Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – July 21-22, 2018 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

As a matter of accounting, the net financial assets held by the non-government sector rise $-for-$ when a sovereign government issues debt.

The answer is False.

The fundamental principles that arise in a fiat monetary system are as follows.

- The central bank sets the short-term interest rate based on its policy aspirations.

- Government spending is independent of borrowing and the latter best thought of as coming after spending.

- Government spending provides the net financial assets (bank reserves) which ultimately represent the funds used by the non-government agents to purchase the debt.

- Fiscal deficits that are not accompanied by corresponding monetary operations (debt-issuance) put downward pressure on interest rates contrary to the myths that appear in macroeconomic textbooks about ‘crowding out’.

- The “penalty for not borrowing” is that the interest rate will fall to the bottom of the “corridor” prevailing in the country which may be zero if the central bank does not offer a return on reserves.

- Government debt-issuance is a “monetary policy” operation rather than being intrinsic to fiscal policy, although in a modern monetary paradigm the distinctions between monetary and fiscal policy as traditionally defined are moot.

National governments have cash operating accounts with their central bank. The specific arrangements vary by country but the principle remains the same. When the government spends it debits these accounts and credits various bank accounts within the commercial banking system. Deposits thus show up in a number of commercial banks as a reflection of the spending. It may issue a cheque and post it to someone in the private sector whereupon that person will deposit the cheque at their bank. It is the same effect as if it had have all been done electronically.

All federal spending happens like this. You will note that:

- Governments do not spend by “printing money”. They spend by creating deposits in the private banking system. Clearly, some currency is in circulation which is “printed” but that is a separate process from the daily spending and taxing flows.

- There has been no mention of where they get the credits and debits come from! The short answer is that the spending comes from no-where but we will have to wait for another blog soon to fully understand that. Suffice to say that the Federal government, as the monopoly issuer of its own currency is not revenue-constrained. This means it does not have to “finance” its spending unlike a household, which uses the fiat currency.

- Any coincident issuing of government debt (bonds) has nothing to do with “financing” the government spending.

All the commercial banks maintain reserve accounts with the central bank within their system. These accounts permit reserves to be managed and allows the clearing system to operate smoothly. The rules that operate on these accounts in different countries vary (that is, some nations have minimum reserves others do not etc). For financial stability, these reserve accounts always have to have positive balances at the end of each day, although during the day a particular bank might be in surplus or deficit, depending on the pattern of the cash inflows and outflows. There is no reason to assume that these flows will exactly offset themselves for any particular bank at any particular time.

The central bank conducts “operations” to manage the liquidity in the banking system such that short-term interest rates match the official target – which defines the current monetary policy stance. The central bank may: (a) Intervene into the interbank (overnight) money market to manage the daily supply of and demand for reserve funds; (b) buy certain financial assets at discounted rates from commercial banks; and (c) impose penal lending rates on banks who require urgent funds, In practice, most of the liquidity management is achieved through (a). That being said, central bank operations function to offset operating factors in the system by altering the composition of reserves, cash, and securities, and do not alter net financial assets of the non-government sectors.

Fiscal policy impacts on bank reserves – government spending (G) adds to reserves and taxes (T) drains them. So on any particular day, if G > T (a fiscal deficit) then reserves are rising overall. Any particular bank might be short of reserves but overall the sum of the bank reserves are in excess. It is in the commercial banks interests to try to eliminate any unneeded reserves each night given they usually earn a non-competitive return. Surplus banks will try to loan their excess reserves on the Interbank market. Some deficit banks will clearly be interested in these loans to shore up their position and avoid going to the discount window that the central bank offeres and which is more expensive.

The upshot, however, is that the competition between the surplus banks to shed their excess reserves drives the short-term interest rate down. These transactions net to zero (a equal liability and asset are created each time) and so non-government banking system cannot by itself (conducting horizontal transactions between commercial banks – that is, borrowing and lending on the interbank market) eliminate a system-wide excess of reserves that the fiscal deficit created.

What is needed is a vertical transaction – that is, an interaction between the government and non-government sector. So bond sales can drain reserves by offering the banks an attractive interest-bearing security (government debt) which it can purchase to eliminate its excess reserves.

However, the vertical transaction just offers portfolio choice for the non-government sector rather than changing the holding of financial assets.

So the issuance of public debt does not increases the assets that are held by the non-government sector $-for-$.

Further, mainstream macroeconomics claims that public debt-issuance reduces the capacity of the private sector to borrow from banks because they use their deposits to buy the bonds. That is also clearly an incorrect statement.

It is based on the erroneous belief that the banks need deposits and reserves before they can lend. Mainstream macroeconomics wrongly asserts that banks only lend if they have prior reserves. The illusion is that a bank is an institution that accepts deposits to build up reserves and then on-lends them at a margin to make money. The conceptualisation suggests that if it doesn’t have adequate reserves then it cannot lend. So the presupposition is that by adding to bank reserves, quantitative easing will help lending.

But this is an incorrect depiction of how banks operate. Bank lending is not “reserve constrained”. Banks lend to any credit worthy customer they can find and then worry about their reserve positions afterwards. If they are short of reserves (their reserve accounts have to be in positive balance each day and in some countries central banks require certain ratios to be maintained) then they borrow from each other in the interbank market or, ultimately, they will borrow from the central bank through the so-called discount window. They are reluctant to use the latter facility because it carries a penalty (higher interest cost).

The point is that building bank reserves will not increase the bank’s capacity to lend. Loans create deposits which generate reserves.

The following blogs may be of further interest to you:

- Quantitative easing 101

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Money multiplier and other myths

- Will we really pay higher interest rates?

- A modern monetary theory lullaby

Question 2:

In a fiat monetary system (for example, US or Australia) with an on-going external deficit that exceeds the public deficit (expressed as percentages of GDP), the private domestic sector cannot reduce its overall debt levels (by overall saving) without incurring employment losses.

The answer is True.

This question is an application of the sectoral balances framework that can be derived from the National Accounts for any nation.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

(1) GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all tax revenue minus total transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total net taxes (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAD

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAD] = (G – T)

where the term on the left-hand side [(S – I) – CAD] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

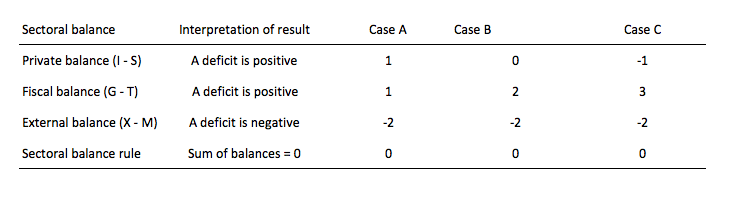

To help us answer the specific question posed, we can identify three states all involving public and external deficits (ignoring the net income transfers):

- Case A: Fiscal Deficit (G – T) < Current Account balance (X – M) deficit.

- Case B: Fiscal Deficit (G – T) = Current Account balance (X – M) deficit.

- Case C: Fiscal Deficit (G – T) > Current Account balance (X – M) deficit.

The following Table shows these three cases expressing the balances as percentages of GDP. Case A shows the situation where the external deficit exceeds the public deficit and the private domestic sector is in deficit. In this case, there can be no overall private sector de-leveraging.

With the external deficit set at a 2 per cent of GDP, as the fiscal balance moves into larger deficit, the private domestic balance approaches balance (Case B). Case B also does not permit the private sector to save overall.

Once the fiscal deficit is large enough (3 per cent of GDP) to offset the demand-draining external deficit (2 per cent of GDP) the private domestic sector can save overall (Case C).

In this situation, the fiscal deficits are supporting aggregate spending which allows income growth to be sufficient to generate savings greater than investment in the private domestic sector but have to be able to offset the demand-draining impacts of the external deficits to provide sufficient income growth for the private domestic sector to save.

For the domestic private sector (households and firms) to reduce their overall levels of debt they have to net save overall. The behavioural implications of this accounting result would manifest as reduced consumption or investment, which, in turn, would reduce overall aggregate demand.

The normal inventory-cycle view of what happens next goes like this. Output and employment are functions of aggregate spending. Firms form expectations of future aggregate demand and produce accordingly. They are uncertain about the actual demand that will be realised as the output emerges from the production process.

The first signal firms get that household consumption is falling is in the unintended build-up of inventories. That signals to firms that they were overly optimistic about the level of demand in that particular period.

Once this realisation becomes consolidated, that is, firms generally realise they have over-produced, output starts to fall. Firms lay-off workers and the loss of income starts to multiply as those workers reduce their spending elsewhere.

At that point, the economy is heading for a recession.

So the only way to avoid these spiralling employment losses would be for an exogenous intervention to occur. Given the question assumes on-going external deficits, the implication is that the exogenous intervention would come from an expanding public deficit. Clearly, if the external sector improved the expansion could come from net exports.

It is possible that at the same time that the households and firms are reducing their consumption in an attempt to lift the saving ratio, net exports boom. A net exports boom adds to aggregate demand (the spending injection via exports is greater than the spending leakage via imports).

So it is possible that the public fiscal balance could actually go towards surplus and the private domestic sector increase its saving ratio if net exports were strong enough.

The important point is that the three sectors add to demand in their own ways. Total GDP and employment are dependent on aggregate demand. Variations in aggregate demand thus cause variations in output (GDP), incomes and employment. But a variation in spending in one sector can be made up via offsetting changes in the other sectors.

The following blogs may be of further interest to you:

- Private deleveraging requires fiscal support

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Saturday Quiz – May 22, 2010 – answers and discussion

Question 3:

The imposition of fiscal rules which aim to limit the discretionary capacity of governments to net spend bias fiscal policy towards counter-cyclical responses when private spending is weak.

The answer is False.

The non-government sector spending decisions ultimately determine the fiscal balance associated with any discretionary fiscal policy.

The fiscal balance has two conceptual components. First, the part that is associated with the chosen (discretionary) fiscal stance of the government independent of cyclical factors. So this component is chosen by the government.

Second, the cyclical component which refer to the automatic stabilisers that operate in a counter-cyclical fashion. When economic growth is strong, tax revenue improves given it is typically tied to income generation in some way. Further, most governments provide transfer payment relief to workers (unemployment benefits) and this decreases during growth.

In times of economic decline, the automatic stabilisers work in the opposite direction and push the fiscal balance towards deficit, into deficit, or into a larger deficit. These automatic movements in aggregate demand play an important counter-cyclical attenuating role. So when GDP is declining due to falling aggregate demand, the automatic stabilisers work to add demand (falling taxes and rising welfare payments).

When GDP growth is rising, the automatic stabilisers start to pull demand back as the economy adjusts (rising taxes and falling welfare payments).

The cyclical component is not insignificant and if the swings in private spending are significant then there will be significant swings in the fiscal balance.

The importance of this component is that the government cannot reliably target a particular deficit outcome with any certainty. This is why adherence to fiscal rules are fraught and normally lead to pro-cyclical fiscal policy which is usually undesirable, especially when the economy is in recession.

The fiscal outcome is thus considered to be endogenous – that is, it is determined by private spending (saving) decisions. The government can set its discretionary net spending at some target to target a particular fiscal deficit outcome but it cannot control private spending fluctuations which will ultimately determine the final actual fiscal balance.

The following blogs may be of further interest to you:

- Saturday Quiz – May 1, 2010 – answers and discussion

- Understanding central bank operations

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

- A modern monetary theory lullaby

- Saturday Quiz – April 24, 2010 – answers and discussion

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

This Post Has 0 Comments