These notes will serve as part of a briefing document that I will send off…

ECB research shows that interest rate hikes push up rents and damage low-income families

I have been arguing throughout this latest inflationary episode that the central bank rate hikes were actually introducing inflationary pressures through a number of channels, the most notable one in the Australian context being the rental component in the Consumer Price Index. The RBA has categorically denied this perversity in their policy approach, and, instead, claimed the rapidly escalating rental inflation was the result of a tight rental market, end of story. Well the rental market is tight, mostly due to the massive cutbacks in government investment in social housing over the last few decades. But the rental hikes followed the RBA rate hikes and the simple reason is that landlords when in a tight market will always pass on the costs of their investment mortgages to the tenants. They weren’t doing that before the rate hikes. A recent ECB research report – How tightening mortgage credit raises rents and increases inequality in the housing market (published January 16, 2025) – provides some robust evidence which supports my argument. That is what this blog post is about.

https://billmitchell.org/blog/wp-admin/edit-comments.php

The ECB research report notes that:

Housing affordability is a hot topic in many euro area countries. Steadily increasing rents and historically high house prices are forcing many households – particularly young people and city-dwellers – to devote ever more of their income to housing.

The same can be said for Australia.

The latest – Housing Affordability Report (released in November 2024) – by ANZ-CoreLogic shows that:

Affordability metrics have worsened, with the median dwelling value-to-income ratio rising to 8.0. Median income households needed 10.6 years to save a 20 per cent deposit.

Other data (cited in the Report) shows that:

1. Gross median household income rose 2.8 per cent in the year to September 2024, while median housing values rose 8.5 per cent and rents rose 9.6 per cent over the same period.

2. The 20-year average dwelling value to income ratio in Australia was 6.7 and by September 2024 it was 8.

3. The 20-year average “years to save a 20% deposit” was 9 and by September 2024 it was 10.6.

4. The 20-year average “% of income required to service a mortgage” was 36.6 per cent and by September 2024 it was 50.6 per cent.

5. The 20-year average “% of income required to pay rent” was 29 per cent and by September 2024 it was 33 per cent.

6. “Modelling for September 2024 shows only 10% of the housing market would be genuinely affordable (require less than 30% of income to service a loan)2 for the median income household. This is well down on the 40% of Australian homes that were affordable for the median income household in March 2022.”

The rent inflation is also running faster than the overall inflation rate and is now causing persistence in the overall rate.

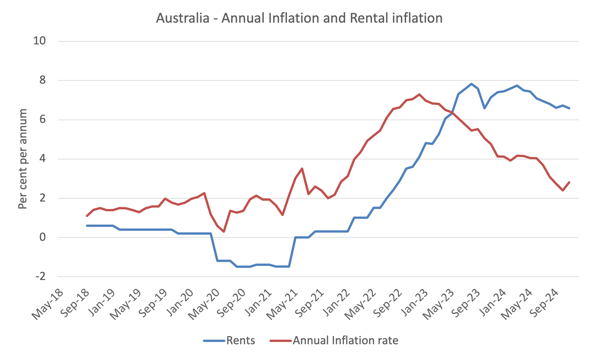

The following graph shows this for Australia.

Note that the so-called ‘tight rental market’ (the RBA diversion ‘speak’) was tight well before the acceleration in rents in the first part of 2022.

The dip in rental inflation during the early years of COVID was because fiscal policy provided rent relief – another demonstration as to how expansionary fiscal intervention is anti-inflationary rather than the opposite.

We are now seeing that effect in the electricity relief schemes in Australia which have countered the price gouging by the privatised electricity providers.

But what happened that period?

The RBA started hiking interest rates and the acceleration in rental inflation then took off.

The ECB Report considers another aspect of central bank policy in this regard.

They note that when the monetary authorities tightened “credit conditions by introducing limits to mortgage debt for banks or for borrowers” to cool housing inflation, the reduced access to mortgage credit reduced the “welfare for renters and prospective buyers.”

The policy had two broad effects:

1. “The wealthier households can opt for a cheaper property than they originally planned – perhaps smaller, of lower quality or in a cheaper area – reducing the amount they borrow to satisfy the tighter constraints.”

2. “However, those already hunting for more affordable properties may find themselves priced out of the market altogether. Therefore, they stay tenants for longer, either buying property later in life or not at all.”

These shifts push up the demand for rental accommodation but then the problem becomes a lack of suitable rental accommodation.

To “entice new investors into the market, rents will have to go up.”

There are equity and wealth implications arising with “a shift from owning your own home to renting and a concentration of housing ownership among the rich.”

The ECB researchers then tried to quantify how “limits to mortgage credit impact house prices and rents”.

They found that “borrowing limits increase rental prices. They are 4% higher four years after the intervention” but that the “house prices are virtually unchanged”.

There is a redistribution of home ownership as a result of the increasing “ownership concentration in the housing market” as the wealthier cohorts hoover up the housing stock while the lower-income families are pushed into rental accommodation that becomes more expensive.

I have consistently noted that the RBA rate hikes are having the same effect and facilitating a massive redistribution of income and wealth to the already high-income cohorts from the low-income cohorts.

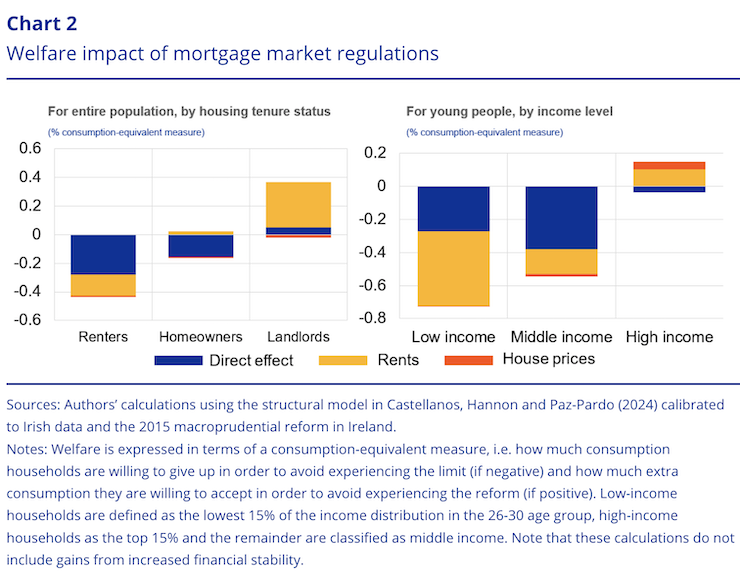

The ECB graph the distributional consequences of reducing the capacity of people to purchase homes, which can be done through credit controls – their example, or through rate hikes.

Here is their Chart 2, which shows that:

… the biggest losers are those who are not currently homeowners and will need credit to access homeownership. They are mostly young households in the lower or middle part of the income distribution.

The measure used to assess welfare is “a consumption-equivalent measure” which you can understand in terms of “how much consumption households are willing to give up in order to avoid experiencing the limit (if negative) and how much extra consumption they are willing to accept in order to avoid experiencing the reform (if positive).”

The research shows that the credit restrictions have negative welfare effects for the renters the largest effects come from the higher rents that impact on low-income households.

Current owner-occupiers are largely unaffected while landlords benefit greatly as a result of the higher rents that follow the central bank intervention.

The interesting part of the research from my perspective (in terms of being able to directly apply it to the Australian situation) was their assessment of the impact of higher interest rates on rental inflation.

They found that:

Overall, we find similar effects to those of the tighter credit limits: rents rise, house prices go down and homeownership rates drop.

Which establishes that rate hikes are inflationary as MMT economists have been arguing for some time in the face of the denial of mainstream monetary economists, who assert, without foundation the opposite.

The ECB research found some significant differences between the impacts of credit rationing and rate hikes.

1. “the rate hike makes saving in financial assets more attractive relative to investing in housing. As a result, rents need to go up even further to keep small housing investors in the market.”

2. “higher interest rates also make it easier to save for a downpayment, though we find this effect is minimal so tenants are still worse off.”

The ECB conclude that higher interest rates:

… have a direct impact on rents that can dampen the cooling effect of monetary policy on inflation as measured by the Harmonised Index of Consumer Prices, as rents form a part of households’ consumption baskets.

And there you have it.

RBA denials

The RBA recently released a chapter in the RBA Bulletin (October 2024) – Do Housing Investors Pass-through Changes in Their Interest Costs to Rents? – that denied that interest rates hikes caused rental inflation.

They note that “Rent is the second largest component of the Consumer Price Index” .

In the RBA’s policy model, rents just “reflect the balance of demand for, and supply of, available housing”, which is the mainstream economic view.

So no allowance for price gouging by landlords or for landlords passing on higher borrowing costs.

They claim that the observation that interest rates and rental inflation tend to move together is just because in times of rising prices, which corresponds to rising spending pressures both the demand for rental accommodation rises and the central bank hikes rates to reduce inflationary pressures.

As a result:

So the observation that rates and rents move together may be a case of correlation, rather than higher rates causing higher rents.

But the RBA article ignores two important things about the current situation:

1. The inflationary pressures were not largely not an excess demand event but rather were the result of supply constraints arising from COVID restrictions and illness, the Putin escapade in the Ukraine, and some OPEC+ price gouging.

So the buoyant demand effect they talk about impacting on the demand for rental accommodation was not part of this story.

2. The “correlation” is somewhat blurred by the lagged response of rental inflation to the overall inflation rate.

As the graph shows, the inflation rate was rising before the rental inflation accelerated (as the supply constraints started to bind) and then the RBA hiked rates, and then rental inflation took off.

Another problem with the RBA study is that it uses data from 2006/07 to 2018/19 when inflation was benign and interest rates were largely falling.

They are aware of this and do find “evidence of asymmetry, with pass-through tending to be more positive when interest rates are rising”.

But they still claim the impacts on rents of rising rates are small.

However, they note:

Our sample period, from 2006/07 to 2018/19, does not include a period where interest rates rose as much as they have in the current cycle. It is plausible that pass-through could be higher when interest costs rise sharply.

More significant though is that they rule out any “spillover” effects between investors with high mortgages and those with lower mortgages.

This is tied up with their method, which I don’t discuss here.

Effectively, they seek to determine whether those with high mortgages push up rents by more than those with low mortgages when interest rates rise.

They assume that there is no difference in rental setting between the groups, which leads them to conclude that there is “limited pass-through” of higher interest rates into rental inflation.

However, in rental markets investors of all kinds observe the movements in rents in the local areas that they are offering tenancies, irrespective of whether they have borrowed heaps or not.

Investors apply ‘what the market will bear’ logic and if rents start rising in the segment that they have property to offer for rental accommodation, then they will follow each other.

Which effectively negates the methodological validity of the RBA approach.

They dodge this criticism by claiming that in Australia, there are “lots of individual landlords all competing for renters” which suggests these landlords all act in isolation and set their rents without regard to the ‘market rates’ that are applicable to the housing segment they are operating in.

I know people who rent houses and flats.

They are all fiercely aware of the rents that are in the local area and beyond and calibrate their rental decisions accordingly.

Further, many landlords work through a real estate agency who manages the properties for them and effectively sets the rents and probably never really knows how much equity the landlord has in the property.

Conclusion

This is another example of how monetary policy as currently practised is not fit for purpose.

Note:

I am travelling to Manila later today for work commitments and will be away all week.

Depending on my free time, my planned blog post for Thursday of this week may or may not appear.

We will see.

That is enough for today!

(c) Copyright 2025 William Mitchell. All Rights Reserved.

The interest rate increases have been a massive success so far and all those responsible for keeping them artificially high have served their puppet master owners well.

The RBA, the government, and the corporations controlling them as always are getting everything they desire and there is absolutely nothing legal we can do to change it.

The RBA were under no illusion about how the rate rises would impact low to middle income families. They simply didn’t care what happened as long as the select few they served were able to capitalise from the situation

Voting out one government sees them replaced by another group of sycophants just as keen as the last to serve the interests of capital at the expense of everyone else.

Labour, Liberal, Green – it makes no difference. None of them care.

Four other important factors, one of which I’d argue is also closely tied to rising interest rates:

1) People forced into the rental market by declining house-purchase affordability

2) Rising population – Australia has endured absurdly high net immigration levels over the past few years (for heaven’s sake, don’t label me racist – I believe there are too many people of all colours (white included), creeds, and religions migrating to Australia)

3) Landlords raising rents to keep up with general price inflation

4) Rising tourism

I have long believed that the housing crisis has little to do with supply shortages (public housing for low-income people excepted) and is largely a demand-side problem. As for purchasing a property, demand is clearly segmented – those who want to purchase a property to live in; those who purchase property for largely speculative purposes. Until tax advantages for those in the latter group are removed, purchasing a property will remain out of the reach of low-income and many middle-income people, especially those located in the major capital cities.

The property market is just one of many institutional rorts – people receiving a financial claim on useful stuff without producing a skerrick of it – what has become the ruling passion of the modern age, once enjoyed by the leisured class, now enjoyed by a large chunk of the population in wealthy nations at the expense of low-income and unemployed people, Third World sweatshop labour, and future generations (natural capital depletion). Given that the percentage of the population in the privileged position is very large, and they have become accustomed to their parasitic lifestyle and expect nothing less, I don’t see any likely change. The sadist thing is that most of them are completely unaware of how much their lifestyle (e.g., flying interstate to watch a couple of days of tennis) imperils so many people, present and future.

Well said Dr Lawn

Landlords can only pass on higher rents in a tight market and high levels of immigration will do that. Personally I don’t care how large the immigration level is so long as the Federal government puts in place the infrastructure to match the new arrivals. Generally not is the answer hence, demand exceeds the capacity of the economy to deliver housing and ….which is pure inflation. If the Australian goverment wants to bring in 1.3m plus migrants fine just build a city the size of Adelaide every 3 years. Thus there is the issue in a nut shell. Bill only ever skirts around immigration as a factor rather than the number one housing inflation factor at present, immigratio is used to juice GDP so the Teasurer can make out he is a good economic manager and hey no recession, but in GDP per capita it’s a near constant recession.

Kent: To be fair, Bill was trying to show that rising interest rates contribute to upward pressure on prices in a variety of markets (which I agree with), of which the housing rental market is one of them. Bill’s view runs counter the mainstream nonsense used by the RBA to justify interest rate rises. Bill wasn’t suggesting that other factors are not at play.

I do have a problem with large immigration numbers at this moment in Australia’s history, even if the infrastructure is built to match the new arrivals, because the huge quantity of resources required to provide it merely marks time (no additional per capita benefits) but leads to a rise in costs – increasing congestion, environmental damage, declining biodiversity, and more unsightly dog-box suburbia. Last year, driving on the Hume Highway, I was appalled but not surprised to see new suburbs (exurbs) popping up in what might be described as Greater Sydney south of the Nepean River. Absolute madness. A case of plonking people somewhere to exist (not live) between going to work and the local shopping mall. More nails in the Earth’s coffin driven by many factors, none more than population growth.

For Indigenous Australians, and I sympathise with them, large immigration numbers have been a problem since 1788.

Of course, if you account rents as GDP, the economy is doing great.

Who also are doing great are billionaires.

There are even some (try not to laugh) working class people who think that’s a good thing: just ask anybody about muskie… They’ll probably say he’s a genius and the billions came from working hard…

Funny how the concept of CONFLICT OF INTEREST completely disapeared out of our dystopian XXI century world.

Paulo: Included in GDP is the expenditure (and use of resources) to repair damaged cars following car accidents, to provide health services to undo mental illnesses caused by long-term unemployment, to undo environmental damage (if such a thing is possible), and I could go on and on. More and more defensive and rehabilitative expenditures to undo and shield ourselves from the impact of excessive growth, none of which is welfare-increasing, only welfare-maintaining at best – therefore, none of which adds to the benefits of economic activity, yet all of which increases the cost of economic activity.

Incredibly, there is still no official macroeconomic measure of the net benefits of economic activity (benefits minus costs). Despite the warnings of Simon Kuznets, the inventor of the GDP statistic, we are still using GDP – a brilliant measure of the monetary value of all new stuff produced by domestically-located factors of production, whether for good or far bad, whether welfare-increasing or welfare-maintaining – as an indicator of national well-being.

Regardless of what increases GDP, we will never really know if we are better off – whether the economy is “doing great” – until we have a decent measure of macroeconomic net benefits. There is a thing called the Genuine Progress Indicator (GPI), which has existed for around thirty years. The GPI measures net benefits. It also includes economic activity conducted within the informal (unpaid) segment of the economy, which is important because around 25-30% of the increase in GDP over the past fifty years has been due to the shift in economic activity from the informal to the formal (paid) segment of the economy. Only activity conducted in the formal segment is included in GDP. The shift from the informal to the formal does not change the GPI.

The per capita GPI values are interesting. For wealthy nations, it appears that little ‘progress’ has been made over the past fifty years, despite per capita GDP having more than doubled over the same period. I’ve come to the conclusion that once per capita GDP reaches a certain level, an increase in per capita GDP doesn’t imply that we are better off. It indicates that it costs more to participate and meaningfully engage in society – an increase in the cost to ‘live’. Meanwhile, the global Ecological Footprint has grown to now be 75% greater than global Biocapacity. It was about the same as Biocapacity fifty years ago – a time when the scale of global economic output was ecologically sustainable, but only just.

“… dampen the cooling effects of monetary policy on inflation…” — still weasel words for the lamestream journos to spew back. It can read to the normie like it is dampening inflation. Also implicitly implies monetary policy by default cools off inflation which is downright false. Correction is : “… reheats up the heating effect of monetary policy on inflation.”

I own a residential property in Perth under a testamentary trust which has been managed by an agent for 12 years. The property manager has always set the rent amount within a range that they advise me at the end of the tenancy period. The rental range is calibrated by comparison with similar properties in the area, and overall rents are kept in lock- step with the rest of the rental market properties.