The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Trade and external finance mysteries – Part 1

I have received many E-mails and direct twitter messages overnight and today following the ‘debate’ on Real Progressives yesterday, where trade issues and related financial transactions were discussed. I saw that section of the debate (after the fact) and concluded that only one of the guests knew what happened when nations exported and imported. But it appears that readers of this blog who listened to the debate were confused by what they heard. So, today, by request, I aim to clarify a few of these issues. They are in fact fairly simple to understand once you trace through the transactions carefully, so it is a surprise that basic errors were expressed in the ‘debate’. So here is the way Modern Monetary Theory (MMT) helps you understand trade transactions.

There appears to be a lot of confusion about the external economy in a fiat monetary system. Many economists do not fully understand how to interpret the balance of payments in a fiat monetary system.

So it is no surprise that the general public struggles in this domain.

For example, most economists will associate the rise in the current account deficit (exports less than imports plus net invisibles) as an excess of investment over saving.

The claim is then that the only way a nation can counter that imbalance is through foreign investment (via an offsetting the capital account surplus) which means that the net accumulation of foreign claims on the nation (via direct investment income, debt repayments or equity dividends) increases.

This is the so-called ‘living beyond our means’ narrative.

I considered these questions in detail in this blog post – Modern monetary theory in an open economy (October 13, 2009).

In the ‘debate’ yesterday, we heard that nations with current account surpluses are more robust and that current account deficits reduce potential growth because the increasing foreign ownership reduces profit retention and hence investment.

The claim is unsustainable in fact.

First, there was a denial that exports are a cost and imports are a benefit. That should be undeniable.

For an economy as a whole, imports represent a real benefit while exports are a real cost.

Exports mean that we have to give something real to foreigners that we could use ourselves – that is obviously an opportunity cost.

Imports represent foreigners giving us something real that they could use themselves but which we benefit from having. The opportunity cost is all theirs!

Thus, net imports means that a nation gets to enjoy a higher material living standard by consuming more goods and services than it produces for foreign consumption.

Further, even if a growing trade deficit is accompanied by currency depreciation, the real terms of trade are moving in favour of the trade deficit nation (its net imports are growing so that it is exporting relatively fewer goods relative to its imports).

German workers, for example, give up hours of labour time, and utilise all sorts of raw materials to make motor cars and motor cycles, which they then put on ships and send elsewhere for the enjoyment of others. That is a real cost to Germany because it could use those productive resources for themselves.

So, on balance, if we can persuade foreigners to send us more ships and airplanes filled with things for us, than we have to send them in return (net export deficit) then that has to be a net benefit to us in real terms.

How can we have a situation where foreigners are giving up more real things than they get from us (in a macroeconommic sense)?

The answer lies in the fact that our current account deficit ‘”finances’ their desire to accumulate net financial claims denominated in $AUDs.

Think about that carefully. The standard conception is exactly the opposite – that the foreigners finance our profligate spending patterns.

In fact, our trade deficit allows them to accumulate these financial assets (claims on us).

We gain in real terms – more packed ships full coming in than leave – and they accumulate $AUDs, in the first instance.

What happens to those $AUD stocks is another question (see below).

If the foreigners change their desires to hold financial or other assets denominated in $AUD then the trade flows will reflect that and our terms of trade (real) will change accordingly (because they will make it harder for us to get foreign exchange to buy the imports).

It is possible that foreigners will desire to accumulate no financial assets in $AUD which would mean we would have to export as much as we import.

In that case, a nation would have to adjust its export and import behaviour accordingly. If this transition is sudden then some disruptions can occur. In general, these adjustments are not sudden.

Now what are the ‘monetary’ effects of this.

A simple understanding that net financial assets can only be created and destroyed in the non-government sector through transactions with either the central bank or the treasury (the ‘consolidated’ government sector).

Government deficits are the sole source of net financial assets for the non-government sector. All transactions between agents in the non-government sector net to zero.

This accounting reality means that if the non-government sector wants to net save (spend less than it earns) in the currency of issue then the government has to be in deficit.

The sectoral balances derived from the national accounts generalise this result and show that the government deficit (surplus) always equals the non-government surplus (deficit).

Fiscal surpluses destroy non-government wealth by forcing the latter to liquidate its wealth to get cash and destroy liquidity (debiting reserve accounts), which is deflationary.

With an external deficit, fiscal surpluses result in increasing private domestic sector debt levels and cannot represent a sustainable long-term growth strategy.

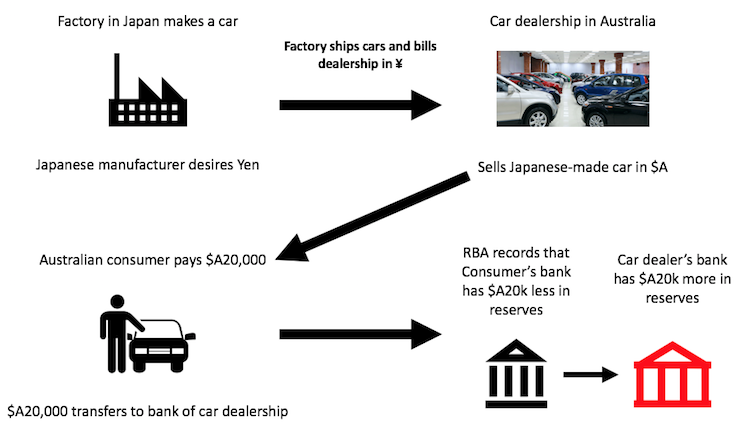

The following graphics will help trace out the transactions that accompany trade.

Narrative:

- I wish to buy a car, which is manufactured in Japan by a company that has costs in Yen and measures its profit and loss in Yen.

- The factor ships cars to Australia to its dealer network and bills the network in Yen.

- The car dealership accepts the yen-liability but sells the Japanese-made car in $AUD.

- If I pay cash or wave a credit card across a sensor at the car dealership (digital cash), my bank reduces my deposit balance by $A20,000 (the price of the car) and the car dealer’s bank would increases the dealers deposits by the same amount.

- The central bank (RBA) records a decrease in reserves for my bank and a corresponding increase in reserves for the car dealer’s bank as part of the clearing process.

- The debit to my bank account is debited and the credit to the car dealer’s account means that the ownership of the $AUD has changed from me to the dealer. No new net financial assets are created.

- If I take out a loan to buy the car, then my bank’s balance sheet now records the loan as an asset and creates a deposit (the loan) on the liability side. When I hand over the cheque to the car dealer (drawing on the loan), the dealer now has a new asset (bank deposit) via the fact that loans create deposits within the system. Again, no new net financial assets are created.

What happens next depends on the aspirations of the car manufacturer.

1. They might want the invoice paid in Yen.

2. They might be happy (if the dealers are wholly owned by the manufacturer) to leave the sales revenue in $AUD accounts at Australian banks.

3. They may decide to purchase AUD-denominated assets (financial or otherwise).

Whatever choice they make, at this stage, the export surplus (1 car) manifests in an accumulation of $AUD assets in the form of a bank deposit (or equivalent).

What happens if the car dealer decides to pay the invoice from the manufacturer? Clearly, there is a currency mismatch. The dealer has $AUD financial assets whereas the invoice requires Yen to be transferred.

- The car dealer has $AUD and needs to get ¥. After deducting their profit, the car dealer will then enter the foreign exchange market (maybe via their bank) and negotiate an $AUD for Yen sale. So someone is currently holding Yen and desires to hold $AUD for whatever purpose.

- A contract is initiated and the two currencies are exchanged.

- The car dealer then transfers the Yen purchased from the counterparty to the Japanese bank of the car manufacturer (we ignore hedging etc, which would have been in operation to cover the uncertainty of the mismatch between revenues and costs).

- The resulting financial effects are: (a) The AUD balances in the Australian financial sector remain the same but are owned differently than before the export occurred. (b) the Yen balances in the Japanese financial sector remain the same but ownership has transferred from the Foreign Exchange dealer to the car dealer and finally to the car manufacturer.

If the manufacturer decided to accept payment of the invoice in $AUD (then the foreign exchange market transaction would be unnecessary) and the transaction would just mean that the Japanese car company would have a new $AUD financial asset (bank deposit).

What it did with that deposit doesn’t alter the fact that all the export has achieved (other than allow me to have a new car) is transfer the ownership of my $A20k deposit to the car firm (including the dealership).

It is more complicated if the $AUDs are converted into Yen, but not overly so, as explained above.

The transaction (and by accounting definitions) net export surpluses do not increase the yen or $AUD balances, just change the ownership.

Now, what would happen if the Japanese car firm decided to store its $AUD assets in the form of Australian Government debt instead of holding the AUD-denominated bank deposits?

Some more accounting transactions would occur:

- The Japanese company would instruct its agent to put in an order for the bonds and the firm would instruct its Australian bank (wherever it was located in the world) to transfer the $AUD bank deposit into the hands of the central bank (RBA) who is selling the bond (ignore the specifics of which particular account in the Government is relevant). The Japanese car maker’s lawyers or representative, in turn, would receive a bit of paper called an Australian government bond.

- The Australian government’s foreign debt rises by that amount.

- This merely means that the Australian Government promises, on maturity of the bond, to credit the bank account of the ultimate holder of the bond (add reserves to the Australian bank the car firm or final holder deals with) with the face value of the bond plus interest and debit some account at the central bank (or whatever specific accounting structure is involved with bond sales and purchases).

If you understand all of that then you will clearly understand that this merely amounts to substituting a non-interest bearing reserve balance for an interest-bearing Government bond. That transaction can never present any problems of solvency for a sovereign government.

Project Fear continues …

Then we hit the Project Fear claim that that foreign purchases of a government’s treasury debt props up that nation’s public spending and, without it, the government would have no financial viability.

The corollary of this theme, is that the power lies in the hands of those foreigners who hold the national government debt rather than the issuer, the national government.

China automatically accumulates US-dollar denominated claims as a result of it running a current account surplus against the US.

These claims are initially held somewhere within the US banking system and can manifest as US-dollar deposits or interest-bearing bonds. The difference is really immaterial to US government spending and in an accounting sense just involves adjustments within the banking system.

The accumulation of these US-dollar denominated assets (bits of paper and electronic bank balances) is the ‘reward’ that the Chinese (or other foreigners) get for shipping real goods and services to the US (principally) in exchange for less real goods and services being shipped from the US.

Given real living standards are based on access to real goods and services, you can work out, from a macroeconomic perspective, who is on top.

Please read my blog – Modern monetary theory in an open economy – for more discussion on this point.

Note, I used the qualifier ‘from a macroeconomic perspective’. A US worker in Detroit who has endured unemployment as a result of cheaper imports coming from nations with lower labour standards (pay and conditions) than the US is unlikely to be among those who benefit.

The US thus benefits from China’s willingness to deprive its citizens of material wealth (use of its own real resources) and net ship its ‘labour’ and other real resources embodied in the exports to other nations.

This is not to deny that when an economy experiences a depletion of foreign exchange reserves or finds the exchange terms of its own currency against foreign currencies it requires to purchase essential imports it has to take some hard decisions in relation to its external sector.

This is especially so if it is reliant on imported fuel and food products. In these situations, a burgeoning external deficit will threaten the dwindling international currency reserves.

In some cases, given the particular composition of exports and imports, currency depreciation is unlikely to resolve the CAD without additional measures.

The depreciation, in turn, raises the relative costs of imports, and imparts an inflationary bias to the economy. Moreover, depreciation leads to expectations of further depreciation and fuels the run out of the currency. There may be no interest rate that is high enough to counter expectations of losses due to depreciation and possible default.

The reality is that a nation facing a lack of ability to purchase imports, for whatever reason, has to either increase its exports or reduce its imports.

For less developed countries faced with currency crises, there is probably no short-run alternative but to urgently restore reserves of foreign currency either through renegotiation of foreign debt obligations, international donor assistance or default.

For an advanced nation, similar constraints might apply and a sudden shift in international sentiment against the nation or other financial assets denominated in that currency are no longer deemed as desirable, then adjustments in the flow of real goods and services sourced from foreigners are required.

And, as I explain in this blog – Ultimately, real resource availability constrains prosperity – the limits for a nation are clear – if it cannot command access to real resources owned by foreigners the it must rely on the resource wealth it has for sale in its own currency.

But none of that reduces the financial capacity of the currency-issuing government to purchase whatever is for sale in that currency.

What would happen if the Chinese holders of US government debt decided to liquidate their holdings of US government debt that have been accumulated to mirror the current account deficit the US runs against China?

This could be done slowly or quickly. A rapid liquidation would devastate the Chinese wealth stored in those $USD assets.

Such a liquidation would have no bearing on the US government’s capacity to buy goods and services for sale in US dollars but would seriously undermine the trading capacity of China.

Please read my blog post – Do current account deficits matter? (June 22, 2010) – for more discussion on this point.

Nominal versus real

But what is the discussion about real and nominal about?

Think about this simple example.

When I go to a shop and buy a good from the store I hand over some cash (or wave a credit card over a sensor which is the digital equivalent of handing over cash) and receive the product in return.

The shop is receiving a nominal payment and sacrificing a real good. The shop wants to accumulate nominal stocks of money whereas I want the real good to consume its use value when I leave the shop.

I clearly value the real benefits from the transaction more than I value the nominal holding of cash.

All commodity transactions share that characteristic except the transaction that involves an employer purchasing labour power in the labour market.

That transaction, as Marx so clearly showed, is unique, because unlike simple commodity exchange – where the exchange value is set during the transaction and the use values arising from the exchange are consumed outside of the exchange – the labour exchange is different.

Unlike the symmetry of a simple commodity exchange, there is an asymmetry in the labour exchange.

For the worker, the use value of the exchange is embodied in the wage received and that is consumed outside the workplace (we abstract from a worker enjoying his/her job).

But for the employer, the purchaser of the labour power, the use value of that ‘commodity’ – the flow of labour – has to be consumed during the transaction period. That introduces all manner of issues include the need to control what the worker does, etc.

So a nation with a current account deficit enjoys a real advantage over the export surplus nations (as explained above) but incurs nominal liabilities – the financial assets that the exporter accumulates.

The exporter could convert those nominal liabilities into real assets (via say FDI – see below) or not.

As I explain below there are some reasons to be concerned about the accumulation of financial assets in the hands of foreigners but they are not the usual suspects (such as the case discussed above concerning liquidation).

Foreign ownership

There was also the contention that a nation that runs a continuous current account deficit ends up only being a nation of workers.

The assertion was that the capital account of the Balance of Payments would reflect the increasing foreign ownership of companies in a nation with a current account deficit and that if that persisted all the “capitalists” would be foreigners.

In turn, it was asserted that this would mean profits were expropriated abroad, which would lead to reduced business investment (capital formation), slower growth, and declining standards of living.

We can break the assertion up into its two components.

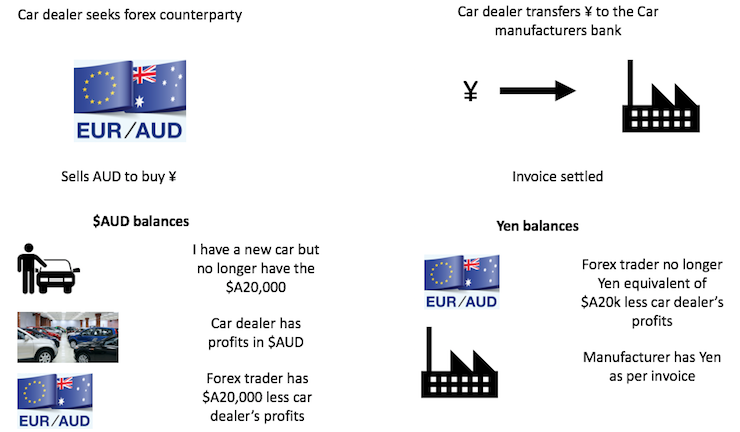

First, Australia is a small, open economy and has been running persistent current account deficits for as long as the most recent national accounting data has been available (September-quarter 1959).

It has been in continuous deficit since the September-quarter 1975 as the following graph shows (from March-quarter 1960 to the December-quarter 2017), averaging 4 per cent of GDP over that time.

Hardly a small deficit.

Second, one can find ownership of Australian companies from the Australian Bureau of Statistics publication – Selected Characteristics of Australian Business, 2015-16 (latest published).

The following table is compiled from that data and refutes entirely the notion that our persistent current account deficit has lead to a mass takeover of our business firms by foreign capitalists.

In 2016, only 2 per of business in Australia were foreign-owned

Unfortunately, there are still plenty of Australian capitalists doing their thing in Australia 🙂

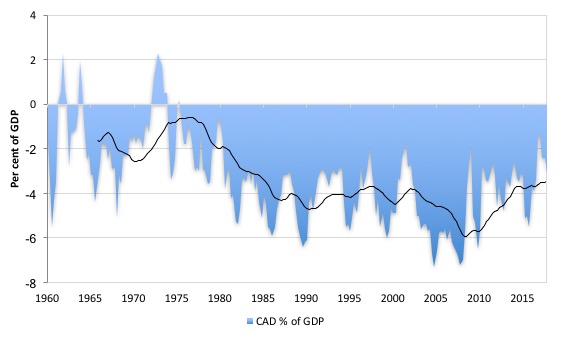

The ABS also published data on – International Investment Position, Australia: Supplementary Statistics (Catalogue 5352.0). The most recent data is for 2016.

The national accounting framework divides financial flows into and out of a nation into Foreign direct investment (FDI) where funds are used to establish an operational business interest of at least 10 per cent ownership (including equipment, buildings, land) in a foreign country and Foreign portfolio investment (FPI) where funds are used to buy financial assets (shares, bonds) in a foreign country.

FPI is divided into liabilities accruing from equity investment (shareholdings) and debt securities (loans).

The following graph shows the aggregates since 2001 for Australia. So much of the financial side of our current account deficit is in fact reflected by foreign debt positions held by the private domestic sector.

Remember the previous graph shows the stock of foreign investment in Australia. So in 2016, total FDI was $A796,072 million while total Australian FDI abroad was $A554,874 million.

For FPI, the 2016 total foreign liability was 1,659,820 million while the total foreign asset was $A869,818 million.

The Net international investment position in thus less for FDI than for FPI.

But from the Balance of Payments data we can also extract more information that bears on this discussion.

The above data is for stocks – so the total assets and liabilities measured at some discrete point in time (annual in this case).

But the stocks of assets (arising from FDI and FPI) generate income flows into and out of the country.

And the question of interest, given the assertion that profits disappear from nations running current account deficits, is what proportion of investment income arising from FDI is reinvested?

The answer can be found in the ABS publication – Balance of Payments and International Investment Position, Australia, Dec 2017 (Catalogue No. 5302.0).

From March-quarter 2008 to the December-quarter 2017, on average 53.6 per cent of investment income flowing to FDI has been reinvested into new FDI in Australia.

So we have seen that a persistent current account deficit does not:

1. Lead to a takeover of local businesses by foreigners.

2. Lead to all profits being repatriated and investment falling.

Investment does not depend on who owns firms anyway

Further, the claim that local investment would suffer and growth would be retarded if foreign ownership increased as a result of current account deficits allowing foreigners to accumulate equity in local firms and repatriated all the resulting profits, misunderstands the way in which loans create deposits.

There is typically no ‘shortage’ of funds available for credit-worthy borrowers (including firms seeking funds to invest in new productive capital) in a fiat monetary system.

We could have a situation where all firms were foreign owned and repatriated all profits and, yet, the local banking system would still stand ready to create loans (and hence deposits) to firms that were deemed to be financially viable who were seeking funds.

Why might we care about foreign ownership?

I will write a separate blog post on this topic in the future.

The main reasons to be concerned are not related to takeover or lack of investment potential.

The idea of foreign ownership has long been a concern for progressives because ownership of financial wealth bestows power and allows the owners to influence government policy to their advantage.

Further, the accumulation of local currency assets can manifest in asset price bubbles (real estate) that disadvantage local residents, especially lower income cohorts.

In this regard, governments have to have strict rules in place as to which assets a foreigner can accumulate in the currency of issue.

More later on that issue.

Conclusion

I hope that clarifies some of these issues.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

“The idea of foreign ownership has long been a concern for progressives because ownership of financial wealth bestows power and allows the owners to influence government policy to their advantage.”

It also gives them pricing power in areas where they have been granted a local monopoly (via copyright, patents, trade marks or property ownership).

The classic example is ‘Marmitegate’ in the UK. Marmite is produced in the UK for local production using local ingredients (traditionally waste from the brewing industry). However the brand is foreign owned, and during the recent currency movements the price of the product was increased for no reason other than to maintain the profit share in foreign currency terms. (There was the usual handwaving nonsense, but that was the purpose).

You see the same with a lot of foreign owned brands – often not by price, but by reducing the size of the product. Confectionary is a favourite for that trick at the moment – the hand waving being that they are reducing portion sizes. The price stays the same – around a price break. Historically that trick has lead to regulated sizes – which is why bread in the UK is required to be sold in 400g and 800g loafs. (the old 1lb and 2lb loafs).

If a floating rate currency is to buffer losses onto non-residents there needs to be regulation to stop non-residents avoiding taking that currency loss – particularly around government granted monopolies.

A+

😉

If the whole resources of the planet were owned by a single person who lived on a desert island, and he/she was a foreigner to every nation, it would not make any difference to the rest of us. Wealth would continually drain to that person. It wouldn’t matter what the currency was, foreign or not. We may be closer to that state than we imagine. People may be distinguished by their passport, but wealth is stateless. (NB It is reported that 50 per cent of “wealth” of the world (or more?) is owned by 48 people, and this is increasing with time.) With the capability of the planet to obliterate much of life at the touch of a button, one wonders when this inevitable occurrence will occur, not if. No doubt that my note will not be displayed, or be ridiculed, but nothing I have stated can be said to be ridiculous.

Ha

Brilliant, superb Bill !

Bill,

I hope you are keeping a close eye on the framing and language being used in the BREXIT negotiations ?

NO ADVANTAGE has morphed into a tough “level playing field mechanism” when the UK leaves.

= The depoliticisation of Corbyn

Finally the EU and the Tories have found something they can agree on – STOP CORBYN !

A great article in the Sunday Times explains it below…..

Fear of Jeremy Corbyn-led government prompts tough EU line on Brexit to protect single market from Labour’s left‑wing policies.

You could virtually write what the tough “level playing field mechanism” will look like. They have already introduced a clause upon leaving to protect businesses from state subsidies proposed by the Labour leader

Fantastic explanation about net exports and the current account balance. I am pleased to say that this is congruent with what I was taught in CGE courses, i.e., the idea that if you can convince the rest of the world to send you more stuff than you have to send it, then you are invariably better off; that if you are are able to run a current account deficit for an extended period of time, then you are seen as a good investment bet.

Thanks Bill for your efforts on this blog.

In the current warped logic of capitalism trade surpluses are an extra source of savings for the rich as the poor would spend all their income anyway. These savings are “net” savings in the sense of the private sector of the surplus country, some agents in the deficit country obviously must increase their short position, so they are not “net” in the wider sense. Let us isolate the private sector in the surplus country – the extra demand has virtually the same impact regardless whether their government runs a deficit of 1 billion dollars, some private sector agents fund their spending by borrowing 1 billion dollars per year or whether the country has a trade surplus of 1 billion dollars. This may be called a “Non‐Capacity Creating Autonomous Expenditure”. China, Germany, the Netherlands and other surplus countries use trade surpluses mostly for stimulating the demand in the “right” kind of industry to encourage the investment and growth there. I am convinced that the “supermultiplier” concept recently popularised by Marc Lavoie is the right framework to analyse this historic phenomenon (but SK thinks in terms of the modified Goodwin model which is not Keynesian-Kaleckian so there is no room for the supermultiplier in the land of stocks of money determining spending and profits being 100% reinvested). The use of trade surpluses to stimulate the demand only makes sense in the illogical logic of capitalism, also mastered by dialectical materialists living in a large Asian country. For American workers the excess of import over export has virtually no benefit as their wages have been frozen due to the globalisation. The poor can buy cheap T-Shirts but they are poor because relatively better-paid jobs in the textile industry are gone and all is left is the “Uber” servitude. It is the middle and upper classes in the US who benefit from the free cargo arriving at their doorsteps – and from suppressing of the real wages. But the Chinese middle-class savers obsessed with hoarding of 40% of their income are also perfectly happy to feed the demand elsewhere. I agree with Warren that the American government could always cover the gap in the aggregate demand caused by the saving habits of upper class here and there. It is the special “logic” of neoliberalism what prevents it from doing so due to the renewed class struggle. It is better to have less than more and to be poorer than richer – if we look at the distribution of ownership of real assets such as land, it is obvious why. Only if we apply the common sense logic the absurdity of the current situation is striking – and Warren has applied the common sense logic with devastating consequences.

A tough “level playing field mechanism” is going to be used to nuetralise the power of a sovereign fiat currency.

Epic blog. Thank you. Clarified a lot.

Keen to me seemed to think something like a gold standard was still operating…trade surplus, more gold, more currency created.

Yes,, very clearly explained.

I was trying to give a similar explanation recently and made a “right mess” of it……. I was trying quite unsuccessfully, to explain the story using the increase and decrease in commercial bank “net foreign assets”…..

Neil Wilson:

“It also gives them pricing power in areas where they have been granted a local monopoly (via copyright, patents, trade marks or property ownership).

The classic example is ‘Marmitegate’ in the UK.”

A worse example is the selling, very cheaply at that, of the only portuguese power company to a powerful foreign state. Sigh.

Thanks due to Prof. Mitchell for another great myth busting blog post in an area where people like me get easily confused. This post is so rich in detail that I will have to read it a good few times!

The only bit that Bill’s Forex explanation didn’t seem to deal with was the role of Central Banks and the way it affects their foreign reserves ( Central Banks accounts with each other?). Does the Forex deal then involve clearing at the Japanese/Australian Central Bank level-and might this not involve some extra Yen/Aud creation in the process?

Any help with this from anyone out their appreciated.

“The only bit that Bill’s Forex explanation didn’t seem to deal with was the role of Central Banks and the way it affects their foreign reserves”

In a floating rate system central banks don’t need foreign currency reserves. For every FX transaction there are always two central banks in play – if you’re buying dollars and selling Sterling, there is another side that is buying Sterling and selling dollars. Each central bank should look after the buy side only and clear the purchase to the relevant bank account.

In policy terms central banks should probably be barred from engaging in the FX market, and concentrate on pre-pack administration of financial entities that go bust instead. With that regime in place expectations are set – an expectation that short sellers that get caught with their pants down will go bust and their assets appropriated.

“if you’re buying dollars and selling Sterling, there is another side that is buying Sterling and selling dollars.”

Do I understand this? I’m thinking that if I’m an Australian auto dealer buying Yen for AU$, then there’s a currency dealer somewhere doing the other side of the trade, and that neither I nor the currency trader have any necessary relationship with the central banks.

Just trying to verify that I understand.

Many thanks to you both Warren and Bill for shedding the light on this salient issue.

“German workers, for example, give up hours of labour time, and utilise all sorts of raw materials to make motor cars and motor cycles, which they then put on ships and send elsewhere for the enjoyment of others. That is a real cost to Germany because it could use those productive resources for themselves.”

I don’t think we should be giving the impression that they are denying themselves the use of said resources and simply shipping it all off to others because they most certainly do not deny themselves of the fruits of their own creativity. They produce all that they can use for themselves and much more and their industries help place them at the cutting edge of the crucial ability to turn knowledge into something real and practical.

Ownership of the means to produce that which others need places Germany in a rather stronger bargaining position during Brexit than many MMT protagonists seem to believe is the case.

The “exports are a cost and imports are a gain” meme has a ring of truth to it but it is a very abstract concept and reality is rather more complex – has Australia now made net gains by shutting down our car making industry (a lot of which was export-oriented)? Will we be better off by having snuffed out our own ability to engage in modern mechanical engineering on a broad scale? Was all the R&D that went along with it a loss as well?

Exactly when and why did the “exports are a loss and imports are a gain meme” arise?

Was it simply formulated to demonstrate the reality that in modern fiat monetary systems, a sovereign nation does not have to earn income from abroad or face going broke?

Clearly the above is factual but I think that focussing so heavily on the abstract over the physical has led MMT’s thinking down the garden path on this particular issue. It becomes extrapolated to “we don’t need the ability to do anything for ourselves because we are better off buying it from others.”

It seems curious to think that perpetually dumbing ourselves down could be viewed as an advantage over those who deliberately choose not to.

In order to be able to export something much more complex than dirt, you must first have the ability to produce and supply it to yourself so I don’t know how many exporters are really denying themselves anything. Conversely, once I have given up my ability to produce my own needs in favour of imports, I become completely reliant on the exporter – it is they who have me by the short and curlies, not the other way round. We may be able to wave a magic wand and produce more fiat money but bringing back entire industries that have been discarded is not so simple and quick.

From where I’m looking, the meme has the ability to be very misleading. Being a major supplier of needs that others have no ability to produce for themselves is quite a powerful position to be in. I’m probably able to fulfil both my own needs and also dictate terms to those who need me. Whether or not I need their money is somewhat beside the point.

Perhaps the meme should be dropped in favour of simply saying that a fully sovereign nation does not need export earnings to fund itself – to imply that those who posses large, advanced industries geared toward export are automatically disadvantaging themselves simply isn’t correct.

We are simply pointing the finger and laughing at those whom we cannot do without – is that smart?

Like what ‘Leftwinghillbillyprospector’ says. Sure imports- real goods- exchanged for pieces of paper or accounting notations are great at some immediate time frame, but if those imports lead to a loss of an industry that cannot be ‘reappeared’ without great difficulty, then that is kind of important isn’t it? And it is very much useless (or academic, if you prefer) to say that the government has the ability to re-employ those who lost their jobs in that industry while the government actually has no intention or real policy to do that.

And is it not the case that the central bank of trade surplus countries is usually willing to exchange the foreign currency earned through exports for newly created domestic currency? I mean does the Chinese exporter (just for example) who receives a foreign currency in exchange for the goods really have to find some other private operator who has the domestic currency but would rather have the foreign currency? These are real questions I have and really would like to find out whether I am way wrong or sort of wrong or maybe even right for a change.

Dear Neil and Jerry,

“In a floating rate system central banks don’t need foreign currency reserves” – this would be correct if there were no large scale privately-owned financial institutions engaging in forex speculation (and the difference between hedging and speculation is “fluid”) – and no large-scale use of monetary policy to achieve macroeconomic goals. In the “real” world central banks have quite significant foreign reserves, China – 3.1 trillion USD what is about 30% of the GDP, Switzerland has foreign reserves equal to 120% its GDP.

The Chinese CB used to exchange USD for the local currency and then perform other open-market operations (so-called “sterilisation”) to mop-up the liquidity. In terms of flows they haven’t increased their position since 2014, they even had to defend the exchange rate of CNY/USD against an “outflow of capital” that is increased willingness to exchange CNY onto USD in 2016. After jailing a few corrupt oligarchs the capital outflow has stopped… they are not Russia or Iran and George S. won’t break the Chinese CB even if he really would like to do so. This is what these reserves are for.

“if those imports lead to a loss of an industry that cannot be ‘reappeared’ without great difficulty, then that is kind of important isn’t it? ” – It is the supermultiplier model what explains why American not Japanese cities look like having been nuked – this point raised by SK is valid as it refers to the real world, but he got lost in his explanations and became an easy prey to Warren’s iron logic of assets and liabilities shifting on balance sheets. We need to distinguish what is possible from what really happens in our insane world. It was entirely possible to avoid any loss of lives in Ireland in 1845-1849 because there was enough physical food available – but the “invisible hand” of so-called free markets (and the social system of exploitation of peasants in Ireland) did not fed the starving population and the government was unwilling to intervene in a meaningful way.

Perhaps we need to look a bit deeper into the issue of trade balance – “exports are a cost and imports are a gain” – this is undoubtedly true for the countries “as a whole” but exports generate increased profits in the export surplus country so exports are NOT costs to the capitalists in the export surplus country, they are gains. It is the workers in the export country who incur the cost – but they may be accepting this, if the alternative is unemployment and poverty. If we look for example at Greece and Germany (operating within the same toxic environment of single currency), the objective “gains”of the Greeks from the era of trade deficits were highly toxic and the debt may never be repaid.

Adam K – thank you for your answer. Reading your entire comment, it seems that you are also somewhat unsure that imports, even if purchased with a fiat currency (something that has no intrinsic value and can be created at will by the issuer), always work out to be a benefit to the importing country- even though the logic or the accounting would seem to show that they do. You mention that China Central Bank has accumulated US Dollar reserves amounting to approximately 30% of GDP and Switzerland CB foreign reserves at 120%. Pretty much seems that at some point, maybe in the past at least, that was a policy choice made by those CBs or governments that sort of destroys the idea that everyone selling a currency needs to find a buyer in an open market for the exchange to happen.

You say that exports generate increased profits for the capitalists of a surplus country- but the workers bear a cost. Why do you say that? Would that hold true if governments or central banks did not try to accumulate foreign reserves? Aren’t they shipping off part of the production their capital helped produce also instead of consuming it themselves? I ask because from my point of view it is the workers in the trade deficit country that get stuck with the costs of the trade imbalance- through lessening demand for their labor. Well, I wouldn’t be surprised if the workers lose in either case I guess…

Neil said:

“In a floating rate system central banks don’t need foreign currency reserves.”

They do if they want to engage in exchange rate manipulation, which they occasionally do.

Couple of points… The whole world can’t run a trade surplus. Some countries will mostly run deficits, some surpluses. It is a symbiotic relationship. Surplus nations need importers as much as importers need exporters. Mmt, as I see it is trying to deal with the reality that we are probably not going to return to a world of national economies producing only for internal markets.

Jerry B said:

“I mean does the Chinese exporter (just for example) who receives a foreign currency in exchange for the goods really have to find some other private operator who has the domestic currency but would rather have the foreign currency? ”

Depends. Does the exporter want to hold foreign currency or not?

If he doesn’t he has to sell the foreign currency in exchange for his local currency (or any other currency for that matter).

Leftwingwhatever said:

“Exactly when and why did the “exports are a loss and imports are a gain meme” arise?”

This is one of the examples of inverted logic found in MMT designed such that MMT can argue that foreign transactions don’t matter (that much).

Henry Rech, I meant if the exporter wants to exchange the foreign currency earned for the exporter’s domestic currency. And whether or not it is common that the Central Bank of trade surplus countries will serve as the counterparty to that trade by creating more of the domestic currency to exchange for the foreign currency.

” And whether or not it is common that the Central Bank of trade surplus countries will serve as the counterparty to that trade by creating more of the domestic currency to exchange for the foreign currency.”

The way I understand it is that the exporter will have to sell his foreign currency position in the foreign exchange market. No new currency need be created.

And the counter party is more than likely a private entity unless it’s a central bank indulging in currency massaging.

“The way I understand it is that the exporter will have to sell his foreign currency position in the foreign exchange market. No new currency need be created.”

That suggests you don’t understand it.

In reality if you buy or sell currency at a bank, the bank generally takes the other side of the deal by simply marking up the account with the relevant number in the relevant denomination – particularly if it is a multinational or a currency dealer with accounts in each currency area.

The majority of FX is margin trading, which is essentially a set of loans. The net exposure is then netted off in the market, which will involve more loans being created and/or destroyed on both sides of the currency border.

“I’m thinking that if I’m an Australian auto dealer buying Yen for AU$, then there’s a currency dealer somewhere doing the other side of the trade, and that neither I nor the currency trader have any necessary relationship with the central banks.”

There’s always somebody on the other side of the deal – which may be a currency dealer or just a bank.

The central bank is largely irrelevant in the process – unless it decides to manipulate the currency by getting involved.

“If he doesn’t he has to sell the foreign currency in exchange for his local currency (or any other currency for that matter).”

It may look like selling from the exporter’s point of view, but from the bank doing the FX transaction point of view they just transfer the FX asset from the customer into their own name and simply mark up the deposit account in the local denomination.

Because FX, as is all currency, is ultimately a loan asset.

The change in currency rates is really deposit takers shuffling such loan assets between themselves – as they often do with other loan assets like securitised mortgages – to manage their perceived risk exposure.

“They do if they want to engage in exchange rate manipulation, which they occasionally do.”

You can’t manipulate exchange rates with foreign currency reserves – because you run out. The other side can always outgun you – as Argentina demonstrated again this last month.

All you can do is pile up foreign currency or foreign denominated assets and issue your own money – which keeps the exchange rate to the foreign denomination lower than it otherwise would be. Those may be called ‘reserves’, but really they are hostages to an export-led policy regime. They can’t be disposed of because they ‘back’ the local issued currency – at least in the mind of the Washington trained people running the central bank who think central banks can have negative equity in their own denomination.

That hostage mentality explains why a net import nation can continue to create money. The hostage money cannot be released without destroying the manipulated export flow and is therefore effectively dead to the circulation.

Neil Wilson, I think you should write a blog piece somewhere – “how foreign exchange really works for MMTers” – or something to that effect – you seem in the know and I’d like to learn more….

Central bank foreign reserves/currency manipulation etc.

Especially the worst case capital flight scenario “all foreigners sell their bonds and sell their currency” scenario that gets trotted out whenever I suggest that a nation with a CAD can still deficit spend.

“In reality if you buy or sell currency at a bank, the bank generally takes the other side of the deal by simply marking up the account with the relevant number in the relevant denomination ”

How’s that different from what I said. The bank, a private entity, if it holds the foreign currency is taking a position. Otherwise in the normal course of business it will also be dealing the other way and the trade will balance to some extent.

“You can’t manipulate exchange rates with foreign currency reserves – because you run out.”

Yes you can run out, but it doesn’t stop CBs from doing this. Ultimately, CBs can gang up in a market and swap currencies so the manipulation can continue.

I’m sorry if I offend you (well not really) because I am questioning MMT – your woundedness and the arrogance covering it is all too obvious. Why don’t you deal with questions in a civil manner?

Dear Jerry Brown,

I hope that what is written below is not utter rubbish.

I am still grappling with the question who pays the cost, how much and which factors determine this. We can attempt answering it from the “old-Marxist” point of view enhanced with the modern Sraffian mathematical methodology (coming from Pasinetti) . We can assume that in a close economy without the government the sum of surplus value is equal to the sum of profits – and look at how the trade imbalance and related problems with the realisation affect the rate of exploitation. Contrary to what Bortkiewicz and Sweezy said, this framework is not self-inconsistent and it was Bortkiewicz who made a so-called “mistake” in the transformation of surplus-value onto profits, not Marx. If we look at cost-prices as including past profits and correctly rescale the amount of socially necessary labour time, the system of equations is perfectly consistent. Ian Wright wrote about this issue in his PhD thesis (“A category-mistake in the classical labour theory of value”). I would go much further, I think that Marx was right but he was misunderstood (maybe on purpose). We would then need to relax some of the initial assumptions made by Marx that is the economy is closed and there is no government. This could work but I didn’t have time to grapple with the lineal algebra (yet). The real issue is somewhere else. I believe that Marx could have reduced skilled labour to simple labour because working in a factory as a foreman in the 1860s didn’t require very sophisticated skills and the number of skilled people was so small they could have been aggregated with capitalists as “petit bourgeois”. But this issue has been picked up by the Austrians slightly later when it became more obvious that one engineer cannot be replaced by 5 workers. If we acknowledge that there are several separate (“segmented”) labour markets and modify the Leontief production function to include several labour inputs, there is a problem of how to scale the MELTs and as a result how to determine the surplus value by going back from profits to socially-necessary-labour-time. (this is possible for the original model). This is also the key question related to the modern class struggle – not the struggle between people selling their labour time and the owners of capital but the struggle between the rentiers, the manageriat, the skilled “professionals” and the modern proletariat. Only when we work it out we can then talk in numbers and guesstimate how much the American workers have lost and how much more the Chinese workers are exploited. Then the next step would be to assess what is “better” or “worse” for them from the use-value not exchange-value point of view, knowing that use-value is somehow subjective (I firmly reject the marginal utility concept as inconsistent with the findings of behavioural economics). For me the Labour Theory of Value is the only tool we can apply here but it still needs sharpening, I am still far away from answering these questions but at least I can ask them.

Hello,

This is a great explanation of the key points of the discussion that Steve did not quite grasp.

One must remember that his Minsky model is purely financial so he sees a flow of income going overseas as bad. It is deflating the domestic economy when one applies the sectoral flow model. An easy mistake to make.

The swapping of fiat dollar credits, that one can create electronically at virtually no cost, for real things such as machinery and food etc, is a sovereign privilege and one should do it as much possible, it is the ultimate free lunch. But does not come out as such mathematically in a model.

As Warren said, the problem is that the policy response to the sovereign privilege is wrong. The currency sovereign should recognise its “free lunch” position and simply add more money to the domestic private sector to make up for the money supply loss going overseas. This way its citizens can enjoy the privilege by way of government spending on the domestic private sector. Such deficit spending should then provide the employment for the jobs that have been “exported” overseas with more pleasant jobs domestically.

The Detroit car worker could become a well-paid fitness trainer in a federal government-funded health and fitness facility rather than a broken alcoholic in his rundown slum rental home watching trash tv all day while eating junk food. This higher level utopist outcome is though not the one we have.

Other benefits of imports are, in addition to exporting unpleasant manufacturing jobs, are that one also exports pollution, congestion and finite resource usage. This keeps the private domestic economy clean, uncongested and finite resources intact for another time. Again not something that one can catch in a purely mathematical flow model.

Qualitative v quantitative benefits.

Another point Steve tried to argue is that foreign trade outcomes is another form of money creation and he used Germany as an example. Germany does indeed have a big trade surplus and is indeed paying its government debt and private debt down. It is doing this tho with existing euros that it sucks out of the other European lands. Germany’s reserve balance goes up and its euro trading partners balances go down, the net number of euros in circulation stays the same overall. There is no money creation going on overall.

In fact, when Germany repays its government debt to the ECB\EU euros are destroyed and the net number of euros in circulation drops.

If someone as clever as Steve does not understand these concepts it is because MMT has not yet succeeded in communicating it as clearly as possible. Or that he has not read widely enough or often enough.

Warren is a genius.

“Why don’t you deal with questions in a civil manner?”

I am doing. The arrogance is on the other side assuming you know how the operations work, when what you say demonstrates you don’t. The underlying assumptions you are making mis-identify the control points in the system. Dynamically, reality doesn’t work like that. You’re looking at the horse from the wrong end and I’m trying to show you that.

If you want to make progress you need to unlearn what you think you know, and learn how the institutions interact dynamically. If you think you are here to school, not to learn, then you are wasting your time. Plenty of others have been and gone before you. We had them all: from gold bugs to anarchists.

When a bank marks up an account they create local money by discounting the foreign money. There is no exchange there. There is creation. Balance sheets have expanded. Whether they stay expanded depends upon the overall macro position between the entities and how they see the risk of holding the FX – which is the ‘savings desires’ that MMT talks about.

The currency movements are really driven by deposit takers adjusting their risk positions which will shrink balance sheets back down again. That’s the bit, I think, Steve Keen has missed – probably because his analysis is flat in the circuitist tradition, not the hierarchical layered view of money MMT takes.

The hierarchical view shows the central bank can undertake another layer of the same process, which can be used to push a mercantile political agenda and export-led policy.

However the causality is the other way around from what is classically stated. Financial entities hold FX assets so they can provide local entities with domestic money for domestic circulation. There is no borrowing, only saving as a kind of collateral.

“Ultimately, CBs can gang up in a market and swap currencies so the manipulation can continue.”

They could but often don’t – for example Argentina, and the famous UK ‘Black Wednesday’ in 1992. No ganging up there. So once again the evidence is against you. The MMT analysis demonstrates that selling foreign currency to keep your currency up is futile – since it puts a patsy in the market without ammunition and no guarantee any other central bank will ride to the rescue. Bretton Woods is dead and not coming back.

Far better to constitutionally bar the central bank from entering the foreign currency market and let the shorters die by the sword. It’s the other side’s job to stop their currency going too high, not yours to stop it going too low. Distributional consequences need to be handled on the real side (by suspending luxury imports for example), and you cannot rely upon a central bank cartel or a big hug club.

Accumulation of foreign currency can be seen as the waste product of export-led growth. Since export-led nations will accumulate foreign currency regardless, there is no need to pay foreign entities interest on government bonds, or likely any other asset – something MMT constantly points out. They are dynamically forced to hold those assets, or abandon the export led policy.

“Neil Wilson, I think you should write a blog piece somewhere – “how foreign exchange really works for MMTers” ”

I have such a thing planned, but I’m still not 100% sure I have all the control points identified and understood.

AIUI the PK position is that the central bank can be forced to intervene on the wrong side of the trade – i.e. can be forced by the market/political pressure to sell foreign currency and can therefore go ‘bust’.

My sense is that is just another example of the ‘must stop private capitalist entities going bust because jobs’ attitude.

Neil said:

“Plenty of others have been and gone before you. We had them all: from gold bugs to anarchists.”

Don’t doubt it, I can see the treatment they get.

And barely a whimper is raised in dissent by those that remain.

Hardly seems an intellectually healthy environment.

I can only presume that the true MMTers have sprinkled the blood of a lamb on their lintels, in appeasement of the Avenging Angel.

Neil,

“The hierarchical view shows the central bank can undertake another layer of the same process, which can be used to push a mercantile political agenda and export-led policy. ”

Can you elaborate on this?

Neil,

“They could but often don’t – for example Argentina, and the famous UK ‘Black Wednesday’ in 1992. No ganging up there. So once again the evidence is against you. ”

Go back to the 1960s and early 1970s and you will find plenty of evidence of CBs working together to defend currencies.

Neil,

“Financial entities hold FX assets so they can provide local entities with domestic money for domestic circulation.”

So how does this work?

Neil,

“When a bank marks up an account they create local money by discounting the foreign money. ”

Then the bank is no longer purely a dealer in foreign exchange – it’s taking a principle position. Is that correct?

That should be an “as principal position”.

The “exports are a loss and imports are a gain meme” sentence comes with a qualifier, at least in this post: for a sovereign country with an advanced economy. If you’re in the euroland or with an economy that would just take the imports and do nothing else, you don’t apply.

Sorry, copy&pasted the wrong quote. “exports are a loss and imports are a gain” is obviously what I meant.

Alan Longbon said:

“The Detroit car worker could become a well-paid fitness trainer in a federal government-funded health and fitness facility….”

Apparently, between 2000 and 2010, Michigan lost 800,000 workers, mainly because of a decline in the auto industry.

https://newrepublic.com/article/99822/michigan-unemployment-gm-chrysler-obama-auto-detroit-bailout

That’s a lot of fitness workers! Michigan would be the healthiest state in the Union under MMT.

exports are a loss and imports are a gain

No, this is not inverted logic or a meme, but a tautology, a definition. It is always true, everywhere. It is true on each transaction and true in the aggregate. “Export” and “lose” are synonyms as are “Import” and “gain”. There is no other way to think about things, to speak fundamentally about things reasonably, except this way. (Though of course there are many ways to rave insanely.) When you go to the supermarket and buy a tomato, you lose/export the money and gain/import the tomato. There is nothing different that happens in national and international economics.

Now lets suppose that people abide by the following rule: Whenever there is an excess of green over red exports, or red over green exports or imports or whatever depending on whether Punxsutawney Phil sees his shadow or not, we must sacrifice 16 virgins into a volcano.

If you wanted to gain fame and fortune as an economist (insane raver) you might write learned articles about how the green/ red export or import imbalance and the machinations of the diabolical Punxsutawney Phil “caused” that poor volcano to be clogged with virgins.

But if you wanted to talk like a rational human being, you would say that the virgin sacrifice rule was the cause and the export balance and the innocent groundhog actually had nothing to do with it.

Thinking or saying that exports can ever be anything but losses and imports ever anything but gains means somewhere you are assuming some kind of Punxsutawney Phil is sacrificing virgins rule and letting it distort everything you say. Or you are speaking in a very strange and obscure language, guaranteed to sow confusion.

Since Alfred Mitchell Innes great papers a century ago til now, MMTers have been pointing out inverted logic and language, how so many thinkers get things exactly backwards, reverse the directions of everything. So it is not surprising that people accustomed to hearing nothing but backwards statements think the straightforward ones are wrong at first.

I think Dr. Keen’s concern (something I think about as well) is that if your population is completely dependent on exports that they can’t make anything themselves then society is going to stagnate. Citizens just sitting on their butts waiting for foreigners to send them stuff. We will become a nation of consumers. Keen also supported entrepreneurship in the discussion, so I just trying to feel why he was saying what he said.

I can already think of many objections to what I have written above but I think my father would have the same concern. Its very taboo and incomprehensible for people to accept that foreigners are sending us stuff at a disadvantage (real goods being shipped out from their nation in exchange for fiat).

There is also this thinking that “lazy” people will get some punishment: if you don’t make this and that stuff yourself, then you will be begging in the future and you can’t blame anyone.

But all of that is assuming (not) free market of course where government/people play absolutely no role in what industry and stuff we support.

Agreed, Tom. Importing or exporting whatever might or might not be a good idea. A nation could get too low a price for its exports and pay too much for imports. (It is not true that real goods being shipped out from other nations in exchange for domestic fiat money is necessarily to their disadvantage though. “Fiat” money is valuable.) But the problems are not helped by inverted language and misidentifying the causes. If a nation lets other nations export unemployment to it by following “sound finance” “balanced budget” rules when it has trade or current account deficits, the problem is the “hey, let’s sacrifice virgins because it’s sound finance” rule, not the export-import etc.

Some Guy, it just isn’t that simple. At least in my perception. For whatever reason, I am reminded of Richard Pryor’s line- something like ‘Honey- I wasn’t cheating on you. Are you going to believe me or your lying eyes?’ The countries that have had export based industrial policies have seemed to do better for their people from my (maybe) lying eyes perspective. These start with the UK and run through the US, Germany, Japan, South Korea, and China. And I’m probably missing a bunch and mangling the economic history but there’s something there that does not agree with the exports are always a cost idea.

Some Guy,

Exports allow you to employ more people – or is that incorrect?

Imports direct income away from local production and employment – or is that incorrect?

Bill said:

“First, there was a denial that exports are a cost and imports are a benefit. That should be undeniable.

For an economy as a whole, imports represent a real benefit while exports are a real cost.

Exports mean that we have to give something real to foreigners that we could use ourselves – that is obviously an opportunity cost.

Imports represent foreigners giving us something real that they could use themselves but which we benefit from having. The opportunity cost is all theirs!

Thus, net imports means that a nation gets to enjoy a higher material living standard by consuming more goods and services than it produces for foreign consumption.

Further, even if a growing trade deficit is accompanied by currency depreciation, the real terms of trade are moving in favour of the trade deficit nation (its net imports are growing so that it is exporting relatively fewer goods relative to its imports).”

It seems to me this is mostly crazy perverse logic.

The more country A can produce surplus to its needs in a particular range of commodities the more it can purchase in a range of other commodities that are surplus to country B. And the more commodities from country B country A gets for its commodities, the better off country A is. Country A gets to consume commodities which it can acquire from country B which country B can produce more efficiently than country A. And vice versa for country B.

Henry @10:45, every single thing Bill said that you quoted seems to be true. Not a bit of it is crazy, or perverse logic, or wrong, as far as I can tell. It all makes sense but it does not agree with my perception of what the reality actually is. And maybe I am stupid or seriously uninformed, but I am going with my perceptions here. Maybe that means there are a lot of side benefits to building an exporting industry that aren’t being considered. Maybe it means Bill would always be right if the country under discussion was always at full employment. Stretching here but maybe there is some fallacy of composition when you add up all the reasonable things Bill said and try to make a conclusion from them. Or maybe I was just looking at the wrong end of the horse and got my head kicked 🙂

Henry Rech said: “The more country A can produce surplus to its needs in a particular range of commodities …”

Here’s an analysis by me, a total newb.

1. The meaning of both ‘cost’ and ‘benefit’ in an accounting sense is free of the emotions of that people associate with profit and loss. People are getting hung up on things that are really very simple accounting entities.

2. If a country is producing something ‘surplus to its needs’ then there’s a cost associated with that production. If you have a farm that’s producing more apples than can be immediately sold and consumed then you’ve a)devoted too much fertiliser, water and work to growing the surplus, resources that you could have used in the future for local consumption, which is a cost in real terms and b)have to find a way to recoup those costs in some way. Exporting surplus apples results in a financial benefit, at the cost of your fertiliser, water and work. You’d have to do a cost/benefit analysis to work out whether that was worthwhile.

Mark you have pointed out something for me at least! If a country is producing something surplus to its needs, yes there is probably a cost associated with that. But what if the investment to make the production possible in the first place would require production at a scale surplus to the needs of that particular country to make it worthwhile? So no trade equals no investment equals no production in that case. While the possibility of trading the surplus means the investment might be reasonable from a economic view and then if it happens the country gets a benefit. Even if the exports of the surplus are sold below cost and represent the real cost that Bill is talking about.

Thanks!

The point is everywhere we look we see countries exporting.

So if exporting was such a bad thing, why is everybody exporting?

I give up.

Think I’ll go and throw a few virgins into the volcano and see what happens.

Dear Jerry Brown,

Net exports trigger investment and this is the essence of the supermultiplier. I thought I have explained it clearly in one of the previous comments. Please look up for papers written by Marc Lavoie. One is “Convergence towards the

normal rate of capacity utilization in Kaleckian models: The role of non-capacity autonomous expenditures” but there are newer available – and some quite convincing econometric work by Fiebiger.

The economic system consisting of mostly the private sector has a tendency towards low capacity utilisation and creeping up unemployment. This is an empirical fact and has been explained by Keynes and Kalecki. I know that this violates Say’s law and all the mainstream general equilibrium theories. So what. The law and the theories are as good as the theory that the Earth is flat – anyone can see that it is flat (unless climbs a hill) – but true philosophers never climb hills. I would not attribute the creation of fiat currency and introduction of taxation as the root cause to the presence of unemployment. It is the phenomenon of hoarding assets which have zero or low elasticity of supply – by some agents, usually the richest. As Keynes stated, fiat money is one of these assets which has zero elasticity. Gold and similar objects have low elasticity, too. Hoarding is related to the presence of social classes not the introduction of money.

Autonomous non-capacity creating expenditures can drive the system towards full utilisation of capacities and trigger investment in productive capital via the investment accelerator mechanism. Autonomous non-capacity creating expenditures can be debt-financed household spending (residential real estate investment, debt-financed consumption), can be export surplus or can also be some forms of government spending generally not offset by taxation. It is important to distinguish between non-capacity creating expenditure (“consumption”) and capacity creating expenditure which is investment in productive capital.

The increase in aggregate demand triggered by export surplus working through the supermultiplier increases profits of the firms. In this context the statement that “exports are a cost” is false. Net exports bring enormous benefits to some capitalists and may enhance the well-being of the whole nation (which is related to a stock – the capital stock, increased by productive investment) despite the leakage of the flow of products abroad. This leakage is why looking from another perspective net exports are a cost to the whole economy – what was explained by Warren.

Now the key point. There might be special conditions such as the presence of a pre-existing stock of foreign debt which needs to be repaid or issues with the import-export propensities and Lerner-Marshall condition but in general stimulating the economy by running trade surpluses is not necessary if the missing aggregate demand can be created by running budget deficits. Some Post-Keynesian economists may reject this preposition but I am firmly convinced that money to finance extra demand can be created and spent by governments without serious side-effects – if it is done wisely and accompanied with proper taxation policies, discouraging unnecessary hoarding of financial assets, especially foreign currencies (what is a curse in Russia). In this case real products and services purchased by the government stay in the country – there is no point passing them to someone else. I believe this is what Warren really meant. There is no point to export cars to stimulate the economy if these people who make them can be employed doing something else for the benefit of the whole nation, the fiscally sovereign government can always afford doing this.

One may think that net exports stimulated internal competition, learning and transfer of technology to China. These would be secondary effects. This might well be true. It is interesting that the Chinese are not running huge trade surpluses against the rest of the world any more, they don’t need to – these enormous deficits killing the American industry is fake news spread by the former lover of Stormy Daniels. The real issue is closing the gap in the level of the technological development and overtaking the US as the strongest economy and trade wars won’t stop this as the Chinese leadership knows they can stimulate their economy without trade even if this is sub-optimal.

“..but true philosophers never climb hills..”

Yep, why spoil a good theory with facts.

“There is no point to export cars to stimulate the economy if these people who make them can be employed doing something else for the benefit of the whole nation”

So who decides what is of most benefit to the nation?

The point is, cars are exported. Why?

Dear Henry Rech,

I believe that Powell Memorandum explains why cars are exported and who decides. The Japanese were coerced into adopting certain policies. But the Chinese are “recalcitrant”.

Adam K,

What about the US, the Germans, the French, the British, the Koreans, the Czech etc. etc. etc.?

Below are the 15 countries that exported the highest dollar value worth of cars in 2016 (88% of total):

Germany: US$151.9 billion (21.8% of total car exports)

Japan: $91.9 billion (13.2%)

United States: $53.8 billion (7.7%)

Canada: $48.8 billion (7%)

United Kingdom: $41.3 billion (5.9%)

South Korea: $37.5 billion (5.4%)

Spain: $35.6 billion (5.1%)

Mexico: $31.4 billion (4.5%)

Belgium: $30.3 billion (4.3%)

Czech Republic: $18.8 billion (2.7%)

France: $18.4 billion (2.6%)

Slovakia: $15.5 billion (2.2%)

Italy: $15.2 billion (2.2%)

Thailand: $11.6 billion (1.7%)

Hungary: $11.1 billion (1.6%)

Total of all countries in 2016, almost US$700billion.

http://www.worldstopexports.com/car-exports-country/

US$700billion of bad economic activity?! Why would all these countries indulge in bad economic activity to this extent?

Is this just neoliberal fake news?

Dear Henry Rech,

And why Wasyl Konstanty Ostrogski (the richest Polish or rather Ruthenian/Ukrainian magnate of the early 16th century) owned 1300 villages, 100 towns and castles, about 2.5 million acres of land and thousands of serfs? His wealth was estimated to be 200% of the whole GDP of Poland when he died. (source “Przy nich Kulczyk był biedakiem! Jak bardzo zamożni byli polscy magnaci?”, A. Węgłowski ) What was the macroeconomic sense of all of this?

And you know what happened in 1648, who was murdered by whom? What was the sense of all of this?

Have you ever been to Czechia? I remember when I first went there they had a lot of monuments “Se Sovetskym Svazem na vecne casy a nikdy jinak” (you can Google it up). These have been replaced by something else. With whom are they “forever and never otherwise” now? They are actually the smartest of all the Slavs. The Czechs fit in, they have the most rational culture. I loved Czechia even when I had really bad time there on business trips in the 1990s.

Why would they run trade surpluses then? Because these are the rules of the game – they cannot easily modify them but they haven’t lost 5% (Poland) or 7% (Romania) of population due to emigration of “guest workers” to the UK/Italy/Spain.

Regarding the Germans I think that this subject has been thoroughly explained on the main blog.

The main point is that these constraints which apply in the EU are political not economic.

Recapping what Keene said to spark off this interesting discussion.

He considers that money is created in the export process and that MMT does not account for this.

From the discussion (particularly Neil’s contributions) it seems that money is sometimes/often created in association with export activity, but that MMT does in fact account for this.

Firstly the reserve bank may directly intervene in forex markets to drive down the currency in support of export incomes.

Secondly commercial banks may issue credit in return for forex assets.

Keene seems correct in aggregate in the context of the whole export lead economy paradigm. Since foreigners must start with a finite amount of domestic currency, we can only export a finite amount before they run out of our currency to pay us with. (Ignoring a program of selling for continually smaller fractions of cents)

To keep export surpluses running year after year, we would have to print money to inject into the process at some point. The mechanisms described above are the methods of choice at the moment?

Looks to me that reserve bank intervention should only be allowed to dampen forex market fluctuations and long term build ups of foreign currency holdings should really be treated like any other government subsidy.

The mechanism for banks to issue credit in return for foreign currency just looks like a failure of accountancy standards. Why can’t a domestic bank cartel just pass a parcel of foreign currency around ad nauseam to run up arbitrary amounts of credit? I guess there is nothing special about the foreign currency asset in this scenario either. Yuck.

I note dually that nations seeking long term prosperity in an import lead economy would also have to continually inject money into the import sector. The willingness of neoliberals to inject money into the export sector and not into the import sector seems to be at the root of the industrial stagnation problems in net importers.

Export workers may feel proud and import non-workers may feel ashamed, but they are both getting a pretty raw deal courtesy of their government’s policies.

Neil Wilson

Wednesday, May 9, 2018 at 17:57

“When a bank marks up an account they create local money by discounting the foreign money.”

I’m afraid I’m a bit behind with all this as I have other more pressing things to attend to, but if you are still monitoring this thread I wonder if you would be kind enough to elaborate on that statement as I am not sure I understand what you mean by “discounting”.

correction – I translated incorrectly, this guy wasn’t that rich

His wealth was estimated to be 200% of the whole budget of Poland when he died

Jerry Brown,

You said:

“…..every single thing Bill said that you quoted seems to be true…..”

And Bill said:

“Exports mean that we have to give something real to foreigners that we could use ourselves”