In the annals of ruses used to provoke fear in the voting public about government…

The inflationary episode is being driven by profit gouging and interest rate hikes won’t help much

I have read an interesting reports in the last months that demonstrate there is a shift in thinking about inflation – away from the tired narratives that attempt to implicate excessive government spending, poorly contrived monetary policies (particularly quantitative easing) or drag in the usual suspect – excessive wage demands from workers. All of the usual narratives are very convenient frames in which those with economic power can extract more real income at the expense of the rest of us, who have little economic power. At least, we have been indocrinated to think we have no power. But, of course, if we could overthrow the whole system of capital domination if we were organised enough but that is another story again. Back to the inflation framing. While it was possible to argue that distributional struggle between workers (organised into powerful unions) and corporations (with obvious price setting power in less than competitive industries) was instrumental in propagating the original OPEC oil shock in 1973 into a drawn out inflationary episode, such a narrative falls short in 2022-23. The workers are largely disorganised and compliant now. The new thinking is starting to focus on the role of corporations – one term that is now being used is ‘greedflation’ – to describe this new era of profit gouging and its impact on the inflation trajectory. That shift in focus is warranted and welcome because it highlights the imbalances in the capitalist system and just another way in which it is prone to crises.

One recent report from the British Unite the Union (published March 2023) – Unite Investigates: Profiteering across the economy—it’s systemic – provides convincing evidence that:

We’re living in the midst of a cost of profiteering crisis …

… key industries which between them are driving over 57% of inflation: energy, food, automotive, and the transport sectors including road freight and shipping that keep our economy moving …

… profiteering has resulted in the high prices we’ve all had to pay – not workers’ wages …

Rampant corporate profiteering has fuelled the cost-of-living crisis … Profit margins for the first half of 2022 were 89% higher than the same period in 2019 ,,,

The crisis is systemic: corporations and investors, facilitated by governments, have won enormous power to set the rules and reap the rewards. Their economy is failing the vast majority of us, both as workers and consumers.

The well-researched Unite report is breathtaking really, even for someone such as me, who examines data every day and has a keen sense of the way capital exploits its power.

The Unite researchers studied the accounts of the top 350 corporations on the FTSE and found that:

1. Profit margins “jumped 73%” in 2021 compared to 2019 (on average).

2. “Profit margins for the first half of 2022 were 89% higher than the same period in 2019”.

3. Profit margins were 5.7 per cent in the first half of 2019.

2. They rose to 10.7 per cent in the first half of 2022.

The Report notes that unit costs have risen for firms as a result of the supply constraints emanating from the pandemic:

The initial triggers of inflation were “supply shocks” including climate crises, post- pandemic bottlenecks, and more recently the Ukraine war. But many companies have taken advantage to boost their profits, driving up prices even further.

So the price increases observed in Britain are way beyond anything that could be justified by rising input costs (whether they be raw materials or labour).

The mechanisms used by corporations to profit gouge are identified as:

1. Initial “supply crunch” – which creates an imbalance between spending (demand) and supply (constrained), which creates the environment in which prices start to rise on the back of increases in unit costs.

It should be noted that many of the factors creating that supply crunch have dissipated (transport shortages etc) or are resolving – which would have made the inflationary impulse transitory.

2. A “Demand jump” – at the end of the ‘restriction phase’ of the pandemic, consumers started spending freely again on a range of goods and services, before the supply constraints had resolved – which reinforced the environment for price rises.

That short-term blip in demand did not justify considering this inflationary period to be a ‘demand pull’ event because the consumers would have adjusted back to more normal behaviour soon enough and the supply side was catching up anyway.

This temporary imbalance between supply and demand is what central bankers are using to justify their interest rate increases.

But their logic is astray given that the major source of the initial inflationary pressures were the supply constraints and they are easing.

Which leaves us with the question: will the interest rates deal with the ‘greedflation’ – the profit-gouging firms?

The answer is unlikely.

3. “Market windfall” – this relates to “Centralised market stuctures” that favour companies – like energy markets etc.

In Australia, for example, the big gas companies have diverted domestic supply into the world export market, which is paying much higher prices as a result of the disruptions arising from the Russian invasion of the Ukraine.

And then, because this is creating threats of shortages in the domestic market, they are pushing through massive prices hikes domestically.

Yet, Australia produces much more gas than we use domestically.

Fault: poor government regulation and profit gouging of the corporations.

4. “Market concentration (oligopoly)” – we see that in energy, shipping, ports, supermarkets, banking and more.

The claim that capitalism is about ‘competition’ is a myth.

Corporations do their best to wipe out competition with aggressive take-overs, buyouts, etc and then they take advantage of their market power to push through excessive price rises.

5. “State-licensed monopolies” – privatisation was really about transferring public wealth into the hands of profit-seekers in the private sector who then exploit the ‘essential service’ nature of their activity to profit gouge.

The problem again is lack of state regulation and privatisation.

We were told that privatisation would increase competition, drive down unit costs, and improve product and service quality.

The reality after around 4 decades of this folly is that the promises that justified the sell-offs and the massive transfer of public wealth were vapid.

The Unite report is clear about “who’s responsible”.

1. “Politicians, media, and the Bank of England still largely ignore the profiteering crisis”.

Remember the Bank of England governor admonishing workers and telling them they had to take wage cuts because they were causing the inflation.

With the real wage cuts that have occurred, yet the inflation accelerated those attacks on workers were just hiding a disregard for what corporations were doing.

2. The survey evidence clearly shows that the majority of business are using the inflation as a veil to push prices “beyond what was required to offset increased costs” – in other words, realigning the distribution of income in their favour at the expense of workers.

3. The other major finding is that the profiteering is not just being done by a few rogue corporations.

The Unite report shows that this is a “systematic” activity, where “(e)ntire industries are choosing to take advantage of a crisis, resulting in the spiralling prices of goods we all need.”

The Unite report findings were also consistent with the UK Guardian analysis (April 27, 2022) – https://www.theguardian.com/business/2022/apr/27/inflation-corporate-america-increased-prices-profits.

That study found that in the US:

… top corporations … are enjoying profit increases even as they pass on costs to customers, many of whom are struggling to afford gas, food, clothing, housing and other basics.

But it is more than passing on the cost rises.

What is happening is different.

Corporations are using the mechanisms noted above to realign the distributional balance in their favour by pushing out profit margins.

Passing on unit cost rises is one thing – at a constant mark-up.

But firms are increasing the mark-up and becoming the source of the inflationary spiral rather than just responding to it.

I have referred to these episodes in terms of initial shock and then the actions of the mechanism that propoagates that initial shock into a broader more persistent inflationary episode.

In the 1970s, the initial shock was the OPEC oil price hikes and the propagation came from the interplay between powerful unions and corporations as to who was going to take the real income loss from the elevated imported oil prices.

In the current period, the shock was the pandemic, OPEC and the Russian folly.

And now, that shock is being propagated into something more enduring by the profit gouging.

There is also an interesting Op Ed from Isabella Weber (March 13, 2023) – A New Economic Policy Playbook – which discusses this topic and makes the case for price controls to thwart price gouging by corporations.

I will consider the issue of price controls in a later blog post.

And what about Australia?

There is strong evidence that the same factors are at work in Australia as the Unite report and the UK Guardian study found for Britain and the US.

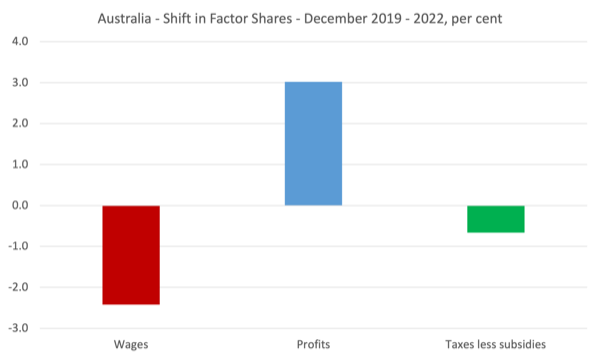

Between the December-quarter 2019 (just before the pandemic) and the December-quarter 2022, the Gross Operating Surplus share in total factor income rose by 3 per cent, whereas the share of Labour compensation fell by 2.4 per cent (see the following graph).

The gains to the profit sector were largely made by the corporations with the small business sector enjoying a smaller boost to their profits.

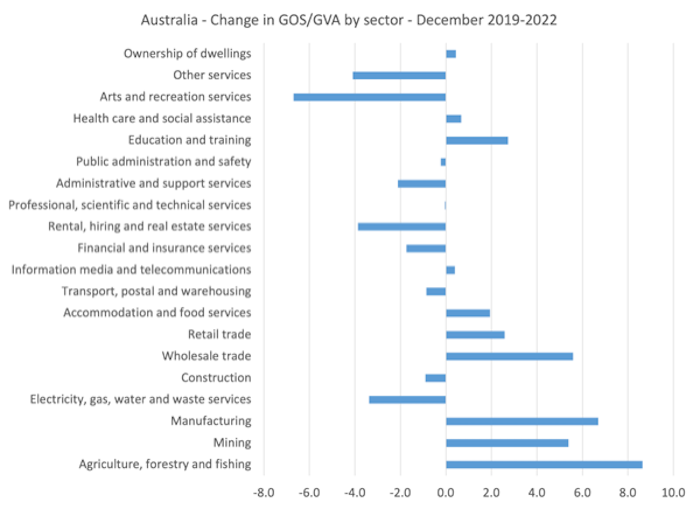

There were substantial variations across the industry structure in terms of the share of GOS in Gross Value Added (output).

The following graph shows the percentage changes for all industries between December-quarter 2019 and the December-quarter 2022.

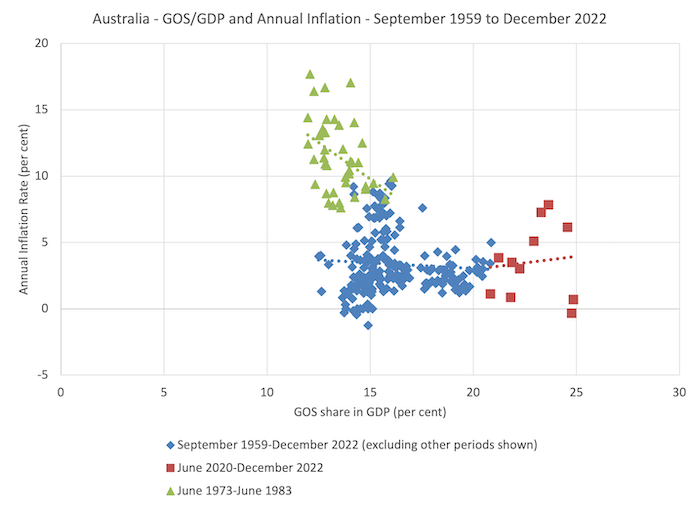

Another way of thinking about this is to trace the GOS/GDP ratio since the September-quarter 1959 (the beginning of the modern National Accounts data) and matching it to the evolution of inflation in Australia.

The following graph shows the GOS share on the horizontal axis for three separate periods:

1. June-quarter 1973 to June-quarter 1983 – the ‘1970s inflation’.

2. June-quarter 2020 to December-quarter 2022 – the ‘pandemic inflation’.

3. All other quarters between September 1959 and December 2022.

The dotted lines are just the respective least-squares trend line for the sub-samples described above.

So in the 1970s inflation period, it is hard to say that the annual inflation rate was driven exclusively by the shifts in the GOS share in GDP.

But in the recent period the relationship between the two variables is substantially different and positive – higher GDS share, higher inflation.

While a cross plot like this (‘eye balling’ as it is known in the profession) doesn’t tell us what is driving what – that is, the causality, it provides us with a lead to motivate further research.

If I ran a detailed regression analysis, I would find that the higher share of GOS – that is the higher profit share is a significant factor driving the inflation trajectory in the latest period.

Conclusion

More detailed analysis of corporate financial statements, along the lines of the Unite study would be useful in Australia to really find out where the profit gouging is going on and the extent of it.

But the sectors that Unite found to be the worst offenders would show up in Australia too – energy, supermarkets, utilities.

Our banks would also be exposed.

I might do that exercise at some point but it would distract me at present from the long pipeline of projects I have to get finished.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

“Remember the Bank of England governor admonishing workers and telling them they had to take wage cuts because they were causing the inflation.”

To be fair to Andrew Bailey, who would be out of his depth in a puddle, he did say the other day

The irony being that he sets the price of money…

“But firms are increasing the mark-up and becoming the source of the inflationary spiral rather than just responding to it.”

That can only happen when there is a lack of capacity to supply. Firms will always charge as much as they can get away with for their products and services. Only when buyers have, and use, alternatives will prices be controlled by market mechanisms.

In other words price rises are always, everywhere, a lack of effective competition.

If the private sector won’t invest to create competitors, then guess who has to create those competitors instead?

Every price rise should have the competition authorities crawling all over it. Yet we see nothing.

Neil,

So, let me get this straight. Bailey believes that if price setters keep increasing the price, he’ll have to make things harder for their competitors while giving them an excuse to keep raising prices?

Well, I’d be scared.

My understanding is that firms as a whole can not increase their profits by, for example, raising prices.

If they were to do so, then fewer “units” would be sold, given a certain level of spending – resulting in no change in profits. Instead, high profit margins currently are a result of high government deficits. See Kalecki Profit Equation – sure you are familiar with. thanks.

Tamara Lothian, Law and the wealth of nations

Firm increasing their profit margins should be one off event, therefore its effects on inflation should dissipate on its own.

@Hepion, except if the corps just choose to make even more profit by increasing their prices more, and more.

You’re absolutely right that we need more data on this. The ABS does great work but they are constantly constrained by the executive government. We desperately need more data about union membership and unit profits.