I started my undergraduate studies in economics in the late 1970s after starting out as…

Myths about pay and value

Today I read a study – A Bit Rich – published in December 2009 by the New Economics Foundation, which is a UK-based think tank aiming to provide an alternative narrative to mainstream economics. That agenda obviously interests me. The study investigates the relationship between pay and value by taking a case study approach and extending our concept of value to include both social and environmental benefits and costs. What they find is that the financial sector is a negative contributor (by some) to society whereas low paid occupations (cleaning etc) are vastly underpaid. What this tells me is that we need a fundamental re-alignment of pay scales in addition to bringing real wage growth into line with productivity growth. We need to reduce the real take of some of the higher paid occupations (especially in the financial sector) and increase the rewards of those currently trapped in low-paid jobs but who serve valuable functions in the overall scheme of our societies’ well-being.

This Bit Rich report begins:

We are in the wake of the worst financial crisis for a century. Yet this Christmas, many highly paid employees of City banks that are responsible for creating this crisis are being paid extravagant bonuses. This comes at a time when wage inequality remains stubbornly high, due in large part to the increased concentration of very high and very low earners in the economy.

The controversies over City bankers’ bonuses raise fundamental questions not only about the remuneration of senior executives and public servants but also about the relative value of the work of everyone in our society. How should we assess the wider contribution our work makes?

… this report … takes a new approach to looking at the value of work. We go beyond how much different professions are paid to look at what they contribute to society. We use some of the principles and valuation techniques of Social Return on Investment analysis1 to quantify the social, environmental and economic value that these roles produce – or in some cases undermine.

So the report “calculates the value to society of a number of different jobs and advocates a fundamental rethink of how the value of work is recognised and rewarded”.

Before I talk briefly about this Report we need some background.

Background

Marginal productivity theory emerged in the second-half of the C19th as the conservatives became scared of the growing popularity of Marxism. Industrialists hired economists to develop theories that made capitalism appear to be fair.

The major insight provided by Marx’s theory of surplus-value was that capitalist profits are sourced in the production of surplus-value. In turn, surplus-value is produced by unpaid labour and so under capitalism workers remain exploited (as they were under previous modes of production).

Exploitation takes on the meaning that workers do “free” labour for the owners of capital as a result of the unequal power relations in the labour exchange and that labour is expropriated as the return to capital. It is clear that the return is the reward for ownership per se.

The interesting part of Marx’s analysis of capitalism is that the exploitation is hidden in what he called the “wage form”. Under previous modes of production the exploitation was obvious and built into the norms of the system. So under feudalism, workers produced surplus labour for part of the week on the feudal lord’s land and for the rest of the week produced their own means of subsistence on their own land allocated to them by the feudal lord.

In the capitalist labour market, the wage form is such that it appears that equals are being exchanged – the wage for the supply of labour-power (the capacity to work) usually specified as a given number of hours of work per day. So it looks like the worker is being paid for the entire day.

But the labour contract is more complex than a normal exchange of commodities where the parties agree on an exchange price (which reflects their assessments of the use value they will get from the swap and then after the contract is finalised they enjoy the use value of the exchange independently. In the labour contract, the use value to the capitalist is the labour emanating from the labour-power and the capitalist “consumes” that during the production process which sees the worker producing more than they are paid. The point is that the worker has to be on the job while the capitalist consumes the use value of the labour power.

So exploitation to Marx related to this inequality in the labour contract which meant workers had to work longer hours than necessary (for their survival) as a result of the unequal ownership of the productive capital.

The important point of Marx’s theory of exploitation for the subsequent developments in economic theory is that it exposed the capitalist system as being unfair. Any notion that a person gets back out of production what they put in is rendered false. The workers clearly do not. And the capitalists are seen to put nothing in (ownership is not a productive input) yet get back the surplus-value which is then realised in the goods market as profit.

With social and political unrest increasing in Europe in the mid-C19th, a major effort was undertaken to produce a theory of income distribution which demonstrated that all owners of productive inputs get back in the form of income payments what they put into the production process.

So the ideological push to make capitalism appear to be fair led to the development of marginal productivity theory. So people are paid according to their contribution to production. That was then represented as a fair system and was used politically to negate the claims that workers were being exploited.

Marginal productivity theory both explained but also justified the outcomes that the capitalist system produced. All was fair. If you wanted higher wages you had to invest in skills to generate higher marginal products. Someone who had invested more in skill development would get a higher return.

But then it was observed that persistent differentials in wage outcomes remained that could not be explained in terms of productivity differentials.

Enter another piece of mainstream ad hocery – the theory of compensating wage differentials. The basic idea is that wage differentials compenstate for differences in the nonpecuniary characteristics of alternative jobs. This dates back to the Wealth of Nations (Book I: Chapter X).

So you have two occupations which are similar in every way but one – danger of work. The more dangerous job will attract a higher wage to compensate for the danger.

The general conclusion is that where jobs are boring, dangerous, dirty, more stressful – that is, are generally less desirable – the market will reward them with higher wages than otherwise. So more pleasant and interesting jobs will offer lower wages than other jobs with less favourable characteristics.

Workers are then seen to shop around for different “utilities” (levels of satisfaction) rather different wages per se when choosing employment.

The segmented labour market theory provides a devastating critique of the mainstream approach to wages. There are good jobs and bad jobs and they pay accordingly. The bad jobs are typically dangerous, boring, unstable, and pay low wages. The opposite is the case for good jobs. The resulting wage outcomes cannot be explained using the mainstream theories.

There was another theoretical development that also destroyed the mainstream approach to income distribution.

The Cambridge Capital Controversies of the 1960s demolished the foundations of marginal productivity theory. I still plan to write a separate blog about these debates some day. Essentially, the debate proved that you cannot explain the distribution of income (as the marginal productivity intended) by appealing to contributions to production (conceptually captured by “marginal products”).

In the style of the debate, the famous Italian economist Luigi Pasinetti said in his 1969 article – Switches of Technique and the ‘Rate of Return’ in Capital Theory – published in the Economic Journal, that (pages 522-3):

Very far from embodying the relevant features of the general case, and from being a simplified way of expressing it, the one-commodity infinite-techniques

construction is … revealed to be an entirely isolated case. As such, it can have no theoretical or practical relevance whatever. At the same time the whole traditional idea that lower and lower rates of profit are the natural and necessary consequence of further and further additions to “capital” is revealed to be false.

In other words, mainstream marginal productivity theory was internally inconsistent and without application.

You might wonder why it still appears in all the mainstream textbooks. Well the orthodox economists just ignored the outcomes of the Cambridge debates and

A good easily read critique of the mainstream distribution theory is Lester Thurow’s 1975 book Generating Inequality. His empirical work found that for the US, the marginal product of labor exceeds its actual returns and the marginal product of capital is less than its actual returns.

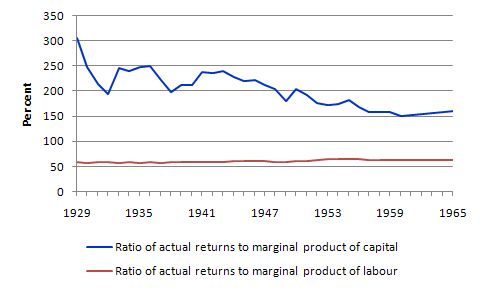

As an aside, in his 1968 article – Disequilibrium and the Marginal Productivity of Capital and Labor – which was published in The Review of Economics and Statistics (Vol. 50, No. 1, pp. 22-31), Thurow estimates the ratio of actual returns (profits, wages) to marginal products from 1929 to 1965 for the US. I have plotted his estimates in the following graph to show you how far askew the marginal productivity theory is when applied to a real world case. I wouldn’t, however, hold much store in this analysis because the estimation approach is somewhat speculative and questionable.

An application

The Report starts by listing some common myths about pay and value that they say need exposing. These are (quoting):

- Myth 1: The City of London is essential for the UK economy – so generalising, the financial sector is crucial for economic growth and stability. The scale of the financial crisis has demonstrated the ability of the financial sector to have major negative impacts on the broader real economy. Yet in terms of the contribution to overall value added the Report finds the UK financial sector “contributes 3 per cent a year in value added compared to 12.5 per cent value added contributed from manufacturing”. The same relativities are common elsewhere. So huge downside risks with relatively modest positive contributions.

- Myth 2: Low paid jobs create a ladder for people to work their way up – opportunities to advance are open to all. Segmented labour market theory shows us that job ladders are very limited for those stuck in poorly paid jobs. There is very little upward mobility. The high income families can also “protect their position and that of their children by buying education, assets and advantage”.

- Myth 3: Pay differentials don’t matter, so long as we eradicate poverty. The Report notes that relative poverty is an important determinant of “crime, ill health, poor educational attainment and addiction”.

- Myth 4: We need to pay high salaries to attract and retain talent in the UK. They show “that high salaries don’t necessarily reflect talent”.

- Myth 5: Workers in highly paid jobs work harder. They show that poorly paid workers “spend more time on domestic and caring responsibilities than their highly paid counterparts. They are also more likely to have more than one job, and for many that is the only route out of poverty”.

- Myth 6: The private sector is more efficient than the public sector. They show that “work that is cheap is not necessarily work that is effective” and that “lower prices are sometimes secured at the cost of service quality”. There are many studies that show that by paying higher wages you elicit higher productivity and greater workforce commitment.

- Myth 7: If we tax the rich, they will take their money and run. While the Report puts an argument to show that “cultural familiarity, environment, proximity to friends and family, and quality of public services” are important, my reaction is so what if the myth was true?

- Myth 8: The rich contribute more to society. They show that the “rich pay proportionately less tax than the poor”.

- Myth 9: Some jobs are more satisfying, so they require less pay. They show that the theory of compensating differentials breaks down badly. Workers in dangerous and dirty jobs in the UK are typically poorly paid.

- Myth 10: Pay always rewards underlying profitability. They show that there is only a weak association “pay and executive performance”.

You can see that these myths are mostly derived from marginal productivity theory and its tack on components like compensating wage differentials.

Marginal productivity theory says that “pay is a reward that reflects merit. Those who contribute more get more in return”. How does this occur? Answer: the mainstream claim it reflects the efficient workings of the market.

However, as the Report notes “(e)ven on its own terms this is problematic, as it is a very narrow measure of economic value that doesn’t account for any impact on a company’s long-term viability” and that “some of the most valued staff – in terms of the day-to-day running of a company – are the most poorly paid”.

The Report studies six different jobs “across the private and public sectors” – three are low paid (a hospital cleaner, a recycling plant worker and a childcare worker) and three are highly paid (a City banker, an advertising executive and a tax accountant).

The Report also extends the notion of productive value to acknowledge that:

the production and trade of goods and services may have a wider impact on society that is not reflected in the cost of producing them. These ‘externalities’ are often remote or hard to see but that does not mean that they are not real or that they do not affect real people – either now or in the future.

In fact, it is often not understood that a correct application of textbook micreconomics has to include social costs and benefits of activities. Too often, the debate stops at establishing something is worthwhile because the private benefit (that which is captured by the private entity) exceeds the private cost (the actual resource costs incurred by the private beneficiary.

But if the accounting of an activities worth does not include wider social and environmental costs that are not incurred by the private beneficiary then our assessment of the worth of an activity will be biased upwards.

In these situations, “the market tends to oversupply products that may have a significantly negative environmental or social impact – such as cheap consumer goods and complex financial products.”

Similarly, if the accounting of an activities worth does not include wider social and environmental benefitss that are not enjoyed by the private beneficiary alone then our assessment of the worth of an activity will be biased downwards.

The Report says that:

In the same way we underpay work that has a high social value, creating high vacancy rates in our most important public services such as nursing and social work. By making social value creation an important societal goal we could set the right incentives to maximise net social benefits, ensure a greater return to labour rather than capital, and a more equal distribution of economic resources between workers.

In general, the Report finds that “some of the most highly paid benefit us least, and some of the lowest-paid benefit us most”.

To give you an idea of their method, this is how they approached the task of assessing the value of the City Banker.

Factors in value created:

1 Average annual contribution of the City to UK economic activity, as measured by gross value added

2 Tax contributions to the Exchequer

3 Jobs provided in the wholesale finance sector.Factors in value destroyed:

1 The cost of the current financial crisis in terms of loss to UK gross domestic product and economic capacity

2 The cost of that crisis in terms of the negative impact on the public finances.

The Appendix of the Report outlines the “methodology for quantifying the SROI value of the six professions” studied. I will leave it up to you to investigate further if you are interested. Like all empirical methodologies there is room for dissent. The important question is whether any dissent would alter the results fundamentally. My view is that the overall picture being presented would not alter very much.

The major flaw of the study from the perspective of Modern Monetary Theory is the inclusion of “tax contributions” as value created and “negative impact on the public finances” as value destroyed. Neither contribution has any implications for intrinsic value.

The tax revenue provides the government with nothing other than a drain on private aggregate spending capacity (noting some taxes are designed to also have allocative effects – for example, tobacco charges). To call it “value created” is to fundamentally misunderstand that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency.

Similarly, it is not very helpful to talk about “negative impacts on the public finances” when public spending outlays are made. It might be that the outlays are addressing negative real outcomes but then these are captured under the first item listed in “value destroyed”.

Public spending per se does not “cost” anything. The real cost of public outlays is the real resources that are tied up by it and that cost should be assessed relative to alternative uses.

But in general, I agree that a study that broadens the concept of value is useful.

What do they find?

First, “while collecting salaries of between £500,000 and £10 million, leading City bankers to destroy £7 of social value for every pound in value they generate.” So when we say that the financial sector is largely unproductive that statement would appear to be very generous.

If this study has any merit then the financial sector – as currently structured and regulated – is a major negative contributor to overall welfare. Please read my blog – Financial markets are mostly unproductive – for more discussion on this point.

Second, “for every £1 they are paid, childcare workers generate between £7 and £9.50 worth of benefits to society. Child care workers are low-paid yet have our children in their company for long periods of their early years. They play a fundamental role in nurturing our children. So it is no surprise that their pay significantly understates the value of the contribution they make.

Third, earning “a salary of between £50,000 and £12 million, top advertising executives destroy £11 of value for every pound in value they generate”. Why? this sector is vital in pushing consumers into higher levels of spending (and environmentally damaging over-consumption) and the accompanying indebtedness.

Fourth, “hospital cleaners play a vital role” in our society and “for every £1 they are paid, over £10 in social value is generated”. This is an example of a secondary labour market job that is relatively low-skilled but has fundamental ramifications for overall societal well-being. A major outbreak of a bacterial infection in a large hospital could have significant social costs.

Fifth, the tax accountant has special skills in encouraging tax avoidance etc. “For a salary of between £75,000 and £200,000 tax accountants destroy £47 of value for every pound in value they generate”. Clearly from an equity perspective tax avoidance schemes are detrimental. But I am less encouraged (as noted above) about the “contributions to public revenue” arguments.

Finally, waste recycling workers help reduce carbon emission and “for every £1 of value spent on wages, £12 of value will be generated”. Once again a case of significant social benefits being derived from the activities of relatively low-skilled workers.

Conclusion

It is clear that one of the current policy failings has been the unwillingness of governments to really introduce fundamental reforms to the financial sector – see blog – Operational design arising from modern monetary theory – for further discussion.

It is also clear that there are no moves afoot to ensure that our approach to wage determiniation and wage relativities changes. Over the last thirty odd years in most nations the gap between labour productivity and real wages has widened.

This gap represents profits and shows that during the neo-liberal years there was a dramatic redistribution of national income towards capital. The question then arises: if the output per unit of labour input (labour productivity) is rising so strongly yet the capacity to purchase (the real wage) is lagging badly behind – how does economic growth which relies on growth in spending sustain itself?

In the past, the dilemma of capitalism was that the firms had to keep real wages growing in line with productivity to ensure that the consumptions goods produced were sold. But in the recent period, capital has found a new way to accomplish this which allowed them to suppress real wages growth and pocket increasing shares of the national income produced as profits. Along the way, this munificence also manifested as the ridiculous executive pay deals that we have read about constantly over the last decade or so.

The trick was found in the rise of “financial engineering” which pushed ever increasing debt onto the household sector. The capitalists found that they could sustain purchasing power and receive a bonus along the way in the form of interest payments.

This seemed to be a much better strategy than paying higher real wages. The household sector, already squeezed for liquidity by the move to build national government surpluses were enticed by the lower interest rates and the vehement marketing strategies of the financial engineers.

The financial planning industry fell prey to the urgency of capital to push as much debt as possible to as many people as possible to ensure the “profit gap” grew and the output was sold. And greed got the better of the industry as they sought to broaden the debt base. Riskier loans were created and eventually the relationship between capacity to pay and the size of the loan was stretched beyond any reasonable limit. This is the origins of the sub-prime crisis.

Without a fundamental change we will be back to crisis before we know it. Please read my blog – The origins of the economic crisis – for more discussion on this point.

That is enough for today!

Maybe this belongs here.

Negative real earnings growth on the lower and middle class (especially workers) and more debt on them to maintain a price inflation target, to trick them into working longer whether in the present and/or in the future, and to jack up stock prices to expand supply does NOT work when there are not more hours to work because of productivity growth and the economy has gone from supply constrained to demand constrained.

“The household sector, already squeezed for liquidity by the move to build national government surpluses were enticed by the lower interest rates and the vehement marketing strategies of the financial engineers.”

I think the lower and middle class of the household sector were too “confident”. That is they were way too “optimistic” about their assumptions of real and/or nominal hourly wage growth and the number of hours that would be available to work when they took on the debt.

“Riskier loans were created and eventually the relationship between capacity to pay and the size of the loan was stretched beyond any reasonable limit. This is the origins of the sub-prime crisis.”

Were some of these riskier loans/riskier loan “packages” being used to make bets on the collateral?

From:

http://www.housingwire.com/2010/04/30/advisor-warns-on-serious-regulatory-ramifications-from-sec-vs-goldman

“According to the research, buyers in synthetic CDOs are normally aware that their products will perform according to collateral performance.”

“Without a fundamental change we will be back to crisis before we know it.”

Do you want your recession hard and fast or long and drawn out (extend and pretend for possibly 10 to 20 years or even longer)?

Or, actually fix the mistakes made in the past to the fungible money supply?

This is suspicious: UK bank assets were 50% of GDP between 1880 and 1970, and then shot up to 500% in 2006. Source: article in The Times, July 19th, by Sam Fleming entitled “Silver bullet plans look tarnished”, with his source being the Bank of England.

I must admit this blog and the associated article certainly brought a smile to my face.

Well done Bill.

More related to the topic: “When Executives Rake in Millions: Meanness in Organizations” (Paper also mentioned in WSJ)

Abstract: The topic of executive compensation has received tremendous attention over the years from both the research community and popular media. In this paper, we examine a heretofore ignored consequence of rising executive compensation. Specifically, we claim that higher income inequality between executives and ordinary workers results in executives perceiving themselves as being all-powerful and this perception of power leads them to maltreat rank and file workers. We present findings from two studies – an archival study and a laboratory experiment – that show that increasing executive compensation results in executives behaving meanly toward those lower down the hierarchy. We discuss the implications of our findings for organizations and offer some solutions to the problem.

You can download it here: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1612486

What should we pay a banker who is the manager of a Super Fund that looses 50% of the cleaning workers capital retirement fund? Well he gets a share, every year, of what capital is left of course! And when the fund managers bank blows up the Gov step in and pumps capital in.

The Gov has abandonded its people by making individuals responsable for their own retirement and modest shelter (that you only get after taking out a mortage that will take 30 years to pay off). Why should individuals care about their country when they are abandoned by it?

Lets pay everyone the same then, comrad.

We are so dissconected from one another that its every person for themselves. No better teacher that this is true than the way our own Gov has abandoned us to the money lenders and money managers.

If we lived in a small village would we put up with the local banker taking home a cleaners lifetime pay every year?

If communism wasnt the answer and Neo Libs failed perhaps the Chinese middle path will show the way.

In any case until the top earners take maternal responsibility for the bottom earners the top earners and their Gov protectors better keep supplying food, entertainment and health services otherwise the “cleaning class” with take what the Banking class has.

Good post Bill, got me a bit steamed up.

That report is a complete load of rubbish. To quote some of the “methodology”:

“We took a multi-stakeholder approach, looking quite widely at the groups affected by the activities described. Because of time and resource limitations, we did not talk to those stakeholders ourselves. Instead we relied on existing data.”

ie Slap-dash.

“We valued the outcomes that mattered most – the things that emerged from the research as having the most impact.”

Pardon? Good use of management jargon (“impact”, “values”, “outcomes” etc), but what does this actually mean? The most important things were the most important? Searing insight.

“We only included things that were material. These analyses are partial, and we were not aiming for exact findings. However, we are confident that we have included the most material outcomes.”

But they have presented the findings as exact. Eg. “City bankers to destroy £7 of social value for every pound in value they generate.”

Overall, these sort of “reports” are simply rhetorical waffle with no credibility. Does anyone for one moment believe there was any possibility that this report would have found anything other than what the author had pre-conceived? Of course not.

I actually agree considerably with the underlying idea, however. Yes the banking sector enjoys a significantly privileged position due to it’s importance to the functioning of the nation. Governments should be looking at ways to reducing this. I have previously argued for more banking services to be provided by the Reserve Bank (such as interest free transaction accounts), and creating a clearer seperation between essential banking services (ie the payments system) and commerial banking services (risk-taking activities such as loans and project finance).

I’m sure many here will disagree, but the “A bit rich” article is basically useless in progressing these sort of ideas. Trying to dress up a rhetorical / emotive argument as scientific by putting numbers of it in this way is a complete waste of time.

The major insight provided by Marx’s theory of surplus-value was that capitalist profits are sourced in the production of surplus-value. In turn, surplus-value is produced by unpaid labour and so under capitalism workers remain exploited (as they were under previous modes of production).

The usual free marketer response to this (or at least the one I’ve heard) is that building the factory or starting the business enterprise is a risky proposition for the entrepreneur. The worker wouldn’t being able to achieve their high level of productivity without the entrepreneur who is willing to take such risks. Therefore, it is only right and just that a proportion of this excess productivity be retained by him/her as a reward for this risk.

Not saying I necessarily agree with this …. but how to respond?

Ken

Ken, leave to the government and its socio-economic program approved by its people! 🙂

If seriously, the question is then how to value these risks and what type of risks they are. Clearly there are monetary risks which are easy to measure. Next is opportunity costs which are more difficult to measure but still feasible. While these are valid points however one can easily raise the same points regarding any hobby. So what is really a difference between being an entrepreneur and having an expensive hobby? Not much to me.

Nevertheless, there is one clear risk where being an entrepreneur is different from having a hobby and it is employment risk. No hobby denies employment but being an entrepreneur and being employed are pretty much mutually exclusive. And here we go back to the main MMT proposition of job guarantee and social security nets. I do not remember where I have seen it (might be even here and in this case Bill or someone else can clearly give a link or more details) but there are more small business born in Europe than in the US because entrepreneurs are not afraid to take risks of loosing on their new ideas because they have strong safety nets to fall into in case they really lose.

“The major insight provided by Marx’s theory of surplus-value was that capitalist profits are sourced in the production of surplus-value. In turn, surplus-value is produced by unpaid labour and so under capitalism workers remain exploited (as they were under previous modes of production).”

Actually, the theory of surplus-value was first suggested by French anarchist Pierre-Joseph Proudhon in 1840 (“What is Property?”) and re-iterated in 1846 (“System of Economic Contradictions”). He was very clear that capitalists appropriated the surplus labour produced by their workforce as well as their “collective force”. Marx expanded upon this and developed it, but he did not invent it. I discuss this here:

Proudhon and Marx on exploitation

This is not to deny Marx’s contributions, simply that he built upon other people’s ideas (regardless of suggestions by Engels otherwise).

Searched “marginal productivity” and got this gem of an article from a decade ago!