I don't have much time today as I am travelling a lot in the next…

Modern Monetary Theory and Value Capture

I live in a Federation where the national government has the currency-issuing capacity and the states rely on their taxation and borrowing capacities to fund their spending. Our system is subject to significant vertical fiscal imbalances in that the Australian Constitution and subsequent decisions gives the major taxing capacity to the federal government but the large spending responsibilities remain at the state level. There are also significant ‘horizontal fiscal imbalances’ between the states and territories due their different capacities to exploit their own tax bases. As a result, there is a complicated system of federal-to-state transfers to ensure that all states have the capacity to deliver infrastructure and services of an ‘equal’ standard to all citizens. In particular, state governments face problems in providing adequate infrastructure while many of their decision deliver windfall gains to land owners where major infrastructure projects are adjacent (such a train or road system). While Modern Monetary Theory (MMT) considers such national infrastructure projects are best funded at the national level where the national government faces no financial constraints (given it is the currency issuer), the reality is that state governments also engage in infrastructure development. As a second-best technique to ensure that states do not play the austerity card and deprive their regions of essential infrastructure development, a system of Value Capture can be beneficial. It is a progressive tax system that can also reduce the tendency to real estate asset price bubbles.

The large areas of government spending such as education, public transport, roads and the like are primarily the responsibility of the Australian states rather than the federal government.

But Section 96 of the Australian Constitution empowers the federal government to make so-called conditional grants to the States for any purpose, which means the federal level has the capacity to influence state-level decisions in all areas even if the Constitution does not allow any explicit federal responsibility or power.

So in many areas such as roads, the two levels of government share responsibilities and roles which leads to problems of administrative duplication and cost shifting from one level to the other in either direction. Public health is a classic case.

On infrastructure provision, the NCOA note that:

Australia’s governments provide much of the nation’s economically essential infrastructure including roads, rail networks and ports. Major investment decisions with respect to public infrastructure are predominantly taken by State governments and most infrastructure is owned by the State. However, substantial expenditure on infrastructure is funded through Commonwealth payments to the States. There is significant institutional and regulatory duplication on infrastructure matters between the Commonwealth and the States.

The responsibility and costs associated with repairing infrastructure damaged in natural disasters accrue mainly to the relevant State government. However, the Commonwealth provides financial assistance to the States to assist with these costs, with funding determined by the claims submitted by the States in line with a designated formula.

This division has resulted in a serious underfunding of public infrastructure as state governments progressively became infested with the surplus at all costs mentality and cut infrastructure spending dramatically at the cost of the scale and quality of service provision.

The justification was that they had to preserve their AAA credit ratings – which was a curious stance given that the ratings, if they are relevant at all to a government body with implicit federal backing, only have an impact if the state is borrowing to expand infrastructure.

This surplus obsession also led to widespread use of so-called public-private partnerships. We inherited the model from Thatcher then Blair and applied it with equal inefficiency.

I considered PPPs and related matters in these blogs (among others):

2. Public infrastructure does not have to earn commercial returns

3. Australia’s crawling Internet speed signifies wider fiscal failure

PPPs are a very poor framework for delivering public infrastructure and emanate from a flawed understanding of the monetary system – they assume the national government is financially constrained and that private provision is always more efficient than public provision.

The blogs listed provided detailed arguments against PPPs.

What are the issues in relation to Modern Monetary Theory (MMT) that apply to the provision of public infrastructure?

This list summarises the respective capacities:

1. The Federal government in Australia is not revenue-constrained and any constraints that it places on itself (to issue debt to match its net spending) are voluntary and unnecessary.

2. The Federal government can thus meet all its liabilities denominated in Australian dollars into perpetuity.

3. Within the current limits of the Australian Constitution, the Federal government can build or buy what it likes if there are real resources available in the economy to be bought. The constraints on the net spending limits of a currency-issuing government are limited by the real resources that are available to be brought into productive use.

4. Imposing these voluntary constraints on net federal spending (via limits on public debt or fiscal deficit ratios) just means that essential public infrastructure is not ‘built’ to the detriment of the nation as a whole and the private business sector specifically (which leverages its own investment strategies off the provision of public infrastructure).

5. State governments in Australia are more like a household because they do not issue the currency and has to fund their spending. Spending not covered by taxation has to be covered with debt-issuance.

6. But State governments are also quite different to a household in another sense – they have a large tax dragnet to draw upon and the likelihood of them ever becoming insolvent is low. That is why they can borrow to fund net spending (deficits) at much lower rates than the private sector.

7. State governments also are involved in zoning decisions, which have significant impact on land use and land values. When tied into the infrastructure spending plans, these State decisions can lead to huge windfall gains being made by property owners in areas where such infrastructure will be created.

The question that arises is whether the division of spending responsibilities/roles in Australia and the fiscal capacities of the different levels of government that has emerged from the Constitution and from the decision of the Australian government to float the Australian dollar on December 12, 1983, is sensible from an MMT perspective?

The answer is clearly not.

First, the federal government should use its fiscal capacity to fund all public infrastructure development in Australia that is deemed to be of national (social) use.

This would free the states from having to access bond markets at all. It would not require any variation in the Australian Constitution.

How would these projects be determined? Australia already has a statutory body (part of government but politically separate) called – Infrastructure Australia – which functions as an:

… independent … body with a mandate to prioritise and progress nationally significant infrastructure.

IA essentially is the public research and operations planning body that “has responsibility to strategically audit Australia’s nationally significant infrastructure, and develop 15 year rolling Infrastructure Plans that specify national and state level priorities.”

It assembles a “priority list” of project which satisfy rigorous analytical investigations and in broad terms rank in order or importance and social return.

It also conducts the – Australian Infrastructure Audit – that:

… provides a top-down assessment of the value-add, or Direct Economic Contribution of infrastructure; considers the future demand for infrastructure over the next 15 years, and delivers an evidence base for further gap analysis, long term planning and future investment priorities.

In the latest – Australian Infrastructure Audit 2015 – IA concluded that:

The available international comparisons suggest that, despite recent increases in government spending and increased private participation, the overall quality of our infrastructure lags behind comparable nations …

… the World Economic Forum has ranked the quality of Australia’s infrastructure 20th out of 144 countries …

While Australia has some unique characteristics, including a large landmass relative to population, countries like Canada have similar characteristics yet rate more highly for infrastructure.

Successive governments at both the federal and state levels have failed to address the growing need to improve the public infrastructure in Australia.

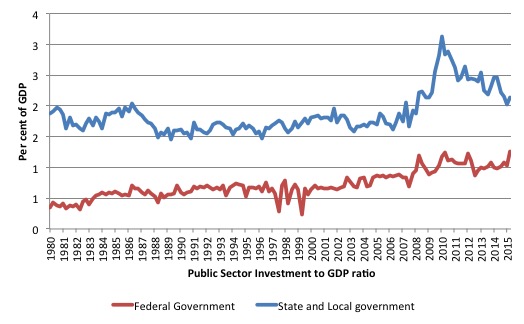

There was a strong infrastructure response during the early period of the GFC as the following graph shows. But now the investment ratio is falling again (at the State and Local government level – where it matters) as states once again pursue austerity measures.

So the Australian government has the fiscal capacity to take over all infrastructure spending and it should take that option as the first-best solution to the on-going need for high quality public capital.

It should use the analysis of IA to determine which projects will be funded up to the perceived limits of the available real resources.

It is that limit that should constrain the rate of growth in public capital formation rather than any false public ‘funding’ ceilings.

The States could still have devolved power to operationalise the projects. Although I should add that a first-best option is to eliminate the State governments altogether – but that is another story.

Second, in lieu of the Federal government taking over the funding of the national infrastructure development, the States have to find funding sources that do not impinge on growth and employment.

Clearly, they can issue long-term debt instruments to cover the cost of construction of large-scale public projects. However, it would be preferred if the debt was issued in the Federal government’s name to avoid all these credit ratings’ games that the state use to voluntary reduce their financial capacity.

It is clear that the federal government can issue risk-free debt instruments whenever it wishes and the bond markets know that irrespective of what the credit ratings agencies might think about the ‘credit risk’ of the paper.

Quite obviously, the notion of credit risk in relation to a currency issuing government with no foreign denominated debt issued is rather nonsensical.

Yes, the Australian government might as an act of bastardry decide to ‘default’ on its outstanding debt obligations. It would be ridiculous for it to do so. But there would never be a financial reason that would require it do default.

Under this scenario, the states still have to raise revenue in order to pay back the debt that was issued to raise funds to build the infrastructure.

An interesting proposal that I consider in this blog which eliminates the need to raise taxes or impose surcharges etc on the general population, who, for example, might not ever use the new infrastructure is called value capture and I consider it consistent with MMT principles and goals which include enhancing equity.

How does VC that work?

The principle of – Value Capture – is straightforward.

Public sector infrastructure developments push up land values in nearby areas and deliver windfall gains to land owners sometimes well in excess of the initial outlays required to fund the project in question.

Land rezoning decisions also have this impact.

When large-scale public transport projects such as new roads or new railway systems are proposed land values in the adjacent areas skyrocket.

One US Report (June 30, 2011) – Value capture: an innovative strategy to fund public transportation projects – stated that:

Boston’s ‘Big Dig’ project, for example, will cost state and federal taxpayers an estimated $22 billion over the next 25 years, but land owners in the surrounding areas have already seen property values rise astronomically. Massachusetts developer Frank McCourt used the increased value of his Seaport District properties – from roughly $10 million to $200 million – to help finance his acquisition of the Los Angeles Dodgers.

Note the conflation here of the term ‘cost’ in relation to state and federal levels. For a currency-issuing government such as the federal US government the ‘cost’ is not the dollars it has to outlay to bring a specific project to fruition but the real resources that it must bring into productive use or divert from other productive uses to complete the project.

For a state government, which faces a financing constraint, cost also relates to the funding costs.

Land Value Capture this aims to ensure that those who gain windfall profits from land holdings that skyrocket in value because of a particular government decision (rezoning, infrastructure project etc) pay for some or all of the project.

The capture would occur over the life of the project rather than be an upfront charge to the land owner.

The mechanism is simple:

1. Government reveals plans for an infrastructure project.

2. It revalues the land before the announcement and then on a periodic basis after that.

3. Each year, the landowner pays a proportion of that value increase.

4. At some point the government pays off the debt that was incurred to fund the development of the project.

5. This would allow the public transport system, for example, to run at strict marginal cost – so the public would enjoy low transport fares and the maintenance of the infrastructure would be covered by the VC.

The system is progressive in the tax meaning because the wealthiest would pay the highest taxes.

The Scottish government outlined some technical matters in this report – Developing a Methodology to Capture Land Value Uplift Around Transport Facilities

State governments might also improve their system of so-called ‘infrastructure impact fees’ and force all those four-wheel drives (SUVs etc) that cause havoc in urban areas to pay much higher registration or road use charges.

So instead of the private sector getting massive profits under PPPs and delivering sub-standard (social) returns to the nation/state, VC mechanisms force those in the private sector who receive windfall gains from public projects to contribute to the cost of those infrastructure projects.

Depending on the rate at which the tax is set, the mechanism could also be a major deterrent to land speculation. Perhaps any value increases above some wider state average would be lost to the state. The details would require analysis.

Application for Value Capture

A scandal erupted recently in the State of Victoria where the previous planning minister now Opposition leader rezoned a major portion of land around the old Port of Melbourne and local industrial areas – the so-called Fisherman’s Bend area.

Some 250 hectares of land was re-zoned as part of the CBD of Melbourne which is an extraordinary decision in its own right. The land area is bigger than the existing CDB.

The Minister at the time apparently ignored advice from his senior experts in planning not to go ahead with the decision.

An ABC news report (October 20, 2015) – Fishermans Bend development approval lacked infrastructure plans, Andrews Government report finds – tells us that the previous Victorian government failed to allow for proper infrastructure development in its rezoning.

The current State Government commissioned an independent report to get to the bottom of the decision of the previous government and found that:

… rezoned this land overnight without giving any consideration to the key infrastructure that would support this community, so public transport, kindergartens, schools, open space …

The Report says that the decision “led to a ‘bidding frenzy’ without any thought put towards public services”.

The decision:

The previous zone was changed into a capital city zone, which had no height controls which immediately increased the value of the land … and made overnight profits for either existing landowners or people who could see this was going to happen …

[there is] … a big windfall, with very little contribution then to the infrastructure and services that must be provided for the massive increase in population …

What that means is that the Government must then in the future pay a very substantially increased price for parks, public transport and so on …

This Fairfax Report (October 20, 2015) – Report slams Matthew Guy on rezoning of Fishermans Bend – traced the scandal in more detail.

We learn that the decision to re-zone “delivered windfall profits to land holders but was unmatched worldwide for its failure to plan for transport and other key services”.

And who gained these profits?

It turns out that further scrutiny reported in this article (November 1, 2015) – Liberals profit at Fishermans Bend – shows that:

Senior Liberal party figures and donors, including the party’s federal treasurer, have reaped multi-million windfalls from the former Baillieu government’s signature urban renewal project in inner Melbourne.

An investigation into the controversial Fishermans Bend project has found Liberals’ honorary treasurer Andrew Burnes is among a slew of party activists and donors who either bought into the renewal precinct before it was rezoned or were long-term property owners that pressed for redevelopment of the area.

Others include auto dealer John Ayre and BRW rich-listers John Higgins and Harry Stamoulis .

It was a Liberal State Government that took the re-zoning decision against the advice of planning experts.

We learn that:

The widely criticised move triggered a dramatic increase in land values and a development frenzy of 46 apartment towers – some reaching more than 60 storeys – that have been proposed or approved in the precinct since January 2014.

… land values had increased up to 500 per cent since the rezoning … For sites where developers have won planning approval for high-rise towers, the increase is greater still.

The Liberal Party honorary treasurer bought into the area for $A7 million just before the July 2012 re-zoning. His property is now worth $A20 million.

There are a number of similar Liberal-insider purchases which the press is referring to as “fortuitous timing”.

The new state Labour government now has major problems in fixing the mess up. It faces massive bills to acquire sufficient land to build the essential public infrastructure that such a large-scale residential development requires given the rise in land values and the fact that the original decision had no ” strategy or funds for decontamination, transport, open space or affordable housing”.

This is an example where VC would deliver returns to the State Government because it could simply tax the windfall profits away and use the funds to deliver the necessary public infrastructure.

Local infrastructure scandal – Newcastle Rail Line

The photo below (taken from the Newcastle Herald) shows the NSW state government contractors ripping up the railway line into Newcastle, NSW.

The government has truncated the train line a few kms out of town to make the rail corridor land available to the land developers – allegedly as part of a renewal project. The reality is that some people are making a lot of money from the decision.

A Fairfax report earlier this year (February 18, 2015) – Newcastle: A city caught between a rail line and its harbour – discussed the issue.

You will learn that the boss of the local Hunter Development Corporation which is a statutory body that “sits within the Department of Planning” was a former employee of a local large building development corporation.

The Report notes that:

HDC’s Hawes is an ex-employee of Nathan Tinkler’s Buildev (which allegedly helped Joe Tripodi drive Jodi McKay out of office for opposing Tinkler’s coal terminal) who, when the truncation decision was made, held a minority share in two properties located – heavens! – right at the end-point. Since then Hawes has increased his share to 50 per cent.

Hawes claimed he did not have any direct input into the decision to cut the rail line.

A story from December 3, 2014, Hunter Development Corporation manager Bob Hawes interests never fully disclosed to HDC board – reported that Hawes had “never directly declared a conflict of interest about his Newcastle property holdings at an HDC board meeting”

In February 2012, the HDC under the managership of Hawes wrote to the Planning Minister “advocating truncation of the rail line at Wickham” just where the Hawes owned properties.

We read that “The letter said ‘investors, landowners and developers’ supported the move.”

A formal enquiry into his real estate activities and his activities as HDC boss said that “The commission notes that while the conflicts of interests by Mr Hawes are apparent and he may benefit financially from the proposed truncating …”

So major public infrastructure decisions also allow individuals to make significant personal gains. The VC principle would clearly deter such strategic real estate purchases and possible use of inside knowledge to advance personal gain.

As an aside, the State Government has lied relentlessly about our local rail line. First, there was going to be no commercial development on the rail corridor and a fast light-rail system would be constructed. After lobbying from the land developers we learned that the light-rail is going down the main street (avoiding the rail corridor) which will create traffic chaos.

There is already traffic chaos now the train line is gone.

Second, we learned last week that the public transport system in Newcastle will be privatised and the ferries, buses and light-rail (if it ever appears) will be run by a profit-seeking private operator. The Government claimed that the decision to rip up the heavy rail into Newcastle was partly driven by poor custom and they were ‘losing money’.

Please read my blog – Public infrastructure does not have to earn commercial returns – for more discussion on this point.

But it is curious that a private operator is planning to enter the market that is not capable of covering costs even!

Anyway, our public transport system is on the way out. Scandalous.

Conclusion

Clearly Federal funding is still desirable which overrides the financial constraints that the state governments face.

But even with the financial constraints removed, there is still a justifiable case for Value Capture taxes on equity grounds and to provide the government with an additional tool to stem real estate asset bubbles.

Further, while the taxes would be unnecessary given the currency-issuing capacity of the federal government, they would allow the government to redistribute expenditure among different spending cohorts without compromising any inflation constraints.

So a VC tax would take from those who enjoy windfall gains and are wealthy and reduce their spending capacity and allow the government to provide increased cash transfers to low-income workers, for example. The tax doesn’t provide the necessary funds – it just ensures the private domestic sector purchasing capacity overall is not increased.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

“Further, while the taxes would be unnecessary given the currency-issuing capacity of the federal government, they would allow the government to redistribute expenditure among different spending cohorts without compromising any inflation constraints”

That’s perhaps something that needs highlighting further – that the total tax take is influenced by the private sector’s desire to save, whereas the distribution of the tax take is influenced by the government’s taxation decisions.

The government hasn’t much influence on the former (the ‘deficit’), but can influence the latter.

The two are completely different – yet are almost always conflated in the public discussion. Which leads to total confusion.

Well news just in the Portuguese government has stepped down by a challenge from the left so there may be hope yet. http://www.nytimes.com/2015/11/11/world/europe/portugals-government-ousted-in-challenge-to-austerity.html?smid=tw-nytimesworld&smtyp=cur

Bill, I’ve left the Australian progressive party and there should be a new party starting soon that has MMT Ada fundamental plank of the party. So there may be hope yet. I may need a blog post proofed by Steven hail or yourself one day. More news to come.

At the end of the day I believe people power is the only thing governments will listen to so I strongly suggest anyone who cares about the environment and natural limits to humanity please support the people climate March before Paris it looks like a worldwide thing maybe. http://www.peoplesclimate.org.au/

Correction the walk looks only Aussie currently. I’d love to see it worldwide before Paris but. Please support wherever you are on this amazing blue planet thanks. The only planet we have after all.

Re-reading that NYtimes article why does it take the small guys Portugal and Greece to be the ones to challenge Germany and Brussels? It’s not fair. I hate injustice but Portugal is incredibly progressive especially with the shameful drug war. Have psychologists treat homeless addicts. It’s a no brainer.

The Australian federation is a mess and has been so since 1901. We can’t blame the “founding fathers” (dreadful American expression) for this as they did the best they could under very difficult circumstances.

The federal constitution needs a complete rewrite and abolishing the states should be part of this. A 2 tier system,regional and federal, would cut out a lot of the present nonsense,provided the regional governments were kept on a very tight rein.Local government is regarded as the most corrupt and for good reason.

Is this reform politically possible? I doubt it but it may be worth a try if enough popular support could be gathered.

Re tax – there is currently a fashionable movement in certain political and economic circles to increase the GST rate. Like all fashions this one doesn’t make any sense. The GST is an extremely regressive tax and should never have been introduced. It should be abolished forthwith.

Taxes should be levied to achieve social outcomes in the main.

Bill, distinguishing between national and state governments, why would you want to eliminate the state governments altogether? Don’t they constitute a division of governmental labor, as it were, and are they not closer to the “coal face”? In saying this, I am not assuming that the current division of governmental labor is at all optimal.

Bill,

Land Value Capture (often called Land Value Tax by ‘Georgists’) is an absolute necessity for any civilized society that would ‘euthenize the rentier.’

What worries me is that the genie is out of the bottle-in Britain we’ve had 30 years of land/housing bubbles-so in the unlikely event of a Government being sane enough to introduce it, we’d be collecting what’s socially due AFTER the escalation and ‘rentier-rave-up.’ What we would need is a sort of 30 back-dated form of it!

In Britain, the Tories bleat on with their crap about ‘hard working families’ knowing fully well they populace is being simultaneously cathertered and enemaed by housing/rent costs-without any opposition (as yet!) trying to elucidate this issue for the public. We’re now rapidly heading back to pre-WW2 conditions where most people rented from swathes of properties owned by rip-off landlords.

Gordon Brown said in 1997:

“I will not allow house prices to get out of control and put at risk the sustainability of the recovery”

since that time, up to 2007 bank lending for mortgages (often buy-to-let) increased 370% worsened when the Tories came up with their 12 billion ‘Help to Buy’ which was really ‘Help to Bubble’ yet the bullshit continues about a rungless ‘housing ladder’ with a near witless populace thinking life is about getting on it.

“Rule, Britannia! rule the waves:

“Britons never will be slaves.”

What a Joke as the Tories wrap themselves in ever larger Union Jacks!

In the UK, social value is a pernicious idea recently enacted in the Social Value Act. Funding bodies must now compare like with unlike using a money value. If you do enough litter picking, is it OK to leave a profoundly learning disabled adult without a non-instructed advocate? This is a question that should never be asked but funding bodies are now legally obliged to make judgments like this. The trend of measuring ethical values in money values is very worrying.

Social value appears to be a rebranding of utilitarian ethics which breaks the golden rule of ethics because utilitarianism doesn’t pass the test of substitution of subjectivity. We don’t apply utilitarianism to criminal law or clinical need. If we accept that non-utilitarian legal and medical practices exist for good reason then why is social care in the UK different? Why is investment in Australia different? There appears to be an implicit ethical methodology which is based on the assumption that money is the best judge of values. In the UK we still consider many things to be too important to be measured in money values.

Social value theories also have another problem of differing uncertainty. When we model uncertain values using adaptive statistical methods we have a separate value for the uncertainty and no decision is usually allowed until uncertainty falls below a defined threshold. Public investment in uncertain potential often produces great benefit for humanity. It’s unclear how public investment and uncertainty can be reconciled outside of problem domains with intrinsically low uncertainty.

On a logical point, social value theories are logically incapable of demonstrating their own social value. For problems like this we usually resort to metaphysics.

There is also the Ricardian transformation problem.

There are about half a dozen popular theories of social value currently in circulation but they fail to address the difficult questions established in the history of value theory and they also ignore the importance alternative methodologies; such as the systems of rights, clinical need and technical specialism.

I don’t quite see how value capture can work in practice. Just where I live the governmental units that affect the value of the land include city, metropolitan, county, school district, watershed district, state, and federal. Their programs act synergistically with those of private developers to increase value. There is certainly no easy formula to decide how much of any additional value gains over time is due to which entity. I can imagine each of them trying to pre-negotiate their percentage of the subsequent added value stream prior to agreeing to do their own part of the project. And then renegotiating every time a new project affects the same land. And you’d have to deal with overlapping jurisdictions. Frankly, that sounds like a nightmare to me. You can’t generate a new income stream without expecting everyone who plays a part in generating it to begin wrangling over their rightful share.

Paul Krueger: “I don’t quite see how value capture can work in practice.”

It’s not difficult. Local governments already have property taxes. And a property tax is just a tax on the buildings & improvements plus a tax on the land, (i.e., the spatial-location).

Just remove the tax from the buildings & improvements and shift it over solely on the land, (a land value tax).

You can even do it gradually over time with a split-rate tax, (i.e., a lower tax on the buildings & improvements than on the land). That is, gradually phase out the tax on the buildings & improvements while gradually shifting it over to a pure land value tax.

It’s just a simple adjustment to the currently existing property tax system. Not difficult at all. 🙂

MMT and Land Value Tax are easily reconcilable.

A sovereign currency requires a tax to create a demand for that currency. LVT can do that just as well as any tax.

By taxing land — which is just economic rent — you’re keeping socially-created, unearned income out of private hands. By untaxing productive behaviors, — e.g., wages, capital goods, consumer goods, etc. — you’re allowing privately-created, earned income to stay in private hands.

It’s like the ultimate synthesis between the demand-side and the supply-side.

Paul:

http://kaalvtn.blogspot.co.uk/p/valuations-and-potential-lvt-receipts.html

This is a great idea

Bill why the terminology value capture as opposed to a land value tax?

Do you suggest as Paul Krueger implies a specific measurement of land price inflation

in relation to government infrastructure spending?

I am also in the land value tax camp.There may need to be initial rebates to

low income ,high land value groups but rasing more tax (destroying more money)from land

speculation as a part of a progressive welfare and tax regime should be part of improving

the economy and society for the majority.

“So major public infrastructure decisions also allow individuals to make significant personal gains. The VC principle would clearly deter such strategic real estate purchases and possible use of inside knowledge to advance personal gain.”

This is quite possibly the strongest argument (from a marketing perspective) for promoting the VC principle. If the planning decisions cannot possibly benefit specific landowners due to the tax arrangements, then the seemingly constant accusations (and perhaps they are often well founded!) of planning rorts would suggest it is a much needed change!