I started my undergraduate studies in economics in the late 1970s after starting out as…

Social entrepreneurship … another neo-liberal denial

UK Tory leader David Cameron is back in print in the Guardian (November 10, 2009) with his claim that Big society can fight poverty. Big government just fuels it. In the same edition of the Guardian, regular commentator Polly Toynbee provided a critical analysis to the Cameron line in her article – David Cameron, social policy butterfly. However, sadly, neither writer understands the principles of modern monetary theory (MMT) which means that neither has the slightest inkling of how the monetary system that they live in works. If they did understand that system and the opportunities that it provides a sensible national government then they would probably not write what they did.

As economies were emerging from the 1991 downturn, various trends emerged as high unemployment rates and rising underemployment persisted. The 1994 OECD Jobs Study spawned the move to activism and we were sold a view of the labour market that any remaining labour market underutilisation was an individual problem – a lack of skills or attitude rather than it being a lack of jobs which would have reflected a system failure at the macroeconomic level.

These individualistic and market-based constructs inherent in neo-liberalism then were diversified into several separate policy agendas, which has obscured its failure to achieve full employment. Unemployment has been desensitised and rendered an individual problem – the ultimate “privatisation”.

A series of “solution packages” or separate policy agendas, begin with individualistic explanations for unemployment and accept the litany of myths used to justify the damaging changes in the conduct of macroeconomic policy. Changes which made it impossible for governments to achieve full employment.

We are thus continually being asked to address “false agendas”, which abstract from the real causes of the phenomena in focus. By failing to ask the correct questions, these “solution packages” then appear, on first blush, to have (undeserved) plausibility. One such false agenda is the so-called “new model” of welfare provision, popularly called Social Entrepreneurship (SE), which emerged in the 1990s.

SE was promoted heavily in the UK by New Labour under its “end of ideology” Third Way agenda – where the claim was that left and right were meaningless now and instead there was this third way that took the best of both.

SE is howver infused with neo-liberal constructs and reinforces the abandonment of sound macroeconomic policy and the persistence of high unemployment and rising levels of underemployment.

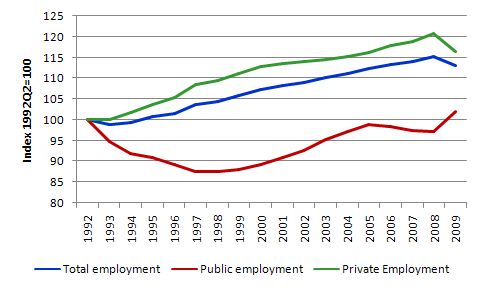

The following graph shows the composition of total employment in the UK indexed at 100 at the second quarter 1992 – Total (green), private (blue) and public (red) and for each second quarter annually until 2009. You can see the contraction of public employment under the Tories and the hesitant increase under the current government – with the total only just returning to its early 1990s level in recent months. In share terms public employment dropped from 24 per cent to around 20 per cent over this period. If they had have maintained their share of employment (that is participated proportionally in the growth) there would have been more than 500 thousand jobs extra jobs available in the UK.

I was reminded of this nonsense again today when I read the latest offering from David Cameron, leader of the Tory party and would-be Prime Minister.

Cameron began his speech (on which the Guardian article is a summary) by saying that “a swollen state has seen inequality thrive. We need a new role for the state to build a stronger, more responsible society”.

He continued by saying that:

The size, scope and role of government in Britain has reached a point where it is now inhibiting, not advancing the progressive aims of reducing poverty, fighting inequality, and increasing general wellbeing. Indeed, there is a worrying paradox – because of its effect on personal and social responsibility, the recent growth of the state has promoted not social solidarity, but selfishness and individualism.

But just because big government has helped atomise our society, it doesn’t follow that smaller government would automatically bring us together again. A simplistic retrenchment of the state which assumes that better alternatives to state action will just spring to life unbidden is wrong. Instead we need a thoughtful reimagination of the role, as well as the size, of the state.

The Tory leader directly appeals SE as the way forward to prosperity for the British people.

Cameron claims that the expansion of the state under the British Labour government has no reduced poverty or inequality. But at the same time the expansion has been associated with:

… creating debts that will have to be paid back by future generations.

So from that one giveaway statement you know he hasn’t the slightest understanding about how the monetary system that he is seeking to govern within operates. Once you understand that then it is reasonable to suspect that it is highly likely that the rest of his analysis will be erroneous because it is prefaced on the mainstream macroeconomics.

I am not defending the policy choices of the current Labour Government in the UK. Their embrace of labour market activism and mad-capped Third Way solutions while at the same time allowing the top-end-of-town to run riot was always going to lead to a race to the bottom for the disadvantaged and rising inequality.

I wrote about that many years ago when commenting on the so-called Third Way mantra that New Labour was pushing as a way to push pernicious neo-liberal policies (especially in relation to the labour market and income support) yet at the same time appear to be a party working in the interests of the disadvantaged.

So it is of no surprise that Cameron can quote empirical studies that show that “the gap between the richest and the poorest got wider” and that “inequality is now at a record high” and that the “very poorest in our society got poorer – and there are more of them” along with other findings of that nature.

The British government has been an exemplary example of a neo-liberal policy machine and the essence of that market-oriented approach is to redistribute national income towards the rich; reduce the supply of public goods; stifle public employment growth; privatise services; and advance wasteful and inefficient public private partnerships.

Typical SE-speak is found in the following claim by Cameron:

An emphasis on responsibility is absolutely vital. When the welfare state was created, there was an ethos, a culture to our country – of self-improvement, of mutuality, of responsibility. You could see it in the collective culture of respect for work, parenting and aspiration. But as the state continued to expand, it took away from people more and more things that they should and could be doing for themselves, their families and their neighbours.

The big government approach has spawned multiple perverse incentives that either discourage responsibility or actively encourage irresponsibility. The paradox at the heart of big government is that by taking power and responsibility away from the individual, it has only served to individuate them. What is seen in principle as an act of social solidarity has in practice led to the greatest atomisation of our society. The once natural bonds that existed between people – of duty and responsibility – have been replaced with the synthetic bonds of the state – regulation and bureaucracy.

Cameron says that what the Tory’s advocate is “big society” which would require a redistribution of “power and control from the central state and its agencies to individuals and local communities.”

SE is laced with rhetoric that Cameron rehearsed continually throughout his speech about the need for “people to take responsibility” and to “transfer power to neighbourhoods”.

Guardian commentator Polly Toynbee provided a critical analysis to the Cameron line in her article (November 10, 2009) – David Cameron, social policy butterfly. She says that his speech was continually

… gliding intelligently across the difficult social questions while leaving not a footprint of policy behind him. With a butterfly lightness of touch, David Cameron alights upon each of the wicked issues that obstruct Labour’s attempts to abolish poverty. His inevitable conclusion is that big government and colossal spending have failed because some poverty is deeper, inequality is more extreme and social mobility has stopped dead. The benefits system is a maze of perverse incentives keeping people in dependency and deterring them from work …

As he flits breezily from one social failure to another, he references all the right research, praising those things everyone loves – social entrepreneurs and community action, promising a state that will be “galvanising,catalysing, prompting, encouraging and agitating for community engagement and social renewal”. With that fashionable phrase, “nudge”, people will be urged towards taking on social responsibilities.

Toynbee that “Everything he says implies … [that the state should spend] … a lot less.” The problem is that he won’t say by how much and where the public spending cuts will occur.

Critique …

The current downturn has taught us categorically that fiscal policy is very effective in stimulating aggregate demand and putting a floor into the downward spiral brought about by the cuts in private spending.

The Great Depression taught us that capitalist economies are prone to lengthy periods of unemployment without government intervention. From 1945 until 1975, governments used fiscal and monetary policy to maintain levels of overall spending sufficient to generate employment growth in line with labour force growth.

The maintenance of true full employment in most countries also was associated with declining inequalities. Most of the work generated was full-time and real wages grew in line with labour productivity. For those who slipped through the gaps in the distribution system there was a strong supportive welfare state.

The advanced economies grew at much more higher rates of growth than they have exhibited in the neo-liberal era.

The period since the the commitment to maintain full employment was abandoned by governments after the 1975 OPEC oil price shocks has been marked by persistently high unemployment and rising underemployment which put pressures on the welfare services provision and has been exacerbated by the regionally-specific declines in manufacturing and ancillary employment.

In response to these problems new debates and conjectures have emerged offering “solution packages” that purport to steer a route through the “extremes” of Keynesianism and neo-liberalism. These so-called progressive Third Way movements, including SE, ignore the fact that mass unemployment is a systemic failure of the national economy to produce enough jobs and the fact that most governments are sovereign in their own currencies.

The latter fact means that expansionary fiscal policy can always generate enough jobs to match the needs and desires of the available labour supply. The failure of governments to pursue those options does not reflect any actual financial constraints on their capacity to spend but rather ideological choices to reduce their responsibility for providing sufficient work for all.

In ignoring these facts, movements such as SE adopt a characterisation of unemployment, albeit somewhat blurred, that is hard to distinguish from the NAIRU hypothesis.

The proponents of SE suggest that government fiscal and monetary policy is impotent and that individuals have to be empowered with appropriate market-based incentives.

The failure of the increasingly influential SE to see mass unemployment in macroeconomic terms represents is its first false premise.

SE highlights local schemes or initiatives, but fails to understand that in a constrained macroeconomy the scale of job creation required is beyond the capacity of local schemes. This specific-to-general logic also pervades neo-liberal logic and formed the basis of the Keynesian attack on orthodoxy during the Great Depression.

So while these packages reject economic rationalism as a way forward and argue that they are neither Keynesian nor rationalist, the reality is different.

In fact, the infusion of the individualistic rhetoric throughout the public debate, driven by a blind acceptance of binding financial constraints on sovereign national governments has led these “solution packages” to lean firmly towards market solutions and maintain the notion of full employability rather than advance full employment in any meaningful way.

By largely disregarding the macro-economy these solutions will fail to deliver full employment. As a consequence, the neo-liberal position is left unchallenged and is actually reinforced.

By ignoring the real causes of strains on the welfare system and embracing a market-based approach to welfare provision, SE introduces three major new problems that do not arise with a rights-based welfare system:

- A flawed model of welfare provision;

- A flawed model of community development; and

- A flawed conception of citizenship.

While SE evades an exact definition, it appears to embrace both corporate and not-for-profit commercial behaviour designed to achieve social objectives and/or seek cost-cutting efficiencies or revenue diversification.

For example, the commercial pursuits by non-profit organisations are seen as a means to cross subsidise social goals. Within the SE literature on non-profit organisations, the entrepreneurial activities and abilities of individuals take primacy over the social dimensions.

Why has this movement evolved? Social Entrepreneurs (SE’s) argue that welfare services need to be delivered more efficiently and that entrepreneurial profits via full-blown business activities are required to cross-subsidise welfare provision, in an era where budget allocations are highly constrained.

The concepts used in the SE literature are heavily borrowed from neoclassical microeconomics. For example, efficiency appears in standard microeconomic text-books and refers to the highest output at the lowest cost.

According to this model, while unfettered private markets allocate resources to the most efficient uses, the presence of any social (external) costs arising from private market transactions which are not valued in the market, will render private entrepreneurship inefficient. Social justice aims cannot be valued in the market and so private entrepreneurial models of welfare provision are unlikely to achieve efficiency.

For example, how would a social entrepreneur allocate resources between profit-making and welfare-providing activities? Despite SE’s using text-book terminology to claim legitimacy for their agenda, no such authority exists.

No neoclassical underpinning exists to suggest that SE delivers welfare more efficiently than the Welfare State model it seeks to replace. Markets fail to value social improvements and public goods and bads and benefits for people who cannot afford to pay. Accordingly, the market is not a legitimate benchmark to justify the changes from rights-based welfare.

SE’s also advocate abandoning the government-individual welfare nexus and instead want government to fund local social entrepreneurs and encourage entrepreneurial projects.

Further, non-profit organisations should enter commercial alliances with corporate businesses. There are significant problems that arise from these proposals.

First, it is unclear how adopting corporate aims to guide social spending advances social justice, which requires that resources are allocated according to an ordering of societal needs, determined in the public domain, rather than by corporations.

Second, non-profit organisations who implement state welfare programs for commercial gain become co-opted (lose their independence) and may undergo fundamental internal changes. In Australia, under our privatised employment services model (the Job Network), non-profit welfare agencies now impose harsh income-losses on some of the most disadvantaged members of the community and it is hard to reconcile this behaviour with their long-standing welfare missions (many being churches).

Third, the community pooling arrangements proposed to underpin community entrepreneurship are unsuitable vehicles for welfare provision. SE’s propose to pool government allocations for health, education, housing, training and employment and social security payments, currently paid to individuals to invest in community ventures.

Accordingly, the government would become a venture capital provider and underwrite small-scale capitalist production, which is known to have high rates of business failure.

It is undesirable to make the fortunes of the disadvantaged at the behest of entrepreneurial vagaries. More significant community entrepreneurship would fail due to moral hazard (where the government takes on a moral obligation to prevent an entrepreneur from failing).

The entrepreneur would face distorted risk and return choices because they can effectively ignore downside risks of any investment. Endemic market failure would result in a proliferation of wasteful investments. There is no problem of moral hazard in a government provided welfare model because allocations reflect political accountability.

Fourth, SE’s claim that social cohesion is best developed at the community level. Social cohesion can take many forms. Some countries like Japan, Switzerland, and Norway avoided the sustained unemployment that beset most economies after the mid-1970s by maintaining what Paul Ormerod (Death of Economics 1994, p.203) said was:

a sector of the economy which … functions as an employer of last resort … [and] … exhibited a high degree of shared social values … [or] … social cohesion, a characteristic of almost all societies in which unemployment has remained low for long periods of time.

Social cohesion, here, refers to the willingness of citizens to allow the state to use macroeconomic policies to maintain full employment. According to SE’s, the community-based model of social cohesion overcomes the “one size fits all” aspect of bureaucratic Welfare States.

However, a plethora of separate, entrepreneurial (competitive) communities are unlikely to develop shared values or social cohesion. Further, the substitution of community-developed, for bureaucratically determined, programs may introduce discord between sections of the community with divergent priorities, including intolerance of minorities.

Finally, any positive outcomes of a small number of organisations will not automatically be transferable to every community. Social entrepreneurs would compete with private companies and employment generated in these communities may be partially or totally offset losses in the private sector.

In short there are numerous dangers in pursuing the community entrepreneurship model. Communities working together with the fiscal power of the federal government to achieve national goals would best ensure the protection of citizens’ rights originally secured by the introduction of the Welfare State, and, avert the possibility of divisiveness between and within communities.

The Keynesian full employment commitment was buttressed socially by the development of the Welfare State, which defined the state’s obligation to provide security to all citizens. Citizenship embraced the notion that society had maintained a collective responsibility for individual welfare and replaced the deserving-undeserving poor dichotomy.

Transfer payments were provided to disadvantaged individuals and groups and a professional public sector, provided standardised services at an equivalent level to all citizens.

Accompanying neo-liberal attacks on macroeconomic policy have been concerted attacks on supplementary institutions such as the industrial relations system and the Welfare State.

To force individuals to become accountable for their own outcomes, welfare policy changes have introduced alleged responsibilities to counter-balance existing rights while promoting the movement from passive to active welfare.

Individuals now face broader obligations and their rights as citizens have been replaced by compulsory contractual relationships with behavioural criteria imposed as a condition of benefit receipt.

SE’s are supportive and claim that individuals have to accept responsibility, be self-reliant, and fulfill their obligations to society.

Unemployment is couched as a problem of welfare dependence rather than a deficiency of jobs. SE’s propose that they can break this welfare dependency by shifting responsibility from government to the individual.

The necessity of reintegrating the allegedly, welfare dependent underclass into the community provides the justification for notions like “mutual obligation” and the concept of “no rights without responsibilities”.

Unfortunately, no reciprocal obligation is on government to ensure that there are enough jobs. The major shortcoming is that the focus on the individual ignores the role that macroeconomic constraints play in creating welfare dependence?

Their preoccupation with instituting behavioural requirements and enforcing sanctions for welfare recipients suggest that they perceive dependence as an individual preference.

MMT shows us that it is a compositional fallacy to consider that the difference between getting a job and being unemployed is a matter of individual endeavour.

Adopting welfare dependency as a lifestyle is different to an individual, who is powerless in the face of macroeconomic failure, seeking income support as a right of citizenry.

Conclusion

Most OECD economies have suffered from persistently high unemployment since the mid-1970s and this has become significantly worse in the current crisis. The UK labour market is in terrible shape.

The major explanation for this pathology has been a deficiency of demand promoted by inappropriate fiscal and monetary policy. Governments reacted to the onset of inflation with restrictive policy stances summarised by a fetish for budget surpluses. In doing so, they have failed to understand the opportunities that they have as the issuer of the currency.

MMT tells us that budget deficits are necessary to maintain full employment if the private sector is to pay taxes and has a positive desire to net save. In this regard, the orthodox treatment of the accounting relation termed the government budget constraint as an ex ante financial constraint is in error.

Government spending is only constrained by what real goods and services are offered in return for it. There is no financing requirement. Debt issuance is seen as part of a reserve maintenance operation by the RBA consistent with their monetary policy cash rate targets. Accordingly, the alleged constraints on government action to restore full employment are based on false premises.

The emergence of approaches such as SE as the costs of the neo-liberal failure have mounted can be shown to have been co-opted into the neo-liberal approach.

In particular the disregard for the role of macroeconomic policy in restoring full employment and the individualisation of economic outcomes represent the major avenues through which the neo-liberal paradigm has absorbed the new so-called progressive agendas of Social Entrepreneurship.

It is not progressive agenda at all.

By failing to address the constraint on aggregate demand that a cut back in the deficit would create and its implications for the number of jobs that this would damage, SE ignore the main game.

While individual community endeavour might produce 100 jobs here and there … which are good and necessary … in advanced countries … millions of jobs are needed. More are needed again in developing countries.

Small-scale entreprenuerial ventures cannot ease a macroeconomic constraint on aggregate demand coming from an inadequate sized budget deficit.

Tomorrow: Labour Force Survey data published

Tomorrow the ABS releases the October Labour Force statistics and we will see whether employment growth is really taking off as some are predicting. Even if it is there is a long way to go to mop up the residual labour underutilisation. Anyway, that will be the topic of my blog tomorrow.

Bill

I work for a government department and just sat through 2 days of presentations on econometric modeling of factors that lead to unemployment, with a focus on isolating and quantifying probabilities for continued participation in welfare programs. What dumbfounds me and fills me with dread is the position policy makers start from. Not only is the causal analysis ideologically loaded, policy makers assume condidtions that as you state in your blog are in no way ‘natural’. These are the same policy makers that should be designing jobs programs aimed at full employment. Further, typical of Australia, we are 10 years behind the brits and are beginning to look at indicators of social exclusion and promoting policies of inclusion. The problem here is these promote SE principles and shift the focus back to the individual and away from the privates sectors inability to support full employment.

As an aside, the blog is probably the most informative place on the web. I have been putting the peices together for a while, (albeit with less precision) reading Minsky and studying from traders how repo markets influence the interest rate and bond issues and coupons. None of it matches up with what a text book say, which confused the hell out of me. I think your work should be central to policy. My fear is that vested interests know what you say is correct, but would rather profit out of boom and bust cycles than have full employment and then negotiate with labour over distribution effects.