I started my undergraduate studies in economics in the late 1970s after starting out as…

Mainstream macroeconomics credibility went out the window years ago

The Vice President of the European Central Bank, Vítor Constâncio, gave the opening speech – Developing models for policy analysis in central banks – at the Annual Research Conference, Frankfurt am Main, on September 25, 2017. Last time I heard Constâncio speak in person, in Florence 2015, he was in typical Europhile central bank denial. He thought the Eurozone was fine, a great success given the low inflation, inferring that the ECB’s conduct had something to do with that. He didn’t talk about the millions of people that had deliberately been rendered jobless because of the austerity obsession of the Troika, of which his institution was an integral part. Things might be changing a bit as the evidence mounts that the mainstream approach to macroeconomics and monetary theory is moribund, at best. But the changes are really just more of the same. There is no willingness to admit that the whole framework is without merit. The mainstream profession is lost in my view and clutching at anything they can to stay credible. But credibility went out the window years ago.

Constâncio began his summary of research at the “cutting edge of economics” by summarising the work of Lawrence J. Christiano – The Great Recession: A Macroeconomic Earthquake – which was published in the US Federal Reserve Minneapolis Economic Policy Papers series (February 7, 2017).

That paper essentially attempts to restore credibility to the failed mainstream macroeconomics approach by claiming that “the traditional macroeconomic paradigm captured by the famous IS-LM”, which “places demand shocks … at the heart of its theory of business cycle fluctuations”.

Unfortunately, the standard IS-LM model is not a viable framework to return to no matter how much it is adjusted. I will not go into detail here for want of time and because I dealt with these issues in considerable detail in the 7-part series I wrote that forms a chapter in our upcoming textbook.

Please read my blog – The IS-LM Framework – Part 7 – and then trace back through the series if you want detail.

Constâncio drew three things out of the Christiano paper for highlight:

1. “the need to recuperate the Keynesian view that demand shocks and the paradox-of-thrift can be important for economic performance”.

2. “the notion that economy is not quickly self-correcting and requires public policies intervention”.

3. “that the financial sector can endogenously generate imbalances with significant consequences for the real economy”

One would suggest these are core insights for any starting point in macroeconomics.

They were provided by Keynes and others that followed, yet have been largely driven out of the mainstream literature by the emerging Monetarist, then New Keynesian dominance of macroeconomics over the last 4 decades.

By the late 1970s, the long-standing dominance of Keynesian policy had been abandoned by a large number of economists

American economist Alan Blinder commented in his 1987 book – Hard Heads, Soft Hearts: Tough‑Minded Economics for a Just Society (page 278) that by:

… about 1980, it was hard to find an American macroeconomist under the age of 40 who professed to be a Keynesian. That was an astonishing turnabout in less than a decade, an intellectual revolution for sure.

The resurgence of the free market approach, which we now rather roughly refer to as neo-liberalism manifested initially as Monetarism, and Milton Friedman and his University of Chicago colleagues championed the entry of these ideas back into the mainstream policy debate.

Of course, the resurgence, largely just reinstated ideas that had been categorically debunked by Keynes himself (and others) in the debate of the 1930s.

Now, it seems that the New Keynesians are trying to establish credibility after being left in shame by the GFC revelations that their approach was bereft by trying, in some way, to reintroduce some of the key insights of Keynes into their ‘micro-founded’ neo-liberal models.

But they miss the point – these elements are in contradistinction with the basic New Keynesian framework.

Constâncio said that:

With hindsight, it is surprising how these points were neglected by mainstream economics for so long. Many other aspects can be usefully added to that list.

No, it was always surprising that the mainstream decided to abandon these basic insights – that the demand-side (spending) is crucial to understanding output and employment, that capitalist economies without a strong fiscal intervention are prone to crises and stagnating and that the financial sector can derail the real econmomy.

Modern Monetary Theory (MMT) is built on those insights. Non-mainstream economists such as Post Keynesians also understood the centrality of those elements.

Now the mainstream is trying to restore itself by admitting the obvious after decades of denial and millions of people having been made unemployed as a result of the policies that their fake models gave justification to.

In one of the papers Constâncio cites we learn that the dominant theory (New Keynesian), used as the organising framework by most mainstream economists and policy making institutions (including central banks) is altered by “one main new parameter”.

This change abandons rational expectations, which assume that individuals on average can accurately forecast the future, with no systematic forecasting errors, and, instead replaces it with an assumption that:

… quantifies how poorly agents understand future policy and its impact.

In other words, the future is inherently unknowable and we make guesses about it based on habit, custom and emotions and regularly make errors.

We also are incapable of solving the complex mathematical equations about future behaviour that would be required to ensure we maximise all future outcomes.

Anyway, we read that as a consequence of this simple variation in assumption from the bizarre to something more ground in the real world, a “number of consequences emerge”:

Among them:

1. “Fiscal policy is much more powerful than in the traditional model” – people “consume more when they receive tax cuts or “helicopter drops of money” from the central bank” rather than policy having no change on overall impact on spending.

2. There is no unique relationship between the interest rate and the real outcomes (this violates the so-called “Taylor principle” that has dominated mainstream monetary theory for years.

3. Monetary policy is unable to create inflation. I was asked at an event last night why I thought expanding government spending by just creating reserves (Overt Monetary Financing) would not be intrinsically inflationary.

I noted in my answer that central banks have been working overtime, with massive expansions of their balance sheets, trying to do just that – increase inflation – with virtually no success. We now should understand that the weakness of monetary policy to adjust spending and inflation is endemic.

Constâncio said this shift “is a welcomed development”.

But don’t get your hopes up that this shift is a epiphany of the road to …

For example, the rational expectations version of the New Keynesian framework holds that “fiscal policy … has no impact” because “agents” (people) “perfectly anticipate” that deficits will have to be paid back through higher taxes and so increase saving now to ensure they can pay the higher taxes.

This is the idea of “Ricardian equivalence” – these “agents” are said to be acting in a Ricardian manner.

They are assumed to know when the taxes will rise and how much extra saving they will require to pay them.

More importantly, it is simply asserted that governments behave in this way – that is, always reverse a tax cut (for example), with an equivalent tax hike or spending cut at some time, to ensure the fiscal balance is zero.

This is not a cyclical adjustment in the fiscal balance via the automatic stabilisers which see the existing tax and spending parameters deliver different balances depending on how strong the economic cycle is.

No. The only reason an “agent” does not act in a Ricardian manner in the revised framework is because:

… he fails to perfectly anticipate future taxes. As a result, tax cuts and transfers are unusually stimulative, particularly if they happen in the present.

So you see the problem. It is still assumed that governments will seek to respond to a deficit with an equal future surplus, but that these agents just don’t get it.

Not much progress at all then! Governments do not normally demonstrate any tendency to balance over any defined cycle or period. In fact, there is no evidence of such behaviour.

Constâncio then told the audience about “some on-going developments in the specification of macroeconomic models at the ECB”.

He said that to be of any use for policy development, two criteria have to be satisfied:

1. “a useful model must fit the data reasonably well and should be able to produce effective economic forecasts”.

2. “The model should be reasonably flexible to be able to adapt to a changing economic and policy environment and to speak to current policy questions.”

He admits that prior to the GFC the main macroeconomic models “were not equipped to speak to all the questions arising in the aftermath of the crisis without further adjustments”.

That is, they were useless. The major policy models excluded the financial sector because according to efficient markets theory (a gospel of the church of mainstream economics), the financial sector could never impact on the real sector in any systematic way.

The GFC crunched that one.

He then advocated a sort of ad-hoc updating of the models used as they proved incapable in the face of new developments.

The problem then encountered within the mainstream New Keynesian approach is that the framework loses its initial (flawed) claim to authority.

The dominant New Keynesian models more or less are clones of a basic structure that outlines “optimal” decision-making for consumers and firms in a competitive economy.

These so-called ‘micro-founded’ macro models just mean that the aggregate relationships are somehow derived mathematically by assuming maximising choice-behaviour with rational expectations (on average we are never wrong).

So these rational, maximising first principles – which violate everything we know about human behaviour and informational constraints – are held out as a sort of scientific authority for the macro framework that is generated.

But then, relating back to Constâncio’s first requirement – that the approach should “fit the data reasonably well and should be able to produce effective economic forecasts” – the New Keynesian economists soon recognise that the basic maximising approach cannot provide a data-fit to even the most basic relationships we observe in the real world.

For example, the basic price-setting assumptions assumed (Calvo) does not allow lagged inflation to influence current inflation. This inertia is almost certainly present in all real world datasets.

As a result of this empirical anomaly, ad hocery enters the fray.

New Keynesians quickly recognised that in the applied world of macroeconomics there is usually a lagged dependence between output and inflation taken into account. The primary justification is empirical.

But trying to build this into their model from the first principles that they start with is impossible.

To thus ‘fit the data’, they usually just introduce lagged inflation. But then this violates the assumptions of rationality and optimality.

So while they claim virtue based on so-called microeconomic rigour they respond to empirical anomalies when the ‘rigorous’ micro-founded approach fails to deliver anything remotely consistent with reality, with ad hoc (non rigourous) tack ons.

Which means that at the end of the process there is no rigour at all. It is a con. They have no claim to presenting results that in any way can be traced back to so-called ‘welfare-optimising’ outcomes. Ad hoc is ad hoc.

In other words, to satisfy requirement one (within the New Keynesian, DSGE framework), you have to employ an almost ‘anything goes’ approach, as in the second requirement.

So Constâncio wants to believe he is operating in the micro-founded world of authority but, in fact, his second requirement – a sort of moving feast of models – one replacing the last when it proves to be inadequate – is just the worst of worlds.

Please read my blog – Mainstream macroeconomic fads – just a waste of time – for more discussion on this point.

It is amazing how slippery these mainstream economists are. Constâncio quotes Olivier Blanchard as saying that “policy models” cannot be expected to have the same tight structure as “theory models”.

But then if they haven’t the same ‘tight’ structure, the properties of the tight models are unlikely to transfer to the policy models. This means that the authority of the tight structure cannot provide any guideness the soundness of policy. Policy just becomes a moving feast – reflecting political concerns, even though economists will wheel out a load of dogma about how the policy suggestions are superior to those using different, non-mainstream techniques.

The alternative to all this hoopla and smoke and mirrors is to start with an approach that faithfully builds on the real world characteristics of the monetary system – for example, how banks actually function, how consumers approach income increases etc.

This is the route that Modern Monetary Theory (MMT) has taken. Rather than be lulled into some false claim to being scientific (when we no there is no such thing in the social sciences), MMT proponents have constructed our macroeconomic reasoning on how the system actually works.

So banks are understood to operate as they do rather than the ridiculous way they are modelled in mainstream textbooks (as waiting for deposits to build reserves, which then allow the bank to lend – the money multiplier story).

As an aside, at a function in Rome on Saturday, in the discussions after my presentation, I was approached by one person who had studied mainstream monetary theory and then, upon graduation, accepted a job in a commercial bank.

As I understood it, the first job assigned was in the loan department. The person recounted how he was somewhat confused early on in his work because while he was efficiently creating deposits with loans, he was trying to work out when the deposit multiplier would come into his work.

It wasn’t in any handbook of operations or anywhere. He eventually realised that the asset management department of the bank (which handles reserves) is quite distinct from the loans department and loans are made without regard for any specific reserve position of the bank. It was quite a revelation for this person.

The rest of Constâncio’s speech just descends into a range of technical statements which detail how the ECB is hanging on to the core mainstream New Keynesian DSGE models but adding ad hoc elements that generate some real world results.

The problem is as above – we still don’t get any understanding from this approach.

The reason fiscal policy works to influence expenditure is not because people are temporarily myopic. It is because firms respond to increased spending in the economy by increasing output to maintain market share if they have excess capacity.

In turn, this increases incomes, which then stimulate further consumption spending.

Monetary policy is not as effective because the impacts of interest rate changes are indirect and ambiguous.

We can get to all that without jumping through the DSGE clusterf.ck.

Conclusion

So not much progress in macroeconomics.

The profession is trying to hang on to the vestiges of a totally flawed approach because without it they have no claim to superiority.

But, even then, their core approach is such a violation of reality that inferiority and irrelevance oozes from it.

Reclaiming the State Lecture Tour – September-October, 2017

For up to date details of my upcoming book promotion and lecture tour in Late September and early October through Europe go to – The Reclaim the State Project Home Page.

Today, I am in Milan for some meetings and also a presentation tonight. After that Helsinki comes next.

Yesterday, I was in Ferrara (Italy) for two presentations. They were run along with the famous – Festival di Internazionale a Ferrara – which is a major so-called progressive festival in north-eastern Italy.

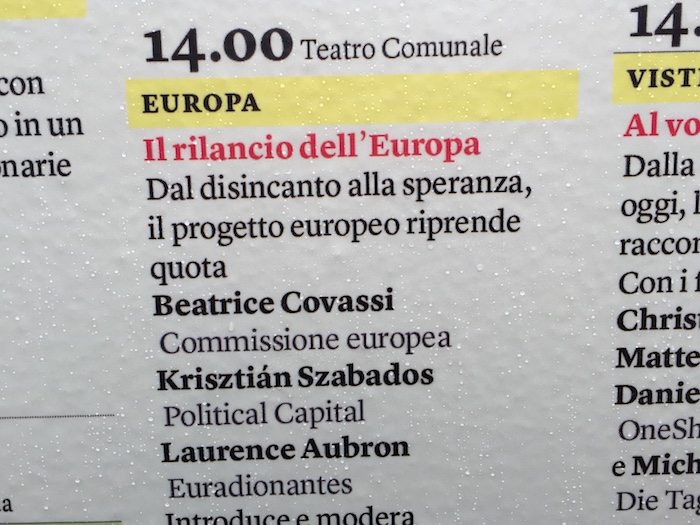

On today’s program was this event, which featured a representative from the European Commission. The EC had a high profile at the festival:

It translates from Italian as: “The revival of Europe: From disenchantment to hope, the European project resumes”.

The propaganda from the EC is never-ending. They are now getting their message back on track that all is well and a revival is underway … yes, as long as the ECB defies the Treaty with its implicit bailout of Member State deficits (minus Greece) and until the next global crisis hits.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Brilliant Bill !

What do you think of Brian’s latest piece.

The Price level does not exist ?

http://www.bondeconomics.com/2017/10/the-price-level-does-not-exist.html

I see it as another part of the jig saw of the monetarists failure to create a clear picture of what actually happens.

We should be replacing the budget constraint by building models that actually predict inflation correctly with an inflation constraint. Which then allows us to understand how deficits will affect the macroeconomy not assuming we are at full employment all the time.

The financial elites that really run the EU are getting worried that the people of Europe are wising up to their little game of looking after themselves and of building the big dream of a United States of Europe. Unfortunately their version of the United States of Europe is more like that earlier dream of Germania but without the theatrics and genocide, just plenty of misery and death through pointless austerity and greed.

A more humane and macroeconomically competent EU is long overdue but don’t ever trust the current financial elites to deliver that goal to the extent needed. Just retaining the fundamentally flawed Eurozone will further entrench wealth disparity in Europe.

No the answer is not Jean-Claude Juncker with a human face but reform of the EU to bring it closer to a preferential trade zone with the European nations regaining their national currencies and more autonomous democratic control within a EU preferential trade zone. The good parts of the EU like environmental policy and regulatory harmonisation and perhaps even a slimmed down European Parliament could be retained. Then nations including the UK may want to join. At some point even Russia and the other states of Eastern Europe could join such a model whilst retaining the existing security structure balance between NATO and Russia which may then improve over time.

I am really really lucky to have found your blog. Great article.

I didn’t know the Swiss bank made the Economics Nobel prize. I notice that Alfred Nobel didn’t envision the Peace prize either from your quote in that order article.

Isn’t the peace prize used for people as political cover for elite to further their empire from time to time? Isn’t economics prize used for cover for the mainstream economics to make them sound legitimate?

=|

Oh wait. Nvm I missed the peace prize. Nobel did have it. sorry all. =(

“I didn’t know the Swiss bank made the Economics Nobel prize.”

It’s the Swedish central bank – the Riksbank.

When it comes to agent modeling, I just keep in mind that the founders of game theory include a paranoid schizophrenic, and the guy Dr. Strangelove is based on.

One thing I’ve never quite understood about Ricardian Equivalence as a proposition is why more isn’t made of the fact that governments borrow by issuing bonds. The value of the bond is exactly equal to the taxes that will fund it. So, in buying the bond in period 0, all the “saving” necessary in anticipation of the associated future taxes has already taken place. It doesn’t require heroic anticipation of the future.

.

If it is necessary to reduce consumption in the present to pay for the bond or pay the taxes, then I suppose that is what happens in period 0, when the bond is sold or taxes collected. If it isn’t necessary to reduce consumption, and there is simply a transfer out of what economist once called a hoard — presumably a desirable policy objective in some circumstances.

.

It seems as if the Ricardian Equivalence argument comes down to trying to foist two intuitions on the public. The first would be that there are no hoards — no one holds financial wealth as insurance or needs “risk-free” assets as a benchmark or hedge. Therefore, a marketable national debt is a “burden” and not a public utility for the banking and payments system.

.

The second intuition is the financial equivalent of what goes up must come down. The idea is that issuing debt now to finance the full utilization of productive capacity in present period zero sets up conditions that will necessitate reduced utilization of productive capacity in the future. In real terms, I can think of ways this might work: a farmer must leave a field fallow to restore its fertility or a factory owner runs down machinery by over utilizing capacity. In financial terms though, it doesn’t seem to have much application. The bonds marketed always exactly equal in value the taxes that would in the future extinguish them, if it was ever necessary to extinguish them; no necessary effect on real production capacity or utilization in the future is implicated, as far as I can see.

Neil,

Thanks for the correction. That was embarrassing.

Bruce Wilder, I would replace the word ‘intuitions’ with ‘hoaxes’, or something similar – ‘intuition’ has too many positive connotations to be used when describing Ricardian Equivalence in my opinion.

According to so-called “rational expectations”, if a take out a loan, the rational thing to do, since it must be paid back, is to save the money I have borrowed so that I can pay the loan back later. That’s absurd on its face. Nothing rational about it. It’s special pleading.

Rather than be lulled into some false claim to being scientific (when we know there is no such thing in the social sciences), MMT proponents have constructed our macroeconomic reasoning on how the system actually works.

This sentence, particularly its first clause & parenthesized comment is probably the most foolish thing I have ever seen written here, for the second clause means “being scientific”. As the mighty thinker whose pupil Marx was once said, such ideas are nothing but a foolish (absurd?) modern prejudice. Well, if belittling ones own work helps get one through the day, fine. But readers don’t have to join in. 🙂

Great post Bill