The other day I was asked whether I was happy that the US President was…

Some MMT considerations for an independent Scotland – Part 1

Later this week, I will be in Britain to participate in a series of events. You can see the details from my – Events Page – and I urge interested readers to support the events that are run by activists. Two of these events will be in Scotland where we (Warren Mosler and I) will discuss, as outsiders, issues pertaining to the monetary arrangements that might accompany a move to Scottish independence. I have noted in the past that this is a controversial issue in itself that is also made more divise because it has become intertwined with the vexed issue of EU membership. I certainly don’t intend to use these presentations to lecture the Scots on what they should do. What I hope to achieve is to set out a framework based on Modern Monetary Theory (MMT) principles to allow the protagonists to make their own decisions, free of the neoliberal sort of monetary myths that I think have dominated the independence debate to date. I am always cautious discussing the pro and con of situations where I have no direct material stake and a less than full understanding of specific cultural and historical influences that are at work. But the Scottish question is interesting and demonstrates many of points that nations should be cogniscant of when discussing monetary sovereignty.

My previous blog posts on Scotland are:

1. Ridiculous MMT critiques distorting Scottish independence debate (April 23, 2019).

2. Oh Scotland, don’t you dare! – Part 2 (June 5, 2018).

3. Oh Scotland, don’t you dare! – Part 1 (June 4, 2018).

4. I would be voting NO in Scotland but with a lot of anger (August 18, 2014).

5. Bonnie Scotland – ignorance or denial – either way it is fraught (October 30, 2013).

6. Scotland should vote yes in 2014 but only if … (September 27, 2012).

While I do not claim to be an expert on Scottish affairs, I have been following the Scottish debate for some years and have read a lot of literature and studied a lot of data.

The Scottish Growth Commission and the currency choice

The Growth Commision – Report – released on May 25, 2018 after the SNP had sought advice on the economic implications of independence, recommended the retention of the British pound until “a series of tests for future currency decisions” are met.

I have dealt with the Report in detail in the blog posts cited above – (1) and (2).

The so-called ‘six tests’ are nonsensical from an Modern Monetary Theory (MMT) perspective and if adopted would lock Scotland into using the British pound indefinitely.

In other words, the newly independent Scotland would become a client state of Britain – with no real independence at all.

The so-called ‘sterlingisation’ option is thus inconsistent with MMT principles.

The Growth Commission also recommended encumbering the new independent government with a series of ad hoc fiscal rules identical to those that have made the Eurozone unworkable.

They want the new nation to replicate the dysfunctional Stability and Growth Pact constraints (3 per cent deficit/60 per cent debt ratio) which have rendered that Pact neither supportive of growth nor stability in the EMU.

However, nowhere in the very long Growth Commission Report is there recognition of the principle that fiscal policy should not function to achieve some given ‘numbers’ but rather should be designed and implemented to achieve functional outcomes that bear on the well-being of the Scottish people.

And further, following that reasoning, it is impossible for the government to really achieve rigid fiscal financial targets because the spending and saving decisions of the non-government sector are major influences on the fiscal outcomes.

In other words, we can only talk about fiscal policy in the context of what is happening elsewhere in the economy.

An MMT analysis of the Scottish position

The new Scotland will continue to run an external deficit, which means that income generated within the economy is leaking out in net terms from the economy to the rest of the world – and to the rUK in particular.

There is a lot of misinformation about this issue.

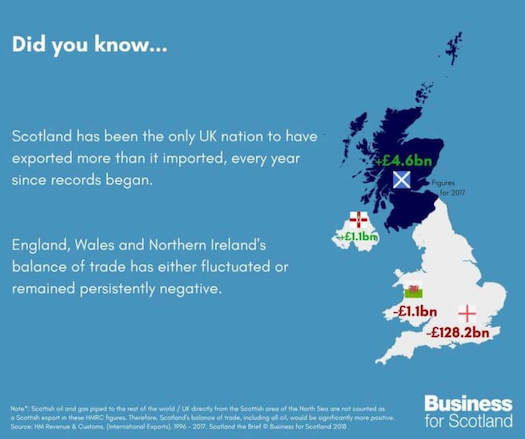

For example, Business for Scotland, which is a pro-independence/pro-EU lobby group representing the produce a regular Scotland the Brief articles in the form of “Fact rich graphics” to summarise different aspects of the Scottish economy.

The ‘Fact rich’ element is, however, questionable.

On the matter of the balance of trade, they produced this graphic covering the year 2017 based on the Regional Trade Statistics published by H.M. Revenue and Customs:

If we consult the most recent H.M. Revenue and Customs – Regional Trade Statistics – Fourth Quarter 2018 (issued on March 7, 2019), we find that for the 12 months to December 2018, Scotland exported more than it imported.

Here is the latest graph:

There are two issues that make this misleading:

1. The Regional Trade Statistics only cover goods and Scottish service exports to the EU constitute 33.6 per cent of total exports to the EU, 39.9 per cent of total exports to Non-EU nations, and 57.7 per cent of exports to the rUK (in 2017).

2. The Regional Trade Statistics only cover trade with outside of the UK – in the December-quarter 2018, exports to the rUK comprised 61.4 per cent of Scotland’s total exports.

In 2017, exports to the rUK were 60.1 per cent of total Scottish exports. 18.3 per cent went to the EU (other than the UK) and 21.6 per cent to Non-EU nations (US being the largest).

In value terms, Scotland’s exports of goods and services to the rUK are worth four times that of exports to the EU.

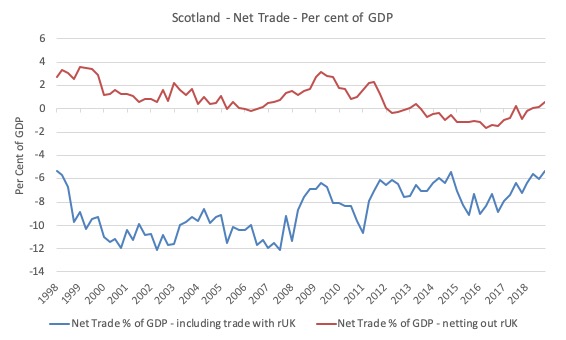

The latest – GDP Quarterly National Accounts, Scotland – (released January 30, 2019) for the December-quarter 2018 show that, in fact, once we include services, the net trade for Scotland is consistently negative.

The following graph shows the evolution of Net Trade as a percentage of GDP from the March-quarter 1998 to the December-quarter 2018 (the latest data).

The red line is the difference between total exports to and total imports from the Rest of the World the (expressed as a percentage of GDP). That is, it excludes trade with rUK, and is a relatively meaningless figure.

The blue line shows the actual trading position of Scotland against the rUK and the Rest of the World (which is what it would be if Scotland became an independent nation.

It presents quite a different picture.

So there is a significant income leakage from Scotland to the rUK via trade.

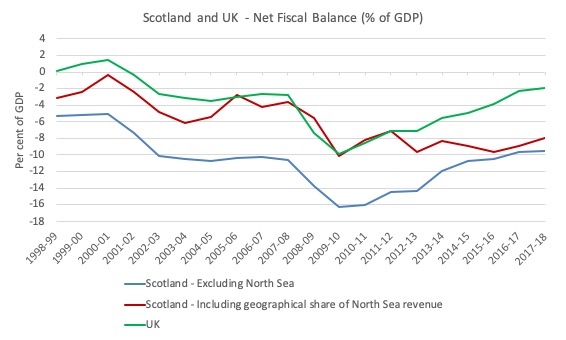

The latest – Government Expenditure and Revenues Scotland (GERS) – data (2017-18), which is produced by Scottish government statisticians:

… estimates the level of public revenue raised in Scotland and the level of public spending for the residents of Scotland, under the current constitutional arrangements.

The data shows that the fiscal deficit in 2017-18 was around 8 to 9 per cent of GDP depending on whether North Sea tax revenue is included or not.

The overall UK fiscal balance was in deficit of 1.9 per cent in 2017-18 (too low but that is what it was).

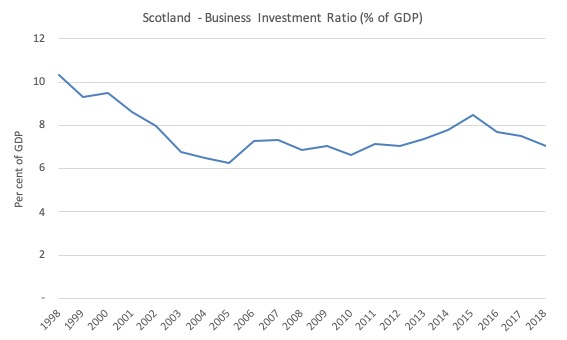

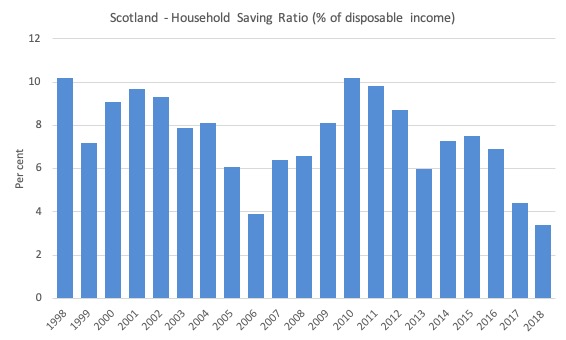

Other relevant pieces of information include the Household saving ratio and the Business Investment ratio.

The first graph shows that Business sector capital formation in Scotland is a lowly 7 per cent of GDP (in 2018) and over the last decade or more has fallen significantly.

The second graph shows that the Household Saving Ratio (per cent of disposable income) has also fallen substantially since the turn of the century.

The Scottish government has recently started publishing much more detailed national accounts and trade data which helps us assess the situation it is in as a standalone nation.

On December 19, 2018, the latest – Primary Income Account and Gross National Income for Scotland – data was published and allows us to examine the difference between GNI and GDP, which means we can now estimate the net flows of income out of Scotland.

Remember that GNI estimates the nation’s total income accruing to its residents (including business) from all sources – domestic or external.

GDP, by contrast, measures the income that is generated in a particular year by the nation, irrespective of whether the income flows to residents or foreigners.

The Scottish publication accompanying the data release – Development of a Primary Income Account and Gross National Income (GNI) for Scotland – notes that:

Gross National Income (GNI) is an adjustment to the conventional GDP measure of economic activity to take account of financial flows into and out of the country due to ownership. For example, where profits made by Scottish companies outside Scotland are repatriated, this would be included in an estimate of Scottish GNI but is not included in Scottish GDP. Likewise, when non-Scottish companies repatriate profits made in Scotland, this is included in Scottish GDP but would be omitted from estimates of Scottish GNI.

The key summary results are:

1. “In 2017 Scottish GNI (including a geographic share of UK extra-regio) was estimated to equal 94.5% of Scottish GDP” – which means that there was a net outflow of income to the rUK and the Rest of the World.

2. “Scottish GNI has remained below GDP throughout the period from 1998 to 2017 … This reflects in part a large insurance and pension sector with policy holders outside Scotland, a predominance of company headquarters in London and the South East and the high level of foreign ownership among North Sea operators.”

3. “In 2017, an estimated £17.2bn came into Scotland from the rest of the UK whilst an estimated £18.5bn went in the other direction. This resulted in a net outflow from Scotland to the rest of the UK of around £1.3bn.”

4. “Scotland has also had a net outflow of income to the non-UK rest of the world throughout the entire period covered by these statistics.”

5. “In 2017, an estimated £7.6bn came into Scotland from the non-UK rest of the world whilst an estimated £15.5bn went in the other direction. This resulted in a net outflow from Scotland to the non-UK rest of the world of around £7.9bn.”

So taken together, we would expect that should Scotland become independent, the net income flows on the current account would be negative and of the order of £9.2 billion (the 2017 outcome).

The external position for Scotland is thus the sum of its net trade position and the net income flows.

The data is still experimental and so I am reluctant to use it for calculations etc in relation to assembling the sectoral balances.

But what it tells me in qualitative terms is this:

1. The external sector would drain income from the Scottish economy both view the trade and income accounts – that is, the current account for the new nation would be negative and fairly sizeable in relation to GDP.

2. The household sector clearly has expressed a desire to save but has been squeezed in recent years.

3. The investment ratio is low – meaning that it is likely that the private domestic sector is only running a fairly small overall deficit.

4. That means that the fiscal net spending injection is supporting growth and may be too low given the declining household saving ratio.

Think about that in relation to what the Growth Commission would have the Scottish government do in relation to fiscal policy.

Ignoring considerations about the debt ratio, any attempts to impose a EMU-type Stability and Growth Pact fiscal rule of 3 per cent deficits or less on Scotland once it become independent would be highly damaging to its growth outlook.

Any attempt to reduce the fiscal deficit which last year was around 7.9 per cent (including the revenue from the North Sea resources) would push Scotland into recession almost immediately.

If anything, the fiscal position will have to provide more support for household saving – via income growth – and also ensure that there is sufficient public spending during the transition from being part of the UK to being independent nation to avoid any hint of recession.

That means increased deficits. Which then raises a number of related issues which I will deal with in Part 2.

Conclusion

In Part 2, tomorrow, I will consider other aspects of the independence decision such as debt sharing, foreign reserves, and the option to enter the EU or not.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

This message is not relevant to what you are currently doing Bill but I think the Saudi Arabian leadership needs lectures on MMT. Up to recently the people have benefited from what their monarchy has received from its oil revenue however the current leadership has now told its people that they have to pay for everything eg overseas prices for oil, electricity and water prices have escalated and, from what I have been told, even income tax is being introduced. In other words neoliberalism on steroids. The argument is the country has to be prepared for when there is no oil! Orwellian reasoning methinks. The people are most bewildered.

Well best of luck on your visit to the UK. Sadly, what you’ll find is that we Brits know everything and that you won’t be able to teach us anything. That goes for politicians and leaders of all parties. I thought you’d like to know that although I’m sure you know it already. I live in utter despair of the political class in the UK. Although there are sound reasons for the UK to leave the EU none of them have been discussed. MMT will lead to hyperinflation. Balanced budgets, deficit reduction, sound money … anything else is nonsense. I’ll say it again but with a local flavour .. Best of British Luck.

Dear Rod White (at 2019/05/06 at 4:47 pm)

Thanks.

We (have to) live in hope! Or we are lost!

best wishes

bill

Hi Bill,

Off topic, this is the USA Senate this week. Not sure if you have seen this yet.

SENATE RESOLUTION 182–RECOGNIZING THE DUTY OF THE SENATE TO CONDEMN

MODERN MONETARY THEORY AND RECOGNIZING MODERN MONETARY THEORY WOULD

LEAD TO HIGHER DEFICITS AND HIGHER INFLATION

https://www.congress.gov/bill/116th-congress/senate-resolution/182

Thanks,

Mark

With your help, Bill, we might be able to persuade our benighted politicians (and the public that elects them) that an independent Scotland is an ideal crucible to show how an understanding of MMT allows a nation to mange it’s economy for the benefit of its resident population.

The Nay-Sayers will tell us it’s all down to oil revenues, but they lie about everything else, so we learn to ignore that.

Without specifically making the point your article here serves to emphasise the sheer stupidity of our obsession with GDP as a measure of economic health.

For as long as governments persist in using meaningless figures…. unemployment figures that are not reflective of underemployment and the slack in the labour market; inflation figures that ignore completely what is going on in the asset markets; GDP measures money that goes through the economy without touching the sides; a Companies House does not monitor real business activities and allows bogus financial vehicles to pop-up and then vanish; HMRC does not effectively collect tax due , despite the importance of tax to the fantasy tax-and-spend dogma……. MMT will remain the elite’s meal-ticket as it has been since 1971; a personal ATM for the already obscenely wealthy. And they know it.

Mark, thanks for the heads up. I noted that the four co-sponsors are all Republicans. What a surprise. Ocasio-Cortex should be put onto this if she isn’t already, although it was only put forward yesterday, IIRC.

Bill, the core of the Resolution of this ridiculous bill contains the following text, and Summers is mentioned first. Presumably, this set of opinions is being set out as evidence.

“Whereas, on March 4, 2019, former Secretary of the Treasury Lawrence H. Summers said that-

(1) MMT is fallacious at multiple levels;

(2) past a certain point, MMT leads to hyperinflation; and

(3) a policy of relying on a central bank to finance government deficits, as advocated by MMT theorists, would likely result in a collapsing exchange rate;

Whereas, on February 26, 2019, Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, said: “The idea that deficits don’t matter for countries that can borrow in their own currency I think is just wrong”;

Whereas, on March 25, 2019, Janet Yellen, former Chair of the Board of Governors of the Federal Reserve System, disagreed with those individuals promoting MMT who suggest that “you don’t have to worry about interest-rate payments because the central bank can buy the debt”, stating: “That’s a very wrong-minded theory because that’s how you get hyper-inflation”;

Whereas the March 2019 report entitled “How Reliable is Modern Monetary Theory as a Guide to Policy?” by Scott Sumner and Patrick Horan of the Mercatus Center at George Mason University found that-

(1) MMT-

(A) has a flawed model of inflation, which overestimates the importance of economic slack;

(B) overestimates the revenue that can be earned from the creation of money;

(C) overestimates the potency of fiscal policy, while underestimating the effectiveness of monetary policy;

(D) overestimates the ability of fiscal authorities to control inflation; and

(E) contains too few safeguards against the risks of excessive public debt; and

(2) an MMT agenda of having fiscal authorities manage monetary policy would run the risk of-

(A) very high debts;

(B) very high inflation; or

(C) very high debts and very high inflation, each of which may be very harmful to the broader economy;

Whereas the January 2019 report entitled “Modern Monetary Theory and Policy” by Stan Veuger of the American Enterprise Institute warned that “hyperinflation becomes a real risk” when a government attempts to pay for massive spending by printing money; and

Whereas the September 2018 report entitled “On Empty Purses and MMT Rhetoric” by George Selgin of the Cato Institute warned that-

(1) when it comes to the ability of Congress to rely on the Treasury to cover expenditures, Congress is, in 1 crucial respect, more constrained than an ordinary household or business is when that household or business relies on a bank to cover expenditures because, if Congress is to avoid running out of money, Congress cannot write checks in amounts exceeding the balances in the general account of the Treasury; and

(2) MMT theorists succeed in turning otherwise banal truths about the workings of contemporary monetary systems into novel policy pronouncements that, although tantalizing, are false: Now, therefore, be it

Resolved, That the Senate-

(1) realizes that deficits are unsustainable, irresponsible, and dangerous; and

(2) recognizes-

(A) that the implementation of Modern Monetary Theory would lead to higher deficits and higher inflation; and

(B) the duty of the Senate to condemn Modern Monetary Theory.”

“Senate Resolution 182-recognizing the duty of the Senate to condemn

modern monetary theory …”

To be condemned by these hacks is a badge of honor. This shows that the plutocrats who ought to fear us *do* fear us.

Brilliant Bill !

I hope part 2 shocks Scottish voters into actually thinking about what being at the heart of Europe actually means in reality.

It’s no independence at all replacing one currency issuer with another and one that would send in the IMF at a drop of a hat.

@ Derek Henry

“It’s no independence at all replacing one currency issuer with another and one that would send in the IMF at a drop of a hat”.

Exactly.

Except (a quibble) that sending in the IMF ceased some ago to be necessary. The Commission itself has been outfitted with all the deadly weaponry it needs with which to deter even the slightest tendency towards adoption by member-country governments of prohibited fiscal policy-making or (failing their being deterred) actually having the temerity to attempt to carry out any such. “Step out of line and we’ll junk your bonds, wreck your economy, etc etc (and what’s all this rubbish about having a democratic mandate?)”.

Examples of the Commission doing just that are proliferating. It’s a complete mystery to me what can cause some Scots to delude themselves into believing that if Scotland applied to join the EU it would be allowed to exempt itself from conforming with the same rules as govern all the existing members (including being obligated to adopt the euro as their currency to start-with?

It seems to me to be instructive to juxtapose this latest twitch in the death-throes (hopefully) of neoliberalism, Senate Resolution 182, against the following (source: Wikepedia):-

“On August 23, 1971, prior to accepting Nixon’s nomination to the Supreme Court, Powell was commissioned … to write a confidential memorandum (for the US Chamber of Commerce) titled “Attack on the American Free Enterprise System,” an anti-Communist and anti-New Deal blueprint for conservative business interests to retake America … It was based in part on Powell’s reaction to the work of activist Ralph Nader, whose 1965 exposé on General Motors, Unsafe at Any Speed, put a focus on the auto industry putting profit ahead of safety, which triggered the American consumer movement. Powell saw it as an undermining of Americans’ faith in enterprise and another step in the slippery slope of socialism. His experiences as a corporate lawyer and a director on the board of Phillip Morris from 1964 until his appointment to the Supreme Court made him a champion of the tobacco industry who railed against the growing scientific evidence linking smoking to cancer deaths. He argued, unsuccessfully, that tobacco companies’ First Amendment rights were being infringed when news organizations were not giving credence to the cancer denials of the industry”. (That last bit reads today as almost unbelievably unconscionable, and even more unbelievable that a person demonstrating such a degree of mendacity could subsequently be appointed to the Supreme Court).

From that date the attack by all the most conservative elements in the societies of the advanced industrialised nations upon the so-called postwar consensus can be said to have entered its decisive phase, culminating after only a decade in complete victory over “socialism” (equated in the conservatives’ minds with communism). The tone of the Powell Memorandum was anything but defensive – on the contrary it exuded arrogant self-confidence. I don’t believe there was the slightest doubt either in Powell’s mind or those of his audience that they were going to come out on top in the coming battle. And as we know, they did.

Senate Resolution 82 seems to me, on the other hand, to exude the exact opposite. Why would its framers feel the need to attack MMT in such a conspicuous manner unless they have lost their former certainty that their ideology has prevailed, conclusively? After all, they (and the “authorities” they cite) are part and parcel of the neoliberal hegemony which has been securely in the ascendant for the last nearly five decades. If they really still felt secure all they would need do is just ignore the very existence of MMT. Instead they are manifestly seeking to shore-up a position they see as being vulnerable. They see MMT (corrrectly) as the embodiment today of the same forces as the Powell Memorandum had in its cross-hairs in 1972 and Resolution 182 is a clear sign that they are seriously rattled. Rather than exuding arrogant self-righteousness it smells of insecurity, of a suspicion that this time they may be the ones who are on the run.

That’s the way I read it anyway. I hope I’m right.

Nice article. Can’t wait to go thru part 2.

There is actually a bill to condemn MMT. Hahaha. This is so funny. What a bunch of coward frauds.