with Krugman that the ECB, which has acted like a fiscal nazi in recent months – bailing governments out via secondary market purchases of their debt while at the same time insisting on draconian fiscal adjustments – is now “acting as if it is determined to provoke a financial crisis”. How? By starting “to raise interest rates despite the terrible state of many European economies” and claiming recently that they will withdraw all support for government debt if there is any talk of debt relief in the EMU. Vince Cable’s public statements reflect this inability to put all the pieces together. He is too quick to fall back on ideological notions that have not basis in economic theory. He claims that:

… it was realistic for the coalition to eradicate the structural deficit by the end of this parliament, adding “our credibility hinges on it”.Credibility here is who? The government? The economy? Credibility in who’s eyes? So we have the Bank of England chief economist claiming that rising interest rates at a time when public demand is falling sharply, business and consumer confidence is low (and falling), and private spending is flat is essential for credibility. And a senior minister in the British government (and a liberal democrat at that) claiming that deliberately putting people out of work and undermining the viability of businesses to grow is essential for credibility. This is the narrative that is being bought around the world that Krugman considers to be the realm of tooth fairies – I agree. Cable unknowingly captures his own lack of perception:

We have had a very, very profound crisis which is going to take a long time to dig out of. It is about the deficit, but that is only one of the symptoms. We had the complete collapse of a model based on consumer spending, a housing bubble, an overweight banking system – three banks each of them with a balance sheet larger than the British economy. It was a disaster waiting to happen and it did happen. It has done profound damage and it is damage that is going to last a long time.The budget deficit is a symptom of the excessive deregulation that allowed the credit binge and the housing bubble and the lack of oversight on the banking system. These causes (the deregulation etc) need to be addressed although I don’t see that happening. As I demonstrated in this blog – I don’t wanna know one thing about evil – the British budget is predicated on household debt rising not falling. Why doesn’t Cable come clean on that? One of the reasons the economy collapsed is now being deliberately fuelled again by the government. In their ideological zeal to demonise public debt and budget deficits they are relying on more private sector debt to drive growth. That is total hypocrisy. The point is that with budget deficits supporting growth as private domestic agents reduce their overal debt levels the economy will remain mired in its stagnant state. With austerity being pursued everywhere it is a fool’s hope to think that net exports are going to swing enough to save the day. Especially, with the Bank of England now preparing to push on interest rates. Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point. I was also semi-amazed by his claim that the British government was flexible enough to allow the deficit to rise should growth fail. He said:

What is not often acknowledged is that there is a lot of flexibility built into current policy. The main element of flexibility is in monetary policy and the second is the basic Keynesian stabilisers. That is the way the government is functioning. We are not trying to maintain budget balance come what may. If the economy slows down, the deficit temporarily has to rise to take account of cyclical change, flexibility is built in.What a curious thing to admit. It is clear that the austerity announcements and policies marketed as TINA are damaging confidence among consumers and firms and without improved confidence there will be no private spending comeback. The economic psychology in Britain right now is one of widespread pessimism – driven by austerity statements from government and stupid statements by central bank economists etc. If you really believed in the “basic Keynesian stabilisers” the you would be trying to stimulate positive sentiment but you would also understand that as private spending falters (the early signs of a British recovery have evaporated) these “basic … stabilisers” will drive the budget into even greater deficit. You would also understand that the lost income and production etc that accompanied those stabilisers would present an even greater challenge to policy and the need for deficits for longer. If you really understood all of that and put political posturing second to sound economic management then you would announce the that the government was necessarily running deficits to support overall economic activity, while the private sector sorted out its balance sheet and was able to sustain spending growth out of wages rather than out of debt. You would extol the virtues of that particular government support and explain the way in which the sectoral balances (derived from the National Accounts) work. Then you might actually get a growth-induced reduction in the budget balance without all the detritus of poor economic management – the latter being the product of advancing the “tooth fairy” stuff that my profession provides to the public debate. Conclusion I think the conflicts in the mainstream narrative at present is telling. The “doctrine of expansionary austerity” – which has no basis in economic theory – is dominating the policy arena now yet if you consider each of the components of that doctrine you realise that is is internally inconsistent quite apart from the role it requires the “confidence fairy” to play. With the external sector in deficit (and likely to stay that way), and private agents deeply indebted, the national government has to run a deficit to support growth. If it tries to run a surplus (the stated policy aim) it will end up running a deficit anyway – courtesy of the automatic stabilisers – but it will be overseeing an even sicker economy that it already is in charge of today. It is time for journalists to really challenge this internal inconsistency rather than just act as press agents for the politicians. Where the British public sector fails There are major problems with the public sector in Britain. Of all the national statistical agencies, the Office of National Statistics has one of the worst on-line statistical services available. It is sometimes impenetrably organised and it is very difficult to access key data in an accessible format. The Bank of England site is similarly poor and often crashes when using the search facility. That is enough for today!]]>

This Post Has 0 Comments