I started my undergraduate studies in economics in the late 1970s after starting out as…

When a nation stops growing

The latest data out this week shows that the Japanese economy contracted again in the March quarter – as consumers cut their spending and exports slowed dramatically in the wake of supply constraints emerging from the natural disaster earlier in the year.

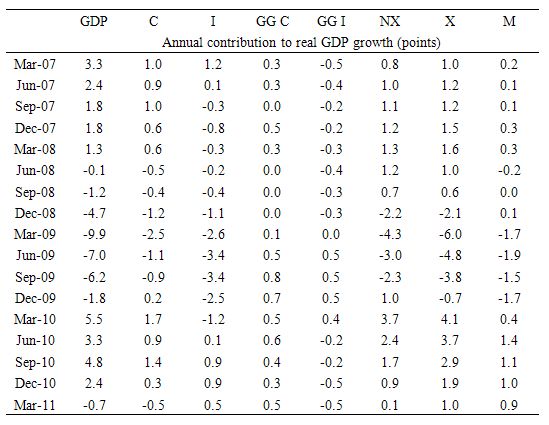

I created the following table to show the contributions to real GDP growth from March 2007 to March 2011 across the National Accounts aggregates.

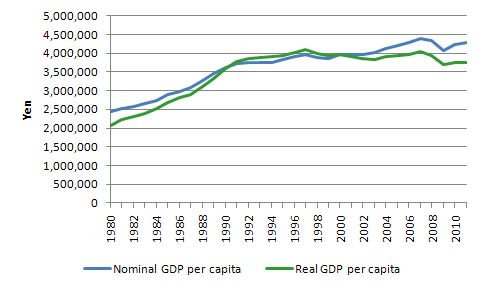

If we consider this in Per Capita terms, the same story unfolds. The following graph compares nominal GDP per capita (blue) and real GDP per capita (green) since 1980. The 2011 figure is an IMF estimate and will probably be overstated given the natural disaster. The difference between the two series is the inflation rate which has been low and sometimes negative in Japan over the period shown.

If we consider this in Per Capita terms, the same story unfolds. The following graph compares nominal GDP per capita (blue) and real GDP per capita (green) since 1980. The 2011 figure is an IMF estimate and will probably be overstated given the natural disaster. The difference between the two series is the inflation rate which has been low and sometimes negative in Japan over the period shown.

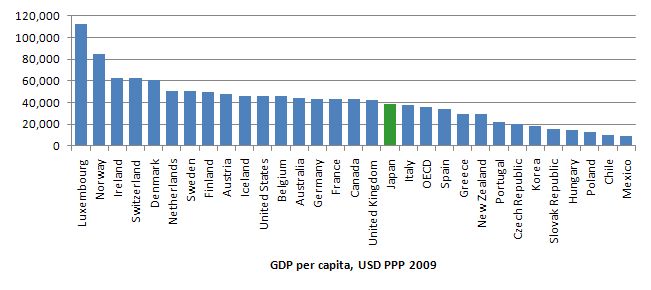

The following data comes from the OECD and shows GDP per capita (compared using USD PPP 2009). You can see that Japan is mid-ranked just below the OECD average.

The following data comes from the OECD and shows GDP per capita (compared using USD PPP 2009). You can see that Japan is mid-ranked just below the OECD average.

The conservatives often blame Japan’s mid-range GDP per capita performance on its regulative structures and tax policies. They also claim it is the result of what they see as Japan’s service sector inefficiency.

This so-called “poor” per capita performance is tied in with the fiscal austerity and structural reform campaigns that the IMF and OECD are pursuing.

In this IMF Working Paper (released January 01, 2011) – The Impact of Fiscal Consolidation and Structural Reforms on Growth in Japan we read:

The conservatives often blame Japan’s mid-range GDP per capita performance on its regulative structures and tax policies. They also claim it is the result of what they see as Japan’s service sector inefficiency.

This so-called “poor” per capita performance is tied in with the fiscal austerity and structural reform campaigns that the IMF and OECD are pursuing.

In this IMF Working Paper (released January 01, 2011) – The Impact of Fiscal Consolidation and Structural Reforms on Growth in Japan we read:

With Japan’s public debt at historic levels, concerns are rising over the growth impact of needed fiscal adjustment. The severe recession and sizeable fiscal stimulus have pushed up Japan’s public debt from 188 percent of GDP in 2007 to 218 percent of GDP in 2009. Bringing down the public debt ratio to more sustainable levels would require a large and sustained adjustment that will weaken aggregate demand.They then claimed that in this context:

Structural reforms could help offset the negative impact of fiscal consolidation and raise medium-term potential growth. In this context, policies aiming at raising services sector productivity through deregulation or increasing competition and labor market flexibility could support fiscal consolidation through higher tax revenues.That is the one-trick the IMF always offer – cut public net spending and deregulate (cut workers’ protections and wages) and – somehow – miraculously – expect the impact on aggregate demand to be neutral in the “medium-term”. We are asked to ignore what happens in the short-run to workers who lose their jobs or entitlements and forget about the hysteretic effects relating to consumer and investor confidence. Firms apparently just love deregulation so much that they will ignore the declining sales volumes as consumers tighten their spending and build productive capacity to allow them to sell more. It just doesn’t work like that. The only times an individual nation has successfully grown as they cut public net spending is when their external sectors and private domestic sectors are growing strongly. Prior to the crisis, the IMF released a paper (January 2, 2007) – Strategies for Fiscal Consolidation in Japan – which said:

Japan’s key fiscal challenge is to put public finances on a more sustainable footing. Large government budget deficits have boosted Japan’s net public debt to over 85 percent of GDP, one of the highest in the OECD … In the years ahead … the government’s net debt could rise to over 150 percent of GDP.I could trawl back through my archives and find similar warnings when the debt ratio was less and they were claiming it would get to 80 per cent and 70 and 50 etc. In fact, the OECD and the IMF have been going on about Japan – relentlessly – for years now and each time they proffer some dire forecast – the situation gets “worse” (by their measurements) and nothing particularly bad happens. In particular, unemployment remains relatively low and their is still a commitment to income security in Japan. The OECD also follow the IMF lock-step and have pursued a long campaign trying aimed at dismantling worker protections in the service sector in Japan. For example in this OECD Economics Working Paper (No. 651) paper (published in December 2008), we read that:

Boosting productivity in the service sector is a key priority for promoting long-term growth. Services account for a dominant share of economic activity in Japan; its share of output increased from 66% in 1993 to 70% in 2003, matching the OECD average. The disappointing productivity performance in Japan’s service sector – which has lagged far behind the manufacturing sector in recent years – is thus a source of major concern.Exactly why is it a source of major concern. Westerners who travel to Japan might think it is a bit quaint to be offered such eloquent service when in a retail setting – especially compared to the generalised rudeness one experiences from bored staff in many European cities. But what is the problem of having people working The OECD correctly say that “(t)he service sector is largely responsible for low aggregate productivity in the Japanese economy”. But it is also responsible for the low unemployment and solid income security that Japanese workers enjoy. It is clear that the Japanese economy is dual in nature. Their export-oriented manufacturing sector is highly productive because it competes in world markets. Its domestic service sector does not have to “compete” in this way and can focus on other objectives that are of benefit to the Japanese people. Like – maintaining high levels of secure employment with comcomitant income security. Like – being nice to each other when transactions are required. Like – being nice to tourists who bring them income. The result from the conservative perspective – low productivity and waste. From my perspective, the mainstream concept of productivity is heavily biased to private costs and benefits. I prefer to see it more expansively If you understand economics, you will realise that even mainstream economists consider optimality in terms of social benefits and costs which include private calculations. In the ideological narratives you will rarely hear them talk as if social outcomes (excluded by the market which values private outcomes) matter. But all their models require consideration of these externalities (external to the private market costs and benefits). So what benefits does the services sector bring in Japan that the private costs and benefits (which lead to the low productivity estimates) ignore. I would think the excluded net benefits are significant which means that a corrected productivity measure would be much higher than the mainstream would care to consider. However, there is another side to the argument that I agree with. As the dependency ratio rises, Japan will have to create more from less (productive workers). This will require a re-think of how they offer services. But that is a separate argument to the macroeconomic argument that the IMF makes that hacking into worker entitlements will somehow create aggregate demand as the public sector hacks into its net spending. That is never going to happen. In that context it was a relief to read one commentator challenging the current conventional wisdom on Japan. A Bloomberg opinion piece today (May 21, 2011) – Japan’s Slump Heightens Calls for Faster Stimulus – calls for more activist fiscal policy from the Japanese government at a time when the IMF and others The author writes that in the March 2011 quarter:

Household spending had the largest back-to-back quarterly drop since the global financial crisis … The figures contrast with comments by Japan’s central bank, which holds a policy meeting today, that the economy’s main challenge is one of supply chain disruptions caused by the earthquake, tsunami and nuclear crisis.And should I add the IMF and OECD line. The Bloomberg article quotes an economist from a major Japanese corporation:

Speed is key here, and the government needs to act … A delay in the second budget is not only going to postpone the economy’s return to growth, but it’s also going to reduce Japan’s capacity to grow in the long run. Companies aren’t going to invest in a country that takes forever to rebuild itself.Fancy a private sector corporate economist talking like that. In Australia, the press would boycott such an opinion because it would fit in with their “growth = inflation = required fiscal consolidation” mantra. But the point is clear. Private spending depends on confidence and investment doesn’t occur when consumers are pessimistic and cutting back. Those conditions were exactly the type that Keynes noted in the 1930s and arise every time the private sector demand wanes. Firms need some certainty that they will be able to sell the products forthcoming from any extra capacity they might build before they will build it. The capitalist economy is driven by guesses in the face of uncertainty. Firms and households are not Ricardian and do not factor in mythical future tax hikes when they see a budget deficit. There is no empirical substantiation of that mainstream notion at all despite the claims to the contrary from conservative commentators. The agenda of the latter is to create small government no matter what and they try to justify that in any way they can. The Bloomberg article correctly notes that “(d)ata for April suggests the economy will continue shrinking this quarter”. What the Japanese government has to do immediately is to expand its discretionary budget deficit. The contraction in private demand and the contribution of net exports has to be replaced. There is only one sector that can do that – the government sector. There will be screams of a rising public debt ratio should the government do that. But the debt ratio will continue rising as long as growth is so sluggish and the Japanese government issues debt to match its deficit. There is no problem at all in increasing its debt ratio. The IMF and OECD predicted meltdown years ago. Only benefits can come from issuing more debt – in the form of stable incomes to the private sector. But I would finally break the debt mould and force the Bank of Japan to “fund” the net spending which is allowable under Japanese law. There is only a deflationary risk in Japan at present. Conclusion There is an urgent need for a new fiscal stimulus in Japan. Presently, it is not a low growth rate that matters in Japan. The problem is that the growth rate is continually being threatened by private spending contraction and a political process that is under pressure from the IMF and OECD and others to impose harsh fiscal austerity. The last thing the Japanese economy needs right now is a contraction in public spending. All the scaremongering about an exploding public debt ratio are lies and should be ignored. The Japanese government has to ensure that the low growth is steady. Stimulating further growth, given the slowing population is probably not going to be possible or necessary. As a matter of long-term structural adjustment, the Japanese government might reasonably start reducing the reliance of the economy on export performance. But that is a topic for another day as is the rising income inequality in Japan. Saturday Quiz The Saturday quiz will be back sometime tomorrow. That is enough for today! ]]>

“I do not advocate growth at the expense of environmental sustainability.”

Perhaps you would like to write a blog on the economic implications of a global population now almost 7 billion, and forecast to reach 9 billion over the coming decades. Include in that the 3 billion or so Chinese, Indian, Malaysian, Thai, Indonesian, Brazilian, Egyptian etc people that want an increased standard of living – a nice house and a car in the garage like Australians and Americans.

I’m no expert on the subject, but a couple of things are quite clear to anyone:

– do Chinese, Indians and Brazilian subsistence farmers and/or impoverished slum dwellers care about what is happening to the environment? Getting an education for their children, putting food on the table, and generally increasing their material standard of living are far more important priorities for these people than reducing carbon emissions and preserving a rainforest (and rightfully so).

– viewing population growth as a positive seems to contradict the very, very first principle of economics: resources are scarce and not limited,

Bill, don’t tell me your like every other mainstream economist and environmentalist that blames environmental destruction on big SUV’s and oil. Deep down, the cause of global warming/rainforest destruction etc is a global population far bigger than it should be. In my opinion, 500 million total would be about right. We have 14 going on 18 times that.

* resources are scarce and not UNlimited

@Andy: Where do you pull your 500 million number out of? Seems totally arbitrary to me.

Just found the blog.

A question. How does this MMT work on a global scale if we abandon the peg to the dollar as a reserve currency???

IF government can just issue money as it sees fit to buy services/goods etc and can do so forever what’s to stop it doing so forever and the citizens losing faith in the currency?

Any blog posts dealing with this?

Thanks,

Steve

Steven,

A good place to start might be the ‘debriefing 101’ section of Bill’s blog. You can find it on the right hand navigation of this page, and it should answer a lot of your questions. A lot to read, but well worth it.

“what’s to stop it doing so forever”

The real capacity limit of the economy – real goods and services it can produce. A sovereign government has no fiscal limits, just real ones.

The current system runs persistently below capacity. It’s like driving a car with the handbrake on.

“In my opinion, 500 million total would be about right.”

Would that be living in mud huts?

We have the intelligence and the ingenuity to sustainably exist at extremely high density. Population growth is a canard and always has been. As time goes on we can do much more with less.

The secret to ending population growth is to bring the very poorest in the world up to standard as quickly as possible. Nothing reduces the number of children like quality of life.

Neil Wilson “The secret to ending population growth is to bring the very poorest in the world up to standard as quickly as possible. Nothing reduces the number of children like quality of life.”

-more specifically I think it is people being confident that they will be well provided for when they are old and infirm and that their children will survive.

I agree with Alex in that wilderness can provide perpetually renewing resources for people but only if there are few people -but we are where we are and the challenge is to make the best of our current situation.

Also Canada shows that even with a very low population density people can live in a spectacularly unsustainable manner if they love their SUVs enough. If their were just 500M people in the world but they all flew around in helicopters and changed their hardwood floors whenever a new edition of House and Home came out- then we would destroy everything plenty soon enough.

Everyone talks about the baby boom generation and Japan’s aging population. An interesting shift in demographics in around 20 years as a high-income cohort with low offspring ratio goes to the heavens (poetic license, please). If population control measures in the developing world take hold (I understand that rates are slowing), there could be a stabilization in population, as well as a wealtth shift (assuming the banks dont own everything by then).

I wish I could be around to see it play out.

Welcome, Steven,

The very best short introduction to MMT I’ve seen yet is this article that Bill wrote for The Nation:

http://www.thenation.com/article/159288/beyond-austerity

economics have to be rethought to make them to consider environment and sustainability.

Solving the population problem by increasing standard of living to current US standard – would kill the planet and humanity instantly. However – trying to reduce population by making everybody poor – will lead to wars that will destroy environment and humanity as well.

No easy solution.

Pebird “If population control measures in the developing world take hold (I understand that rates are slowing), there could be a stabilization in population, as well as a wealtth shift”

-I’m always puzzled by why China’s one child policy isn’t talked about as leading to an impending tremendous demographic hicup. If couples all really did just have one child, then won’t that trump what happened in Japan?

Given the last 20 years or so you would have thought that, if anywhere, there must be some wise old birds in Japan that have figured out the truth about public deficits. Why have they not followed through?

Bucky Fuller showed years ago that population increase is roughly proportional to distributed energy use per capita. At the time he focused on electrification, as I recall.

He also recommended addressing population growth with rural electrification. His solution for handling social issues was raising the general level of education. He advised addressing resource use through “design science,” i.e., “doing more with less,” comparing naval and aircraft design with land-based architecture.

@ Neil Wilson, stone

The problem you both ignore is that most people on the planet don’t care about environmental sustainability. Would you care about sustainability if you made $2 a day? How about if your factory job depended on electricity generated at a coal plant? What about if you can afford a vacation in Spain – do you care about the resources required to transport you halfway around the world? Yeah right!

You can all say that “we have the technology such that 7 billion people can live sustainability”, but that will never happen. We also have the technology to send men to the moon and build supersonic jet fighters, yet we can’t feed half the population. As far as I’m concerned, I don’t care about environmental sustainability so long as the worlds population is growing. It’s pointless doing so.

Sure, Chinas one child policy may be a demographic nightmare, and men who can’t find wives may become very unhappy, but its the single best policy enacted so far in stopping environmental destruction.

“I do not advocate growth at the expense of environmental sustainability.”

I’ve been a reader of your blog for only a short time, and in general, I like everything you write. Your discussion of MMT was quite interesting and helpful, even though it was difficult to follow.

But I’m really sorry to see you write something that takes the word ‘sustainability’ seriously. The utter uselessness, in my opinion, of that word is hard to capture.

Here’s an example:

Every time we breathe we consume oxygen and create carbon dioxide, therefore contributing to global warming. Putting to one side that we’re “using up” the finite stock of the Earth’s oxygen as we breathe, we’re also adding to the amount of Greenhouse gases. So I ask you, is breathing “environmentally sustainable”? The word “sustainable” is so meaningless, so empty of any content, that I don’t see how one could not accept that human breathing is not “environmentally sustainable”.

About zero-growth, I don’t know, I don’t think it’s really possible if population is going to continue to grow. And what about nuclear power? Why aren’t the Greens making a big push for it? Since obviously the Kyoto Protocol approach is not “working”.

Cheers, and thanks again for your writing.

I would like to remind people to distinguish between stocks and flows. Fossil fuels which provide 85% of the world’s energy production are a non renewable energy stock. Oil is more or less on peak oil, we are really close to peak coal (China is there, USA is past peak coal in energy terms and so on) and even NG stock is not as abundant as people think. Renewable energy is a flow, with large energy capacity but extremely small energy density (just try to calculate the required m2 of PV cells to match the energy content of a typical saudi oil well). It will provide a larger percentage of the current energy consumption but the necessary investments are totally enormous and require fossil fuel to complete them. Renewable energy will more or less provide only electricity (don’t count on oil from algae to make any substantial difference in the future) while global transportation (car, ship, airplane) is more or less stuck with ICE engines running on fossil fuels. Lastly, anyone waiting for nuclear fusion to take over the world should take a closer look at the underlying physics problems. Nuclear fusion is more or less not feasible in large scale during the current century.

Reading articles on the oil drum would be a good start. Especially the article by Jeremy Grantham is excellent and quite enlightening (http://www.theoildrum.com/node/7853).