I am travelling today to Tokyo and have little time to write here. But with…

Trickle down. Remember that. The evidence base continue to reject the notion as a scam

Trickle down. Remember that? This was the idea that if we redirect real income towards capital by boosting profits via real wage suppression and/or corporate tax cuts, as if by magic, corporations will start investing the largesse in productive capital, which stimulates economic growth, and, the benefits ‘trickle down’ to the workers who made the initial sacrifices. The evidence base has never supported the idea yet it still resonates. I read two interesting articles yesterday, which are related even if at first blush they may not appear to be. The first reveals the shocking decline in productive investment by both private and public sectors and the long-term damage that that will have for our capacity to meet the climate challenge. The second shows that the arguments that cutting corporate taxes is good for economic growth is false.

Australian experience with real wage cuts and business investment

In 1983, a Labor Government took office in Australia. They initially tried to create a tri-partite arrangement with unions, business and government to manage wages such that the so-called ‘real wage overhang’ (considered to be an excess of real wages over productivity) could be reduced.

The corporate sector refused to go along with any sweetheart deals and so the government went it alone by introducing a wages accord, which was just a fancy term for a systematic cutting of real wages over the next decade.

The trade union leadership (at the peak level) sold the workers out and negotiated this deal with the government, which has had long-term impacts on the capacity of shop floor union officials to negotiate on behalf of their membership.

The workers were promised by the Government that if they accepted the real wage cuts through the wage setting system, then business would invest more and everyone would be better off.

The former happened but the latter did not.

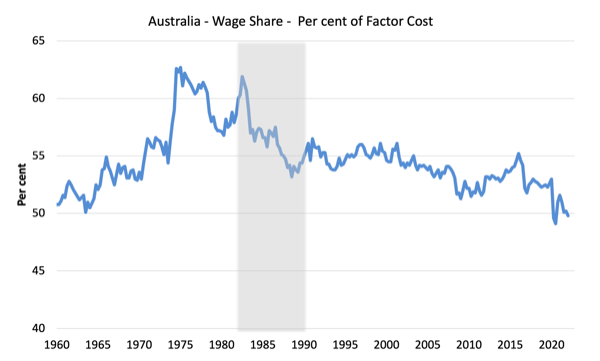

The first graph shows the wage share, which is equivalent to the ratio of the real wages divided by productivity. If the wage share is falling then real wages must be growing more slowly than productivity or falling by more.

The shaded are is the effective period of the wages accord. Over that period, real wages were falling because the wage setting tribunals did not pass on the full CPI increases.

The situation after the Accord period has deteriorated further and the wage suppression mentality became entrenched and successive governments attacked union capacity to deliver wage increases.

The next graph shows the private investment ratio from the September-quarter 1959 to the March-quarter 2022. The shaded are is the effective period of the wages accord.

The ratio didn’t significantly rise over the course of this period.

So in Australia we have first hand experience of the sham that redistributing national income to corporations away from labour improves the fortunes of us all.

Declining investment in productive capacity is a global phenomena

The poor behaviour of the investment ratio has in fact been a global trend under neoliberalism.

The Financial Times article (July 19, 2022) – The investment drought of the past two decades is catching up with us – by Martin Sandbu bears on this point.

He finds that:

Between 1970 and 1989, the share of gross domestic product devoted to investment by six of the world’s seven biggest economies averaged from 22.6 per cent for the US to 24.8 per cent for Germany. The seventh, Japan, was an outlier with 35 per cent.

Of the G7, only Canada has sustained this level of investment: its 22.5 per cent in this millennium is barely down from 22.8 back then. All the others have only managed to match their 1970-89 investment levels in four instances: the US in the boom years of 2000 and 2005-06, and France in 2021.

He argues that this seems odd given “lower-than-ever financing costs”.

Most nations are investing less of their GDP to build productive capacity and provide the conditions for stronger economic growth without invoking inflationary pressures

The article notes that:

The G7 account for about $45tn in annual GDP. Restoring their investment ratios could fill nearly half the global shortfall to the $4tn the International Energy Agency calls for in annual clean technology investment if we are to meet net zero by 2050.

The private sector is not the only laggard.

Public sector investment has also fallen dramatically as nations fell under the spell of ‘fiscal consolidation’, ‘budget repair’, austerity etc.

While we could argue that the climate emergency requires less productive capacity, so why worry, the reality is that the state of the existing productive capacity is ill-equipped to deal with the sort of carbon-reduction activities that are desperately required.

The lack of investment has run down existing productive capacity and left nations with many carbon-intensive stranded assets.

One just has to look at the electricity sector in Australia where a rising number of coal-fired power stations are now being scrapped because they have become unreliable due to lack of upkeep.

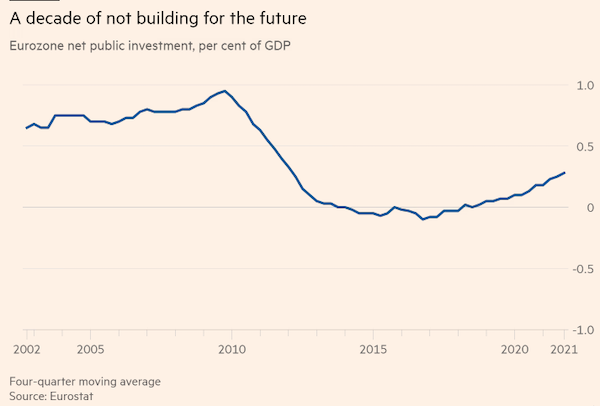

I thought this graph from the article was scary (thanks to the FT). It show the net public investment in the Eurozone as a per of GDP.

Net investment is the difference between gross investment and depreciation (replacing worn out capacity). If it is falling then the capital stock is declining.

The FT article asks:

Why have we lived for so long off past investments and failed to make enough new ones? Financing costs have clearly not been the problem, with interest rates at record lows …

Instead they blame lack of demand (austerity) and cheap labour (wage suppression and moveing out to the east of Europe).

The same causes are global.

Businesses that have access to cheap labour have no incentive to substitute it for more expensive capital.

Further, if the existing capital stock is sufficient to maintain production at current expenditure levels then why build capacity that cannot be used?

This duality is a hallmark of neoliberalism and exposes it myopic nature.

A high wage economy is one where workers enjoy increasing real living standards as business is forced to invest to increase productivitity to ensure wages growth can be accommodated.

We get better products, higher quality work and everyone is better off in material terms.

The neoliberal way has been the opposite.

Suppress wages growth -> low investment -> low productivity -> high profits.

It is ultimately an unsustainable system.

The other reason that productive investment has fallen is that capitalism has shifted from an industrial capital base to the fly-by-night financial capital dominance.

The financial sector is the most unproductive sector. It does very little other than shuffle gambling proceeds.

Sure enough it is quick money and doesn’t require those with funds dealing with pesky workers and having to actually sell things consumers might need or like.

This late capitalist phase is now dominated by speculators and spivs and the entrepreneurs have gone to sleep.

More anti-trickle down evidence

The other article I read that bears on this topic will be published in the European Economic Review (August 2022) – Do corporate tax cuts boost economic growth? – and the authors were Sebastian Gechert and Philipp Heimberger.

The answer to the question they pose in the title is a simple NO!

The relevance of the study is clear.

Corporate lobbyists are continuing harassing politicans to enact tax cuts for corporations on the basis that more profit will lead to higher productive investment, stronger employment growth, and higher wages growth.

It is the trickle down logic.

Boost profits and everyone benefits.

Except they don’t.

There has been a growing literature examining this question now that we have endured neoliberalism for several decades and have enough data to do meaningful statistical research on some of the key propositions – such as this one.

Eyeballing data is always a good place to start.

It doesn’t prove anything but provides the basis for conjecture and one can often easily eliminate some of the competing theories just by looking at the data.

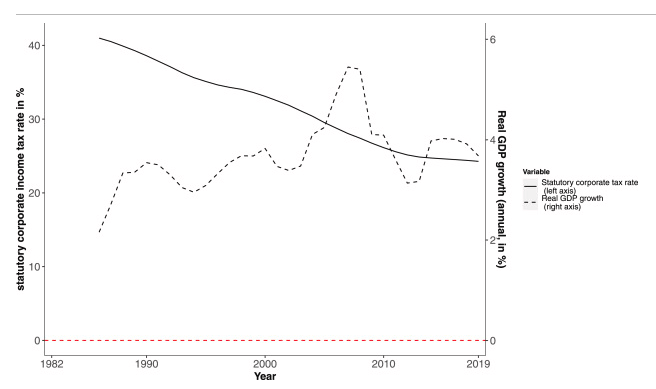

The authors provide this graph, which shows the 5-year moving average of the global corporate tax rates and real GDP growth rates.

The corporate tax rate has been in continual decling over the last 4 decades but there has not been any commensurate increase in real GDP growth rates.

Some studies that they review predict higher growth with lower corporate taxes, but the authors find statistical bias in the estimates and they conclude:

After correcting for this bias and taking heterogeneity across studies into account, we cannot reject the hypothesis that corporate tax changes have, on average, no economically relevant or statistically significant effect on economic growth.

Which means that they cannot find a statistically significant relationship between corporate tax rates and real GDP growth.

I won’t go into all the statistical material in the paper.

You can read that if you like – but in general, the techniques are sound.

They find that:

1. “the short-run response of GDP to a cut in corporate taxes is even less growth enhancing than for estimates that do not explicitly identify the time horizon.”

2. “we do not find that the long-run growth impact of corporate tax cuts is significantly more positive …”

3. “there does not seem to be a substantial difference between OECD and non-OECD countries regarding the growth effects of corporate tax changes.”

4. “if we hold government spending fixed, a corporate tax hike will be slightly more detrimental to growth” – which just means that government spending is growth-inducing.

Reprise on yesterday

I deleted a lot of comments from yesterday’s blog post – Mask mandates should be reintroduced to stop our rising death rate (July 10, 2022) – largely due to the fact they did not address the discussion.

Some were just outright rude but that is normal and they go straight into the bin.

But the discussion yesterday was not about zero Covid.

The deleted comments failed to engage with the actual reason I wrote the post.

It was about the fact that Covid in Australia is now accelerating quickly again and the death rate is rising fast.

The problem then is that our hospital system is now close to breaking with many people being turned away who have non-life threatening problems that would normally require surgery and treatment because there are no beds available and increasing numbers of health care professionals are either abandoning the system through excessive stress or becoming seriously ill themselves.

That was the issue I was addressing and the only short-term way to deal with that is to use all the means available to us to suppress the acceleration of the virus.

I know all about the freedom lovers out there who think individualism triumphs over the collective well-being.

But if the pursuit of individual freedom means our society fails because we can no longer even offer guaranteed and adequate health care then we have a major problem.

I also don’t buy the argument that several commentators made that being ‘forced’ to wear proper protective masks in certain places, where they have been unambiguously shown to reduce the spread of infection from these respiratory viruses, will create a mental health disaster.

That is pure nonsense.

Further, the comments didn’t address the inconsistency of the ‘freedom’ argument, that seems to accept red lights at intersections and speed limits, which seriously impede the freedom of rev-heads to have a good time in their fast vehicles, yet thinks having to wear a mask is an unacceptable symbol of authoritarianism and state control.

Finally, I note a lot of Left-leaning commentators who take this ‘freedom’ argument to the extreme in one breath, then advocate all sorts of penurious regulative control over capitalists, bankers, corporations, entrepreneurs because they argue if we leave these characters to their own devices there will be damage done to all of us through excessive greed.

The individualism in one breath, the collective in the next one.

My view is that we have to take a collective viewpoint to maintain social integrity. If we can pursue our individualism without compromising that then we should be able to.

Usually we have to regulate individual and corporate behaviour to strike a balance that allows for ‘society’.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Anti mask mandaters can’t see past the end of their own noses.

It is interesting for behavioral economics though, to see how most people completely fail to objectively evaluate risk. 60 people a day die in Australia? Do the math! Here in NZ over half the population have caught the mysterious-brain-disease-with-unknown-long-term-consequences known as Covid19, yet everyone else at my workplace doesn’t wear a mask, even though that is the proven most effective way to avoid said disease!

However, public health policy and individual risk assessment are two different things and our neoliberal governments have got them both wrong.

I found this review of corporate taxation useful and timely given the current contest to select a new leader of the Tory party in Britain. Liz Truss has promised to ditch Rishi Sunak’s proposed increase in the corporation tax rate, probably on the basis of trickle down economics. Sunak, meanwhile, presents his tax increases as necessary to get the public finances into a good state by reducing the size of the national debt.

A good opportunity for the left to correctly present taxation as a device to move resources from the private sector to the public sector rather than to raise revenues.

“The workers were promised by the Government that if they accepted the real wage cuts through the wage setting system, then business would invest more and everyone would be better off.”

If I remember correctly, the other trade off promised to the unions was an improvement in the social wage, which I think the Labour government did manage to deliver on.

“The other reason that productive investment has fallen is that capitalism has shifted from an industrial capital base to the fly-by-night financial capital dominance.”

Yes this is true, but investment also shifted from the West to the East, mainly following cheap labour.

Reality changes so quickly that one has to question why are we still discussing such nonsense as the trickle down trope, after so much evidence of its failure.

Demand colapsed worldwide and inflation rises. What the neanderthals of liberalism have to say?

That demand is driving inflation.

So why are we still buying such lies?

Because the media keep feeding us with neoliberal propaganda.

We still think of the media as something vaguely related to information and jornalism.

It’s not!

But most people don’t like beeing fed with lies.

Fortunately, there’s always somebody who rejects it.

Bill is one of them and he just mentioned another one that I follow on tweeter: Philipp Heimberger.

Bill, could you write something on what would happen in the US when the US$ ceases to be the world’s reserve currency?

Neoliberalism, what a success, those how initiated to shift power and resources from the many to the few could probably not even in there wildest fantasies have dreamed of this smashing success for the few.

A few lines from Oxfam:

“World’s richest 1% have more than twice as much wealth as 6.9 billion people, says Oxfam”

“In Canada, the top one per cent own significantly more wealth than the bottom 70 per cent.”

“Ten richest men double their fortunes in pandemic while incomes of 99 percent of humanity fall”

“World’s billionaires have more wealth than 4.6 billion people””

“Women and girls put in 12.5 billion hours of unpaid care work each and every day -a contribution to the global economy of at least $10.8 trillion a year, more than three times the size of the global tech industry.”

Fewer and fewer owns the worlds.

“the number of billionaires owning as much wealth as half the world’s population fell from 43 in 2017 to 26 last year (2019). In 2016 the number was 61.”

The neoliberal propaganda lies promised us multiplicity of supply, small and middle sized companies would grow up and compete for our best.

What we got was fewer and fewer owns this world, some hundred financial conglomerates control 85 % of global corporations.

@Henry Rech re: ‘investment also shifted from the West to the East, mainly following cheap labour.’ I read this as western capitalists shifted their investment from their own countries to Eastern countries ie primarily China. Maybe this isn’t your intended meaning, as my understanding is the likes of Apple have taken advantage of the huge investment by the Chinese state in its Eastern seaboard export set-up (cities, factories, ports) plus a little from Taiwan firms, while minimising its own workforce and racking up superprofits.

@Patrick B

Some years ago someone made study then iPod I think it was, final product value shipped to US accounted for Chinese export to USA. But only minor part for assembly was added in China. Most of the technical advanced stuff was produced in e.g. South Korea and Taiwan. I suppose in these things marketing, design and r&d are located in US.

Here in Sweden we often hear that half our GDP comes from export, of course its the net of import-export that counts in GDP. But export sector i the largest importer and value added here is probably not much more than 25% of the export number.

I don’t read her every day, maybe it is written about. But it would be interesting to hear about what Russia has done, demand payment in Ruble. Read something about it in Asia Times many years ago, some fellow arguing it would be a better system than relaying on USD as the main trade currency. Exporting countries demanding payment in their currency.

It occurs to me that a many who prioritise their right as an individual are confusing human rights with freedom. Human rights establish minimum standards for the individual. The right to protect one’s health and well being will always trump an individual’s demand for freedom. We are social and collective by nature. If someone truly wants to operate as an individual without social interference they are referred to as a hermit.

There is also the trope that wages and conditions in the West are too high and therefore a lot of industry has offshored to low wage nations. So called free trade deals put pressure on and suppress conditions so that we are “competitive”. Some neoliberal family members argue along these lines whilst enjoying comfortable lives. They also argue that if wages and conditions in low cost nations were higher the price of clothing etc would rise substantially.

The pandemic also highlighted the vulnerabilities of reliance on overseas products but they argued this is “efficient”. These are well educated but are in thrall to neoliberal propaganda.

Of course these deals end up in a race to the bottom. “Fair trade” would overcome much of this.

Patrick B,

My intention was as you describe.

The US and Europe began in the 1980s to invest in south east Asia and then China. Even Japan began to do it once its domestic costs became uncompetitive, which partly explains its stagnation of the last 25 years.

As China internalizes its economy (a stated policy goal), its internal cost structure will rise and make it less competitive. It’s being squeezed out western markets for geostrategic reasons anyway.

Prof. Mitchell,

This post is quite apropos the Jobs and Skills summit the Albanese government is calling for September.

Based on what the media has revealed, what’s your opinion about it?

More generally, how do you evaluate Hawke’s Accord? Was Medicare – maybe one could add Superannuation? – sufficient compensation?

And, lastly, what do you think of the constant calls for productivity, productivity, that all the VSPs are making?

A lot of people misunderstand what the word freedom means, and are very easily manipulated because of that.

There is no such thing as absolute freedom.

You never have the right to do whatever you want, regardless of the impact on those around you.

You are always living within a society. What you do have is relative freedom.

You can do what you like, as long as it doesn’t impact someone else negatively.

@/lasse, I sent this letter to Private Eye, which I don’t suppose they’ll publish, but I did get this response today: “The Ed says: Thank you for your letter. It has been passed to Slicker”. I wonder whether I should ask them to send Slicker a link.

—

I was dismayed to read your City correspondent’s criticism of the Governor of the Bank of England (Bailey’s Circus, No. 1576), viz his “ever more glaring failure to raise interest rates”, and the reference to the “underlying permanence of inflation”.

Firstly, the cause of the current bout of inflation is transitory supply constraints resulting from a series of global economic shocks – no matter that ‘transitory’ could mean an extended period of adjustment by markets.

Secondly, interest rate adjustment (monetary policy) is not the correct tool. Could the sado-monetarists give an example of when high interest rates had the effect of decreasing inflation without the side-effects of unemployment and recession?

Fiscal policy – tax and government expenditure – is what is required to ensure that in the world’s fifth richest country the basic human necessities, at least, are afforded to all no matter the constraints. The ultimate solution is direct command and control by government of real resources, as in wartime. It should be noted that we had the same real resources after as before the Great Financial Crash.

The continuing transfer of wealth from the workers who produce it to those who don’t since the mid-1970s coincided with the advent of monetarism.

Carol

Just so you all know what we’re now up against. This is today’s pearl of wisdom from the sado-monetarists.

…

Yes you did read that first sentence correctly. If rates are too low, economies don’t grow at their fastest pace…

“Yes you did read that first sentence correctly. ..”

The second sentence explains their rationale. With interest rates at, say, 6%, enterprises are disciplined, even forced, to add value of 11% to get a 5% return. At interest rates of 2%, enterprises could slack off and add only 7% value.

Of courses this is the old “assume a can opener”. It assumes that actual enterprises simply dial-in the amount of value they’re going to add. Far more likely that a real enterprise would find that 7% AV was as much as they could do, and 1% profit wouldn’t support the real people involved.

But economics and economic policy and economics journalism go on anyway.

I had a Twitter exchange with Wren-Lewis today. My last reply was to send him this: https://billmitchell.org/blog/?p=50121 in response to his:

” So central banks in the US, UK and EZ are pointlessly raising interest rates right now, and there is no danger that they will create a recession. Great news if true.” My previous: “That’s monetary policy – monetarism. I thought that was discredited even before GFC.”

I think that Bill is copied in, and Stephanie, but they don’t bother with such tripe, and I don’t know why I do either.

I hope to get a pass to the TUC conference in September, so I can have a go at Geoff Tily, Chief Economist. That’s worth doing, I think.

The question to ask Wren Lewis is why he is in favour of unelected wonks in banks taxing poor mortgage payers and transferring that money to rich deposit holders, rather than the elected parliament doing the jobs and taxing both poor mortgage payers and rich deposit holders.

Is he just a shill for the rich who wants them to have more money?

” Far more likely that a real enterprise would find that 7% AV was as much as they could do, and 1% profit wouldn’t support the real people involved.”

That’s the idea from what I can see. They intend those firms to fail – which is what creates the increase in the unemployment buffer that, as we know, actually halts the inflation.

If that was all that was required we could do the same with wage increases. Increase the wages of the workers, keep the prices the same and you have the same requirement to add value.

But wage increases put up prices, where as interest rate rise don’t put up prices – apparently. Quite why a firm wouldn’t respond in exactly the same way to an increase in costs no matter where it comes from isn’t explained.

Other than the belief that wage earns spend their money and rich deposit holders don’t.