The other day I was asked whether I was happy that the US President was…

Naked Keynesianism

New York Times columnist and Nobel Prize winner Paul Krugman occasionally brushes up against an understanding of how the macroeconomy works. Some people actually have said to me that he does get it but chooses for political purposes not to disclose a full understanding of the basic principles of Modern Monetary Theory (MMT). Well in his most recent column – We’re Not Greece – published May 13, 2010, I think you can conclude that when left to his own devices he doesn’t have a clue about what is really happening in the macroeconomy. So today, we are exposing his mainstream (neo-classical) keynesian nakedness – he is now naked and without clothes.

The title inspiration today comes from one of the funniest television segments I have ever watched which I feature later on during Intermission as my billy blog comedy spot. The alternative working title is how can grown adults humiliate themselves so thoroughly in public and still keep a straight face. Great acting, great comedy. I hope you will enjoy it.

You may also like to read this blog – Those bad Keynesians are to blame – which explains flavours of Keynesians to understand how a Keynesian can be a mainstream neo-classicist. They are the worst by the way!

Anyway, why would I say all these horrid things about him?

Krugman rightly points out that the mad crowd out there (the gold bugs, the free-market lobby, the mindless conservatives; the hapless progressives who don’t know what day it is) are all exploiting the crisis in Greece as:

… an excuse to dismantle Social Security … Everywhere you look there are editorials and commentaries, some posing as objective reporting, asserting that Greece today will be America tomorrow unless we abandon all that nonsense about taking care of those in need.

So that is a line I agree with totally and have been writing about a lot lately. The US is not Greece, fundamentally because they have two completely distinct and non-comparable monetary systems which bestow on their respective governments a very different opportunity set and a very different set of constraints. I will return to this.

As a point of clarification, the free-market lobby don’t actually believe in free markets. They just believe that the parts that will maximise their chance to raid real output if deregulated should be and the parts that give them the most if regulated or subject to corporate welfare should remain that way. A free market would have seen Goldman Sachs insolvent by now!

So we all agree that Krugman gets it! Sorry to disappoint. The “US is not Greece” according to Paul Krugman is a stunning litany of non-sequiturs, category errors and plain factual error. He couldn’t be posing and writing this stuff.

Krugman asks “how do America and Greece compare?”. So a coherent comparative macroeconomic analysis would start with the most important similarities and differences and that means first focusing on the characteristics of the monetary system and the position of the currency in that system. Worrying about debt ratios; deficit ratios; or any other statistical series would not be a place to start your analysis.

Why not? Because these ratios etc are statistical artefacts of the monetary system and can only be interpreted within the context of the monetary system generating them. If the you have two very different monetary systems then comparing public debt ratios across the systems is meaningless. Anyone who understood how monetary systems operate would know that.

Not our Paul. He chooses to initially focus on deficit ratio and tells us that:

Both nations have lately been running large budget deficits, roughly comparable as a percentage of G.D.P. Markets, however, treat them very differently: The interest rate on Greek government bonds is more than twice the rate on U.S. bonds, because investors see a high risk that Greece will eventually default on its debt, while seeing virtually no risk that America will do the same. Why?

One answer is that we have a much lower level of debt – the amount we already owe, as opposed to new borrowing – relative to G.D.P. True, our debt should have been even lower. We’d be better positioned to deal with the current emergency if so much money hadn’t been squandered on tax cuts for the rich and an unfunded war. But we still entered the crisis in much better shape than the Greeks.

My gosh! Sometimes you read analysis from those who are held out in the public debate as knowing a thing or two and you just want to lie on the floor and weep (in a Monty Pythonesque style of total despair – for readers who are familiar with this 1970s English comedy program).

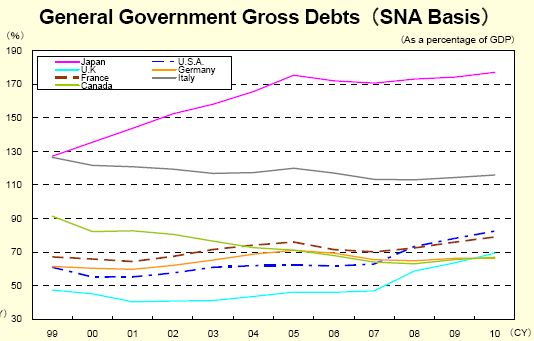

While I am on the floor in apoplexy, can someone please take the time to send Paul an E-mail from all of us and ask him how Japan with public debt ratios at the top of the class maintain bond yields below 1.5 per cent almost indefinitely? The following supplementary material might be used to frame the question to him.

The following graph comes from the Japanese Ministry of Finance Quarterly Newsletter and shows outstanding central government debt for a number of nations. I have no need to comment on it.

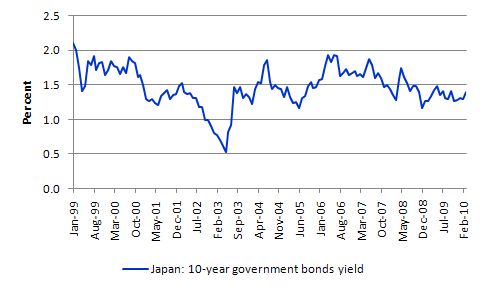

This graph uses data available from the Bank of Japan and shows the 10-year Government bond yields. Perhaps you might add this graph and the preceding one as attachments when you send Paul the E-mail asking him about Japan.

So very significant budget deficits, rising public debt ratios do not cause higher interest rates Paul. This has nothing to do with the Greek versus US demarcation.

I might also add – as I have often – that over the last two decades as Japanese public debt ratios have continued to rise and the deficits continued to flow, not only have interest rates been hovering around zero but the price level has been more or less deflating.

If you want to run the line that continuous deficits result in hyperinflation then you will have to exclude the second largest economy in the world from your analysis. The obvious reason for all of it is that Japan is a sovereign nation that issues its own currency and freely floats it on foreign exchange markets and has been struggling with a high domestic saving ratio for years.

Second, Krugman says that it is true that the US public “debt should have been even lower” and that the US would be:

…. better positioned to deal with the current emergency if so much money hadn’t been squandered on tax cuts for the rich and an unfunded war. But we still entered the crisis in much better shape than the Greeks …

I cried some more upon reading this but managed to stay seated in my chair this time.

No-one who understands anything about macroeconomics would say this. He is trying to be progressive and talk about wasted public assistance to the rich and the military machine. These things matter and should condition the public debate about the composition of public spending (or who gets tax cuts). But they are irrelevant when it comes to deciding who was in “better shape” to withstand the crisis.

The US was clearly in better shape than the Greeks – than any nation in the EMU for that matter – but not for the reasons that Krugman offers.

This goes to the heart of the differences between monetary systems. The Greek government does not issue its own currency and has to “finance” every euro it spends. If taxes will not cover its spending desires then it has to issue debt. The current crisis is manifesting as the bond markets not being willing to lend to the Greek government any longer because they fear default. Or if they are willing they want ridiculously high yields.

These funding constraints do not apply to the US government, which is sovereign in the USD and can never be revenue constrained. It is the monopoly issuer of the US dollar. This translates into an ability to spend whatever the government wants at any time. The only constraints that US government spending face are real resource availability (not currently a problem with 16 per cent of the workforce without work) and political factors.

Certainly, the political constraints can be binding but they are not of a financial nature which is the implication of Krugman’s claim here.

Further, whether the US government had have been running surpluses or deficits in the past, and irrespective of the size of these budget outcomes, it can still spend whatever it likes in the current period. Past surpluses do not provide any extra capacity to spend now and past deficits do not provide a diminished capacity to spend now.

Any statement to the contrary is clearly untrue in financial terms.

Krugman then noted another “difference”:

Even more important, however, is the fact that we have a clear path to economic recovery, while Greece doesn’t.

The U.S. economy has been growing since last summer, thanks to fiscal stimulus and expansionary policies by the Federal Reserve. I wish that growth were faster; still, it’s finally producing job gains – and it’s also showing up in revenues. Right now we’re on track to match Congressional Budget Office projections of a substantial rise in tax receipts. Put those projections together with the Obama administration’s policies, and they imply a sharp fall in the budget deficit over the next few years.

Yes, because the fiat monetary system provides the US with a fiscal path out of the mess. Greece has no such path under the EMU constraints and is now being forced to do exactly the opposite to what is needed to define a “clear path to economic recovery”.

But the differences all relate to the two different monetary systems. The irony is the political constraints in the US have forced the government to take a conservative fiscal path which is definitely prolonging its recession and making the permanent income losses greater. To some extent the US government is being forced (by it own neo-liberal tendencies) to act like an EMU nation by imposing stupid limits on itself.

The floor in the downturn and the subsequent growth in the US has been driven by automatic stabilisers in no small degree as the US Treasury has been deliberately restraining its discretionary fiscal policy intervention as the President marches around the country saying that the US has “run out of money”.

The reason the so-called Keynesian stimulus has resulted in 10 per cent unemployment (narrow measure) and not 8 per cent as projected is because the discretionary fiscal expansion was insufficient and badly targetted. This comment will also be relevant when you listen to the comedy segment later.

In terms of dividing the policy credit for the expansion between monetary and fiscal, I suspect the low interest rates and quantitative easing has had a very small role to play. The expansion of bank reserves probably stabilised the financial system but didn’t do much for growth.

Krugman then said:

Greece, on the other hand, is caught in a trap. During the good years, when capital was flooding in, Greek costs and prices got far out of line with the rest of Europe. If Greece still had its own currency, it could restore competitiveness through devaluation. But since it doesn’t, and since leaving the euro is still considered unthinkable, Greece faces years of grinding deflation and low or zero economic growth. So the only way to reduce deficits is through savage budget cuts, and investors are skeptical about whether those cuts will actually happen.

Yes, because the essential difference between the US and Greece is the different monetary system they operate within. Greece could always restore trade competitiveness by exchange rate depreciation and continue to stimulate growth via fiscal policy if it left the Eurozone.

The fact that “leaving the euro is still considered unthinkable” is testament to the skewed nature of the policy debate in that country. If people really understood the options right now I am sure they would walk.

And finally – Krugman is groping towards something when he says:

It’s worth noting, by the way, that Britain – which is in worse fiscal shape than we are, but which, unlike Greece, hasn’t adopted the euro – remains able to borrow at fairly low interest rates. Having your own currency, it seems, makes a big difference.

… it seems!

Why didn’t he start at this basic point of difference? Why not just say, the UK, the US and most other nations are sovereign in their own currency. They have their own central banks which set interest rates, and the currency floats on foreign exchange markets which frees fiscal and monetary policy to focus on domestic welfare exclusively.

Why not acknowledge that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency whereas all EMU governments have imposed gold-standard type constraints on themselves?

Why not say at the outset that the EMU nations were never positioned to withstand the crisis given the design of their monetary system?

Why not? Because “it seems, makes a big difference” rather than it is what the whole issue turns upon.

Having come to that point – on the edge of comprehension, Krugman then concludes:

In short, we’re not Greece. We may currently be running deficits of comparable size, but our economic position – and, as a result, our fiscal outlook – is vastly better.

The fiscal positions cannot be compared given that “(h)aving your own currency, it seems, makes a big difference”. The fiscal outlook, as noted above, is no better or no worse as a result of any particular public debt ratio. The fiscal position in the US is not a problem because the US government has a non-convertible fiat currency at its disposal. That is the reason!

So by now Krugman is as naked as you can get!

In the last few paragraphs of his piece he decided to outline America’s “long-run budget problem” which he thinks, in no small part is because of “a deliberate political strategy, that of “starve the beast”” where:

conservatives have deliberately deprived the government of revenue in an attempt to force the spending cuts they now insist are necessary.

How bad can it get? The US government doesn’t need revenue to spend. The fact that this political strategy by the conservatives has constrained its willingness to spend it a demonstration of how the deficit terrorists and the mainstream macroeconomists have been able to hide the truth. The only reason the US government is not spending more and bringing the economy more closer to full employment is because it has accepted the political constraints imposed upon it by the conservative polity.

See the Peter G. Peterson note that follows!

He then falls into the intergenerational/health costs crisis black hole and I gave up thinking for a moment. Krugman is like all these self-styled progressive deficit doves. They actually make the political case for full employment harder to make because they are held out as the “left wing” of the debate. So regression towards to mean takes us further to the right. Centrist positions now are out there a fair distance to the right and a long way from what we used to call the centre!

Digression: so much for hope in the US

As an aside, the Peter G. Peterson Foundation has recently conducted a survey and they polled “the most senior economic officials from the last eight administrations and Congressional leaders from the past 30 years”.

The survey reveals:

… broad agreement that failure to address the country’s long-term structural deficit challenges would lead to another economic crisis within the next ten years. There is also consensus around the solution to the deficit problem: it must include both spending cuts and tax increases, according to a group of more than fifty former top economic officials.

If you care you can read the Results. My only reaction was that this country has nuclear weapons. The leaders on both sides of politics are nuts. Ignorant is too kind an epithet to describe them.

I would also like to get a statistics class to examine the questionnaire. It reeks of bias in the way the questions are framed and the lack of conceptual development behind them.

Which brings us to Intermission today.

Intermission: The billy blog comedy spot

Given I have been in despair today reading Krugman and others which I chose not to report, I thought we needed to lighten things up a bit before going to more serious data analysis next.

So while we gather ourselves and restore equanimity I thought a comedy spot might help. In fact, the title of today’s blog comes from this next comedy segment. It is one of the funniest things I have seen where adults take it as their job to humiliate themselves and relentlessly lie to their audience. It is hilarious especially the bit where the so-called financial expert goes “its naked Keynesianism”. I wondered what Keynesianism with clothes on was like.

Anyway, enjoy the fun and when we return we will get serious again.

In case you cannot see the embedded video the link is HERE.

Someone asked me at the recent Washington Teach-In, I was asked about my perception of the the relative standard of the public policy debate in the US and Australia. I mentioned that I had seen Fox news the night before in the hotel and they were running some special promotional feature that they had termed “Drowning in Debt”.

Each time this segment came on, they wheeled out another suited commentator, usually male but not always, who upon being asked the first question, launched into a tirade about deficits, debt and governments. I had to turn the volume down as they also ramped up the screeching as their level of vehemence rose exponentially from the start of the interview to the end.

I thought at the time how lucky we were in Australia to have exported Rupert Murdoch to the US although he still has print media control over here. I told the Teach-In that you might be able to summarise the differences they were seeking comment on by the fact that we don’t have Fox news available. would not watch that sort of television over here. Any channel that ran that stuff hour-in-hour-out would go broke for lack of patronage. The only Fox TV in Australia is Fox Sports and that is harmless enough.

But before you go here is the last laugh – the Fox News Asia-Pacific Home Page Header (Source). I wonder what unfair and unbalanced constitutes?

Digression: The data trail pointing to slowdown is getting stronger

The Lending Finance, Australia data for March 2010 was published today by the Australian Bureau of Statistics and provides further evidence that the Australian economy is slowing in the wake of the fiscal withdrawal.

AAP reports (May 17, 2010) that “Weak lending finance figures released on Monday show the economy is stalling”. They quoted a bank economist who said that:

This is further evidence that the domestic economic recovery is going sideways and stalling rather than seeing any significant growth … Not only has retail sales been consistently weak, but consumer borrowings, which is a good lead indicator of future spending, is actually tracking lower as well, with personal finance recording its weakest monthly reading since last October.

I hope all the commentators who have been falling over themselves to tell us all that the Australian economy is heading out of control into a hyperinflationary growth spiral at present are finally picking up the scent of the trail of data that has consistently been pointing in a different direction.

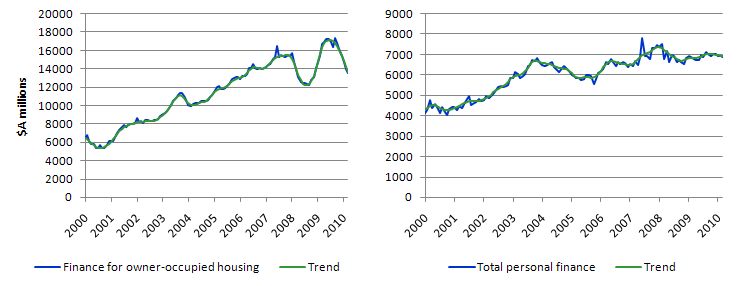

The seasonally-adjusted data shows that Total personal finance commitments fell 1.3 per cent in March (see graph below) while housing finance for owner occupation fell 3.4 per cent.

Overall lending was “down 12 per cent on a year ago, recording its weakest annual growth rate in 13 months”.

The following graphs show today’s data release for finance for owner-occupied houseing (left-panel) and total personal finance (right-panel) in $A millions.

The housing finance data reflects several policy interventions (first-home buyers grant offer and then withdrawal; RBA interest rate decisions; fiscal stimulus withdrawal).

Neither graph is indicating the households are embarking on a credit-fuelled consumption binge at present.

Conclusion

I also read an IMF Report today that is so bad that I almost confused it for a Fox News script.

Anyway, after that harrowing day ….

That is enough for now!

I thought this comedy joke was really a joke. Unfortunately it was incredibly frustrating. How much energy does it take to retain common sense among all these …?

Dear Sergei

That’s the joke – they are dead serious and think they have something to offer the world.

It is frustrating but then News Limited has billions to spend hiring these fools … most of us have pennies.

best wishes

bill

Hi Bill,

I know nothing about macroeconomics or whatever (sorry). I come from the UK, and was made unemployed in the 1990s recessions before Labour came to power and I was scarred by it. I already had a pretty poor upbringing, what with my mother believing in the minimum state, and being ashamed of me if I needed any help – sink or swim Thatcherite ideology – I sank. After going on to be kicked out of a succession of jobs for being different, I developed mental health problems ( or maybe it’s everyone else).

When Labour came to power they did very well at getting unemployment down, but it was too late for me. All the employment schemes they introduced were for people under 25 – “to make sure another generation would not be let down”.

They fixed the schools and eductaion, “to make sure another generation would not be let down” – again too late for me.

They introduced Sure-Start centres to make sure children were given the best start in life – very good, but too late for me.

They had intellectual debates about ‘obstacles to employment’, yet in all my visits to the Job Centre, no one ever asked me about my obstacles to employment.

When I became suicidal, I did the right thing and asked the Local Mental Health Team for help – all they did to tell me I had “two arms and two legs, so why don’t you just get a job” – as if the cure to severe depression and unemployment were the same things – to be humiliated for being unemployed. (It’s okay I’m not suicidal anymore!)

What ever Labour did to help people they did almost nothing to help people who had already been let down, only helping preventing it happening to another generation.

And yet with some proper help I can recover properly and go to work. I know lots of people in my situation who have just been forgotten. And it’s come back to haunt Labour, as recent statistics (I can’t remember the source) have said that social mobility has got worse under 13 years of Labour – presumably because it is a lagging indicator and is reflecting people like me who grew up under the Conservatives, and were subsequently ignored by Labour.

During the recent elections Labour promised a ‘Guarantee of a Job’ – you guessed it, ‘for all young people’.

I just thought you might be interested in knowing about the kinds of people who get left behind in job creation schemes etc. In case you have any clout and can make governments wake up and do the job they are suppossed to be doing properly.

Dear CharlesJ 10:00

I am very sorry to read your story and all strength to you for continuing to advocate for a better outcome for people in your position.

My Job Guarantee proposal is unconditional – anyone who wants a job can get one at a living wage. No-one should ever get left behind nor excluded.

good luck in the future.

best wishes

bill

Thanks Bill,

I’ve stumbled across your site trying to learn something about what’s wrong with my country, and have spent the last 5 hours reading your articles – keep it up. A picture is starting to form in my head, that I being sold alot of rubbish by just about everyone in with any authority or influence in the UK. I thought you might understand my gripe and you did – so delete my last post if you want.

By the way, our new coallition government in the UK looks like it’s struggling a bit – the whole ‘savage austerity measures paradigm’, so i’ll try and get other people to visit this site – and figure as much out for myself too.

Wikipedia idea looks really good.

Thanks again.

“Why not acknowledge that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency whereas all EMU governments have imposed gold-standard type constraints on themselves?”

But the US imposes the same type of “gold-standard constraint” on itself as the ECB imposes on the EZ by prohibiting direct Fed “financing” of government debt. No overdrafts are allowed.

The US merely has more centralized power to break the constraint rule if necessary than EZ countries do individually.

But it has to be able to break its own rules in order never to be “revenue constrained” in an absolute sense.

MMT seems to interpret breaking of the rules as if it’s operational fact.

It’s really more an MMT assumption. A realistic assumption, but an assumption.

Murdoch’s army is wining the worldwide indoctrination war. Bill, can’t you invite this guy to your beautiful country and take him sting-ray diving or something? Preferably with a solid gold weight belt – tell him he can watch its value rise the further down he goes…

I read Paul Krugman regularly and I am convinced he actually does understand the MMT point of view, and probably actually agrees with it, but hews to the conventional thinking about the dangers of deficits in his public statements in order to avoid being dismissed as a wild-eyed nutjob by “serious” people. However, I agree with you that by doing this Prof. Krugman is falling for a transparent ploy by the Republicans to shift the centrist position to the right.

Which brings me to my current theory about the Republican’s and deficits and MMT. I think the Republicans actually embraced a variation of MMT years ago as signaled by Dick Cheney famous statement that “deficits don’t matter.” The Bush administration aggressively worked to cut the link between taxation and spending by cutting taxes and liberally increasing spending, both military (the Iraq invasion) and social (the expansion of Medicare).

But what about the “starve the beast” rhetoric, the Republican supposed secret strategy to kill big government by increasing the deficit so much that social programs had to be cut? I don’t think there ever was a starve the beast strategy; it was just a story to buy time with the remaining fiscal conservatives in the Republican party. The Bushies knew they would blow the minds of the fiscal conservatives, and split the party, if they admitted to embracing MMT, so when confronted by fiscal conservatives they placated them with some story about how it was all really designed to screw the poor (you can get conservatives to accept any policy if you can spin it designed to screw the undeserving poor).

But back to today. I think the Republicans are still true-blue proponents of MMT. They are just using fear mongering about the deficit to discredit and undermine the Democrats so they can retake Congress and the presidency. Once the Republicans get back in power watch for them to forget all about balancing the budget and actually increase the structural deficit even more using tax cuts and increased spending on non-social welfare programs. The Republicans are not fiscal conservatives or even ideologues; they just want to increase the share of real output consumed by the affluent and decrease the share consumed by the not-so-affluent; and from moment to moment they adopt whatever ideological rhetoric will advance that goal at that point in time.

Bill,

Thanks as usual for the illustrative posting, but especially for pointing out that what stands as a progressive-type economist in Paul Krugman either doesn’t have a clue about, or simply refuses to acknowledge the existence of, something called a “monetary system” as being relevant to any aspect of the socio-economic impacts spanning the globe.

While I admit to being somewhat monetary-system-centric in my own perspective, I find from all my economist friends that it was the study of monetary systems “door” that they all avoided to come to understand the machinations of economic theory.

I personally feel that the study of monetary systems – as in DelMar’s “History of Monetary Systems” ought to be the pre-requisite for beginning the study of macro-economics, and therefrom to micro-economics, and not the other way around.

Having said that, I start with the Fox-fools skit on Jamie Galbraith and point out again the failure of MMT practitioners to differentiate between deficits and debts as the things that don’t matter.

That differentiation is centered on the point of whether the government must BORROW, and therefrom indebt, the amounts of deficit spending balances in order to fund the budgeted activities of what might be called a progressive socio-political agenda.

The Fox-fools department are given the fodder of massively increasing government debts, funded by private wealth and costed by private debt-rating agencies, due to the failure of MMT-protagonists to raise the possibility of a sovereign monetary system and the rights of the governed under such a system to “equity-fund” whatever amounts are necessary for what I call the “balances formerly known as deficits”.

Bill, the concepts contained in MMT can only be made more palatable to those from the Austrians like Ed Harrison to the neo-liberal centrists like Krugman if they include a thorough explanation of WHY deficits don’t matter under monetary sovereignty, and the answer is NOT that we can just continue to run up debts for the grandkids, but that, in fact, under such a system, we also CANNOT run up those debts.

Along with an explanation of how not, and why not.

Thinking Frederick Soddy here.

respectfully.

Well that was a nice, humorous post. Someone\’s in a good mood! Look, I just dunno about PK, because as much as I share his distaste of the right-wing lunatics given far too much airtime as it is, he is also a polemicist (talking about the rich, the wars etc). To be fair, I\’m sure he\’s trying to maintain mainstream credibility without giving too much ammunition for the \”loud voices\” of extremism (right wingers understand something very key – if you appeal to base instincts…and do it loud and often..you generally get a more than your fair share of bites). Still, his pulpit, as a Nobel Laureate no less, would be a terrific platform to educate people about MMT principles (though even economists I work give me a blank stare when I invoke MMT principles, so there\’s more than a last mile problem there).

The Fox clip was a cracker with the eye rolling and tut-tutting, though you could get a hundred of these through the day. It\’s an ignorant, aggressive and malignant network (and that\’s being kind), and a fractal of worst the US has to offer. I\’d be interested to see the inevitable stunned mullet expression from these vapid numbnuts were they asked to explain how the monetary system actually worked, what the differences were between countries and systems, what exactly they disagreed with and why etc. Now THAT would be good sport.

The problem you identify….\”Centrist positions now are out there a fair distance to the right and a long way from what we used to call the centre!\”….has been something I\’ve noticed also for a couple of decades now (making even ole Malcolm Fraser look like a softie), and seems to get worse in poor economic environments (see http://www.voxeu.org/index.php?q=node/5047). I see this this as kind of intuitive anyway given harsher environment tend to bring out the worst in people.

“But the US imposes the same type of “gold-standard constraint” on itself as the ECB imposes on the EZ by prohibiting direct Fed “financing” of government debt. No overdrafts are allowed”

This comment interests me as I try to wrap my head around MMT.

Where can I learn more about how the Fed is prohibited from financing government debt.

There’s a difference between something being politically difficult versus being actually proscribed.

I listened to an interview James Galbraith gave to some idiotic Rush Limbaugh style radio host a few months back (the link is somewhere on his website) and every single caller objected to the idea that the government isn\’t just a big household. James calmly and intelligently explained to them that this was a simple minded approach that replaces metaphor for thought and the callers, aside from being flabbergasted, just became more indignant. When James referenced the historical evidence of the six surpluses the U.S. has run which anticipated recessions (as he did in the article the idiot on Fox was sampling from), I was reminded of Brecht\’s Galileo when the members of the court refused to look through the telescope, and instead preferred the testimony of the astronomers. The idea that a sovereign government (legally and financially) is different in kind from a citizen and not just in scale seems to be beyond comprehension because so much of what people believe is built up around this deceptive metaphor. But the garbage from Fox isn’t the only problem. The Hip opposition in the media are equally responsible for the misinformation since they tacitly except the idea of financial restraint when trying to sound informed and overtly refer to it when they want to moralize against the war or the bailouts but don’t want the conversation to get too philosophical. Also, I love the sub-text in the comedy show posted above. “Think of the Morality” the Brit says, sidestepping the economics, and the female host mentions new credit-card restrictions on college students like U.S. government = college students. “Think of what this teaches our children\”, which is a great sentiment coming from the people who decry the “Nanny-state” since it implies a “Role-model State”. And this is another one of their tricks: to imply that the high levels of private debt are caused by the citizenry imitating the governments profligacy and not because they are trying to substitute through private debt what has been excised from public spending. Tina Fey (famous for lampooning Palin), on Saturday Night Live the other night, did a bit as stupid as anything on Fox with the pernicious assumption that the Greeks were lazy and glutinous (with shades of the old “welfare queen in a Cadillac” canard) – completely omitting the Greeks’ very low levels of private debt and the high number of hours they work. So a young liberal watching this show is going to get the impression that the problems over there are caused by weak morality – without ever watching Fox.

In correspondance with some economists I was asked to show with simple algebra the relationship between the adequacy factor in production and employment of resources and the level of output and prices. I post this here as well for those who are interested to see that full employment of resources does not always leads to rising prices.

Assume for simplicity (although not correct!) that we have a representative firm producing a single physical output (y), and setting a price (p) using a forward and monetary model (non spot/barter) with a discrete mode of production that has either systematic or random steps/jumps. The adequacy factor of resource utilization in production is a step which is equal to the inverse of the square root of overhead or indirect labor (E(L(0)(1/2)). This corresponds to the labor used for management/ maintenance of productive capacity/ sales promotion (Minsky 1986), labor recruitment (Farmer 2010) and other organizational requirements of a forward production and market firm. Indirect labor shifts with innovation while direct labor varies with output. Direct (L(1)) plus indirect (L(0)) employment is total employment and total labor productivity (a) is given by the state of technology of productive capacity. The wage rate of labor employment (w) and the rental rate of productive capacity (μ) are given. (Notice that the real wage is not equal to the MPL). (μ) includes the debt service cost of financing productive capacity requiring market power (MInsky 1986). After some simple manipulations of algebra, the systematic version of the equations of (p) and (y) are as follows.

y= aL [1-E(L(0))(1/2)] (1) Notice that as L(1)—->L, L(0)——>0 (spot production/market mode) and the real wage

equals the MPL and y=aL.

p= (w+μ) [aE(L(0)(1/2)](-1) (2)

Assuming full employment of labor and given the productive capacity and total productivity, a step change of the adequacy factor from innovation or reorganization of the mode of production, probably as a response to expected inflation costs, will correspond to a higher output and a lower price level.

anon: “But the US imposes the same type of “gold-standard constraint” on itself as the ECB imposes on the EZ by prohibiting direct Fed “financing” of government debt. No overdrafts are allowed.”

Not to worry. The Fed gives Treasury a break. Overdraft fees for them are only $10.00.

😉

In that case, let’s do it.

“The Greek government does not issue its own currency and has to “finance” every euro it spends. If taxes will not cover its spending desires then it has to issue debt. T”

There is a bit of a controversy going on about this at WM’s blog, that I’m not a completely without responsibility…And it’s far from resolved judging by the divergence in the comments. Look under post Marshall’s latest.

Basically, a US state keeps an account at a private bank. Greece, on the other hand, keeps an account at the ECB, so spending by the former is an increase in monetary base. Doesn’t this fit squarely with the definition of issuer of currency? Whether Greece is more restricted than the US, and ultimately may face its checks being bounced by the ECB would then be a political matter, not as much an operational as I had assumed earlier.

Have I got this right (I’m still learning)?

The reason why public-sector borrowing does not necessarily cause inflation during an economic downturn is because during such a period, unemployment, for a while at least, will be higher than normal.

This means it is an employers market and workers generally take what level of pay they are given cos they don’t want the sack for going on strike.

As a budget deficit kicks in, and the private sector begins to grow again and take on more workers, the balance of power gradually shifts from employer to workers, as the level of employment gets closer to its ‘Full Emplyment’ point.

Hopefully, by this time the automatic stabilizers come into affect, along with the increase in tax revenue due to better employment, and the public deficit reduces meaning less money needs to be borrowed and so reducing the threat to inflation which may only go up a bit.

My gut response to this blog entry: how to defend Pauli Krugman 😉

I genuinely like Krugman and his writings. Especially his book “The Conscience of a Liberal”. Now he’s certainly wrong from the MMT perspective. But I don’t think he’s an clueless idiot. So here’s my take how to read Paul Krugman op-eds:

Some years ago Peter Berger published “The Social Construction of Reality” and I think it’s still a worthwhile read. One of the thing he states is that society creates a “Symbolic Universe” to legitimate its social institutions. A set of beliefs everybody “knows” to put things in their right place. Now money and debt are very symbolic notions and people hold strong believes in regard to them. These believes are out of sync with factual reality but nonetheless they are real, because reality is also a social construct. They date back to the Gold-Standard and Bretton Woods. Berger explains when things change and the symbolic universe is under attack, Universe-Maintenance mode kicks in. Especially elite groups try to maintain the status-quo and provide new “scientific” explanations to validate and maintain the old symbolic universe.

Now as a journalist Krugman operates within this symbolic universe and he can’t ignore it. He can slightly shift the perspective but he cannot abolish it. Otherwise he wouldn’t have a lot of readers left. Also that’s not his job as a journalist. The attack on the old universe by presenting the new one is Bill’s job. All Krugman can do is follow-up on this Star Wars and nudge the public carefully in the right direction. He can’t change the social construction of reality over night. But I might be wrong and other commenter will correct me, that he’s just another Universe-Maintenance-Worker.

In reply to CharlesJ:

Here is how I explain to myself why printing money during an economic downturn will not cause inflation.

Inflation comes when too much spending is chasing too few goods and services. Supply and demand.

An economic downturn is, by definition, a condition where total spending is too low to keep everyone busy (hence high unemployment).

The government should be able to print money to finance public spending without causing significant inflation up to the point where more or less full employment is reached simply because total spending cannot outstrip the available supply of goods and services until full employment is reached.

By the way, most of the famous inflationary periods you have heard of were associated with reductions in the real supply of basic commodities while spending stayed constant or rose. Weimar? The French occupied the industrial Ruhr and the Germans there either stopped working at their jobs, or slowed down their work, in a campaign of passive resistance which reduced the real output of the German economy. Zimbabwe? Government appropriation of white-owned farms caused a dramatic reduction in food supplies. Stagflation of the 70s? The oil embargo + Iran caused reduction in oil supplies.

“I read Paul Krugman regularly and I am convinced he actually does understand the MMT point of view, and probably actually agrees with it, but hews to the conventional thinking about the dangers of deficits in his public statements in order to avoid being dismissed as a wild-eyed nutjob by “serious” people.”

If this is so, it constitutes a simple case of “la trahison des clercs.” Cowardice and intellectual dishonesty, or more bluntly, selling your soul for fame and fortune.

Very interesting article.

I don’t understand why money must be lent in to circulation by banks and why tribute to banks must be paid in perpetuity in the form of interest on a debt balance that will never be paid down.

Since banks create money from nothing when it is loaned into circulation, why are they necessary for this function when the state can create money from nothing and spend it into circulation without paying tribute to the private banks?

I have come to ask these questions after reading “The Lost science of Money” by Stephen Zarlenga.

“The government should be able to print money to finance public spending without causing significant inflation up to the point where more or less full employment is reached simply because total spending cannot outstrip the available supply of goods and services until full employment is reached.”

I feel that’s simplistic.

It can outstrip the supply of goods. There is no law that states you have to expand first, and only once you have expanded can you put prices up. Once an organisation is at full capacity, it is more likely to put prices up than expand if there is a fundamental lack of confidence. You make more profit that way.

Services I’m less certain about, as you can probably find somebody something to do. The problem I have with the ‘wisdom of Solomon’ idea of a Job guarantee scheme is that the public sector is notoriously bad at getting value out of people. So public jobs, which would have to be short term and interchangeable if the private sector was to have any hope of hiring people away, are likely to end up deteriorating into the classic ‘dig a hole and fill it back in’.

My thoughts around this was to make those people on ‘Jobs Guarantee’ available to the registered charitable sector. There usually quite good at getting maximum value out of people, and they are set up to deal with people dipping in and out of ‘volunteering’.

I want a world that provides for everyone but I’m struggling with how MMT could deliver that. I’m in the UK and I’m struggling to grasp how MMT or anything else could sustain our level of affluence and so keep us from the austerity measures we are told are coming. We get so much from the rest of the world (cheap manufactured stuff from China, oil, food etc) and provide little in return. Before the crisis, the financial speculation industry apparently “earned” our imports from trading in the global economy. I don’t see how we can sustain a level of consumption so out of step with that in the world at large unless we provide something valuable to them in return.

As a second point my fear is that government spending has a tendency to fund regulators as that is the easiest way to find something to keep people occupied. Regulators actually damage the prospects of getting useful stuff done as they get in the way of people trying to do real work.

to glenn

the questions of seigniorage and the rental of the debt-money system by the sovereign people with the power to create their own money system only seems to arise in the chartalist discussion as a matterof how to deal with the public sectoral balances now known as the deficits of the annual budget.

Among the chartalists there is certainly far from unanimous support for the notion that the government should not need to borrow those balances, absent the self-imposed constraint of a legal requirement to do so. So we passed a law that says that we the people must borrow those balances and that is why we now borrow those balances.

But certainly a comprehensive program of monetary reform would include the abolishing of that self-imposed constraint immediately.

While only taking care of government borrowings, it would open the door to the full replacement of fractional reserve debt-money, so-called banking as we have known it with a system of government-issue, equity-money, or debt-free money, to level the playing field of free enterprise.

Andy,

“Stagflation of the 70s? The oil embargo + Iran caused reduction in oil supplies”

Sorry, this is a typical neoclassical myth. Stagflation had nothing to do with oil. Firstly, the ‘stag’ was caused by a collapse of a world-wide real estate boom (hence, why construction and manufacturing in non-oil intensive sectors investment collapsed the most, and well before the oil shock, at least in the UK – let’s not forget the second banking crisis!).

Secondly, the inflation was the result of a huge explosion of transfer payments; transfer payments rose exponentially, whilst private investment and utilisation capacity was contracting. Literally. In fact, most of the inflation and rise in interest rates took place well before the oil shocks:

http://www.mees.com/postedarticles/finance/general/a47n35b01.htm

http://www.rba.gov.au/publications/confs/2009/kilian.pdf

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=588243

The data simply does not support the claim that stagflation was caused by oil shocks. Minsky has come the closet to identifying that stagflation had nothing to with oil, but finance of REITs (the ‘stag’) and transfer payments ‘the flation’.

Indeed, if anything the oil shock made the economy grow faster; e.g. demand for fuel efficient cars increased; employment in the oil sector rose by 400 000 jobs in 1974-75.

Steve

Stephan, this is indeed the problem. Every culture is defined by its universe of discourse, and the boundaries of this universe are created by the norms. These norms are the given and form the basis of the conventions and institutions. See 1993 Nobel Douglass C. North, Economics and Cognitive Science. (It’s a short paper and well worth the read.) If one steps outside of these boundaries, one is automatically marginalized.

People do break through, however. In psychology, Abraham Maslow confronted Skinner’s behaviorism and ultimately won. I was involved at the time and remember a top name (like Paul Krugman in economics) circulating a private paper signaling his assent, but he would not come out in public until much later, when the coast was clear, so to speak. He was tenured professor at a major university with a huge reputation. Big investment to risk if things went the other way. I think a lot of people in economics are in that bag.

Paul Samuelson admitted as much in this quote in a recent Randy Wray post.

paul-samuelson-on-deficit-myths

There is no way that the people at the top don’t understand a fiat currency and its opportunities. After all, why did President Nixon shut the gold window for in the first place? It is impossible to be economically literate and historically aware and not know this. Maybe not all the details, but the overall picture is clear. The gold standard myth is a holdover that still functions as norm in the prevailing universe of discourse in order to provide a brake for “excessive spending” by politicians. But when that spending is for “necessities,” like wars and bailouts of the financial system (read financiers), then “deficits don’t matter.” It’s the same with the voluntary operational constraints imposed by law. They are observed to prevent “too much public spending” but when its about “necessities,” then it turns out that the Fed has “emergency powers” that allow it to circumvent the rules. And so it goes.

For a study of the cultural underpinnings of money symbols, I heartily recommend “Savage Money” by Chris Gregory of the ANU (Interestingly, his work seems very close to chartalism without referencing chartalists – he goes to some lengths to show how Friedman’s quantity theory of money ignores the meaning/role of state taxation – a bit of independent rediscovery perhaps?).

Stephan,

If a wealthy, tenured, Nobel-Laureate economist does not have the freedom to say what he believes, but it is up to Bilbo Baggins burrowing in his Aussie Sand Dune, then this is a “voluntary constraint” not an “external constraint”.

P.S.

When did “naked” become a slur? Naked Keynesianism doesn’t sound so bad.

RSJ,

lol!

There’s a George Michael song “Father Figure” and it starts “Thats all I wanted something special, something sacred in your eyes … For just one moment, to be bold and naked at your side”

The problem with krugman and almost all economists is that they can’t explain (or even consider) the difference between price inflating with currency and price inflating with debt.

“If you care you can read the Results. My only reaction was that this country has nuclear weapons. The leaders on both sides of politics are nuts. Ignorant is too kind an epithet to describe them.”

I’m of a different opinion.

The democrats are out to spoil their rich friends using gov’t debt and a price inflation target.

The republicans are out to spoil their rich friends using private debt and a price inflation target.

In both cases, it is about the rich getting richer.

Tom Hickey said: “After all, why did President Nixon shut the gold window for in the first place?”

IMO, it was because the rich wanted to run a trade deficit without interest rates going up and to allow the rich foreigners to acquire financial assets in the USA.

Correction! In my last post I have erroneously written eqn. (2). It should be p= (w+μ) E[(α(1-Ε(L(0))(1/2)](-1) (2)

Unfortunately writting math is limited and mistakes are easy to make!

For those interested the simplified model is extended a) to determine the real rental rate and the level of employment given the level of effective demand and b) to include more dynamic features.

Dear Bill,

Like CharlesJ I have no formal training in finance or economics (am sure it shows)! My understanding of MMT begins then, very simply – without money. I start with real people and real resources: what to do with the wheat in the fields or the oranges from the orchards; the minerals in the ground, and all of the goods and services people can produce. All of the ideas that may exist about using these, (to draw from a Teacher who existed over 5000 years ago called Patanjali) could be called “the rain-cloud of knowable things” – well, in the realm of commerce at least. What precipitates from this cloud is a reflection of human nature, and manifests as a physical reality (which we love to contemplate, hypnotically!).

If on top of all of the goods and services produced there is a legal system to stop people hurting each other and stealing from each other well and good. If there is a government to make decisions about the use and distribution of the resources in the broad public interest, even better. Obviously, all of this could happen in some form or another without money – like it did, a very very long time ago! (Money, I am told, is just a symbol and token of what we could probably call ‘concretised energy’ – used to enable resources). In the end, it’s all about distribution and usage of the resources; equity, justice, mutual benefit. It’s really all about people!

It’s NOT about money! Why? Because the government of the day (should be) is the sole issuer of money (these days) and can issue or destroy as much as it likes. This should probably be hitched up to a sky-banner and flown across the cities every weekend until people begin to wake up. Money is the joystick for all of those lovely resources, and woe betide the citizens and the government that hand it over to others to play with (big noses) and control. Such a government is a failed government. To govern means to steer the economy in such a way that the best use and distribution is made of existing resources. Buying and selling to me, is just a way of sharing; and sharing is a way of multiplying a benefit to many people, that may otherwise have remained in the hands of just a few. The real knife edge, on which everything falls on one side is called selfishness, and on the other side are the multiple benefits of sharing.

The whole economy is just one big mirror showing to us these aspects of ourselves. It’s not about money although that is what everybody incessantly talks about! To me its not even about the distribution of resources although that is important. It’s about being human, and discovering what that actually means: it’s about looking in the mirror and liking (or not liking) what you see. It’s about satisfying an innate urge, inside of every human being that has ever stepped out onto this earth – to be fulfilled!

So, I think that it is important that people understand the potential of money, to establish those conditions on our earth that will allow people to have the time and comfort to appreciate their existence: joy and happiness are the most important aspects of this stepping out – from the moment of birth to the very last breath. Besides, what else can you take with you from this world, that is real?

Cheers ….

jrbarch

In reply to Neil Wilson, who said:

“[With regard to goods] [t]here is no law that states you have to expand first, and only once you have expanded can you put prices up. Once an organisation is at full capacity, it is more likely to put prices up than expand if there is a fundamental lack of confidence. You make more profit that way.”

I would have agreed with you 40 years ago. However, in this globalized era there is a vast horde of entrepreneurs spread all over the globe (many in China, but it’s not confined to China) looking for opportunities to make money in manufacturing. If Manufacturer A decides to raise prices because of increased spending by the government (financed with printed money), then there is a very good chance that someone in China is going to throw up a factory and try to cash in on those higher prices.

Also, we are talking about an economic downturn. Let’s say prices were at a particular point at the peak of the business cycle before the downturn began. Why would prices go up if the government simply prints and spends enough money during the downturn to get aggregate demand back up to where it was at the peak of the business cycle? The aggregate demand is the same; shouldn’t the price level be the same?

Bx12, Tuesday, May 18, 2010 at 2:42, continued:

Let me synthesize my views on this thread. Hopefully, it will motivate a rebuttal.

Here’s how I would frame the debate :

A = [ Greece spends by crediting bank accounts, resulting in an overall increase of banking reserves, because its account keeper is the ECB]

B = [Greece is issuer of the Euro currency]

Either i- A does equate B, or ii- A is false

ii- would be hard to be believe as the Euro legislation says clearly that ECB via the NCBs are fiscal agents of the govs. If i-, then “issuer of its own currency” is a misnomer.

The issue of whether an overdraft at the CB would be allowed if necessary, is separate. Legally, anyway, the US gov does not have that privilege either.

My interpretation is that currency issuance (as a result of deficit spending) in the Euro zone is distributed among member states, whereas it is centralized (Federal gov) in the US.

Both in the US and in the Euro-zone, however, central banking is decentralized : Branches in the former, NCBs in the latter. The operational realities are not fundamentally different.

However, whereas there is one market for US Tsy’s, each nation in the EZ issues its own Tsy’s, so that the markets are able to attack the weakest link (Greece).

If the Euro-members had a centralized bond issuing auction, as they have for coins and bills, the Euro and the US would on par in terms of credibility.

That’s not to say, in this new configuration, that neither the US nor the Euro would not be tested by the markets, but such an event is less likely than it is for a small entity such as Greece. The downside, however, is that in this much less likely event, the consequences would be more dramatic.

Who would come to the rescue of the US/Euro? I guess the CB would eventually overrule the no-overdraft legislation to avoid a return to the bronze age. But if it gets to that, the Greek problem will look like pittance.

“Having your own currency, it seems, makes a big difference.”

When I read that I couldn’t help but think of Hamlet:

“Seems, madam! Nay, it is; I know not ‘seems.'”

Like commenting on why sharks can stay submerged under water longer than a porpoise;

It seems gills make a difference!

Tom Hickey says:

“After all, why did President Nixon shut the gold window for in the first place?”

Could this be a reason?

And BTW the closing had already started when LBJ was president.

14 March 1968

Big dollar crisis: the price of gold on London gold market have increased to $44 per oz. The gold market is closed. During the weekend 16-17 March in Washington where all active members of the Gold pool have gathered – that is all except France. The signification of the “solution” is that the Second Gold Exchange Standard de facto ceases to exist when USA no longer unconditional exchange dollar for gold on request from Central Banks. The Gold pool is abolished, which means that price formation of Gold outside the Central banks is let free. The London Gold market is not open until beginning of April.

It was turbulent times back then; there was an annoyance in Europe concerning USA buying real European assets for deficit dollar. De Gaulle had threatening to expropriate American assets in France at book value paying with the accumulating dollars in the Central Bank.

Conspiracy theories then were that USA initiated the boost in oil prices to wipe the European balance sheet clean of dollar with a higher energy bill for Europe. USA was at the time a major oil producer an at boost in oil price would give nice profits to American oil producers and foreign taxes was to deductable in USA for the American oil companies. Another idea was that Nixon wanted to create an advantage for the emerging nuclear energy production.

The French arab-oil expert Nicohlas Sarkis did tell the story about an OPEC summit in Alger 2 June 1972 when Nixons energy tsar James Akins (later ambassador in Saudi Arabia) did drop a “bomb” at the summit, he told them that some oil producers planed to double the oil price, the arab oil experts was stunned nothing they have heard anything about. According to Sarkis it was followed by similar provocative “invitations” from USA. A famous American journalist then, Jack Anderson, did claim he hade informers inside ARAMCO that have revealed documents that ARMCO tried to push Saudi Arabia to levy higher taxes on oil production.

Might be so or maybe not, but if so the thing did probably get out of hand and OPEC did levy their new weapon beyond expectations.

“After all, why did President Nixon shut the gold window for in the first place?”

Michael Hudson explains all this in detail in “Superimperialism.”

http://www.soilandhealth.org/03sov/0303critic/030317hudson/030317.imperialism.pdf

Hmmm. Looks like the book isn’t downloadable any longer–just the intro.:

The story of how the U.S. Government, operating over the last century with what might seem a long-range plan, created a super imperialism that controls most of the planet primarily through financial manipulation, and until recently, used military force only as secondary measure. Hudson wrote with such mental clarity that one chapter, his lengthy “Introduction,” comprehends all the major points in the book. The Introduction alone should provide a series of major realisations to someone who has already been observing the resort to force happening with ever-increasing frequency and magnitude. To download just the introduction, click here. Super Imperialism can be purchased in-print-on-paper through all the usual channels of retail trade.The entire book downloads as a PDF of 1.52 mb. AVAILABLE HERE WITH PERMISSION OF THE AUTHOR.

There’s a review of the book here:

http://www.globalresearch.ca/index.php?context=va&aid=14195

Superimperialism available here:

http://www.multiupload.com/C04JKZTCF6

Also very interesting:

The Globalization Gamble: The Dollar-Wall Street Regime and Its Consequences, by Peter Gowan (recently deceased).

http://www.marxsite.com/Gowan_DollarWallstreetRegime.pdf

Split the USA into countries whose borders are delineated by the current federal reserve districts :

Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco.

That’s a total of 12.

– Keep the US dollar as the common currency, let Fed+12 branches keeps its tools and don’t change its inflation mandate.

– Instead of one Federal Treasury headquartered in Washington DC, allow each country to have its own treasury whose fiscal agent is, obviously, the federal reserve branch in the same country.

In particular,

– spending and tax collection are now decentralized.

– Each of the Boston, NY, Philadelphia, Cleveland etc. treasuries issue their own treasury bonds, and there is therefore a bond market for each.

I claim : this is a template for the EMU, except there are 12 countries, not 16.

If the US was solvent before the split (MMT claim for the US), why would it not be after the split?

Conversely, if it is not solvent after the split (MMT claim for the eurosystem), why then should it be solvent before the split?

————————————————————–

It is easier to rock a small boat (12 of them), and ultimately make it capsize, than it is for a big ship.

I claim : this is why Greece is being tested first, not the US.

That’s not to say Greece is not ultimately solvent, but it depends on the following:

Each boat/ship may have a special flotation device on board to prevent capsizing, but for obscure reasons, it’s use is strictly forbidden, and only the master captain has the code to unlock it, so what happens in case of emergency is a matter of … speculation.

I claim : this special flotation device is the overdraft at the Fed or the ECB, and the master captain are Bernanke and Trichet, respectively.

may be someone can explaine this to me.

who issues the euros , the greek central bank or the ECB.

if the greeks do, then cant they keep issuing euros, regardless of what the regulations say about how bigger deficit they can run.

they have allready being doing this, and they have been caught out. so why not just flout the rules and keep issuing euros and see what the EMU will do .

i mean whos going to take them to court or have the guts to expell them. the germans can may be invade them, they are good at that.

they only have legal constraints, which arnt worth the paper they are written on somnetimes. the germans werent any good at keeping to their word, munich agreement and all.

so why not keep issuing euros.

im sure i am going mad, but perhaps someone can enlighten me as to why this is not possible.

Hi Mahaish,

Here is an attempt. At the cost of confusing you, the NCBs can print as much as they wish! There is no limit set by the ECB. This is because the ECB understands that demand for currency notes is actually demand-led! For a more legal treatment see this legal framework document by the ECB. DECISION OF THE EUROPEAN CENTRAL BANK of 6 December 2001 on the issue of euro banknotes. Its somewhat confusing though. (2) says

Currency notes accounting is done in such a fashion that it always appears on the liabilies side of the NCBs and the ECB. For example, an NCB for some reason get currency notes. One example is: An NCB sells you furniture and you pay them with Euro banknotes. They adjust their balance sheets and reduce the item “Banknotes in circulation” in Liabilities.

The reason, I pointed out to the fact that currency notes always appears on the liabilities side is that it is possible that the Greece NCB- (Bank of Greece) receives some payment in banknotes which have been issued by the Deutsche Bundesbank – the German NCB. One may be left with the ambiguity – does the Bank of Greece increase its assets or reduce its liabilities ? Answer: the latter. (!)

Secondly, the NCBs or the ECB cannot purchase government securities directly from the governments. They can purchase it from the secondary markets, but only if the ECB decides/allows/asks the NCB(s) to do so.

Have you been reading Paul Krugman’s columns and blogs on a regular basis or is this a response to a single post read in isolation?

If the latter, you should read more of his work, including:

1. Posts where he explicitly notes that a major portion of Greece’s problem (as opposed to the problem of the countries whose banks hold Greek debt) is that it is using the euro and not a currency of its own.

http://www.nytimes.com/2010/02/15/opinion/15krugman.html

http://www.nytimes.com/2010/05/07/opinion/07krugman.html

http://krugman.blogs.nytimes.com/2010/05/17/et-tu-wolfgang/

Not to mention his articles on the distinctions between a floating currency and a pegged currency with respect to financial crises:

http://web.mit.edu/krugman/www/crises.html

2. Posts where he explicitly notes that government debt levels are not a fundamental economic problem but a political problem – one of perception.

http://krugman.blogs.nytimes.com/2010/03/05/debt-is-a-political-issue/

http://www.nytimes.com/2010/04/09/opinion/09krugman.html

3. Posts and articles where he explicitly notes that the U.S. (and Japan) have the power to create money in ways other than borrowing:

http://krugman.blogs.nytimes.com/2009/03/20/fiscal-aspects-of-quantitative-easing-wonkish/

http://web.mit.edu/krugman/www/trioshrt.html

That isn’t to say that he got it all right and that there is nothing to criticize, but it seems to me that your claim that “he doesn’t have a clue about what is really happening in the macroeconomy” is not justified.

So if you have read his earlier work and still chose to do such a hatchet job, shame on you for your ethics. If you hadn’t read his previous work and based this only on one short article, then shame on you for your lack of due diligence and you owe Paul Krugman an apology.

Other way, the one shown naked here is you, which is a great disappointment to me.

Are bees smarter than people? I’ve never seen an unemployed bee.