I grew up in a society where collective will was at the forefront and it…

Greece still should exit and escape the grip of the vandals

Greece is back in the news as the IMF, the Germans and the European Commission slug it out pretending to talk tough and propose solutions to the Greek tragedy. There is no solution of course. All the debate about whether the primary surplus target should be 3.5 per cent of GDP (European Commission position) or slightly lower (IMF position) is just venal hot air. Anybody who knows anything and isn’t protecting their past mistakes would assess that a fairly large and sustained fiscal deficit is required in Greece to rebuild some of the lost capacity and to provide an inkling of hope to the youth who are facing a lifetime of diminished prospects as a result of the decisions the adults around them took. All the talk about ‘deficits mortgaging the grand kids future’ – sick. The austerity has meant the grand kids might not ever emerge given the constrained circumstances their would-be parents will face as they progress through adulthood. The reality remains – firmly – Greece should exit the Eurozone, convert any outstanding liabiliites into a new currency at parity, and stimulate its domestic economy with expansionary fiscal policy. It should continue to impose capital controls. As part of the stimulus, it should introduce an unconditional Job Guarantee at a decent wage to provide a pathway back into employment for the many that the Troika have rendered jobless.

In last year’s – Greece: Staff Concluding Statement of the 2016 Article IV Mission (released September 23, 2016) – the IMF said:

Looking forward, growth prospects remain weak and subject to high downside risks, and unemployment is expected to stay in the double digits until the middle of the century.

Yes, remember that little piece of understatement – the Greek unemployment rate will remain in double figures until at least 2050.

33 years to go.

Some young people in Greece may never have the opportunity to work.

Yesterday (February 7, 2017), the IMF released its so-called – 2017 Article IV Consultation – which is its annual review of the Greek economy, is pretty dire reading. The IMF loves to sugar coat the disasters that it has often been at the centre of creating. We read that Greece’s “economic situation has stabilized since” the last “confidence crisis in mid-2015” – stabilised at the bottom of the depression ocean! Drowning at a stable rate.’

The IMF acknowledges that:

Despite significant progress in unwinding its macroeconomic imbalances, Greece’s economy has not yet recovered.

But fails to attribute causality. It is exactly the unwinding of these so-called imbalances that has caused the problem.

And, in part, its external deficit is better understood in the context of the German external surpluses (which continue to breach the European Commission rules but go on without sanction).

Remember this Reuters report (March 23, 2010) – Broke? Buy a few warships, France tells Greece.

We read that:

In a bizarre twist to the Greek debt crisis, France and Germany are pressing Greece to buy their gunboats and warplanes, even as they urge it to cut public spending and curb its deficit.

I have written in the past about how the Germans had been pushing Leopard tanks and other weapons onto Greece at the same time as claiming the Greeks were lazy and were spending too much.

Please read my blog – Hyperdeflation, followed by rampant inflation – for more discussion on this point.

The blackmail element in the so-called negotiations between Greece and the Troika is not a new development.

The Reuters report said:

“No one is saying ‘Buy our warships or we won’t bail you out’, but the clear implication is that they will be more supportive if we do what they want on the armaments front,” said an adviser to Prime Minister George Papandreou, speaking on condition of anonymity because of the diplomatic sensitivity.

Apparently, when the Greek prime minister was negotiating at the time about fiscal austerity, the French we pressuring them to go ahead with billions of euros of military ships and helicopters. They agreed!

Germany has continued to flog submarines to the Greeks and has put those expenditures outside the austerity net in its demands through the Troika.

How far do you think Germany would have got if all the importers stopped buying German products as part of some German-inspired thrift (austerity) measures.

And the assessment that Greece’s fiscal deficit was an imbalance depends on what benchmark one uses. For the IMF and the rest of the Troika, the benchmark is the Stability and Growth Pact, which contains rules that have clearly been demonstrated to provide neither stability nor growth.

My benchmark is whether the labour market is generating full employment and by that standard the current fiscal situation which the IMF lauds is a massive imbalance – a perversity.

By my benchmark, Greece should be running large primary deficits and the only way they will be able to do that is if they leave the Eurozone.

The IMF though are obsessed by ‘structural reform’ – aka hacking into health care, education, pension, public employment, wages, job security, and the rest of the programs that define a civilised society.

The IMF wants further fiscal cutbacks, but they admit that:

Cross-country evidence suggests that few countries having managed to maintain such high surpluses for extended periods of time, and even fewer (one in Europe) have done so while also experiencing double digit unemployment rates … [and] … that double-digit unemployment rates are expected to persist for several decades.

They have normalised that unemployment prediction now – it doesn’t seem as shocking as it did last year when it first entered the IMF spin.

This sort of slippage in our attention is how neo-liberalism has created the disaster that befalls the world after three or more decades of the regime.

We become anathematised to this sort of dire prediction – ‘oh, well, Greece is going to have 20 per cent unemployment or thereabouts until 2015, what’s next’ – that sort of complacency has allowed them to get away with this agenda which has allowed the top-end-of-town to prosper at our expense.

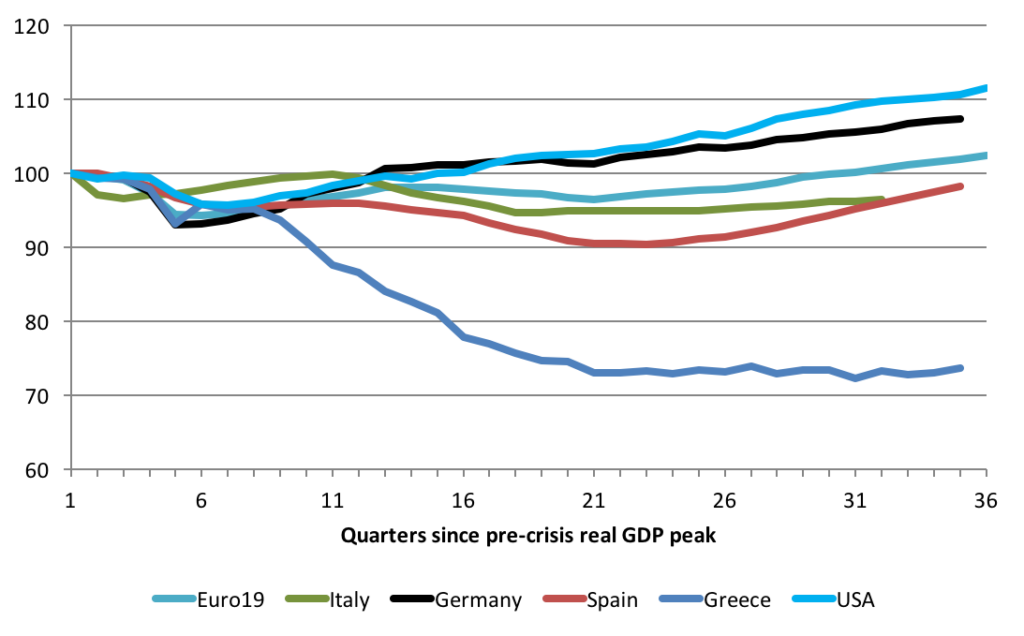

Here are two graphs based upon National Accounts data to remind us of the Greek situation.

The first graph shows real GDP indexed at 100 for the peak period before the crisis (it varied by a few quarters in different nations) for the 19 Eurozone nations, Germany, Greece, Italy, Spain and the US. The data for Europe is from Eurostat. The US data comes from the Bureau of Economic Analysis.

In general, the data goes to the third-quarter 2016 (although the US and Euro19 data covers the period ending the December-quarter 2016).

Prior to the crisis, Greece was growing in line with the rest of the Eurozone. The turning point from the peak is identical for the Eurozone in general.

The downturn and the slight recovery that followed (as the fiscal deficits grew to attenuate the loss of private spending) was shared across the Eurozone – Greece followed the same pattern in Greece of the other Eurozone nations.

Then the break point came – March-quarter 2009 – and from there the Greek disaster began and has continued to the current period.

The break point came when the Greek government started to impose fiscal austerity in an environment when private spending was extremely weak and deteriorating further.

A sequence of events including the Troika bailouts built on that austerity and caused real GDP to fall by around 26 per cent.

The IMF initially claimed the austerity would boost growth but then had to admit that it has bungled its modelling of the expenditure multipliers and, lo and behold, their revised parameters were telling them that austerity would cause considerable damage to growth in Greece.

And that is what happened – and was always going to happen – despite all the nonsensical narratives about “growth friendly austerity” that became the norm for IMF and European Commission officials etc.

The difference experiences of the Eurozone in general and the US reflect the imposition of austerity in Europe relative to the US, where the fiscal deficit was allowed to remain at relatively higher levels for longer to support growth in private spending.

The result was that US real GDP recovered more quickly and is now 11.6 per cent above the pre-crisis peak. And, remember, that this is a relatively weak recovery by US historical standards.

The EU19 real GDP took 29 quarters to pass its pre-crisis peak. It has only grown by 2.4 per cent in the last 9 years (36 quarters since peak).

Spain and Italy remain below their peak levels.

The Greek economy might have “stabilised” in the IMF’s assessment but is skating along the bottom having shrunk by 26.3 per cent since the crisis began.

That is, Greece has lost more than a quarter of its production and income generation.

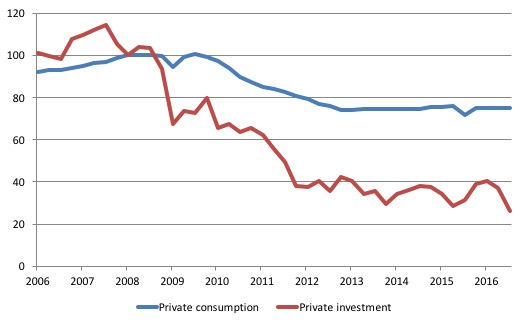

The next graph shows the evolution of Greek private spending (Consumption and Investment) from the March-quarter 2006 to the September-quarter 2016. The index equals 100 in the March-quarter 2008.

Clearly, investment led the crisis in 2008 and 2009 as financial markets froze in the wake of the American housing disaster. As employment fell and incomes started falling, private consumption started to fall.

The government started to cut spending in 2009 and then accelerated the cuts in early 2010 at a time when private spending was still deteriorating, meaning fiscal policy became pro-cyclical when responsible policy conduct should see counter-cyclical fiscal intervention.

In other words, when the private spending cycle is contracting and unemployment is rising, public spending should expand, and vice versa.

The conduct of Greek fiscal policy, once the crisis hit, was irresponsible and the austerity that was imposed exacerbated the contraction that was led by the collapse of private investment.

Household consumption has fallen by 25 per cent and shows no signs of picking up given the on-going income losses being incurred.

But, business investment is now 74 per cent lower than it was in the March-quarter 2008. That scale of collapse is almost without precedent.

No advanced nation has endured such a massive collapse in productive capacity building.

The IMF, the European Commission and the ECB have conspired to destroy the prosperity of this nation for many decades to come. There should be criminal charges laid.

While consumption expenditure can pick up fairly quickly, the problem of such a decline in business investment is that it has undermined the future growth potential of the nation.

It will hit the inflation barrier much more quickly than in the past because full capacity is now likely to occur at much lower levels of spending growth.

The Troika, by vandalising the economy, has also provided very little scope for the youth of the nation to be absorbed back into productive employment unless very carefully planned, large-scale public employment schemes are implemented that do not strain productive capacity.

This Newsweek report (July 13, 2015) – Greek Crisis has seen a rise in Suicides and Depression – while a bit dated provides a glimpse of how bad things have become within the health system in Greece.

After more than 9 years of recession and stagnation we know that in Greece:

1. The OECD Health Statistics database shows that in 2010, Greece spent 9.9 per cent of GDP on health care (all areas). By 2015, this had fallen to 8.2 per cent.

The OECD remarked in its Health Statistics 2014 Report that:

Health spending in Greece has dropped in each of the years since 2009, driven by a sharp reduction in public spending as part of government-wide efforts to reduce the large budgetary deficit. Greece saw double-digit percentage reductions in health expenditure in both 2010 and 2012, leaving the overall level of expenditure around 25% below its peak in 2008.

2. “the observed 12 percentage point rise in unemployment during the austerity period … largely accounts for the overall suicide increase in working-age men during this period”. Suicide rates have risen sharply – in 2007, the suicide rate per 100,000 was 2.93. By 2012, it had risen to 4.56. (Source).

Some data on the labour market disaster

I investigated some of the age-related Labour Force data from Greece the other day to document how bad things have become – underneath the headline unemployment rates, with the IMF and European Commission like to tell us are falling.

Detailed data is available from the March-quarter 2008. So we can trace the changes since the crisis.

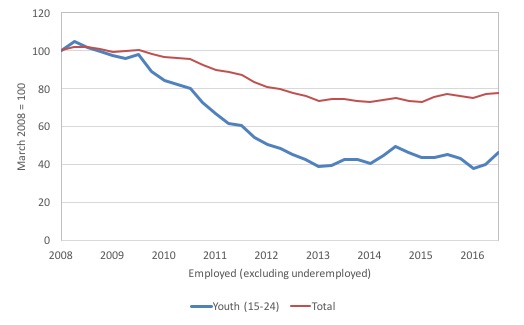

Dramatic decline in employment

The first graph shows trends in employment for the Youth (15-24 years) and All workers in Greece from the March-quarter 2008 to the September-quarter 2016. The indexes are equal to 100 as at the March-quarter 2008. They exclude the official underemployed.

For youth, the decline in employment has been dramatic – 54 per cent (from 273.2 thousand to 125.8 thosuand). The Employment-Population ratio for this group has fallen from 21.6 per cent to 11.9 per cent over the time examined.

Even if we add back the underemployed workers which have risen from 13.3 thousand in the March-quarter 2008 to 23.7 thousand in the September-quarter 2016, the decline in employment is still of the order of 48 per cent.

For all workers, the decline has been of the order of 22.2 per cent (or 19 per cent if we add back the underemployed).

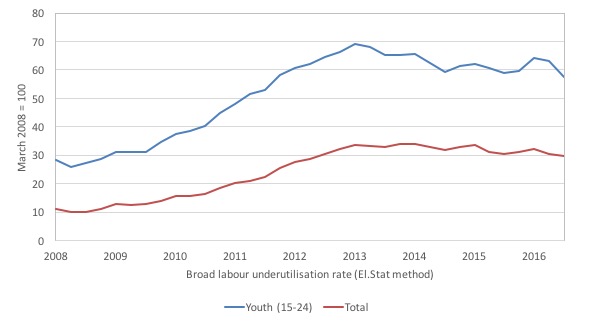

Massive labour wastage

The youth unemployment rate has risen over this period from 23.3 per cent to 44.2 per cent. Overall, the national unemployment rate (all workers) has risen from 8.4 per cent to 22.6 per cent (September-quarter 2016).

The Troika likes to tell us that these rates have fallen. Youth unemployment peaked at 60 per cent in the March-quarter 2013 and has steadily declined since then.

But over the same period, the participation rate has fallen from a peak of 31.2 per cent in the September-quarter 2009 to 25.3 per cent in the September-quarter 2016.

In terms of the working age population that is equal to 63 thousand odd young workers exiting the labour force as a result of no job opportunities.

In scale terms, here were 118.1 thousand young people unemployed in Greece in the September-quarter 2016, so another half of that (about) have dropped out.

Including them as hidden unemployed would push the unemployment rate up to 54 per cent which means it hasn’t come down all that much at all over the last 8 years.

The Greek Statistical Office estimate that 23.9 thousand of those Not in the Labour Force are currently available for work but have given up looking.

Adding them back in would give an adjusted unemployment rate of 48.7 per cent.

There has also been a sharp rise in underemployment (part-time workers who desire more hours of work but cannot access them).

We consider this group to have dual qualities – on the one hand, they are employed but the extra desired hours are conceptually equivalent to being unemployed.

That is why national statistical agencies are starting to publish broad labour underutilisation data – the unemployment rate is a so-called ‘narrow’ indicator of labour wastage.

Depending on how we treat the participation drop (that is, we use my method of computing what the labour force would be at recent peak participation rates OR we use the estimates from the Greece agency of workers who are available but not looking) we find that the broad labour underutilisation rate for youth in Greece is 57.6 per cent (using El.Stat method) or 63.7 per cent(using my method).

The truth is somewhere in between, given that several people will adopt marginal status as not in the labour force but will indicate they are neither available nor looking but would take a job if one was offered.

The underemployment rate for youth has risen from 3.6 per cent (March-quarter 2008) to 8.8 per cent (September-quarter 2016).

The next graph shows the broad rates for youth and all workers (using the Greek El.Stat method of assessing hidden unemployment).

Once we aggregate official unemployment, underemployment and hidden unemployment we see that there has been no improvement over the last three to four years for workers (all). The broad labour underutilisation is at 29.9 per cent and has been stuck around there since 2012.

A similar situation exists for the youth.

Conclusion

This is the legacy that the current generation is leaving their children and their children.

The lack of jobs, the cutbacks in education and training, the lengthy periods of unemployment, the rising underemployment, the loss of participation, and all the attendent consequences are the legacy.

This is directly the result of the austerity which was imposed in the name of providing a brighter future for young Greeks.

The reality is that their future looks very bleak indeed.

Greece is now a failed state – a colony of Germany and a plaything of the IMF.

If there was any semblance of political courage they would get out of this bind immediately and start building from the ashes.

Life will continue to be tough if they did leave – but improvement would come much more quickly than anything the current policy mix is likely to provide.

And my comments have nothing to do with the question of Greece’s debt burden. Obviously, they will never be able to pay that back in Euros. But debt relief, which the IMF is now trying to use as a means of distancing itself from the German obsession with more Greek punishment, will not help much at all.

What is required is freedom to increase fiscal deficits and start a public sector led recovery. They will never be able to do that while they are within the straitjacket of the Eurozone.

So in a few weeks, the next debt-bailout saga will hit the headlines and the talk will be the same. But I suspect the IMF will not pull the pin and force a Grexit. Mores the pity.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Given they currently have the Euro and freedom of movement (capital and people) what stops the Greek unemployed pricing themselves back into work? What stops those European employers wanting cheap labour moving their factories to Greece to employ unemployed Greeks at rock bottom wages? Why isn’t the ‘free market’ working in textbook fashion? Could it be that it isn’t really free enough?

at February 8, 2017 at 13:46

Ahh the good old text book fashion, tongue firmly in cheek no doubt

The so called free market is not working, there are so many unemployed all over Europe there is no need to move factories, but in any case there is such low demand (free market working here) there is scant employment anywhere !

Bazz

Why isn’t the ‘free market’ working in textbook fashion? Could it be that it isn’t really free enough?

So why do all the worthy solutions to the Greek economic crisis that Bill has so often explained, continue to be ignored? Clearly the democratic process in Greece and in the EU are not functioning correctly and are instead serving the financier class. The European electorates also generally remain ignorant of the straight forward solutions suggested by Bill which is probably due to control of the mass media by the financier class.

The left in Europe still remain as captive to neoliberalism and austerity as the centre right or simply lack the necessary courage to act in the best interests of citizens unfortunately leaving the opportunity for the hard right to win office.

The bigger fish such as France and Italy may be needed to initiate the process to breakup the eurozone as Greece’s political class clearly lacks the courage.

What is going on in Greece shames us all.

It’s a failure of policy and politics.

Neil, as someone from the US, I am not sure how what is going on in Greece should shame me. For once there is some crisis that is difficult to pin on the US. Unless you are saying that the US should not have let the EU get away with what it was doing and should have intervened…?

Neil, I am afraid my earlier comment was a bit cynical. The humanitarian disaster that is the Greek economy should bother us all. As should many other disasters throughout the world. But the Greeks are able to start fixing it all by themselves if they so choose. Leave the Euro. Repudiate the debt, or pay it off at once in the new currency. Tax effectively from now on. Consume what is produced or trade some of what is produced for imports. Quit wasting about a quarter of their workforce in unemployment. They will get back on track if they do that.

Jerry Brown – “Tax effectively from now on”. But on MMT logic as I understand it you wouldn’t want to tax at all while there was an output gap as evidenced by largescale unemployment. Which underlines the problem as I see it with MMT. The algebra is fine but not the psychology. Until Bill coverts the mainstream economics establishment, then deficits matter ….. just because mainstream thinks they matter. Perceptions and prejudice beat algebra. I fear the ‘new drachma’ would be shunned. Any Greek with clout will demand to be paid in a ‘hard currency’. Giving up the old drachma may have been a mistake; but introducing the new drachma if there is no confidence in it, might be an even bigger mistake.

Mutatis mutandis this article applies to all Europeripheral nations.

Andrew, MMT definitely says that taxes drive the value of the currency. I understand that to mean that without effective taxation any new currency would be mostly worthless. Greece is in a very bad situation and there really is nothing that will make that situation all better overnight. Greece might have to make “demanding to be paid in a hard currency” by anyone in Greece a felony and enforce that rule. It might have to demand something like a poll tax in its new currency upon introducing it. And enforce it. None of that is nice stuff, but neither is what is going on there for the last 8 years.

And none of that means that the government could not spend more than it taxes as long as it can tax in its currency. Government is not always Mr. Nice Guy in MMT. Just see Warren Mosler’s explanations on turning his business cards into currency.

Andrew, here is a link to Warren Mosler http://www.netrootmass.net/fiscal-sustainability-teach-in-and-counter-conference/warren-mosler-the-deficit-the-debt-the-debt-to-gdp-ratio-the-grandchildren-and-government-economic-policy/

So Andrew Wakeling, given the magnitude of the catastrophe in Greece you are saying that introducing a new currency could be a bigger mistake? What sort of bigger mistake? Would Greeece simply disappear as a nation and sink under the sea? Should they just be complacent about the euro and do nothing? Is the risk of adopting a new currency bigger than that of remaining in the Euro? I am sick and tired of people scaremongering in the europeripheral countires about the thought of leaving the euro. For God’s sake! The disaster is now. We want a future for our children. There clearly is none within this ill-fated currency union.

I agree with Jerry. And Andrew, think about something else: afters years of sucking Greeks dry the tax system has become nastier than it ever was. Likewise in Spain: despite being managed by mafiosi the government is emptying the pockets of the average citizen with great success -while filling those of their cronies-. This means that both countries are perfectly capable of running an effective tax system so the currency would be in demand. Yes, some people would like to have their savings in euro and those in the tourist industry will have access to foreign currency so areas of the Greek economy will not be controlled by the government. But it is evident that the tourist industry is not enough to generate opportunity for all and it is not the hoteliers I am worried about -a higher sojourn tax can deal partly with the problem as well as a land or poll tax-. But the Government can create more opportunities in mainland Greece away from the beaches. Yes, you would have to run a high fiscal deficit but that not is equivalente to saying that people would be exempt of paying taxes. So yes, Greece would be better off oustide the Euro. As would all the PIGS. We’d rather not share our pigsty with the HOGS (Holland, Österreich, Germany and Suomi-Finland). Nothing personal. I have good German and Dutch friends. We just want our life back.

Andrew Wakeling asks why other Euro countries don’t move factories to Greece to make use of what Andrew calls the “rock bottom wages” in Greece. The answer to that is that if Greek wages really were “rock bottom” the basic problem would not exist: that is Greek products would be sufficiently cheap that Greek exports would boom. Problem solved.

Barry De says there is “scant employment” anywhere in Europe. Yes there is: in Germany and other core countries. Of course the core countries do not have full employment in the unemployment = zero sense. But they have full employment in the conventional sense, i.e. unemployment = about 5%.

And finally my solution for Greece: let Greece implement import tariffs for a few years, while it gets its costs down. That would improve Greece’s balance of payments problem and hence get it out of debt and enable something nearer full employment there. Of course tariffs go against the whole grain of the EU, but what of it? Desperate times call for desperate measures. That could be a bit less desperate than Greece leaving the EZ.

One does wonder why Greece has not made the break yet. I did read somewhere that Greeks’ trust in their politicians is so low, the Troika stuffing them up now have a better rating. Imagine that.

“I fear the ‘new drachma’ would be shunned. Any Greek with clout will demand to be paid in a ‘hard currency’.”

You impose a volumetric hut tax on Greek citizens backed by military force and the appropriate perception management (avoiding the tax is socially unacceptable). If necessary drag a few perps in chains through the streets and humiliate them in public.

The capacity of a nation to move forward with public provision via a government ultimately boils down to its citizens not wanting to bear the consequences of the taxman’s wrath. And that is always backed by persuasive and where necessary coercive power.

Once the Drachma is reintroduced, the government will impose taxation to force the population to use it. Some may wish to use another currency as well, but they would not be able to pay their taxes with it. Varoufakis, while finance minister, set up an alternative payment system that he has recently stated is ready to go should the Greek government wish to implement it. His aim was to replace the Euro. Whether Tsipras will stand up to the Troiks, as he has recently indicated he might, is not clear. I suspect he will cave in. Again.

“hut tax on Greek citizens backed by military force and the appropriate perception management (avoiding the tax is socially unacceptable)”

Cmon how likely is that to get through. You wouldn’t get elected! TO start with, Greece has no national LAND REGISTRY:

http://www.nytimes.com/2013/05/27/world/europe/greeces-tangled-land-ownership-is-a-hurdle-in-recovery.html

I have read that over 2.5 million greeks are without health care and reliant on largely german charities that keep clinics running!

“More than 2.5 million Greeks have been left without any healthcare coverage. Shortages of spare parts are such that scanning machines and other sophisticated diagnostic equipment have become increasingly faulty. Basic blood tests are no longer conducted at most hospitals because laboratory expenditure has been pared back. Wage cuts have worsened the low morale.

“The biggest problem is shortage of staff because people are retired and never replaced,” said Dr Yiannis Papadatos, who runs the intensive care unit of one of the three paediatric hospitals in Athens. “Then there’s the problem of equipment and, periodically, lack of supplies like gloves, catheters, and cleaning tissues.”

Small acts of heroism have done much to keep the broken system afloat: doctors and nurses work overtime, with donors and philanthropists also helping (Guardian).

Greece is such a tragedy, it’s getting slowly strangled and can’t do anything about it. =[

How can the EU be so heartless to the Greek people? What do mainstream economists say about how to revive the Greek state? Don’t tell me they are in favor of the IMF and ECB’s austerity policies…

Also, can someone give me an example of austerity somehow working to bring a country to prosperity? Has it ever worked?!

The situation in Greece is indeed dire and there is no easy way out. I am not sure if William Mitchell is correct in all of the remedial actions which might be necessary to, eventually, give Greece some hope for the future but one thing is certainly true: Greece can never repay its external liabilities in Euros. Surely this is well known to everyone with a basic grasp of economics so should come as no surprise. As a result some form of debt forgiveness is a given, as is a departure from the Eurozone. It’s time to be realistic and lance this particular boil. The EU, while not entirely to blame, is undoubtedly the biggest contributor to the Greek problem. I would suggest that an organisation that deliberately ruins lives is not fit for purpose.

Paul Samuelson:

“I think there is an element of truth in the view that the superstition that the budget must be balanced at all times [is necessary]. Once it is debunked [that] takes away one of the bulwarks that every society must have against expenditure out of control. There must be discipline in the allocation of resources or you will have anarchistic chaos and inefficiency […]”

Here I think Samuelsson is perpetrating a myth, that if politicians didn’t believe fake economics and it’s alternative facts they would spend like drunken sailors. The empirical facts point more to the opposite, they love punishing the unruly people with austerity, taking “hard” decisions and show “responsibility” as it was personal sacrifice. Ordinate self-flagellation for the people while them self wine and dine in Brussels.

Paul Samuelson on how US got out of the great depression:

https://www.youtube.com/watch?v=EeeasEyTZqo&t

I knew a Greek family just before and after the Credit Crunch and visited them a few times, and through them met many ordinary Greeks..this was in Corfu.

At that time they told many of the young men and women would head off to Athens for jobs and return to the island to help with the family tourist business..hotel, restaurant, bar, taxis etc in the summer months.

The biggest thing they talked about then was the crushing effect the Euro was having on their tourism as Brits, Swedes, Germans and Dutch were *going to Turkey* and elsewhere because their money went far further with meals, drinks etc.

I remarked on how quiet it was in the bars and restaurants in any village that catered to anything less than a really super-rich tourism level.

They were crystal clear that it was this just because of the Euro…

Now the world doesn’t begin and end with how well one’s tourism industry is working, but in some countries, and Greece is one, it is a massive part of the economy.

So even in this restricted area leaving the Euro would , because the new Drachma would fall (initially) would give both tourism and the whole associated area of buying and doing up holiday homes across Greece by Northern Europeans, a massive shot in the arm. Northern European middle classes looking for both sun and clear investment opportunities could create a stampede starting at minute one, day one.

The investment world is both interconnected and starving for good opportunities that have instant appeal to ordinary investors and people (albeit more well off ones).

This would help small builders, plumbers, etc etc as well as the tourism industry itself.

I am not coming from a massively data supported point of view so much as just remembering what just about everybody said and everybody knew 05 through 10-11 that I met in Greece…that absent the (too highly valued…for Greece) Euro they felt money would come back to the country.

Ted. So your Greek friends reckoned they were losing business to Turkey etc. because “money went further with meals and drinks etc”; and ‘this was just because of the Euro’. And the new Drachma would attract this business back – because the new Drachma would fall and drinks would be cheaper …..(?)

This might work but wouldn’t it be easier to just lower prices and wages where necessary and keep the Euro? What is wrong with the simple solution?

Dear Andrew Wakeling (at 2017/02/10 at 8:06 pm)

The fact that you keep offering wage cuts to solve mass unemployment and deficient aggregate spending tells me you have not studied the vast literature on this topic going back to the famous debates of the 1930s. The reason why wage cuts do not solve the problem was done and dusted then.

Further, most of us have contractual obligations that are denominated in nominal (money) terms rather than in real terms (purchasing power equivalents).

So we have to deliver X amount of dollars (or euros or whatever) per period (say a month) to a bank (mortgage etc) or some other credit organisation. If we do not make the payment we default and lose the asset (typically our home).

We entered those agreements based on a level of money wage income.

While there will be some room to make cuts to non-essential spending (going out for dinner etc), soon enough cutting money wages will impair our capacity to service these nominal contractual agreements. We are unable to say to the creditor – take a money payment cut!

Given these institutional realities, an economy will soon spiral into a deep recession as major bankruptcies and foreclosures result, if we try to cut wages to solve unemployment.

best wishes

bill

Thank you Bill.

As you say, and at the heart of the problem : “So we have to deliver X amount of dollars (or euros or whatever) per period (say a month) to a bank (mortgage etc) or some other credit organisation. If we do not make the payment we default and lose the asset (typically our home).”

If moving to a ‘new Drachma’ is the only way to lower the real prices of drinks (to bring the tourists back) and the real costs of servicing the mortgage then so be it. But please let’s not lose sight of the more direct and less complex alternatives. Yes, along with letting market forces lower prices and wages, it may well be necessary to partially forgive mortgages and unrepayable loans, and if banks and lenders won’t or can’t do this (a market failure) then the State should make it happen. It may also be necessary for the State to increase its own employment and this may further increase the deficit.

To my mind pressure needs to be increased on the EU monetary authorities to write off unrepayable Euro debts, and allow / encourage increased Euro deficits to support increased economic activity. The Euro area provides a wonderful opportunity for increased economic efficiency, and it would be a tragedy to lose it. There needs to be a real and effective European central bank, a ‘European Federal Reserve’. The politics is clearly challenging, but it would be better to have the debate about managing the Euro area rather than dealing with Greece.

That is an impressive amount of gobble de goop Mr. Wakeling

I am somewhat envious.

Andrew wakeling

First of all you should understand 3 things 1.supply not always create new demand

2.money is not neutral in the long run

3 gross substitution effect is non existent in the real world to assests like money the bond markets and etc.

When you accept that its can only exist in a hyper rational world where peoplw can predict on average the future with zero percent mistakes and where there all people have identical tastes (its been proven by SMD conditions btw).

Then in this case lowering wages of people will most likely decrease the effective demand in the system even before debt deflation will take its course.

The Greeks i know trying to do business in their own country now tell me the Austerity is destroying businesses even they thought would never be touched. It just keeps unraveling.

The Greece situation has provided an unfortunate laboratory of proof for the empirical power behind many facets of MMT.

The causality can be seen each year the Greek government was shedding thousands of civil servant jobs and then watch the GDP go down. Nothing more effective at killing an economy than killing the well paid government sectors.

More broadly people need to see the writing on the wall: free markets delivering any workable outcomes? Where? (fed up with people justifying the existence of pink unicorns) i think this stage of capitalism when one group of capitalists are making opportunistic grab at profit its just reflections/ripples of some government(s) deficit spending somewhere. Every day there is some issue in France, Italy etc which is the inefficiency of free markets/specifically this so loved ‘single market eurozone’ is causing real permanent damage. 1. damage to the physical ability to produce stuff 2.damage to the real people which ARE the economy. (no invisible hand required). Then the media and political class simultaneously praise ‘the single market’ its the modern speak for Orwellian double-think. 😉