These notes will serve as part of a briefing document that I will send off…

US inflation rate down to 3 per cent and falling fast – it was transitory, folks

Yesterday’s US inflation data from the Bureau of Labor Statistics (July 12, 2023) – Consumer Price Index Summary – June 2023 – shows a further significant drop in the inflation rate as some of the key supply-side drivers continue to abate. The annual inflation rate is now back to 3 per cent and dropping fast. The risk now is that the conduct of the Federal Reserve will drive the US into a deflationary period with rising unemployment. Given that inflation peaked in the third-quarter 2022, that wages growth has been relatively subdued, and inflationary expectations’ survey evidence suggests no-one really thinks the inflation was going to endure, means that the US Federal Reserve’s logic is deeply flawed and not fit for purpose. They have been chasing an obsession that exists in a parallel universe to the real world. The risk is that they will continue to chase that obsession and use the fact that unemployment has still not risen much to claim there has to be higher unemployment. However, hopefully, the 3 per cent inflation rate result yesterday will cut-off any wild claims that they have to get the inflation down more quickly or risk a wages or expectations explosion. All cant of course.

The US inflation situation

The BLS published their latest monthly CPI yesterday which showed for June 2023 (seasonally adjusted):

- All Items CPI increased by 0.2 per cent over the month and 3 per cent over the year (down from 4.1 per cent in May).

- The peak monthly rise was 1.2 per cent in June 2022.

The BLS note that:

The index for shelter was the largest contributor to the monthly all items increase, accounting for over 70 percent of the increase, with the index for motor vehicle insurance also contributing.

The food index increased 0.1 percent in June after increasing 0.2 percent the previous month … The energy index rose 0.6 percent in June as the major energy component indexes were mixed.

The index for all items less food and energy rose 0.2 percent in June, the smallest 1-month increase in that index since August 2021 …

The all items index increased 3.0 percent for the 12 months ending June; this was the smallest 12-month increase since the period ending March 2021. The all items less food and energy index rose 4.8 percent over the last 12 months. The energy index decreased 16.7 percent for the 12 months ending June, and the food index increased 5.7 percent over the last year.

Summary: Inflation is falling fast in the US and that largely reflects the energy price dynamic which contributes in its own right but also by influencing other CPI components (for example, food delivery costs, etc).

Since the peak in August 2022, energy prices have fallen by 16.5 per cent.

Food prices are still rising, albeit at a much slower pace, as the lagged effects of the energy inflation is working its way through.

This inflation episode, while distorted by events no-one saw coming (Ukraine), is clearly a transitory phenomenon.

When I first conjectured about the sustainability of this episode, there was criticism.

I indicated at the time that ‘transitory’ doesn’t necessary mean a short period.

Rather, it meant that once the causal factors driving the inflation abated, we would see a sharp fall in the rates.

The other way of thinking about this is that a transitory episode is one where there is no on-going inflation being driven by real income resistance from capital and labour.

There clearly hasn’t been a wages component pushing this inflation along, unlike the 1970s.

The only qualification I would make is that we also didn’t anticipate the flagrant margin push from corporations even with benign wages growth that has led to some persistence.

There was an interesting paper published in the American Economic Association (AEA) Papers and Proceedings, in May 2023 – The Wage Phillips Curve under Labor Market Power (the link is to the Working Paper version) that came out in July 2022.

The authors wonder why “wages have grown slowly despite strong employment growth” in the US (and elsewhere of course).

They note that if the wages growth-unemployment rate relationship has become very flat (that is, large declines in the unemployment rate do not trigger rising inflation), then the attempt by central bankers to manipulate the unemployment rate to discipline inflation will be ineffective.

In theoretical terms, this casts the whole NAIRU story into doubt.

All that pushing up the unemployment rate will do is hurt those who lose their jobs and their families through income loss and stigma and will do little to reduce the inflation rate.

They “used online vacancy postings in the U.S.” to:

… study the interaction between labor market power and monetary policy. We show empirically that labor market power amplifies the labor demand effects of monetary policy, while not disproportionately affecting wage growth.

They found that:

1. “U.S. firms are well known to have significant labor market power, allowing them to “mark-down” wages from the marginal product of labor” – which means that US employers exploit the unequal power in the labour exchange to suppress wages below productivity growth and take more for themselves.

2. “accommodative monetary policy can lead to a decline in the unemployment rate that is decoupled from an increase in wage growth” – which means that when economic growth occurs, the unemployment rate falls but there is little wages growth.

3. It also means that when monetary policy is driving the unemployment rate up, there will be little impact on the inflation rate.

Which, in turn, means that central banks who follow the NAIRU narrative (that rising unemployment disciplines inflation) will keep pushing the interest rates up until they significantly increase the unemployment rate in a wasteful pursuit of lower inflation.

And in the current context, where the inflation is supply-driven anyway and has nothing much to do with wage pressure, that pursuit by central banks will be massively damaging to the unemployed while inflation will be declining independently (as the supply forces abate).

That is where we currently are heading if the central bankers don’t stop hiking rates.

Anyway, back to the current data release.

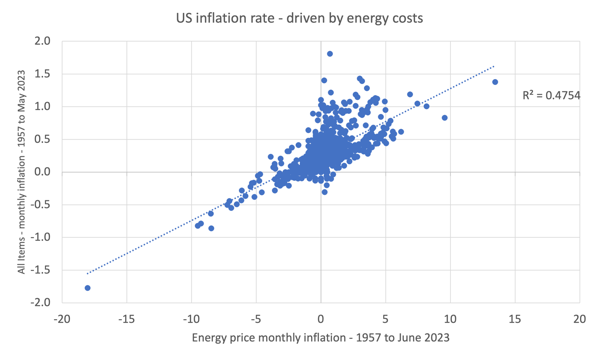

The following graph shows the importance of energy prices to the overall US inflation rate.

The simple regression line (dotted) yields an R2 of 0.48. That means that around 48 per cent of variation in the overall CPI is driven by energy price variation.

It is a little more complicated than that in statistical terms, but, that rough figure is a good guide to how influential energy prices are.

Effectively, the sharp drop in US inflation is down to the sharp drop in energy and petrol prices.

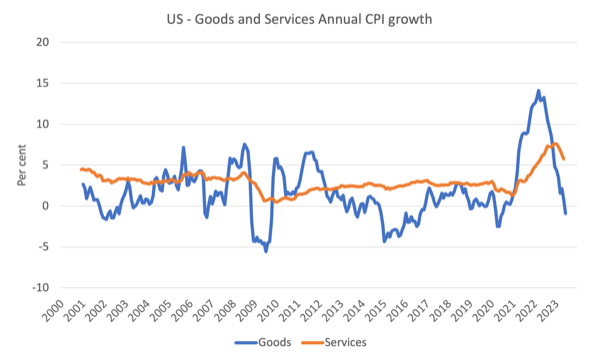

The next graph shows the evolution of annual price rises for the goods sector and for the services sector since 2000 – up to June 2023.

The contention always has been that the inflation has been largely driven and instigated by the supply factors that constrained the ability of the economy to meet demand for goods – the Covid factory and shipping disruptions and the like.

The graph shows clearly that those factors have been in retreat since the second-half of 2022 as the supply chain constraints ease.

The services sector, which is derivative of the supply drivers, lagged behind the goods sector and while still recording higher inflation that the goods sector, now has peaked and is also on the way down.

And the inflation has been falling sharply while the US labour market has been rather stable.

I analysed the latest Bureau of Labor Statistics employment release in this blog post – US labour market weakening – job openings fall and underemployment rises (July 10, 2023).

While there was a slight slowdown in employment growth there is no sign of a significant recession-type slowdown.

The point is that the lack of correspondence between the labour market dynamics and the inflation dynamics shows the poverty of the logic used by the Federal Reserve Bank to justify their interest rate rises.

That is reinforced by the research paper I discussed above.

The Federal Reserve logic is all about the strength of the labour market (they believe the actual unemployment rate is below the NAIRU) and that drives their zeal to create more unemployment and kill off wages growth, which, in turn, stops inflation in its track.

The data is thus not kind to the Federal Reserve logic.

Inflation is falling fairly quickly because the main drivers, which are not particularly interest rate sensitive, are in decline.

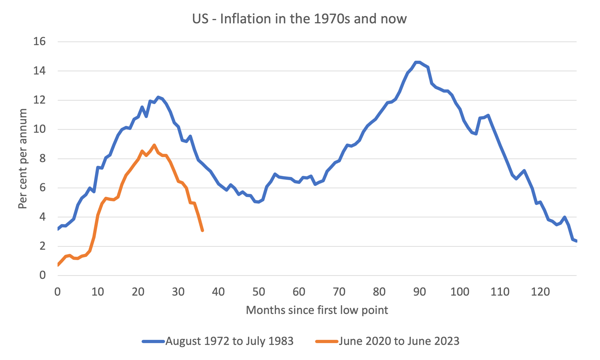

Consider the next graph, which shows the 1970s inflation episode, which effectively ran for just under 11 years from October 1972 to July 1983 and the current episode from June 2020 to June 2023 (current data).

The horizontal axis starts each series at the month that the inflation episode really began and then traces the evolution out by the months that follow.

In the first episode, the trace is from the low-point at the beginning (October 1972) to the next time that the inflation rate returned to that level (July 1983).

That event was drawn out.

The inflationary pressures were already emerging in the late 1960s as a result of the expenditure related to the prosecution of the Vietnam War.

It was starting to abate in early 1972, but really started to accelerate after the first OPEC oil shock in October 1973.

As you can see, before the situation could resolve, the wage-price pressures pushed the inflation rate back up and that was exacerbated by the second OPEC oil shock in late 1978 as a result of disruptions in oil supply due to the Iranian revolution.

By stark contrast, the current supply-driven episode did not have any additional propagation mechanisms at play (for example, wages pressure following the supply-side shocks) and that meant the inflation rate didn’t go close to the level reached in the 1970s and turned very quickly down.

It will be exhausted in about 40 months.

Conclusion

The inflation is burning out pretty quickly.

I consider my assessment that this was always going to be a transitory period of inflation has been validated by the data.

I also think we have reach peak lunacy in terms of our monetary policy understandings and practice.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

Just as ’transitory (inflation) doesn’t necessary mean a short period, the mounting evidence is that ‘peak lunacy in terms of (their) monetary policy understandings and practice’ can last for an extended period.

Likewise in Spain. The annual CPI growth rate is now at 1.9% showing that we are on track toward what the EU does best: permanent deflation with massive unemployment in the South. In the current disappointing electoral campaign (mostly revolving aroung identity politics and Pikettyan proposals in what remains of the sundry leftwing groups that coalesced around Podemos a few years back and are now grouped in a bickering coalition called Sumar) their chief economist, Nacho Alvarez is constantly congratulating himself for the success of the Spanish Government in beating inflation. I constantly reply: maybe it’s got to do with the lack of distributional conflict in a job market where unemployment has officially been greater than 13% for decades.

Hi Bill. I was just wondering if you’ve anywhere specifically addressed the claim that fiscal stimulus during COVID caused the recent inflationary spike. I’m not sure where this argument originated, but I’ve heard it floating around and even today being spouted by an ABC reporter. My gut instinct is that the argument is thinly veiled, class-based victim blaming ie “the real reason for inflation is that we raised the unemployment benefit to somewhere near liveable for a short period of time.” Sickening really. Would love to have some evidence-based ammo the next time I hear this sort of crapola come up.

Core measures of inflation anticipate future movement of total inflation better than total inflation itself. The two common measures used here in America are the personal consumption expenditures (PCE, less food and energy) and the trimmed mean PCE.

Here are values of the trimmed mean PCE over the past year (May 2023 is the latest):

5/2022: 4.10

6/2022: 4.48

7/2022: 4.51

8/2022: 4.75

9/2022: 4.73

10/2022: 4.75

11/2022: 4.70

12/2022: 4.68

1/2023: 4.62

2/2023: 4.64

3/2023: 4.70

4/2023: 4.81

5/2023: 4.61

A downtrend? How long to reach 2% or below in this measure, which is the Fed’s stated goal?

We’re going to see higher interest rates.

Nathan,

the rescue package WAS poorly targetted; money was given to many who did not need it to cover essential living expenses, and therefore some excess pirchasing power was built up in the community during the lockdowns, when nobody could discretionary spend.

Of course the ABC reporter is blaming the wrong people. and his naming of the covid support as “stimulus” is ridiculous. – the economy was in enforced ‘hibernation” with production (and supply) reduced to essentials, while effective demand collapsed because we all had to stay home. Certainly the economy didn’t need “stimulating” from its enforced hibernation., during the pandemic.

The sad thing is the governement could have paid all essential living costs, and avoided both the run up in public debt – which “must be repaid with interest” ( Chalmers), and the subsequent demand inflation, part of the overall inflation, including more significantly, supply inflation.

Nathan, I have seen reports about reports written by the Federal Reserve Bank of San Fransisco that said that the covid spending in the US caused about 0.3%-age points to 0.5%-age points of the 6% to 7% rate of inflation. So, about 4.5% of 6.5% inflation.

Obviously, 4.5% is not much of the total inflation.

This should be worded as 0.4%-age pt of the 5.6 to 6.6%-age pt the US would have had anyway, because of other factors (like: supply shortages, OPEC raising the price of oil, the war in Ukraine, and esp. price gouging by corps with monopoly pricing power to make more profits). The evidence can clearly be seen in the corps increased profit reported and by their CFO words to their shareholders.

Thank you for your response, Neil. My concern is around the implication that the temporary Jobseeker supplement was at least partially responsible for the inflationary spike. While there may have been pent-up savings across the economy more broadly, I wouldn’t think people living hand-to-mouth were squirreling their extra payments away to spend when things got back to normal. The suggestion feeds the narrative that supporting society’s most vulnerable is bad for the economy. It also provides a convenient diversion from the fact that one of, if not the most significant contributors to this round of inflation has been, as noted several times on this blog, profit-gouging (I’d prefer to call it rent-seeking). It shouldn’t go unchallenged.

Thanks, Steve. That’s handy.

Natham.

Yes, those on job-seeker payments were among the people who needed the extra money they received, to pay their essential living costs. during the lockdowns. The mainstrean journalists haven’t got a clue.

You should provide a link to the data in your graphs.

When the only have one tool and it is a hammer, everything looks like a nail, even if it is a screw.

The Fed only has one tool, interest rates. As bill, Warren, and (numerous) others have and continue to point out, raising interest rates is more counter productive than effective at curbing inflation. At least until it results in a recession/depression.

This is not only because NAIRU is a farce, but also because Friedman’s Monetarism is also a farce. Inflation is not “always and everywhere a monetary (demand-side) problem”. Inflation is always and everywhere a supply-side problem primarily resulting from capitalism’s intrinsic deficiencies and neoliberal policies.

Monetary supply and supply-side demands might facilitate inflation, but the root causes are essentially supply-side. This includes neoliberal governments not planning for mitigating capitalism’s intrinsic limitations that are the root causes of inflation.