The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

As the mainstream paradigm breaks down

On September 2, 2021, the Head of the BIS Monetary and Economic Department, Claudio Borio gave an address – Back to the future: intellectual challenges for monetary policy = at the University of Melbourne. The Bank of International Settlements is owned by 63 central banks and provides various functions “to support central banks’ pursuit of monetary and financial stability through international cooperation”. His speech covers a range of topics in relation to the conduct of monetary policy but its importance is that it marks a clear line between the way the mainstream conceive of the role and effectiveness of the central bank and the view taken by Modern Monetary Theory (MMT) economists. I discuss those issues in this blog post.

First, note that Claudio Borio openly admits:

… the loss of policy headroom is not technical in nature … as central banks purchase a growing amount of assets, they risk being perceived as eroding the basis of a market economy.

In other words, all this talk about the need for fiscal rules, and other constraints on government (treasury or central bank) are really not financial (“technical”) but, rather, issues of ideology.

If you think the “market economy” is the ultimate arbiter, then, of course, intervention into those processes will be seen as sub-optimal.

I do not hold the outcomes of an unfettered market economy as being the desirable benchmark upon which we assess government policy.

Quite the opposite in fact.

Other Issues arising from Claudio Borio’s Speech:

1. “inflation has proved rather insensitive to monetary policy easing, thereby thwarting central banks’ efforts to push it up to target post-GFC.”

2. “in its recent review, the Federal Reserve downplayed the role of an unobservable equilibrium rate of unemployment in setting policy” – meaning that the US central bank has effectively abandoned the NAIRU mentality that has ruled monetary policy for several decades and sustained elevated and very wasteful levels of labour underutilisation.

It was all in vain folks.

And in this paper from June 1987 (which was actually written in 1985) – The NAIRU, Structural Imbalance and the Macroeconomic Equilibrium Unemployment Rate – I provided a comprehensive framework and empirical evidence as to why it would be in vain.

34 years later it is, according to Claudo Borio a “well known factor”.

Takes time to catch on, eh?

3. “inflation expectations may be rather backward-looking or at least unresponsive to policy announcements” – all the academic papers that claimed that monetary policy had to pursue inflation targetting and fiscal policy should be submissive to that agenda because that was the way inflationary expectations would remain anchored – what do they say now?

4. That the economic cycle is now driven by the “financial cycle” – which means excessive credit and private debt accumulation as financial market regulation and oversight was weakened.

Claudio Borio says:

There is no question that a key reason for the rise in the financial cycle has been financial liberalisation.

And if you go back to the 1980s, when the mainstream New Keynesian macroeconomists were falling over each other to extol the virtues of financial market deregulation as the path to financial stability, and setting us up for decades of financial instability and crisis, you have to wonder how they can still retain their highly-paid, protected jobs and keep getting the public platform.

5. To all the inflation-mavens, who have run out of credibility claiming government deficits would send them broke, and now hang onto the only thing left – inflation scaremongering, Claudio Borio noted:

It is hard to believe that the inflation process could remain immune to the entry of 1.6 billion lower-paid workers in the global economy, as the former Soviet bloc, China and emerging market economies opened up.

Add to that the relentless labour market deregulation and anti-union attacks in advanced countries, which have made “the wage-price spirals of the past (“second-round effects”) less likely”.

This is a point I have been making for ages – you need propagating mechanisms for inflation to become entrench after an initial shock.

At present, the global supply chains are in chaos.

I was told last week from a friend who uses large bulk freighters as part of his company’s business that the freight prices are rising steeply, in part, because there is huge congestion in China’s system of ports as a result of the Delta Covid strain causing long delays in port clearance.

And, the short-term price spikes are evident.

But to become entrenched as an accelerating inflation, the real income struggle between labour and capital has to be ignited.

That propogation will not be forthcoming any time soon.

The Volcker Shock

Claudio Borio invokes the “Volcker’s efforts” in the 1980s as evidence that:

… central banks worldwide succeeded in taming inflation.

This is one of those dubious claims that persist in history.

The Volcker Shock was like treating a mild headache with a morphine overdose.

It should not be used to demonstrate the ‘effectiveness’ of monetary policy in disciplining price pressures.

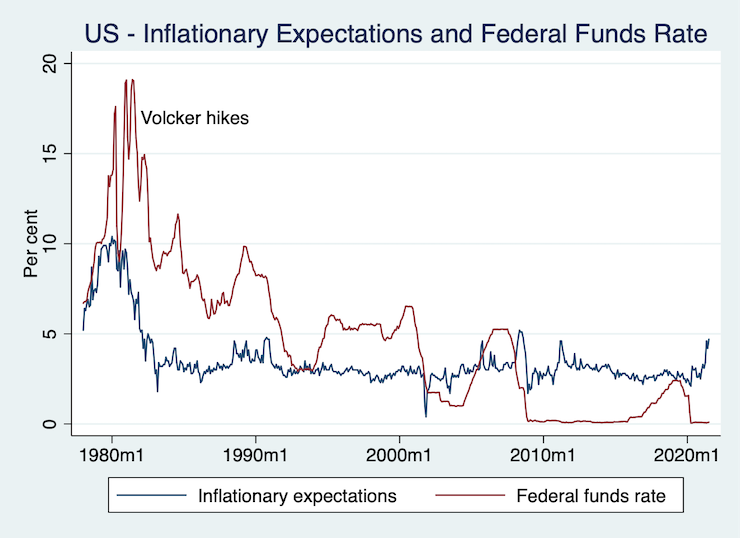

Here is a plot of the University of Michigan Inflationary Expectations data from January 1978 to July 2021 and the Federal Reserve Funds Rate for the same period.

You can see that there is not a close correspondence between the time series behaviour of the two series.

Just to satisfy my curiosity, I spent a little while running Vector Autoregressions and Granger causality tests on the data with various lags. Cutting through the jargon, these econometric procedures are standard ways to investigate the associations across time at various lags of the variables.

While the work was nascent, experience tells me that there was no causality running from the federal funds rate to price expectations, although it did work the other way. The interrelationship is thus complex and one cannot infer that monetary policy (adjusting the funds rate) disciplines inflationary expectations.

History tells us that in all the nations I have studied, it was the large recessions (1981-82, 1991 depending on country) that expelled the persistently high inflationary expectations (as a result of the OPEC oil hikes) from the economies.

Those episodes were not exclusively brought on by monetary policy adjustments.

You might say that Volcker knew that if he hiked the funds rate, he would choke off borrowing and that would create a recession, which would discipline expectations.

The problem was that the Monetarist causality he had in mind did not prove to be realised.

He thought he could control the broad money supply by controlling the base money (reserves plus currency) – making it harder for banks to acquire, which would push up rates in the financial markets and squeeze borrowing.

Interest rates went into a sharply upward spiral and borrowing was reduced.

But as a result of the higher rates, there was a dramatic increase in capital inflow in pursuit of dollar-denominated financial assets, which pushed the exchange rate up from the Autumn of 1980 to November 1982 (by around 40 per cent against the major currencies).

This severely undermined US exports and the recession.

Unemployment started to escalate sharply.

The inflation that was in train at the time was the result of oil price hikes in 1979 (quadrupling) and this caused recessions everywhere. The cost pressures were working their way through to other commodities (food, housing, etc) and so by the time Volcker set about wrecking prosperity, the inflation dynamic was already waning.

Further, I am often surprised when people introduce the so-called Volcker Shock as evidence that monetary policy should be the primary macroeconomic counter-stabilisation tool.

Within normal limits of interest rate movements, adjusting interest rates has very little impact at all on the real economy.

The fact that Volcker was prepared to push the overnight rate so high (around 20 per cent) and precipitate a widespread financial crisis, which then pushed thousands of firms into bankruptcy and forced unemployment to rise above 10 per cent in order to kill inflation that was already dissipating is not something to be recommended.

Extolling the virtues of a policy tool that only really achieves the stated aims by invoking a massive crisis, when the target is hardly a worry is not very clever.

One can cure a headache by taking massive overdose of morphine. But the patient dies!

Comparing paradigms

Claudio Borio then expressed a view that the standard New Keynesian macroeconomics:

… by playing down the role of financial factors and overestimating the self-equilibrating properties of the economy, it could not identify the build-up of risks ahead of the crisis nor replicate its dynamic.

In this context, history has caught up with the mainstream paradigm:

1. “There is also a growing recognition that financial factors are important” – remember that the standard NK macroeconomics discounts the impact of financial shocks on “the smooth return to a steady state” and that shifts in monetary aggregates only have temporary effects (if at all) on the real economy.

The evidence is quite the opposite.

2. “the concept of the financial cycle is at the very heart of the macroprudential frameworks implemented post-GFC” – once again, contrary to the way macroeconomics is taught in mainstream programs.

3. “there is still a certain divide within central banks and among their researchers” – the macroeconomists preach NK market-clearing principles and those researchers who understand the impact of financial instability and how it causes recessions.

The advice received by policy makers is schizoid in nature given these two polar opposite views.

Why does this divide persist in the face of evidence that the NK macroeconomists have missed the mark?

He says that “professional experience matters”.

This is code for persistence in thinking reinforced by Groupthink. As one who has worked in economics departments all my life (except for the last several years when I have been working on in a research centre separate from a departmental structure – to my relief), I can tell you that the forces for conformity are strong.

I have written often about that process. It just doesn’t ‘pay’ for a young academic in a tight-knit NK department to buck the system. They want promotion, publications, research money and invitations to the ‘prestige’ conferences.

Prestige doesn’t equate to any notion of quality. It is defined by the inner group as the benchmark everyone has to aspire to within the Groupthink paradise.

Moving on

Claudio Borio essentially challenges the core beliefs of the NK paradigm.

1. “More to the point, once it is recognised that monetary policy has an impact on the financial cycle, it is hard to believe that for any relevant policy horizon monetary policy could be neutral. There is substantial evidence that financial booms and busts leave very long-lasting if not permanent scars on the economic tissue, especially if banking crises follow.”

2. Once inflation is low, “there could be a stronger tendency for inflation to remain range-bound” and “expectations may well play a smaller role. On the one hand, they may be less responsive to actual inflation; on the other hand, they may have a weaker impact on it.”

The last point is important.

The whole NAIRU paradigm is predicated on the fact that inflationary expectations drive the inflationary process independently of the state of activity in the economy.

And, that central banks can discipline the expectations through ‘credible’ deflationary strategies.

But, now, Claudio Borio, who is reflecting on the evidence concludes that “Inflation expectations may be less responsive to inflation” and an important reason for this is “the absence of second-round effects is loss of bargaining and pricing power.”

This is a point I have been making for some years.

Workers have much less capacity to defend their real wages now than they did in the 1970s.

Which means that price shocks are unlikely to trigger entrenched inflationary episodes.

But finally …

With all that said, Claudio Borio reverts back to form and claims that:

… a key challenge ahead for monetary policy is to regain room for policy manoeuvre, ie to rebuild buffers. Economies that operate with small safety margins are exposed and vulnerable. Building buffers will be especially important in the wake of the Covid-19 crisis, which has also dramatically cut fiscal policy headroom.

He wants rising interest rates – because they won’t be that damaging to output and will reduce “higher risk-taking, weaker financial institutions, capital misallocation, etc”.

This is code for – avoiding taking a harder line of lax financial decision making within banks etc; boosting bank profits with higher rates (screwing the borrowers); and poorly designed tax systems that allow speculative behaviour in asset accumulation to be financially rewarded.

He also claims that the current central bank narrative around the world that they are trying to push up inflation to levels consistent with ‘price stability’ runs against the facts that low levels of inflation are hardly a problem.

He didn’t elaborate on the fiscal ‘headroom’ but he is just running a standard and erroneous line that continuous deficits are unsustainable.

Which is a claim that runs against the facts.

Conclusion

The Speech was interesting because it demonstrated the chaos that the mainstream are now in as their core models are running against the facts and some of the economists within that tradition are breaking ranks to try to save their own credibility.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

How much of monetary policy is just asset price manipulation by way of yields.

Reduce interest rates and the price of yielding assets goes up but future flow of income from gov sector goes down without an increase in net spending by gov to counteract it.

Same in reverse. Increase the level of interest rates and the price of those assets goes down and alongside the equity of the private sector which reduces the borrowing capacity of the private sector. But the gov sectors newly issued bonds increase inflows into the private sector.

If the gov doesn’t spend at all in the latter case you would see the equity of the private sector go down. But a very sledgehammer type response.

In the former although inflationary at the initial response since old assets go up in value, you have a net reduction in money coming into the economy from the gov side. Negative rates would allow it to work but then flip the script and now you expect banks to create money above the assets they hold(negative equity) while the gov taxes with newly issued bonds.

Kind of seems like no matter what it comes back to fiscal as the control level of money inflows. Without even talking about how fx plays a role.

Translation of Borio’s proposal to raise rates in response to evidence that the monetary policy regime is an empirical failure:

“Admittedly, reconstituting sunshine from cucumbers has proven rather more difficult than our models predicted. Solution? We just need more cucumbers and more time!”

(with apologies to Dr Swift)

I am afriad that Claudio Borrio does not speak for every neoliberal, such as, say, Rishi Sunak. Sunak isn’t ready to ditch, in even however small a way, any of his neoliberal propensities, as witnessed by his latest tax proposals. Utterly regressive. But he ‘soldiers’ on nevertheless. His hedge fund micro mind set seems to prevail no matter what the reality, with a slight exception for the pandemic influence. Even in this case, he did as little as he thought he ‘needed’ to do in the circumstances and reverted to his normal as soon as he deemed it ‘wise’ to do so.

Bill,

Speaking of the Volcker years, can you please let me know what you think of my short article on that period?

https://www.pmpecon.com/post/what-really-happened-during-the-volcker-years

Correction: Borio.

Recently I’ve heard Warren Mosler opine that the policy rate strongly influences the inflation rate — that the traditional central bank belief that raising rates as a response to inflation has the relationship precisely backwards, both in causality and results. So the inflation rate eventually tends towards the prevailing policy rate over time.

Has anyone encountered any literature about this proposition? So far I have only encountered it in interviews of Mosler.

It’s just occurred to me that Neoclassical thought is the economic version of Miasma Theory.

It’s time we washed our hands of it.

“Has anyone encountered any literature about this proposition?”

It’s the forward pricing channel.

http://moslereconomics.com/2014/10/13/there-is-no-right-time-for-the-fed-to-raise-rates

I have repeatedly heard Warren Mosler make the claim that inflation in the US at the beginning of the 1980s came down not because of Volcker’s “nuclear option” of 20% interest rates, but rather because of the deregulation of natural gas some two years earlier by the Carter administration.

Can anyone point to an article or other evidence to that effect? This has always seemed very plausible to me, but I’d like to have some backup for that idea.

Miasma as a poisonous vapour. A bit like Covid particles in the air being microscopic bullets and many idiots believing they have a divine right to be random shooters (not wear masks and socially distance) just because they’ve had two jobs. So commonsense rules be f*cked! Reminds me of that great Neoliberal Adam Smith’s inability to read human nature!

“The natural effort of every individual to better his own condition, when suffered to exert itself with freedom and security is so powerful a principle that it is alone, and without any assistance, not only capable of carrying on the society to wealth and prosperity, but of surmounting a hundred impertinent obstructions with which the folly of human laws too often incumbers its operations; though the effect of these obstructions is always more or less either to encroach upon its freedom, or to diminish its security.“

— Adam Smith Source: (1776), The Wealth of Nations, Book IV, Chapter V, paragraph 82.

https://www.gutenberg.org/ebooks/3300

“Jabs” of course!

To eg:

This is not a new notion, and Randall Wray has said in interviews, and I think in at least in one Levy Institute paper, that we have no certainty that either proposition is true, either that increases in the interest rate drive inflation, or that the neo-classical synthesis version that lower interest rates spur economic activity (and thus inflation). However, Wray clearly thinks it more likely that higher interest rates spur inflation. Mike Norman has repeatedly made the case that the cost of credit is reflected in the cost of all goods and services (and he makes a strong argument repeatedly about the stagnatory effects of excessively low interest rate policy). Neil Wilson’s arguments about QE being a tax essentially work in the same direction — reductions in savers’ incomes are deflationary. The most powerful theoretical article supporting Mosler’s claim is likely the simulation provided in Chapter 11 of Marc Lavoie and Wynne Godley’s seminal work, Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth, which concludes that a higher rate of interest produces a paradoxical effect, bringing about a positive impact on output and employment in the long run. Interest payments are treated like a public expenditure, generating a positive

multiplier effect, despite the negative short-run impact on business investment. I think that Godley and Lavoie provide strong support for Mosler’s argument; however, they also seem to be making the case that excessive interest rates over a long period can eventually have a contrary effect, due to the inability of household debt to drive growth in the long run. Instead, the servicing cost of household debt eventually reduces consumption. The amounts previously borrowed by households

lead to a decline in consumer demand, thus disabling the growth regime driven by

household debt (and high interest rates). Finally, this was a common point in the 1970s and late 1980s, among progressive economists before so many of them got co-opted by monetarist and then rational expectations thinking. In Canada, where during the 1970s the Central Bank showed great commitment to monetarist policies of “monetary gradualism”, it was commonplace in the 1980s for well-known economists (well-known in Canada that is) such as Clarence Barber and Gideon Rosenbluth to argue that that the higher nominal rates under gradualism had actually contributed to inflation by raising the financing costs of businesses and households, costs which were then passed on to consumers in a readjustment of the general price level. I think they each make that point (I do not have it to hand) in Rosenbluth’s 1992 collection of articles False Promises.

Can anyone point to an article supporting Mosler’s contention (which I find very appealing) that the inflation of the late 1970s in the US was controlled not so much by Volcker’s “nuclear option” of 20% interest rates, so much a result of the deregulation of natural gas two years earlier by the Carter administration?

eg, I too have seen Warren tweeting that recently, but sure I’ve seen it here too.

This post generates a number of speculative thoughts in my mind. I don’t assert my speculative thoughts are accurate models of the world or its directions but I regard them as “notes towards”.

1. Tentative thoughts about the advent of cryptocurrencies – What could it mean for MMT?

There is always a competition between capitalists as Marx observed. The “new financial capitalists” innovating cryptocurrencies discerned that the established financial capitalists of the banks and merchant banks had captured the processes of fiscal and monetary policy. The established financial capitalists further innovated, themselves or via their proxies), Quantitative Easing and low or zero real interest rates. These enable large established financial capitalists to obtain and maintain the advantage of almost endless free loaned capital provided by the state. This is a superb method for generating asset inflation for assets already held and for enabling the acquisition of further assets. Established big capitalists (oligarchs and plutocrats) become assured of continued asset accumulation if they can continue to rig the entire game in this way.

When one can’t rig a game and participate in the rigged game as a winner one must over-trump the rigged game with a new game. At least, that is one way to fight the rigged game. The old game is fiat currency managed by monetarist prescriptions and then supercharged with Q.E. The dominant financial capitalists have monopoly control (by substantially capturing governments) over the prescriptions for fiat money creation, fiat money “easing” and interest rates. The way to trump that game, in the minds of some, is to invent a new form of currency. That new form of currency is the cryptocurrency as a genre.

The problem for these new innovators or opportunists is to make the new form of currency “stick” as a medium of exchange or failing that simply to make it “stick” at first as a new form of speculation. For a time, speculation, mania (as in Tulip mania), pretensions to reliability, some new claimed or real forms of protection against inflation, deflation and devaluation, claimed or real support of contractual obligation enforcement (by block chain contracts) outside the minarchist state service for same and even attractiveness for black-market and anonymous transactions, can all serve as “feet in the door” to get the alternative cryptocurrency running at some level.

The cryptocurrency challenge is now possibly more serious than corporate-captured governments and their conventional corporate masters recognize. While some cryptocurrencies have failed or are failing (including possibly Bitcoin for example) because of high creation and transaction costs and the failure to support high transaction volumes, new “meta”-cryptocurrency platforms like Solana might be overcoming a number of these problems though this still might be smoke and mirrors.

From the points of view of Marxian and Veblenian theories, these new cryptocurrencies are still scams against workers (working with brain and/or body) as the fundamental and direct creators of value beyond the free gifts of nature. But the advanced cryptos while very likely still being “scams” can more complexly can be regarded as “escape variant innovative capitalism”, emerging and evolving to compete against against existing dominant financial capitalism and its neoliberal captured fiat variant as “store of value”.

With modern cryptocurrencies like Solana, it appears possible in theory to create DAOs (Distributed Autonomous Organizations) as competitors for conventional finance and conventional corporations. Instead of shareholders, these DAOs have crypto holders or token holders who vote on proposals for using DAO “treasury” or cooperative funds for paying for salaries and for contracted services etc. In a sense this could be, I emphasize “could be”, a radical new kind of business cooperative functioning as an autonomous workers’ collective or cooperative, albeit only accessible and functional for tech-savy “worker-capitalists” as a potential new class.

Each one will be a worker and a capitalist and collectively they will be a cooperative competing against established corporate and oligarchic capitalists. Of course, if successful, the biggest individual players may well become the “New Oligarchs”, one predicts. Meet the new boss, just like the old boss. This development won’t necessarily turn into the fortuitous evolution of “distributed autonomous socialism”. In fact, my guess is that it wouldn’t do this without a revolutionary socialist vanguard reclaiming the state, to use Bill’s phrase and directing processes that way. These young, tech-savy “worker-capitalist” geeks don’t seem the least bit interested in ushering in a socialist worker utopia, though they do tend to believe that they are ushering in a liberal anarchist or libertarian anarchist utopia of fully realized individualism.

The competitiveness of the most innovative of these new cryptocapitalism will express itself as the push to establish and extend the operation of cryptocurrencies, block chains and smart contract chains and to avoid holding fiat dollars, government bonds and even sometimes corporate bonds. Looking at these trends might (I emphasize might) expose some new phenomena arising in the capital system where capital itself is potentially transmogrifying to a new form beyond government fiat.

The most innovative of the “cryptocapitalists” want to limit their holdings in fiat currency (US dollars for example) and in fiat currency denominated bonds to as little as possible (just using fiat currency as a flow of “hot potatoes” while maintaining a minimal stock at any point in time) to limit their exposure to the sovereign, seigniorage and demurrage risks they see as inherent in fiat currencies and their operations which they see in turn as captured by conventional (and thieving) corporations and/or subject to clear statist actions based on exigency, contingency, opportunism or caprice by supposedly democratic or openly authoritarian governments.

The above is speculative theorizing as I said. The cryptocapitalists certainly believe the conventional financial capitalists are dinosaurs who do not understand the next paradigm. The cryptocapitalists certainly believe they are going to win. China is possibly the place to watch for the earliest and strongest statist push-back against cryptocurrencies if states want to protect their fiat currencies. This is all just in my speculative theorizing opinion (IMSTO). 😉

The interest rate relation with inflation rate was something I first became aware of from Richard Werner, prior to Warren Mosler fairly recently publicly making the connection. Werner puts forward that growth leads and interest rates follow rather than the reverse from his observations.

Werner’s comments on this aspect, for example, can be found on YouTube at “Why Don’t Economists…?” posted 27JAN18 at around the 30min mark.

Ikonoclast, thank you for your thoughtful musings about cryptocurrency and its proponents. Unfortunately, my encounters with them lead me to infer that they are labouring under the commodity money illusion, with a particular affinity for the scarcity premise of the gold standard. Their creations are never going to usurp the place of fiats unless they are able to gain political control of the state and render the taxes, fees and fines thereof payable in them. Absent the tax obligation backed by the state’s monopoly over the legitimate use of force, their creations are NOT currencies, despite vulgar parlance; lacking as they do any inherent use value, they aren’t even commodities — they are merely electronic gambling tokens.

Chicken and the egg debates are not very useful.

Always been more persuaded by mark up conflicts and costs as inflation drivers

than equilibrium models .

It seems factual that interest rises will increase firms debt costs which can only put upward pressure

0n prices. Maybe that can be mitigated if significant rate rises reduce spending by indebted households but that is more speculative.

@Schofield

I stave off mosquitoes with my chain link fence.

I find the Mosler’s proposition that higher interest rates stimulate growth via a wealth effect and thus fuel inflation a bit awkward and contrary to evidence. When the euro was introduced and the peripheral countries of Southern Europe joined the common currency their interest rates aligned at a considerable lower level with those of the Northern member states. The result was that consumers increased their indebtedness like never before and engaged into a spending spree mainly on real estate and luxury imports, which artificially manifested as higher economic growth, rising prosperity and lower inflation. However, with the onset of sovereign debt crisis of 2008 and the consequent austerity policies imposed upon these countries, people’s incomes were reduced by approximately 30% but their debts didn’t get a haircut as it presumably happened to government debt. Reduced overall aggregate demand pushed these economies into the most severe recession since the Great Depression and for some of them, like Greece, it looks like they’ll remain in the mire for years to come.

eg,

My advisor (my investing son) agrees that cryptos are not currencies. He states they are more like securities or stocks. However, he further states that while they are not currencies they still could have an effect on fiat currencies if traded in large enough volumes. He says the “hot potatoing” of the fiat currency implicit in high crypto use and trading could increase the velocity of money with inflationary effects for the fiat currency. It’s an interesting view. If true it implies governments may (will?) have to regulate cryptos just as they should probably do greater regulation of other recently innovated financial instruments.

So yeah, I am still struggling to understand what my son says about this sort of stuff. His view, I think, is that DAOs have the potential to supplant and out-compete traditional banks. Traditional banks run under neoliberal capitalist precepts are taking a huge skim off people and other businesses and getting massive public funds to bail themselves out every time they stuff up. The DAOs may come to constitute a new kind of competition with far less overheads than a more traditionally configured bank or merchant bank.

Thanks so much to Neil Wilson, Thomas Bergbusch, and Fred Schilling for your helpful suggestions regarding more resources concerning the forward pricing channel.

To Schofield, I would beware of confusing the caricature of Adam Smith propagated by the neoliberal thought collective with the body of ideas that he actually wrote. I believe his views are terribly distorted by serious omissions and constant repetition of brief snippets taken out of context in the service of a market fundamentalism that Smith himself would have outright rejected. For starters, please see his “Theory of Moral Sentiments” — the work that Smith himself considered to be his most important. The usual suspects who constantly parrot “invisible hand” or the quote you posted NEVER reference that text because it would undermine their program to misrepresent Smith.

Thanks also Ikonoklast for some more interesting thoughts about the interaction of banks, cryptos and regulation. I agree that there will be action in that space, and I will be watching the developments with considerable interest.

Ikonoclast: “Tentative thoughts about the advent of cryptocurrencies – What could it mean for MMT?”

Your notes towards cryptos provided me with a base to see things clearer than ever before:

1. MMT is a lens for fiat currency system, meaning, double-entry book keeping – a concept, expressed in “money being” as a debt instrument.

Crypto is a thing, an asset, like a tulip dug from our backyard. It is not a debt instrument.

2. Central bank crypto project, now, I can see clearly, that it will be the same as “notes and coins”, but in electronic form. Nothing more.

That is only one way for any central bank cryptos can be issued, existed, or enter into the sectoral balance, or the economy by being aligned with the central bank’s balance sheet, moving between “reserves” and “notes and coins” items on the list of the liability side of the balance sheet.

3. Using crypto as a currency is based on a barter concept. As far as I know, it is only a myth propagated in many macroeconomic textbooks, there is no anthropological evidence to support it.

4. Now, I come to a sudden insight and understanding why some of the popular cryptos’ prices keep rising, the only reason is hedging activity, the holders of “weak” currencies that want a better place to store value.

5. Paying interest on cryptos by anybody or organization is a pure fantasy because the concept of interest is based on “time” – the current inflation and/or its expectation relatively to the value of that fiat currency at a point of reference, or as agreed. But cryptos are based purely on demand and supply like gold or oil.

Thank to your post, and other posts too, they helps me understand cryptos more than ever before.

Effect of interest raise probably differ across economies.

Large public debt & small private debt would be different than small public debt and large private debt.

@eg,

Also, IIRC, they are “mined” currently by using computers that are powered by coal powered powerplants in China. So, they are wasting a lot of electricity to make gambling tokens and adding CO2 to the air.

eg: “Their creations are never going to usurp the place of fiats unless they are able to gain political control of the state and render the taxes, fees and fines thereof payable in them.”

Yes, and the people championing Bitcoin etc are exactly the kind of people wholly against the idea of ‘political control of the state’, which is usually wheeled out as a reason for them being against the ‘evils’ of fiat currency in the first place. So they are content to maintain their limited Bitcoin mimicking money supply control, reaching limits. Some clown I met recently denied the limit saying the Bitcoins can officially be further divided into smaller units. So they are now adopting practices totally at odds with the so-called ‘benefits’ of their intangible gold.

The only real threat from cryptocurrency is a mislead state (Salvador anyone?) imagining that it can adopt it.