I am travelling today to Tokyo and have little time to write here. But with…

Business investment in retreat for the second successive quarter

The Australian Bureau of Statistics released the latest version of – Private New Capital Expenditure and Expected Expenditure, Australia – today (May 26, 2022), which is part of several releases leading up to the publication of the June-quarter National Accounts next Wednesday. Today’s business investment data shows that private new capital expenditure in Australia fell by 0.3 per cent in the March quarter but was up by 2.2 per cent on the year. This is the second successive quarter in which business investment has fallen and it is likely the September-quarter will also record a contraction, which will all but wipe out the positive annualised result. This is the Australian business community at work – they are enjoying massive cuts to real wages for their workforces, record levels of profits, a rising profit share – and their investment performance is pathetic. There is some tension in the data though – as the expectation series indicates business investment growth over the next 12 months. I think that is overly optimistic given that household expenditure is likely to slow down with the rising interest rates and high energy prices really squeezing low-income families. One of the challenges facing the new Federal government is to somehow convince the business community to change their behaviour in this respect. Good luck with that. The way that the business sector has hijacked the ‘Jobs and Skills Summit’ agenda to turn it into a justification for more skilled migration – which will further dampen wages growth, push up unemployment, and further strain the almost impossible rental and home market – is evident that they are not for changing. And, if the new Treasurer keeps harping on about the $A1 trillion debt and the need to cut the fiscal deficit we will sink into recession.

The ABS data shows that for the June-quarter 2022 (real and seasonally-adjusted):

- Total new capital expenditure fell by 0.3 per cent over the quarter but increased by 2 per cent over the year.

- Buildings and structures investment fell by 2.5 per cent over the quarter but grew by 1 per cent over the year.

- Equipment, plant and machinery rose by 2.1 per cent over the quarter and by 3.2 per cen over the year.

- Mining investment fell 0.3 per cent for the quarter but was 10 per cent higher on the year.

- Manufacturing investment rose by 2.2 per cent for the quarter and 3.9 per cent on the year.

- Non-Mining investment fell by 0.3 per cent for the quarter and by 0.9 per cent on the year.

We see the way business in this country works by the way the Federal government’s Jobs Summit, which started today in Canberra, has been hijacked by the skills agenda.

What started out as the preparation for a new White Paper on ‘full employment’ – which was the new government’s early sell for the event – has been hijacked by the business lobby and replaced by a concentration on skills shortages -> increased migration -> keep wages growth low.

This is despite the claim that wages growth is central to the agenda.

Further, the Treasurer has now indicated they will not have ‘room’ in the federal finances to increase the unemployment benefit from its current level, which is well below the poverty line because they have a ‘trillion dollars in debt’.

Meanwhile, they have remained committed to the previous conservative government’s tax cuts which will reduce tax revenue by around $230 billion and overwhelmingly favour the top few percent of income recipients who are mostly males. The bottom of the wage distribution will hardly benefit.

This is the continuation of neoliberalism – Labor Party style.

I will write further about the concept of ‘Deep Adaptation’ next week. But class conflict is a pivotal dynamic in the Australian system and unless the power of corporations is significantly reduced then no reasonable adaptation is possible.

Change will then be forced on us by the climate deterioration and how that turns out will not be pretty.

The state of business investment in Australia

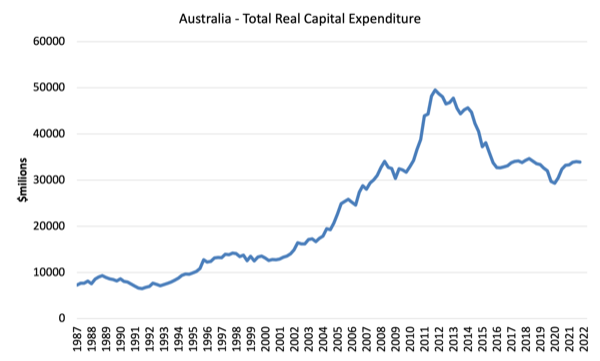

The first graph shows the scale of Australia’s problem with respect to investment in productive capacity. It shows total real capital formation from the September-quarter 1987 (start of sample) to the June-quarter 2022.

The huge hump relates to the once-in-a-century mining boom (see below).

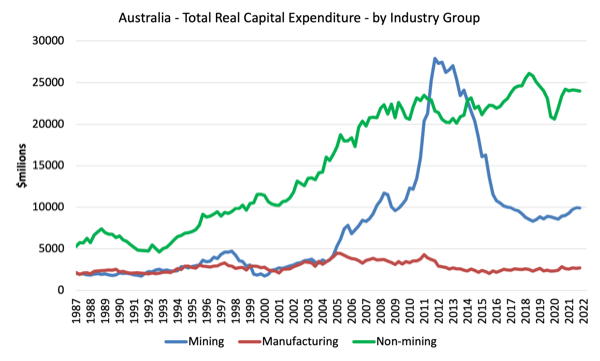

The next graph shows real private capital expenditure by broad sector.

The boom and bust in the Mining sector is quite extraordinary in historical terms.

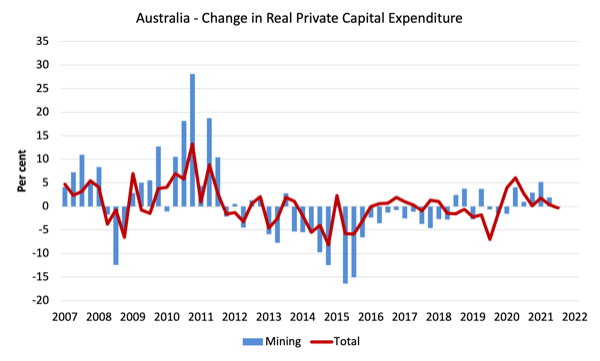

The next graph shows the quarterly percentage change in Total and Mining private capital expenditure in real terms from the December-quarter 2007 to the June-quarter 2022.

The damage to capital formation from the GFC is clear.

It was also the case that there was some sporadic recovery in investment expenditure leading into the pandemic but the fortunes turned in 2020 as the pandemic impacts dampened sentiment.

Expected business investment

The ABS – Explanatory Notes – help us understand their expected investment expenditure series.

We read that:

Surveys are conducted in respect of each quarter and returns are completed in the 8 or 9 week period after the end of the quarter to which the survey data relate (e.g. March quarter survey returns are completed during April and May).

– Businesses are requested to provide 3 basic figures each survey:

– Actual expenditure incurred during the reference period (Act)

– A short term expectation (E1) and a longer term expectation (E2).

In relation to this pattern, the ABS say that for 2022-23:

- the first estimate was available from the December 2021 survey as a longer term expectation (E2)

- the second estimate was available from the March 2022 survey (again as a longer term expectation)

- the third estimate was available from the June 2022 survey as the sum of two expectations (E1 + E2)

- in the September 2022, December 2022 and March 2022 surveys the fourth, fifth and sixth estimates, respectively, are derived from the sum of actual expenditure (for that part of the year completed) and expected expenditure (for the remainder of the year) as recorded in the current quarter’s survey

- the final (or seventh) estimate from the June quarter 2023 survey is derived from the sum of the actual expenditure for each of the four quarters in the 2022-23 financial year.

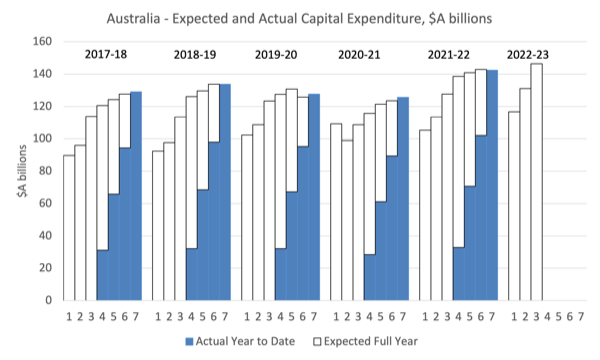

As a result we get the following graph of Total Capital Expenditure in the year to date (solid columns) and Expected full year capex (clear columns), which allows you to trace the shifting expectations of expenditure (the plans) and what actually transpires.

It is clear that expected (planned) private investment expenditure for 2022-23 is higher than it was in the current year, which has one-quarter to go.

The ABS note that:

Estimate 7 for 2021-22 is $142.8b

This is 0.6% lower than Estimate 6 for 2021-22

Estimate 3 for 2022-23 is $146.45b

This is 11.7% higher than Estimate 2 for 2022-23

In other words, expected investment is still pointing to an expansion in overall investment spending over the next 12 months.

It is hard to square the expectations with what is actually happening.

That sort of turning point tension – where the actual series is starting to turn and expectations have not yet caught up – is at work here.

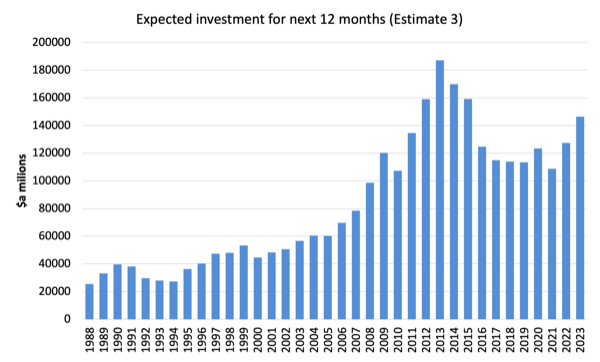

The next graph shows the expected investment for the next 12 months (Estimate 3), which is the most recent we have for 2022-23.

The data is pointing to a 14.7 per cent increase in business investment over the next 12 months.

Once again, it is hard to believe this will come to fruition – with RBA hiking interest rates and future consumption expenditure likely to slow.

The ABS also released their latest – Lending Indicators – July 2022 – which showed in seasonally adjusted terms, the value of new loan commitments:

- fell 8.5% for housing.

- rose 7.7% for personal fixed term loans.

- fell 35.4% for business construction and over the 12 months fell by 38.4 per cent.

- rose 40.2% for business purchase of property and over the 12 months rose by 2.5 per cent.

It is hard to interpret the investment aspect of this release.

Clearly, housing finance is in retreat – with the RBA going feral on interest rates, the charge to buy houses and apartments is coming to a end.

Housing prices are starting to fall as sharply as we have seen for decades as households face a doubling of their monthly mortgage repayments.

That decline has to be put in the perspective of the massive boom that we have just been through in housing, which has made it almost impossible for new entrants to purchase affordable housing.

But the news on business lending is mixed.

Lending for business construction is now in retreat.

But businesses are buying up property again after a substantial decline in June 2022.

The ABS, however noted that the latter series “can have volatile month-to-month movements as it is strongly affected by small numbers of high value loans.”

So we will have to wait and see.

Conclusion

It is likely that business investment is now in terminal decline even though profits are at record levels as real wages plummet.

Businesses are buying up property and paying enormous executive salaries while resisting providing decent wages growth for their workforces, even though productivity growth has improved recently.

One of the challenges facing the new Federal government is to somehow convince the business community to change their behaviour in this respect.

Good luck with that.

The way that the business sector has hijacked the ‘Jobs and Skills Summit’ agenda to turn it into a justification for more skilled migration – which will further dampen wages growth, push up unemployment, and further strain the almost impossible rental and home market – is evident that they are not for changing.

And, if the new Treasurer keeps harping on about the $A1 trillion debt and the need to cut the fiscal deficit we will sink into recession.

Next Wednesday, the Australian National Accounts come out and we will see by how much this negative investment performance drags down growth.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

We need an investor of last resort.

I wonder who that could be?

Is the federal treasurer ignorant about this country’s sovereign fiscal capability or concerned that if the cat is let out of the bag that it will be deluged by spending demands with potential inflationary impacts?