The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Shipping disruptions unlikely to precipitate another inflation surge

It’s Wednesday and while I usually have a few topics to discuss, today I am concentrating on the recent disruptions to shipping channels and the likely impact on inflation. I was also hoping to post a video of the recent launch of my new book with Warren Mosler in Melbourne on September 12, 2024 but the editing is not quite finished. If we analyse the shipping data it is quite clear that global shipping channels are being seriously disrupted by a number of factors. Most particularly, the Suez Canal is becoming unusable while the Panama Canal is struggling with water levels following a devastating drought. The impact of the former has been for major shipping companies to divert their movements around the Cape of Good Hope, adding time and costs to the freight deliveries. If we reflect on the implications, the most reasonable conclusion at this stage is that these shifts in shipping patterns are unlikely to precipitate another surge in inflation. There might be some temporary cost and price shocks but I cannot see them persisting. And, there is nothing here that is relevant to central bankers.

Inflationary pressures from supply arising from Middle East conflict

I was looking at the shipping data the other day, which is a useful exercise if one wants to get a feel for the fluidity of global supply chains.

The two major shipping routes – the Suez and the Panama canals – are now under stress from various sources and the workarounds by shipping companies will add costs to traded goods.

The most stark impacts of the conflict are showing in the dramatic decline in shipping traffic through the Suez Canal as a result of the resumption of missile and drone attacks by the – Houthi Movement – in Yemen, who have been engaged in a struggle against a US-backed oppressive government since the early 1990s.

In solidarity with the Gaza cause, the Houthi have effectively brought shipping in the Suez Canal to a standstill and the might of the nations against them, led by the US and Britain, has so far been unable to thwart their guerilla-style tactics.

What the US and its other bullying allies have in military strength, the Houthi have in dedication to freeing Yemen from the corruption of the US-backed regime.

While the mainstream media and narratives portray the Houthi as an Iranian vassal group, the reality is quite different.

The Houthi have been resisting and enduring massive air strikes against them for years.

They are well-placed geographically and have worked out that attacking shipping, which is difficult to defend, brings world attention to their cause and is relatively easy to accomplish from a military technology aspect.

What is clear is that the IDF and US-British attacks, whether it be on the Houthi or Hamas/Hezbollah groups, cannot wipe out their ideological commitment.

Whether one agrees with their causes or not is beside the point.

Bombing and killing the ‘rebels’ only makes them stronger and allows their recruitment to increase.

That observation alone demonstrates to me that the stated motivation of the Israeli government – to root our Hamas (initially) – is fake.

They must know they cannot do that – which gives more credence to the ‘genocide’ claims.

The Houthi are riding on the anti-US-Israeli wave that has grown since the Gaza death toll has risen well beyond anything that could be constructed as ‘wiping out Hamas’.

Young children and babies are not carrying guns for Hamas.

But the impact of the Houthi actions in the Red Sea which usually carries around 30 per cent of all shipping container volume and around 12 per cent of the world shipping trade has been dramatic.

Rerouting shipping adds an extra week (or 3,315 nautical miles on a trip from Rotterdam to Tokyo (Source).

Which adds costs.

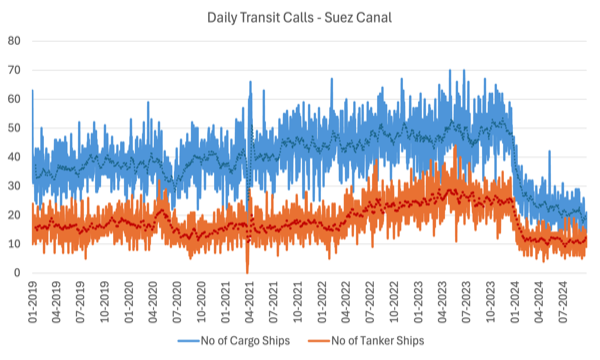

The following graph is taken from the – IMF Port Watch – platform that “monitors trade disruptions from Space”.

It shows the Daily Transit Calls (Number of Ships) from January 2019 to September 30, 2024.

There is a lot of daily volatility and the darker smoother lines are 14-day moving averages to give a better impression of the overall movement.

Clearly, the Houthi actions are having an impact.

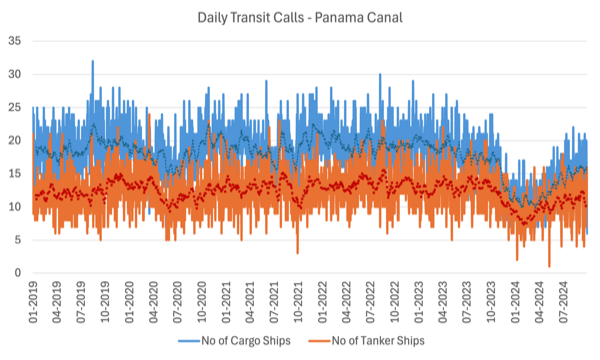

The next graph shows the disruptions to shipping through the Panama Canal since early November 2023, which has arisen because (Source):

Water levels have fallen to critical lows because of one of the most severe worst droughts in the canal’s 143-year history. On October 30, 2023 the Panama Canal Authority announced a substantial restriction to the number of booking slots to pass the canal, effective November 3, 2023.

If you visit the – IMF Port Disruption – page, you will be surprised as to how many incidents impact daily shipping movements.

That fact alone means we have to exercise caution in thinking that the highly publicised disruptions, for example, in the Suez Canal, will be catastrophic and cause another inflation episode.

However, there is no doubt that the major shipping companies are now working around the disruptions and that is impacting on shipping costs.

The FDD Briefing (September 6, 2024) – Maersk Reports Houthi Attacks Cause 66 Percent Drop in Suez Canal Traffic – provides a fairly concise evaluation of the impact in the Suez.

The Danish shipping company, one of the largest, is now “diverting ships away from the Red Sea” and is now “rerouting ships around Africa” which it claims will cause “congestion at alternative routes and transshipment hubs essential for trade with Far East Asia, West Central Asia, and Europe.”

This action is also damaging Egypt and Jordan, which are facing increasing costs as a result of the Gaza fallout.

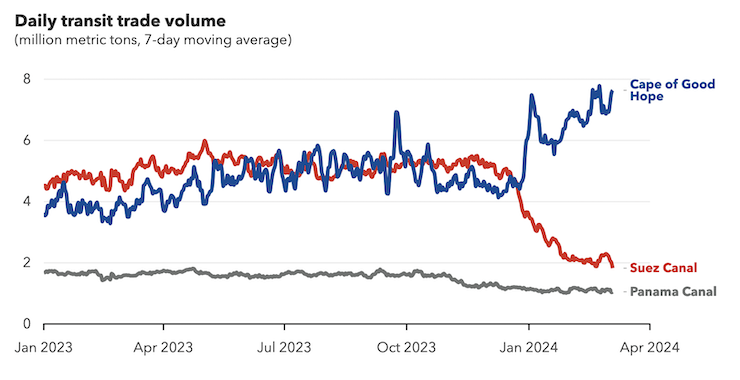

The next graph shows the combined impact of the Suez, Panama on shipping around the Cape of Good Hope (it is also from the IMF Port Monitor).

The next graph shows the – Shanghai Containerized Freight Index – from January 2014 to the most recent observation, September 2014.

The index was first compiled in October 2009 and “reflects the spot rates of Shanghai export container transport market. It includes both freight rates (indices) of 13 individual shipping routes and a composite index.”

It is considered a reliable indicator of world shipping cost movements.

The latest data suggests that the spot shipping rates may have peaked as a result of the Red Sea conflicts and are now abating.

So what is the likely impact of all this disruption – another Covid price spike?

Unlikely.

Just as the invasion of the Ukraine was highly disruptive to trade in grains and timber products, the world soon worked out ways around it.

As the earlier graph shows, the large shipping companies are now avoiding the Suez and so the cost implications of that diversion are probably already factored into the cost structure of traded goods.

There is little likelihood of the ships returning to the shorter route through the Suez anytime soon.

The US and British cannot root out the Houthi and the shipping is an easy target.

The Houthi will not stop the attacks on the boats until the Israeli come back into the real world.

And that is not going to happen as long as the US keeps funding them, which it will.

I am unsure how significant the cost impacts will be.

Obviously shipping costs have risen – running costs of the ships in particular.

There is no suggestion that oil prices are also about to escalate again.

So it is just the longer journey that is adding to fuel costs.

The other source of inflationary pressure might come from the delays in delivery due to the longer voyages.

But that effect is unlikely to endure as wholesalers will adjust their inventory levels to cope.

There is no suggestion that spending around the world is accelerating to the point that there will be chronic excess demand in retail markets.

So overall, I think the claims that central banks will have to tighten again soon or hold current higher levels of interest rate to be far fetched.

And at any rate, increasing interest rates will do nothing to speed up the boats around The Cape.

Music – Zeinab Shaath

This is what I have been listening to while working this morning.

This song was originally recorded in 1972 by the young Palestinian resistance singer – Zeinab Shaath.

This article – The Protest Song the IDF Tried to Silence (March 26, 2024) – provides a good background to the music and the struggles to keep it alive amidst Israeli attempts to bury it.

The work of the – Majazz Project – in creating the Palestine sound archive – is worth supporting as it

The song – The Urgent Call of Palestine – was part of a 4-track EP put out by the PLO to raise international interest in their cause for a ‘Free Palestine’.

Here is the original video and audio that has been resurrected through the work of the Majazz Project.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

Someone said that Lizz’s Truss government fell, not because of what was in its agenda, but because speculators felt it was a weak government and they could take advantage of it, to make a easy profit.

The sort of weakness that we saw when John Major’s was in government, at the time of the black wednesday (no need to mention that the bank of england couldn’t fight the short-sell, because there was – and there is – no independent central bank in the UK, that could fight it by its own).

The recent bout of inflation is not that different: it happens because the markets are not free, and they are manipulated by big corporations, who are making a BIG profit out of it.

No need to argue about it.

The numbers are public.

So, the problem is the same: weak goverments.

Well, just have a look at them.

What feeling come to mind when we look at the government (any government) today?

Look at the US, the UK, France, Italy, Germany, Canadá.

They can’t even say nothing about the ongoing genocide in Gaza.

That feeling can only be Shame!

With Israel driving the escalation up against Iran, I can see bigger retaliations.

With the US as a puppet of AIPAC, the 23 year old plan of Netenyahu and his vile policy to gain the Greater Israel may come true as the US gets dragged into it.

To me, what will rock the west is when Iran takes out oil field assets, as a direct result of Israels escalation.

Using Oct 7 as a reason is not a serious argument, there was always rebellion from the people that Israel occupied since 1948 Nakba ethnic cleansing as Israel slid deeper and deeper as an apartheid state

Hezbollah created because of the 1982 over stay of 18 years by Israel in Lebanon

To Hamas being elected to push back against occupation and imprisoning 2.5 million people half of which are children in the largest open air prison.

The world is surprised there was a prison break on oct 7?

Another reason I dislike US hegemony over me is also because of AIPAC.

So i must be antisemitic, in their mind, then my legislators punish me to be silent.

Not democracy in my book.

.

I don’t think its just AIPAC, US and Israel’s relations go both ways. Biden himself is a Catholic Zionist and the influence of American right-wing Christian groups is visible in other countries as well.

For example, In India, many Christians (not sure if majority, there is no polling done on this I think) support Israel for biblical, religious reasons. It sad really, but there are many Christians who understand what is going on in Palestine. The bombs don’t kill just Muslims but Palestinian and Lebanese Christians as well.

@Sidharth The USA (and to a lesser extent Canada) has a larger and more evidently practising Christian population, and 2:1 Protestant to Catholic, than non-Latin/Catholic countries in Europe and South America, and included in this, also a larger number of evangelicals, a few of whom venture forth, but I wouldn’t say they have that much influence over the well-established (historically and in practice) Christians or others elsewhere, including India. I don’t claim much knowledge, from study or short time living in India (not as a Christian), but Indian Christians (26m per wiki) are a pretty diverse lot. I’d be very sceptical of any reporting of them as a collective, especially in these days of Internet nonsense, supporting Israel for biblical reasons. Like mainstream Christians elsewhere, their tribal/cultural biases probably range from live and let live (humanity) to being tinged with anti-semitism and/or islamophobia. Same with mainstream Christians in the USA, though they are also subject to the pro-Israel bias of mainstream (and more extreme) media. The biases of governments/mainstream media are more easily identified: US clearly pro-Israeli because of the power (interference in democracy) of the Israel/Israel supporting lobby, support for its anti-Iran ‘ally’ in the middle-east, non-recognition (of the similarity of) colonial history of the US and Israel and islamaphobic bias outweighing antisemitic history. The UK, taking its cue from the US, with similar though more insidious Israel lobby interference. Germany – a still illogical bias based on guilt. India – longstanding recognition of Palestine but increased co-operation with Israel in recent years in arms and people to replace Palestinian surfs in the construction industry.

@Patrick B

It wasn’t my intention to paint Christians as a monolith. I just wanted to counter the claim that it was AIPAC and the Israel lobby responsible for US policy on Israel when it goes both ways. While there are certainly Jewish Supremacists (most than half of Israelis don’t even want a Palestinian state), the impact and influence of Christian Zionists in the US is certainly noticeable abroad.

https://www.youtube.com/watch?v=Fo77sTGpngQ

https://www.haaretz.com/israel-news/2024-10-07/ty-article/.premium/almost-half-the-jews-nearly-all-arabs-think-the-gaza-war-must-stop-survey-shows/00000192-620b-d249-a9da-7fabaf3c0000

Archive: https://archive.is/LZrHU https://archive.is/y0ODG

Thankyou, Bill, for a profound post.

The witchhunt against Corbyn and the left was always about Palestine – but ultimately, about the power of the Military Industrial Complex (I’ve only recently ‘got it’).

I’ll be using this in the response I’m putting together to a good comrade who sent me lots of Marxist anti-MMT ‘rubbish’.