As the ballistic missiles between Iran and Qatar seem to have gone quiet for the…

Champagne socialists in the banking sector reaping millions from public money

It’s Wednesday, and before we get to the music segment, I document some developments in the banking system which are not receiving much press at the moment. I refer to the fact that the rate hikes now being implemented by most central banks are not just allowing the commercial banks to widen spreads between deposit and lending rates which will generate significant windfall profits for the banks and their shareholders. The increasing interest rates are also delivering massive cash injections to the banks who hold reserve accounts at the central banks. Why? Because the quantitative easing programs from the past have resulted in a massive buildup of excess reserves which are liabilities for the central banks. They are paying support returns on those reserve, which are scaled against the rising policy target rates. So the payments have escalated significantly and delivering a massive corporate welfare boost to the banks while the same interest rate rises are causing hardship to borrowers, especially those on low incomes. And amazing redistribution of income towards the ‘champagne socialists’ all via our central banks.

The counteracting impact of interest on reserves

A friend from Europe sent me an interesting snippet of information the other day.

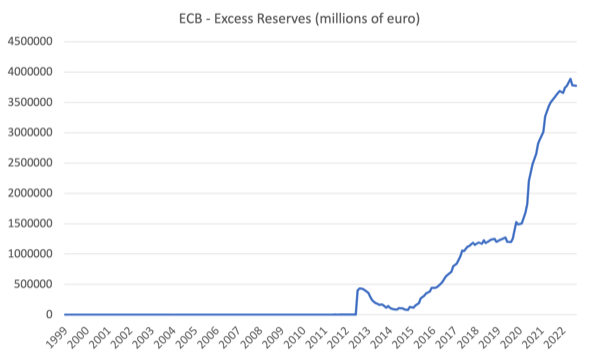

As the ECB hikes interest rates, this also means that the commercial banks are now receiving massive ‘economic rents’ because of the excess reserves that were created by the ECB’s quantitative easing program.

In the European system that amounts to trillions of euros of largesse that the banks are being given by the ECB.

Think about that in relation to the alleged need to squeeze overall liquidity via the interest rate hikes.

The redistribution of income from those squeezed by the inflationary pressures and the interest rate increases to the shareholders and executives of the commercial banks is massive.

In this article (September 23, 2022) – ECB seeks to cut subsidy to banks as rate hikes leave it on hook, sources say – we learn that the ECB has lifted the support rate it pays on the qualifying excess reserves “from -0.5 per cent to 0.75 per cent in less than two months”.

Which means?

This leaves the ECB on the hook for tens of billions of euros in annual interest on those reserves …

It also puts the ECB in the politically uncomfortable position of subsidising banks at a time when the public is struggling amid high inflation.

Note, that I deleted the second half of the first sentence in that quote that made spurious claims about the capital base of the ECB being threatened.

Please refer to this blog post for more information about that sort of ruse – The ECB cannot go broke – get over it (May 11, 2012).

But the other point it makes is relevant.

This is a huge transfer of ‘public money’ to banks and their shareholders while in the same act (hiking rates) the ECB is punishing borrowers.

The article notes that banks are borrowing from the ECB under its – Targeted longer-term refinancing operations (TLTROs) – which offered “banks long-term funding at attractive conditions” and then retaining those funds as excess reserves and profiting from the interest rate arbitrage.

The peak body European Banking Federation claimed there was nothing to see here, which is always the response from corporate welfare recipients.

Since then, the ECB has responded to one of the issues, see – ECB recalibrates targeted lending operations to help restore price stability over the medium term.

Those changes take effect today.

At its October Board meeting, the ECB raised interest rates to 0.75 per cent and changed the current LTRO scheme (rates and repayment dates).

It also changed the support rate on minimum reserve balances held at the ECB.

But it still remains that the ECB is carrying a massive liability in the form of excess reserves as shown in the following graph, which is just a reflection of the massive asset-buying that the ECB has been engaged in under various programs (APP, PEPP, etc).

The minimum reserve balances though are a fraction of the total excess liquidity in the system so any changes will have minimal impact.

As at September 2022, there were 3,774,724.48 million euros of excess reserves outstanding.

You can do the calculation of the change in payments that are now flowing to the banks.

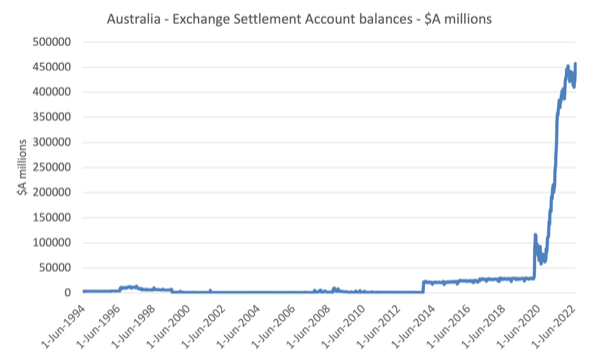

A similar situation has arisen in Australia where the RBA pays the banks a support rate just below the RBA’s cash rate target on any positive balances in the so-called Exchange Settlement Accounts (which are basically the reserve accounts).

There is a formula that the RBA applies to determine so-called ‘surplus’ ESA balances.

These RBA briefings are relevant – Exchange Settlement Account Policy and Liquidity Facilities.

This graph shows the history of the ESA balances since June 1, 1994 up until July 27, 2022.

That picture on the liability side is matched by the shifts on the asset side that is almost all to do with the RBA’s government bond-buying program that commenced in the early days of the pandemic in 2020.

Here is the history of the RBA Australian dollar investments (almost all government bonds) since June 1, 1994 (to July 27, 2022).

With the cash rate target rising from 0.10 per cent on April 6, 2022 to 2.85 per cent on November 2, 2022, the RBA is now paying the commercial banks and other financial institutions who hold ESA balances with it a massive amount of cash each period, while punishing the low-income families who have mortgage debt.

The problem, of course, is that if the RBA didn’t pay the support rate on the surplus ESA balances then it would have to drain them using other operations (for example, selling government debt to the banks) or otherwise lose control of their policy target rate, as a result of the competition that would emerge between the banks to rid themselves of their excess funds.

But this is an example of how monetary policy decisions are not unbiased in terms of their impacts on income distribution and how they worsen income inequality.

Tomorrow, I will write further on how perverted monetary policy has become and why a reliance on it leads to poor policy making.

My European banking friend concluded this was Champagne Socialism at its best.

Hard to disagree with that.

Keeping children warm

I saw a Tweet this morning that indicated that children in British schools are being asked to wear “thermal underwear” to school because the schools are turning off heating for most of the day as heating bills more than double and the Department of Education has declined to provide supplementary funding.

I gave a presentation today to a research and policy intitute in Canberra (Australia) (from Kyoto, Japan) which focused on how Modern Monetary Theory (MMT) can help policy makers understand the policy space more effectively.

The mainstream obsession with financial ratios surround fiscal policy – which are irrelevant in the context of a currency-issuing government like Australia – distorts the sort of policy options that are conceived and moves policy makers to consider options that ultimately are vastly inferior to what would be a chosen action if MMT was understood more fully by those in these positions of responsibility.

In the case of the UK, the government introduced a ‘supported wholesale price’, which they considered would become a ‘price cap’ for six months (Source).

The contention though, is that the scale and duration of the support is inadequate as is indicated by the call for children to clothe themselves more thickly.

One CEO of a private school providing trust around Oxford was quoted by the BBC as saying (Source):

I don’t want to be sensationalist but it’s about reducing the time the heating is on, restricting the heating is an option we have to explore.

We haven’t as a trust decided yet what we have to do. But we might have to ask children to wear their coats in classrooms too, like we did in Covid times.

Charles Dickens’ most gloomy images come to mind.

The point is that while governments need to be careful in relation to spending increases when there is an inflationary episode in train, even if it is largely a supply-side event, there is no reason for austerity.

Funding the schools for adequate heating will not add pressure to the existing price level dynamics.

It might reward profit gouging from energy companies, which means the government would be better placed dealing with that directly through regulation and nationalisation if required.

But the future of Britain lies not in whether the government reduces the deficit by some amount, but, rather in how much education its children can effectively receive in the formative years of their lives.

Sitting in cold, austere classrooms is unlikely to be an optimal learning environment.

The British government cannot ‘save’ money.

Saving is the act of financially-constrained households who desire to expand their future consumption possibilities and must reduce their current consumption in order to achieve that goal.

A currency-issuing government such as the British government issues the currency and never needs to ‘save it up’.

Occassionally it will need to withdraw some of its net spending to balance nominal spending growth with available productive capacity.

But trying to cut spending on school heating is not one of those cases and just undermines the environment that its children need to achieve their potential and become functioning citizens into their adult years.

Mindless.

Music for today – All Along the Watchtower

I have not been able to get this song out of my head recently. While riding my bike, walking, running, whatever, it resonates.

One of the classic songs.

I love the concept of Playing for Change but I like what they produce even more.

It is one my favourite Jimi Hendrix songs (written by Bob Dylan) – All Along the Watchtower.

Bob Dylan put it out on his 1967 – John Wesley Harding album and I liked it then.

But then when Jimi Hendrix put it out a year later (1968) on his – Electric Ladyland – I was mesmerised by the song.

Electric Ladyland remains one of my favourite all-time albums. I purchased it in 1969 (we always got albums on delay in Australia) from the only import record shop in Melbourne (Bourke Street), which was run by a musician Keith Glass, who I subsequently got to know when I starting playing professionally around the city.

On the Playing for Change version, we see that John Densmore pops up playing drums by the beach.

And Cyril and Ivan Neville with Ivan on the Hammond.

And those Lakota Singers and Dancers.

And the lead Sitar break.

And the Bizung Family Drums.

And master percussionist Yu Hatakeyama.

It is just all happening.

And that is what Playing for Change does.

And the sun is shining outside too, today.

And here is the original Jimi Hendrix version.

It has original Rolling Stones member, Brian Jones, playing percussion.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

“The mainstream obsession with financial ratios surround fiscal policy – which are irrelevant in the context of a currency-issuing government like Australia – distorts the sort of policy options that are conceived and moves policy makers to consider options that ultimately are vastly inferior to what would be a chosen action if MMT was understood more fully by those in these positions of responsibility.”

They know how it works but politically and ideologically all political parties have embraced liberal democracy and the US rules based order. Which is, Central planning by the private sector and that the financial sector will allocate the skills and real resources. Even that massive change wasn’t ideologically enough for them that they also out source everything to venture capitalists and hedge funds.

The Skye Bridge economic model and the Glasgow airport model.

Where they place a toll on the skills and real resources used on the project, after the financial sector has allocated the skills and real resources via bank lending. So the rent seekers can extract rent.

£4 just to pick up and drop off at the airport now. Every square inch of the airport is now outsourced. Speaking to the taxi drivers who work there, some services are outsourced several times for the same service to the point that some travel agents now run large parts of the airport. Jet 2 being the main one in Glasgow. Swissport being the baggage handlers. When billing a service to the users of the airport they out source the billing to another company who in turn out sources it to somebody else. Taxi drivers receive a bill for being able to sit outside the airport and it has gone via 3 different companies before they get it. Each taking their cut and why taxis from the airport are so expensive. The venture capitalists who own the airport don’t actually run anything, they just sit and collect rent from every service that has been outsourced several times. As the skills and real resources are allocated under terrible conditions via bank lending. Until they have squeezed everything they can out of every square inch before selling it on to the next parasite.

The financial sector scream for a balanced budget, saying, “We don’t want the government to fund public infrastructure. We want it to be privatised in a way that will generate profits for the new owners, along with interest for the bondholders and the banks that fund it; and also, management fees. Most of all, the privatised enterprises should generate capital gains for the stockholders ” , as they jack up prices for what used to be a public service.

MMT 101 – the public will still pay taxes on top of this charade and end up paying more than they ever did.

After the tools booths have been placed on everything from education to healthcare via bank lending and Wall Street and the City of London have allocated the skills and real resources. Whoever owns the tool booths then layer the cake with outsourcing. Allowing them to extract even more rent.

It is the Geopolitical economic model that crosses borders and what the EU treaties and US rules based order is all about. Written within the trade deals in stone. What the war in Ukraine is really all about. As the psychopaths push this model up against every border on the world map until they own it. Laced throughout with Orwellian language and double speak.

The central banks role is to protect this geopolitical model and the US rules based order. The poachers have become game keepers. They are now the trade union of the bond holders, commercial banks, rent seekers, venture capitalists and hedge funds.

As the UK has shown they can perform regime change anytime they feel like it to get who they want in charge. All of which is outwith the democratic process. Unaccountable to anybody and how the EU chooses its leaders most of whom come from the financial sector. Sunak is the UK’s Mario Draghi.

This largesse that you speak about is beeing sold to the public opinion as applied MMT.

It seems that the money “printing” (or zeros added on the right side of commercial bank’ accounts, that ammounts to the same thing) turns out to be MMT’s fault.

It’s kind of magic: you wreak havoc the economy and, in the end, if you can blame others for what you did.

But MMT is also about fiscal policies.

If you “print” money so as to keep alive private unsustainable BIG businesses, you’re going to end up with trillions of useless money.

That’s inflation. The prices going up are the fallout of inflation – not the inflation itself.

The fact is: they “printed” money, but they gave no good use to it: they just gave it away to the elites, who now are having trouble finding out ways of how to speculate with it.

That happened in the US, the UK, the EU (maybe in Australia too, I don’t have enough data).

For many years inflation has been offset by the deflation brought in by the Chinese low priced imported goods.

But that’s over and inflation sprung out of its box.

All the big US unicorns are in trouble and some are already going down.

The US needs China again to keep afloat.

The question is: will China do it?

My older now deceased brother bought Electric Ladyland in 1969 and introduced me to the wild guitar playing of Jimi Hendrix. ‘All Along The Watchtower’ was my favourite song from that album. I never realised at that time how great a guitar player Jimi was, but my brother did.

Couldn’t agree more Derek. The Financial Capitalists have all their puppets lined up including Starmer. Yet not one analysis of this by any ‘expert’ in newspapers or on TV.

2 years for the Tories to asset strip the country before the next election.

“Occassionally it will need to withdraw some of its net spending to balance nominal spending growth with available productive capacity.” The other option for the government would be to increase the resources, such as training workers.

We, with some understanding of MMT, should let it be known at every opportunity, that no Treasury Bonds should be issued in the first place. There also needs to be a language change. Public Sector Borrowing Requirement should never be used. How about, Net financial assistance to (a growing) society (NFAS). Reference to growth should satisfy our present bunch of politicians.

On the subject of classroom heating and wearing coats, I tend to agree with you (being cold is not conducive to learning) and it shouldn’t be an area for penny-pinching, but a) properly fed children are pretty resilient and don’t need to be evenly heated throughout the seasons and b) being properly dressed for winter, with thermal undies, is a lot more energy efficient than turning up the heating. I’d propose a thermal underwear grant. I had experience of teaching in unheated classrooms for 8 years in China, just south of the central heating line (cuts across Central China), it gets pretty chilly, and wearing coats inside was completely normal. The person that seemed to suffer the most was the adult in the room. No coal was being burnt on our behalf.

“the US rules based order” – that would be the one where the US makes the rules (for others) and imposes the order?

Hendrix and Dylan combine at their very best.

“My European banking friend concluded this was Champagne Socialism at its best.

Hard to disagree with that.”

I must challenge this. As a socialist, I find it offensive that my choice of wine is used to associate me with such people. For those who can’t afford to drink expensive Champagne, there is now a range of such wines for sale at Aldi and other places for as little as $30 a bottle. The Left should take back this status symbol of the bourgeoisie and make it our own!

So, let me get this straight. The ECB is paying ~50 B€ to lower the propensity of banks to keep doing the wild speculation of the last decade.

Yep. Sounds about right. I can’t even imagine the level of self-destruction if conflicts with China escalate on schedule.

Bill writes “this is an example of how monetary policy decisions are not unbiased in terms of their impacts on income distribution and how they worsen income inequality.”

Provocative point. By my calculations, in the US, the $3.1 T of reserve balances now on deposit at the Fed would earn $122.1 billion annually, at current policy rate of 3.9 percent.

That contrasts with the $5.3 billion of interest on reserves paid by the Fed in 2021. (per Fed report 1-22)

To help me get a grip on what’s going on here, I’ll try mapping out the sequence of events that led up to this point:

1. Great Recession tanks global economy

2. Central banks reach for new solutions and hit upon Quantitative Easing in effort to reduce long-term borrowing rates and stimulate spending

3. (In the US) Fed gets Congressional authorization to pay interest on reserve balances of commercial banks

4. Bank reserve accounts at central banks balloon to huge scale as CBs purchase government bonds from banks

5. High inflation arrives, post-COVID

6. Central banks sharply raise policy interest rate

7. Banks begin receiving hundreds of billions of dollars of interest on reserves annually

8. Era of champagne socialism is announced

This reinforces some questions I’ve always had about QE: Why did banks choose to sell government securities to central banks? Why did they want to swap those safe, interest-earning assets for restricted-use cash balances at central banks?

Having done so, is it now problematic for banks to earn the policy rate on their balances?

One way or another, a bank is going to maximize its risk-adjusted returns. Swapping government securities for reserve balances must have made financial sense to banks (as I can’t find anything to suggest, at least in US, that they had no choice in the matter).

Perhaps they anticipated that the policy rate would suffice? Or did they anticipate being able to use reserve balances to purchase government securities from other depository institutions, to restore their original position?

Outside of MMT circles, government debt securities aren’t generally understood as “subsidies.” (I’m convinced that for the most part, they should indeed be considered subsidies)

The payment of interest on reserve accounts seems no different in principle.

I went looking for a new issue to be outraged about here, but I’m not really finding one.

Nothing new under the sun?

Got some help on my questions offline from someone who knows this far better than I ever will.

Banks weren’t the only sellers of bonds to the Fed in QE. In all likelihood they weren’t even the largest sellers. Mutual funds, pension funds, and insurance companies were major suppliers of QE bonds.

No investor had to sell bonds to the Fed. The Fed accomplished massive purchases by offering attractive terms in a competitive process.

I was misled by the fact that bank assets – reserves – grew by huge quantities during QE. That doesn’t mean banks sold bonds directly to the Fed; it means bank depositors did so.

When a pension fund sells a treasury security or agency MBS, its bank must act as an intermediary (because only the bank has a reserve account at the Fed). The sale is settled when the Fed credits the bank’s reserve account, and the bank in turn credits the pension fund’s checking account. That’s how commercial bank reserve accounts got so large.

Having sold its security to the Fed, the pension fund can then cut a check for whatever new investment asset it chooses.

QE transformed trillions of dollars of privately held government securities into cash bank balances. For willing investors, it substituted new bank liabilities for government liabilities. In common parlance, “QE injected money into the banking system.”

Now, coming to champagne socialism, note that QE provided banks both new assets (reserves) and new liabilities (deposits). Banks presumably pay interest on the new liabilities at a rate closely linked to the policy rate.

Therefore it’s not clear to me how much of banks’ interest income on reserves can fairly be called a subsidy.

This assessment is interesting — Bernanke and Kohn: The Fed’s interest payments to banks (brookings.edu) They argue that subsidy is basically nonexistent.