Yesterday, the Reserve Bank of Australia finally lowered interest rates some months after it became…

Australia’s low wage workers lose ground on gaining a ‘living wage’

On Thursday (May 30, 2019), Australia’s wage setting tribunal, the Fair Work Commission handed down its – Decision: Annual wage review – which saw the minimum wage rise by 3 per cent from July 1, 2019. The new minimum wage will be $740.80 per week or $19.49 per hour. Given that the annual inflation rate is running around 1.3 per cent (or thereabouts), the decision means that the real minimum wage is now higher than it was a year ago, which is a good sign. But over the last year, low-paid workers have had to endure cuts in pay rates for work during non-standard hours (so-called penalty rates), which Fair Work Australia made operational on July 1, 2017 and being phased in over a few years, with more pain to come. Given the conservatives won the federal election a few weeks ago, those penalty rate losses will not be restored. So the 3 per cent increase should be seen in that light. Our wage setting tribunal is giving with one hand and taking it back (and then some) with the other. The most sordid aspect of all this is that many employers demanded Fair Work Commission deliver real wage cuts in the annual review.

In this blog post – Australia’s minimum wage rises – but not sufficient to end working poverty (June 6, 2017) – I outlined:

1. Progressive minimum wage setting principles.

2. The way staggered wage decisions (annually) lead to falling real wages in between the wage adjustment points.

I won’t repeat that analysis here. But it is essential background to understanding why the decisions taken by Fair Work Australia have been inadequate for a long time.

In its – 2019 Annual Wage Review decision – Fair Work Australia wrote:

The factors identified above have led us to award an increase of 3.0 per cent. The NMW will be $740.80 per week or $19.49 per hour. The hourly rate has been calculated by dividing the weekly rate by 38, on the basis of the 38-hour week for a full-time employee. This constitutes an increase of $21.60 per week to the weekly rate or 56 cents per hour to the hourly rate …

We have awarded a lower increase this year than that awarded last year having regard to the changes in the economic environment (in particular the recent fall in GDP growth and the drop in inflation) and the tax-transfer changes which have taken effect in the current Review period and which have provided a benefit to low-paid households …

We are satisfied that the level of increase we have decided upon will not lead to any adverse inflationary outcome and nor will it have any measurable negative impact on employment. However, such an increase will mean an improvement in the real wages for those employees who are reliant on the NMW and modern award minimum wages and an improvement in their living standards.

The Decision applies to around “2.2 million or 21.0 per cent of all employees in Australia” through flow-on effects via Australia’s award pay system.

However, “the proportion of all employees that are paid at the adult NMW rate is estimated to be 1.7 per cent (or around 180 200 employees)”.

The Fair Work Commission decision took into account the following considerations:

1. “gross domestic product (GDP) growth has slowed”

2. “real net national disposable income (RNNDI) increased by 3.7 per cent over the year to the December quarter 2018 compared with 1.5 per cent at the time of the last Review;”

3. “business survival rates increased to be the highest in at least a decade.”

4. “the profit share of factor incomes increased by 1.2 percentage points to a 7-year high of 28.5 per cent over the year to the December quarter 2018.”

5. “labour productivity increased by 0.8 per cent over the year compared with a decline of 1.0 per cent at the time of the last Review.”

6. “inflation is more subdued.”

7. “wages growth, as measured by the Wage Price Index (WPI), picked up slightly over the past 12 months.”

8. “the unemployment rate was 0.4 percentage points, lower than at the same time last year with employment growth at 2.5 per cent, compared with 2.9 per cent at the time of the last Review).”

9. “The low rate of nominal wages growth cannot wholly or substantially be explained by low growth in labour productivity, as some parties have contended.”

In summary, the rise in real minimum wages over the least several years has not exacerbated inflation nor damaged the employment prospects of the lowest paid.

This is despite what employers and conservative politicians keep claiming. But that shouldn’t surprise anyone.

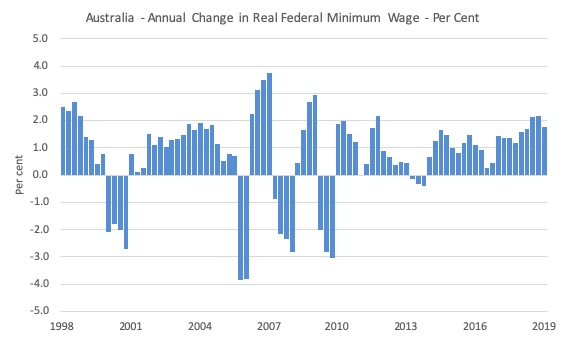

The following graph shows the annual percentage change in the real Federal Minimum Wage since the September-quarter 1998 up to September-quarter 2019 (the first quarter the new level will be applicable).

I assume the inflation rate will be constant at its March-quarter value for the next two quarters.

The Australian Council of Trade Unions had sought a rise of 43 per week (a 6 per cent increase) argued that while the 3 per cent increase was good for workers it would still not be sufficient to move the minimum wage to the level that would constitute a ‘living wage’.

This is often considered to be 60 per cent of the median wage.

They also noted that as well as the new minimum wage becoming operative on July 1, the next phase of the penalty rate cuts will also become operational on that date.

The President of the Fair Work Commission agreed that there were many workers in highly disadvantaged situations:

Some low paid, award-reliant employee households have disposable incomes which are less than the 60 per cent of median income relative poverty line …

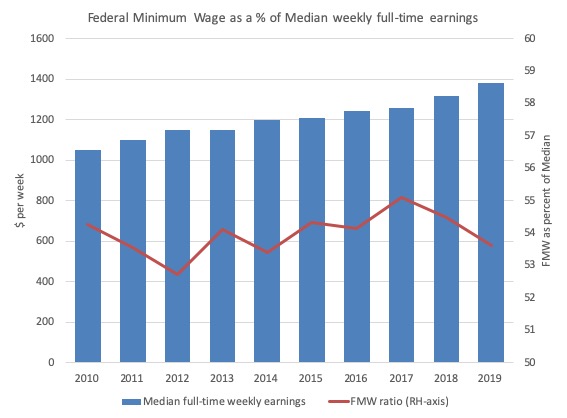

The following graph shows Median weekly earnings of full time employees from 2010 to 2018 (blue bars) and the Federal weekly minimum wage as a proportion of the median (red line, right-axis, per cent).

For median earnings I extrapolated the annual growth from 2017-18.

Over time, this ratio has languished well below 60 per cent, which is the benchmark that is universally used to denote a ‘poverty threshold’.

The last two annual increases in the Federal Minimum Wage have seen the ratio deteriorate, which gives justification to the ACTU’s criticism of the quantum awarded in this decision.

The Federal Minimum Wage is still around $88 per week shy of reaching the 60 per cent of median benchmark.

As usual, the employer groups called for miniscule wage increases crying the usual ‘major disincentive to employment’ ruse. They never say that when they are handing out massive CEO payments.

The peak employer body, Australian Industry Group (representing big business) only wanted a 2 per cent increase and said that:

The economy has slowed, businesses are struggling to cope with high and rising input costs, especially energy costs

The small business peak body, the Australian Chamber of Commerce and Industry only wanted a 1.8 per cent rise and claimed the decision would threaten the viability of small businesses.

The evidence suggests that with the penalty rate cuts now in their second year the claims that they would stimulate massive increases in employment have been exposed as a lie.

These groups routinely lie and should be disregarded.

The Australian government did not show any leadership in the issue.

The Australian Government submission (March 15, 2019) to Fair Work Australia was more muted about the implications of a wage rise for employment than previous submissions.

But they introduced a new angle to suppress the likely wage rise – the tax trade-off.

They claimed that as a result of their new tax cut policy (which was one of the election sweeteners) that low-wage workers would be better off by around $4 to $5 per week (in disposable income).

The FWC bought the argument saying that “These changes are a moderating factor on our assessment of the appropriate level of increase to the NMW and modern award minimum wages arising from this Review” although they did not “apply a direct, quantifiable, discount to the increase in the NMW” as a result of the Government’s estimates.

The reasons they gave were:

First, such a direct discount would unfairly impact on some low-paid employees who did not benefit from the Budget measures …

Second, the Budget measures are plainly intended to benefit low-paid households. A direct discount which entirely negates that legislative intention is not appropriate.

While this annual decision appears to benefit low-paid workers it only presents part of the story.

The overhwelming problem is that the low-paid workers are enduring the phasing in of the decision by the Fair Work Commission to cut penalty rates (for weekend or public holiday work).

So workers are paid a standard hours rate, which cannot go below the minimum hourly rate specified by FWA.

However, if workers are engaged in non-standard hours they receive loadings, which the employers have long tried to eliminate.

For many low-paid workers, these penalty rates (loadings) provide a significant proportion of their weekly income.

The FWC has bowed to the relentless pressure from employers and the conservative Federal government and workers in retail, Pharmacies, hospitality, fast food, are the first to experience the cuts as FWC alters the conditions sector-by-sector.

For some low-paid workers the cuts will see them lose around $6,000 per year once the phase-in period is completed.

So while some workers will get an increase of 3 per cent in the weekly pay as a result of the annual wage review they have lost much more via the penalty rate cuts.

The response of the employers is even more shameful when you consider that fact.

Wage Parity

I have already showed the parity with respect to the accepted poverty threshold (see above).

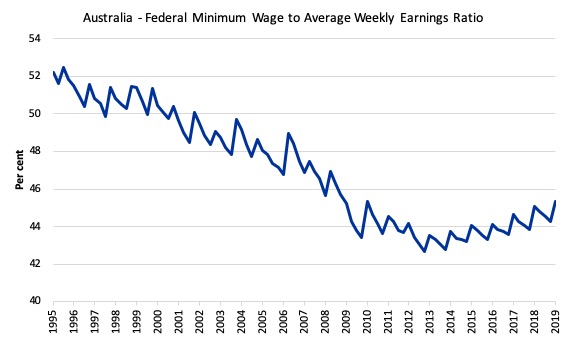

In terms of other parities with other wage earners, the following graph shows the ratio of the Federal minimum wage to the Full Time Adult Ordinary time earnings series provided by the ABS (the latest being for the December-quarter 2017). This series in now bi-annual (previously quarterly). I have interpolated on the basis of the most recent growth.

I simulated this series out to September-quarter 2019 (the quarter after which the latest FWC Annual Wage decision will start impacting) based on a constant growth in earnings (assessed over the last 12 months).

The new FWC applies from July 1, 2019 so will be constant over the rest of the 2018-19 financial year.

The logic of the neo-liberal period which encompasses the data sample shown was to at least achieve cuts at the bottom of the labour market, given that workers with more bargaining power would put up resistance against generalised cuts.

Successive minimum wage decisions forced workers at the bottom of the wage distribution to fall further behind in relative terms.

In the December-quarter 1993, minimum wage workers earned around 55 per cent of the Full Time Adult Ordinary time earnings. By June 2019, this ratio will have fallen to around 44.3 per cent.

There has been a serious erosion of parity over the last 23 years.

But in the last two years, as the general Wage Price Index grows at record low levels (and overall real wages flat-line) and the FWC awards moderate real wage increases to the minimum wage workers, the erosion in the parity has ended and the ratio is slowly rising (albeit in a staggered fashion).

The ratio reached a low of 43.2 per cent in the June-quarter 2015.

Another way of looking at this dismal outcome is to compare the movement in the Federal Minimum Wage with growth in GDP per hour worked (which is taken from the National Accounts). GDP per hour worked is a measure of labour productivity and tells us about the contribution by workers to production.

Labour productivity growth provides the scope for non-inflationary real wages growth and historically workers have been able to enjoy rising material standards of living because the wage tribunals have awarded growth in nominal wages in proportion with labour productivity growth.

That relationship has been severely disrupted by the neo-liberal attacks on unions, wage fixing tribunals and other legislative initiatives that have eroded the capacity of workers to share in labour productivity growth.

The widening gap between wages growth and labour productivity growth has been a world trend (especially in Anglo countries) and I document the consequences of it in this blog post – The origins of the economic crisis (February 16, 2009).

But the attack on living standards has been accentuated at the bottom end of the labour market.

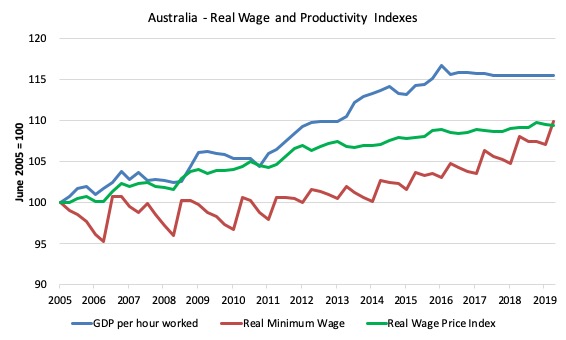

The following graph shows the evolution of the real Federal Minimum Wage (red line), GDP per hour worked (blue line), and the Real Wage Price Index (green line), the latter is a measure of general wage movements in the economy.

The graph is from the June-quarter 2005 up until September-quarter 2018 (indexed at 100 in June 2005 and extrapolated as above out to September 2019).

By June 2019, the respective index numbers were 115.5 (GDP per hour worked), 109.4 (Real WPI), and 109.9 (real FMW).

Overall, all workers have failed to enjoy a fair share of the national productivity growth, and that minimum wage workers in Australia have been largely excluded from sharing in any of the productivity growth although the low-paid workers have fared a little better in recent years.

Of-course, like all graphs the picture is sensitive to the sample used. If I had taken the starting point back to the 1980s you would see a very large gap between productivity growth and wages growth, which has been associated with the massive redistribution of real income to profits over the last three decades.

Staggered adjustments in the real world

The following graph shows the evolution of the real Federal Minimum Wage (FMW) since the June-quarter 2005 extrapolated out to September-quarter 2017 (the quarter in which today’s decision will start impacting) based on a constant (current) inflation rate.

This is the FMW expressed in purchasing power terms.

You can see the saw-tooth pattern that the theoretical discussion I provided in this blog post – Australia’s minimum wage rises – but not sufficient to end working poverty (June 6, 2017) – describes.

Each period that curve heads downwards the real value of the FMW is being eroded. Each of the peaks represents a formal wage decision by the Fair Work Commission. If the trough in the saw-tooth lies below the 100 line on the vertical axis then the real wage falls by the end of the period.

If the trough lies above the 100 point then the inflation during the year after the last wage decision has not fully eroded the real wage increase and so there is some modest net real wage increase for Federal minimum wage workers over the period.

The decisions since 2012 have provided for some modest real income retention by these workers although it depends on how inflation is measured.

You can also see the troughs are shallower in recent years than in the past because the inflation rate has moderated as a result of the GFC and the austerity since that has kept economic activity at moderate levels.

So while each adjustment provides some immediate real wage gain for workers, those gains are ephemeral and the inflation process systematically cuts the purchasing power of the FMW significantly by the time the next decision is due – these are permanent losses.

Conclusion

While Australia’s lowest-paid workers received a small wage rise last week the rise was not sufficient to end working poverty.

In terms of the accepted 60 per cent of median full-time weekly earnings, the Federal Minimum Wage remains some $88 per week shy of reaching that benchmark.

The gap reflects a history of decisions by Australia’s wage setting tribunals which have undermined the capacity of low-paid workers to enjoy real wage gains and keep pace with productivity growth.

The last three annual reviews have reversed those trends somewhat but the FWC clearly believes that if it was to move closer to a living wage, there would be adverse employment impacts.

No justification has been given for that belief.

But we cannot consider this annual decision in isolation from the recent penalty rate decision by Fair Work Australia, which delivered massive pay cuts to some of the lowest paid workers in Australia.

And if the employers and Federal government had their way, these workers would be enduring even harsher real wage cuts. So at least the FWC rejected their calls.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

I can directly relate to this disgraceful trend as I have three children, two of whom need financial support to stay afloat. We are relatively comfortable retirees but our comfort is being eroded by that financial support.

Both low and more middle income wage earners are being squeezed by wages that are barely keeping up with the cost of living. It’s not even good for the economy as a whole as we who know even a smidgin of economics that the propensity of lower income earners to spend is much greater than higher paid income earners.

Question: would a JG need to be introduced in all nations more or less at the same time, to avoid devaluation of a particular currency in relation to other currencies (disregarding those nations that need or would need foreign aid)?

When Stephanie Kelton was asked in an interview: why has MMT not been generally accepted by now, I was not entirely satisfied with her complicated answer.

Surely the resources exist to implement universal above-poverty participation in the economy?

What’s the problem? Is it related to my initial point?

Same story here. Government decides the maximum wage increase, they say, to keep competitive with other EU nations, but in essence it’s just a corporate giveaway. (And then the corporate tax rate is lowered almost every year also)

£10.70ph min wage in Aus vs. just £8.21ph in the UK.

Actually that doesn’t sound too bad in comparison, unless Australian living costs are 30% higher than UK’s(?). I think £10ph min wage is UK Labour Party policy – but that’s looking like a low aspiration now.

Re: overtime rates, so many min wage jobs in UK now are casualised/zero-hours/deliberately set at part-time/fake self-employment that I imagine overtime rates are a distant dream for most min wage workers. If they need more money, they work at extra jobs.

It’s shocking how low we have sunk here, and sad for Australia that it looks like it wants to follow us down to the bottom.

Minimum wage workers in Australia are doing well relative to Canadians were the rate is $13.85 cdn or about $14.80 Aus. Even getting to that point has been an enormous struggle, despite the plentiful natural resources the world seems to want.