It is a public holiday in Australia today celebrating our national day - the day…

Are the OPEC production cuts a problem?

It’s Wednesday and so I have a few items to discuss followed by some music. Many readers have E-mailed me asking about last week’s decision by the OPEC+ cartel to cut production of crude oil by 1.66 million barrels per day. Taken together with the previous cuts (2 millions barrels per day) in October, this pushed the price of oil up within a day or so back over $US80 per day. Many commentators immediately announced this would drive inflation back up and force central banks to go harder on interest rates. I disagree with those assessments. When analysing cartel behaviour (and OPEC+ is such an organisation), one has to distinguish between price stability and price gouging exercises. As I explain below, I believe OPEC+ to be engaged in a price stabilising activity in the face of anticipated reductions in global demand for crude oil. The risk is that demand will fall further than the producers expect and they will have to make further cuts. But even if the new price level holds, that won’t really trigger a new bout of accelerating inflation.

OPEC+ production cuts – problem?

On April 3, 2023, the OPEC cartel published a press release following the 48th meeting of the so-called JMMC – 48th Meeting of the Joint Ministerial Monitoring Committee.

This Committee is the coordinating body for OPEC.

One decision which was made in liaison with Russia (which makes it OPEC+) was to engage in what they called ‘voluntarily production adjustment’ – aka cutting supply by some 1.66 million barrels a day allegedly to support the “stability of the oil market” – aka maintaining a price floor to maximise profits.

Taken together with the cuts announced in October 2022, the supply cut will amount to 3.55 million barrels a day or 3.7 per cent of the total world demand.

Why would they have made that decision?

A cartel is an anticompetitive organisation of suppliers (in any sector) that allows the individual units to gain the benefits of output control and other techniques (such as market share agreements, price fixing and rigging tender processes).

The current OPEC+ decision is of the output control variety and typically is used to either push up prices or to stop them falling below some desired threshold.

In the former case, by restricting supply the organisation can, under some circumstances, push up the price, as long as demand is relatively inelastic.

What does that mean in English?

Inelastic demand just means that the demand for the good is not particularly price sensitive so that when the price rises, demand hardly shifts.

In that case, total revenue to the firms in the cartel rise because they are selling the same amount (say) at a higher price and as long as unit costs do not rise accordingly, that revenue increase is pure profit.

I will come back to that because it bears on the current situation.

The other motivation noted above is that supply restrictions are used to stop prices falling below a certain level.

This is very relevant in the current situation.

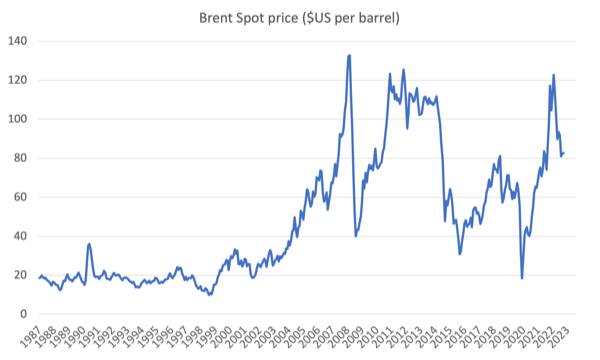

The following graph uses data from – US Energy Information Administration – and shows the monthly price for Europe Brent Spot in USD per barrel from March 1987 to February 2023.

It reached a recent peak in June 2022 of $US122.71 per barrel and today is trading at around $US85 per barrel.

Its most recent trough was on March 17, 2023 when the price was $US72.77 per barrel.

Last Friday (March 31, 2023), the spot price was $US79.89 per barrel and within 2 days, it had jumped to $US85.23 per barrel and has largely stabilised at that level since.

What OPEC+ is fearing is that the irresponsible interest rate hikes from most central banks will push global demand down as economies go into recession, which would push prices below the $US80 mark quite quickly.

There are also concerns that the interest rate hikes are causing banks to crash (in the way we have already seen), which will lead to a GFC-type situation and suppress demand for OPEC+ oil.

The other point about the production cuts is that they signal to the financial markets that the producers have the power not the speculators.

Before the OPEC+ decision, the financial markets were out in force, trying to profit by short-selling oil in future markets.

They were doing that because they were betting that prices would fall further below $US70 per barrel.

The speculators have always bothered OPEC bosses because they destabilise the oil market.

So, by pushing through supply restraint, OPEC can prevent the oil price from falling and thus thwart the bets placed by the short-sellers.

That has to be applauded!

The other point – and here were are going back to the issue of elasticity.

While OPEC+ desires to put a floor under the oil price in the face of anticipated drops in demand, it also doesn’t want to exacerbate the negative effects on demand coming from monetary policy shifts.

That means that the production cut is unlikely to have been motivated by a desire to push prices back up to around $US100 per barrel or higher.

The cartel knows that there would be consequences arising from that, that they may not be able to manage.

1. Price rises would push demand down further.

2. Price rises would encourage non-OPEC states to expand their supply. OPEC current supplies about 60 per cent of global trade in crude oil.

Some of the non-OPEC states (such as US, Canada, Norway) are large producers in their own right, although they are also high consumers of oil, so their capacity to export large volumes is limited.

Shale oil in the US still has significant potential but requires further capital investement, which will become more attractive if OPEC+ was to pursue a large price gouging exercise.

3. The price rises might contribute to higher inflation and more interest rate hikes and lower overall demand for oil.

Is the production cut a problem?

I believe it is a price stabilising exercise rather than a price gouging exercise.

The slight rise in prices since the decision are unlikely to produce any significant impact on the inflation trajectory in oil-dependent nations.

The only impact on that trajectory might be to drag out the current decline in inflation rates for a longer period.

But that should not provoke central banks to keep pushing up rates.

It seems that central banks might finally be getting the message that they have overdone the response.

For example, yesterday, the RBA held the rate constant even while talking big about future rate hikes.

They realise that the damage from their decisions is about to get serious (as more mortgage holders come of historically low fixed rate arrangements).

Given that the OPEC+ decision will likely just hold the spot prices at a new level – a once-off impact – the flow on into other prices will not be of an accelerating nature.

The other point is this – if economies continue to slow along the current trajectories – then OPEC+ may, indeed, find it hard to stabilise the spot oil price above $US80.

It is one thing to be able to manipulate the price by supply control but another to sustain that manipulation if demand collapses.

That is the big risk that OPEC+ are now taking.

On September 23, 2022, the Brent spot price was $US84.87 per barrel.

Then OPEC cut production by 2 million barrels a day, and the price rose according to $US97.92 per barrel by October 7, 2022.

It stabilised around there until early November, and, then as global demand fell, so did the spot price.

That is likely to happen again with this new production restraint.

The uncertainty though relates to how China behaves as it ramps up its global demand for oil after its Covid restrictions eased.

We will see how that all pans out in the coming months.

My new podcast – Letter from The Cape

Last week, I launched my new podcast – Letter from The Cape.

The context is that our educational venture – MMTed – is now an affiliate of 3CR Melbourne, which is a community radio station in Melbourne.

As part of that relationship, MMTed is assisting a new radio program – RadioMMT – which is hosted by Anne Maxwell and Kevin Gaynor and is presented every second Friday from 17:30 to 18:30.

I now contribute a regular segment on their program.

The topics I cover are general but sometimes there will be specific local context provided, given the location of the radio station.

They topics focus on Modern Monetary Theory (MMT) concepts applied to contemporary issues in the real world.

While the segment goes to air in Melbourne on a regular basis, I decided to make it available via my home page as a podcast so that it reaches a wider audience.

A new podcast will be posted about every fortnight.

Music – YMO

This is what I have been listening to while working this morning.

I hadn’t listened to the = Yellow Magic Orchestra – for a while but loaded it back onto my iPhone the other day to remember the great music they created as an experimental band in the 1970s

I was prompted by the death of the keyboard player – Sakamoto Ryūichi – last week (March 28, 2023) at the age of 71.

Unfortunately, two of the three YMO members are now gone – we are all getting older.

Drummer – Takahashi Yukihiro – died earlier this year (January 11, 2023) and Sakamoto died last week.

Only bass player – Hosono Haruomi – survives and he was quite a few years older than the parted members.

They were pioneers of electronic music using the famed ARP Odyssey, Prophet 5, and Yamaha C-80 synths to create a really complicated sound.

I first heard this band when they released their first self-titled album in 1978.

But thie second album was the best and here the famous song – Rydeen – which was on that second album released in 1979 – Solid State Survivor.

It is a sign of the times I guess that musicians that have been important parts of my life are now dying off!

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

Oil markets only apply to western and small economies?

Big consumers, like China, have no oil markets.

They bargain directly with the producers.

The west still follows Friedman’s catechism.

If inflation is the product of QE, because QE only accrued to the real estate bubble, what use will hiking interest rates have – if we soon will be turning back to QE?

Well, the only outcome of interest rates hiking is another spree of wealth transfer from the 99% to the 1%.

As Bill wrote last March 30 “(…) This was the mainstream idea that underpinned the belief that quantitative easing (swapping bank reserves for bonds) would stimulate the economy at the depth of recession.

Of course, it didn’t and the reason it didn’t was because bank lending is not reserve constrained.(…)”

If part of the global economy is going the way of progress and the other still follows feudal fairy tales, the only outcome of this will be economic decline for the later, as we’re seeing in the US, in the UK and in the EU.

The media only talks about the elites and omits every sign of decline.

Note: Sorry. Stupid of me to cite you.

Oil markets only apply to western and small economies?

Big consumers, like China, have no oil markets.

They bargain directly with the producers.

The west still follows Friedman’s catechism.

If inflation is the product of QE, because QE only accrued to the real estate bubble, what use will hiking interest rates have – if we will soon be turning back to QE?

Well, the only outcome of interest rates hiking is another spree of wealth transfer from the 99% to the 1%.

If part of the global economy is going the way of progress and the other still follows feudal fairy tales, the only outcome of this will be economic decline for the later, as we’re seeing in the US, in the UK and in the EU.

The media only talks about the elites and omits every sign of decline.

Energy (and other commodity) prices are explicitly excluded from the inflation measures used by central banks to determine interest rates. Even if OPEC undertakes price gouging, the central banks won’t react to the higher prices as “inflationary.”

Central banks are worried about sticky prices, especially of services, not short-term commodity prices. Energy and other commodity prices are very slow to influence sticky services prices.

Dear John B. (at 2023/04/06 at 7:39 am)

Yes, but energy prices feed into transport and other product groups that are included in the CPI regimen and influence the policy outcomes that way. If oil prices rise, petrol becomes more expensive and supermarket goods are marked up because the transport costs to shops increase.

best wishes

bill

Bill, what do yu think the will happen when Australian fixed mortgages revert to variable mortgages?

Thanks for the post Bill. I am really sad about hearing about the passing of Sakamoto-san.

He really was one of a kind. He has left us and the world for eternity a beautiful corpus of music.

I hope I can post this, but I was recently listening to his 1982 album with British singer Robin Scott. Produced by Sakamoto-san and featuring his YMO band mates, “The Left Bank” resonates with me. I hope you enjoy it.

https://www.youtube.com/watch?v=jO3Q7VR-5sE