I started my undergraduate studies in economics in the late 1970s after starting out as…

No wages breakout in Australia evident

Today the Australian Bureau of Statistics released the Labour Price Index, Australia data for the March 2010 quarter and it shows that we are back on the path to suppressing real wages growth while productivity growth has picked up strongly. The ABS results show that the annualised growth to March 2010 was 2.9 per cent which was steady but down on the higher growth achieved during the expansion. This is barely keeping pace with inflation and well below labour productivity growth. In recent months, I have noted that commentators are increasing claiming that a wages breakout will lead to an inflation breakout unless the government quickly tightens fiscal policy. Today’s data provides more evidence that this argument is flawed and reflects ideological fervour rather than being grounded in the facts. Today, we also heard the speech made at the National Press Club by the Opposition Shadow Treasurer in response to last week’s Government’s budget. The conclusion from my analysis of that speech: there is no political choice in Australia. All the parties are lost in deficit hysteria and the rest of us will endure the costs.

Most of the “wages breakout” claims are coming from Rupert Murdoch’s New Limited press that continues to be a blight on reasoned analysis in our fair land. But at least we haven’t got Fox News. All Murdoch can manage to keep solvent here in TV terms is Fox Sports and they seem to cover golf a lot which most people sleep through. So Rupert is providing us with a service to ease insomnia.

You regularly read comments such as this one in February coming from a prominent industrial lawyer in the News Limited-owned national newspaper The Australian:

Prior to the last election it was predicted we would see a return to 1970s-style wage breakouts. Now we’re seeing them …

And this comment from rival media owners Fairfax, which demonstrates no capacity to understand what is going on at present:

The tightening of the labour market will be a growing concern for the RBA, particularly after the government announced this week that it expects that the economy will approach full employment by mid-2012 … Indeed, this highlights the risk of a wages breakout … In this week’s budget, the government forecast wage inflation of 3.75 per cent in the year to June 2011, although the risks are skewed to an even higher rate given that the economy already is growing around trend and doing so with little spare capacity.

So we should be seeing a surging real wage index if this prediction is accurate.

Just yesterday, before today’s data had come out there was this report from Bloomberg published in the right-wing Business Week:

Rising wages underscore the Reserve Bank of Australia’s decision to embark on the most aggressive round of interest rate increases among Group of 20 policy makers to prevent inflation from climbing above its target range of 2 percent to 3 percent. Vacancies for skilled workers gained in May for an 11th straight month …

So any sign that the labour market is recovering is met with this hysterical reaction. They forget that we still have 12.5 per cent of our willing labour resources idle (either unemployed or underemployed).

The bank economists also continue to shine in all their glory. Here is a sample of their predictions from the Bloomberg article:

The turn in annual wage inflation with a further acceleration to come through 2010 reinforces the already building inflation risks for 201

A key justification for interest rate rises has been the threat of inflation, given a tightening labor market … While wages growth has been moderate to date, there are now some signs that wages growth has turned a corner.

Well what did the ABS data today reveal? Apart from the headline figures that the nominal hourly wage index grew by 2.9 per cent in the year to March 2010, there was scant reporting of the release in the press this afternoon. But the data clearly is sending a message which will confound all the rhetoric that has been building to near hysteria in recent weeks about the looming wages breakout.

The Melbourne Age did carry a story – Public employees lead wage gains – this afternoon (May 19, 2010) and concluded that:

Australia’s workers saw their pay packets swell by 3 per cent in the year to March, with the largest gains posted by public employees and those in Tasmania.

Don’t you just love the terminology “pay packets swell”. The journalist could have reflected on whether the workers’ cupboards will be overflowing with extra real goods and services, which “swell” implies. As I show later, there was no real wage increase worth mentioning and the distribution of national income kept heading away from wages towards profits.

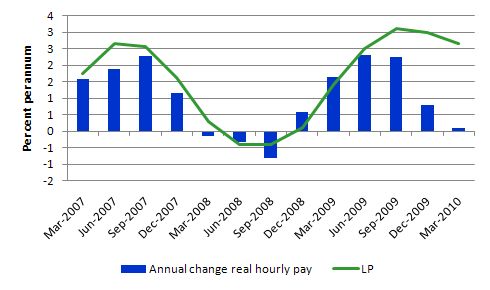

The following graph comes from today’s ABS data release and shows the growth in real hourly pay (so the nominal index deflated by the Consumer Price Index and aligned for the different bases) from March 2007 to March 2010 (blue bars). The green line is the GDP per hour worked measure of labour productivity available from the ABS National Accounts.

What do you observe? First, the cyclical nature of the time series is very noticeable. Second, the recovery in real wages was driven by the fiscal stimulus and once that has died out so has the growth in real hourly pay. Third, productivity growth is accelerating and leaving real wages growth behind which means distributional shifts in real income are going in favour of profits.

The wages breakout story is running in tandem with the other major narrative in the media at the moment which is that Australia is booming on the back of the “mother of all mining booms” and this will drive unsustainable wage rises. I have shown last week in this blog – Labour force data – no boom yet! – that there are serious problems with this claim.

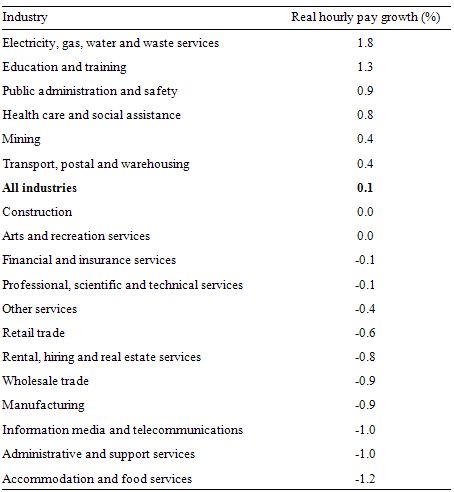

Today’s wages data advances my case. The following Table computes the annualised growth in real wages by industry for the ANZSIC 1-digit level classification for the last year (to March 2010). There has been very modest growth in Mining real hourly wages and certainly well below the GDP per hours worked productivity growth rate (which I don’t show but know to be above the national average of 2.7 per cent over the same period).

The other interesting point is that the highest real wage gains are in industries dominated by the public sector and are probably the result of the stimulus package maintaining reasonable wages growth in those areas. But, I emphasise that the real wages growth in these “top performing” sectors is still well below the GDP per hours worked productivity growth rate over the same period.

Conclusion: no wages breakout evident and workers are handing real GDP over to profits at an increasing rate as has been the trend for some years.

In a blog from last week – It will only take 6 months – I noted that the origins of the economic crisis – (also covered in detail in this blog – The origins of the economic crisis) – can be traced back long before the sub-prime crisis manifested.

The roots of the crisis are to be found in the way in which the neo-liberal policy agenda forced a major divergence between productivity growth and real wages growth to occur from around the mid-1980s (the date depends which country you are talking about). Historically, real wages have tracked labour productivity growth closely and for good reasons.

Firms needed workers to have the capacity to purchase the goods and services that were being produced to avoid an aggregate demand failure – or as Marxists might term it – a realisation crisis.

From the mid-1980s onwards, real wages in most nations failed to track labour productivity growth. The gap between labour productivity and real wages was claimed by capital and manifested as a rising profit share. Many neo-liberal developments helped to ensure this outcome – privatisation; outsourcing; pernicious welfare-to-work attacks on unions etc.

The problem was that such redistributions create tensions for the capitalist system. If the output per unit of labour input (labour productivity) is rising so strongly yet the capacity to purchase (the real wage) is lagging badly behind – how does economic growth which relies on growth in spending sustain itself? This problem was exacerbated by the tendency of governments around the world to tighten fiscal policy to support their inflation-first monetary policy quest.

The way the realisation problem was solved, albeit temporarily, was in the growth of the financial sector which spawned the rise of “financial engineering”. This trend saw ever increasing debt pushed onto the household sector. The capitalists found that they could sustain purchasing power and receive a bonus along the way in the form of interest payments. This seemed to be a much better strategy than paying higher real wages.

The household sector, already squeezed for liquidity by the move to build increasing federal surpluses were enticed by the lower interest rates and the vehement marketing strategies of the financial engineers. The financial planning industry fell prey to the urgency of capital to push as much debt as possible to as many people as possible to ensure the “profit gap” grew and the output was sold.

And greed got the better of the industry as they sought to broaden the debt base. Riskier loans were created and eventually the relationship between capacity to pay and the size of the loan was stretched beyond any reasonable limit. This is the origins of the sub-prime crisis.

There were real gains to be made along the way and the top-end-of-town made sure they received them.

So one of my recurrent themes is that to restore macroeconomic stability to our economies, not only do we have to dramatically revise the way we think about monetary and fiscal policy and fundamentally alter the way we regulate the financial institutions, but we also need to ensure that real wages closely track productivity growth.

To accomplish that last requirement will require a fundamental shift back in the distribution of national income towards wages. In part, this will squeeze the real income available to capital. The dramatic shift in national income under the neo-liberal period towards profits allowed the financial sector to gain a greater share of real GDP. Shifting the balance back to wages will reduce the capacity of the financial markets to squander real income.

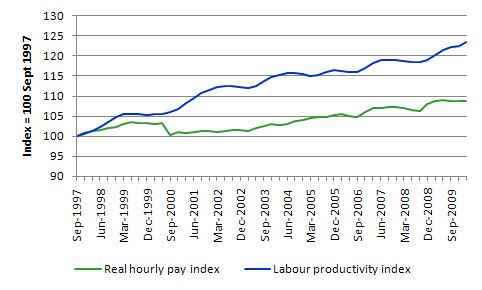

With that background, today’s wage data shows that we haven’t learned the lessons of the neo-liberal period. It shows the movement in real hourly wages and real GDP per hour worked (labour productivity) since September 1997 (when the Labour Cost Index which the real wage measure is based on began).

Over that time, labour productivity has growth by 23.5 per cent while the growth in real hourly pay has been a muted 8.7 per cent. You can see that in the current recovery, the past trends are reinstating themselves which means that nothing much has changed.

Just in case you still don’t believe the mounting evidence that the Australian economy is performing very modestly at present, today’s consumer confidence data that is published by a prominent bank shows that their consumer sentiment index for May fell 7 per cent.

The Sydney Morning Herald story – Consumer confidence dives most since GFC – May 19, 2010, reported that:

It was the second consecutive fall in consumer sentiment, and the largest since October 2008, the depth of the financial turmoil.

The commentary surrounding the release suggests that the public response to the austerity path that last week’s federal budget outlined combined with the six interest rate hikes by the RBA since last October have damaged the consumer outlook.

Several large retailers are reporting “flat sales” in the last quarter and a major retail outlet went broke today.

Why there is no political choice in Australia

As you will guess I have no regard for the current Labor Government at all. They are neo-liberals to the core and only marginally better in social policy than the current Opposition which was last in power between 1996-2007.

After today’s speech by the Opposition Treasury spokesperson in response to last week’s national budget you realise why there are no political options in Australia, given that The Greens are also neo-liberals.

The Shadow Treasurer Joe Hockey had promised a detailed plan to cut the budget deficit – they claim they can get the deficit down more quickly than the government. It is a race to the bottom and the next economic crisis.

While Hockey claimed the Coalition would cut around $A47 billion from public net spending there were no details.

The Finance spokesperson was left to pick up the story. He released some details this afternoon and told the press that “Australia has no more money left”.

I hadn’t heard any news flash today that the Australian government had announced that it was abandoning the fiat currency system that we operate in Australia. So I assumed the Opposition finance spokesperson had had a bad dream last night where the Prime Minister did make such an announcement.

There is an infinite (minus 1 cent) national government spending capacity in financial terms. The idea that there is “no money left” only applies to households and other non-government entities. It can never apply to a sovereign government unless they abandoned the fiat currency system.

Anyway, Hockey’s speech was a gem. Total nonsense clothed in all the folksy rhetoric that conservatives in Australia use. The approach is quite different from the conservative narratives that you read originating from the US.

You can read the full Speech here.

Before we get onto the fiscal policy section, Hockey made one interesting point:

… there is one key aspect of the Budget which I want to vigorously dispute. The government identifies an unemployment rate of 4.75% as full employment. I do not accept that at all. When I was Minister for Employment in 2007 I left Labor with an unemployment rate of around 4%.

We never gave up on people even at significant cost to the Budget through Welfare to Work and Work for the Dole programs.

Full employment in Australia from my perspective, is solely defined as the level where everyone who wants a job can get a job.

So Joe Hockey thinks that a 4 per cent unemployment rate is equivalent to full employment. He also only equates it to a capacity to get a job rather than a job that provides the hours of work that are desired by the workers.

The second paragraph is the giveaway. When they were in government they never gave up on pushing pernicious supply-side legislation onto the unemployed. They invoked what I have called “full employability” rather than taking responsibility for full employment.

Following the first OPEC oil price hike in 1974, which led to accelerating inflation in most countries, there was a resurgence of pre-Keynesian thinking. The Keynesian notion of full employment was abandoned as policy makers progressively adopted the natural rate of unemployment approach or the more recent terminology of the Non-Accelerating Inflation Rate of Unemployment (NAIRU) approach.

This approach redefines full employment in terms of a unique unemployment rate (the NAIRU) where inflation is stable, and which is determined by supply forces and is invariant to Keynesian demand-side policies. It reintroduces the discredited Say’s Law by alleging that free markets guarantee full employment and Keynesian attempts to drive unemployment below the NAIRU will ultimately be self-defeating and inflationary.

The Keynesian notion that unemployment represents a macroeconomic failure that can be addressed by expansionary fiscal and/or monetary policy is rejected.

Instead, unemployment reflects failures on the supply side failures such as individual disincentive effects arising from welfare provision, skill mismatches, and excessive government regulations. Extreme versions of the natural rate hypothesis consider unemployment to be voluntary and the outcome of optimising choices by individuals between work (bad) and leisure (good).

So we had a plethora of training and other policies directed at getting workers “work ready”. The evidence is that unemployment only fell when employment growth occurred as a result of rising aggregate demand.

In a substantial way these supply-side policies were the policy areas where the previous (and current) government aspire to humiliate and punish the most disadvantaged workers among us. This is the area of public life where we allow our government to directly attack the victims of that governments own policy failures – the failure to ensure there was enough aggregate demand to underpin enough employment creation.

The main reason that the supply-side approach is flawed is because it fails to recognise that unemployment arises when there are not enough jobs created to match the preferences of the willing labour supply. The research evidence is clear – churning people through training programs divorced from the context of the paid-work environment is a waste of time and resources and demoralises the victims of the process – the unemployed.

Please read my blogs – The revolving door – how social policy is co-opted – Training does not equal jobs! – Boondoggling and leaf-raking … – for more discussion on this point.

In last week’s Budget Speech, the Treasurer said that:

Best of all, the unemployment rate is expected to fall further from 5.3 per cent today to 4¾ per cent by mid-2012, around the level consistent with full employment.

Please read my blog – What part of accounting don’t they get? – for a reminder of what the Government said last week.

The Government was just reinstating its belief in the NAIRU. There was no focus on underemployment or hidden unemployment in the Budget Papers and Speech. At present there are around 7.3 per cent of willing Australian workers who are not working enough hours and about 2 per cent who dropped out of the labour force (hidden unemployed) because there is a dearth of vacancies.

If the official unemployment rate drops to 4.75 per cent, then underemployment may drop to around 6.75 or 7 per cent and hidden unemployment will drop to around 1.8 per cent.

So, since when does full employment, which used to mean full capacity, coincide with around 11.5 per cent or thereabouts of your available labour not working enough hours, some not working at all?

So neither the Government nor the Opposition have any idea of what full employment is. When in doubt they just change the definition and demean the concept and policy aspiration in the process.

Hockey spent considerable time in his speech today providing us with his insights on the “deficit and debt”. It was a comedy show.

Hockey said:

Quality of life is heavily influenced by what you can afford … The more the government borrows to fund its deficit the more it detracts from national savings.

The best way to improve Australia’s national savings in the short term is to get the Budget into surplus. It is also necessary to pay off net government debt as quickly as possible to avoid a crowding out of capital markets.

Running surpluses do not add to national saving. There is no meaning to be attributed to the concept of a sovereign government “saving” in its own currency.

Surpluses destroy private purchasing power and provide no extra spending capacity in the future to the government. When households save and forego consumption, they build up increased future capacity to consume.

A sovereign government can always spend in the future irrespective of the budgetary decisions it has made in the past. The only constraints on government are real (availability of real goods and services) and political (what they can get away with).

Hockey then recited his religious belief in “crowding out”:

The government does not believe in crowding out … I do. If the government with its AAA rating continues to borrow on average around $100 million every day in competition with small business, mortgage holders and the banks themselves, then ultimately the cost of borrowings for others will be higher.

There is no financial crowding out. The idea that governments compete for funds from a “finite” saving pool which drives interest rates up and damages private spending is false.

The government just borrows back what it has spent. There is no finite pool of saving. Saving expands with income and income responds to aggregate demand which government net spending adds to.

There is no systematic relationship ever been found between real interest rates and budget deficits that stands up to scrutiny.

The only crowding out that matters is whether there are real goods and services available. If they are fully utilised then if the governments wants to increase its command on them they have to deprive the non-government sector. That is crowding out!

More likely government deficits that support growth “crowd-in” private resource usage via increased demand and improved confidence.

Please read my blog – Saturday Quiz – April 17, 2010 – answers and discussion – for more discussion on this point.

Hockey then went on about sovereign debt risk:

There is a growing anxiety about sovereign exposure to debt markets. Around the world we are seeing what happens when government finances become unsustainable. Greece is struggling to finance its ongoing deficits in the market. That has prompted a trillion dollar rescue package by the European Union and the IMF.

Australia is not in the same camp as many other nations because the Rudd Government inherited a $20 billion Budget surplus, zero net debt and $60 billion in the Future Fund. Our starting point was streaks ahead of everyone else.

We need to prepare now for the next crisis. Governments must reduce sovereign debt and we must reduce sovereign risk if we want precious investment dollars for the private sector to come in.

Well the past surpluses have had nothing to do with Australia not facing the EMU problems at present. Australia never faces sovereign debt risk as long as it borrows in Australian dollars. It is the monopoly issuer of the currency and can always meet its public debt liabilities.

Our past fiscal patterns have nothing to do with our solvency risk. We are not in a better or worse position to remain solvent because we ran surpluses in the past (or had we run deficits). We have no public debt solvency risk because we enjoy the capacities of a sovereign government that issues its own currency.

There is no race to the finish line of rectitude where the nation’s starting point is handicapped by its public debt ratio.

In terms of the “Coalition’s Budget Strategy”, Hockey said:

The Coalition has always taken great pride in the high quality of its economic management and fiscal rectitude.

I remember my dad always saying to me “money doesn’t grow on trees”. Well when I became the Minister responsible for bank notes in the Coalition Government I confirmed to him that he was right.

The Coalition believes in fiscal conservatism. The Coalition will restore fiscal rectitude. We will run a Budget surplus over the cycle. We will repay Labor’s $93 billion of net debt as quickly as we can.

Okay, it doesn’t grow on trees. It is much more straightforward than that. National government spending in Australia comes from the stroke of a computer keyboard linking the Treasury and the Central Bank and the commercial banks. A sovereign government is never revenue constrained because it is the monopoly issuer of the currency.

So the issue is not whether the national government can spend. It can always purchase whatever is for sale in Australian dollars.

Further, the “balanced over the cycle” canard is no different to the government’s own aspirations. It is a foolish rule to espouse and try to follow.

As I have explained often, whether a budget surplus is an appropriate fiscal aim depends on what is happening in the external sector and the saving desires of the private domestic sector. If the external sector is in deficit which it always is in Australia (as a capital importing nation), then a government surplus will always be associated with a private domestic deficit.

Even a balanced public budget over the cycle will ensure the private domestic deficit is on average over the cycle is equal to the current account deficit.

On-going private domestic deficits mean that that sector is becoming increasingly indebted. That is not a sustainable growth strategy. Eventually, the private sector will try to stop accumulate ever-increasing levels of debt and then spending wanes (or collapses) and the fiscal drag compounds the aggregate demand failure.

It was this pattern that defined the conditions that led to the current crisis.

Quite clearly, if the external sector is in deficit and the private domestic sector desires to save overall (spend less than they earn) then the spending gap has to be filled by an on-going government deficit or real GDP growth declines and the economy moves into recession.

So politicians who just repeat these mainstream economics mantras – balanced budget averaged over the cycle – haven’t a clue as to what they are signing up for.

It is a mindless rule to commit to. But both sides of politics (and The Greens) all espouse it. There is no sensible choice available.

Hockey also said:

Labor also claims to return the Budget to surplus, but their record in government suggests it will never be achieved. Our record in government clearly demonstrates that we can restore the Budget to real surpluses and that we have the discipline to sustain those surpluses.

The last time Hockey was in government, they ran 10 surpluses in 11 years. The only way they could do that was because the household sector took on record and dangerous levels of private debt. If the financial engineering had not been so successful, the government would not have been able to run the surpluses for as long as they did.

Conclusion: there is no sensible choice available in Australian politics.

Conclusion

Australia escaped recession purely because the Federal government introduced an early and significant fiscal stimulus. Then the Chinese government introduced a huge stimulus which also helped to keep our economy moving with only one negative quarter of growth. So two large fiscal interventions at appropriate times saved us.

Now the local stimulus is all but exhausted all the indicators – retail sales, housing finance, the labour market and now labour costs – are pointing to a slowing economy. Slowing from nearly dead stop.

Further, there is evidence that China may start to put the brakes on to avoid overheating – more on this another day – and this will impact significantly on our growth path.

That is enough for today!

Hi Bill,

I am Austrian (geografical speaking) and read your blog with great interest. Every morning I am eager to find your new message to the world.

What I wonder is that almost nobody in command is getting your message. How comes that? Wouldnt it be much easier for politicians to please their electorate than to punish them? All over the world the same messages: Austerity.

As citizen of the EMU I wonder if MMT could be applied by allowing the ECB to credit the treasuries of the memberstates directly, bypassing private banks, as long as full employment is achieved.

Regards

Gerhard Bastir

P.S. I would like to extend your message to german speaking audience. Is there any german speaking community, as I would not like to reinvent the wheel?

but every once in a while, truth leaks in:

http://www.nytimes.com/2010/05/20/business/economy/20econ.html

Hard for wages to breakout when there is a man in the penalty box.

Bill –

“Well the past surpluses have had nothing to do with Australia not facing the EMU problems at present. Australia never faces sovereign debt risk as long as it borrows in Australian dollars. It is the monopoly issuer of the currency and can always meet its public debt liabilities.”

Is all the current borrowing in Australian dollars?

Hi Gerhard,

Ich bin auch Österreicher und les schön brav das Billy-Blog. Was deine Frage nach German-speaking community betrifft. Gibt’s net. Dafür ganz viele Mises und Hayek Apologeten 😉 Dringend gesucht: eine neue Wiener Schule. Das müssten wir schon selber machen.

Stephan

PS: Aber zumindest ist das BMF prominent auf Billy-Blog vertreten. Ich hab Bill mal eine Anzeige des BMF geschickt, als Vorbild für alle anderen staatlichen Sparer: https://billmitchell.org/blog/?p=9686

Aidan

As at last June, all except $7m of Australian government debt is in $A.

Dear Aidan (thanks to nealb)

You can find the data at Australian Office of Financial Management.

best wishes

bill

Anyone have any idea where I can find a good graph comparing labor productivity and real wage growth for the U.S.? I went to the BLS website and got this graph for productivity (output per hour worked):

http://data.bls.gov/PDQ/servlet/SurveyOutputServlet?data_tool=latest_numbers&series_id=PRS85006092

and this graph for compensation (not sure if this is adjusted for inflation):

http://data.bls.gov/PDQ/servlet/SurveyOutputServlet?data_tool=latest_numbers&series_id=PRS85006102

But these graphs appear real choppy and I don’t see any clear relationship.

Hallo Gerhard und Stephan,

Ist Peter Bofinger ein Begriff fuer Euch?

Peter Bofinger (* 18. September 1954 in Pforzheim) ist ein deutscher Ökonom und Professor für Volkswirtschaftslehre an der Universität Würzburg. Seit März 2004 ist er Mitglied im Sachverständigenrat zur Begutachtung der gesamtwirtschaftlichen Entwicklung (die fünf Wirtschaftsweisen).

http://de.wikipedia.org/wiki/Peter_Bofinger

Unter anderem lese ich

” Fiskalpolitik

In der Fiskalpolitik setzt sich Bofinger nachdrücklich für eine antizyklische Haushaltspolitik ein. Er kritisiert den Maastricht-Vertrag zur Begrenzung der Schuldenaufnahme des Staates und hält diesen für zu unflexibel. Er hält die Richtwerte – die Neuverschuldungsbegrenzung in Höhe von 3 % sowie die Schuldenstandsquote von 60 % des Bruttoinlandsprodukts – für willkürlich, da diese nicht nach wissenschaftlichen Kriterien ausgewählt wurden, sondern aus dem Verschuldungsstand der EU-Staaten von 1990 abgeleitet wurden. Zwar spricht er sich langfristig für eine Begrenzung der Staatsverschuldung aus, u.a. da diese auch mit negativen Umverteilungswirkungen verbunden sei. Jedoch erlaube der Maastricht-Vertrag nicht die von ihm befürwortete antizyklische Fiskalpolitik, die sich in einer angemessenen Erhöhung des strukturellen Defizits in konjunkturellen Schwächephasen ausdrückt. Dazu müssten, wenn das Regelwerk der Währungsunion eingehalten werden soll, regelmäßige Haushaltsüberschüsse in beträchtlicher Höhe erzielt werden.

Als Vorbild für den Erfolg der antizyklischen Fiskalpolitik führt er unter anderem die Vereinigten Staaten und das Vereinigte Königreich an. Diese hätten beispielsweise in den Jahren 2001 bis 2003 nach dem Zusammenbruch der Dotcom-Blase in einer konzertierten Aktion das strukturelle Defizit massiv ausgeweitet und gleichzeitig den Leitzins drastisch gesenkt, was zu einem dauerhaft hohen Wirtschaftswachstum geführt habe. Er betont in diesem Zusammenhang die Bedeutung der Koordinierung von Geld- und Fiskalpolitik, die nicht gegeneinander agieren dürften (wie dies in Kontinentaleuropa häufig der Fall gewesen sei).”

Aber leider geht er nicht die ganze Strecke zu MMT. Kann man ihn vielleicht “bearbeiten”?

Gruss

Graham

PS sorry to all those who don’t read German but most of the above came from the German wikipedia – too much to translate.

I’m basically asking if our Austrian friends are aware of Professor Peter Bofinger who seems to be a 50% MMTer.

Peter Bofinger is mentioned as being opposed to Professor Hans-Werner Sinn on wikipedia. Sinn is one of the big names in German economics.

http://en.wikipedia.org/wiki/Hans-Werner_Sinn

Here is the english version of wikipedia on Bofinger

http://en.wikipedia.org/wiki/Peter_Bofinger

although it doesn’t give much info on him

Dear Stephan, Gerhard and Graham

Cultural diversity is great. But so is inclusion.

I would prefer it if we could keep comments in English or with a translation supplied so that no one is prevented from participating.

For others: if you are worried about your English writing skills and want to comment send me an E-mail with the comment in your own language and I will translate it myself (French, Dutch) or have it translated by those who are more skilled than I.

Apologies for my anglophonic monopoly tendencies.

best wishes

bill

I think part of the deficit hysteria is due to the fact that AUS is riding a commodities and real estate bubble, so you can chalk it up to disregard for your fellows as a majority of households still perceives themselves as growing in wealth.

As soon as the s*it hits the fan and the commodity/land bubbles pop, the middle class will become much poorer and there will be a clamor for government to ease the pain. Unfortunately having 15% of the population be underemployed is just not enough. Wait until house prices fall by 30% and copper is trading at $1500 a ton.

@Stephan

That were you?! I wondered where Bill could find this strange ad of our omniscient secretary of Finance Mr. Proell. (can`t stand him talking in TV)

@Stephan,Graham

I am intending to set up a homepage with referencees to Billy`s daily Blogs with a short german translation. Unfortunately he so productive. I think I shall call it unserschilling.net. Will see if we can attract traffiic.

@Bill

Thanks for the reminder and the mild slap on my lazy fingers. My comment was only a direct reply and I think 99% of the readers would judge it a waste of time. Didn’t expect such a lengthy German reply. That said I will confine myself from now on to ONLY English postings.

Now in regard to Graham’s Posting. It’s about German economist Peter Bofinger, who’s a member of government appointed committee of five economists to regularly review and report on the German economy also known as the five economic sages. Everybody who reads their reports regularly must come to the conclusion, that the term “five economic sages” is a sublime joke to confuse the public. But Graham is right, that Bofinger is somehow heroic in his endeavors to counter the relentless madness produced by the sages. That’s probably also the reason why he’s very frequently labelled “left”, which is nothing else than a media signal for the German public to better ignore him.

In 1997 there was a conference in London titled “North versus South? The Political Economy of EMU” and Bofinger was one of the main participants. Bofinger argued among other things that, with the Maastricht Treaty in place, treating government bonds as zero risk would be problematic. Given that national central banks could no longer finance government debt, there would be a solvency risk for the state. I think Bofinger is aware of the implications of a sovereign issuing a non-convertible, free-floating currency. But the problem is (like already mentioned in the Naked Keynesianism blog entry) to venture full-motion into MMT publicly is sort of professional seppuku. At least in Germany.

Graham is also right, that the economist who conducts the economic chorus is Hans-Werner Sinn. Need an opinion or assessment – let’s call Hans-Werner. The ÜBER-sage. Last year I read a paper titled “Economic journalism in Germany – a case of market failure”. The reason this paper was written was a book written by Sinn titled “Can Germany be saved”. In edition 1 and 2 of the book Sinn showed a graph named “Driven off the world markets” showing % share of world market (footnote: export share) of the US and Germany to further his relentless crusade, that Germany is constantly losing market share due to lacking competitiveness. His cure: the whole neo-liberal mantra.

Now the problem was, that instead of showing the export share the figures actually showed the import share. Nonetheless the media and politics picked up the message and went in full panic mode, because it came from the ÜBER-sage. Newspapers printed the graph as further evidence of Germany going South. The error was unnoticed for almost one year and instead was the poster-child example that there must be something done about restoring competitiveness. I think this story illustrates pretty well the modus operandi of the media and why truth not always trumps ideology. At least in the public debate. And there was a little too much done to restore lost competitiveness 😉

@Gerhard

I think UnserSchilling.net is not a very fortunate choice. My prediction: a lot of Austrian lunatics will be very thrilled and use the opportunity to lecture us about the Gold-Standard and/or Free Banking. Next they will enlighten us about the danger of fractional-reserve banking and in general introduce us to their newest findings, that central banking is a conspiracy against the market and really evil.

Finally some right-wing nuts will come along, who have always preferred to keep the Schilling and have one million other reasons to hate everyone, Europe and the EU. They will happily post their “I told you so” and then tell us that we’re Utopian socialists expropriating the hard working middle class by promoting inflation.

I read sometimes some of this blogs and I can assure you, that in Austria and Germany you can find plenty of people who really think there’s only one step left on the road before serfdom is upon them. And because Mises and Hayek are not radical enough they start reading quietly Hans-Hermann Hoppe and dreaming of benevolent aristocracy.

Or they come up with other brilliant ideas, like that democracy is the cause for all maladies because it’s not democracy anymore but ochlocracy. The remedy in this case: only net tax payers are allowed to vote. All the others are a self-serving mob which cannot be trusted.

PS: If you want some flavor of this thinking, check out Ortner Online. I mean this idiot is writing for a major Austrian newspaper? Last time I was amazed to learn from one commenter that Glenn Beck’s “The Revolutionary Holocaust” is a good documentary and we can really learn a lot of it. We’ve an education problem in Austria.

@Stephan

I checked out this Ortner type und also Unterberger. You are right, that type of discussion is dispensable.

Gerhard

P.S. I am not the “Gerhard” writing in a.m. Blogs.