I started my undergraduate studies in economics in the late 1970s after starting out as…

Another sorry chapter in RBA history is looming

On Friday, the RBA signalled that it wanted to start hiking interest rates early in the upturn (and be one of the first central banks to do so). The justification was that this recession was more like the shallow, short-lived downturn in 2000-2001. I disagree. The evidence doesn’t support that contention. Increasing interest rates now will have serious impacts on the solvency of households currently struggling to get anywhere near enough hours of work. The RBA once again will be choosing to use underutilisation as a tool rather than a policy target. Another disgraceful chapter in their history is looming.

The House of Representatives Economics Standing Committee met in Sydney on Friday, August 13, 2009 and Governor of the RBA, Glen Stevens appeared before it to answer questions relating to its on-going Review of the Reserve Bank Annual Report 2008 (second report) .

In practice, the meeting gives the two arms of government a chance to examine how the economy is progressing and for the RBA to signal issues that will guide its future policy intentions. And yes, the central bank and the treasury are part of the consolidated government sector for operational purposes with respect to the monetary system no matter what hoopla is played to pretend the central bank is an independent agency not under Cabinet control.

You can hear the full proceedings – Part 1 and Part 2 (be warned that Part 1 is 75 MB mp3 and Part 2 is 83 MB mp3). Unfortunately, the transcript is not yet available so you have to listen to the proceedings (as I did today) to find out what was said.

You can see a short House Video about the first meeting of this Committee this year.

What arises from the meeting is that the RBA thinks that this downturn compares more closely with the 2000 downturn. In December 2000 we had one quarter of negative GDP growth which came as the consumer driven binge started coming to an end. Luckily for the government of the day, the fiscal drag that was rising due to their obsessive pursuit of budget surpluses didn’t melt the economy down at that point. They were saved by the commodities boom which kept the show rolling for a further 7 years or so.

Anyway, while we have all been looking for comparisons between now and 1991 as a result of the huge decline in the world economy, the RBA is now conditioning us to believe that we are in for a short 2000-style downturn and growth will quickly return.

As a consequence they want to get back to pushing up interest rates again because they are allegedly worried that inflation will emerge out of the high labour underutilisation and 70 per cent capacity utilisation rates!

The The Governor (pictured left) told the Economics Committee that Australia will be the among the first countries to start hiking (sometime soon). He said:

There is ample evidence elsewhere in the world of the problems you ultimately get if you keep the emergency setting (of interest rates) in place too long.

Yes, what evidence? Japan? 16 years at zero! Deflation.

The Economic Committee heard talk of a “neutral” or “normal” interest rate – which reporters have said is somewhere between 5 and 6 per cent. Stevens didn’t provide any number.

I will write a separate blog about this notion. It is nonsensical really. The normal interest rate for a fiat monetary system is zero! Any increase above that is abnormal. But the justification for that statement will have to wait for another blog sometime.

In trying to compare this downturn with 2000 and disabuse us of any notion that it is more akin to the 1991 recession, the RBA Governor pointed to the drop in working hours which have been less severe than in 1991 but much more than during the 2001.

He also said:

On the basis of the information to hand at present, this may well turn out to be one of the shallower recessions Australia has experienced.

RBA at it again

As a matter of historical fact, the Reserve Bank of Australia (RBA) was legally constituted to pursue full employment as one of its three goals (price stability and general welfare being the others). The functions of the RBA Board are set out in Section 10 of the Reserve Bank Act 1959. However, the RBA has been significantly influenced by the NAIRU concept and it conducts monetary policy in Australia to meet an openly published inflation target. The persistently high unemployment in Australia over the last 25 years, would suggest that the RBA is not working within its legal charter.

It uses its control of the cash rate (market rate on overnight funds) to influence short-term interest rates. To what extent is the RBA working within its legal charter, which as noted above includes the maintenance of full employment?

In September 1996, the Treasurer and Reserve Bank Governor issued the Statement on the Conduct of Monetary Policy, which set out how the RBA was approaching the attainment of its three identified policy goals. It elaborated the adoption of inflation targeting as the primary policy target. The RBA (1996: 2) said it had “… adopted the objective of keeping underlying inflation between 2 and 3 percent, on average, over the cycle.”

In terms of the priorities, the Statement said:

These objectives allow the Reserve Bank to focus on price (currency) stability while taking account of the implications of monetary policy for activity and, therefore, employment in the short term. Price stability is a crucial precondition for sustained growth in economic activity and employment.

The rest of the text emphasised the need to target inflation and inflationary expectations and the complementary role that “disciplined fiscal policy” had to play. There was no discussion about the links between full employment and price stability except that price stability in some way generated full employment even though the former required disciplined monetary and fiscal policy to achieve it.

In a stagflation environment if price spirals reflect cost-push and distributional conflict factors, such an approach can surely never work. In the Job Guarantee approach that I advocate, the causality and emphasis is reversed – the creation of full employment guarantees price stability. Without employment buffers (which are the basis of the Job Guarantee approach), the RBA will always control inflation by imposing unemployment.

How does the RBA answer this apparent contradiction? The RBA says that it only has to meet an average inflation target over a business cycle. In 1999, the then Head of Economic Analysis at the RBA, Malcolm Edey argued that the Bank is sensitive to the state of capacity in the economy when it pursues a change of interest rates aiming at the inflation target (Source):

Consider, for example, a situation in which inflation is regarded as likely to be too high. A rise in interest rates will help to reduce inflation but can also be expected to reduce growth. How far and how quickly interest rates should be raised will depend partly on how the economy is performing at the time. If the economy is operating with very little surplus capacity or is overheating, a fairly rapid rise in interest rates might be called for; if, on the other hand, there is significant surplus capacity in the economy, the appropriate increase in rates might be more gradual. Thus it makes sense for policy to take account of short-run cyclical developments in pursuing the inflation target.

But in the next paragraph, Edey (1999) says that the trade-off between inflation and unemployment is not a long-run concern because, following NAIRU logic, it simply doesn’t exist.

Ultimately the growth performance of the economy is determined by the economy’s innate productive capacity, and it cannot be permanently stimulated by an expansionary monetary policy stance. Any attempt to do so simply results in rising inflation. The Bank’s policy target recognises this point. It allows policy to take a role in stabilising the business cycle but, beyond the length of a cycle, the aim is to limit inflation to the target of 2-3 per cent. In this way, policy can provide a favourable climate for growth in productive capacity, but it does not seek to engineer growth in the longer run by artificially stimulating demand.

The RBA is silent, however, about the stock of long-term unemployed that exists beyond the cycle. The empirical evidence is clear that the economy has not provided enough jobs since the mid-1970s and the conduct of monetary policy has contributed to the malaise. The RBA has forced the unemployed to engage in an involuntary fight against inflation and the fiscal authorities have further worsened the situation with complementary austerity.

So are back to this again.

The salient facts

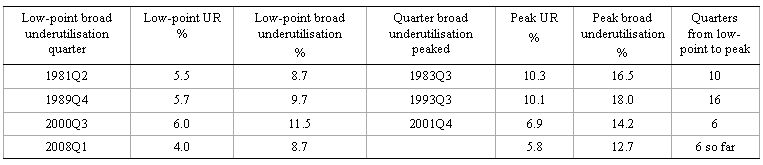

The following table shows the relevant timing of each of the four recessions (or downturns) since 1982 in terms of the low-point official unemployment rate and the CofFEE Broad Labour Underutilisation rate (both in per cent) and then the quarter and accompanying data when the Broad Labour Underutilisation peaked. The right-hand column tells you how many quarters the trough-to-peak of labour underutilisation transition took. The Broad Labour Underutilisation rate is the sum of the official unemployment rate, hidden unemployment and underemployment.

On that data, we are not yet in as parlous a situation as 2000. But that has to be put in perspective. We had another 8 years of growth after 2000 which further reduced the overall level of labour underutilisation to 8.7 per cent (by February 2008). We also need to consider the speed of decline to gauge the intensity of the episode. The next graphs help in that regard.

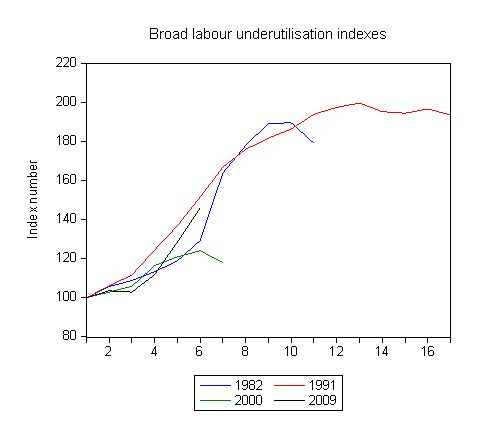

The first graph shows the evolution of the official unemployment rate for the 4 episodes described in the Table from the low-point unemployment quarter (Index = 100) to one quarter after the peak.

You can see that the current episode is much more akin to the 1991 and 1982 recessions in terms of how quickly the unemployment rate has risen. The 6 quarter 2000-01 episode (low-point to peak) is very different and unemployment went from 6 to 6.9 per cent over that time and dropped back one quarter later to 6.6 per cent.

At present the rise in the official unemployment rate (black line) is already twice as much as occurred during 2000-01 having gone from 4.0 in February 2008 to 5.8 per cent now.

There is no expectation that the unemployment rate will stop increasing over the next 6-9 months. All the Government’s own forecasts (and the RBA forecasts) point to unemployment continuing to rise for 9-12 months. To compare this aspect of the downturn with 2000-01 is ridiculous.

The next graph shows the same evolution in terms of the broad labour underutilisation rate (black line is current period). In the 2000-01 downturn, broad labour underutilisation rose by 2.7 per cent from low-point to peak (6 quarters). Over 6 quarters since February 2008, the same rate has risen by 4 per cent and is still rising fast. There is no expectation that broad labour underutilisation will not peak closer to the 1991 limits sometime next year.

In terms of dynamics (speed of deterioration) the current downturn is much closer to 1991 albeit the composition of the labour wastage is different – more underemployment and less unemployment. I will come back to that soon.

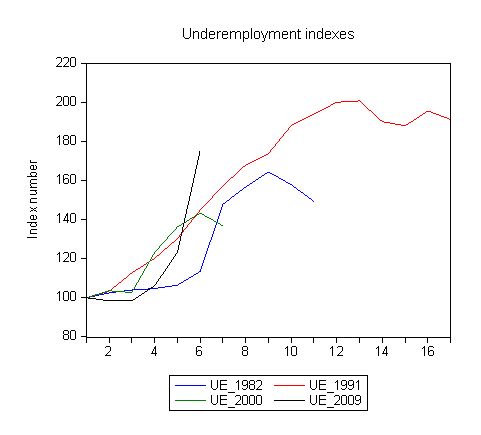

Finally, the next graph shows the same evolution in terms of underemployment (black line is current period). It shows the defining feature of this recession has been the rapid escalation in underemployment. In my blog – Tale of two recessions and more – I analysed how growth in total hours worked started trailing behind growth in persons employed after the 2000 downturn.

So while that downturn was relatively short it left a legacy that is now haunting the labour market. In this downturn, firms have quickly shed hours of work and instead of pushing the burden of the adjustment onto official unemployment have driven underemployment up.

In that respect, this downturn is nothing like the 2000-01 episode.

Conclusion

Is it better to have underemployment than unemployment? In some ways yes but in one very significant way no. At present, households are burdened with very high levels of debt which has been left over after the credit binge. That will take years to resolve as households save more. The return to the typical situation of household saving is helping that task at present.

But the loss of working hours for a family with two bread-winners and carrying high levels of debt may be just as likely to push them towards insolvency as the loss of all working hours. It all depends how many families are on the margin. The anecdotal evidence is that there are many families on the brink of insolvency and so underemployment – which amounts to a wage cut in another guise is just as serious as outright job loss. In both cases, the family is unable to service their nominal contractual commitments with the wage income they are in receipt of.

While I don’t think the hiking of interest rates will in the ranges anticipated dampen aggregate demand in themselves I do think they will drive more families already trying to cope with significantly reduced working hours (and rising underemployment) over the insolvency edge. That has been one of the advantages of the low interest rates to make it easier for households to save while still servicing their nominal contractual obligations.

There is no inflation risk in the foreseeable future given the capacity underutilisation that is projected to persist for some years to come. So I agree with the IMF for once that now is no time to be talking about interest rate increases.

Another very sad chapter in the RBA’s role in the history of the abandonment of full employment in this country is about to be opened.

I am uncomfortable with your decision to use an index rather than plot percentage point changes from the UE low point. In your methodology, the same percentage point movement from the UE low point in this recession will chart higher simply because it is being indexed off a lower base.

I agree we have lost a lot of hours this recession, but I think that is better than jobs.

The seasonally adjusted UE rate has pretty well flat-lined over the last five months. It is plausible to speculate that it wont get above 6 per cent. That would not be a bad outcome. And closer to full-employment than we have been for most of the last 40 years (since the commencement of the MLFS in 1978). On that basis, I wouldn’t be too criical of the RBAs fight inflation first strategy.

I am less conviced on inflation not being something to worry about. Core inflation remains high, well above the 2-3 percent band favoured by the RBA. Since the 2008 GFC, a housing bubble has emerged (especially in the stimulated first home buyers market) – average loan values have jumped – volume has almost doubled – aggregate first home lending has more than doubled. There are good reasons to be vigilant.

Dear The Econotician

1. Your point about my use of index numbers is incorrect. The level of the base is irrelevant which is exactly why we use index numbers. To see this open a spreadshet (Open Office!) and create two time series. Any two numbers will do – one a low base and one a high base value. So for simplicity I choose 10 (low base value) and 20 (high base value). Now inflate them by the same percentage growth. I chose 10 per cent per period. Then index the two series to 100 at the base year. You will get the following sequence of numbers for both series (that is, the same) 100, 110, 121, 133.1, 146.4, 161.1, 177.2, 194.9, 214.4 and so on (rounded to one decimal place).

2. I agree that it is better to lose hours than jobs except for those highly indebted families whose household economies required those extra hours and without them become unable to service their nominal contractual commitments. In either case – job loss or hours loss these marginal families lose their house!

3. Your perception of the seasonally adjusted UE is not accurate. The ABS provide the following estimates of Underemployment:

Feb 2008 5.9 per cent

May 2008 6.0 per cent

Aug 2008 5.9 per cent

Nov 2008 6.5 per cent

Feb 2009 7.4 per cent

May 2009 7.6 per cent

and rising.

Our own estimates are also showing UE to be rising.

So by now (August) it will probably be over 8 per cent if the hours data is anything to go by and rising. That is, well above your worst case scenario of 6 per cent.

4. In terms of proximity to full employment. It is only 31 years since the quarterly LF data started (February 1978). In February 1978, underemployment was about 1.2 per cent and official unemployment was 6.7 per cent – so a sum of 7.9 per cent. By the end of the most recent growth boom official unemployment was 4.0 per cent and underemployment was 5.9 per cent (ABS data). This means at the end of the longest growth period since the Post-World War 2 growth period (up to 1975), we could only get total labour underutilsation down to 9.9 per cent (and that is ignoring the marginal workers – hidden unemployed) which were zero in the true full employment period – 1945-1975. During that period official unemployment was around 2 per cent, UE zero and hidden unemployment zero.

Now we have official unemployment at 5.8 per cent, UE at 7.6 per cent which totals 13.4. That figure will rise over the next 12 months (even by the RBAs own reckoning). Our estimates of hidden unemployment are about 2 per cent (so add that to get 15.4). That doesn’t sound remotely like what we had in February 1978 which was bad enough. It is also so far from being near to true full employment that any suggestion otherwise should not be taken seriously. So I am very critical of the RBA using monetary policy to make underutilisation a tool against some inflation bogey which was slain in the 1991 recession. The costs of keeping that proportion of your willing labour supply not producing income are huge.

I also would not tackle a specific housing bubble using a blunt instrument like monetary policy. We might first ditch first-home buyer schemes, scrap negative gearing and start taxing specific asset classes if there is a problem.

Forcing the unemployed to bear the costs of the speculative excesses of the wealthy is not my idea of good policy.

best wishes

bill

I agree with you that there’s no case to be thinking about an interest rate hike at the moment. and still a case for lowering them further. So much for the RBA’s vaunted “inflation targeting” – if it was true to its stated goals it’d have rates testing the zero bound now.

But maybe Stevens doesn’t mean what he says and is just agonising about housing prices – we’re still in a bubble that hasn’t yet burst and perhaps he thinks he can deflate it a bit by jawboning. We’re in a dreadful place there, mainly driven by bad microeconomic, not monetary, policy and I agree it’s not something that can be easily fixed by monetary policy.

How comparable are those numbers to the US BLS U6 series? … headline unemployed + part time employed for economic reasons + marginally attached (interested in work, actively sought work in the last year but not last month), over labor force plus marginally attached.

For comparison, U6 is JUN:JUL 16.5%, 16.3% seasonally adjusted, 16,8%, 16.8% raw.

Dear Bruce

Fairly comparable. The ABS estimates do not take into account not in the labour force effects – so they only sum U3 and UE. CofFEE estimate the hidden unemployment a little differently to the way the BLS does it – we use a regression based approach to get a potential labour force that is cyclically invariant then work back from there.

CofFEE’s hours-based measures are currently (to be released Wednesday) for May 2009: U3 = 5.8 per cent, UE = 5.1 per cent; and Hidden = 1.9 per cent (seasonally adjusted) totalling 12 per cent. This will have certainly risen in the months since then.

By contrast the ABS (persons-based measures as are the BLS) has for May 2009: U3 = 5.8 per cent, UE = 7.6 per cent. So 13.4 per cent. If hidden unemployment is around 1.9 per cent then we are at 15.3 per cent on nearly comparable measures to the US.

That is how bad it is over here despite everyone saying it is time to hike interest rates and make sure the stimulus is withdrawn sooner rather than later. As you know, with any recession, the aftermath, which is typically forgotten is the most damaging part – the entrenched underutilisation of labour.

best wishes

bill

The RBA has limited tools at hand. Interest rates and the fear of interest rates. At this time they have deemed it worthy to start playing the fear card. Of course this is much too early, but a large section of the community has not felt the pain that was expected late last year, and I do get the sense for many the credit binge is not over, it is just on hold, ready to burst back into life.

multiple objectives + one policy instrument = disaster.

I’m calling this one RBA’s Law.

derrida derider: I think you are on to something there. I get the impression that the RBA is torn between not wanting to raise rates while unemployment is rising, but is unhappy about the continuing strength of the property market. They always get nervous about low rates fuelling property prices, particularly in these days where the Greenspan doctrine (only worry about CPI not asset price inflation) is well and truly dead. So, I would see this as a simple matter of Steven’s using the other tool in the RBA tool-kit: jawboning. The TV news duly obliged and reported the testimony as a worry for home-buyers. So, I do not expect the RBA to start raising rates very much very soon, but I would expect them to talk as though they are.