I have been a consistent critic of the way in which the British Labour Party,…

Fake news is not just the practise of the Right

The daily nonsense that economics journalists pump out in search of sales for their newspapers is nothing new and one would think I would be inured to it by now. But I still am amazed how the same old lies are peddled when the empirical world runs counter to the narratives. I know that the research in psychology has found that people save time by using ‘mental shortcuts’ in order to understand the world around them. Propositions that we ride with are rarely scrutinised in depth to test their veracity. Rules of thumb are commonly deployed to navigate the external world. And we are highly influenced by the concept of the ‘expert’ who has a PhD or something and talks a language we don’t really understand but attribute an authority to it. In the field of economics these tendencies are endemic. We are told, for example, that the Ivy league universities in the US or that Oxbridge in the UK, are where the elite of knowledge accumulation resides. So an economist from Harvard carries weight, whereas another economist from some state college somewhere is ignored. And once we start believing something, confirmation bias sets in and we ignore the empirical world and perspectives that differ from our own. The consequences of this capacity to believe things that are simply untrue his one of the reasons our human civilisation is failing and major catastrophes like the LA fires are increasingly being faced.

Progressives like to cite the proportion of statements from the incoming US President that are lies and rail against him for making out that it is the media that peddles ‘fake news’.

They approach this task with more than a touch of sanctimonious virtue and claim that it is domain of the Right and its media domination (Sky, Fox, etc) to behave in this outrageous way.

Yet, every day, the same progressives peddle ‘fake news’ in order to sell news.

For example, the weekend UK Guardian article (January 11, 2025) – If a Labour chancellor has to start cutting, keep calm. It’s not a betrayal – which attempts to justify more spending cuts from Rachel Reeves and warns the trade unions to behave, has all the overtones of the mid 1970s when the then Labour Chancellor Denis Healey lied to the British people about the country running out of its own currency and having to borrow from the IMF.

This is a classic example of ‘fake news’ and it is constantly peddled by those who would self-identify as being ‘progressive’ and antagonists of the Right.

My most recent in depth National Accounts analysis for the US was here – British GDP growth depends on the current fiscal position – a fact that is being forgotten (August 26, 2024).

As at the June-quarter 2024, the contribution from the public sector (both recurrent and capital expenditure) was 0.39 points to the 0.57 per cent growth recorded was obviously highly significant.

In the most recent data release for the September-quarter 2024, that contribution has declined to 0.16 points and GDP growth has declined to zero.

I also showed that if there is an external deficit, which for the UK has been constant since 1998, then the external sector is draining demand (spending) from the economy.

In the September-quarter 2024, the current account deficit rose to 2.8 per cent of GDP.

Export volumes fell for the third consecutive quarter while import volumes also fell, reflecting the weakening domestic demand.

The household saving ratio was slightly lower at 10.1 per cent compared to 10.3 per cent in the June-quarter, but still means that the household sector is spending only about 90 per cent of their disposable income and withdrawing the rest from the spending cycle.

If the overall private domestic sector desires to save overall (which is different to the household saving ratio being positive) then that also constitutes a net spending drain from the economy.

The only way the economy can then maintain positive growth is if the fiscal balance is in deficit and greater than the spending drains from the other two sectors.

The relatively large fiscal deficits in the UK during the GFC, provided the GDP (income) support for the private domestic sector to increase saving overall while the external sector was in deficit.

As the Tories pursued fiscal austerity in the period between the GFC and the pandemic, and the external balance moved into slightly higher deficit, the capacity of the private domestic sector to save overall vanished.

Private sector indebtedness rose substantially and was the only reason growth was possible in the face of the fiscal austerity .

That, of course is an unsustainable growth path because eventually the private balance sheets become too precarious and cuts backs in private spending are necessary to reduce the risk of insolvency.

With the external position still in deficit, any attempts by the Labour Government to reduce the discretionary fiscal deficit will be associated with a deterioration in the private domestic sector saving position.

Which means that the only way the British economy can sustain growth at present with the planned fiscal cutbacks is if the private domestic sector plunges into widening deficits and builds up ever increasing levels of debt.

That is not a smart national strategy.

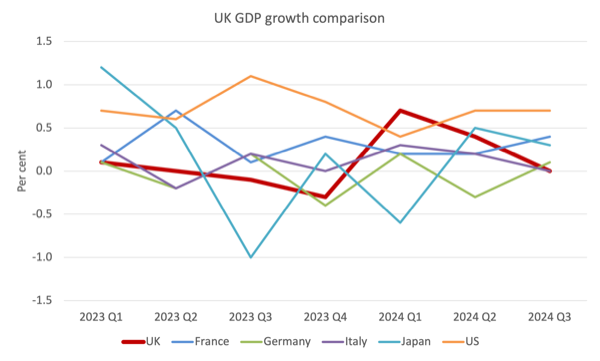

Further, Britain is now performing worse than the major EU economies, which themselves are highly constrained as a result of not having their own currency and having Brussels imposing ridiculous fiscal rules which hamper government capacity.

The following graph compares GDP growth rates since the March-quarter 2023 to the September-quarter 2024.

The UK Guardian article thinks it is sensible to compare the UK, as a currency-issuer, with France, a currency-user constrained by EU fiscal dictates.

Such a comparison is common with the usual being some statement about not wanting ‘to end up like Greece, therefore austerity is imperative’ or similar.

All such comparisons are comparing two different monetary systems which are incommensurate in terms of the capacities of the national governments in question and are therefore not valid.

The commentators who make these comparisons clearly do not understand the difference which should disqualify them from making commentary in the first place.

Their readers are also none the wiser and just swallow the cant.

The UK Guardian article urges “Labour’s backbenches and … the big public sector unions” to “stay calm and and recognise that the UK is in a hole from which it will take years to emerge”, thus supporting the Chancellor as she contrives to cut spending in the UK.

Apparently:

Trade unions, in particular, need to dial down the rhetoric of betrayal should Rachel Reeves need to take a scalpel to departmental spending and delay eagerly awaited projects until she has the money to pay for them.

Well, my advice to the British unions is to defend the interests of your members and bring down any government that lies about not having “the money to pay for” progressive policies.

The unions should disassociate themselves from the British Labour Party both in terms of providing it with electoral funding and being compliant as the Labour government acts to undermine the prosperity of their members as it further lines the pockets of the ‘wealth shufflers’ in the City.

According to the journalist (Inman):

As looks increasingly likely, she will not have the funds this year after a dramatic slowdown in economic growth, more persistent inflation than was expected and a rise in borrowing costs.

Can you believe that?

All the fictional elements are there:

1. That the GDP slowdown is causing unemployment to rise so tax revenues are declining.

2. Higher interest rates have pushed bond yields up so the government is paying more on its outstanding debt than before.

Neither fact reduces the capacity of the British government to spend its own currency whenever it wants especially now that GDP growth is zero and heading towards recession (meaning there are available real resources that can be brought back into productive use with additional government spending).

The inflation rate has fallen significantly and is not persisting as a result of a chronic excess demand (spending) problem.

There is excess productive capacity, which means that there cannot be an overall excess demand.

Soon after that, another one of the classic fictions is paraded to the unwitting readers:

The Treasury’s independent forecaster, the Office for Budget Responsibility (OBR), could say in its March review that all of Reeves’s financial buffer, set aside in the October budget as a cushion against a negative turn of events, has been eaten up, forcing the chancellor to revise her spending priorities.

Ignoring the fiction that the OBR is ‘independent’, here we have the recurring fiction that the currency-issuing government has to build up ‘stores’ of its own currency for rainy day events and when those ‘stores’ evaporate, the government has to reduce spending elsewhere.

Households, like you and me, have, if they are fortunate, what Keynes called ‘precautionary’ balances.

See this – Precautionary demand – for an explanation.

Basically, as a result of being financially constrained, households try to store up some saving to cover problems that arise in emergencies (health etc).

We have to do that because if such a calamity arises we want to be able to fix our car or repair our house or whatever.

But trying to transfer that concept and behaviour to a currency-issuing government has zero application.

Such a government has infinite minus a penny financial resources whenever it wants to draw on them.

No ‘stores’ of saving a required.

A stroke of a pen (or computer keypad) is all that is required.

The notion that there is some ‘buffer’ that the government needs for emergencies is used to justify unjustifiable austerity.

Just wait until the US government announces its financial support package for California – no stockpile of funds will be required.

The Federal Reserve will just clear all relevant accounts and the real resource assistance will flow.

The UK Guardian article’s conclusion is that:

With a steer from Treasury insiders who say that extra borrowing and higher taxes have been ruled out, spending cuts are the only option left on the table.

And that the unions etc should accept that and realise that “more borrowing to pay for public services” is not possible because the City will punish such an idea.

Please read my blog post – The British government does not have to appease the financial markets ( October 14, 2024) – for more discussion on why the proposition that the CIty can dominate the Government is preposterous.

To justify his claim, Inman looks over the Channel and says that Macron’s failed strategy (“a rise in debt to pay for increases in welfare and investment spending”) should be a warning to the UK.

Ridiculous.

France’s bond yields are rising because the debt it issues carries credit risk as a result of the nation using a foreign currency (the euro).

Further, France relies on the ECB to control bond yields and that organisation is not playing ball at present.

The UK is not remotely in the same situation.

The only similarity is that GDP growth is collapsing in both countries as the austerity sets in and while France is caught in that cycle by dent of its decision to surrender its currency and accept the fiscal rules, the British government has all the capacity it needs to break out of the decline.

But it seems intent on worsening the situation and the progressive media wants the unions and their members to comply.

The UK Guardian article also says that the options facing government are even more limited because:

From now on, the defence and NHS budgets will both need to rise quickly, putting the Treasury in a double bind. Where once it could rely on annual cuts in defence spending to pay for rising health costs, it must now look elsewhere.

Sure enough, spending on the NHS must rise to reverse the appalling situation created by 14 years of Tory mishandling.

But why does defence spending have to rise?

And, of course, spending on defence does not preclude spending on other important areas that have been hollowed out by the Tories.

Conclusion

Fake news is not just the practise of the Right.

That is enough for today!

(c) Copyright 2025 William Mitchell. All Rights Reserved.

Indeed the mainstream unchallenged myths put out by the likes of the G’s economics expert (and his ilk everywhere) continue to undermine economies and societies, more insidiously than blabbermouth Musk.

The only real justification for the UK govt keeping a over-tight fiscal and monetary policy at the moment is to try to maintain the value of the pound.

That’s probably not a good idea in the longer term and it will only line the pockets of the currency speculators.

In any case, if this is what Rachel Reeves and the BoE are doing they should be open about it.

It’s pretty clear the Powers That Be are still trying to maintain a pseudo-fixed exchange rate.

It’s all fixed exchange rate, neutral rate thinking. The same mantras as ever – we need to attract ‘foreign investment’ which will need free access to ‘foreign markets’ so they can suck demand out of some other country and we can live off the crumbs. After all its worked for Ireland (if we ignore everywhere outside Dublin).

To put it all in perspective: Reeves’ trip to China resulted in pledges of £600m over five years. That’s 0.012% of the £5tn government budget over the same period. She could have just rounded up the capital budget to the nearest billion and saved the plane fare.

And by increasing the capital budget she’d hit the ‘fiscal rules’ as well since tax take doesn’t care if spending is labelled ‘revenue’ or ‘capital’. It goes up with either.

Yet they have cancelled previously approved capital projects, like the dualling of the A1 up and into Scotland.

A few days ago, I read something in one of Robert W. Malone’s posts that goes more or less like this: somebody meets a Chinese friend and ask her something about the news.

She replies that, in China, nobody watches the news.

Why? he asks.

Because everybody knows the news is only propaganda.

We should all know that the news is propaganda in China and elsewhere – EVERYWHERE!

So much propaganda that it gets demential.

Just like the special envoy of the Portuguese public televison to the US, covering the 2024 presidential election.

She spent weeks saying that Kamala Harris was in front of “all” the polls.

Those who watched her reports must have been convinced that she would win by a large margin.

We all know what happened on election day.

The Portuguese do not vote for the US election, so what’s the point?

Well, she remains reporting from the US.

Now “special envoy” to what nobody knows.

I’ve been shouting at the TV too, also appalled by the faux logic in the Guardian piece, but also the headline UK TV news “analysis” of the shambles Reeves has created through her tunnel vision. The wrong ‘conventional wisdom’ type analysis has dominated almost across the entire commentariat.

Global news management really is very tightly controlled by the ruling elite.

I also reject “the concept of the ‘expert’ who has a PhD or something and talks a language we don’t really understand but attribute an authority to it.”

For some strange reason the media often refers to a commentator with a narrow range of expertise for much wider general opinions.

Closeted individuals in many research and political spheres are often privileged in being insulated from the experiences and impact resulting from their judgements.

It is particularly disingenuous when the ‘expert’ works for a think tank or allegedly independent research and policy organisation invariably driven by the agenda of its funders, often with concealed identities.

Both BBC and ITN regularly use incredibly biassed specialist commentators from such as the IEA, IFS, IPPR, Chatham House, and CPS – all of which carry massive doctrinal baggage. Tufton St is a morass of low level propaganda.

Even so, these ‘experts’ then feel qualified to comment on wider social and environmental issues of which they are mostly ignorant, and are actually consulted on that basis. There are a few well known political economists in the UK, often retired, vlogging, blogging or writing OpEds (so hardly peer reviewed) way outside their areas of expertise.

Additionally, many specialists are often appalling generalists and are rarely able to see the wood for the trees. Even then, with a particular world view, they actually do think in their tanks, aka silos, so bring the confirmation bias of their organisations.

An individual’s analytic skillset and ability to focus intensely and doggedly on a narrow research topic, such as is required for PhD study, does not necessarily confer the same ability to connect or synthesise across wider spheres. Generalists require a different way of looking at things. that recognise and can see wider connections, patterns, associations and trends.

This is why the work of Donella Meadows, in particular, in identifying and examining systems, and the coherent way of thinking she tried to develop, that looked at stocks and flows, time sequences, feedback loops and interdependency was so important, but still has yet to inform many of those pretending to comment on complex systems.

Watching the societal rot set it from austerity regimes is all the more distressing once you’re educated in MMT. The fact that it isn’t inevitable and thoroughly avoidable is so hard to stomach.

Don’t despair Cs, neoliberalism will be destroyed.

We’re perturbed that the economic reasoning is flawed, even if our goal (de-growth) is so achieved?

The elites just love to kick the can down the road, the little guy just keeps picking it up for them.

When will the little guy stop bending over?

@JOHN B an economic recession isn’t going to further degrowth (functioning within limits conducive to environmental sustainability). We should learn from the global financial crisis and covid and their aftermaths, that, as Bill says from a few blogs back, a bit of economic pressure and shake-up will not mean ‘corporations suddenly take into account not only their owners interests but also a broader array of ‘stakeholders’ like workers, the broader community, and the environment.’ It may lead to less consumption by an already constrained and indebted poor but it won’t (per the Degrowth Declaration Barcelona 2010) stop ‘An international elite and a “global middle class” are causing havoc to the environment through conspicuous consumption and the excessive appropriation of human and natural resources.’ And it won’t help the shift to cleaner, less environmentally damaging energy. Did the great recession forced on Greece from the Eurocrisis help it to transition from being reliant on coal to something more abundant and less consuming such as solar and tidal energy?

Hi Bill,

I’m bit of a globalist, if we have very large amounts of immigration but on 1 year temporary visas (not stealing skilled doctors etc) in UK who are not allowed join JG and deported after 1 year if not renewed, whilst still implementing JG no ill effects?

Neil Wilson wrote:

“Yet they have cancelled previously approved capital projects, like the dualling of the A1 up and into Scotland.”

London-based politicians would rarely if ever use it, so it makes no difference to them.

Bill wrote:

“France relies on the ECB to control bond yields and that organisation is not playing ball at present. The UK is not remotely in the same situation.”

Agreed, and I see your point, however, staying aligned with the EU is what successive UK governments have done in recent years, and the current government is openly wedded to the EU.