In the annals of ruses used to provoke fear in the voting public about government…

Inside the Bank of England governor’s dreams – the wage-price spiral we cannot see

Many central bank officials have been trying all sorts of conditioning narratives to convince us that their interest rate hikes have been justified. Now they are actually defying the information presented in the official data to simply make things up. Last Wednesday (May 17, 2023), the Bank of England governor gave a speech to the British Chamber of Commerce – Getting inflation back to the 2% target − speech by Andrew Bailey. It came after the Bank raised the bank rate by a further 25 points to 4.5 per cent the week before. In that speech, he admitted inflation was declining and the main supply-side drivers were abating. But he said the rate rises were justified and unemployment had to rise because there was now persistent inflationary pressures coming from a “wage-price spiral”. The problem with this claim is that there is no data to support it.

There is a wage-price spiral in the UK – pity I cannot see it.

The Bank of England governor told the Chamber of Commerce gathering that Britain was in an “extraordinary situation” (Covid, etc) and like all nations had been hit with “a series of big supply shocks”, including the decline in output as Covid restricted activity and households shifted spending from services (which were constrained) to goods.

This shift in 2020 and 2021 prompted some economists to claim that inflation was a demand-side phenomenon, which required hard government net spending cuts and interest rate rises.

However, my position all along is that it is a rather bizarre construction of events to consider the appropriate remedy is to stifle demand – which has the result that unemployment rises – when the supply contraction was temporary and would resolve in due course.

The last thing we should be doing is creating unemployment because when governments engage in demand suppression either directly through fiscal policy or indirectly through monetary policy, unemployment tends to rise quickly and fall slowly, leaving a trail of personal and community hardship and disadvantage behind it.

The correct response was the one taken by the Japanese government and monetary authorities.

Japan was subjected to the same global supply constraints which pushed up costs but the central bank governor told us that they had formed the view that the supply pressures were transitory and didn’t justify an all out attack via interest rate increases which would endanger the nation’s low unemployment.

The Cabinet agreed and used fiscal policy to provide some cash support to households to ease the (temporary) cost of living pressures and to businesses as part of a deal to suppress profit margins and keep the price rises down.

The result of this approach has seen inflation dropping well below the levels in other advanced nations and unemployment remain very low.

By any measure a success.

And it is a wonder that the mainstream press ignores the ‘experiment’ and just mimics the narratives presented by the other central bank governors.

I even heard an economist telling the national ABC radio the other day in a key feature on the economy that ‘central banks are increasing rates everywhere’.

Which was a lie and the journalist failed to pick her up on it.

In his speech to the Chamber of Commerce, the Bank of England governor acknowledged that:

… global supply pressures have eased.

Significantly to say the least.

He also indicated that the rising energy costs as a result of the Ukraine situation “will also now reverse”.

So then what is driving inflationary pressures in the UK?

Well he claims that the third:

… supply shock has been a domestic one …

And there we learn that Covid led to a sharp fall in the “size of the workforce” through inactivity – which mostly is because of illness.

The most recent labour market data from the Office of National Statistics (released May 16, 2023) – Labour market overview, UK: May 2023 – is quite shocking in its revelations.

1. “those inactive because of long-term sickness increased to a record high.”

2. “2.55 million people were not able to work in the three months to March, which is over 6% of the country’s working population. That was up nearly 100,000 on the previous quarter.” (Source).

3. “the pandemic is likely to be one of the main causes for the increase in the number of long-term sick over the past three years or so, including those suffering from long COVID symptoms such as post-viral fatigue.”

4. “This is now comfortably the largest number of people out of the labor market due to long-term health problems that we have ever seen”.

The reality is that our nations will endure a large (and growing) cohort of workers with permanent disability as a result of Covid infections.

The cavalier way in which we are now in full stage denial of this problem is astounding.

But the governor is also keen to note that the workforce shortages that became acute during the early years of Covid are “reversing somewhat”.

Then there are “food prices”, in part arising from the “disruptions to Ukraine’s supply of agricultural products to the global market”, which have been a major contributor to British inflation in the last year (“the annual CPI inflation for food and non-alcoholic beverages in the United Kingdom has risen from 5.9% in March 2022 to 19.1% in the latest March 2023 numbers”).

All of these points are incontestable really.

As is his observation that inflation hurts “the least well-off harder” because they spend more of their income on the items that have inflated the most.

But there is no retreat from his view that the interest rate rises were essential – even if they hurt the low-income families the most – “to bring inflation down”.

He noted that the “real income” losses that arise from rising imported raw materials or products cannot be solved by monetary policy.

So why did they raise rates?

His simple explanation is that the Bank had:

… to take action to ensure that inflation falls as the external shocks abate – that inflationary impulses from these external sources do not cause persistent ‘second-round’ effects on domestic wage and price setting that could hold inflation up for longer. That is why we have increased Bank Rate by nearly 4½ percentage points from December 2021, from 0.1% then to 4.5% now.

Ah, the wage-price spiral argument – finally.

The ‘dreaded second-round effects’.

He claimed that even though inflation is falling as the supply drivers abate, there is a dangerous persistence setting in due to these “second-round effects”.

What are they?

Well, he said the Bank had desired a rise in unemployment (a “shallow but long recession”) the problem is that the rise has been “happening at a slower pace than we expected in February”.

In other words, they haven’t yet achieved their goal of pushing tens of thousands of workers into joblessness.

As a result, he claimed that the MPC:

… continues to judge that the risks to inflation are skewed significantly to the upside, primarily reflecting the possibility of more persistence in domestic wage and price setting.

So we have moved from narratives, such as those pushed by the Reserve Bank of Australia governor that they ‘fear’ a wage-price spiral, to more definitive claims that the inflation is now being driven by the presence and operation of such a spiral.

Which has become their justification for the on-going interest rate hikes.

The evidence?

Central bank governors like to mention their private briefings with the business sector and have claimed in those meetings they learned about higher wages growth.

Initially, we couldn’t refute the claims because we didn’t have enough official data, which would have eventually revealed the growing wage pressures had they been occuring.

But now more than 18 months into the rising inflationary pressures, the official data for Britain is still recording real wage cuts, of a systematic nature, which rules out any wage-price spiral dynamics.

If we observed a leapfrogging pattern – where a large nominal wage increase resulted in real wage increases was followed by a surge in inflation next quarter and so on – then we might conclude that the distributional struggle between labour and capital as to who would take the losses in real income as a result of the imported cost increases.

But when the real wage cuts are systematic then it is much harder to construct the problem as an interactive wage-price spiral.

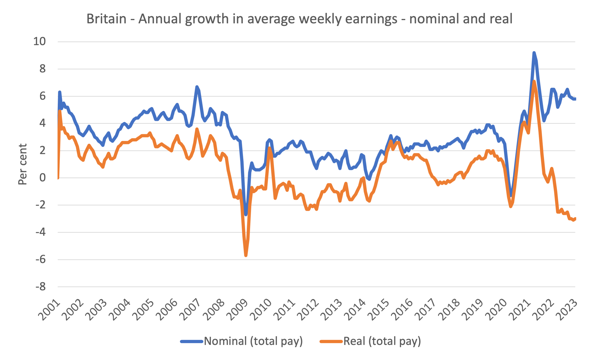

The latest ONS wages data (released May 16, 2023) – Average weekly earnings in Great Britain: May 2023 – the day before the governor made his speech shows that:

Growth in employees’ average total pay (including bonuses) was 5.8% and growth in regular pay (excluding bonuses) was 6.7% in January to March 2023.

However, and this is the significant point:

Growth in total and regular pay fell in real terms (adjusted for inflation) on the year in January to March 2023, by 3.0% for total pay and 2.0% for regular pay; for real total pay a similar fall was seen in the previous three-month period and remains among the largest falls in growth since comparable records began in 2001.

The following graph shows the annual growth in nominal and real average weekly earnings (total pay) from the March-quarter 2001 to the March-quarter 2023 (latest data).

Note the dynamics.

The initial recovery in earnings from the lockdown period soon gave way to a systematic loss of purchasing power as the supply-side inflation powered off and nominal wages failed to catch up.

Since mid-2022, workers have endured real wage cuts each quarter.

Even the nominal wage inflation has been fairly stable since the end of last year.

The last two quarters have seen no acceleration in nominal wages.

Conclusion

Remember when the inflation was just taking off, the Bank of England governor told British workers that they had to take a pay cut or else he would make more of them unemployed than he was already planning to do via the interest rate hikes.

Well, they did take that pay cut, albeit in an involuntary way, and real wages have fallen systematically over the last year.

Now the same governor is blaming workers for creating a persistent second-round wage-price spiral by refusing to accept an even larger real wage cut.

I know all the economic models of wage-price spirals – mainstream and others – and none would suggest that such a dynamic could really occur and persist when there are systematic real wage losses being incurred.

There is no hint of a leap-frogging pattern in Britain.

This is another central bank governor that needs to be rendered unemployed.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

On the other side thanks to index linked gilts and rising interest rates there has been a 4% of GDP increase in the interest income injected into the UK economy since 2021

Yet they never mention that there may be an interest/price spiral.

Inflation is one of the “outputs” of all that goes on in the economy.

Since economies got global, the “equation model” that describes the “outputs” is the function of a gigantic number of inputs and has become too complex to any human or even machine to ascertain.

In fact, they were already too complex before globalization.

So, it’s kind of stupid (I should say criminal stupid) to think that a single tweak on interest rates can drive the “output” to the gilded 2%.

But nobel prizes went to charlatans (“champions” of the swindle of micro-economics applied to macro-economics), and so many of us thought it was the right way to go, even after volcker proved that inflation goes up, when interest rates hikes.

You just need the media to keep silent, everytime the narrative goes wrong with the evidence (rembember WMD in Iraq?).

And that is the easy part: the media are just a bunch of parrots, paid to replicate anything the elites tell them to do.

But, none of this has anything to do with macro-economics.

It has only to do with redistribution of wealth.

As long as we keep the elites in power, we should expect them to take the doe out of your pocket and into theirs.

The lies are songs they need to sing, in order to keep you calm (“keep calm” says the cap).

Imagine what would happen if the 99% knew the truth about interest rates hiking.

Anyone that spouts the nonsense of BofE independence might want to rethink on the basis that halving inflation is PM Sunak’s no 1 back of fag packet pledge and he will take all the credit for the BofE Gov’nor’s work on his behalf, as well as easing of supply side pressures. Nos 2 and 3 are creating better paid jobs (but not for Drs, nurses, teachers etc) and reducing the national debt. Laugh or cry?

I am struggling with the argument here.

If employers follow some cost markup practice in pricing then it would seem reasonable to expect that an increase in wages would lead to an increase in prices.

If the wage increases are equal or greater than inflation, then, one would expect increasing inflation.

If the wage increases are less than inflation, then, one would expect decreasing inflation.

Is the argument that, since most wage increases have been less than inflation and, therefore, any inflation due to increasing wages would be declining, then it is inappropriate to consider this a wage-price spiral?

As lender of last resort the government tends to keep bankers in work. Immoral hypocrisy doesn’t get any finer with Andrew Bailey refusing to recognise this!

I am struggling with the argument in this piece.

If firms follow a cost + markup approach to pricing then as wages increase one would expect prices to increase.

If wages increase by more than inflation then one would expect to see an increasing inflation over time.

If wages increase by less than inflation then one would expect to see a decreasing inflation over time.

Wages have been increasing at less than the inflation rate so we would expect to see the inflation rate dropping over time.

Is this why it is argued that there is no wage-price spiral?

MartinD – Yes, falling real wages (wage increases less than the rate of inflation) are part of the story, as are falling input costs (supply-chain improvements), and worker productivity improvement (more output per unit of wages).

To me, though, Bill’s decisive argument is that there’s no real negotiating strength on labor’s side this time around (for example, in the form of a large, strong union movement). So the “distributional struggle” that led to a wage-price spiral in the seventies is unlikely to play out again. See this post: https://billmitchell.org/blog/?p=60735

If wage rises are lower than inflation + productivity, then the planned markups of firms cannot be achieved overall. Somebody must be disappointed as there isn’t the monetary flow to validate the all the plans.

Unless there is an explosion of private sector net borrowing, or increased net government spending, to fill the gap.

In a sane world the following things would happen to control inflation.

When something radical happens such as a worldwide pandemic that shuts down supply chains to the factory of the world (China), plus a war in a European food bowl, causing huge supply-side shocks, what is needed is a federal regulatory body, the head of this body would be called the minister for the public-shaming of profit gouging inflation creators.

Due to the lack of regulations in the Neo-liberal era causing a lack of competition, we have large businesses with an absurd amount of market power These large businesses’ need to be constantly monitored so they cannot profit gouge, for example when input costs have come back to normal (petrol, fertilizers, imported components, etc.) they must reduce their prices accordingly or they will have price controls applied by the minister.

Check out the current balance sheets of any of these large businesses, profits are through the roof.

It goes without saying if someone wants to start a business say for example create a solid-state battery that does not require rare earths in its chemistry and is relatively easy to recycle at the end of the batteries life, we should all be cheering for their success.

Back to our insane world.

The Neo-liberals are saying we have inflation due to high demand and a lack of supply, so we need to create an equilibrium by bringing demand down by raising interest rates to meet this new lower supply level. The lower supply level is transitory, so as supply chains gradually go back to normal, we will not have a problem with supply levels, so it is insane to raise interest rates causing unemployment to rise and prices such as rents to increase.

When will this insanity stop?

When the average person knows how money and the financial system really works.

So, when people hear Neo-liberal TINA BS being sprouted, they are fortified with a rational economic understanding to help move towards a civilized world.

I’ve sent this today to several contacts within the labour movement (TUC, IER, Unite the Union). Whatever power they retain within the Labour Party they should be using MMT to show that full employment is a meaningful objective still.

“they must reduce their prices accordingly or they will have price controls applied by the minister.”

Why not just create a public owned competitor?

Inflation is fundamentally a lack of excess supply. Price rises are therefore an indication of lack of competition.

So create some. It’s not as if we’re short of funds.

Then the simple threat that a public competitor will be created will be enough to get private firms to think twice before putting their prices up.

It is a shame, and rather ironic, that the next generation of influential voices in the public sphere within finance and gambling are regurgitating the economic “truths” from these “prophets of rationality”; isn’t the goal greater wealth and prosperity…? Both worlds are full of people who best encapsulate the irrationality of these “prophets of rationality” who manically devote their blessings and sacrifices to the idols of “logic” and “reason”, justifying the fracturing of society as “evolutionary progress”, dismissing the actual cause – degeneration and corruption from increased ignorance; inciting louder drums for cover.

Both environments promote the belief that the freedom for individuals to have control over their decisions to pursue their needs should be made with conditions of the environment individually formulated and agreed upon by a few individuals; not in the sense of collective mutuality, by rather to avoid nihilistic catastrophe. Unfortunately, this belief not only conveniently neglects the fact that the nature of the environment is formed by the power of regulatory implementations, but it is also distorting the boundaries set by collective public consensus by reframing them as individual, private, interests. These “prophets of rationality” promote the end result as sacredness, and their decision-making process as perfection, therefore encouraging and supporting each other to rage war against people who inherently understand they need to be removed from consequential decision-making because at their hands society is suffocating and their hearts are indifferent to the living-souls withering away.

These “prophets of rationality” have become so conditioned to being societies angels that they don’t recognise how superstitious they have become of any existential threat that undermines their doctrine of control. They love showcasing their irrational pursuits as symbolisms for the power of “logic” and “reason”, thus justifying societies deterioration as a “natural” consequence of “intellectual evolution”; ignorant of mother nature demonstrating the consequences of their short-sightedness.

‘One should never gamble against the natural world, for the universe’s catastrophic spirit lays dormant’

@mk “The lower supply level is transitory”.

The lower supply level caused by the pandemic is transitory.

But the lower supply level of energy caused by the war in Ukraine would appear to be long term.

The terms of trade have moved against the UK and we are correspondingly poorer.

The current strikes are about how this reduction in GDP will be distributed throughout the society.

If you have debts, going on strike to defend your living standards becomes more difficult since you now have higher interest payments to meet.

I feel sure that, this effect of higher interest rates will have been well understood by the BoE.

In times of national emergency (notably war) governments must command real resources where markets fail to ensure their fair and efficient allocation. Actually they need to do this generally.