The other day I was asked whether I was happy that the US President was…

Jean-Claude Juncker in denial and somewhat delusional

Last week (September 13, 2017), the President of the European Commission, Jean-Claude Juncker, presented his State of the Union Address 2017 in Strasbourg before the European Parliament. My only query arising from the speech was which Member State has left, given that the President began his speech by thanking “the 27 leaders of our Member States” (joke). He opened by saying how unity among the Member States had “showed that Europe can deliver for its citizens when and where it matters”. I wonder which Planet he was referring to. I thought Europe was on the Mother Earth and it certainly hasn’t been delivering for its citizens, if the usual measures are considered. Juncker’s speech just continues what I considered to be ‘Groupthink and Denial on a Grand Scale’, which was the subtitle of my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale. It is amazing that the denial continues after 10 years and that guys like Juncker can still command an audience and a salary.

In heaping praise on his own regime, the EU President said:

We are now in the fifth year of an economic recovery that finally reaches every single Member State.

Growth in the European Union has outstripped that of the United States over the last two years. It now stands above 2% for the Union as a whole and at 2.2% for the euro area.

That statement is true. But the US reached the pre-GFC peak after only 15 quarters whereas it took 27 quarters (3 more years) before the EU28 reached the pre-GFC level and 30 quarters for the Eurozone Member States (taken together).

So the lost output due to the crisis was much higher for the European Union (especially the Eurozone) than it was for the US.

Other nations such as Australia never had a recession because it introduced a large discretionary fiscal stimulus early on in the crisis and held it for long enough to maintain overall growth.

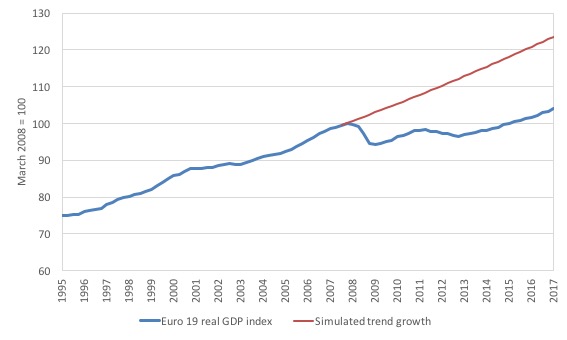

The next graph shows the path of real GDP in the Euro19 Member States from March 1995 to December 2016 (indexed to 100 at the March-quarter 2008 – the peak before the GFC).

The simulated line is based on extrapolating out the actual growth path from 1995 to the December-quarter 2007 using the average quarterly growth rate over the period.

Despite the President’s claims, actual real GDP is only 4.1 per cent higher than it was in the March-quarter 2008 for the Eurozone as a whole.

A comparable figure for the US is 12.7 per cent; for the UK, 9.1 per cent; Norway 11.4 per cent; and Australia 23.7 per cent.

That makes the Eurozone’s growth look shocking – and it has been.

The average growth rate since the September-quarter 2015 (when the Eurozone finally passed the level of GDP attained before the crisis) has been 0.51 per cent per quarter compared to the average rate of 0.64 per cent per quarter between March 1995 to December 2007.

So the rate of growth is still well below the pre-crisis level and the output gap is massive. I qualify that statement by noting that the red line is probably not the current sustainable trend rate of growth given the massive collapse of capital formation in the Eurozone since the crisis.

In fact, potential GDP has probably fallen significantly.

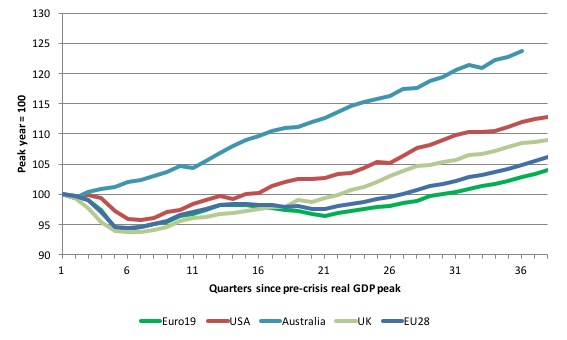

The next graph provides some relative information by comparing post-GFC real output performance for the US, the UK, Australia, the Eurozone 19 and the EU28.

The series for each nation is indexed to 100 at their respective peak. So for Australia the peak came three quarters later than it did say for the Eurozone 19 (hence the shorter series for the former).

The European performance has been vastly inferior to that of the three Anglo-speaking nations.

If we consider the lost output since the peak, the following data is relevant:

- EU28 – at trough 94.4 (June 2009) – 27 quarters to return to pre-GFC peak. Index at June 2017 = 106.2

- Euro19 – at trough 94.3 (June 2009) – 30 quarters to return to pre-GFC peak. Index at June 2017 = 104.1

- Greece – at trough 72.9 (December 2016) – still 26.4 percentage points below pre-GFC peak. Index at June 2017 = 73.6

- Spain – at trough 90.4 (September 2013) – 37 quarters to return to pre-GFC peak. Index at June 2017 = 100.4 (after major fiscal stimulus which violated all Stability and Growth Pact rules)

- Italy – at trough 90.5 (March 2013) – still 6.4 percentage points below pre-GFC peak. Index at June 2017 = 93.6

- USA – at trough 95.8 (June 2009) – 15 quarters to return to pre-GFC peak. Index at June 2017 = 113.6

- UK – at trough 93.7 (June 2009) – 23 quarters to return to pre-GFC peak. Index at June 2017 = 109.0

- Norway – at trough 95.8 (September 2010) – 18 quarters to return to pre-GFC peak. Index at June 2017 = 110.0

- Australia – at trough 99.3 (December 2008) – 2 quarters to return to pre-GFC peak. Index at June 2017 = 123.7

Juncker then decided to seek solace in the labour market data. He said:

Unemployment is at a nine year low. Almost 8 million jobs have been created during this mandate so far. With 235 million people at work, more people are in employment in the EU than ever before.

The European Commission cannot take the credit for this alone. Though I am sure that had 8 million jobs been lost, we would have taken the blame.

I just love it when politicians claim there “are more people working than ever before”.

Which always seems to echo (in my mind) – sure and there are more people than ever before – so what!

The overall European Union population has expanded by 11.5 million since the March-quarter 2008, while total employment has risen by 4.5 million, a slight fall in the ratio of employment to total population.

So the employment rate is lower.

It is about rates you see.

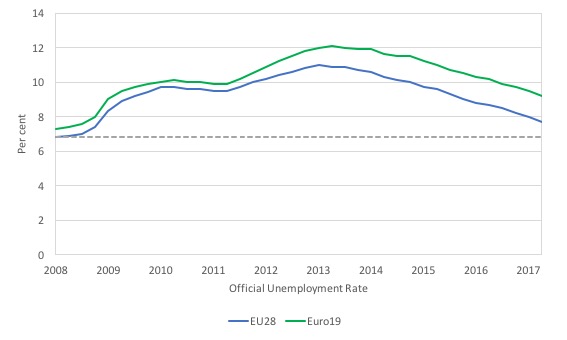

The following graph shows the evolution of the official unemployment rate for the EU28 (blue) and the Euro19 (green) from the March-quarter 2008 to the June-quarter 2017. The dotted grey line is the March-quarter 2008 EU28 level

The rates are still at elevated levels more than 9 years after the crisis began.

Further, while there are more people in employment there are also 3.4 million more workers unemployment in the EU28 than there was in the March-quarter 2008 and 3.9 million more in the Eurozone.

But consider the fact that the European Commission was entrusted with creating conditions that would allow convergent (rather than divergent) outcomes to be achieved.

That clearly hasn’t happened.

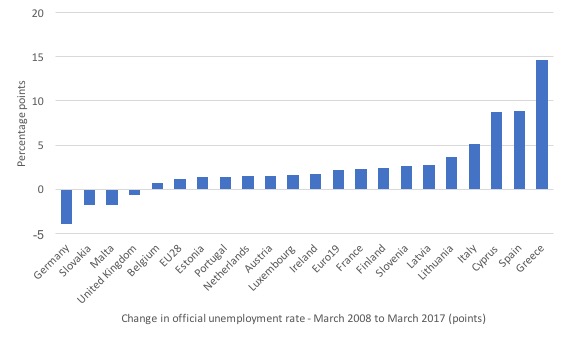

The next graph shows the change in the official unemployment rate between the March-quarter 2008 and the March-quarter 2017 in percentage points.

So the Greek unemployment rate has risen from 8 per cent to 22.6 per cent (a change of 14.6 percentage points). Similar Spain’s unemployment rate is 8.9 percentage points higher than what is was in the March-quarter 2008 (nearly double).

Italy’s unemployment rate has risen from 6.5 per cent to 11.6 per cent over the same period.

But in contrast, some nations have reduced their official unemployment rate (noting that only the UK operates a fiat currency).

Clearly divergent outcomes are the norm in terms of this most important indicator.

Another way of viewing the failure of the European Union and the Eurozone, in particular, is to exclude the impact of the German economy.

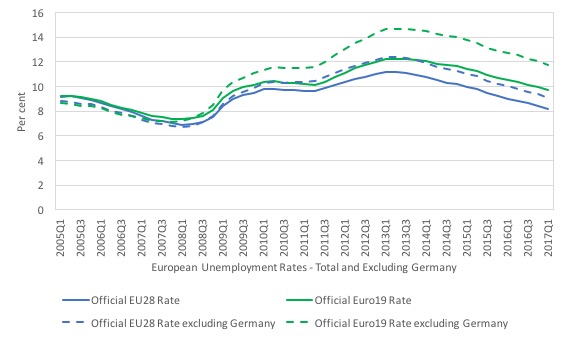

The next graph shows the official unemployment rate for the EU28 and the Euro19 Member States with (solid line) and without Germany (dotted line) from the March-quarter 2005 to the March-quarter 2017.

The dotted lines just take the German unemployment and labour force out of the respective totals for the EU28 and the Euro19 aggregations.

Once again you witness divergence. Germany’s success has come at the expense of rather significant losses elsewhere in the Eurozone, particularly in the Southern States (Italy, Spain, Portugal, Greece, Cyprus).

The Eurozone unemployment rate excluding Germany is a full 2 percentage points higher (at 11.7 per cent) than the official rate. It has been above 10 per cent since the June-quarter 2009 and peaked at 14.7 per cent.

That is not a system that I would be crowing about.

Juncker praised the European Investment Plan which he said had “triggered €225 billion worth of investment so far”.

I last wrote about thta plan in this blog – Hype aside – the Juncker Plan – a failure from day one.

The so-called ‘Juncker Plan” was announced on November 24, 2014 as a EU launches € 315 billion Investment Offensive to boost jobs and growth.

There were three components to the ‘Juncker Plan’:

1. the “creation of a new European Fund for Strategic Investments, guaranteed with public money, to mobilise at least € 315 billion of additional investment over the next three years (2015 – 2017)”.

2. “establishment of a credible project pipeline … to channel investments where they are most needed.”

3. “an ambitious roadmap to make Europe more attractive for investment …”

It was claimed the Juncker Plan would “add €330 – €410 billion to EU GDP over the next three years and create up to 1.3 million new jobs”.

So for the President, 3 years into the plan to admit that it had “triggered €225 billion worth of investment so far”, when the aim was to add € 315 billion, signals failure.

And that is not to mention that the Juncker infrastructure plan was a drop in the ocean of what was needed, given the collapse in investment during the crisis.

Further, the ‘Juncker Plan’ was not an addition to the net financial assets of the Member States (that is, a ‘federal’ spending injection funded by the ECB) but, rather, was just redistributed Member State spending.

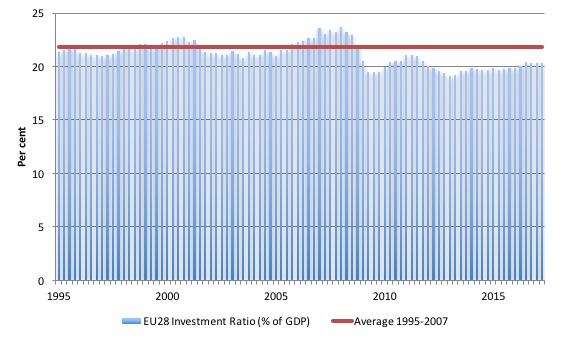

To put that assessment in context, the following graphs shows the evolution of investment ratios (as a percent of GDP) in the European Union (28) and the Eurozone (19) from the first-quarter 1995 to the June-quarter 2017.

The investment ratio is the share of capital formation (buildings, equipment etc) in total national output and is a strong measure of sentiment and growth potential in the economy.

At the onset of the GFC (March-quarter 2008), the investment ratios were 23.7 per cent for the EU28 and 24.1 per cent for the Euro19.

They reached a trough during the GFC of 19.2 per cent in the EU28 (March 2013) and 19.4 in the Eurozone in the same quarter.

By the June-quarter 2017, the EU28 investment ratio was only 20.3 per cent (and below the December-quarter 2016 value) and the ratio for the Eurozone was 20.5 per cent, also below the December-quarter 2016 value of 20.7 per cent.

Both ratios are still well below the pre-GFC levels and are now falling.

Juncker told the Brussels gathering that:

We can take credit for the fact that, thanks to determined action

How can Jean-Claude Juncker claim that sort of data to be evidence of a successful policy intervention? Answer: Groupthink and Denial.

Juncker was obviously reaching a delusional state as he moved through his Speech. Towards the end he claimed that he wanted “a stronger Economic and Monetary Union” and a “More United Union”.

At that point, he claimed that:

If we want the euro to unite rather than divide our continent, then it should be more than the currency of a select group of countries. The euro is meant to be the single currency of the European Union as a whole. All but two of our Member States are required and entitled to join the euro once they fulfil all conditions. Member States that want to join the euro must be able to do so.

Result: an immediate furore, especially in Germany.

The German press, in particular, was incensed by the implication that a whole range of “Greece-type countries” would be admitted to the common currency.

A headline in Die Welt (September 13, 2017) – Junckers Idee zum Euro ist völlig absurd (“Juncker’s idea of the euro is completely absurd”) and went on to say that:

In seiner Grundsatzrede hat Jean-Claude Juncker seine Vision für Europas Zukunft vorgestellt. Doch sein zentraler Vorschlag klingt mehr nach einem Horrorszenario.

Which says that in his speech, Juncker presented his vision for the future. But his central suggestions sounds more like a horror story.

They went on to say:

Wenn Europa mitten in der tiefsten Krise steckt, braucht es dann wirklich mehr Euro für noch mehr Länder?

Man muss leider feststellen: Es wäre der beste Weg, um aus dem Traum von einem gemeinsamen Europa einen nicht enden wollenden Albtraum zu machen.

Which says that with Europe being in the midst of the deepest crisis, does it need more countries to adopt the euro. Unfortunately, one has to say that this would be the best way to turn the dream of a common Europe into a never-ending nightmare.

That is saying it!

One might reasonably conclude that the nightmare began years ago when they adopted the currency and this would just be another chapter in that sad tale.

Last Friday (September 15, 2017), the European Commission issued an emergency press release – Juncker: ‘I don’t intend to force countries to join the euro if they are not willing or not able to do so’ – to quell the outrage that emerged after Juncker got ahead of himself.

The European Commission clearly ran scared after this torrent of abuse and stated that:

All EU Member States should have the possibility – as required by the EU Treaties – to introduce the euro, but no one would be forced to do so … The strict euro-accession criteria would continue to apply … Yesterday I didn’t insist or request that everyone, by 11 o’clock in the morning, should now adopt the euro – I am amazed by much of what is written in the press, and that includes the German press. What I said was that those countries that have not yet adopted it, but that want to, must be given that possibility. And we should provide the technical – and in some cases financial – assistance to enable them to do so …

I have no intention of forcing countries to join the euro if they are not willing or not able to do so.

Phew. The thought of Romania and Bulgaria with the euro – that is a worse nightmare than Greece!

Conclusion

Juncker’s speech displayed the usual mixture of hubris, denial and error-prone behaviour that has defined his Presidency.

Sure enough, the Eurozone is growing again, albeit rather slowly and in a divergent way from a Member State perspective.

But the legacy of all the fiscal austerity remains with suppressed growth rates, elevated unemployment levels and inferior employment outcomes.

And that is not to mention the continuing poor investment performance, despite Junckers ‘grand’ (not) plan for revival.

Reclaiming the State Lecture Tour – September-October, 2017

For up to date details of my upcoming book promotion and lecture tour in Late September and early October through Europe go to – The Reclaim the State Project homePage.

You can also find details on that site of how to purchase a copy of the book (paperback version) at discounted prices, well below the current market price from the booksellers.

The discounted price I can make the book available (while my stock lasts) is plus postage.

My stocks are limited (getting very low now) – only 12 left as I post this blog.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Bill, as we know, Juncker was not one of the favorites for the job he has. He only got it because of Merkel’s intervention. Here he clearly illustrates why some did not want him, in addition to his past. Some of his audience didn’t seem to want to be there and listen to his bullshit. Especially after he went on and on. The whole thing turned out to be a fiasco.

The EU may be growing more strongly than the US at this point, but that doesn’t change the fact that the problems of the EU are structural and the US’s are not (atleast not nearly to the level in europe).

Most people (even some in Brussels) don’t believe that the euro will survive another 10 years, a lot of this has to do with the fact that the ECB cannot cope by itself with keeping the EU on constant life support without any assistance (which it will never get).

When the next financial downturn arrives (sooner rather than later it seems) the EU as we know it will cease to exist.

One can’t say that about the US despite it’s myriad flaws.

Hello Bill,

What a fantastic blogg. Very important information clearly demonstrated. I have had my dislike of the EU after the treatment of Greece. The UK is also suffering from the madness of austerity but hopefully, your visit to the Labour Party Conference will give them a boost to change things.

All the best

Ron

Schauble and Juncker has done far more damage to Europe than Farage ever could.

It’s difficult to know what aspect to comment on first. Delusional and perhaps mendacious bureaucracy; economic hegemony, inequality and subservience; structural financial instability and non-convergent social and political entities. It would take a person of superior intellect to grasp the complexity of the issues and a bureaucrat with messianic charm to resolve them. Sadly, it would appear that Jean-Claude Junker is neither a skilled politician or a capable bureaucrat.

This is probably great news for Europe- Jean Claude Junker is only ‘somewhat’ delusional. It could be worse…

How can this Juncker person say that the Eurozone is working out when the Greek people are living in absolute nightmare. It’s unreal.