I started my undergraduate studies in economics in the late 1970s after starting out as…

Gold price surge … what is it about?

Mostly, financial markets (the wealth shuffling casino) and the real economy (where people live and work) run as parallel universes. But occasionally as in the case of the GFC morphing into a full-blown real crisis with massive income and job losses the two merge. In many cases the merger is driven by a poor understanding of the way the fiat monetary system operates. As a consequence we get decisions taking by the gamblers (they prefer to be called speculators – it sounds better) based on faulty analysis of how the econmy works, pushing asset prices up (or down) which in turn affect the way governments are reacting to the “real crisis”. The surge in gold prices in the last few days might be an example of that.

Yesterday Gold traded at $US990.74 an ounce which was the highest price since June 2009. It has risen sharply however in the last week. On August 28, 2009 it as selling at $USD955.50 per ounce.

The following graph shows the movement in the USD gold price per ounce since the beginning of this year (up to September 4). The question is whether the current surge is anything exceptional or not and what is driving it. Data is available from The World Gold Council.

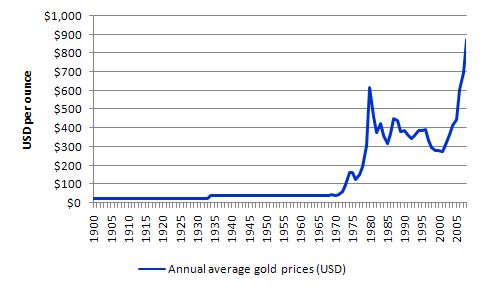

To get a better perspective the following graph shows the average annual gold price in USD per ounce since 1900 (up to 2008). You can see the change in the monetary system is very clearly denoted. In 1971 when the Bretton Woods system of fixed exchange rates was finally abandoned and non-convertible fiat currencies became the norm, gold prices started to fluctuate with the market.

After that time, fiscal policy was finally freed from the restrictions of having to finance itself via taxation or public borrowing. The problem is that the policy makers aided and abetted by the economics profession still act as if we are in that period when gold prices were stable.

Gold is often bought as a hedge against economic uncertainty which might be triggered by a falling US dollar or fears of inflation. At present, the US dollar and Euro are fairly steady and the share market is not gyrating much.

So what is driving the gold price surge?

Usually economists differentiate between a price movement that is being driven by so-called fundamentals (that is, underlying real conditions) and technical adjustments.

In terms of fundamentals, gold prices tend to rise when the USD falls. Since the downturn began in late 2007, the major shifts in the gold price have been in reaction to changes in the USD parity and/or shifts in the share market, nothwistanding the initial fall in price as the bad news started to consolidate.

But in the last week, these drivers are benign. At present the USD is steady although in recent months it has slipped against the Yen, Euro and the AUD. But the sudden spike cannot be due to a falling USD. Oil prices are also steady. So the question is being asked – what is driving the sudden surge in gold prices?

At this point, the neo-liberals are quick to jump in with the following evaluation. The gold price surge represents the fact that the reduced interest rates and the increasing budget deficits as part of the strategy by governments to stop their economies collapsing are now driving investors into the safety of gold as a hedge against inflation and currency debasement.

In the LA Times today it was noted that this time it might not be about the USD specifically, but about all currencies:

Some analysts say gold may be benefiting not just from concern about the dollar’s outlook but also from investor jitters about the future value of all paper currencies, as central banks around the planet pump massive sums of money into the financial system — a recipe for currency debasement and inflation.

Some even say it will reduce potential growth because investment will be diverted. But the casino has very little to do with creating productive capacity. Wealth shuffling does not create capacity to build jobs and productivity.

The Australian today, reported commentary from a “senior futures trader” who provided this gem:

Economists expect … [US employment to drop and the unemployment rate to rise] … A weaker-than-expected reading could spark further safe-haven buying, while a stronger-than-forecast number could incite inflation-hedge buying … The charts indicate we’re in an upward trend … We could easily be at a thousand in the blink of an eye.

Yes, the graph is going up at present!

But this is the danger in getting too much information from financial market analysts feeding into the daily press and into our national psyche. The real economy is not a switch-point where one bit of bad news sends spending etc in one direction to 10 and a bit of good news sends it to 10 the other way. Real life is more subtle than that.

If the employment data is the US is better than expected then it won’t signal that inflation is the next stop on the journey. Demand pull inflation (that is, price pressures driven by aggregate demand growth in excess of the real capacity of the economy to absorb it) is not on the radar at present.

Having this sort of commentary on our TVs and radios and in the newspapers prompts alarmist reactions and distorted decision-making.

Further, if this is driving the gold price surge then it reflects a failure to understand the way in which the fiat monetary system operates. More about which later.

Other commentators are saying that there is growing fear of a double-dip recession which will push the USD down in value. They are pointing to renewed pessimism that the tepid recoveries will soon double-dip back into recession. Share prices are coming off their rise and today’s US labour force data may signal a bleak second half of 2009.

So as in the early stages of the crisis, gold is becoming a safe haven. I don’t believe that this is behind the current surge though. I don’t think there is any danger at present of a major meltdown of the type that we were threatened with in 2008.

More realistically, the moves could be technical and reflecting changing regulation in the US. The CFTC is the US Government Commodity Futures Trading Commission which was established in 1974 to “regulate commodity futures and option markets in the United States. One E-mail I received today from a major macro hedge fund manager I know said that the feeling is that tightening regulation by the CFTC is “starting to restrict certain types of speculative positioning” which is driving demand into physical (non-future) commodities like gold.

The gold price surge is according to him related to a rapid rise in exchange-traded fund (ETF) and exchange-traded note (ETN) redemptions as the regulation net imposed on futures contracts by the CFTC starts to bite. Given the gold ETFs are physically backed, speculation is not via a futures contract but by physically storing the metal. This takes this sort of speculative behaviour out of the purview of the regulators (CFTC).

Will the surge last? The issue though is that in this sort of move eventually speculators start to seek an exit to take profits. The speculators have to time that carefully because the sudden surge in gold price will be accompanied by an equally sudden downwards correction when profit taking emerges. At $USD1000, the speculative component has to be very high and so the turning point will come suddenly.

In this context, an interesting fact is that at this time of year, there is typically a spike in gold prices driven by the marriage season in India. Indians are the largest buyers of gold. But the monsoon has failed in India this year which will reduce demand.

Further, a friend (major trader) told me today that:

… the last 2 times we have been up here in gold, we have seen a wall of selling on physical markets from scrap supply from cash strapped victims of the credit crunch in the US and Europe, and from thrifty Indian and Chinese punters willing to part with some jewellery.

So downside pressures reinforcing the likelihood of a sudden correction as profits are taken (and losses made).

Do budget deficits matter for gold prices?

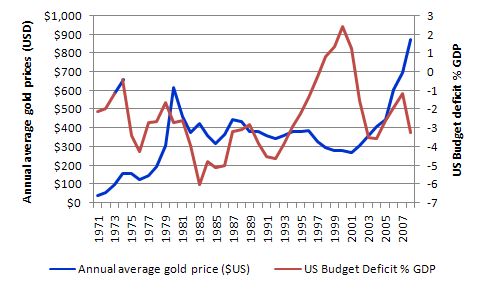

The following graph shows the evolution of the gold price in USD per ounce and the US Federal budget balance as a percentage of GDP (data from US Federal Reserve) since 1971 (after convertibility was abandoned). A close examination of the movements in the data doesn’t suggest there is a close relationship (even in lagged form) between the two series.

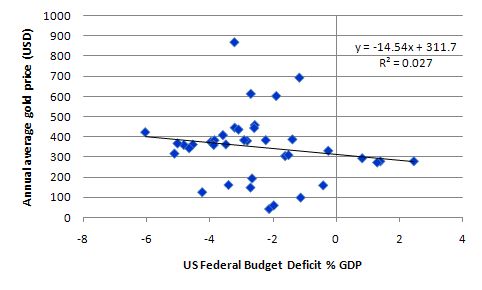

This is confirmed by the following graph which shows the Us budget balance as a percentage of GDP on the horizontal axis and the gold price in USD per ounce on the vertical axis. There is the mildest of negative relationships shown (rising surplus associated with lower gold prices) but the relationship is not statistically significant (based on the regression). I wouldn’t put to much store in the formal result. The visual conclusion is enough in this case.

The obsession with financial market data

Charles O. Hardy, in his 1940 book Risk and Risk Bearing (University of Chicago Press) considered speculators to be gamblers in a casino. What is good for the gamblers is not good for the general public.

It goes a long way to help us understand how far entrenched neo-liberalism has become. All the major public policy changes in the last 20 years – privatisation, social security reforms, public-private partnerships etc are all based on the idea that individuals have to be responsible for the flux and certainty of markets. The classic was George Bush’s proposed social security reforms which would see workers managing their own “individual retirement accounts” (via managers of their choice).

The speculative culture has been infused into the most basic elements of our lives – social welfare, health care and more.

The changes to the Australian superannuation system under the previous conservative federal regime were designed to “increase competition” and give workers a “personal stake in managing their own futures”. So without understanding much at all about the complexity of these markets and the way they move, many workers moved into high risk funds at the behest of the commission-driven financial planners (many of who have insufficient qualifications to provide such advice) only to see now that their retirement incomes are significantly reduced.

Further, this was accompanied by the then government’s campaign to turn all of us into shareholders via the privatisations of the big public enterprises, not the least being Telstra. Suddenly people were enjoying rising expected superannuation wealth (all unrealised nominal) and started to borrow more against those expected future gains to speculate further in the share markets.

The house of cards has now come down for many. The period of private dis-saving has been one of the most significant elements of recent economic history in Australia and elsewhere. It has been totally atypical. The other atypical behaviour has been the federal budget surpluses over the same period – killing private purchasing power and forcing households further and further into debt.

A lovely piece appeared in the UK Guardian newspaper on Monday, March 5, 2001. On this theme, it concluded:

Naive? – possibly. But their choices were limited. Having been ideologically cajoled and politically coerced to invest in their “own future” they now find they have gambled it in capitalism’s largest casino.

Why do we get daily financial data on the TV and radio news bulletins etc which most of us have no real understanding of?

This break-out of information appeared as the neo-liberal era unfolded. It is meant to invoke a sense of importance in our minds. They are telling us every night that the Nikkei is down so that must be important to our daily lives.

In fact, what happens in the casinos we call financial markets have little importance to anything. It is only when government policy fails that the dangers that the wealth shuffling will contaminate the real economy rise. When things get really bad, we get the current situation.

But if governments around the world were attending to their responsibilities – full employment and price stability – and ensuring workers enjoyed real wages growth in proportion with productivity growth, and making sure our public education and health systems were in excellent shape – then the damage that the casino could do to us would be significantly reduced.

As I have said previously – most of the so-called toxic debt would still be okay if people hadn’t lost their jobs and their ability to pay. The latter is a direct consequence of poorly designed and implemented fiscal policy – the government could make sure there was enough demand to keep us all working. They failed to react and stop the labour market contamination. Then more debt than was warranted became toxic.

It has always amused me that we have a negative view of the gambler in the dark room in front of the pokies relentlessly losing their children’s futures down the pokie drain plug but we see the financial market gamblers in a totally different light.

That is one of the artifacts of the neo-liberal era. We lost our ability to see what was important and what was not!

Instead of all the financial data in our faces each day I would prefer the ABC ran the national labour market report each night. Ramming home to us the underutilisation rate and assembling nice charts of lost income that results etc. That would be more constructive.

In saying all this I am not being personal about the workers in the financial markets. My best mates rank among them. It is the institution I am talking about and the way we have lost perspective about what is important.

My friend Warren Mosler, who is a large player in the financial markets, has a saying:

The financial sector is a lot more trouble than it’s worth.

Conclusion

If this is a serious asset price bubble emerging it will burst soon enough and leave damage in its wake.

But given some of the analysis that has been out there in the last few days, it is highly likely that the buying is being driven by the failure to fully understand the way the fiat monetary system operates.

It is being driven by an wrong-headed construction of the way budget deficits work and an almost pavlovian reaction that any public spending is inflationary.

The real cost of that ignorance though is that governments are likely to be influenced by the speculative gyrations and modify their fiscal and monetary policy positions to the detriment of the real economy and real people.

That is something we need to educate against.

Crazy! Plus India imports gold! What a waste.

This is quite a peripheral comment, but I must take exception to the description of financial markets as mere “wealth-shuffling casinos”. An astute economist as yourself certainly should not need to be reminded that equity markets are but one source of funding for private-sector corporations. These funds are actually used in the “real economy” for capital investment outlays, hiring, executive pay increases, etc. Buyers of equity are investing in corporate economic activity in the real world which engender risk. Therefore, just becasue there is risk involved with investing in corporate equity, that is not a sufficient condition to equate equity markets with casinos and investing with gambling.

The “problem” you seem to point about markets are their irrationality as irrational investor behavior inflating asset prices (dot-com, realestate, CDOs, etc.) have been responsible both for wealth creation and subsequent destruction. Are “markets” somehow to blame for this ? What to we mean by “markets” anyways ? Are we to blame the irrationality of humans ? How do you propose to solve that ?

So you might want to ask what economic factors affect investor irrationality ? Certainly one can point to loose credit and the abundance of cheap liqidity which led to the asset-price bubble. And the subsequent contraction of credit led to the rapid decline in asset prices. Clearly, sound fiscal management of credit leads to rational economic behavior and asset-price stability. It’s really just common sense.

Dear Tokyotrader

Share markets where equity is raised are not financial markets in the sense that was being use in that post. The hedge funds etc are all wealth-shufflers.

best wishes

bill

How does it feels three years later, with gold prices at 1,700 and no sign of reversing the trend? Maybe is time to start reading those despised Austrians afterall…

David, it is interesting that the gold price hasn’t behaved according to most MMT predictions, yet… I guess my faith is still with MMTers in that the gold price will eventually collapse. Unless there is a serious increase in gold consumption. Since gold is inert and all gold products can be easily converted to gold, then most types of gold consumption are actually a type of gold savings. So true gold consumption – consumption that would result in the elimination of gold, which can only be achieved by nuclear reactions where gold is converted into some other element – is basically non-existent. Unless someone is cornering the gold market & gold supply the gold price will fall sooner or later. Gold has no utility value as fiat performs the function of tracking obligations.