Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – July 3, 2010 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

The private domestic sector can save overall even if the government budget balance is in surplus as long as net exports are positive.

The answer is False.

This is a question about the relative magnitude of the sectoral balances – the government budget balance, the external balance and the private domestic balance. The balances taken together always add to zero because they are derived as an accounting identity from the national accounts. The balances reflect the underlying economic behaviour in each sector which is interdependent – given this is a macroeconomic system we are considering.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

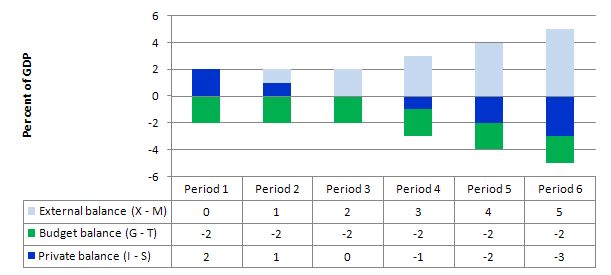

The following graph with accompanying data table lets you see the evolution of the balances expressed in terms of percent of GDP. In each period I just held the budget balance at a constant surplus (2 per cent of GDP) (green bars). This is is artificial because as economic activity changes the automatic stabilisers would lead to endogenous changes in the budget balance. But we will just assume there is no change for simplicity. It doesn’t violate the logic.

To aid interpretation remember that (I-S) > 0 means that the private domestic sector is spending more than they are earning; that (G-T) < 0 means that the government is running a surplus because T > G; and (X-M) < 0 means the external position is in deficit because imports are greater than exports.

If the nation is running an external surplus it means that the contribution to aggregate demand from the external sector is positive – that is net addition to spending which would increase output and national income.

The external deficit also means that foreigners are decreasing financial claims denominated in the local currency. Given that exports represent a real cost and imports a real benefit, the motivation for a nation running a net exports surplus (the exporting nation in this case) must be to accumulate financial claims (assets) denominated in the currency of the nation running the external deficit.

A fiscal surplus also means the government is spending less than it is “earning” and that puts a drag on aggregate demand and constrains the ability of the economy to grow. So the question is what are the relative magnitudes of the external add and the budget subtract from income?

In Period 1, there is an external balance (X – M = 0) and then for each subsequent period the external balance goes into surplus incrementing by 1 per cent of GDP each period (light-blue bars).

You can see that in the first two periods, private domestic saving is negative, then as the demand injection from the external surplus offsets the fiscal drag arising from the budget surplus, the private domestic sector breakeven (spending as much as they earn, so I – S = 0). Then the demand add overall arising from the net positions of the external and public sectors is positive and the income growth would allow the private sector to save. That is increasingly so as the net demand add increases with the increasing external surplus.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Saturday Quiz – June 19, 2010 – answers and discussion

Question 2:

Central bankers are talking about the possible need for more quantitative easing to ease the aggregate demand losses associated with the implementation of fiscal austerity programs. However QE cannot be compared to a net fiscal injection because it creates no new net financial assets in the currency of issue.

The answer is True.

Quantitative easing then involves the central bank buying assets from the private sector – government bonds and high quality corporate debt. So what the central bank is doing is swapping financial assets with the banks – they sell their financial assets and receive back in return extra reserves. So the central bank is buying one type of financial asset (private holdings of bonds, company paper) and exchanging it for another (reserve balances at the central bank). The net financial assets in the private sector are in fact unchanged although the portfolio composition of those assets is altered (maturity substitution) which changes yields and returns.

In terms of changing portfolio compositions, quantitative easing increases central bank demand for “long maturity” assets held in the private sector which reduces interest rates at the longer end of the yield curve. These are traditionally thought of as the investment rates. This might increase aggregate demand given the cost of investment funds is likely to drop. But on the other hand, the lower rates reduce the interest-income of savers who will reduce consumption (demand) accordingly.

How these opposing effects balance out is unclear but the evidence suggests there is not very much impact at all.

You should read the answer to Question 2 to reflect on how fiscal policy adds net financial assets to the non-government sector by way of contradistinction to QE.

The following blogs may be of further interest to you:

- Money multiplier and other myths

- Islands in the sun

- Operation twist – then and now

- Quantitative easing 101

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

Question 3:

The expansionary impact of deficit spending on aggregate demand is lower when the government matches the deficit with debt-issuance because then excess reserves are drained and the purchasing power is taken out of the monetary system.

The answer is False.

The mainstream macroeconomic textbooks all have a chapter on fiscal policy (and it is often written in the context of the so-called IS-LM model but not always).

The chapters always introduces the so-called Government Budget Constraint that alleges that governments have to “finance” all spending either through taxation; debt-issuance; or money creation. The writer fails to understand that government spending is performed in the same way irrespective of the accompanying monetary operations.

They claim that money creation (borrowing from central bank) is inflationary while the latter (private bond sales) is less so. These conclusions are based on their erroneous claim that “money creation” adds more to aggregate demand than bond sales, because the latter forces up interest rates which crowd out some private spending.

All these claims are without foundation in a fiat monetary system and an understanding of the banking operations that occur when governments spend and issue debt helps to show why.

So what would happen if a sovereign, currency-issuing government (with a flexible exchange rate) ran a budget deficit without issuing debt?

Like all government spending, the Treasury would credit the reserve accounts held by the commercial bank at the central bank. The commercial bank in question would be where the target of the spending had an account. So the commercial bank’s assets rise and its liabilities also increase because a deposit would be made.

The transactions are clear: The commercial bank’s assets rise and its liabilities also increase because a new deposit has been made. Further, the target of the fiscal initiative enjoys increased assets (bank deposit) and net worth (a liability/equity entry on their balance sheet). Taxation does the opposite and so a deficit (spending greater than taxation) means that reserves increase and private net worth increases.

This means that there are likely to be excess reserves in the “cash system” which then raises issues for the central bank about its liquidity management. The aim of the central bank is to “hit” a target interest rate and so it has to ensure that competitive forces in the interbank market do not compromise that target.

When there are excess reserves there is downward pressure on the overnight interest rate (as banks scurry to seek interest-earning opportunities), the central bank then has to sell government bonds to the banks to soak the excess up and maintain liquidity at a level consistent with the target. Some central banks offer a return on overnight reserves which reduces the need to sell debt as a liquidity management operation.

There is no sense that these debt sales have anything to do with “financing” government net spending. The sales are a monetary operation aimed at interest-rate maintenance. So M1 (deposits in the non-government sector) rise as a result of the deficit without a corresponding increase in liabilities. It is this result that leads to the conclusion that that deficits increase net financial assets in the non-government sector.

What would happen if there were bond sales? All that happens is that the banks reserves are reduced by the bond sales but this does not reduce the deposits created by the net spending. So net worth is not altered. What is changed is the composition of the asset portfolio held in the non-government sector.

The only difference between the Treasury “borrowing from the central bank” and issuing debt to the private sector is that the central bank has to use different operations to pursue its policy interest rate target. If it debt is not issued to match the deficit then it has to either pay interest on excess reserves (which most central banks are doing now anyway) or let the target rate fall to zero (the Japan solution).

There is no difference to the impact of the deficits on net worth in the non-government sector.

Mainstream economists would say that by draining the reserves, the central bank has reduced the ability of banks to lend which then, via the money multiplier, expands the money supply.

However, the reality is that:

- Building bank reserves does not increase the ability of the banks to lend.

- The money multiplier process so loved by the mainstream does not describe the way in which banks make loans.

- Inflation is caused by aggregate demand growing faster than real output capacity. The reserve position of the banks is not functionally related with that process.

So the banks are able to create as much credit as they can find credit-worthy customers to hold irrespective of the operations that accompany government net spending.

This doesn’t lead to the conclusion that deficits do not carry an inflation risk. All components of aggregate demand carry an inflation risk if they become excessive, which can only be defined in terms of the relation between spending and productive capacity.

It is totally fallacious to think that private placement of debt reduces the inflation risk. It does not.

You may wish to read the following blogs for more information:

- Why history matters

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- The complacent students sit and listen to some of that

- Saturday Quiz – February 27, 2010 – answers and discussion

Question 4:

The change in the net worth of the non-government sector when the government increases its net spending is invariant to government issuing debt $-for-$ to match the net spending rise.

The answer is True.

This answer is complementary to that provided for Question 3 and relies on the same understanding of reserve operations. So within a fiat monetary system we need to understand the banking operations that occur when governments spend and issue debt. That understanding allows us to appreciate what would happen if a sovereign, currency-issuing government (with a flexible exchange rate) ran a budget deficit without issuing debt?

Like all government spending, the Treasury would credit the reserve accounts held by the commercial bank at the central bank. The commercial bank in question would be where the target of the spending had an account. So the commercial bank’s assets rise and its liabilities also increase because a deposit would be made.

The transactions are clear: The commercial bank’s assets rise and its liabilities also increase because a new deposit has been made. Further, the target of the fiscal initiative enjoys increased assets (bank deposit) and net worth (a liability/equity entry on their balance sheet). Taxation does the opposite and so a deficit (spending greater than taxation) means that reserves increase and private net worth increases.

This means that there are likely to be excess reserves in the “cash system” which then raises issues for the central bank about its liquidity management as explained in the asnwer to Question 3. But at this stage, M1 (deposits in the non-government sector) rise as a result of the deficit without a corresponding increase in liabilities. In other words, budget deficits increase net financial assets in the non-government sector.

What would happen if there were bond sales? All that happens is that the banks reserves are reduced by the bond sales but this does not reduce the deposits created by the net spending. So net worth is not altered. What is changed is the composition of the asset portfolio held in the non-government sector.

The only difference between the Treasury “borrowing from the central bank” and issuing debt to the private sector is that the central bank has to use different operations to pursue its policy interest rate target. If it debt is not issued to match the deficit then it has to either pay interest on excess reserves (which most central banks are doing now anyway) or let the target rate fall to zero (the Japan solution).

There is no difference to the impact of the deficits on net worth in the non-government sector.

You may wish to read the following blogs for more information:

- Why history matters

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- The complacent students sit and listen to some of that

- Saturday Quiz – February 27, 2010 – answers and discussion

Question 5:

While continuous national governments deficits are possible if the non-government sector desires to save, they do imply continuously rising public debt levels as a percentage of GDP.

The answer is False.

While Modern Monetary Theory (MMT) places no particular importance in the public debt to GDP ratio for a sovereign government, given that insolvency is not an issue, the mainstream debate is dominated by the concept. The unnecessary practice of fiat currency-issuing governments of issuing public debt $-for-$ to match public net spending (deficits) ensures that the debt levels will always rise when there are deficits.

But the rising debt levels do not necessarily have to rise at the same rate as GDP grows. The question is about the debt ratio not the level of debt per se.

Rising deficits often are associated with declining economic activity (especially if there is no evidence of accelerating inflation) which suggests that the debt/GDP ratio may be rising because the denominator is also likely to be falling or rising below trend.

Further, historical experience tells us that when economic growth resumes after a major recession, during which the public debt ratio can rise sharply, the latter always declines again.

It is this endogenous nature of the ratio that suggests it is far more important to focus on the underlying economic problems which the public debt ratio just mirrors.

Mainstream economics starts with the flawed analogy between the household and the sovereign government such that any excess in government spending over taxation receipts has to be “financed” in two ways: (a) by borrowing from the public; and/or (b) by “printing money”.

Neither characterisation is remotely representative of what happens in the real world in terms of the operations that define transactions between the government and non-government sector.

Further, the basic analogy is flawed at its most elemental level. The household must work out the financing before it can spend. The household cannot spend first. The government can spend first and ultimately does not have to worry about financing such expenditure.

However, in mainstream (dream) land, the framework for analysing these so-called “financing” choices is called the government budget constraint (GBC). The GBC says that the budget deficit in year t is equal to the change in government debt over year t plus the change in high powered money over year t. So in mathematical terms it is written as:

which you can read in English as saying that Budget deficit = Government spending + Government interest payments – Tax receipts must equal (be “financed” by) a change in Bonds (B) and/or a change in high powered money (H). The triangle sign (delta) is just shorthand for the change in a variable.

However, this is merely an accounting statement. In a stock-flow consistent macroeconomics, this statement will always hold. That is, it has to be true if all the transactions between the government and non-government sector have been correctly added and subtracted.

So in terms of MMT, the previous equation is just an ex post accounting identity that has to be true by definition and has no real economic importance.

But for the mainstream economist, the equation represents an ex ante (before the fact) financial constraint that the government is bound by. The difference between these two conceptions is very significant and the second (mainstream) interpretation cannot be correct if governments issue fiat currency (unless they place voluntary constraints on themselves and act as if it is a financial constraint).

Further, in mainstream economics, money creation is erroneously depicted as the government asking the central bank to buy treasury bonds which the central bank in return then prints money. The government then spends this money.

This is called debt monetisation and you can find out why this is typically not a viable option for a central bank by reading the Deficits 101 suite – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

Anyway, the mainstream claims that if governments increase the money growth rate (they erroneously call this “printing money”) the extra spending will cause accelerating inflation because there will be “too much money chasing too few goods”! Of-course, we know that proposition to be generally preposterous because economies that are constrained by deficient demand (defined as demand below the full employment level) respond to nominal demand increases by expanding real output rather than prices. There is an extensive literature pointing to this result.

So when governments are expanding deficits to offset a collapse in private spending, there is plenty of spare capacity available to ensure output rather than inflation increases.

But not to be daunted by the “facts”, the mainstream claim that because inflation is inevitable if “printing money” occurs, it is unwise to use this option to “finance” net public spending.

Hence they say as a better (but still poor) solution, governments should use debt issuance to “finance” their deficits. Thy also claim this is a poor option because in the short-term it is alleged to increase interest rates and in the longer-term is results in higher future tax rates because the debt has to be “paid back”.

Neither proposition bears scrutiny – you can read these blogs – Will we really pay higher taxes? and Will we really pay higher interest rates? – for further discussion on these points.

The mainstream textbooks are full of elaborate models of debt pay-back, debt stabilisation etc which all claim (falsely) to “prove” that the legacy of past deficits is higher debt and to stabilise the debt, the government must eliminate the deficit which means it must then run a primary surplus equal to interest payments on the existing debt.

A primary budget balance is the difference between government spending (excluding interest rate servicing) and taxation revenue.

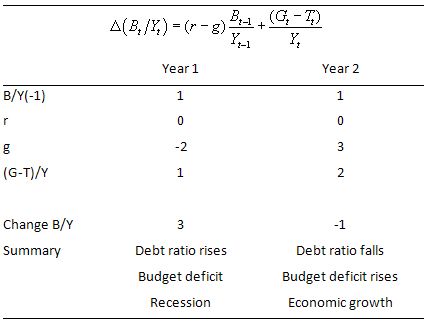

The standard mainstream framework, which even the so-called progressives (deficit-doves) use, focuses on the ratio of debt to GDP rather than the level of debt per se. The following equation captures the approach:

![]()

So the change in the debt ratio is the sum of two terms on the right-hand side: (a) the difference between the real interest rate (r) and the GDP growth rate (g) times the initial debt ratio; and (b) the ratio of the primary deficit (G-T) to GDP.

The real interest rate is the difference between the nominal interest rate and the inflation rate.

This standard mainstream framework is used to highlight the dangers of running deficits. But even progressives (not me) use it in a perverse way to justify deficits in a downturn balanced by surpluses in the upturn.

Many mainstream economists and a fair number of so-called progressive economists say that governments should as some point in the business cycle run primary surpluses (taxation revenue in excess of non-interest government spending) to start reducing the debt ratio back to “safe” territory.

Almost all the media commentators that you read on this topic take it for granted that the only way to reduce the public debt ratio is to run primary surpluses. That is what the whole “credible exit strategy” rhetoric is about and what is driving the austerity push around the world at present.

So the question is whether continuous national governments deficits imply continuously rising public debt levels as a percentage of GDP. While MMT advocates running budget deficits when they are necessary to fill a spending gap left by non-government saving, it does not tell us that a currency-issuing government running a deficit can never reduce the debt ratio.

The standard formula above can easily demonstrate that a nation running a primary deficit can reduce its public debt ratio over time.

Furthermore, depending on contributions from the external sector, a nation running a deficit will more likely create the conditions for a reduction in the public debt ratio than a nation that introduces an austerity plan aimed at running primary surpluses.

Here is why that is the case. A growing economy can absorb more debt and keep the debt ratio constant or falling. From the formula above, if the primary budget balance is zero, public debt increases at a rate r but the public debt ratio increases at r – g.

The orthodox economists use this analysis to argue that permanent deficits are bad because the financial markets will “penalise” a government living on debt. If the public debt ratio is “too high” (whatever that is or means), markets “lose faith” in the government.

To make matters simple, assume a public debt ratio at the start of the period of 100 per cent (so B/Y(-1) = 1) and a current real interest rate (r) of 3 per cent. Assume that GDP is growing (g) at 2 per cent. This would require a primary surplus of 1 per cent of GDP to stabilise the debt ratio (check it for yourself).

Now what if the financial markets want a risk premium on domestic bonds? Also assume the central bank is worried about inflation and pushes nominal interest rates up so that the real rate (r) rises to 6 per cent. Also assume that the primary surplus and the rising interest rates drive g to 0 per cent (GDP growth falls to zero).

So now the the fiscal austerity (primary surplus) has to rise to 6 per cent of GDP to stabilise debt. The sharp fiscal contraction would lead to recession and as the popularity of the government wanes the uncertainty drives further interest rate rises (via the “markets”). It becomes even harder to stabilise debt as r rises and g falls.

But consider this example which is captured in Year 1 in the Table below. Assume, as before that B/Y(-1) = 1 (that is, the public debt ratio at the start of the period is 100 per cent). The (-1) just signals the value inherited in the current period.

It is a highly stylised example truncated into a two-period adjustment to demonstrate the point. But if the budget deficit is a large percentage of GDP then it might take some years to start reducing the public debt ratio as GDP growth ensures.

Assume that the real rate of interest is 0 (so the nominal interest rate equals the inflation rate) – not to dissimilar to the situation at present in many countries.

Assume that the rate of real GDP growth is minus 2 per cent (that is, the nation is in recession) and the automatic stabilisers push the primary budget balance into deficit equal to 1 per cent of GDP. As a consequence, the public debt ratio will rise by 3 per cent.

The government reacts to the recession in the correct manner and increases its discretionary net spending to take the deficit in Year 2 to 2 per cent of GDP (noting a positive number in this instance is a deficit).

The central bank maintains its zero interest rate policy and the inflation rate also remains at zero.

The increasing deficit stimulates economic growth in Year 2 such that real GDP grows by 3 per cent. In this case the public debt ratio falls by 1 per cent.

So even with an increasing (or unchanged) deficit, real GDP growth can reduce the public debt ratio, which is what has happened many times in past history following economic slowdowns.

Economists like Krugman and Mankiw argue that the government could (should) reduce the ratio by inflating it away. Noting that nominal GDP is the product of the price level (P) and real output (Y), the inflating story just increases the nominal value of output and so the denominator of the public debt ratio grows faster than the numerator.

But stimulating real growth (that is, in Y) is the other more constructive way of achieving the same relative adjustment in the denominator of the public debt ratio and its numerator.

But the best way to reduce the public debt ratio is to stop issuing debt. A sovereign government doesn’t have to issue debt if the central bank is happy to keep its target interest rate at zero or pay interest on excess reserves.

The discussion also demonstrates why tightening monetary policy makes it harder for the government to reduce the public debt ratio – which, of-course, is one of the more subtle mainstream ways to force the government to run surpluses.

The following blog may be of further interest to you:

“The income-expenditure type of monetary theory has its roots in classical economic theory, but as a body of theory it has largely been developed since World War I & especially since the onset of the Great Depression in 1929. The writings of such outstanding economists as Wicksell, D.H.Robertson, Hawtrey, Hicks, Schumpeter, Hansen, Aftalion, & many others have contributed to the development of the theoty. Its present dominant position, however, is perhaps mostly attributable to the publication of Keynes’ General Theory of Employment, Interest & Money, in 1936. and to the efforts of the National Bureau of Economic Research, the United States Department of Comerce, and other agencies both public & private to collect & compile statistics in accord with the framework & concepts of the theory…”

So MMT is an attempt to expand upon its mechanistic approach. Herein lies the problem:

John Maynard Keynes gives the impression that a commercial bank is an intermediary type of financial institution serving to join the saver with the borrower when he states that it is an “optical illusion” to assume that “a depositor and his bank can somehow contrive between them to perform an operation by which savings can disappear into the banking system so that they are lost to investment, or, contrariwise, that the banking system can make it possible for investment to occur, to which no savings corresponds.”

In almost every instance in which Keynes wrote the term bank in the General Theory, it is necessary to substitute the term financial intermediary in order to make the statement correct. Perhaps this is the source of the pervasive error that characterizes the Keynesian economics, the Gurley-Shaw thesis, Reg Q, the DIDMCA of March 31st, 1980, the Garn-St. Germain Depository Institutions Act of 1982, Financial Services Regulatory Relief Act of 2006, Emergency Economic Stabilization Act of 2008, sec. 128. Acceleration of the effective date for payment of interest on reserves, Modern Monetary Theory, etc.

I.e., contrary to the Keynesian system, savings doesn’t actually equal investment. But it doesn’t stop there. The Liquidity Preference Curve is a false doctrine. The money supply can never be managed by any attempt to control the cost of credit (whether using the FFR, repo rate on governments, or IORs). The Taylor Rule is also a fictious “sign post”. It is ex-post.

People talk as if we have a zero interest rate policy (ZIRP ?) No, by definition the interest rate “floor” is the remuneration rate. There is no “liquidity trap”. The FED is “pushing on a string” with its new policy tool – IORs.

What the FED has fostered is a contractionary policy with the use of a risk rate penalty.

The floor on the FFR (or the interest rate on excess & required reserves), now @ .25%, has created dis-intermediation among the non-banks (an outflow of funds), and has reduced money velocity.

IORs have caused massive portfolio shifts in the earning assets among the commercial banks ($1,047,858T in new excess reserves).

These portfolio shifts have induced system-wide bank credit contraction (the remuneration rate on IORs will have exceeded all 4-week, 3-month & 6-month Treasury bills for 2 years as of this Nov 5th).

Your effort to point out a solution is amazing. But it won’t work despite your best efforts. Congress will fail to wake up and act in time. Nominal GDP will cascade in the 4th qtr (down in every month – Oct, Nov, & Dec), without extra (upwards of the linear path), stimulus. We won’t ever reach “escape velocity”.

Dear Bill,

Would you published an alternative Macro textbook?

Cheers

Anas

Bill –

I fail o see how your solution to question 1 proves the statement false. What am I missing?

As for question 2, I remain unconvinced. Since when did creating new net financial assets become a prerequisite for comparison?

If the objective of QE is to enable better use to be made of financial assets, surely failure to compare it with a net fiscal injection would be irresponsible?

Maybe I’m missing something too, but I think the answer to q.1 should be true, or at least maybe.

If (I – S) + (G – T) + (X – M) = 0

and we are given X-M>0, G-T<0, then the sign of I-S is indeterminate. I-S could be T-G.

Last sentence should read I-S could be less than zero if X-M is greater than T-G.

OK, after re-reading Q.1, I’m gathering that the point is that X-M>0 is a necessary, but not sufficient, condition for I-S<0, given G-T<0. i.e net exports have to be positive, AND larger in magnitude than the government surplus.

Question one has to be true, using the very logic presented in the solution.

Ken

I agree with everyone else about Q 1. unless you’re implying that its false because the extent to which net exports are positive (in order to overcome the budget surplus effects) isn’t stated.

About Q1:

I note a lot of people think that the answer should be true.

If you read the question carefully it says – “The private domestic sector can save overall even if the government budget balance is in surplus as long as net exports are positive.“. Well that statement is false. The private domestic sector cannot save with a government surplus in every situation (“as long as”) where there is an external surplus. Therefore the statement is false.

As ParadigmShift worked out over what appeared to be several iterations – the positive net exports is a necessary but not a sufficient condition.

best wishes

bill

Sorry, I’m not getting why Q1 could not be maybe.

Domestic saving = 100

Gov’t budget surplus = 100

net exports = 200

(0-100) + (0-100) + (200-0) = 0

What’s wrong with that?

I believe you should get rid of the true/false format.

Dear Bill,

Could you comment on the article written by Andy Grove, former CEO of Intel? I believe that he correctly understands at least one side of the problem even if he is most likely not aware of the opportunities offered by MMT.

“U.S. Versus China

Today, manufacturing employment in the U.S. computer industry is about 166,000 — lower than it was before the first personal computer, the MITS Altair 2800, was assembled in 1975. Meanwhile, a very effective computer-manufacturing industry has emerged in Asia, employing about 1.5 million workers — factory employees, engineers and managers. ”

…

“You could say, as many do, that shipping jobs overseas is no big deal because the high-value work — and much of the profits — remain in the U.S. That may well be so. But what kind of a society are we going to have if it consists of highly paid people doing high-value-added work — and masses of unemployed?”

…

“Offshore Production

Consider this passage by Princeton University economist Alan S. Blinder: “The TV manufacturing industry really started here, and at one point employed many workers. But as TV sets became ‘just a commodity,’ their production moved offshore to locations with much lower wages. And nowadays the number of television sets manufactured in the U.S. is zero. A failure? No, a success.”

I disagree. Not only did we lose an untold number of jobs, we broke the chain of experience that is so important in technological evolution. As happened with batteries, abandoning today’s “commodity” manufacturing can lock you out of tomorrow’s emerging industry.

Our fundamental economic beliefs, which we have elevated from a conviction based on observation to an unquestioned truism, is that the free market is the best economic system — the freer, the better. Our generation has seen the decisive victory of free-market principles over planned economies. So we stick with this belief, largely oblivious to emerging evidence that while free markets beat planned economies, there may be room for a modification that is even better.

No. 1 Objective

Such evidence stares at us from the performance of several Asian countries in the past few decades. These countries seem to understand that job creation must be the No. 1 objective of state economic policy. The government plays a strategic role in setting the priorities and arraying the forces and organization necessary to achieve this goal.”

http://www.bloomberg.com/news/2010-07-01/how-to-make-an-american-job-before-it-s-too-late-andy-grove.html

Fed Up: “Sorry, I’m not getting why Q1 could not be maybe.”

Maybe was not an option. That being the case, unless the statement is always true, it is false. 🙂

Bill, if central bank buys private sector financial assets then net financial assets DO increase (i.e. new assets are created) unless central bank targets an positive interest rate. Or do I get something wrong here?

Dear Sergei

QE just swaps assets. No new net assets are created.

best wishes

bill

Bill, it swaps private assets (e.g. corp bonds) for new bank reserves. This means to me that net financial assets in private sector still increase but total financial assets do not.

Or I feel like I am completely lost with regards to what is what

The problem I see with question 1 is the word “can.” At this point, I think most of the people confused by the question, as I was, understand the explanation of the situation, so now it’s almost purely a question of semantics. Personally, I’d still say the answer is “true.” That I say that without disagreeing with the mathematical explanation of the sector-balance situation suggests that it’s a poorly worded (i.e ambiguous) question.

bill & Sergei, Is QE using central bank reserves about increasing net financial assets IN THE PRESENT (to be removed later) AND only DIRECTLY in the banking system (can central bank reserves be used directly outside the banking system for the “real” economy)?

Also, is QE about preserving bank capital and keeping interest rates low in the hope of suckering the lower and middle class into going further into debt so that the HOPE is new, good debt can be used to replace old, bad debt and/or even if the real economy recovers enough to make the old, bad debt good?

Dear WHQ

Sometimes my questions may be poorly worded. This one was not.

When dealing with the sectoral balances the relative magnitudes are crucial to understand. The question was deliberately designed to test that understanding and to differentiate between a necessary and sufficient condition.

If you did understand these things you had no other choice than to say FALSE. The statement was not correct in all situations. If I had have put a MAYBE option then fine but then I would have been leading you to much.

best wishes

bill

Professor Mitchell, I think there is a real difference in English usage, understanding and interpretation here (Australian vs. American?) regarding the phrase “X can be true even if Y as long as Z.” In my own personal dialect, and apparently that of many other educated native speakers of English, “The statement was not correct in all situations” does not at all imply that the answer to Q1 is “false.” “As long as” does not mean “in every situation” here, when I carefully read, write or speak English. “I can save as long as I have an income” does not mean to me “I save in every situation where I have an income.”

For me, all that was necessary for a answer of “true” was that there is one situation where the statement – “The private domestic sector can save overall” – was correct. In fact, if I were teaching a non-native speaker English, then before I saw your, an educated native speaker’s, interpretation of “can … even if … as long as”, I would not have hesitated to call that interpretation simply wrong, not English.

Dear Some Guy

Thanks very much for your comment.

Your example is correct but it doesn’t capture the essence of the question I asked. I explicitly added the extra information that the government sector was in surplus. Given there are two other sectors then the question has to also consider relative magnitudes if one truly understands the relationships between the sectors in the national accounting context.

Further, remember we are talking about the macroeconomy here so statements about individuals are erroneous and run the danger of committing a fallacy of composition. Just because the economy has income doesn’t mean households in aggregate can save. Individual households may be able to save if they have sufficient discipline but overall the sector may not be able to.

I don’t think it is a US-OZ usage issue. But the linguists out there can correct me.

best wishes

bill

This is, without question, false:

The private domestic sector can always save overall even if the government budget balance is in surplus as long as net exports are positive.

This is, without question, true:

The private domestic sector can save overall even if the government budget balance is in surplus as long as net exports are sufficiently positive.

I don’t think the first statement would have been too leading, but it would have been less ambiguous. The second would have been less ambiguous, but too leading.

Another unquestionably true statement, which may have lacked the focus on relative magnitude, would be:

The private domestic sector can save overall even if the government budget balance is in surplus only if net exports are positive.

The word “can” can be taken to imply “is possible under some situation (meeting the following conditions)” or to mean “necessarily has the ability to.” I can go to the store if I take the bus, since I live somewhere with bus service that goes to the store, right? Of course, I have to take the right bus, not just any bus.

How about this?

The private domestic sector can save overall even if the government budget balance is in surplus.

This is true, right? It is possible.

(Sorry for kicking this possibly dead horse again. The silver lining is that we all agree with the reality of the situation the question relates to even if we don’t agree on the phrasing of the question. That’s far more important in the end.)