These notes will serve as part of a briefing document that I will send off…

Fiscal policy must be the tool of choice to respond to major climate related calamities – BIS

“Fiscal support can manage the direct economic fallout from extreme weather events.” That quote came from an interesting new research paper published in the 98th edition of the Bank of International Settlements Bulletin (February 10, 2025) – Macroeconomic impact of extreme weather events. The paper seeks to tease out what the economic impacts and policy implications are of the climate changes that are now manifest in various extreme weather events, such as droughts, wildfires, storms, and floods, which are increasing in incidence across the globe. The researchers recognise that such events are increasingly imposing “high economic costs” and “social hardship” on communities around the world. Their conjecture is that the “most extreme weather events have been rising and are likely to increase further” which will challenge policy makers. They discuss the implication of this increased exposure to such events for fiscal and monetary policy but recognise that fiscal policy must be the frontline tool to respond to the damage caused by such events.

The BIS researchers are associated with the “BIS Americas Office” and chose to study that region (8 major economies) although they indicated the analysis applies elsewhere.

The focus is because the “macroeconomic impact” of extreme weather events “is already tangible in the region” (Americas).

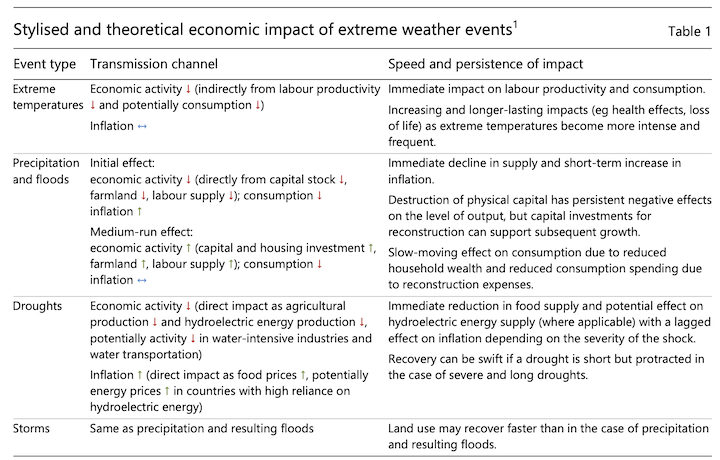

Their observation is that the different events have different macroeconomic impacts which are summarised in their Table 1, which I reproduce below.

One of the interesting observations is that:

A key feature of extreme weather events is that their direct impact is localised.

Which suggests means that regional cooperation is indicated to ameliorate the national impacts (for example, “Economic activity may temporarily increase in other regions to cushion the supply shock in affected ones”).

Although that shock absorbing capacity is limited if, for example, the impacted region is the home to a key sector (“responsible for a large share of production or consumption of specific goods”).

The researchers also examined the ‘role of insurance’ as a mitigating factor in reducing the macroeconomic impacts of event disasters.

There are two major problems in relying on the private insurance industry for relief.

First, it is clear that insurance premiums are rising which for many households and businesses makes it impossible to maintain cover.

There is evidence of a strong correlation between losses from natural disasters and non-life insurance premiums.

Second, many insurance companies are withdrawing their cover in certain regions and/or for certain events.

This withdrawal creates what the authors call an “insurance gap” which is the proportion of the losses that are covered by the insurance policy.

The authors suggest:

Given the large insurance gap and the need for fiscal relief measures, disasters can increase fiscal deficits and sovereign debt yields, affecting the fiscal space to react to future shocks.

Which introduces the first mainstream fiscal fiction about fiscal space.

The assertion is that if private insurance fails in the face of increasing extreme event damage, then fiscal deficits will rise, which will push up government bond yields, and reduce the capacity of national governments to respond to further major negative shocks.

The assertion is wrong but because it has so much traction among orthodox economists who advise policy makers, it serves to inform a host of voluntary constraints on government policy settings, which make our responses to climate change less effective (to say the least).

First, there is no direct relationship between the size of fiscal deficits and the yields that government bonds issue at.

Second, if, for some reason, the bond markets became increasingly risk averse and demanded higher yields, and if the government thought the income flows that would follow from interest repayments was not appropriate for the given macroeconomic settings, then it could instruct the central bank to engage in yield curve control à la the Bank of Japan at present.

Third, a national government that issues its own currency could stop issuing debt altogether given that it is not needed to facilitate government spending and the central bank has alternative ways to manage liquidity as part of its interest rate maintenance operations (for example, paying a support rate on excess reserves).

Fourth, a currency-issuing government’s spending capacity in financial terms is always infinity minus a penny.

How much of that capacity it chooses to use (that is, the level of government spending) depends on its objectives and the state of spending and saving flows in the non-government sector relative to available real (productive) resources.

The capacity to spend up to that financial limit today is not conditional on what the government spent previously.

The choice of how much to spend in any one period is conditional in the sense that if the government has been running its fiscal policy appropriately and maintaining full capacity utilisation of the available productive resources, then its fiscal space is limited in the current period.

Note, fiscal space is not a financial concept as implied by the BIS researchers.

Fiscal space is a real concept and reflects the available productive resources that can be brought back into productive use by government spending.

Fiscal space is limited at full employment, but immense when there is mass unemployment.

It has nothing to do with the deficit to GDP ratio or the public debt to GDP ratio.

So using discretionary fiscal policy to remedy the consequences of an extreme weather event, for example, is not limited in financial terms.

But if governments believe the fiction that past deficits limit their current fiscal space then they are prone to making poor policy responses.

For example, in February 2022, there was a major flooding event in northern NSW (Australia), a region where the so-called ‘Northern Rivers’ dominate the landscape.

You can read about that incident in this UK Guardian article (February 20, 2023) – The never-ending fallout of the northern rivers floods: ‘People are just worn down’.

Major flooding occurs in that region at 9.72 metres above the – Australian Height Datum – which is the benchmark against which vertical heights are measured in this country – and is approximately the average sea level of “thirty tide gauges positioned around the entire coastline.”

The Levee Wall Protection in place can resist up to approximately 10.7 metres AHD.

In 2017, there was a major event where the water level in the rivers rose to 11.59 metres AHD.

But in 2022, the level rose to 14.4 metres AHD – massive – the largest natural disaster since Cyclone Tracey in 1974 wiped out Darwin.

Lismore is a medium-sized country town and around 20,000 households were seriously impacted.

The government responded with aid but the scale of support was inadequate – fiscal constraints were used to ‘justify’ the moderate assistance.

Many families are still living in caravans, tents etc 3 years after the event.

Further, as a result of an unwillingness of government to spend the appropriate amount necessary to relocate the flood prone part of the town to higher ground, the rebuilding has been done in situ – which means that massive losses will be repeated when the next flood occurs – and they are occurring with increasingly frequency.

It also cannot be said that the government faced resource constraints – building materials that have been used to rebuild the houses that were destroyed could have easily been used elsewhere where the flood threat is lower or non-existent.

The BIS researchers then sought to statistically estimate the negative effects of extreme weather events.

They found:

1. “significantly negative effect of extreme weather events on output in the short term, but their effects on long-term GDP growth are mixed”.

Droughts lead to a “strong negative effect on GDP growth over the following six quarters … while storms, floods and wildfires do not.”

For the US, storm damage costs about 0.25 per cent of GDP between 2000 and 2023.

2. “The effects on inflation vary in both magnitude and direction, depending on the type and magnitude of the shock.”

Inflation falls “after extreme temperature shock”.

Effects are “short-lived” increasing “temporarily over the three-month period after most types of disaster”.

The more extreme the event the “more pronounced and persistent effect on inflation”.

Storms – push up energy inflation for one month.

Wildfires – “strong increase in food prices only two to three months after the shock”.

“Overall, we do not find a persistent impact of extreme weather events on inflation”.

3. Overall “average annual cost of natural disasters was sizeable … The worst events in these countries caused damages over 10 times larger than the median” and vary across nations depending on the type of event.

I consulted the – EM-DAT International Disaster Database = which is housed at the Centre of Research on the Epidemiology of Disasters (CRED) at the University of Louvain in Belgium.

Between 2000 and 2025, they record 132 major natural disasters for Australia including Drought, Flood, Infestation, Storms, and Wildfires.

In terms of total $US damage in thousands, they estimate (the data is not perfect) that the costs of the events are:

Drought $US 4,844,049 thousands

Flood $US 3,3415,798 thousands

Infestation $US 212,336 thousands

Storm $US 664,3507 thousands

Wildfires $US 25,677,500 thousands

So very significant in terms of total impact on GDP.

I am studying this dataset more carefully and will report more detail in due course.

The BIS Paper finally considered the policy implications and argued that:

Fiscal support can manage the direct economic fallout from extreme weather events.

Which was the opening quote.

This is a significant recognition from central bankers as to the relative importance of fiscal and monetary policy for macroeconomic stabilisation in the face of negative shocks.

Fiscal policy can always reduce the negative income losses arising from such events.

They then argue that:

Whether and how monetary policy responds depend on: (i) how a specific event affects physical capital; (ii) the relative effect on supply and demand; and (iii) the risks of second-round effects on inflation and inflation expectations.

Once again this is significant because it demonstrates that even with the mainstream paradigm, monetary policy is limited in what it can do.

They conclude that:

… tightening monetary policy can be appropriate if the impact of an extreme weather event on inflation is expected to be more persistent.

They claim that if fiscal policy is constrained then it is better “‘looking through’ inflation”, which means that the impacts on the supply-side on prices from the extreme weather event are likely to be short-lived and as long as there is no evidence of persistence excess demand, then central banks should not react and just wait for the inflationary impacts to dissipate.

This logic bears on the recent monetary policy shifts in response to the pandemic-induced inflation.

As regular readers will know, I argued at the outside (in 2021) that the inflationary impacts of the pandemic (and then Ukraine and OPEC+) would be transitory and that there was no evidence of a structural excess demand (too much spending).

In that case, the central banks should have maintained their monetary policy positions (that is, not hike rates) in the way that the Bank of Japan did.

Then the massive income redistributions from low-income mortgage holders to high-income financial asset holders would not have occurred.

And the inflation would have dropped as the supply factors abated, which is what happened.

But being the BIS, they had to revert back to Monetarist doctrine form.

They claim that central banks would have to consider “an increased sensitivity to inflation after the recent bouts of higher inflation and the resulting high price levels in many countries” because:

… even small and short-lived shocks to inflation could lead to a more persistent increase in inflation expectations.

This was the argument that central banks used in the recent inflationary episode to justify increasing interest rates.

The RBA, for example, kept warning us that inflationary expectations were possibly going to break out if they didn’t bring inflation down quickly.

There was never any hint of that happening (the breakout) and it was just a ruse to give the RBA cover.

Interestingly, the BIS authors close with the observation that if a major weather event wipes out physical capital or housing then:

… the economic costs of an increase in policy rates (ie high rates slowing the rebuilding of the capital stock and thus leading to longer periods of lower productivity growth) may outweigh the costs of short-term increases in inflation.

Central bank policy makers rarely acknowledge the long-term damage of interest rate hikes.

They talk about getting inflation down quickly but ignore the possibility that their rate hikes will reduce long-term investment in productive capital, which leaves a nation more vulnerable to stagnating growth hitting up against a ‘lowered’ inflation ceiling as a result of the slow growth in potential GDP (as a result of the lagging capital formation).

Conclusion

Finally, while I found the BIS discussion interesting it was focused on what happens when a major weather event occurs.

Another discussion is how to reduce the vulnerability to these events before they occur in the face of climate change.

In that context, the fiscal implications that arise from policies that will be required to transit to low-carbon economies are massive and monetary policy has little to offer in meeting that challenge, other than to avoid hindering necessary capital formation.

That is enough for today!

(c) Copyright 2025 William Mitchell. All Rights Reserved.

Neoliberal ideology works a lot like the polls: they can’t shift too much from the truth, so it can continue to be accepted as macro economics.

If the gap between truth and lies becomes too big, it will naturally become an hoax.

What does a tornado or a forest fire care about fiscal policies?

Suggestions as to how to add to our ecological footprint, albeit at a slower rate, are a dime a dozen.

No evidence exists that fiscal spending can *reduce* humans’ ecological footprint. But a reduced EF is what is necessary.

Electrification, to the extent that it reduces carbon emissions, reduces the *rate* at which humans’ ecological footprint *grows*. But electrification, like all historical additions of new energy sources, nonetheless *adds* to our total ecological footprint.

Economics needs a theoretical framework that begins from environmental resource limits, not from spending needs.

Do you agree with this Bill from Neil? I don’t fully understand what “real resource constraints.”

“The planning would be in physical terms – much as budgeting for a war is. That would get translated into monetary terms. The problem at the moment is everybody starts talking money first, rather than thinking through how to deploy resources as we would if we were at war. It isn’t a new idea. This budgeting concept is in “Full Employment in a Free Society”, but then they were in a war at the time and more used to thinking like that. The real resource limit is when government runs out of things to buy at the price it is prepared to pay. That’s when government spending stops. Moving resources back to the private sector is fairly simple. Moving the other way is more difficult and the tools imprecise – taxing and banning things. There will be collateral unemployment, and that’s what the Job Guarantee picks up. The size and spread of the JG buffer is the real time data on resource usage. The control data coming back to the Treasury would be the current position of the JG buffer across the nation, and any “unable to purchase at that price” failures from the departments.”

Isn’t expropriation also possible? Sure, it could undermine support for the Government but that depends on who are targeted.

All the privatized state assets can be nationalised. The only people who will complain are the oligarchs (and their neoliberal supporters).

Shouldn’t fiscal space also include real resources like energy, natural resources (fresh water, minerals, …), materials, etc? After all, of workers exist but resources don’t then spending will not be immediately productive without first spending to acquire the necessary resources. No?