I started my undergraduate studies in economics in the late 1970s after starting out as…

Australia – fiscal policy outcomes signal a failed government

The deranged individual who held the people hostage in Sydney over the last 24 hours wasn’t an Islamic State terrorist despite what the commercial news frenzy tried to tell us. He was a deranged individual. But while the news frenzy was as deplorable as his act (see this more sober account), it did one other thing – it kept Joseph Pinstripe Bulgington Hockey off the front page. Who is JPB Hockey? The Australian Treasurer and yesterday he released the Federal Government’s – Mid-Year Economic and Fiscal Outlook – which was comedic, hypocritical and demonstrates that we haven’t come very far since the days we believed the world was flat. The hostage drama in Sydney meant JPB had to take back stage and the 16 ridiculous pages that the News Limited rag the Daily Telegraph in Sydney devoted to what they called an “attack by the Islamic State”, effectively choked the coverage of the MYEFO. Some saving grace.

Yesterday, amid all the hostage dramas in Sydney, the Australian government released its MYEFO, which is designed to provide fiscal updates and revisions 6 months out from the May fiscal statement (aka ‘The Budget’). The facts are clear:

- The fiscal deficit forecast for the current fiscal year is estimated to be $A10 billion higher at $A40.4 billion than projected in the May Fiscal Statement. It is forecast to be 2.5 per cent of GDP rather than 1.8 per cent of GDP.

- The Government is now projecting a fiscal surplus in 2019-20 rather than 2018-19.

- The fiscal deficit in 2015-16 is projected to be $A31.2 billion (1.9 per cent of GDP), up from the May forecast of $A17.2 billion.

- Various reasons and excuses are being given – weak wages growth undermining tax revenue (so the neo-liberal attack on real wages undermines their desire for a surplus); declining terms of trade (China is slowing) which undermines tax revenue; recalcritrant Senate obstructing the proposed cuts in the May statement.

- The Senate rejection of the cuts has probably meant the projected deficits are in fact smaller than what might have happened if all the proposed cuts had been introduced. Real GDP growth is declining but it would have been worse if all the cuts had have gone through

- What no one is really talking about is the fact that the revised estimates project unemployment to rise to 6.25 per cent in the May statement (already exceeded) to 6.5 per cent in the MYEFO and persist at that rate until the end of 2015-16. So they are predicting the rise in unemployment will worsen and not be reduced for at 1.5 years. Why isn’t that headlines?

- They are also predicting no change in the participation rate, which is well below the November 10 peak. In other words, they are prepared to tolerate increased hidden unemployment.

Taken together, these projections signal a government that has failed to achieve its own agenda, which in one way is good because the real economy would be in worse shape than it is had they been more successful at imposing austerity.

But we are still in an austerity mindset and they are still cutting to try to ramrod a fiscal surplus, albeit later than they had previous forecast.

How can a national government claim to be in control when they are deliberately overseeing a rise in mass unemployment, which on their own reckoning will persist until at least the end of the 2015-16 financial year?

It beggars belief how misplaced our national priorities have become and how silent the mainstream media is about that.

Basic Principles of Fiscal Policy

The Government thinks that the purpose of fiscal policy is to deliver a fiscal surplus as soon as possible. It realises that it cannot do that at present because its tax base is linked to income growth, which is waning.

But it still believes that it can cut discretionary net spending without further undermining growth. It also is still stating that the policy goal is to achieve some financial ratio outcome (surplus) without relating that to the real outcomes that follow from trying to achieve that outcome.

Modern Monetary Theory (MMT) tells us that fiscal policy (public spending and taxation) provides the government with the scope to influence total spending in the economy so that it can ensure that everyone who wants a job can find one, that incomes are sufficient in society to ensure citizens are socially-included and not alienated by unemployment and impoverishment, and that the spending balance maintains price stability.

We learn that fiscal policy is not an end in itself. The measures of fiscal policy are not ends in themselves. They should never become policy targets. The actual measurement of fiscal policy is irrelevant out of the real context that the government is influencing – real output, employment, etc.

A 3 per cent of GDP fiscal deficit might be totally appropriate at one point, while a 10 per cent deficit might be appropriate another time. A surplus might sometimes be appropriate.

How would we tell? By consulting the state of the economy. A 3 per cent deficit will be fine if employment growth is sufficient to satisfy the demand for hours by the labour force, for example. But then a 3 per deficit might be totally irresponsible if there is rising unemployment, waning growth and very weak employment growth – the situation we have now.

It all depends. You can never assess whether the fiscal parameters are correct by looking at the measures and comparing them to a surplus.

There is nothing sacrosanct about achieving a fiscal surplus. That can never be a sensible benchmark. The benchmark is full employment and price stability – the fiscal outcome should be whatever it takes.

Where did we get this fiscal surplus benchmark from?

The fact is that for Australia and most nations, continuous fiscal deficits are the historical norm. The financial media keeps entertaining the notion that continuous deficits are somehow abnormal or bad.

The public are barraged with propaganda that makes them think that responsible governments ‘balance their budgets over the business cycle’ or achieve surpluses as the norm. Where did anyone get that idea from other than ideologically-laden mainstream macroeconomic textbooks that our students forced to use?

The reality is that fiscal deficits have been the norm over any of the successive business cycles. There is no evidence that Australian governments ‘balance budgets’ over the cycle. The same applies to the US, Japan, and many advanced nations.

The further evidence is that as the neo-liberal persuasion has become dominant in macroeconomic policy, Australian governments have attempted to run discretionary surpluses. The outcomes of this behaviour have not been good and overall this period (since around the mid-1970s) have been associated with lower average real GDP growth and more than double the average unemployment rate.

You can compile a reasonable dataset to explore this question spanning the period 1953-54 to the present day from two sources. The earlier data (1953-54 to 1970-71) is from the historical publication by R.A. Foster and S.E. Stewart (1991) Australian Economic Statistics, 1949-50 1989-90, Reserve Bank of Australia, Sydney.

The second time series (1970-71 to 2010-11) is from Statement 10 which is the data appendix to Budget Paper No. 1 published by the Commonwealth Government when it delivers its annual fiscal statement.

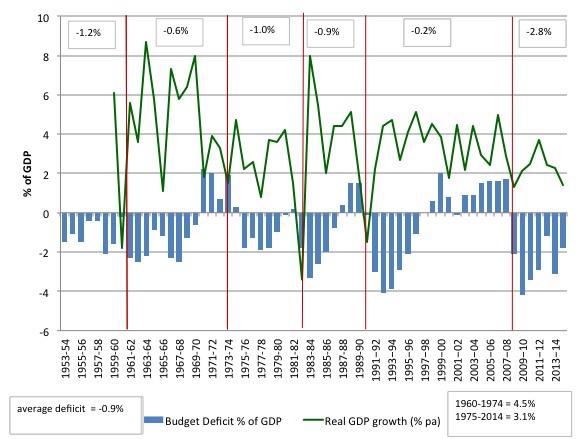

There are some issues about combining this data set and also with each individual data set. But in general the graph below is a reasonably reliable depiction to the history of Federal government fiscal outcomes outcomes over this period. The columns show the Federal fiscal balance as a per cent of GDP (negative denoting deficits) while the green line shows the average quarterly real GDP growth (averaged over the financial year at June).

The red vertical lines denote the trough of the respective business cycles. So the real GDP growth line approximates where in the year the negative real GDP growth manifested. But for our purposes it is near enough.

The upper numbers in boxes are the average deficits over each cyclical periods. The average deficit over the whole period was 0.8 per cent of GDP. The average real GDP growth per quarter from 1959-60 was 1.2 per cent and after 1975 this dropped to 0.8 per cent. The unemployment rate averaged below 2.0 per cent in the pre-1975 period and averaged around 5.5 per cent after 1975.

The 1975 Budget was a historical document because it was the first time the Federal Government began to articulate the neo-liberal argument that budget deficits should be avoided if possible and surpluses were the exemplar of fiscal responsibility.

Some points to note:

1. One the rare occasions the budget was pushed into surplus (usually by discretionary intent of the Government) a major recession followed soon after. The association is not coincidental and reflects the cumulative impact of the fiscal drag (that is, the surpluses draining private purchasing power) interacting with collapsing private spending.

2. There is no notion over this period that the budget outcome was ‘balanced’ over the business cycle. The historical reality is that the federal government is usually in deficit. If I had have assembled more historical data which is available in the individual budget papers going back to the 1930s then it would have just reinforced the reality that surpluses have been rare in our history independent of the monetary system operating (the old convertible system or today’s non-convertible system).

3. The Australian federal government ran fiscal deficits of varying sizes in 75 per cent of the years between 1953-54 and 2014-15 (46 out of the 61 years). A similar history if found for the US, for example.

4. The fact that the conservatives were able to run surpluses for 10 out of 11 consecutive years (1996 to 2007) is often held out as a practical demonstration of how a disciplined government can run down public debt and provide scope for private activity. The reality is that during this period we have witnessed a record build-up in private indebtedness, which is now driving a return to more normal private spending habits as households try to restructure their balance sheets away from debt.

The only way the economy was able to grow relatively strongly during this period was that private spending financed by increasing credit growth was strong. This growth strategy was never going to be sustainable and the financial crisis was the manifestation of that credit binge exploding and bringing the real economy down with it.

5. The higher deficits in the recent period are testament, first, to the fiscal stimulus package and, then, perversely, the fiscal contraction that followed. Remember this is a ratio of the fiscal balance to GDP. So if the numerator (fiscal balance) goes up faster than the denominator (GDP) then the ratio rises and vice-versa. But if the denominator falls more quickly than the numerator (at a time of fiscal austerity) the ratio can also rise. The previous government cut hard in their second last fiscal statement and that caused the economy to slow.

The POINT – there is nothing normal about fiscal surpluses. They were atypical in our history and accompanied the neo-liberal ideological dominance of economic policy. They failed to promote higher growth and sustained prosperity. They did ensure a massive redistribution of national income to the higher income groups and inequality rose. As we have learned recently (officially) but knew all along – rising inequality actually white ants economic growth and poverty reduction.

AND – fiscal deficits are the norm and allow the private domestic sector to save overall in an environment where the external sector is a drain on overall spending (as in Australia’s case).

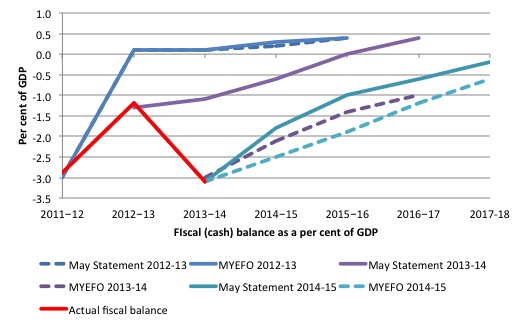

The following graph shows you how wrong the Treasury has been over the last several years. The red line is the actual fiscal deficit as a percent of GDP from 2011-12 to 2013-14. The other lines are the respective May Fiscal Statement predictions (solid lines) and the following MYEFO updates (dotted lines). So you can see that in 2011-12, the Labor government was predicting a surplus in 2012-13 of 0.1 per cent of GDP but actually recorded a deficit of 1.2 per cent.

The following May (2012-13), reality had set in and they projected they would achieve a surplus in 2015-16 with decreasing deficits from 2012-13.

Their sharp fiscal contraction in that year, undermined growth and with the terms of trade starting to moderate the fiscal deficit expanded again to 3.1 per cent of GDP. By now, employment growth was flat and the unemployment rate was rising.

The correct thing to do would have been to introduce a new fiscal stimulus.

But in the 2013-14 Fiscal Statement in May (the last of the Labor statements before they were defeated), they hung onto their surplus obsession, cutting a little and pushing out the surplus achievement to 2017-18.

Then the conservatives took office and in the MYEFO of late 2014, they maximised the political capital by deliberately increasing the fiscal deficit (the $A8 billion capital contribution to the central bank) and slightly revised the deficit reduction trajectory.

Cuts in public investment and a quickening in the decline of the terms of trade have squashed real GDP and income growth and their estimates of the fiscal trajectory have been proven to be dramatically wrong.

The lesson from all this is that if you try to target a stand-alone fiscal outcome and cut public spending then it is highly probable, especially when private spending is subdued, that the fiscal deficit will rise as you kill economic growth.

That is exactly what the government has done and they are harvesting their own stupidity – in political terms. But worse, the rising unemployment and underemployment and rising poverty is damaging the lives of nearly two million citizens (at least 17 per cent of the working age population).

Foreign Aid disgrace

Readers may remember this blog from 2012 – Neo-liberals can’t even identify self-interest when it is staring at them – where I examined, among other things, the 1970 United Nations resolution (agreed to by Australia) to ensure that “official development assistance to the developing countries and will exert its best efforts to reach a minimum net amount of 0.7 percent of its gross national product at market prices by the middle of the decade.”

I documented how in 2002 this resolution was reaffirmed, given that most nations were lagging behind in their commitments. In 2011, Australia was at 0.34 – half the agreed target.

The then Federal labour government committed to raising this proportion to ensure they would reach a ratio of 0.5 by 2016-17.

Then the mindless austerity and surplus pursuit set in and in the 2011-12 Fiscal statement the government cut foreign aid significantly and the ratio was forecast to remain around 0.35 per cent of GDP.

The conservatives took over in September 2013 at the federal level and set about cutting aid further to ‘save’ money (ridiculous they would even say that).

The MYEFO announced cuts of around $A4 billion to aid (and remember successive governments have shifted aid money into the building and operation of prisons on Pacific Islands, where they lock up refugees – and still call this foreign aid!).

The Treasurer announced yesterday that “The cut in foreign aid is by far the largest reduction” as if it was a badge of honour. Their reasoning is that this will cut net public spending but not undermine domestic demand. So we just impoverish our neighbours.

The Fairfax article today (December 15, 2014) – Foreign aid budget plunges to lowest level in Australian history – says that

Under the cuts, Australia will drop from being the 13th most generous nation to the 20th, out of 28 of the world’s wealthiest countries.

The foreign aid spending will fall from 0.32 per cent of GDP to 0.21 per cent by 2017-18, once again demonstrating what a terrible international citizen we are as a nation.

The Fairfax article concludes that “this brings Australian aid down to the lowest it’s ever been comparatively”.

Various commentators described the decision as:

Joe Hockey is effectively Robin Hood in reverse, robbing aid that has been committed to the poorest people in the world and using it to try and get his budget balanced …

the cuts will hurt “millions” of vulnerable people throughout the world … We see it as wrecking ball by the government …

While our Prime Minister waxes lyrical about how generous we are as a nation in the light of the hostage drama and how we all pull together, the reality is that we are becoming a mean-spirited, selfish nation driven by ignorance and incompetence.

Hypocrisy and the Role of the media

The funny thing about the MYEFO process is that the Government has demonstrated massive hypocrisy and are now trying to reinvent the wheel.

As the previous government was failing in its pursuit of a fiscal surplus, the current Treasurer (then in opposition) was like a snarling attack dog – blubbering daily about the fiscal wrecking balls that the Labor government had in place.

In 2012, Hockey claimed that Labor’s excuses for not achieving a surplus were just trying to cover up failure. He told the press:

No qualifications, all the excuses that Wayne Swan talks about – falling commodity prices, a high Australian dollar, nominal growth not being up to standard. Somehow the GFC is ongoing all the time.

I mean, none of these excuses were used when they made these solemn promises and of course it was Julia Gillard who said you can’t run this country if you can’t manage its budget. Well damn right. It’s the Labor Party that said in 2008, it was going to have a temporary deficit. Now Wayne Swan says he cannot deliver a surplus this year because he has a temporary shortfall in revenue. The revenue shortfall he has identified is one per cent of this year’s revenue – one per cent. So what they’ve been doing is they’ve been doing everything they possibly can to try and meet the politics but not the economics.

It was a daily event – Joseph Pinstripe Bulgington Hockey – parading in front of the media telling everyone how the sky was about to fall in because of the on-going fiscal deficits.

Then, in September last year, the conservatives regained power and immediately announced that the “adults were back in charge” and would get “the budget back into surplus”.

Now, with the same economic processes (slow growth driven by fiscal irresponsibility) increasing the fiscal deficit via the automatic stabilisers, the Treasurer is all about “headwinds” and “shock absorbers”. Ridiculous really.

Some in the media have recognised and exposed the hypocrasy of the current government relative to when they were in opposition.

The Fairfax article (December 15, 2014) – Karma bus comes around for Joe Hockey – an example.

The author announced that JPB Hockey is “likely to go down in history as one of the Treasurers who never delivered a surplus” and interestingly adds “Not that there’s necessarily anything wrong with that, depending on reasonable priorities at the time.”

That sort of reporting is a rarity.

In that article, the journalist, Michael Pascoe also documents the cuts made to the Indigenous and Remote Eye Health Service (IRIS) which has reduced the incidence of blindness among the most disadvantaged Australians through glaucoma etc.

Pascoe concludes that as a result of the cuts “people will go blind”. Sickening.

However, while generally it is being observed that the Government has been hooked on its own petard, the media is not using this as an opportunity to debrief the public about the myths that both sides of politics introduce into the public debate about deficits.

Many articles still emphasise the need to “repair the budget” as if fiscal policy is a broken down car. Even some of the journalists that actually know better use emotive and loaded language that is misleading and amounts to neo-liberal propaganda.

For example, the Fairfax article (December 16, 2014) by Economics Editor Peter Martin – Advice for Hockey: Sting super and fix the budget in one hit – uses terms like “fix the budget”.

He then suggests that the government needs to introduce “one really big tax hike (spending cuts won’t raise enough), but one won’t rip money out of wallets and purses”. He proposes we increase the tax the compulsory superannuation contributions which are currently taxed at a concessional rates.

Sure enough, the contributions are compulsory so the tax could not be easily avoided. But it would dent private savings and the prediction would be that it would either reduce consumption or force households into further debt.

But the point is that while the journalist claims in relation to the Treasurer this proposal would “solve his problems in one hit”.

The relevant question is – what is the problem? Sure enough, the Treasurer now has a political problem. But that is of their own making.

A fiscal deficit per se is not an economic problem. The economic problem is that the deficit is not large enough given the drain on income from the external sector and the current conservatism among private domestic spenders (households and firms).

Why isn’t the press talking about that?

Conclusion

And just where did the name joseph Pinstripe Bulgington Hockey come from? The First Dog on the Moon’s analysis of the MYEFO no less – Behold! Joe Hockey’s Myefo has arrived!.

That is enough for today!

(c) Copyright 2014 William Mitchell. All Rights Reserved.

“A 3 per cent of GDP fiscal deficit might be totally appropriate at one point, while a 10 per cent deficit might be appropriate another time. A surplus might sometimes be appropriate.”

Ah but you haven’t consulted the Great Robert Peston at the BBC. He understands these things very well having consulted with Mr Market in the City and he’s very clear on the subject.

“Wren-Lewis and Krugman would presumably agree that a 10% deficit is unsustainably high – and if it recurred for years would prompt fears for the UK’s solvency.”

And as we all know, mediamacro is never wrong.

Never underestimate the power of human stupidity (Heinlein). Conversely,never underestimate the power of human laughter (Whoever).

First Dog is making a valiant stand at the bridge a la Horatio.

What we need is a latter day antipodean version of Monty Python to give support to the Dog.

There sure as hell is no lack of material for ruthless satire.

Clear long term economic stagnation is occuring in the traditional developed Triad of EU, USA and Japan. The global economy is also stagnating though not to the same extent due mainly to the development of China. The empirical evidence of long term stagnation is clear. Global economic growth in the 6 percents in the 1960s has declined to the 2 percents today. The Triad has basically ceased to grow at all.

Monopoly capitalism is the basic cause as it chokes on its own success. Monopoly capitalism left to its own devices stagnates due to the crisis of capital accumulation (overaccumulation). Events external to monopoly capitalism itself (from large government interventions in the economy to wars) can alter this trajectory. Another attempt to deal with overaccumulation is the last few decades’ financialisation of the economy and the credit-debt binge leading to asset bubbles, instability and crashes.

The process sketched out above is inherent to monopoly-finance capitalism as detailed in “The Endless Crisis” by John Bellamy Foster and Robert W. McChesney. There is nothing in the authors’ stagnation thesis (as a crisis of capital accumulation of monopoly capitalism leading to the current stage of monopoly-finance capitalism and occuring under and exacerbated by neoliberal economic policy) that contradicts MMT.

Maybe “secular stagnation” is the wrong term for the above process. Bill certainly took issue with the “secular stagnation” label. But clearly, capitalism is stagnating under neoliberal policies and all of Marxians, Keynesians and MMT proponents would agree on the immediate medicine although perhaps not on long term solutions.

The immediate medicine required is;

(a) increasing regulation of finance and of capitalists generally;

(b) increasing taxes, at least relatively, on the rich;

(c) increasing welfare for the poor;

(d) increasing wages and increasing the wage share of the economy compared to the profits share;

(e) increasing rights for workers and decreasing the rights and powers of oligarchs;

(f) increasing equity and reducing wealth and income disparities;

(g) guaranteeing and implementing full employment;

(f) running a counter-cyclical macroeconomic policy;

(g) focussing on real outcomes not budget number outcomes.

Ultimately we have to go further. The power to dispose of surpluses must devolve to the workers who create them and in part to truly democratic government not our current debased government bought and suborned by oligarchs. Worker democratic cooperative enterprises will be the way to achieve this. Society cannot be democratic until all workplaces are democratic. Large private individual owners of productive capital and their specialist managers must be abolished as classes and re-absorbed as workers with equal but no more rights than anyone else.

Economics profession, with the exception of MMTers, is a Liars Club. They lie about everything they can get away with.

There’s no getting around it. A – prolonged – failed government indicates a failed electorate. What does it take to re-motivate citizens, and get them to actually start thinking again?

If you look at U.S. budgets over the past 100 years, you will find them in deficit for 85% of the time, compared with the lower percentage mentioned for Australia. I am unclear about the reason for this difference. If anyone knows, please elucidate.

It is the usual history repeating itself. 1930s: mass unemployment so lets cut spending and wages. Result mass unemployment and continued depression until the war. Costello and Howard bragged about surpluses (as did Keating the keen privatiser) but privatised and ensured massive levels of private debt. Now Hockey etc are “concerned” about “deficits” so cut services and want to charge more for everything, Result more private debt for students which will remain for a long time, just so they can pretend to be doing something about the imaginary problem of the “deficit”

Someone gets it …

http://theconversation.com/why-the-federal-budget-is-not-like-a-household-budget-35498

In another example of the complicity of the media in pushing the mythical budget surplus, Ross Gittins is unable to explain his own position:

“I’m not saying balancing the budget is unimportant; of course it’s important.”

Then, in the very next para,

“It doesn’t achieve anything positive.”

http://www.theage.com.au/comment/has-the-lucky-country-lost-its-ardour-and-ambition-20141216-12828s.html

Callam Pickering in Business Spectator gets closer,

“More broadly, we need to ditch our obsession with running a budget surplus. We need to recognise the Howard years for what they were — a brief period of unprecedented economic success — rather than assuming that it was the norm.

That isn’t to say that we should ignore fiscal conservatism, but perhaps it is time that we recognised that running a modest deficit — as we have for most of the last century — is a perfectly reasonable approach to public spending. That approach has led us to where we are today: government debt levels that are the envy of the developed world.”

http://www.businessspectator.com.au/article/2014/12/15/australian-news/surplus-rhetoric-deficit-sense

Callam Pickering in Business Spectator gets closer,

“More broadly, we need to ditch our obsession with running a budget surplus. We need to recognise the Howard years for what they were – a brief period of unprecedented economic success – rather than assuming that it was the norm.

I cannot agree. Pickering is still linking a budget surplus with economic success.

The focus on the Howard years should be that it was an economic failure of immense proportions.

The rise in household debt due to the governments ideological fixation on surpluses.

The fact that much of the economic growth during the period was driven by the private domestic sector spending more than they earned [credit]… and so on.

Factor in the massive rise in housing prices during the Howard years, massive cuts to Universities. and so on ..

Thus, the so called economic success was little more than a massive burden on future generations.