In the annals of ruses used to provoke fear in the voting public about government…

Central bankers have created excessive unemployment for decades because they use the wrong theory

It’s Wednesday and also a holiday period, so just a few things today. First, I discuss a research paper that has concluded that central bankers have been using the wrong model for years which has resulted in flawed estimates of the state of capacity utilisation, and, in turn, created excessive unemployment. Second, we have a little Modern Monetary Theory (MMT) primer before going to the beach.

Modigliani was right

In 2000, Italian economist, Franco Modigliani, who was a co-author on a paper that introduced the term NAIRU (Non-Accelerating-Inflation-Rate-of-Unemployment) into the economics lexicon, seemed to reflect on the damage that adherence to the NAIRU concept among central bankers and other policy makers had done.

Reflecting on what central bankers had done in his name, he wrote:

Unemployment is primarily due to lack of aggregate demand. This is mainly the outcome of erroneous macroeconomic policies … [the decisions of Central Banks] … inspired by an obsessive fear of inflation … coupled with a benign neglect for unemployment … have resulted in systematically over tight monetary policy decisions, apparently based on an objectionable use of the so-called NAIRU approach. The contractive effects of these policies have been reinforced by common, very tight fiscal policies (emphasis in original

We considered Modigliani’s about face in detail in my 2008 book with Joan Muysken – Full Employment abandoned,

The point he was making is clear.

Monetarism inspired central bankers to prioritise inflation above all else, even if their charters were multi-dimensional and invariably included reference to ‘full employment’ or similar.

In this era – 1970s on – full employment as a policy goal was largely abandoned, even though the mainstream economists got around the obvious difficulties in telling people that they had to endure unemployment that policy makers were deliberately creating, by redefining full employment in terms of the NAIRU.

In Australia at the time – this shift allowed mainstream economists to claim that full employment in Australia was now 8 per cent or higher when a short time earlier it had been 2 to 3 per cent.

It was a scandalous abuse of facts.

The point is that unemployment, which prior to Monetarism had been a major policy goal of governments who saw the obvious advantages in minimising it,

became a principle policy tool in the new era, to be used at will to create such bad conditions that workers would no longer bid for higher wages.

A recent Working Paper from economists at the Peter Peterson Institute for International Economics – 25 Years of Excess Unemployment in Advanced Economies (released October 2022) – provides argument that supports the observation made by Modigliani more than 22 years ago.

It also supports what MMT economists have been saying for 25 or more years.

The paper concludes that:

1. Stable inflation “For about 25 years before 2020 … had a dark underside that was not widely understood.”

2. “Unemployment was almost continuously higher than needed to keep inflation low. Unless central bankers change their economic models, the world

is likely to return to chronically excessive unemployment in the years after the COVID-19 inflation surge.”

3. “It seems likely that for at least 25 years, unemployment has been above U* almost continuously in most advanced economies” where U* is the NAIRU – the unemployment rate that central bankers claimed would be associated with stable inflation.

4. Central bankers rely on economic analysis that generates estimates of output gaps – which are estimates of how close the economy is to full capacity.

The problem, which I have highlighted many times, is that “the possibility of experiencing 20 consecutive years of negative gaps is essentially ruled out by design” – that is, the way they estimate the gaps (using New Keynesian frameworks) often conclude that the economy is operating at over full capacity (positive output gap), which then leads to policy tightening, when in fact, the output gap is still significantly negative.

5. Further, “True output gaps are more negative than published gaps” and, importantly, “Large positive published gaps have no effect on inflation”.

What we observe is that prolonged period of positive output gaps, which should, if the New Keynesian logic was valid, lead to accelerating inflation, do not produce that outcome.

We even observe exactly the opposite – inflation falling when ‘estimated’ mainstream output gaps are positive and large.

6. The paper concludes that the output gaps are always biased to the positive and overestimate the extent of capacity utilisation across many economies.

And when authorities, like the Congressional Budget Office in the US, the IMF, the OECD etc, revise their past estimates, when it is clear they are unrealistic, the tendency is towards “systematic overestimation”

7. The upshot is that “Monetary policy has been excessively tight for many years”:

The evidence suggests that output and employment have been below potential in most, perhaps all, years in the major advanced economies since the mid-1990s. Moreover, conventional estimates of these gaps have been systematically biased upward toward zero, so that central banks were not fully aware of the sustained underperformance.

Which was exactly what Modigliani had already observed in 2000.

The policy advice they give has merit:

If inflation does not return quickly to the 2 percent target, central banks should not deliberately push their economies below potential and risk recessions in order to return to 2 percent. Instead, they should take the opportunity to correct the mistake of 25 years ago and raise their targets moderately above 2 percent.

We must exit this era where policy makers deliberately create unemployment when we all know that the models that lead them to pursue this approach are deeply flawed and do not achieve the goals they set for themselves.

Pillar seven: modern monetary theory is bunk – what?

I realise that trying to impart complex ideas within an 800-1000 word newspaper limit is a challenge.

Trying to squeeze subtley and nuance into word limits like that is very difficult and an art.

In general, I think the UK Guardian’s economics writer Larry Elliot does a good job of bringing complexity to the level of his readership.

He is also a good person – he bought me a soft drink a few years ago when we caught up for a chat in London!

But his column today (December 27, 2022) – In 2022 Liz Truss tried to bin economic orthodoxy – but what is it? – which carries the descriptor ‘Explainer’ – doesn’t really represent Modern Monetary Theory (MMT) very well.

The column summarises a series of propositions – Pillars (seven of them) – that define what he callls “the conventional” as opposed to “the maverick” when it comes to thinking about the economy and policy options.

The seventh pillar is about MMT or at least that is what the reader will assume.

The problem is that it is such a facile representation of our work that it almost immediately will lead the reader astray and back into mainstream framing.

Larry Elliot writes:

MMT represents a real challenge to the orthodoxy because it says that budget constraints don’t really exist for countries that issue their own currency. Put simply, MMT says governments can print as much money as they need to spend because there is no risk of them going broke. This runs counter to the belief – strongly held in both the Treasury and the Bank of England – that governments should finance spending through taxation and keep a wary eye on the level of borrowing.

1. It is not a case of “don’t really exist” – there are no financial constraints on government spending for a currency-issuing government.

None!

The constraints are a combination of real resource availability and political.

2. The claim that “governments can print as much money as they need” suggests there is an alternative option that doesn’t involve ‘printing’ money.

This seriously misrepresents the way that governments spend on a daily basis in two major ways:

(a) There is no ‘printing’ involved – that is an emotional term that immediately invokes a mainstream frame – and then triggers all sorts of related anxieties about historical hyperinflation states, lack of discipline, etc.

(b) There is no alternative state – all government spending occurs in the same way – some official (treasury/finance) instructs some other official (central bank, usually) to makes some adjustments to bank accounts held in the non-government sector.

The numbers in accounts change and the spending is complete, irrespective of what the government is doing with respect to its taxation policy or its bond-issuance arm.

MMT just cuts through all the fiction that taxes and debt issuance somehow represent an alternative way to facilitate government spending to the reality presented above.

It is true though that MMT has been so fiercely resisted within the mainstream dialogue exactly because it exposes the principle control mechanism that orthodoxy uses to stop governments from advancing well-being generally rather than acting as an agent for capital and ensuring, as a priority, that the interests of the powerful and the elites are first satisfied.

If everyone knew, as I know, that mass unemployment is a policy choice then the distribution of national income would be more equal and workers would have more power to prosecute their interests.

US Inflation trends

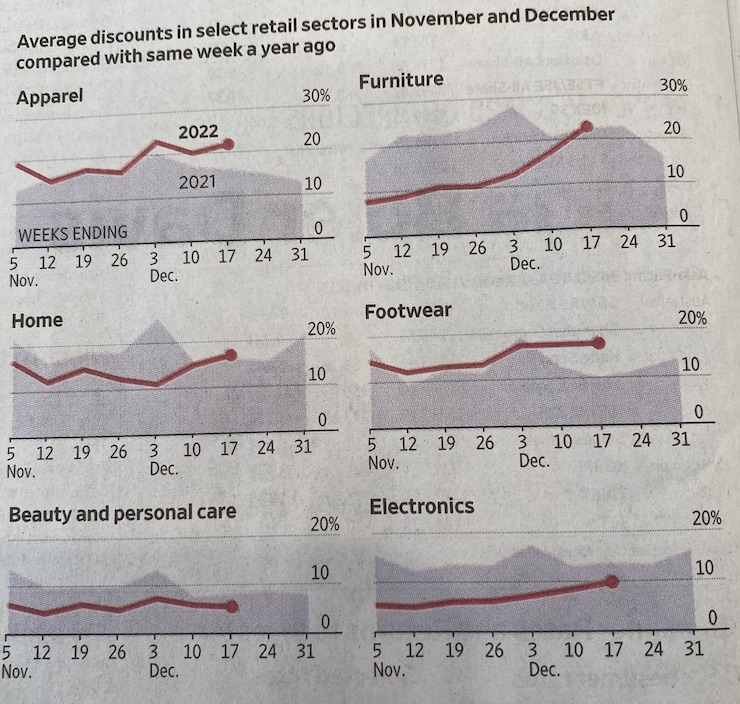

I was sent this interesting graphic (thanks Tom N) that compares the ‘average discounts’ over the last two months of 2022 (red lines) relative to the same behaviour a year ago (blueish areas).

It is looking very much like the inflationary spike has peaked and the trend is moving in the opposite direction now.

Some upcoming changes to my blog

This week’s quiz, the last for 2022, will also be the last published on my blog site.

We are making some big changes to the ‘back office’ that hosts my site – shifting servers to a different Linux distro, which allows for more security control and the most recent software additions.

We will also be integrating the blog under my home page structure such that the blog will be found once the changes are operational at http://www.billmitchell.org/blog

You will soon find that link as we will run an automatic URL redirection from the existing address to the new address so that the transition will appear seamless.

And, apropos of the Saturday or Weekend Quiz, I am integrating that into the MMTed site.

The Quiz will become available 24/7 via that site and the app I have written will randomly generate questions from a new database upon access.

It will generate answers and the usual discussion to help you understand the logic of the answer and broader educative elements.

Once the site if fully functional (soon) it will save me compiling a quiz each week on my blog site.

The motivation for this shift is twofold:

1. The quiz is better situated conceptually on the MMTed site, which is the educational venture that I am steadily creating.

2. In moving servers and moving to a new Linux distro, the old plugin that ran the quiz on my blog site will no longer work and satisfy our security requirements.

Hence we were forced to move it, but I think the new site will still present readers with the challenge – whenever they like to test themselves.

Once all these changes are in place, my blog will be published Monday, Wednesday and Thursday – unless something special requires additional posts.

Music – On the Beach

This is what I have been listening to while working this morning.

It is beach weather on the East Coast at present – suddenly things have warmed up after a very modest start to Summer in Australia.

So I think this song – On the Beach – from the album of the same name – On the Beach by – Neil Young – is, in name, at least, relevant.

I bought the album when it came out in 1974 and thought it was one of Neil Young’s best, although I recall the reception in the music press would have said the opposite.

It is an introspective offering after the almost light-weight Harvest album.

Very mellow and cruising – sparse.

The title song is about how becoming famous is a trap.

It is a common theme – wanting attention but repelling against it when it comes

I was packing up crates of my old albums over the last few days (moving) and have been recalling lots of things associated with the times and places where I bought or listened to the albums.

This one is a favourite, even if Neil Young was a Republican supporter.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Central bankers have created excessive unemployment for decades because the whole neoliberal approach to central banking. That is, the idea that the economy is inherently stable, it will inherently reach full employment and stable economic growth on its own, and so the only thing that the macro policymakers have to worry about is keeping a low inflation rate and everything else will take care of itself. Of course, as we’ve seen, this whole neoliberal approach to macroeconomic policy is badly mistaken.

The whole neoliberal trend in macroeconomic policy. The essential thing underlying this, in my view, is to try to reduce the power of government and social forces that might exercise some power within the political economy-workers and others-and put the power primarily in the hands of those dominating in the markets. That’s often the financial system, the banks, but also other elites. The idea of neoliberal economists and policymakers being that you don’t want the government getting too involved in macroeconomic policy. You don’t want them promoting too much employment because that might lead to a raise in wages and, in turn, to a reduction in the profit share of the national income.

Central bankers and politicians belong to the elite.

It should be no suprise that they push the kind of policies that the elites are pushing for the last 50 years (and futher in time, but let’s not go deeper into the past, than the strickly necessary).

Inflation and “wage-price” spirals are bed time stories, to keep the masses asleep.

Because what’s bringing about inflation are not wage spirals, but the weight that rents are having on prices (see Michael Hudson https://michael-hudson.com/2022/12/oligopoly-unchecked/).

Rentiers are the elite.

Rents are unproductive costs and they are going up, as economies are beeing increasingly monopolized by hedge funds (just consider the sheer size of the big three, mainly blackrock).

Inflation is driving up assets prices, making the rich richer and the poor poorer. You only need to keep wages down, while inflation goes up.

What CBs are doing? Hiking interest rates!

Interest rates are making huge profits for commercial banks, that are beeing paid interest on reserves. They could close all branches and sack all employees, and they would make record profits.

The outcome of all this: the west is following the development model of Latin America in the 1970s.

Lets keep a blind eye on the shanty towns that are growing in the US (and soon elsewhere), as we always did in Venezuela.

I had come to the conclusion that central banks, by design, are aristocratic institutions inimical to labour. Would it be more accurate to describe them as “acting as an agent for capital and ensuring, as a priority, that the interests of the powerful and the elites are first satisfied”?

If a government was legally required to implement a Job Guarantee (as described by MMT), within a ZIRP scenario, then a range of inflation management tools would need to be available to deal with different supply/demand affecting circumstances.

Government might even have to distribute goods/services via special allocation rather than change non-government bank accounts.

Just some random thoughts, after Jim Chalmers told me the public won’t accept controlling inflation via taxation……

The objection that the public will not accept raising taxes to control inflation and that tax rates can’t be fine tuned or changed fast enough is why I have suggested that in addition to the JGP there be a UBI [or a UBI only for the bottom half of the people by income], and the Gov./Fed? can change the gift to the people [the UBI] any time it wants to, or needs to, without a law change. This is more in keeping with the US Constitution.

Central banks are by design undemocratic, generally acting as an agent for the FIRE sector. If voters prefer higher inflation and lower unemployment, shouldn’t they, in a democracy, be able to have that?

Well remember July 2021.

Leftwing rural teacher Pedro Castillo sworn in as president of Peru.

US ambassador in Peru is Lisa Kenna. 9 years at the CIA, Pompeo’s state department executive secretary and senior advisor. Political adviser at the Pentagon. National security council director at the Iraq office.

We’ll coup whoever we want.

The mistake is thinking winning elections or referendums will actually change anything. Central bankers are involved in all of it. A case could very easily be made that certain US universities were given the task to introduce an economics framework that reflected the ambitions of NATO.

Which was openly admitted on live TV in 1990 below.

https://m.youtube.com/watch?v=ZdMszmjSAso

Mankiw has written two popular college-level textbooks: the intermediate-level Macroeconomics (now in its 11th edition, published by Worth Publishers) and the more famous introductory text Principles of Economics (now in its 9th edition, published by Cengage). Subsets of chapters from the latter book are sold under the titles Principles of Microeconomics, Principles of Macroeconomics, Brief Principles of Macroeconomics, and Essentials of Economics. The book was signed for a record advance. The New York Times reported in 1995 that Mankiw “was offered a $1.4 million advance by Harcourt Brace in Fort Worth to write a basic economics textbook. “That’s about three times as big as any other in the college textbook market and rivals those of all but a few celebrity authors.”

When the first edition of the Principles book was published in 1997, The Economist magazine stated,

“Mr. Mankiw has produced something long overdue: an accessible introduction to modern economics. By writing more in the style of a magazine than a stodgy textbook and explaining even complex ideas in an intuitive, concise way, he will leave few students bored or bewildered…. Most refreshing, though, is the book’s even-handedness. Mr Mankiw seems to revel in setting out how different schools of thought have contributed to economists’ current state of knowledge.”

Since then, more than one million copies have been sold, and Mankiw has received an estimated $42 million in royalties from the book, which is priced at $280 per copy.

I have no doubts in my mind and the time frame fits perfectly that this was the starting gun of this process discussed openly on live TV by one of Thatchers closest advisors. Getting these textbooks into as many Universities as possible was the equivalent to a CIA, Pentagon psych – op.

The central banks theory is not wrong for these people. It is a perfect theory for what they are trying to achieve with NATO and the IMF.

Guess who is pencilled in next as the leading name to take over the IMF. Jens Stoltenberg.

Getting foreign students to come to the West and fill their heads with Mankiw and sending them back is the equivalent of a Trojan Horse.

Neil Halliday, if I understand MMT right, the Job Guarantee is itself the inflation management tool of the economy – at least for demand driven inflation.

For supply driven inflation (for example, Saudi Arabia deciding to increase the price of petrol), there is no single tool or solution to fit all cases.

I would also add that current policy makers in most countries rely on a single tool to manage inflation: interest rate targets, which is highly ineffective for that purpose. The Job Guarantee itself would be, even in isolation, a much better tool than this current one.

I was excited to test out the new genius AI on the block. chatGPT with regard to money creation. Unfortunately while you can get it to admit that money is created when currency issuing governments take the decision to spend and that tax payments must be paid in government money and that this money is essentially destroyed when taxes are paid, it still insists that governments need taxes to finance their operations. Oh Dear !

Dear Andrew (at 2023/01/03 at 5:38 pm)

I have experimented with chatGPT and found that if it initially delivers less than accurate information you can submit a better answer and over time it will adapt to your input and eliminate the falsehoods.

In other words, unlike many humans, mainstream economists included, it learns rather quickly from its mistakes.

Give it a try. I was really happy with the adaptive learning process.

best wishes

bill

Redefinition of full employment as the NAIRU can be prevented by showing that the Phillips curve slope is small in the short run and zero in the long run.