I started my undergraduate studies in economics in the late 1970s after starting out as…

My letter to the Governor (arnie)

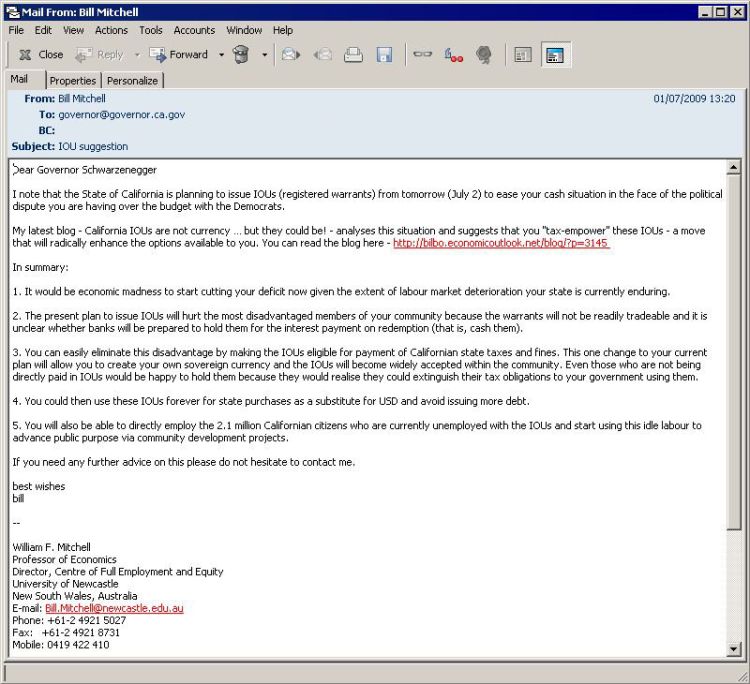

At lunchtime today I decided to take matters into my own hands and help save the State of California which is in fiscal strife at present. This is what I did …

I sent this E-mail to Governor Schwarzenegger …

I then received this formal reply …

We will see what he says!

Brief technical note: The E-mail address for the Governor shown in my E-mail client bounces (they block it) and you are then diverted into a WWW-based form which enables you to send the E-mail as shown. Then you get the feedback page once they accept it.

Update: Wednesday, July 8, 2009 – a week later

No reply from Arnie yet. I’m patient though! But a reader sent me this report from the Sacramento BeeM the main newspaper in the capitol.

Bill would let IOUs pay for Calif. taxes, fees

The Associated Press

Published: Tuesday, Jul. 7, 2009 – 1:48 pmSACRAMENTO — State vendors and contractors could use their government-issued IOUs to pay state taxes, fees and liens under a bill approved by an Assembly committee.

The Business and Professions Committee unanimously passed the bill by Assemblyman Joel Anderson during its first legislative hearing Tuesday. The bill requires the state to accept its own IOUs as payment for money owed to the government.

Anderson, a Republican from La Mesa, says the measure would help businesses and others being paid with IOUs. The state began issuing the warrants last week as lawmakers struggle to close a $26.3 billion deficit.

The Assembly speakers’ office has not decided if the bill needs a second committee hearing before it can be considered by the full Assembly.

Update: Thursday, July 98, 2009

Here is a picture of California’s “new currency”, after:

A California tax authority announced today that it would accept state-issued IOUs as payment from those who owe personal or corporate state taxes.

Dear Bill

I agree with your comment from the previous post that it will be difficult to know what the California $ exchange rate would be relative to the US $. I think it’s important to make explicit, though, that because all California citizens and businesses are required to pay US taxes in US $, this exchange rate will necessarily be much more important to the citizens of California than is typically the case with a sovereign currency issuer like the US govt.

It would seem one thing that California could do to stabilize private exchange rates would be to set its spending at par value (1 US$ of contractual spending obligations = 1 Cal $ of contractual spending paid) and also guarantee its tax collection at par value. This would seem to have a stablizing effect and could provide some automatic stabilization to the exchange rate value, as the Cal $’s would be used relatively more to pay taxes (and thus drained from circulation) precisely as the exchange value vs. the US $ was dropping, and vice versa.

Best,

Scott

Dear Scott

Definitely.

Also we should remember that the IOUs would also attract interest on redemption. So the rate that is paid relative to the cash rate paid for holding USD’s in deposit accounts would also affect the parity.

best wishes

bill

I don’t know if Arnie was listening, but it looks like someone in CA has the right idea:

http://www.sacbee.com/state_wire/story/2007369.html

It seems they ARE going to use it as payment of taxes. According to this link http://latimesblogs.latimes.com/lanow/2009/07/stateissued-ious-accepted-as-payment-for-some-taxes.html – A California tax authority announced today that it would accept state-issued IOUs as payment from those who owe personal or corporate state taxes. Taxpayers must sign the back of their IOUs and write, “Pay to the order of the Franchise Tax Board.”

It looks like we won’t get to see this experiment.

Dear Sean

Yes, bad luck for our laboratory.

best wishes

bill