The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Central bankers live in a parallel universe

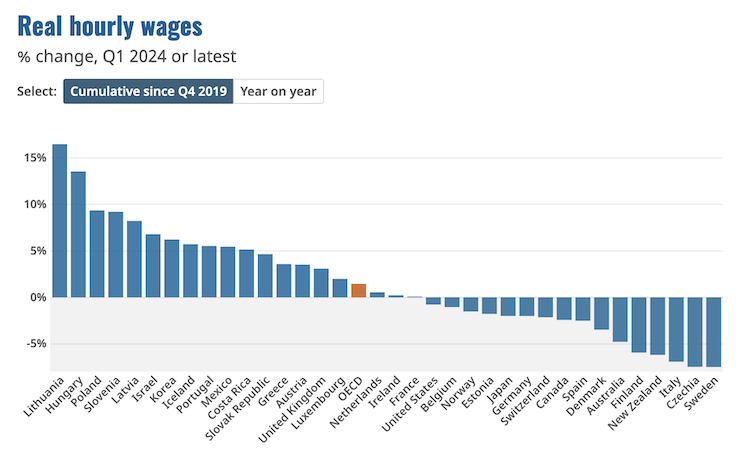

It’s Wednesday, which means a few (sometimes unrelated) items are discussed or analysed. Today, we see that real wages in 16 of the 35 OECD countries are still below the pre-pandemic levels, which tells us among other things that the inflationary pressures were not wage induced. Further, a speech yesterday by the Federal Reserve boss demonstrated quite clearly how central bankers fudged the whole rate hike narrative. And after all that, some music from the 1960s.

OECD Employment Outlook

The OECD released its – OECD Employment Outlook 2024 – yesterday (July 9, 2024) – which showed that real wages in Australia are still around 4.8 per cent below the pre-pandemic levels and that Australia is one of the worst performing countries – along with Finland, New Zealand, Italy, Czechia and Sweden.

That was the most striking outcome that was presented.

The OECD wrote:

Real wages are now growing on an annual basis in many OECD countries but remain below 2019 levels in about half of them. In Q1 2024, yearly real wage growth was positive in 29 of the 35 countries for which data are available, with an average change across all countries of +3.5%. However, in Q1 2024, real wages were still below their Q4 2019 level in 16 of the 35 countries.

The following graph presents that conclusion visually:

The fact that real wages were systematically cut in the early quarters of the recent inflationary episode was indicative of the fact that the latter could not be considered a wage problem despite some of the narratives that central bankers were using to justify their rate hikes.

Federal Reserve Boss Testimony

Yesterday (July 9, 2024), the Federal Reserve boss appeared before the Committee on Banking, Housing, and Urban Affairs of the U.S. Senate to present the – Semiannual Monetary Policy Report to the Congress.

It was a bizarre presentation because he avoided the obvious disconnect given that the interest rate hikes were explicitly justified as being necessary to push the unemployment rate up to discipline wage pressures and slow aggregate spending down.

The first part of his statement waxed lyrical about how strong the US economy has remained throughout the interest rate hiking period:

Recent indicators suggest that the U.S. economy continues to expand at a solid pace … Private domestic demand remains robust, however, with slower but still-solid increases in consumer spending. We have also seen moderate growth in capital spending and a pickup in residential investment so far this year. Improving supply conditions have supported resilient demand and the strong performance of the U.S. economy over the past year.

He also noted that the:

In the labor market, a broad set of indicators suggests that conditions have returned to about where they stood on the eve of the pandemic: strong, but not overheated.

So what did the interest rate hikes actually do?

More pertinent, if the economy is still going strongly, then the interest rates have not curbed total spending, which brings into question the purpose of the rate hikes.

And if inflation has been declining quickly – “Inflation has eased notably over the past couple of years” – while the demand-side of the economy has been growing robustly, then the inflation could not have been primarily an excess demand problem in the first place.

Which goes to the validity of the entire policy narrative that central banks have used to justify their (unjustifiable) rate hikes.

Jerome Powell also noted that:

Longer-term inflation expectations appear to remain well anchored, as reflected in a broad range of surveys of households, businesses, and forecasters, as well as measures from financial markets.

And they hardly moved during the period that inflation was accelerating.

Why not?

Because almost everybody ‘in the know’ understood fairly clearly that the inflation was a transitory phenomenon driven by the supply constraints arising from the pandemic, then the disruptions from Putin and OPEC+.

The central bankers had two narratives to justify their rate hikes and one of them was that they wanted to avoid inflationary expectations from breaking out.

They never did even when inflation was accelerating.

It was a total scam run by the policy makers to cover their tracks.

The Federal Reserve boss still claimed that:

Our restrictive monetary policy stance is helping to bring demand and supply conditions into better balance and to put downward pressure on inflation.

Given the data that statement is just nonsensical.

Total spending in the US is booming and, now, that is mostly because of the rate hikes.

The rate hikes around the world have precipitated a massive redistribution of income away from low-income mortgage holders who are being squeezed relentlessly, towards high-income financial asset holders, who have enjoyed huge income gains from interest income.

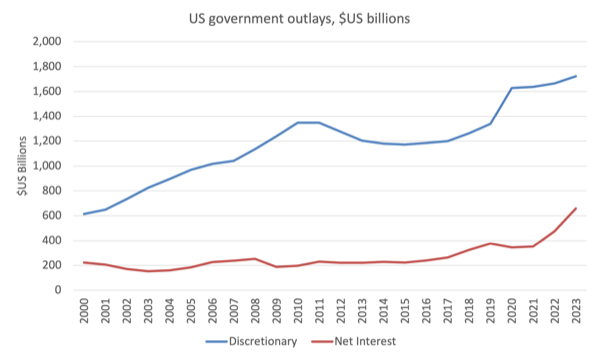

The US government is also spending heavily on net interest payments as a result of the relatively elevated levels of outstanding public debt and the rising interest rates.

This graph show what has occurred between 2000 and 2023.

That fiscal stimulus is also pushing demand along and is a primary reason for the on-going GDP growth.

The Federal Reserve boss then tried to stake out the importance of his work:

We continue to make decisions meeting by meeting. We know that reducing policy restraint too soon or too much could stall or even reverse the progress we have seen on inflation. At the same time, in light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face. Reducing policy restraint too late or too little could unduly weaken economic activity and employment. In considering adjustments to the target range for the federal funds rate, the Committee will continue its practice of carefully assessing incoming data and their implications for the evolving outlook, the balance of risks, and the appropriate path of monetary policy.

This statement received the press attention but should not have.

It is clear that that monetary policy is relatively ineffectual in moderating aggregate spending despite the continuing posturing by central bankers who are pressured by commercial bankers to push rates up because the increases push profits into the private corporations they represent.

MMTed announcement – MMT MOOC will soon be available 24/7

Thanks to the legal and production team at the University of Newcastle, I have now secured all the media that was created for the edX MMT MOOC that the University ran several times over the last few years.

I have now been given permission to make that material available through my on-line educational endeavour – MMTed – outside of the edX platform.

That means the 4-week MOOC course can be made available on an on-going basis to anyone who is interested.

There will be no enrolment process.

Some of the edX functionality will not be available (discussion forums, etc).

But the basic course materials (media, text, quizzes, etc) will be freely available.

You will be able to learn at your own pace.

This is a great initiative of the University to enter the world of open-source educational resources and this material is the first instance of that.

I hope to get it all sorted and made available on our servers by the middle of August at this rate.

Music – Kenny Burrrell and Jimmy Smith

This is what I have been listening to while working this morning.

This is from a 1963 album I dug out the other day – Blue Bash – released on the Verve Label.

It was a collaboration by guitarist – Kenny Burrell – and Hammond organist – Jimmy Smith.

Jimmy Smith played a B3 organ with a Leslie Speaker which revolutionised the way the organ was used in jazz and later R&B and Blues music.

Playing with them on this track – Fever – is:

1. Milt Hinton – Double Bass.

2. Mel Lewis – Drums.

All the players bar Burrell are long gone unfortunately.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

Ah, Chechia is Czechia/the Czech Republic. How have Swedish workers/voters been so terribly deceived in the last decade or so, now going backwards under a right wing minority government headed by the so-called Moderate Party? Well done to Lithuanians anyway, but most of the larger economies/populations seem to be on the right, poorly performing side of the real wages graph. Meanwhile, someone in the UK Treasury, probably on an above average salary, has been wasting their time figuring out that if the UK economy had grown at the average rate of OECD economies since 2010, it would have been more than £140bn larger, resulting in an additional £58bn in tax revenues last year. But how could it have grown so under the tutelage of unproductive waste of space ‘economists’ like that?

that’s great news about the MMT101 course becoming freely available;

I’m dead proud of my wee certificate and will encourage all & sundry to participate, to learn how to make a better world.

It is disheartening when the standard misconception about countries running out of money is perpetrated in reputedly leftist journals like the UK Tribune.

To Rebuild Britain, Tax the Rich.

https://tribunemag.co.uk/2024/07/to-rebuild-britain-tax-the-rich

No, We Haven’t Run Out of Money

https://tribunemag.co.uk/2024/07/no-we-havent-run-out-of-money

“The rate hikes around the world have precipitated a massive redistribution […]”

Another successful neoliberal move, they go from victory to victory.

The basic concept of neoliberalism is to move power and resources from the many to the few. The post-war decades were terrible, it did the opposite. A historic deviation. The normal state of affairs since we left hunters & gatherers and started to build so-called civilization has been to move resources from the many to the few.

@Patrick B

“now going backwards under a right wing minority government […]”

Well, they have ruled since October 2022, so 20-21-22 it was social democratic government, that are intertwined with the labour unions. Will they make a fuzz about these OECD numbers? I doubt it.

It is interesting to see that the “bad” members of the EU, Hungary and Poland, are in the top position. Donald Tusk has only ruled 2024, but he will probably try to stop this deviation from the neoliberal EU norm.