I grew up in a society where collective will was at the forefront and it…

Dr Die Schwarze Null still not thinking beyond more austerity

Project-Syndicate recently published the latest Op Ed (April 16, 2021) from former German finance minister and current President of the German Bundestag, Wolfgang Schäuble – Are We Risking a Debt Pandemic?. He is the person who personified the so-called ‘die schwarze null’ (Black Zero) while finance Minister. His conduct as finance minister was an instrumental element in extending the GFC across the Eurozone. He is still influential in European politics and his latest Op Ed makes it clear that the austerity mindset is still alive and well despite the current relaxation of the Stability and Growth Pact rules during the pandemic. The problem is that if Europe reverts back to that mindset, the essential changes to the monetary union that are necessary to make it viable will never be discussed. It will be just more of the same. And that same is pretty ordinary for the common folk across the EMU.

These blog posts give some background on the way that, the German obsession with the ‘Black Zero’ (managed and propagated by Wolfgang Schäuble) has been a black cloud over Europe for the last decade or more.

1. Die schwarze Null continues to haunt Europe (May 21, 2018).

2. Germany should look at itself in the mirror (June 17, 2015).

Consider the following graph, which shows real GDP indexed to 100 at the March-quarter 2008 for the Eurozone, the US and Australia.

In the 12 years from the March-quarter 2008 to the December-quarter 2020, the Eurozone grew by 3.5 per cent, the US economy grew by 19.9 per cent and the Australian economy grew by 31.8 per cent.

And, to put that into perspective, the Australian economy has been constrained in growth by excessively tight fiscal policy.

There is more to life than economic growth clearly, but it does tell you something about the relative material prosperity of a nation.

The Eurozone is effectively a failed experiment and the likes of Wolfgang Schäuble has been an instrumental part in that failure given the position he held in the policy making hierarchy over the course.

As an aside, the French weekly current affairs magazine – Marianne – published an article last week “Comment l’Allemagne tond la France… et l’Europe” (‘How Germany has fleeced France’), which argued that Germany has ridden roughshod of the nation in many ways in pursuit of Germany’s self-interest.

The author of the article commented in this – Interview (April 1, 2021) – with Sud Radio, that “We have an elite who are so in thrall to our German neighbours that the moment anyone legitimately defends our national interests, the elite cry ‘Germanophobia'”.

I will comment on that article in more detail in another blog post.

I have long argued that Germany has effectively ‘played’ the other partners in the common currency for their own ends and left the bloc in a dreadful state.

In my book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published May 2015) – I showed how the growing obsession within the French elite at being ‘like Germany’ – for example, the ‘franc fort’ approach pursued by Jacques Delors, effectively allowed him, a bit later, to push through his dysfunctional design for the monetary union into the Maastricht process.

At that stage, Europe was doomed to sub-standard economic outcomes.

At least, there is a growing voice in France now coming to realise what has been going on for the last few decades.

In his Op Ed, Wolfgang Schäuble remains on form.

His basic point is that while the pandemic has temporarily given the 19 Member States a reprieve from the Stability and Growth Pact restrictions and the enforcement of the Excessive Deficit, a renewed bout of austerity must be introduced “to maintain budgetary discipline.”

He correctly notes that government deficits have risen sharply to combat the crisis but incorrectly says that this meant that:

… a huge volume of net borrowing was needed. This headlong acceleration of debt, in Germany and in countries around the world, is the price being paid to stave off the economic consequences of COVID-19.

For Germany, the debt issuance was necessary to fund the deficits because that nation does not issue its own currency.

But for most other countries, the rise in debt that matched the rise in deficits was purely a political choice. There was no necessity for their debt levels to rise at all.

For those nations “the price being paid to stave off the economic consequences of COVID-19” is not the monetary amounts associated with the rising deficits (or for that matter the associated matching debt increases).

For a currency-issuing nation, these numbers on bits of paper are not a cost.

The cost is the extra resources that are necessary to implement the program in question.

Given that a significant proportion of the fiscal outlays were targetted at maintaining existing resource usage, then the actual ‘cost’ of the programs, in real resource terms, was very small.

They just look large because of the skewed way we seek to understand the concept of an economic cost.

By focusing solely on monetary numbers we will typically never appreciate what is going on.

The Eurozone is another matter given that the nominal amounts take on an extra signficance.

Wolfgang Schäuble thinks the rising “debt burden” in Germany is becoming a significant issue now.

He says that Germany has been:

… adhering to the rules of the Stability and Growth Pact of the Maastricht Treaty and reducing our debt to less than 60% of GDP before the COVID-19 pandemic hit.

One could contest that assessment given that the way in which a Member State in the Eurozone is appraised is, in fact, – multi-dimensional – and, in addition to the Stability and Growth Pact rules, a nation must satisfy the conditions pertaining to – The Macroeconomic Imbalances Procedure (MIP).

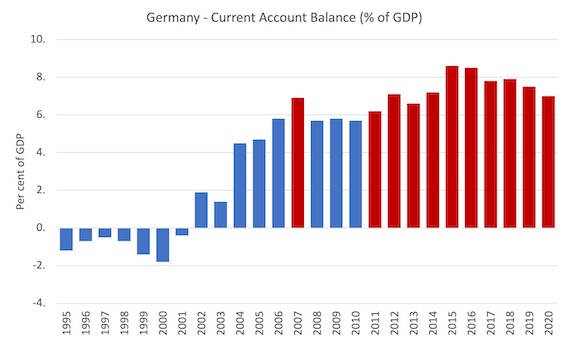

One of the required outcomes is the “3-year backward moving average of the current account balance as percent of GDP, with thresholds of +6% and -4%”.

As the next graph reveals, Germany has violated that requirement for the last 10 years and 11 of the 20 years of EMU existence. It is a serial offender.

And in doing so, it has gamed the other states given that a high proportion of Germany’s trade is Intra Europe. The obvious point is that the mirror of these persistent violations are on-going external deficits and external indebtedness across many other Member States.

So while Wolfgang Schäuble thinks Germany has been a model citizen his assessment is blinkered.

The reason this is important relates to his next statement:

These consolidation measures over the past 12 years have given Germany some financial leeway that can now be used in the crisis. The Harvard University economist Kenneth Rogoff, a former chief economist of the International Monetary Fund, has long argued that Germany’s strong balance sheet gives it the capacity to react forcefully in a deep crisis. In other countries this is not true, at least not to the same extent.

What Kenneth Rogoff thinks is irrelevant. He of the ‘spreadsheet’.

But the point is that Germany’s persistent violation of EU fiscal rules as above has meant it has been able to continue running large external surpluses, which have:

(a) covered them while they have inflicted damage to their domestic economy (real GDP per capita has only risen by 4.6 per cent in the 12 years since 2008), which is good relative to other EMU nations (Belgium declined by 2.5 per cent; Greece declined by 27.3 per cent; Spain declined by 8.6 per cent; France declined by 4 per cent; Italy declined by 14 per cent; Portugal declined by 2.2 per cent; and Finland declined by 4.5 per cent).

The peoples in these nations, on average are poorer in material terms. That is what the Eurozone has done to them.

So while Germany looks a little better than its large ‘partners’, its own performance is pathetic.

Australia’s per capita real GDP growth since 2008 has been of the order of 11.7 per cent. The US 19.9 per cent. Even tiny Iceland, which had a massive banking collapse during the GFC, has seen its per capita real GDP grow by 10.4 per cent since 2008.

(b) allowed their revenue to grow strongly via the export income and that has been a major reason they have been able to stick within the SGP fiscal rules.

But that has been at the expense of suppressed growth and slower growth in tax revenue in its EMU partner states.

Rob Peter to pay Paul.

Wolfgang Schäuble doesn’t really provide any answer to the problem he sets.

He acknowledges that “an exogenous shock like the COVID-19 pandemic justifies a rise in public spending, as well as reinforced financial solidarity across borders”.

But then says that “money is not a panacea, and borrowing makes sense only if it is carried out prudently and reasonably”.

Which are just – weasel words.

Increased monetary outlays were the only way that incomes could be protected during the pandemic, for example.

And the fact that economic outcomes have been poor in the Eurozone is a sign that the Member States didn’t take advantage of the relaxed fiscal rules to spend more.

What exactly does Wolfgang Schäuble classify as spending “prudently and reasonably” in this context.

Weasel words.

And, of course, all of this has been in the context of the massive ECB government bond-buying program.

The total Eurozone government debt was 10,027,291.4 million euros in the December-quarter 2019.

By the third-quarter 2020, it has risen to 11,112,101.5 million euros a 10.8 per cent increase.

That is the latest data available.

Over that period, the ECB has increased its holdings of EMU government debt via the Public Sector Purchasing Program (PSPP) from 12,515 million euros to 23,102 million euros.

Further, between March 2020 and September 2020\1, the ECB’s other government bond purchasing program, the Pandemic Emergency Purchasing Program (PEPP) – had accumulated 629,169 million euros worth of government debt on top of its PSPP purchases.

Taken together that is about 58.9 per cent of the total debt issued during the pandemic up until the third-quarter 2020 has been purchased by the ECB.

The proportion has increased over the last 6 months, but we do not yet have total EMU government debt outstanding for that period.

For example, between March 2020 and March 2021, the PEPP has accumulated 943,647 million euros worth of government debt – a massive ramping up over the last 6 months.

Of course Wolfgang Schäuble thinks this is:

… swelling the money supply and increasing the risk of inflation.

But he doesn’t bother to explain how, given that the ECB has been trying for years to push up the inflation rate with no success.

And why hasn’t Japan got runaway inflation given the Bank of Japan has been doing the government bond-buying thing for a lot longer than the ECB.

And his use of Larry Summers and Olivier Blanchard as authorities on the inflation risk argument is about as bad as using Kenneth Rogoff to talk about government debt thresholds.

The only difference is the former two haven’t been sprung with dodgy spreadsheets.

Apparently, inflationary expectations are going to rise with “the European Central Bank running the printing press overtime”.

The most recent edition of the ECBs – The ECB Survey of Professional Forecasters – the first quarter 2021 tells us that:

Shorter-term inflation expectations were largely unchanged at 0.9%, 1.3% and 1.5% for 2021, 2022 and 2023 respectively. Longer-term inflation expectations (for 2025) averaged 1.7%, confirming the signs of stabilisation reported in the previous round and possibly indications of a slight uptick …

The outcome implied a small upward revision beyond the first decimal. Taking a slightly longer perspective, following four rounds of downward revisions during 2019 by a cumulative 0.2 percentage points and having remained at historical low levels in a narrow range (1.64-1.67%) during 2020 …

I liked the “beyond the first decimal”.

Yeh, out of control man. Time to head to the bunkers!

OOf course, what Wolfgang Schäuble forgot to mention in his Op Ed was that if the ECB wasn’t buying up all this government debt, then, given the size of the fiscal deficits (even though they are well below what is necessary), the yields on some government bonds would be rising sharply and those nations (Italy, Spain, even France) would be facing insolvency.

The ECB government bond buying programs, which began in May 2010 with the introduction of the Securities Markets Program, has saved the monetary union from breakup, given that Italy would have been insolvent in mid-2012 (at least) if the ECB hadn’t bought up its debt and suppressed the bond spreads with the bund.

That is the story.

The inflation threats are just an application of mainstream macroeconomics, which has been proven to be consistently wrong it is predictions.

The story is that the ECB interventions, that have run against the advice of mainstream economists, have rescued (in a sort of blighted form) the EMU from its dysfunctional architechure, which, itself, was the product of an application of mainstream economics.

On concrete plans, Wolfgang Schäuble is unable to go beyond generalities other than to invoke the applicability of an initiative in the US in 1792 to deal with a crisis (The Hamilton sinking fund plan).

1. “a firm vision of how the burden of public debt can be reduced once the coronavirus has been vanquished.” Nothing proposed.

2. Apparently, government debt is widening the “competitive disadvantage” between the EU and China and the US. How? Not specified.

3. No “community” debt can be envisaged. Each country has to “strive to maintain budgetary discipline”. That is, austerity.

4. “maintaining competitiveness and a sustainable fiscal policy are the responsibility of member states.” That is, pay cuts, more precarious work, and austerity.

5. Unless Draghi scorches the earth in Italy, “we will need a European institution that not only monitors compliance with the Union’s jointly agreed budgetary rules, but has the power to enforce them.”

More anti-democratic interventions from Brussels.

6. The 1792 Panic was about a financial asset bubble – not the main problem facing the Eurozone.

When Hamilton took over after the War of Independence, he wanted to device a fund for paying off the US government’s debts (both domestically and to foreign nations (mostly France), which had been used to prosecute the War against the British.

He proposed restructures which forced losses on creditors and established a sinking fund in 1790, which was a political stunt to restore confidence in debt markets.

He basically paid US Postal Service profits into the fund which would then pay back government debt.

The Sinking Fund also bought up the degraded public debt via ‘open market operations’.

In 1790, the Treasury Secretary Alexander Hamilton also created the Bank of the United States (a central bank) by injecting 20 per cent of the capital and then issuing shares for the rest to the private sector.

A major speculative boom then followed and the credit bubble was curtailed sharply by a banking credit crisis in 1792.

Hamilton’s bank became a ‘lender of last resort’ to offset the growing insolvencies, which has become an essential feature of modern central banking.

The Sinking Fund also bought up government debt to stabilise the markets.

But what this has to do with the European crisis is another issue. There will be no public debt crisis in the Europe as long as the ECB keeps purchasing it. That is the upshot of the dysfunctional architecture of the EMU.

Effectively, Schäuble’s advocacy of a sinking fund, is just another version of the crippling austerity that Member States are exposed to in a system where there is no federal government and no willingness to have community assets.

Conclusion

The real issue is the dysfunctional architecture of the EMU.

As long as they persist with the system they created there will be a propensity to crisis.

The patch ups to deal with the crisis are always biased to austerity. That is the consequence of having 19 Member States which retained the primary responsibility for fiscal policy but surrendered their currency sovereignty.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

“Australia’s per capita real GDP growth since 2008 has been of the order of 11.7 per cent. The US 19.9 per cent.”

This doesn’t make sense to me in light of the graph showing Australia GDP growing more than the US. Unless maybe the population of Australia grew much more than the US?

For me Wolfgang Schäuble knows all of this. They all know this, but after World war 2 they have no choice.

Germany knows as they were experts at industrial capitalism even had their banking sector set up the right way, but losing the war to financial capitalism after the Berlin wall came down changed all of that.

They knew the US and the UK were going to demand that they export their way to growth after they lost the war. So did Japan. They knew they were going to be forced to work to give their real resources away to be sent to the winners of the war. Germany would have insisted the UK to do the same if they had won the war. In a way, the way the EU has been set up it has allowed Germany to insist that from other smaller member states. There is a pecking order within the Geopolitical landscape.

For me today’s fiscal rules and Monetarism is all about Geopolitics. It is not the case that Wolfgang Schäuble or central bankers are stupid. They have to do what the US tells them to do. They know how sovereignty actually works. They deny and attack MMT for geopolitical reasons not because it is a wrong theory. The first words that came out of a German economist mouth from the ECB when debating with Stephanie Kelton on Bloomberg was Geopolitics.

As Michael Hudson describes in his article on the 14 th April. American neoliberal financialisation v’s China’s industrial socialism.

https://michael-hudson.com/2021/04/americas-neoliberal-financialization-policy-vs-chinas-industrial-socialism/

3 options for how a conquering power might treat states that it defeated in war but that “have been accustomed to live under their own laws and freedom.

1. To destroy them

2. To stay there in person

3. To permit them to live under their own laws, drawing a tribute, and establishing within it an oligarchy which will keep it friendly to you.

Number 3 was a task given to Wall street and the ivy league American universities to get ready when the Berlin wall did come down. Task them with the issue of what was the most effecient way to do option 3 After building over 800 military bases across the world. A task that Mankwi and his gang and the big banks jumped at with relish.

After reducing Germany and Japan to paying tribune after defeating them in World War II, U.S. diplomacy quickly reduced Britain and its imperial sterling area to financial capitalism slaves by 1946, followed in due course by the rest of Western Europe and its former colonies. The next step was to isolate Russia and China, while stopping them from coming together.

Clyde V. Prestowitz Jr, trade advisor in the Reagan administration explained what the free world expected when it welcomed China into the World Trade Organisation. Exactly what they expected after introducing the Euro in Europe. Financial capitalism slavery and an oligarchy that remains under your control. Increased trade with and investment in China would inevitably lead to the marketisation of its economy, the demise of its state-owned enterprises.

Putin had to step in When they tried the same thing in Russia after the wall came down. They thought they had the friendly oligarchy after the US broke every promise they made to Russia before the wall came down. Then trying to break it up by surrounding it with army bases and bringing the Baltic states and the Ukraine under US control.

The US is the problem they are war mongering psychopaths that want to collect Tribune from the entire planet. The conundrum everybody faces is that China or Russia would be no different if they ever gained that kind of power. MMT is the antithesis of all of that.

For me – Why economists who got their economic textbooks into universities the world over after being tasked with option 3 before the Berlin Wall came down attack us so much. They know how monetary systems work. They are paid to deny reality. You can’t run a central bank for over 100 years and not know how it works. For me that is simply impossible.

You can’t set up the Eurozone or CFA Franc in your own geopolitical interests without knowing how it really works as the MMT textbook describes.

It is not simply the case of using the MMT lens. It’s the actual power that you have to take on and defeat in order to do so. The Powell manifesto was just the start. Reclaiming the state simply means reclaim back some geopolitical power from the US.

@Derek Henry,

Thx for the Michael Hudson link; an interesting read.

Apologies that this is a little off today’s blog subject, but this article in the G today doesn’t make sense to me: ‘A Bank of England digital currency for the UK has moved a step closer after the chancellor Rishi Sunak announced a top-level taskforce to explore the benefits and risks of the idea.’ My understanding was that the BofE already creates a digital currency called the £. Corruptible Sunak goes on to say: “Our vision is for a more open, greener, and more technologically advanced financial services sector. ” I would have thought those aims could only be advanced through a simpler, much reduced financial services sector.

“(T)he austerity mindset is still alive and well despite the current relaxation of the Stability and Growth Pact rules during the pandemic. The problem is that if Europe reverts back to that mindset, the essential changes to the monetary union that are necessary to make it viable will never be discussed. It will be just more of the same.” Bill puts his finger here on a much bigger problem than the EU, as important as that problem is. The NEOLIBERAL mindset is still alive, if not well, for the moment, and if the world reverts back to it, then the essential changes to the global economy necessary to make it viable, as in more humane and environmentally sustainable, will never be discussed apart from lip service, and we’ll return as a species to eagerly pursuing our exploitative, imperial, ecocidal trajectory. Our hope IMHO, however awful and painful in the short run, is that Covid mutations and surges will prevent the resumption of economic business as usual for a much more extended period of time. The longer that things are disrupted and intermittently paralyzed, the more the larger and deeper lessons of the pandemic can sink in and take root. As I see it, along with Pope Francis, the pandemic almost providentially offers humanity its last chance to change its thinking and behavior so as to avoid the worst of the civilizational and ecological collapse already underway. If there was ever a time for big picture thinking, radical thinking from the ground up, philosophical or religious thinking in the universal sense, it’s now…now or never to grapple with the most fundamental question: “What’s it all about, Alfie?” What better time to revisit that hauntingly beautiful song?

@Paul B

I don’t get the whole obsession with a digital currency either. I guess the idea is they have bettered the technology so they can track digital £’s better through the system but I don’t see how that will make much of a difference to most people, although it might serve up better data for economists.

“Unless Draghi scorches the earth in Italy, “we will need a European institution that not only monitors compliance with the Union’s jointly agreed budgetary rules, but has the power to enforce them.””

Jesus-thats sounds terrifying,

To think if the EU wasn’t sabotaging the continent with austerity caused sharp gdp per capita losses it could instead pursue fiscally active spending programs which boost gdp per capita,raising productivity, modernising infrastructure, developing science and technology which competes with USA and East Asia.

But no,they insist on ordoliberalism with patchy ECB interventions which contradict there own rules.

more money = less value = inflation = currency school nonsense.

Derek Henry

“bringing the Baltic states and the Ukraine under US control.”

I need to contest this point. The people of the Baltic States overwhelmingly supported independence from the Soviet Union and joining the EU and NATO. It was not a US takeover. In fact if the Baltic states had not joined the latter there is a good chance Putin would have re-occupied these states or a province or two around the time of his invasion of Crimea and Eastern Ukraine. Now the cost of such adventures is much higher.

A majority of Ukrainians probably also want to join the EU and NATO but even I can see that this would be very danaging to Russia’s geopolitical circumstances and so armed neutrality with economic and military support for Ukraine would be a wiser path.