With an national election approaching in Japan (February 8, 2026), there has been a lot…

Trade and finance mysteries – Part 2

I was running late yesterday and the blog post was already rather long so I left some matters concerning central banks for today. The question we address briefly today is what is the role of central banks in all these trade transactions. Does an export surplus country face an ever increasing money supply as central banks provide the counterparty service to traders who sell in a foreign currency but want their own currency (such as a manufacturer who incurs costs in say Yen but sales revenue in $AUD – as per our example yesterday)? There appears to be confusion on that front as well. So while I am not typically going to write a detailed blog post on a Wednesday, in the interests of continuity, here is Part 2 of the series on trade and currencies.

In this blog post – Do current account deficits matter? – I explained some of the central bank operations that occur in this regard.

One should immediately understand that under a flexible exchange rate system, monetary policy is freed from defending some fixed parity through ‘official intervention’ (buying and selling currencies in the foreign exchange market).

Under flexible exchange rates, the sovereign government can make use of this expanded policy space to pursue economic growth and rising living standards even if this means expansion of the current account deficit (CAD) and depreciation of the currency.

The foreign adjustment is then accomplished by the daily variations in the exchange rate.

Please read my blog – Gold standard and fixed exchange rates – myths that still prevail – for more discussion on the differences between monetary systems.

While there is no such thing as a balance of payments growth constraint in a flexible exchange economy in the same way as exists in a fixed exchange rate world, the external balance still has implications for foreign reserve holdings via the level of external debt held by the public and private sector.

Further, if the central bank is still engaging in official intervention in a flexible exchange rate regime then it is aiming to manipulate the currency value in some way. There is no other reason for such intervention.

Sterilisation enters the scene here as well. It is often erroneously thought that financial inflows (corresponding to the CAD) via the capital account of the Balance of Payments boost commercial bank reserves. Mainstream economists who operate within the defunct money multiplier paradigm think this might be inflationary because it will stimulate bank credit creation.

The flawed logic is – increased bank reserves -> increased capacity to lend -> increased credit -> excess aggregate demand -> inflation.

You might like to read the following blogs – Money multiplier and other myths – Building bank reserves will not expand credit and Building bank reserves is not inflationary – to understand why that is totally at odds with the way the credit creation system operates.

The mainstream claim is that the central bank can ‘sterilise’ (drain) this impact by selling government debt via open market operations. However, if there is excess capacity in the economy, the central bank might refrain from sterilising and allow aggregate demand to expand.

I showed yesterday that no such increase occurs from a macroeconomic perspective.

Think about what a CAD actually means. I always argue that it is essential to understand the relationship between the government and non-government sector first. A common retort is that this blurs the private domestic and foreign sectors. My comeback is that the transactions within the non-government sector are largely distributional (as I also showed yesterday), which doesn’t make them unimportant, but which means you don’t learn anything new about the process net financial asset creation.

In the case of CAD, what mostly happens is that local currency bank deposits held say by Australians are transferred into local currency bank deposits held by foreigners.

If the Australian and the foreigner use the same bank, then the reserves will not even move banks – a transfer occurs between the Australian’s account in say Sydney, to the foreigner’s account with the same bank in say Tokyo.

The point is that the AUD never leaves ‘Australia’ no matter who is holding it or where. The same goes for the USD and all the fiat currencies.

If the transactions span different banks, the central bank just debits and credits, respectively, the reserve accounts of the two banks and the reserves move.

What happens next depends on the approach the commercial banks take to the reserve positions. We know that excess reserves put downwards pressure on overnight interest rates and may compromise the rate targetted by the central bank.

The only way the central bank can maintain control over its target rate and curtail the interbank competition over reserve positions is to offer an interest-bearing financial asset to the banking system (government debt instrument) and thus drain the excess reserves.

So sterilisation in this case merely reflects the desire of the central bank to maintain a particular target interest rate and is not discretionary. The alternative is to offer a return on excess returns equivalent to the target rate.

An important point to understand is, to repeat, that in a trade transaction the sale currency never ‘leaves’ the country which is importing.

Sure enough, a foreign holder of a USD income stream can, ultimately, only realise these holdings by buying goods and services (or assets) denominated in US dollars.

Unless they enter the foreign exchange market, which we analysed yesterday.

Currency manipulation under flexible exchange rates

During the fixed exchange rate period (Bretton Woods) between 1945 to 1971, the German Bundesbank, for example, regularly engaged in official intervention to keep the value of the Deutsche mark low so as to maintain the competitiveness of its industrial export sector.

It would accumulate foreign exchange reserves by selling the mark when there was excessive upward pressure on its exchange parity.

The Deutsche Mark was also often pushed up in value by speculators in the currency markets, who were betting that the US dollar, the Italian lira and the French franc were overvalued.

In these situations, the Bundesbank was forced to sell marks and buy other currencies (principally US dollars), which pushed more marks into circulation.

This was seen as placing a constraint on its capacity to achieve certain growth rates in the money supply and forced the Bank to engage in offsetting policy initiatives – that is, ‘sterilisation’ – which relates to the goal of insulating domestic monetary developments from those associated with the central bank’s defense of the exchange rate.

In this situation, for example, the Bundesbank could reduce the supply of loans it provides to banks in need of reserves to offset its sale of Deutsche marks in the international currency markets.

The problem for the Bundesbank was that this intervention came up against their obsession with inflation and so they were torn between maintaining as lower a mark value that was allowed under the Bretton Woods arrangements and maintaining a check on the flow of marks into the economy.

They often erred on the side of the latter concern and forced central banks in the US, France and Italy (among others) to take the burden of foreign exchange adjustment to maintain the parities.

This was a major reason the post-Bretton Woods European Monetary System arrangements did not promote currency stability.

Once Germany surrendered its currency and joined the Eurozone, the adjustments to maintain competitiveness had to come from manipulating domestic prices and wage costs because the Bundesbank no longer had direct control over the exchange rate.

Hence, in the early years of the EMU, we saw the draconian Hartz reforms introduced in Germany.

Now jump into the modern day and consider the case of two nations both with, ostensibly, floating exchange rates: China and Japan.

In yesterday’s example, I used the case of a Japanese car manufacturer offering their products for sale via a dealer network in Australia (which may or may not be owned by the car manufacturer) to Australian consumers.

The sale price was in $AUD yet the manufacturer invoiced the dealership in yen.

There were two options:

1. The car dealer after deducting their $AUD costs and markup would enter the foreign exchange market, exchange the left over $AUD sale price for yen, and arrange for those yen funds to be paid into the bank of the car manufacturer (which might be in Japan or somewhere else – but accounts in yen).

2. The car manufacturer decides to keep the sales revenue in $AUD either in a deposit account or in some other financial or real asset.

The second option might involve the car manufacturer re-investing its profits (as FDI) into a local assembly or design plant, for example.

In both cases, as they stand, the volume of yen and $AUD in the respective financial systems did not change, merely the ownership of those financial assets.

Now consider Option 1 in the context of a central bank that is actively engaged in currency manipulation – an accusation that has been levelled at various times against the Chinese government and its People’s Bank of China.

The central bank is unlikely to be the initial counterparty in the foreign exchange transaction between the car dealer and the initial holder of yen balances.

In this scenario though, the export surplus nation, under flexible exchange rates will be facing upward pressure on its exchange rate, which, other things equal, reduces its real exchange rate and hence its international competitiveness.

Why is that so?

Think about the operations of the foreign exchange market.

Exchange rates are determined by the supply of and the demand for currencies in the world foreign exchange markets, which could be the local bank foreign currency desk or elsewhere, like a train station kiosk in a city where travellers meet.

The supply of and demand for currencies are in turn linked to trade and capital flows between countries.

Consider the supply of Australian dollars to the foreign exchange market. When Australian residents buy foreign goods (imports), buy foreign assets or lend abroad, they need to purchase the relevant foreign currencies in which the transaction is denominated. To buy the currency they desire, they supply $AUDs in exchange.

Alternatively, on the demand side, when foreigners buy Australian goods and services (exports) and/or Australian financial assets they require $AUD. They purchase them in the forex market by supplying their own currency in exchange.

If there is an excess demand for $AUD then there is pressure for the $AUD to appreciate in price relative to other currencies.

If there is an excess supply of $AUD, the $AUD depreciates and one unit of foreign currency buys more $AUD, so the exchange rate increases.

These changes in the exchange rate work to resolve the supply and demand imbalance but with time lags.

In the case of an depreciation in the Australian dollar, the foreign price of Australian exports is now lower (less yen required to purchase a given $AUD priced good), and with export demand varying inversely with price (by assumption), the demand for exports and hence $AUD’s rises.

Assuming a fixed import price in the foreign currency, the $AUD price of imports rises whiich reduces the quantity demanded.

While most currencies float freely against each other, at times the central bank will enter the foreign exchange markets as a buyer or seller of the local currency as a means of influencing the parity determined in that market.

This is called Official intervention.

So for export surplus nations, the central bank may see it is in the interests of their industrial exporters to engage in some currency manipulation – that is, sell its currency into the foreign exchange markets and purchase targetted foreign currencies (perhaps to improve bi-lateral real exchange rates against major trading partners).

In doing so, the central bank will accumulate foreign reserves and the base money stock will rise. Mainstream economists claimed that would be inflationary because they erroneously believed in the operations of the money multiplier.

Please read my blog post – Money multiplier and other myths (April 21, 2009) – for more discussion on this point.

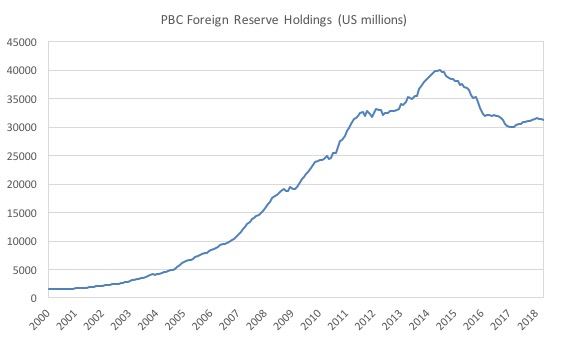

Consider the first graph which shows the foreign exchange reserves held by the The People’s Bank of China from January 2000 to April 2018 (the units are $USD millions).

Between 1950 and 1990, the average was $US14.4 million, after which the holdings steadily rose until the early 2000s, when the PBC started accumulating foreign reserves in large volumes.

More recently, it has been selling them off again.

The next graph shows China’s current account balance as a percent of GDP 1997 to 2017. In the lead up to the GFC, China’s current account surplus rose substantially only to return to levels below 2 per cent of GDP.

Relative to Germany, China does not have a large external surplus.

But prior to the crisis, the huge external surpluses were placing upward pressure on the Chinese currency as is shown in the next graph.

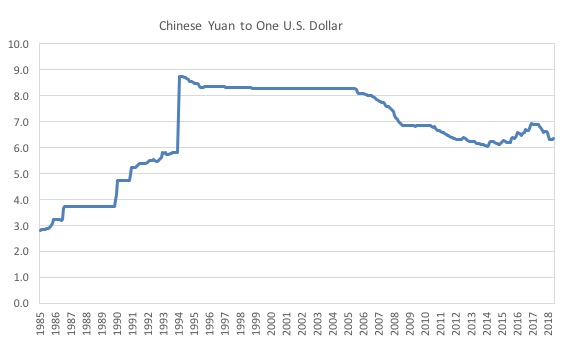

The following graph shows the movement in the Chinese yuan (to one US Dollar) from January 1985 to April 2018.

The 50 per cent devaluation in December 1993 is obvious. This was when China unified its dual exchange rate system and aligned its official and swap centre rates as part of its so-called take-up of the ‘socialist market economy’.

It devalued by 33 percent overnight to 8.7 to the dollar and then allowed the market to take the yuan further down.

In 2005, the PBC stated that it was shifting to a “a managed floating exchange rate based on market supply and demand with reference to a basket of currencies”.

This pushed the value up against the USD.

The flat section during the GFC followed the PBC pegging the currency against the USD to insulate the Chinese economy from the GFC.

This led to allegations that the PBC was manipulating the value of the yuan against the USD to favour China’s exporters.

There was no definitive conclusion though because there was widespread disagreement as to whether the yuan was overvalued or undervalued.

But, with international pressure rising, China entered a period of appreciation from 2010 came with the PBC announcing that it was ending the peg and allowing some ‘flexibility’ into the yuan.

In February 2012, the yuan appreciated to 6.2884 which was a record high level for the currency.

The value then eased only to begin a new phase of appreciation in 2017.

I put together the exchange rate time series with the build up of foreign exchange reserves at the PBC (using monthly data) to show you the relationship (if any).

During the GFC, when the PBC pegged the rate against the US dollar, the build up of foreign currency reserves accelerates.

Prior to that foreign exchange reserves were increasing significantly even though the yuan was appreciating. The point is that the Chinese government was containing that appreciation in some orderly way through official intervention.

Note that the depreciation that became in 2014 was accompanied by a sell off of foreign exchange reserves.

Finally, consider the next graph which shows the relationship between China’s current account balance and the stock of foreign reserves held by the PBC.

The lower part of the graph starts in 1997 and shows the rising current account surplus with a rising stock of foreign exchange reserves.

As the current account has returned to much lower values, the foreign exchange reserves continued to rise.

In other words, there is nothing unidirectional about this relationship. It all comes down to whether the central bank chooses to manipulate its currency in international markets or not.

Now consider Japan.

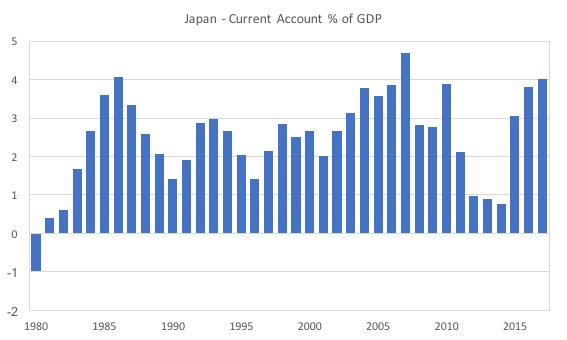

The first graph shows its current account balance as a percent of GDP from 1980 to 2017. It averaged 2.47 per cent over that period.

Relative to China, Japan runs a significantly larger external surplus.

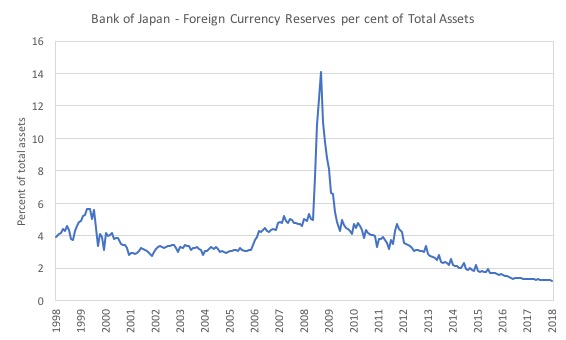

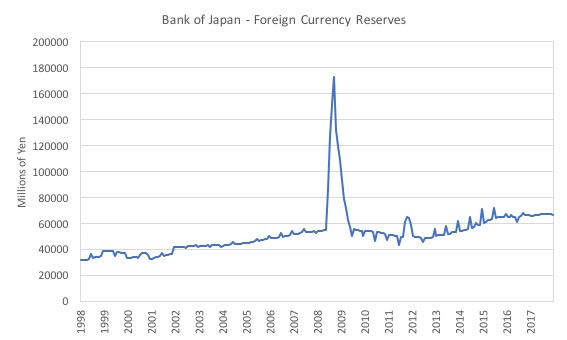

Now here is a graph of foreign currency reserves (millions of yen) held at the Bank of Japan. The spike occurred during the GFC when the Bank was taking extraordinary steps to help its export sector.

There has been hardly any trend increase over the 20 odd years shown.

And as a percentage of total Bank of Japan assets, foreign currency reserves have been very stable and since the recovery period have been falling.

Conclusion

The point is that there is no consistent relationship between external surpluses and the holdings or changes in holdings of foreign exchange reserves at the central bank.

Clearly, if a central bank is engaging in currency manipulating to try to reduce the currency effects of current account surplus then it will be increasing the monetary base.

But Japan shows that that is not an inevitable outcome of external surpluses on the current account.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

“In these situations, the Bundesbank was forced to buy marks and sell other currencies (principally US dollars), which pushed more marks into circulation.”

Other way around from the Bundesbank point of view? bought dollars and discounted them into marks.

Bill,

I would appreciate your view on the coming conflict between the Petrodollar and the gold backed Petroyuan.

What do you expect the consequences are for the Global economic system.

Dear Neil Wilson (at 2018/05/09 at 6:47 pm)

Yes. A typo-thinking-too-fast-without-enough-time-variety.

Thanks very much.

best wishes

bill

Dear Bill

If a country keeps running current-account deficits, then more and more of that deficit will be used to pay investment income to foreigners, not to import. Let’s illustrate this. Ruritania runs a CAD of 50 billion every year. Let’s further assume that the return on assets held by foreigners is 4%.

Year….CAD….import surplus..investment income

1………50………..50…………….0

2………50………..48……………-2

3……….50……….46……………-4

10……..50……….32……………-18

20……..50……….12……………-38

26……..50………..0…………….-50

30……..50……….-8…………….-58

In year 26, the entire CAD has to be used to pay investment income to foreigners. After that, Ruritania has to run an export surplus to pay for all the investment income earned by foreigners.

The rate of exchange is not only determined by trade flows but also by differences in the interest rates. If country A has higher interest rates and higher inflation than country B, then the currency of country A may well appreciate because of short-term investors taking advantage of its higher interest rates, even though it should be depreciating because of its higher inflation rate. If we want flexible exchange rates, we should couple that policy with rigid control on short-term capital flows to prevent that the exchange rate of a country will move in the wrong direction.

Regards. James

This feels dumb, but can I assume that central banks all have accounts with each other to implement their foreign-currency holdings? That PBOC’s US$ holdings are held at an account at the FED, as the Bundesbanks US$ holdings are and used to be? This would place the FED as the ultimate arbiter of who owns US$ and who doesn’t, the PBOC as the ultimate arbiter of who owns Yuan and who doesn’t, etc.

James,

Import income is spent. You have assumed it is all saved. If it is saved, then you just accommodate it as you do with all savings.

To get 4% on the assets, the assets have to sell something to somebody, or the assets are financial in the denomination of the currency in which case they can just be created.

But since the exporter will save anyway, you just don’t need to pay them interest.

Dear Prof. Mitchell,

I understand your points from this 2 part series. But, how can they be applied to a country such is Serbia ( or any other smaller country for that matter), which is not part of EU yet, but has CAD and about 15 billion Euro nominated debt. How do we propose MMT solution in such situation?

“So for export surplus nations, the central bank may see it is in the interests of their industrial exporters to engage in some currency manipulation – that is, sell its currency into the foreign exchange markets and purchase targetted foreign currencies (perhaps to improve bi-lateral real exchange rates against major trading partners).

In doing so, the central bank will accumulate foreign reserves and the base money stock will rise. ”

So whether or not the central bank of the export surplus country will accommodate the interests of the exporting companies seems to depend on whether that is what they want to do. They might or they might not seems to be the best answer. And every country seems to have a semblance of industrial policy, even if they say they don’t. I know the US does at least- we kept General Motors and Chrysler in business and always keep our weapons manufacturers in business. And the freaking banks, although its a stretch to call that an industry.

Just looking at the world during my lifetime, it still is not obvious to me that a competently run exporting based industrial policy imposes a net cost to the people of that country. I suppose in a world where domestic demand was always maintained at the proper level then exports would represent a total overall cost. But that cost would be balanced by the benefits of whatever was imported.

Well I asked a question yesterday and definitely got some responses, including this post, (not that I assume it was directed at me, but thanks Bill) and I thank Adam, Henry, and Neil for helping. Btw Neil, which end of the horse should we be looking at? I think its always safer to stay a distance from them, they are pretty big creatures…

Thanks you so much for this article. I have always found foreign sector hard to understand in terms of the mmt perspective.

Thanks Bill for these great blogs.

You can clearly see from the data that levels of central bank forex reserves in China and Japan are not directly correlated with the level of the trade surplus.

Official intervention does occur (“off balance fiscal deficit” as Mosler called it in the debate) but it is a policy choice not an automatic occurrence (which I think Keen sort of suggested).

“and about 15 billion Euro nominated debt”

Who owes the Euro denominated debt?

If it is privately owned, and they have no insufficient Euro denominated income to service it, then you pre-pack those firms via an administration process and re-finance them in Dinar via the central bank. That then sends the losses to the foreign lenders via the bankruptcy process.

If it is sovereign debt, then the nation has borrowed in a foreign currency, which makes it less of a country and more of a colony. The first job is to stop issuing Euro denominated sovereign debt, and the next is to tax exports sufficiently to recover enough Euros to eliminate the debt. You need exporters to have to swap into Dinar, and you need importers to pay in Dinar so that foreign entities will tend to hold it to keep their sales channel open.

A useful trick may be to require all invoices into Serbia to be priced in Dinar and settled in Dinar. Switched on exporters to Serbia know that local currency invoices increase sales. The state can force that issue – which pushes the FX cost onto those exporting to Serbia – and hopefully they won’t bother. Rationally such a move shouldn’t change anything since you’re not eliminating anything, just moving it. However in a world with humans in it, it probably will. Prices will tend to be sticky in the denomination invoices are issued in.

“it still is not obvious to me that a competently run exporting based industrial policy imposes a net cost to the people of that country.”

Perhaps time to visit the old East Germany, where “Alternative Fuer Deutschland” is on the rise.

If you are exporting, you are relying upon stealing demand from other nations. So you are imposing a net cost on those other nations by draining their monetary circulations. Which works until the net importing nations discover MMT and implement monetary accommodation policies. Then you’ll find the net importing nations suddenly have a much higher standard of living than you do – largely because you are providing it for them via vendor financing.

As far as i understand if a country has a cad reserves are drained which will bring a situation where there will be an upward pressure on interest rate and thus if the central bank do not wish the interest rate to float they will have or to engage in open market operations or to allow indirect money creation via repos.

Am I incorrect to say that regardless of any exchange value arbitrarily placed on a currency by the present international financial regime and their monetary paradigm of Debt Only, that if one could somehow reduce prices via digital policies and so simultaneously increase individual purchasing power….that their valuation “system” would effectively be transcended?

Daniel,

I will not try and fail to say something economically correct, instead I’ll just say recent posts imply the government (including the CB) can set the rate at whatever it wants with the right operations.

Jerry Brown,

I am not sure if what I am about to write helps in judging the vlaue of running constant export surpluses or not. It has been pointed out that exports are a net loss. Yes from an accounting perspective that is certianly true. But this loss is only momentary. The fiat currency that was gained in the transaction can then be, and mostly will be used to buy real goods and services.

Germans export autos. Then they import Japanese autos, chinese computers, Spanish strawberries,

and go on vacations everywhere.

Couid they do this if they did not run an export surplus? I guess so, as long as people elsewhere are willing to accept the Euro for payment, at least indirectly. It was pointed out in part one of this series that unemployed Michigan auto workers could be given new jobs, for example working as fitness trainers for those lucky enough still to have a job. Then I think that it was Henry who pointed out that Michigan would certianly be the healthies state with 800,000 fitness workers.

I to am greatly troubled by the international implications of mmt. The USA has huge amounts of valuable real estate. I mean land that rain actually falls on not a giant desert. Therefore it seems to me that the US Dollar is actually backed by US real estate and that will keep US Dollars valuable to a the time that global warming has reached such a point that food can not be grown even in the USA. How far off do you think that is, centuries or decades? Anyways that means that the USA is sitting on something far more valuable than a gold mine.

Conventinal wisdom is that is something that the US government should take full advantage of.

To me that seems like stepping on the necks of the world’s most vulnerable.

If I had to break the necks of 10 vulnerable people to save my daughters life I would do it in an instant. But by the time I got to the 11th I think that the thought would cross my mind, hey wait a second how much longer am I going to continue like this.

Neil Wilson @15:01 “If you are exporting, you are relying upon stealing demand from other nations. So you are imposing a net cost on those other nations…”

That is a good description of how I always looked at the situation before reading Bill Mitchell and MMT. And it probably still describes what I think now, but with much less certainty on my part for sure.

But it is not compatible with the imports always being a positive for the importing country, or exports always being a cost to the exporting country that this post and the last post are describing (I think).

“Which works until the net importing nations discover MMT and implement monetary accommodation policies”. Which kind of implies that, at the present time, that policy still works. Until. ‘Until’ has not happened yet, which as a MMT fan, I find very unfortunate and distressing. But perhaps it may be one of the sources of my genuine confusion on this subject at this time, as in until some countries actually act like they understand MMT. Which actually makes me feel better about being confused.

So Thanks!

Neil said:

“If you are exporting, you are relying upon stealing demand from other nations.”

Why not say you are providing them with goods and services they want?

Are they forced to buy your exports?

Why would they willingly buy your exports if it is a theft of something they have (whatever it might be)?

Thanks Curt. Obviously, I remain unconvinced by this series on this issue, but am at a loss as to exactly why and really have no basis to argue past what was already written (not that it ever stopped me before). But on the brighter side of things, I am not worried that foreign exporters are going to buy up US farmland so that we starve :). Even if they wanted to do that, the land remains in the US and subject to US law. Which is still responsive enough to the people to avoid some tragedy like the Irish potato famine. Climate change is worrisome though. But President Trump is going to make America great again or something like that and I suppose that includes the climate.

Dear All

Francisco J Flores has commented that:

He has an argument to support that.

I disagree with his conclusion that we have glossed over all this. I made it clear in my Part 2 blog post what would happen if the central bank in the foreign nation became the counterparty (not directly but through its operations in the markets).

Anyway, to avoid a complex set of interactions (like when he contested the view that ‘taxes don’t fund anything’) I decided not to publish all his arguments.

But in fairness he has a Home Page where he sets out his arguments.

http://mmt-inbulletpoints.blogspot.com/2018/04/the-kids-are-not-alright-truth-about.html

best wishes

bill

Professor: Judging from the back and forth above, there seems to be wide disagreements and discussion on the topic, which I certainly haven’t contributed to. So why don’t you address the questions in short pithy answers:

1) How did China and Japan accumulate trillions of US dollars? Was this all Central Bank intervention in an effort to keep their currencies weaker?

2) I’m not clear on this: so a bank account in the US owned by a foreigner, is that a Net Financial Asset?

3) Per Godley’s sector analysis: 1) Govt, 2) Non Govt, & 3) Foreign? Doesn’t the Foreign Sector deficit (plus the Private sector surplus) exactly offset the Govt Deficit? So foreign Govt Dollar purchases is driving this- making the formula stay true? If Foreign CB’s didn’t intervene, The Foreign Sector would be much smaller? So then what would offset the large Govt Deficit to make the Sectoral Balance —> balance.

Thanx, Francisco

Dear jerry,

It was not my intention to imply that Americans would starve because the Chinese and Germans own American Farm Land. It was my intention to say that US Dollars will be desired not only because Americans need Dollars to pay thier taxes but in addition outsiders need it to buy American Real Estate which will be valuable until the end of humanity.

For a long time I have been troubled by Americans making data entries and buying the world’s resources with this easily created money. Yet if the world accepts it and uses it for further trades how can I say that any nation, company, or person has suffered as a result. Well except in hte sense that it is rich capitalists determining what get produced. But that is not the fault of fiat money.

So i have been wondering why the rest of the world allows the USA this leading position when many nations have an equivilent power. So right now I am guessing this is where the World Bank and the International Monetary Fund come in. These must be the institutions which insure that world trade remains a global circus. Rather than a situation in which Germany and Europe break their strategic alliance with the USA and form a new strategic alliance that would be with Russia, China, India, and Africa to punish the USA for its wars of aggression and for being an unrealable partner in fighting climate change.

I would think that there is enough talent in Germany, Russia, China, India, and Africa that if these countries worked together they could force the USA back in to the western hempisphere where it would have to make due with the resources of one continent rather than using one whole planet as if it had the carrying capacity of four planets.

The dream of such an alliance is NOT the part of a plan to create a “Aquarian” Utopia. But it could accidently be the first step on a scenic tour in that direction.

Francisco,

It is far easier to see what is going on once you realise there is little functional difference between somebody holding Sterling in London, Ontario and London, England. When you do that you become part of the Sterling currency zone.

Similarly there is little difference between somebody holding US dollars in Cambridge, England and Cambridge, Massachusetts. They have both become part of the US dollar currency zone.

There are entities all over the world that sit with a leg in multiple currency zones.

The confusion arises because national accounts are drawn up to country borders, rather than around holdings in a denomination. And accounts are in a reporting currency which has the effect of *converting* holdings for reporting purposes into the reporting currency – whereas in reality they cannot be converted, only exchanged.

In a floating rate system, ignore the foreign sector and instead track the institutional entities as they drop in and out of currency zones.

Once you do that you see that saving is just saving and it has the same effect of denying somebody else an income wherever it is held. And therefore it either has to be accommodated or confiscated to maintain demand.

Neil,

I have a question. Does money really ever sit idle? If so what percent of money sits around idle?

I used to think that the answer was near zero. I had this idea that the banks loaned out our deposits and therefore money never sat idle even when it was saved because if it was saved in a bank and not a matress or basement the money would quickly get spent by the bank. Now that I know that the banks do not need our money to make loans I can see how some money might sit idle. But would this not be a pretty small percent in the grand scheme of things?

Wait Wait just a minute maybe I should think before I write. We make a house payment every month. Could it be said that money that goes towards the principle of what I owe on our house is sitting idle? Are we contributing to unemployment by building equity in our home and not borrowing against that equity at low intrest to take a vacation abroad or even better to purchase a vending machine that will sell popsicles to thristy children at the town pool?

I guess what I am getting at is saving just saving or saving just investing? Do I need to take out a loan against the equity in my house to call it investing or can I call it investing in the future of the neighborhood if I just build up my home equity? It is true that this question kind of gets off track of the domestic and foreign sector balances thing. I think that I can bring it back to that question though by asking should the people of one country be allowed to have more fiat money per capita than the people of another country with which to work out their investment (and consumption) strategies?

Neil said:

“Once you do that you see that saving is just saving and it has the same effect of denying somebody else an income wherever it is held.”

This is the problem with thinking in terms of ex post sectoral balances.

Saving is an accounting fiction. It is not real in and of itself. You can’t see saving per se stacked up in a warehouse somewhere. (Although saving can represent changes in inventory, which can end up in a warehouse.)

Saving, by definition, is that part of income flow that is not consumed but is either income flow comprised of investment goods, government goods or foreign traded goods.

Saving represents a change in the composition of income flow.

There is no denying someone of an income.

Dear Francisco J Flores (at 2018/05/11 at 2:16 pm)

1. You asked “1) How did China and Japan accumulate trillions of US dollars? Was this all Central Bank intervention in an effort to keep their currencies weaker?”

In various ways. Read earlier IMF and BIS annual reports and you will see some of it (particularly BOJ) is a legacy of the earlier fixed exchange rate system. More recently, with floating rates, it has to be related to managing the float – which some might call currency manipulation.

2. “so a bank account in the US owned by a foreigner, is that a Net Financial Asset?” It is a financial asset. And it may have come about because the ‘foreigner’ was selling their products (exports) for USD to a USD citizen – and the financial assets just changed ownership. Nothing net would have been created in that case.

3. You said:

Accounting statement is correct.

But it doesn’t have to be “foreign Govt Dollar purchases” that are the financial flows (on the capital account) that are accompanying the current account deficit. Private domestic sector entities in foreign countries clearly hold financial claims in other countries.

best wishes

bill

Wikipedia tells us that:

The term “capital account” is also used in the narrower sense that excludes central bank foreign exchange market operations: Sometimes the reserve account is classified as “below the line” and so not reported as part of the capital account.[4]

Expressed with the broader meaning for the capital account, the BoP identity states that any current account surplus will be balanced by a capital account deficit of equal size – or alternatively a current account deficit will be balanced by a corresponding capital account surplus:

current account + broadly defined capital account + balancing item=0.

The balancing item, which may be positive or negative, is simply an amount that accounts for any statistical errors and assures that the current and capital accounts sum to zero.

https://en.wikipedia.org/wiki/Balance_of_payments#Components

So, majority of the deviations between developments of CAB and reserve balances can probably be explained by changes in the capital account balance, especially because, to my knowledge, capital account flows are much larger than current account.

Then there are entities like China Investment Corporation, which drain official reserves and convert them into other assets.

“As of 2007, the People’s Republic of China has US$1.4 trillion in currency reserves,[3] while this had grown by 2013 to US$3.44 trillion.[2] The China Investment Corporation was established with the intent of utilizing these reserves for the benefit of the state, modeled according to Temasek Holdings of Singapore.

At the end of 2015, the CIC had over US$810 billion in assets under management.”

https://en.wikipedia.org/wiki/China_Investment_Corporation

So it gets rather complicated.

Bill. Here’s a question for you. “in a trade transaction the sale currency never leaves the country which is importing.” “A holder of usd income stream can only realize these holdings by buying goods and services denominated in us dollars.” Dollars must be leaving the country. Isn’t it true that many places in the world the population uses or accepts dollars as payment for goods and services? The dollar would be considered a hard currency. If I grew coffee in a central american country I might insist on being paid in dollars for coffee I had someone sell for me here. My employees might want that too.

We would want the cash.

Bill. Another question. Isn’t there truth to the Triffin Dilemma? If foreign wealth and power, more fully subjugating and subordinating its’ population, floods this country with its savings, buying all the real and financial assets it can, couldn’t we end up sharecroppers, a colony, working on property owned by individuals living somewhere else?

Dear Yok (at 2018/05/19 at 5:20 am)

You concluded:

I have some euros and British pounds and US dollars and a whole heap of other currencies (usually a few small denomination notes) that arise when I travel. They are in my desk drawer at work (note: potential thieves – there are not enough to worry about).

None of those currency notes have left the monetary system from which they sprang irrespective of the fact they are sitting in a desk drawer in Australia.

The monetary system of a nation is not defined by geographic boundaries.

So you might grow coffee in Panama and hoard US dollars that you receive in revenue. But the US dollars you are hoarding have never left the US monetary system (“the country”).

best wishes

bill

Good Teacher. Billy. Thank You for responding. Hey. Question. “Do current accounts deficits matter?” Maybe I’ll be able to find my own answer.

“Question. “Do current accounts deficits matter?””

A ‘current account deficit’ is a consequence of drawing the accounting boundary at physical borders, rather than around entities wherever they may be.

When you look into it you find that it is just saving, so then the question changes to this: Is there a difference between somebody saving Sterling in Birmingham, Alabama and somebody saving Sterling in Birmingham, England.

Once you change that viewpoint you find that ‘dollarisation’ and ‘current account deficits’ are part of the same process – the currency area boundary growing and shrinking beyond and below the physical borders.

MMT is largely about seeing and thinking about things from a different viewpoint. When you do that new information arises.

“In the case of CAD, what mostly happens is that local currency bank deposits held say by Australians are transferred into local currency bank deposits held by foreigners.”

For me, the article lost it’s relevance there.

For as long as MMT continues to approach current-account deficits from the perspective of countries that can issue debt in their own currencies (large countries like the US, UK and Australia), don’t expect it to be taken seriously.

Alex Aslanidis:For as long as MMT continues to approach current-account deficits from the perspective of countries that can issue debt in their own currencies (large countries like the US, UK and Australia), don’t expect it to be taken seriously.

(a) Most countries, not just large ones, can issue such debt

(b) Most people in the world live in such countries

(c) All countries have the implicit capacity to issue their own debt, implicit monetary sovereignty that may be bound by laws or agreements. Otherwise they wouldn’t be sovereign countries. In other words, the MMT analysis and framework underlies whatever half-baked ideas have been superimposed on it.

So it is hard to see what is wrong in approaching things from such a perspective

Should the economists who think that such a practically universally applicable perspective is somehow improper – be taken seriously?