I started my undergraduate studies in economics in the late 1970s after starting out as…

Contrasting narratives about the outcomes of the euro

I have presented to a diversity of participants at the various events we have attended in the US, UK and Europe over the last 2 weeks. One way of expressing this diversity is in terms of the type of audience. At many events, the audience has been comprised of people who would see themselves as activists on the progressive side of politics. Some have been students, others, members of Leftist political parties, local business people, and community organisations. They uniformly express concern over the state of Europe, and the Eurozone in particular. They express concern about unemployment, underemployment, precarious work, poor wages growth, welfare cuts, infrastructure degradation, and other uncertainties relating to the state of politics. I sense that some of the participants were pro-Europe and pro-euro, but, there was an overwhelming feeling that the monetary union had failed and would be difficult to retrieve. On the other hand, I have addressed events where politicians, central bankers, private bankers, finance ministry officials and the like have been the main participants. Here the message changed significantly. I heard politicians, firmly wedded to the European ideal, talk about how the Eurozone had brought unlimited benefits to the Member States and how solidarity among states and citizens enhanced by European Commission leadership was taking Europe to a new, higher level. Hello! Earth calling! It was quite an eye-opener to see how much denial there is among those who have done well from the system.

Last week (September 28, 2017), the IMF Director of the European Department, Poul Thomsen presented the lastest update – The Euro Zone: What’s Next – at a Financial Times event in London.

Recall, that Thomsen was the IMF representative captured on a leaked audio recording in 2016 talking to two of his colleagues about how they needed to create a new solvency disaster in Greece to get its way with its other Troika members, particularly the puppet master in the Eurozone, the German government (Merkel).

On April 2, 2016, WikiLeaks released a new document – 19 March 2016 IMF Teleconference on Greece – which demonstrated the IMF’s bullying and destructive culture.

The accompanying media release – IMF Internal Meeting Predicts Greek ‘Disaster’, Threatens to Leave Troika – discussed the content of the “Transcript of an Audio Recording of an internal IMF meeting” held on March 19, 2016.

Three IMF officials who are “managing the Greek debt crisis” are recorded in the conversation. The officials were Poul Thomsen, the head of the IMF’s European Department, Delia Velkouleskou, the IMF Mission Chief for Greece, and Iva Petrova from the IMF.

The context was a meeting in Athens to discuss the next tranche of bailout assistance from the Troika.

By way of background, the reports coming out of Athens in March 2016 were that there was increasing tension between the IMF and its Troika partners over what new economic tyranny they would all push on Greece.

The teleconference occurred amidst that tension. It was discussing when the bailout talks that were stalled might resume.

To bring leverage in favour of what the IMF desired, they proposed creating an “event” to bring Greece to the brink and force the IMFs Troika partners to agree to the IMF position.

It was a shameful recording.

Please read my blog – The destruction of Greece – “only a down payment” according to the IMF – for more detail.

But Thomsen is still in his job unfortunately.

In his latest intervention (cited above), Thomsen claim that the Eurozone was looking good.

He said that:

But most encouraging is the fact that the recovery is broad-based. All euro area countries are growing above trend and unemployment is declining. Looking at our measure for the dispersion of growth rates across member states, this is the most evenly distributed recovery for more than two decades.

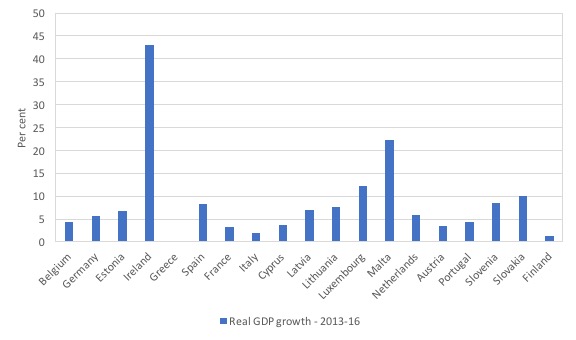

The following graph shows percentage real GDP growth for the 19 Member States since 2013 (when growth in the overall union resumed). If that what “evenly distributed” means then I must have forgotten all my statistical training.

More precisely, the Median absolute deviation for this data, which is a robust measure of variability in a univariate sample is 2.5. This is a preferred measure of dispersion due to the outliers in the data (Greece, Ireland). The average is 8.4. Conclusion: massive variability.

Thomsen then repeated the usual IMF claims – fiscal deficits have to come down, structural changes (meaning cuts to wages, pension, privatisation, deregulation) have to accelerate and the ECB has to keep breaking the law (no bailout clause) – although he didn’t express the point about the ECB in that way.

So this is the line that I heard among the central bankers and many of the politicians at events I spoke at in the last week. I heard it repeated several times – “The euro has brought much greater benefits than the temporary setbacks during the crisis”.

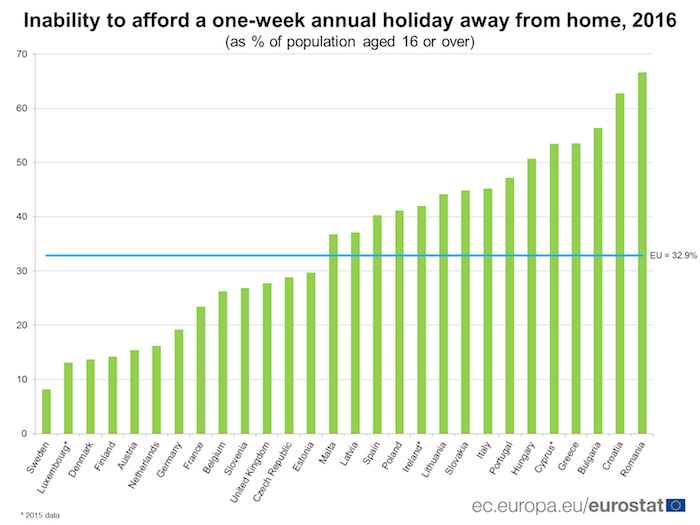

I then recalled seeing a Eurostat news release (released July 31, 2017) – 1 in 3 Europeans cannot afford a one-week annual holiday.

The following graphic was produced by Eurostat and is self-explanatory.

We learn that:

For many people in the European Union (EU), summer means holidays and travel. However, around a third (32.9%) of the EU population cannot afford a one-week annual holiday away from home …

Over half the population in Bulgaria (56.4%), Greece (53.6%), Cyprus (53.5% in 2015) and Hungary (50.7%) were also in this position.

The ratio for Greece has risen from 51.2 per cent in 2011 to 53.6 per cent in 2016.

I also read a recent report (September 7, 2017) – Survey shows crisis-ridden Greek households cut even on milk and bread – which reports the results of a Nielsen survey of Greek household spending in the first half of 2017.

We learn that:

1. Consumption spending for essential goods (milk, bread, etc) have fallen.

2. Spending on milk fell 8.6 per cent over that time.

3. Spending on bread fell by 5.3 per cent.

4. Alcohol sales dropped.

5. Retail sales fell overall by 1.1 per cent.

6. Personal care products fell by 4.4 per cent.

Since 2009, sales of food in Greece have fallen by 18 per cent.

The euro seems to have brought massive benefits to Greece – that is clear, not!

And finally, I read a study in The Lancet (Vol 389, April 1, 2017) – Future life expectancy in 35 industrialised countries: projections with a Bayesian model ensemble – by researchers at Imperial College, London.

The study found that:

1. “Life expectancy is projected to increase in all 35 countries”.

2. “Of the countries studied, the USA, Japan, Sweden, Greece, Macedonia, and Serbia have some of the lowest projected life expectancy gains for both men and women.”

The first-named author told the media that (Source):

In Greece in recent years there has been an increase in mortality at certain ages and this is probably related to the difficult economic situation in the country. The result was a slowing down of the life expectancy rate, which would remain low under these conditions …

The impact of the crisis is significant, as Greece has drastically cut spending on health. Countries with a rapid increase in life expectancy are those with strong health systems and healthcare and public health successes, such as the prognosis and treatment of chronic diseases or the reduction of obesity and smoking.

So we can see how great the euro has been for the Greek citizens.

Conclusion

I could document any number of similar indicators which tell the same story.

But, it is clear that the euro has delivered significant net benefits to many Europeans in the upper income groups, while at the same time, bringing despair and poverty to millions.

That doesn’t sound like a successful system to me.

When I write the next blog I will be back home in Australia – recovering from all the whirlwind travel and the flu that has been bugging me since the US leg of the trip.

Milan Event – October 2, 2017

On Monday evening, I was on a panel in Milan for the Festival Itala Per Una Rinascita Delle Art (Festival Itala for the Revival of the Arts). The following video shows my presentation and answers to two questions.

The video edits out the translation in Italian, ably done by my co-author Thomas Fazi. The video was filmed by an iPhone held in the hand by a friend in the audience (thanks David) and so is a bit shaky at times. I have also zoomed the footage and so the centre moves a little and the audio is not perfect.

I was asked by the organiser to pitch the talk within the context of the austerity cut backs to the Arts in Europe. The following UK Guardian LINK provides access to a series of articles about how these cuts are playing out.

Dance troupes are disbanding, orchestras merging or disappearing altogether, theatres closing, archival work being stopped, and more – all consequences of the ill-considered funding for the Arts.

This was the poster from the event:

Reclaiming the State Lecture Tour – September-October, 2017

For up to date details of my upcoming book promotion and lecture tour in Late September and early October through Europe go to – The Reclaim the State Project Home Page.

Yesterday (October 4, 2017), The Italian press gave some coverage to the first event in Rome last Saturday (October 1, 2017) – La sinistra alla riconquista dello Stato secondo Fazi e Mitchell.

The following photos were taken from that event.

Today (Thursday, October 5, 2017), I am presenting a public lecture at the University of Helsinki on Reclaiming the State.

Location: University of Helsinki, Lecture Hall 5, Main Building.

Time: The event will begin 16:00.

Entry: Free. All are welcome.

Then, tomorrow afternoon – the final event in Paris.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Hello,

Great work. All that jet lag and travel is very energy and health draining. Take it easy, take lots of supplements and rest as much as you can. Drink lots of water too and spend time in the sun.

Bill, Will you be doing some book launch gigs in Oz?

I was just saying to my wife that it was a very arduous trip you have made. You should take a break to get over the ‘flu. It can be very debilitating. You must take a holiday – don’t force yourself to attend every prior-booked engagement. Your contribution is too important!

In this context I would like to share this example from Thierry Gaudin’s, The world in 2025: A challenge to reason about the approach of saturations, which is a great story to tell and share with others to get things across.

Here is a plot of land, located in a city; it is used as a parking place. The activity of the city grows, and the intensity of traffic too. The demand for parking places increases over the capacity of the existing places. The matching of the offer and demand is operated increasing the price rates. The owner of the land, therefore, grows suddenly rich. He produces nothing, and the standard of life is not improved by his activity. And you can probably predict that people being aware of this potential increase in revenues without any effort added would propose to buy the plot of land, the value of which becomes speculative.

In contemporary economics saturations multiply such situations, and the tendency to multiply speculative bubbles grows as a result of competition to capture rents. And most real goods underneath are not productions. In most cases they are assimilated to property rights: intellectual property patents and copyrights, tolls on highways, parking, telephone communications or electricity. Many compulsory consumptions of the average citizen are involved. And her/his perception is inevitably a reduction in his/her standard of living.

The free market approach of these situations would be an attempt to reduce the prices by increasing competition. But, going back to our parking plot, it does not work. The high prices are due to scarcity. In that case, it is insuperable. Another way to deal with the problem would be to ask about the nature of the saturation money: is it private or public? If it is private, it might generate bubbles and produce nothing. If it is public, assimilated to a common good, then the money, if conveniently managed, may be recycled in urban planning, common transportation or other means to overcome the saturations.

I think the mass persuasion system that supposed to transforms the worshipped “invisible hand of the market” into an invasive conquest of the public’s neurons is failing, no matter what all these politicians are claiming. Look at Brexit and what is happening in Catalonia, Austria and elsewhere. I live in the Netherlands and like a lot of others I don’t use the health services anymore because of the own contribution you have to pay which amounts to € 385 next to obligatory basic insurance. Politics is complaining that health services are much too expensive, while on the other side you observe that company’s and the health profession are expanding more and more their “commercial” services for an obligatory basic insurance which we as users cannot control. Government has upped the own contribution for 2018 to € 400. So Bill, in making these observations would you say that next to Groupthink you could also speak of cognitive dissonance?

“They express concern about unemployment, underemployment, precarious work, poor wages growth, welfare cuts, infrastructure degradation, and other uncertainties relating to the state of politics.”

Surprisingly its more than that too. The effect high unemployment rate produces ill effects throughout the entire workforce.

There is high levels of worker burnout and high percentage of over-qualification of scare jobs.

Here is a typical hard hit area in France with its >33% ‘surdiplômés’:

http://www.bretagne-bretons.fr/emploi-bretons-plus-surdiplomes-de-france/

The euro-austerity up-optimizes the whole workforce period.

Have a rest Bill, then back on the bike. All the best!