The other day I was asked whether I was happy that the US President was…

The planned destruction of Greece continues …

After all the hoopla last year with the rise and fall of Syriza one’s attention span strays from what is happening in Greece at present and how it demonstrates the continued (and permanent) failure of the Eurozone. We also become inured to badness after badness is normalised. I was reminded of the depth of the malaise in that nation last week when I was in Kansas City. I won’t disclose confidences but an influential person (in the Greek context) I spoke to now regard their previous support for remaining within the Eurozone as a mistake and they consider my assessment of the situation (which they opposed at the time) to be closer to reality. That was an interesting conversation and credit to them for being able to recognise an error of judgement. I was also reminded of the absurdity of the Eurozone when the IMF released its latest – Greece: Staff Concluding Statement of the 2016 Article IV Mission (September 23, 2016). This is normalisation of badness in bold! The current thinking is that the Greek unemployment rate will remain in double figures until at least 2050, that business investment has collapsed, real GDP is around 27 per cent below its pre-GFC level – and – more significant and accelerated austerity is required. If an organisation can exhibit psychopathy then the IMF has it!

On June 22, 2016, there was a press report – Greek Labour Minister Katrougalos says IMF wants ‘blood’ – where the Labour Minister said that the:

IMF would make harsh demands on labour matters during the new round of negotiations scheduled for next Autumn … Katrougalos said that no matter what these demands entailed the Greek government would not cave in. ‘We will not offer blood on the labour issues’, he said. He went on to say that the Greek government was not interested in making any concessions to the IMF if that meant backtracking on fundamental principles and commitments to protect workers’ wages … He criticised the IMF’s policies as leading to a complete impoverishment in Greece.

The Labour Minister had earlier (May 29, 2016) admitted that the policies adopted by Syriza under pressure from the Troika amounted to a “concentrated and distilled form of neoliberalism adopted during the past in Pinochet’s Chile” (Source).

The IMF has also been calling for “massive redundancies” in the Greek public service (Source) and the Greek government had agreed to the so-called “automatic cut” in pensions which would be “announced every April 30 and would last for 3 years”.

So unlike the usual expectation where citizens look forward at some point in the year to the automatic rise in pensions (usually for indexation), the Greek government has conspired with the Troika to have an automatic cut. Like it or lump it! Extraordinary really.

Minister Katrougalos isn’t taking his foot of the pedal in terms of his on-going verbal war with the IMF. In the Reuters report (September 14, 2016) – Greece says to stand up to IMF on demands for labor reform – he told the press that:

Greece will tell its creditors it cannot comply with labor reforms demanded by the International Monetary Fund as a condition of its support for the country’s third bailout …

The IMF have demanded further wage cuts, cuts to the minimum wage and further relaxation of dismissal protections and a virtual ban on industrial action.

The Labour Minister told the press:

I insist that the IMF is an extreme player in this negotiation because its position does not reflect the European acquis … Those who want to save Europe can no longer implement such practices.

At a press conference (September 15, 2016), the week before the Article IV process began in Athens and a day after Mr Katrougalos’s latest anti-IMF tirade, the Director of IMF Communications (the spin doctor), one Gerry Rice gave a press conference to provide an update on the meetings with the Troika about the ESM Program and Greece.

The – Transcript – records the following interchange:

QUESTIONER: Okay. So yesterday the Greek Minister of Labor said that the Greek government cannot accept what you guys suggest regarding the labor market reform.

MR. RICE: You guys?

QUESTIONER: The IMF. So he also described the distance between the two sides huge, and he described the IMF as an extreme player. How do you comment on that?

MR. RICE: I haven’t seen those comments actually, so I don’t have any comment on them …

….

QUESTIONER: Can you tell us, Gerry, what is your position on the labor market? I mean, do you agree with the government?

MR. RICE: You know, it’s something that’s going to be under discussion, in the context of the ESM review, and I’m sure that it will also be something that will be looked at broadly in the context of the Article IV …

The IMF describe its Article IV process under – Surveillance – whereby:

… an IMF team of economists visits a country to assess economic and financial developments and discuss the country’s economic and financial policies with government and central bank officials.

The IMF also tell us that “The consultations are known as “Article IV consultations” because they are required by Article IV of the IMF’s Articles of Agreement.

If you read the Articles of Agreement of the International Monetary Fund – which were adopted at the “United Nations Monetary and Financial Conference, Bretton Woods, New Hampshire, July 22, 1944” (and have been revised several times since) you will see that Article IV: Obligations Regarding Exchange Arrangements’ relates to the responsibility of each member state to “to assure orderly exchange arrangements and to promote a stable system of exchange rates”.

The original intent of the Article IV process was to ensure that the fixed exchange rate system, which gave birth to the IMF as the overseer, would deliver stable outcomes. The IMF was charged with providing sufficient foreign reserves to help nations who were struggling with current account deficits (and hence experiencing downward pressure on their parities).

In this context, the current Article IV processes are ludicrous given that the Eurozone nations do not have an “exchange rate” that they manage through central bank foreign exchange intervention. They surrendered their exchange rate flexibility when they joined the Eurozone.

Further, the intent of the Article IV process was never to turn the IMF into a ‘big brother-type’ moral arbiter and front-line attack dog for big capital and the ruling ideology. It was more of a functional role – to keep the fixed exchange rate system that affected all participating nations stable.

However, in an era of flexible exchange rate, the Article IV process has become so bastardised that it bears little familiarity with the original intent.

Now the surveillance is of the type that the old East German Stasi or the old German Sicherheitsdienst would be proud to be part of. It is bullying, issues threats of insolvency and economic disaster, invokes fear, and tramples on democratic freedoms.

All the characteristics of what Noam Chomsky considers to be the hallmarks of terrorism which he notes is defined in the US army manual as “the calculated use of violence or threat of violence to attain goals that are political, religious, or ideological in nature. This is done through intimidation, coercion, or instilling fear.”

That is what the Article IV process has become in this neo-liberal epoch.

And the IMF feels it is now just normal communication to admit in the – Greece: Staff Concluding Statement of the 2016 Article IV Mission – released on September 23, 2016 that:

Looking forward, growth prospects remain weak and subject to high downside risks, and unemployment is expected to stay in the double digits until the middle of the century.

For F*CK sake, we are only in 2016!

The IMF solution is to “pursue deep reforms in key areas” – meaning the sort of steamroller cuts and retrenchment of social and labour protections that the Labour Minister feared.

The IMF wants “a significant deepening and acceleration” of the neo-liberal steamroller. Don’t kick a ‘man’ when he is down, used to be the norm for people who wanted to be considered civilised.

The IMF makes an art form of going harder the worse the situation gets.

They want cuts to the “unaffordable pension spending” and other areas while admitting that the cuts to date have left Greece with:

… hospitals lacking syringes and public busses immobilized by lacking parts.

They “welcome” the recent “1 percent of GDP” equivalent cuts to pension but the cuts “are well short of what is needed”.

They want tax hikes on workers (through the “lowering the generous income tax credit”).

They note that the banks are now holding “Non-performing loans … close to 50 per cent of total loans, the second highest in the euro-area …”

A “weak payment culture” is cited as a reason and so the Greek government is implored to “further strengthen and fully implement the legal tools for debt restructuring to restore the payment culture” – read: seize assets from the unemployed who cannot service loans taken out when they had jobs.

And the IMF claim the “should relax the …[capital] … controls rapidly” – read: so the rich can get more of their assets out of the nation.

The IMF also note that:

Despite successive attempts to address its weak institutions, Greece has not managed to regain competitiveness, with productivity growth among the lowest in the euro-area, investment down by more than 60 percent, and export growth lagging peers.

The burden of the austerity has “been borne largely by wage earners” – the so-called internal devaluations – read: trash worker entitlements and wage prospects – and surprise surprise – haven’t worked!

But the IMF is not relenting – “it would be wrong to conclude that labor market reforms should be reversed” – no that might stimulate domestic demand a bit and provide some incentive for business firms to invest in new productive capital.

That would be too much for the IMF to conceive! They want total capitulation of every sector within the nation.

The data is a pretty convincing witness to the folly of the Eurozone, which was built on claims of convergence to better times across all Member States.

Nothing could be further from the truth. Even the so-called powerhouse nations such as Germany does not look in great shape. But nations such as Greece are in disastrous straits.

The Hellenic Statistical Authority El.Stat last week (September 22, 2016) published the latest – Job Vacancies – data up to the June-quarter 2016.

We learn that:

The number of job vacancies in the 2nd quarter 2016 has recorded a decrease of 10.7% in comparison with the 2nd quarter 2015 (15,178 and 17,000, correspondingly), while the corresponding number of job vacancies in the 2nd quarter 2015 had recorded a decrease of 8.6% in comparison with the 2nd quarter 2014 (17,000 and 18,596, correspondingly).

In the second-quarter 2009, there were 45,886 job vacancies immediately available to be filled. In the June-quarter 2016, the number was 15,178.

Seven years of devastation at the hands of the Troika will do that.

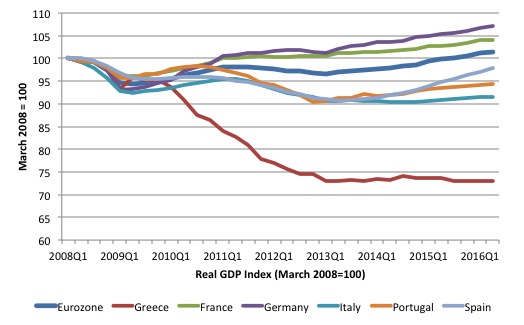

This data is no surprise (no matter how devastating it is) given the drivers. The next graph shows real GDP indexes (March 2008 = 100) for various nations within the Eurozone and the currency union in total.

The sample is from March-quarter 2008 to the June-quarter 2016 (latest data). A change in the index from quarter to quarter signifies growth (or contraction).

Germany and France lead the way although their growth over the 8 or so years shown is pathetic – 7.2 per cent overall for Germany and 4 per cent overall for France.

The Eurozone has grown by only 1.4 per cent in the 34 quarters shown. Barely at all.

Then we see Spain (-2.2 per cent), Portugal (-5.6 per cent) and Italy (-8.4 per cent) form the next group. They have still not regained the level of output that they were achieving at the outset of the GFC.

But Greece has now contracted by 26.9 per cent from its March-quarter 2008 level and there appears no end in sight. It has sort of entered a period of stagnation – no Depression – and the policy settings in place are holding it there.

Years of unnecessary suffering for its people.

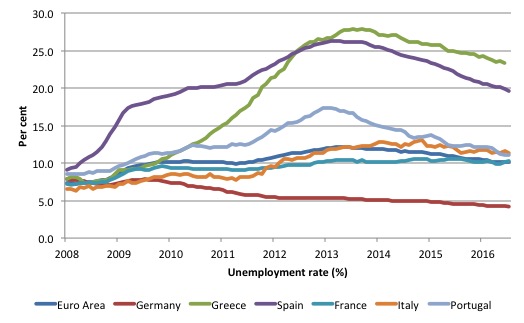

The next graph shows the evolution of the unemployment rate (%) from January 2008 to July 2016 for the same set of countries within the Eurozone.

While the Eurozone as a whole still endures unemployment above 10 per cent (10.1), Greece has been stuck around the mid-20s for some years now.

The IMF thinks it will not get below 10 per cent until 2050.

I wouldn’t trust the IMF’s judgement. Appaling as it is, it is likely to be an overestimate of the fall in Greek unemployment over the next decades.

http://www.imf.org/en/data

There is little to stimulate growth in that nation. Sure enough, the labour force contraction through net outmigration and ageing will reduce the unemployment rate.

But that just leaves the nation in a geriatric state still in Depression.

I have previously analysed the abysmal forecasting performance of the IMF.

For example, please read my blogs – The case to defund the Fund and Governments that deliberately undermine their economies – for more discussion on this point.

Also search, if you are interested, through the posts at the – IMF – category for all my posts in this regard.

In the latest WEO forecasts (April 2016), the IMF predicted that:

| Indicator | 2017 | 2018 | 2019 | 2020 | 2021 |

| Real GDP growth (% pa) | 2.662 | 3.106 | 2.792 | 2.361 | 1.533 |

| Unemployment rate (%) | 25.028 | 23.358 | 21.677 | 18.856 | 18.000 |

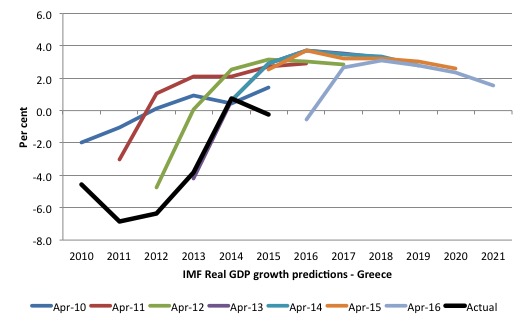

But these two graphs will let you see how poorly the IMF predictions are.

The first shows the evolution of its predictions in each April World Economic Outlook release from April 2010 for real GDP growth in Greece.

The black thick line is the actual outcome in each of the years.

Each WEO predicts out several years (as the Table above shows for the April 2016 WEO). But even in the light of catastrophic forecasting errors the IMF fails to make significant adjustments to their forecasting approach.

They also have admitted using spending multipliers that predicted growth in the face of spending cuts whereas they now acknowledge that the actual multipliers would lead to the conclusion that austerity kills growth.

This admission was revealed in October 2012 – see blog – The culpability lies elsewhere … always!.

But they are still bullying Greece into more austerity.

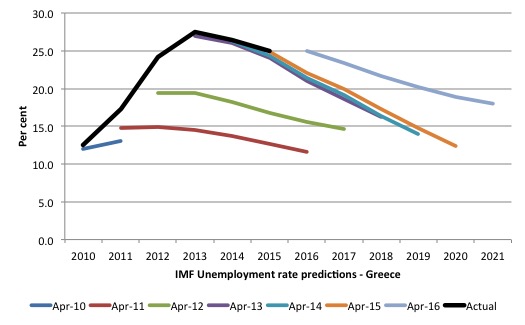

The second graph is even more stark. It shows the evolution of its predictions in each April World Economic Outlook release from April 2010 for Greek unemployment.

Between 2010 and 2012, as the IMF and the Troika were inflicting austerity on Greece they consistently failed (by a huge factor) to realise what damage they were doing.

Their more recent forecasts have clearly been re-calibrated at the higher level but even as late as 2015, they were predicting a steady fall to around the same levels by 2020 that they thought would be achieved by now back in 2011.

Their most recent forecasts are more dire for sure but probably optimistic.

Conclusion

I haven’t written about Greece (or the Eurozone) for a while – it is depressing thinking about it really and I cannot imagine how the citizens in Greece are dealing with the planned destruction of their prosperity by highly paid officials in Brussels, Frankfurt and, particularly Washington.

The scale of the destruction is beyond belief really and constitutes in my non-legal brain a crime against humanity.

Someone in the IMF and Brussels should be paying for the professional incompetence that has created this human disaster.

Advertising – My Eurozone book

My current book – Eurozone Dystopia – Groupthink and Denial on a Grand Scale – is published by Edward Elgar.

I am able to offer a Special 35 per cent discount to readers to reduce the price of the hard cover version of the book.

Please go to the – Elgar on-line shop and use the Discount Code VIP35.

It is also now available in much cheaper paperback form for £32.00.

Also the eBook is available 36.27 US dollars from Google Play or 61.45 Australian dollars from eBooks.com.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

If democracy won’t work and mass disobedience is ignored then that just leaves insurrection but maybe the Greeks are waiting for the Eurozone to collapse before taking that road?

“more significant and accelerated austerity is required”

Over our dead Aggregate Output!

in other words, the beatings will continue until morale improves …. or else!

This is an amazing story that summarizes institutional momentum run amok.

Which institutions? One has to conclude that they are a chorus of banking & wealth lobbies so used to singing to themselves that they have forgotten that the rest of their electorates even exist. They only see their modeled GDP numbers.

It’s Aesop’s fable of the Belly and the Members, all over again.

http://www.bartleby.com/17/1/29.html

You have to wonder how such distributed technical brilliance can once again generate such abysmal aggregate stupidity.

Things are getting pretty ugly there, with extremist austerity measures being enforced by almost mafia style tactics. So much for the loyalty of the nation state to it’s people. Unemployment and underemployment are just the tip of the neo liberal iceberg:

http://www.defenddemocracy.press/creditors-destroy-greece-syriza-not-resisting/

It is really criminal, isn’t it. There is no excuse for such wilful and destructive mismanagement. Greece’s 0.1% are not suffering, I have read.

Hello,

I am new to your work and blog, I am very impressed and moved by the concepts and explanations that you present – more to the point you are 100 percent right.

Are you familiar with Fred Harrison and his work on the role of Ricardo’s law of rent, speculation in land, boom-bust cycles and global crisis? It is very similar to your own work but comes in at a slightly different angle.

It would be very interesting to hear your views on Fred Harrisons’ work. It would make a great blog topic for you.

Thanks

Alan

The lower unemployment rate in Portugal relative to Spain is interesting. Could this be because more unemployed workers have gone in search of greener pastures and are no longer on Portugal’s radar? Labour mobility within the EU would make it difficult to maintain statistics.

Dear Bill.

As you have made this assessment years ago I also made the same back in 2009. When I was asked by important politicians of the then government and I told them my assessment of the dangers of austerity, the inability to function with the appropriate degrees of freedom with the “straight jacket” of the EZ and the need of immediate debt restructuring I was told that the IMF/EU technocrats knew better. At about the same time, some well known US economists told me ( will not reveal their name although now they argue against this program!) that there was no other alternative than the EZ and the “fiscal consolidation” program!!!! Keep up the good work you are doing, educating the people!

Appalling.And Unforgivable.

The mother of Facism has always been austerity as well.

This won’t bode well.

I cannot fathom the possibility that e.g. Euclid Tsakalotos does understand all that. What I also cannot fathom is that they’re playing along gratuitously and recklessly simply so that they can continue personally to benefit (and/or to bring favors to their clients and friends).

At the top, ignorance and intellectual laziness reign. Tsipras is truly a very limited person intellectually, and has no capacity for deep understanding of anything.

I meant to say that e.g. Euclid Tsakalotos DOES understand “all that”, i.e. that there can be no growth in output, no increase in employment etc. if all sources of effective demand are shrinking and are scheduled to be further shrunk. This is parasitism. Asset-striping to pay off and/or service accumulated debts. This is debt-peonage.

there is a financial and political limit to this nonsense .

the yield across the maturity structure on the greek debt ranges anywhere between 6.5 % to 11% over a 52 week spread. greek gdp growth is nowhere.

either the greeks are going to elect a government that’s going to pull the plug on all of this, or the EU is going to walk away . divorces are complicated messy things sometimes , and anyone that counts is in denial. denial will change to real anger, and then there will be one last desperate attempt at redemption , and then the jig is up.

im betting Italy is actually going to leave before Greece, because of a much more toxic economic cocktail brewing there . now if I could only find a bookie to take me on 😉

“Tsipras is truly a very limited person intellectually, and has no capacity for deep understanding of anything.”

hi grkstav,

this isn’t rocket science, this about the bleedin obvious.

the state has two primary responsibilities. one is to defend the realm, and the other is ensure that everyone that wants a job has one.

to quote sir Humphrey applebey, a government can have as much unemployment as its prepared to put up with. how much humiliation are the greeks prepared to put up with.

Bill,

I went to the Edward Elgar site and the discount isn’t 35%.

Maybe they have communicated this, but they aren’t applying that discount.

cheers

Dan

Dear Dan (2016/09/29 at 1:19 pm)

I just checked and the discount code seems to work if you apply it at the appropriate link. It reduced the price from £99 to around £71.

What happens at the actual payment stage I do not know. I can follow up though if interested.

best wishes

bill

“there is a financial and political limit to this nonsense”

Is there? It seems to me that Greece is an experiment in how far a population can be pushed under corporate neoliberalism, and the answer so far is incredibly far.

Largely because those doing the pushing end up being so called Lefties who end up being Corporatism’s useful fools. They are so desperate to avoid upsetting or disadvantaging anybody that they’d rather disadvantage everybody permanently than make a hard decision.

You know Bill, I am done feeling sorry for Greece. Why? because this has been going on for many years and they don’t have the balls to tell the IMF and the EU to go to hell. They could have quit the EU. They could have quit the euro. But they didn’t do anything to help themselves and they show no signs they ever will. At this point they only have them selves to blame.

John Wilkins I can’t share your sentiment. The Greek left don’t have the understanding or the guts to break free from the Eurozone and begin restructuring to bring prosperity back to their people. The blame here for the austerity and the massive destruction being placed on here is with the IMF, ECB and the European Commission.

You don’t help people by cutting their incomes and slashing jobs and have them pay back such huge sums to service debt.

J Christensen

It’s personal percieved wisdom only, but I think there are many more Potugese immigrants in the UK than Greek. There is local to me a very good Portugese community that integrates well and they are all wealth-creators. Good on them. But I hardly ever come across a Greek. I even ran into a Portugese in Jersey who was running a very successful cafe. I asked why she was in Jersey and she replied there’s no work in Portugal. Can’t argue with that.

Thanks for your reply Nigel Hargreaves. Bill’s graphs on relative unemployment levels within the EU got me thinking.

This has me wondering about the tracking of provincial employment data here in Canada as well, were there is full labour mobility across a vast geographic space. I know many people who travel across provincial lines to work everyday. They can only be accounted for as an employed individual in the province in which they working in the moment which can be very short.

The unemployment levels in places that become net exporters of labour tend to look far better than they ought to, since people do not report that they are seeking work were they reside and are not counted as unemployed there even though they naturally have a preference for work closer to home but can’t find it.

This of course makes governments look like they are managing unemployment, while taking no responsibility for ensuring sufficient jobs exist within their own jurisdictions to meet the needs of residents at all. Just another example of how everything is geared toward the wishes of large corporations in the neoliberal system, while politicians are allowed to twiddle thumbs rather than encourage job creation. People are forced to scurry to wherever the corporations decide they want to locate next bearing all the costs of travel themselves. It also fiddles with local tax bases. Fiddling as Rome burns that is.

This is purposeful degradation of a nation and it’s people. They are testing, pushing, prodding trying to figure out how much they can get away with and still have some semblance of civil order. How much the victims will put up with, in short, before they either just quit (which would be OK) or revolt (which can get messy, but omelets, eggs, etc. etc) and how to calibrate the program.

We will be doing the same sort of thing here in the US before long, with Puerto Rico and Illinois as test cases. Should be pretty interesting

indeed neil,

its remarkable the humiliation that’s been put up with . in the good old days someone would have invaded somebody by now 😉

its near the end of 2016 now. the Eurozone monetary union wont exist by 2025.

J Christensen

That’s interesting. Similar in Jersey which is only a half hour boat trip from the French coast and they have a huge commuting workforce, mostly in catering. Most hotel and restaurant staff are French. So French unemployment is commensurately lower than it might otherwise be. I find it really interesting talking to locals as you find out all sorts of things. Particularly in Italy as I do have some Italian. Sadly French not so good, but all these waiters etc of course speak excellent English.

One way the European Union may evolve is to have an inner circle that uses the Euro and is much like the current EU and an outer circle with national currencies, minimal EU control – just regulatory harmonisation and preferential trade within the outer and inner European circles. The inner circle I would imagine would suit Germany and other Northern European nations with similar economies and mindsets like Belgium, Holland, Denmark, Luxembourg and possibly France. Nations would be free to hop between the inner and outer circles. The disadvantage is that Berlin via Brussels would still be the imperial centre, be as undemocratic as the current EU, even the inner circle would not have a unified taxation system and a true federal political system which is probably essential to make a common currency zone work, and would still be vulnerable to degenerating into a neoliberal corporate/banking feudal or even fascist union just like the current EU (as is also happening in the US and Australia).

Alternatively reason will prevail the EU would abandon the Euro and decentralise most political power back to each nation and just become a preferential European trade zone like the old EEC which would also make it easier for Russia, Ukraine, the Commonwealth of Independent States and Turkey to join eventually once democratic standards and human rights guarantees improve. NATO would still provide a military counterbalance to Russia and the CIS and over time this face off should simmer down.

I have asked this question elsewhere before but didn’t get a good reply.

Would it be possible to come up with a practical way of allowing all EU member nations to use the Euro at the consumer transactional level but at the same time allow each nation to use a national sovereign currency at the upper macroeconomic level? National currencies would not be tied to the Euro and so would be free floating and thus all the benefits of having a sovereign currency would apply. Wages would be determined in the national currency but paid in Euro’s. The consumer would never actually see the national currency and no notes and coins would exist in the national currency.

If the Eurozone was abandoned at some stage, retaining the Euro at the consumer level would make the life of tourists easier, avoid the hassle of making notes and coins unique for each nation and may be politically popular.

Cash is a consumer level form of money that operates in parallel with money that exists mostly as a ledger or spread sheet entry – so currently there exists a two level system of money. Multi currency bank accounts are common in Europe so in an age of computers and floating currencies, keeping track of such a dual currency system should not be technically difficult. Many nations use the $US at the consumer level and have national currencies, for example Zimbabwe and many of us have bought from retailers in Asia where you could pay in the local currency, or $US, or UK pounds, or Euro’s or $AU for example.

Andreas Bimba

Not sure where you live, but probably not in Europe? Forgive me if I am wrong.

There already is a two-tier currency system in the EU. Not all EU members are also members of the eurozone. Some newly-joined members are not because they have not yet met the fiscal convergence critera, and some, like the UK prefer to keep their own currencies (thank goodness). One of the problems with the eurozone is that it was all well and good when it started out and all the members had similar economies (well they made it look as if they did), but after the GFC the various economies drifted apart. Without their own currencies they have no fiscal space to get out of the rut.

Your idea about two different currencies in the same nation I don’t think would be practical. As you say, some states like Zimbabwe use the US dollar, and used also to used the Zimbawean dollar until it was discontinued last year. But they are all basket case economies, and rely on the fact that the US dollar is effectively an international currency. It wouldn’t work in such advanced economies as Greece or Portugal for example. Worth a look, however.